Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMMUNITY HEALTH SYSTEMS INC | d575538d8k.htm |

| EX-2.1 - EX-2.1 - COMMUNITY HEALTH SYSTEMS INC | d575538dex21.htm |

| EX-99.1 - EX-99.1 - COMMUNITY HEALTH SYSTEMS INC | d575538dex991.htm |

| EX-10.1 - EX-10.1 - COMMUNITY HEALTH SYSTEMS INC | d575538dex101.htm |

Acquisition of

Health Management Associates: Acquisition of Health Management Associates:

A Compelling Opportunity for Value Creation

A Compelling Opportunity for Value Creation

July 30, 2013

July 30, 2013

Exhibit 99.2 |

1

1

1

Forward-Looking Statements

Forward-Looking Statements

Certain statements contained in this communication may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to, statements regarding the

expected timing of the completion of the merger, the benefits of the merger, including future financial and

operating results, the combined company’s plans, objectives, expectations and other

statements that are not historical facts. Such statements are based on the views

and assumptions of the management of CHS and HMA and are subject to significant risks and

uncertainties. Actual future events or results may differ materially from these statements. Such

differences may result from the following factors: the ability to close the transaction on the

proposed terms and within the anticipated time period, or at all, which is dependent on

the parties’ ability to satisfy certain closing conditions, including the receipt of

governmental approvals; the risk that the benefits of the transaction, including cost savings and

other synergies may not be fully realized or may take longer to realize than expected; the

impact of the transaction on third-party relationships; actions taken by either of

the companies; changes in regulatory, social and political conditions, as well as general

economic conditions. Additional risks and factors that may affect results are set forth in HMA’s and

CHS’s filings with the Securities and Exchange Commission, including each company’s

Annual Report on Form 10-K for the fiscal year ending December 31, 2012. The

forward-looking statements speak only as of the date of this communication. Neither CHS nor HMA undertakes any

obligation to update these statements. The

presentation also contains certain non-GAAP financial measures. This presentation and the Company’s earning

releases for the quarter and year ended December 31, 2012, and the quarter and six months ended

June 30, 2013, located on the company’s investor relations page at www.chs.net,

include a reconciliation of the difference between certain non-GAAP financial

measures with the most directly comparable financial measure calculated in accordance with

GAAP. These non-GAAP financial measures should not be considered an alternative to the GAAP

financial measures. References to “Company” or “CHS” used herein refer to Community Health

Systems, Inc. and its affiliates, unless otherwise stated or indicated by context.

References to “HMA” used herein refer to Health Management Associates, Inc. and

its affiliates, unless otherwise stated or indicated by context. |

2

2

2

Important Information and Where to Find It

Important Information and Where to Find It

Community Health Systems, Inc. (“CHS”) intends to file with the Securities and

Exchange Commission (the “SEC”) a registration statement on Form S-4 that

will include a proxy statement of Health Management Associates, Inc. (“HMA”)

and a prospectus of CHS relating to the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT CHS, HMA AND THE MERGER. Investors and security holders will be able to obtain

these materials (when they are available) and other documents filed with the SEC free of

charge at the SEC’s website, www.sec.gov. In addition, stockholders will be able to

obtain copies of the registration statement and proxy statement/prospectus (when they become

available) and other documents filed with the SEC from CHS’s website at www.chs.net

or and HMA’s website at www.hma.com or by directing such request to CHS at 4000

Meridian Boulevard, Franklin, Tennessee 37067, Attention: Investor Relations, or to HMA

at 5811 Pelican Bay Boulevard, Naples, Florida 34108, Attention: Investor Relations.

CHS, HMA and certain of their respective directors, executive officers and other persons may be

deemed to be participants in the solicitation of proxies in respect of the merger.

Information regarding CHS’s directors and executive officers is available in

CHS’s proxy statement filed with the SEC on April 5, 2013 in connection with its 2013 annual

meeting of stockholders, and information regarding HMA’s directors and executive officers

is available in (i) HMA’s proxy statement filed with the SEC on April 8, 2013 in

connection with its 2013 annual meeting of stockholders and (ii) HMA’s consent

revocation statement filed with the SEC on July 19, 2013 in response to the consent solicitation conducted by

Glenview Capital Partners, L.P. and certain of its affiliates. Other information regarding

persons who may be deemed participants in the proxy solicitation and a description of

their direct and indirect interests, by security holdings or otherwise, will be contained

in the registration statement and proxy statement/prospectus and other relevant materials

to be filed with the SEC when they become available.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell

or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10

of the Securities Act of 1933, as amended.

