Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST INTERSTATE BANCSYSTEM INC | d574950d8k.htm |

Keefe,

Bruyette & Woods 2013 Community Bank Conference

The Marriott Marquis | New York City

July 30-31, 2013

Exhibit 99.1

Page 1 |

First Interstate

BancSystem Safe Harbor

Page 2

This presentation contains forward-looking statements by First Interstate BancSystem, Inc. (the

“Company”) regarding revenues, income from the origination and sale of loans, net

interest margin, quarterly provisions for loan losses, loan growth, non-performing assets

and net charge-off of loans. This presentation may also contain other forward looking

statements, including statements about the Company’s plans, strategies and prospects. All

forward-looking statements involve known and unknown risks, uncertainties and assumptions

that are difficult to predict. Therefore, the Company’s actual results, performance or

achievements may differ materially from those expressed in or implied by these forward-

looking statements. In some cases, you can identify forward-looking statements by the use of words

such as “may,” “could,” “expect,” “intend,”

“plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,”

“would” and variations of these terms and similar expressions, or the negative of these

terms or similar expressions. Factors that may cause actual results to differ materially from

current expectations are described in the section entitled “Risk Factors” in the

Forms 10-K and 10-Q most recently filed by the Company with the SEC.

The risk factors described in Forms 10-K are not necessarily all of the important factors that

could cause the Company’s actual results, performance or achievements to differ materially

from those expressed in or implied by any of the forward- looking statement contained in

this presentation. Other unknown or unpredictable factors also could affect the Company’s

results.

All forward-looking statements contained in this presentation are expressly qualified in their

entirety by the cautionary statements set forth above. Forward-looking statements speak

only as of the date they are made and the Company does not undertake or assume any obligation

to update publicly any of these statements to reflect actual results, new information or future

events, changes in assumptions or changes in other factors affecting forward-looking statements,

except to the extent required by applicable laws. If the Company updates one or more

forward-looking statements, no inference should be drawn that the Company will make

additional updates with respect to those or other forward-looking statements. |

Page 3

|

First Interstate BancSystem

Long Term History with Solid Performance

Company Snap Shot

Headquartered in Billings, MT with 74 branches across

Montana, Wyoming and western South Dakota

Total Assets of $7.3 Billion

Total Loans of $4.3 Billion

Regional bank offering retail, mobile and commercial

banking, along with wealth management, cash

management, credit card and mortgage services

NASDAQ: FIBK

Company

Performance

Strong organic growth complemented by 9 strategic

acquisitions over last 20 years

25 consecutive years of net income; Over 18 years

consecutive quarterly dividends

Increased dividend to $.14 per share July 2013

Q2 2013 net income to common shareholders of $21.5

million, EPS $.49

Improving credit quality

Page 4 |

First Interstate BancSystem

Impressive Market Shares

Ranked #1 by market share in Montana and Wyoming, and #2 in the western South Dakota markets

we serve. -Data Per SNL Financial

($ in Millions)

(June 30, 2012)

MSAs

Market Share

Billings, MT

27%

Missoula, MT

30%

Casper, WY

29%

Rapid City, SD

21%

Jackson, WY-ID

20%

Gillette, WY

31%

Sheridan, WY

42%

Kalispell, MT

18%

Great Falls, MT

20%

Laramie, WY

51%

Bozeman, MT

12%

Riverton, WY

35%

Spearfish, SD

36%

Cheyenne, WY

12%

Helena, MT

5%

Page 5

51%

36%

13%

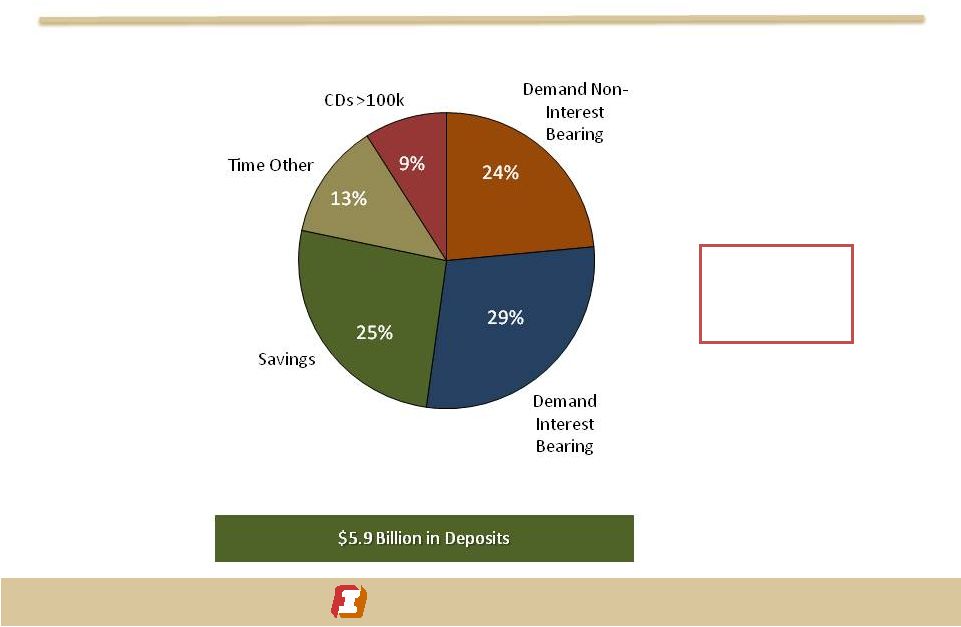

Allocation of $5.9 Billion in Deposits

South

Dakota

Wyoming

Montana

(As of 6/30/13) |

First Interstate BancSystem

Diversified Economic Base

Agriculture

Cattle

Crops

(Barley, Wheat , Sugar Beets)