|

3

3

3

3

Transaction Summary

Transaction Summary

CHS is acquiring HMA for an aggregate purchase price of $7.6bn plus a contingent value right

(“CVR”) of up to ~$270mm

Total consideration:

$13.78 per share before CVR

Consideration mix:

Cash:

$10.50 per share

Stock:

0.06942 shares of CHS stock per HMA share,

or $3.28 based on CHS’ stock price of $47.23

as of 7/29/13

CVR:

Up to $1.00 per share

Pro forma ownership:

CHS:

84%

HMA:

16%

$150mm – $180mm of annual synergies expected within 2.5 years Committed financing by Bank of America Merrill Lynch

and Credit Suisse

Leverage ratio post-closing projected to return to current levels within 12 – 18

months

Transaction unanimously approved by both Boards of Directors Expected to close by end of Q1 2014 |

4

4

4

4

Compelling Strategic Rationale

Compelling Strategic Rationale

Unique opportunity

to acquire well

developed hospital

system

•

71 facilities spread across attractive non-urban and suburban markets

•

Complementary geographic fit

Establishes largest

hospital footprint

Creates platform

well positioned for

Health Care Reform

•

206 facilities across 29 states

•

Enhances economies of scale and operating efficiencies

•

Strengthens hospital and physician networks

•

Adds highly accredited hospitals to existing portfolio

69 Joint Commission accredited with Gold Seal of Approval

18 received chest pain center accreditation by Society of Cardiovascular

Patient Care

•

Pro forma, 91 hospitals (~45%) named Top Performers on Key Quality Measures by

The Joint Commission

•

Supported by CHS’

successful track record of acquiring and integrating

hospitals/systems

•

Successfully

integrated

Triad

–

$5bn

revenue

company

•

Expect breakeven EPS year 1; meaningfully accretive thereafter

Excluding amortization of asset write-up (cash EPS), single-digit accretion in year

1 •

Modest increase in leverage post-closing; de-levers meaningfully within 12–18

months Apply best practices

to maximize synergy

potential

Financially attractive

transaction |

5

5

5

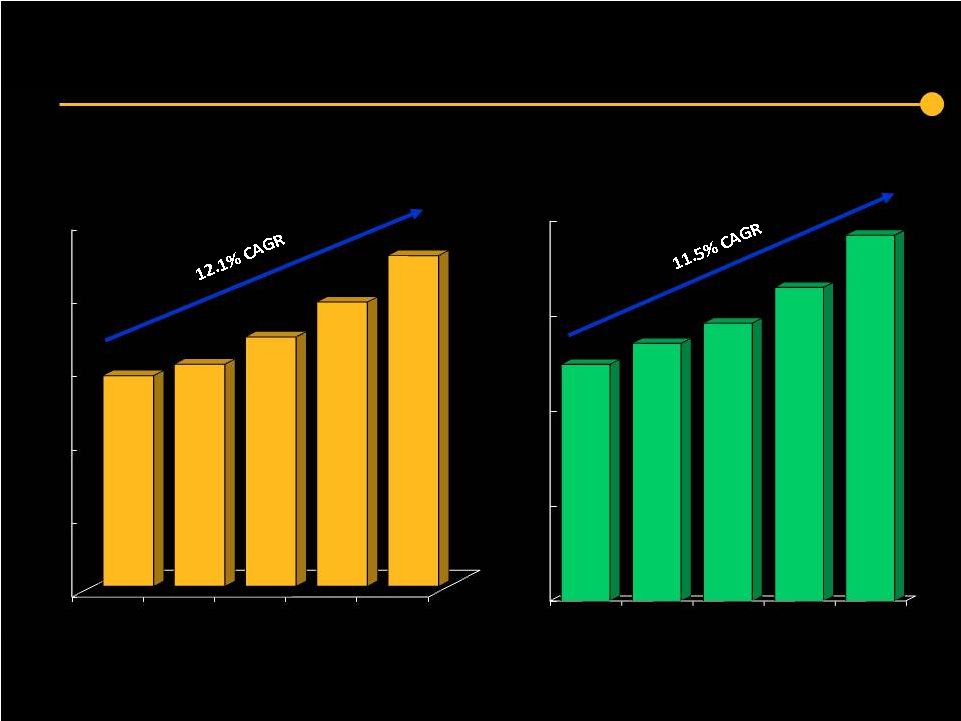

($MM)

Revenues

EBITDA

($MM)

HMA Revenue and EBITDA Performance

Note: Revenues before adjustments for bad debt and do not reflect the accounting

change. 0

1,500

3,000

4,500

6,000

7,500

2008

2009

2010

2011

2012

$4,302

$4,536

$5,092

$5,804

$6,753

0

250

500

750

1,000

2008

2009

2010

2011

2012

$623

$678

$732

$826

$963 |

6

6

6

Revenues

EBITDA **

($MM)

CHS Has Successfully Grown the Company

** See the Unaudited Supplemental Information contained in this presentation for a definition of

EBITDA and a reconciliation of Adjusted EBITDA, as defined, to our net cash provided by operating

activities as derived directly from our consolidated financial statements for the six months

ended June 30, 2013 and 2012. For purposes of this presentation, EBITDA means Adjusted EBITDA.

Note: Revenues before adjustments for bad debt and do not reflect the accounting

change. 2010, 2011, and 2012 net operating revenues after bad debt was $11,092,

$11,906, and $13,029, respectively. Revenue and EBITDA for 2009 and prior years

have not been adjusted for discontinued operations. 2007 amounts include

adjustments for change in estimate taken inQ407. 2006 EBITDA excludes increase in

allowance for doubtful accounts of $65 million taken in Q306.

|

7

7

7

7

Combined Company

Combined Company

Note:

Revenues based on twelve months ended 6/30/13.

($ in millions)

CHS

Pro Forma

HMA

Revenues

$13,037

$18,905

Hospitals

135

206

States

29

29

Licensed Beds

20,176

31,241

11,065

71

15

$5,868 |

8

8

8

8

HMA has an Attractive Portfolio of Hospitals

HMA has an Attractive Portfolio of Hospitals

Cardiology / Respiratory

General Practices

Oncology

Orthopedic

Renal

Surgery

Women's Health

Hospitals = 71

Clinics = 472

Behavioral Health

Neurology

Neurosurgery

Others

Pediatrics

Urgent Care

•

71 facilities with over 11,000 beds in 15 states

•

Non-urban focus primarily in southeastern US

•

Establishing broad delivery models in several key markets

Source: HMA website.

Note:

Pro forma for recent acquisition of Bayfront. |

9

9

9

9

Complementary Geographic Fit

Complementary Geographic Fit

CHS

HMA

Overlapping States

23

2

2

8

2

9

3

2

1

3

2

2

10

2

3

1

7

3

2

6

9

11

1

17

2

2

1

3

1

3

1

1

1

4

6

3

9

9

1

3

1

3

17

4

IN

206 hospitals with over 31,000 beds across 29 states

Note:

Pro forma for recent HMA acquisition of Bayfront.

Top 5 states

Pro forma 2012 revenue

Florida

12%

Pennsylvania

11%

Texas

9%

Tennessee

8%

Indiana

8%

Total

48%

FL

PA

TX

TN |

10

10

10

Strong Market Presence and Diversification

Strong Market Presence and Diversification

•

13 states with revenue greater than $500 million

—

Over 75% of CHS’

and 85% of HMA’s hospital revenues from these markets

PF 2012 Combined

($ in millions)

CHS

HMA

Combined

Revenue

%

Florida

2

23

25

$2,320

12%

Pennsylvania

17

3

20

2,095

11%

Texas

17

1

18

1,780

9%

Tennessee

11

9

20

1,475

8%

Indiana

9

–

9

1,460

8%

Alabama

9

2

11

1,115

6%

Mississippi

2

10

12

1,070

6%

Arkansas

8

2

10

775

4%

South Carolina

6

2

8

690

4%

Illinois

9

–

9

685

4%

Washington

2

2

4

670

4%

Oklahoma

3

7

10

600

3%

Arizona

4

–

4

545

3%

Total

99

61

160

$15,275

80%

Hospitals |

11

11

11

CHS Commitment to Quality

CHS Commitment to Quality

Consistent improvement in inpatient core measures

Significant reductions in readmissions and hospital acquired conditions

4Q 2008

4Q 2009

4Q 2010

4Q 2011

4Q 2012

Readmission Rates

AMI down 23.0%

HF down 20.1%

Pneumonia down 17.8%

19.8%

Combined

Decrease

Hospital Acquired Conditions

Selected Measures:

11.7% reduction in pressure ulcers

27.5% reduction in central line associated infections

18.1% Reduction in catheter associated UTIs

16.3%

Combined

Decrease

in all

HACs

2011-2012

2011-2012

* For consistency, new Core Measures mandated as of 2012 not represented.