Page 6

Energy

Oil and Natural Gas

Greater Williston Basin Area

Bakken formation

Powder River Basin

Coal

MT Ranked #1 and WY ranked #3 in demonstrated Coal Reserves

WY Ranked #1 in Production

Wind

MT, WY and SD in the top 10 for wind potential

MT has the fastest national growth rate for wind energy |

First Interstate

BancSystem Diversified Economic

Base Page 7

Canada

Williston

Basin

MT

ND

SD

WY

Greater Williston Basin Area

Bakken Oil Field

FIBK Headquarters

Billings, MT |

First Interstate

BancSystem Tourism

Glacier National Park, MT

Yellowstone National Park, WY

Major National Parks

Summer/Winter Opportunities

Mount Rushmore, SD

Page 8

Healthcare

Aging population base

Regional healthcare centers

Veterans Administration healthcare

Military /Government

Ellsworth Air Force Base, SD

Malmstrom Air Force Base, MT

F.E. Warren Air Force Base, WY

B1B Lancer,

Ellsworth Air Force Base |

First Interstate

BancSystem Stable

Employment Page 9

MT 5.4% Ranked 13th

WY 4.6% Ranked 7th

SD 4% Ranked 3rd

0% -

4%

4% -

6%

6% -

8%

8% -

10%

10% or more

(As of May 2013) |

First Interstate

BancSystem Page 10

Loan Portfolio

Asset Quality Trends

Strong Deposit Base

and Earnings |

Diversified

Loan Portfolio $4.3 Billion in Loans

$4.3 Billion in Loans

Credit opportunities

2013 Loan growth flat to modest,

however positive economic indicators

Construction activity increasing

Home sales increasing

Low unemployment

Disciplined credit practices

In-house limit of $10 Million

Disciplined pricing and terms

First Interstate

BancSystem (As

of 6/30/13) Page 11 |

First Interstate

BancSystem Improving Credit

Quality Trends Page 12

(In millions)

Peak mid-2012

Earnings

Improvement driven

by Improved Credit

Metrics

Non-Performing Loans

OREO

Non-Performing Assets |

First Interstate

BancSystem And Reduction in

Criticized Loans Page 13

(In millions)

$321 million , or 44%, decline over 2 years

Special Mention

Substandard

Doubtful

Total Criticized |

First Interstate

BancSystem Strong Core Deposit

Base First Interstate

BancSystem Page 14

(as of 6/30/2013)

Q2 2013

Cost of Funds

.32% |

First Interstate BancSystem

Earnings Improvement

Page 15

(in thousands)

|

First Interstate

BancSystem Non-

Interest Income Revenue Streams

Page 16

NII opportunities

Wealth Management growth

AUM -

$4 Billion

Mortgage lending

Less competitors in market place

Strong customer base

Credit card activity

Card issuer to customers within our

footprint

Increasing business card usage

33% of Total Revenue

33% of Total Revenue

Home Loans

34%

Service

Charges

15%

Other

Income

7%

Wealth

Management

14%

Other Service

Charges,

Commissions

and Fees

30% |

First Interstate

BancSystem 2013 Headwinds

NIM Pressure

Q2 2013 Net interest

margin 3.56%

Competitive pressure

impacting loan growth

& rates

Q2 2013 average yield 5.21%

Investment yields

Effort to minimize extension risk

by de-emphasizing callable

agencies in favor of MBS

Short duration

Low credit risk

Page 17

Investment Portfolio

0%

20%

40%

60%

80%

100%

Other

Municipal

MBS

CMO's

Agencies |

First Interstate BancSystem

Advantages

#1 Emphasis is on the Customer

Banking channels adaptive to customer needs

Face-to-Face

On-line

Mobile

Full scope of Payment Products for our customers

Credit card issuer

Cash management products

Merchant processing

Expedient response to loan applications

Internal-focus is on efficiencies

Average branch size exceeding $100 million allows efficient use of resources

Further centralization of processes; business process improvements

Technological efficiencies

Page 18 |

Long Track

Record of Profitability Leading Market Positions

Attractive and Healthy Footprint

Improving Credit Metrics

Low-Cost Core Deposit Base

Growth Opportunities

Increasing Shareholder Returns

First Interstate

BancSystem Page 19

Why invest in First Interstate BancSystem? |