91.9%

95.4%

96.6%

97.6%

98.9% |

12

12

12

CHS Physicians –

CHS Physicians –

Trusted Partners in Care

Trusted Partners in Care

employed physicians

physician satisfaction rate

employed physician practice locations

Physician

Leadership

•

Physician Leadership Groups in affiliated hospitals

•

Annual Chiefs of Staff Meeting

•

Physician Advisory Boards in Selected Specialties

physicians serving on affiliated medical staffs

17,000

2,500

89%

650 |

13

13

13

Cleveland Clinic National Strategic Alliance

Cleveland Clinic National Strategic Alliance

•

Vast National

Hospital Network

•

Growing Physician

Base

•

Recognized for

Operational

Excellence

•

Financial Strength

and Success

•

Nationally Acclaimed

Academic Medical

Center

•

Aligned Physician

Strategy

•

Sophisticated

Clinical Expertise

•

Innovative Approaches

to Patient Care

CHS

Collaboration

to identify

synergies and

develop

solutions for

the changing

health care

landscape |

14

14

14

HMA Regional Clinical Affiliations and Strategic Partners

HMA Regional Clinical Affiliations and Strategic Partners

Hospital Clinical

Affiliations

Selected Strategic

Partners

(Oklahoma) |

15

15

15

CHS Growth Through Acquisitions

CHS Growth Through Acquisitions

* Excludes a small number of divestures.

Focused on

State Network

Development,

Clinical

Excellence

and Value

in Order to

Succeed in

the Era of

Health Care

Reform

2013-Future

Select

Divestitures

Strategic

Acquisitions

Development

of Integrated

Networks

2008-2012

50+

Hospitals

Added in

Triad

Hospitals

Acquisition

Larger, More

Competitive

Markets

2007

Significant

Growth

through

Acquisitions

IPO on the

NYSE in

2000

1997-2006

Collection

of Small

Rural

Hospitals

Sole

Community

Providers

1985-1996

1996 Number of

Hospitals:

36

2006 Number of

Hospitals:

77

Number of Hospitals

following Triad

Acquisition:

128

2012 Number

of Hospitals:

135 |

16

16

16

16

CHS has a History of Successfully Integrating Acquisitions

CHS has a History of Successfully Integrating Acquisitions

** See the Unaudited Supplemental Information contained in this presentation for a definition

of EBITDA and a reconciliation of Adjusted EBITDA, as defined, to our net cash provided

by operating activities as derived directly from our consolidated financial statements. For purposes of this presentation, EBITDA means Adjusted EBITDA.

*

Revenues have not been restated to reflect the change in bad debt.

|

17

17

17

Recent Acquisitions Provide Opportunity to Improve

Recent Acquisitions Provide Opportunity to Improve

Profitability and Drive Growth

Profitability and Drive Growth

CHS

HMA

Total

Number of hospitals acquired

4

5

9

8

5

1

19

4

12

4

9

–

1

12

31

~$1.4bn

~$1.3bn

~$2.7bn

2010

Revenue

acquired

since 2010

2011

2012

2013

Total |

18

18

18

•

Acquisitions

•

Ancillary Services

—

Pharmacy

—

Laboratory

—

Surgery

—

Imaging

•

Billing and Collections

•

Compliance

•

Community Cares

•

Customer Service

•

ER Management

•

Executive Recruitment

•

Facilities Management

•

Financial Reporting and Control

•

Group Purchasing

•

Health Information Management

•

Home Health

•

Information Systems

•

Insurance Programs

•

Joint Commission

•

Legal Services

•

Managed Care

•

Marketing

•

Patient and Physician Satisfaction

•

Physician Advisory and Leadership

Board

•

Physician Recruiting and Support

•

Quality & Clinical Transformation

•

Revenue Strategies

•

Senior Circle

•

Specialty Services

Improve Hospital Operations

Improve Hospital Operations |

19

19

19

Name

Title

Years of

Industry

Experience

Background

Wayne T. Smith

Chairman, President and CEO

30+

President and Chief Operating Officer at Humana

W. Larry Cash

Executive Vice President and CFO

30+

Vice President and Group CFO at HCA;

Senior Vice President of Finance & Operations at Humana

Rachel A. Seifert

Executive Vice President, Secretary

and General Counsel

20

William S. Hussey

President, Division IV

30+

David L. Miller

President, Division I

30+

Thomas D. Miller

President, Division V

20

Michael T. Portacci

President, Division II

25

Joined as Hospital CEO in 1987;

Became Group VP in 1991

Martin D. Smith

President, Division III

15

Joined as Hospital CEO in 1998 and became Division III VP

of Operations in 2005; Various positions with HMA

T. Mark Buford

Senior Vice President –

Internal Audit

25

Joined as Corporate Controller in 1986 and became Chief Accounting Officer in

1988 and Senior Vice President –

Internal Audit in 2012

Larry M. Carlton

Senior Vice President –

Revenue Management

30

Director of Health Financing with Humana, Galen and HCA

Kenneth D. Hawkins

and Development

20

Barbara Paul, MD

Senior Vice President &

Chief Medical Officer

20

Martin G. Schweinhart

25

CFO of Denver and Kentucky Divisional Markets;

Various positions with HCA and Humana

J. Gary Seay

Senior Vice President &

Chief Information Officer

25

Vice

President

–

Cigna;

Various positions with Humana

Lynn T. Simon, MD

Senior Vice President &

Chief Quality Officer

20

Senior Vice President & Chief Medical Officer –

Jewish Hospital & St. Mary’s HealthCare in Louisville, Kentucky

Kevin J. Hammons

Vice President &

Chief Accounting Officer

15

Various positions with Ernst & Young.; joined as Director of Financial

Reporting in 1997, became Vice President of Financial Reporting in 2005 and

Chief Accounting Officer in 2012

Deep and Experienced Management Team

Deep and Experienced Management Team

Senior Vice President – Acquisitions

Senior Vice President – Operations

Joined as AVP in 2001; Divisional President – Tampa Bay Division, HCA Divisional Vice President – HMA; Various

positions with Humana

President & CEO – Lutheran Health; CEO of Tri Cities Market in northeast

Tennessee CEO of Tri Cities Market in northeast Tennessee Vice

President of Development – Champion Healthcare

Director of Quality Measurement & Health Assessment Group – CMS

Department of HHS

Vice President – Legal Operations, HCA

|

20

20

20

20

CHS Management Significantly Improved Triad’s

CHS Management Significantly Improved Triad’s

Operating Results

Operating Results

Substantial corporate cost savings and

purchasing synergies achieved

–

First Calendar Year: $145mm

–

Peak Synergies: Over $275mm

Recruited ~2,400 physicians to Triad

facilities since acquisition

Focused CapEx on high ROI projects

Delevered ~1.5x Debt/EBITDA within

2.5 years |

21

21

21

21

Attractive Financial Profile

Attractive Financial Profile

•

Expect to realize $150mm –

$180mm of annual synergies within 2.5 years

Over 40% expected to be realized in year 1

•

Expect transaction to be break-even EPS in year 1; meaningfully accretive thereafter

Excluding amortization of asset write-up (cash EPS), single-digit accretion in year

1 •

Pro forma debt / EBITDA mid-5x and expected to return to current levels within

12–18 months post closing

•

Committed to deleveraging balance sheet

•

Overhead reduction

•

Supply management

•

Case management

•

Revenue cycle management

Run-rate Synergies

$150mm –

$180mm |

22

22

22

22

Contingent Value Right (CVR)

Contingent Value Right (CVR)

•

HMA shareholders may receive up to $1.00 per share in cash less

90% of any Losses post CHS’

deductible of $18mm

–

Losses are defined as legal expenses, fees, fines and settlement

amounts relating to HMA’s Existing Litigation with DOJ, SEC and

related litigation and claims

•

First $18mm of costs related to Losses would not reduce the CVR

payment amount

•

After the first $18mm of Losses, the CVR payment amount would

be reduced by 90% of such Losses

•

Settled in cash after CVR Payment Date which is the final resolution

of all Existing Litigation |

23

23

23

Imperatives of Health Care Reform

Imperatives of Health Care Reform

23

* Congressional Budget Office: July 2012

*

Commit to

Quality

Deliver Care

More

Efficiently

Build

Services and

Infrastructure

for Value-

Based Care

Clinical

Integration &

Collaboration

14 Million Newly Insured

Patients in 2014 |

24

24

24

24

Next Steps

Next Steps

•

Regulatory approval process

–

Hart-Scott-Rodino

–

State and local approvals as required

•

HMA shareholder vote

–

70% vote required

–

HMA

shareholders

own

~60%

of

CHS’

stock

today

–

Break-up fees exist

•

Prior integration experience will be helpful

•

Closing expected by end of Q1 2014 |

25

25

25

25

Transaction Enhances Shareholder Value

Transaction Enhances Shareholder Value

•

Increased scale

•

Complementary geographic fit

•

Strong market presence and diversification

•

Network opportunities

•

Synergies

•

Attractive financial profile

•

History of successfully integrating acquisitions |

26

26

26

Unaudited Supplemental Information

Unaudited Supplemental Information

EBITDA consists of net income attributable to CHS before interest, income taxes, and

depreciation and amortization. Adjusted EBITDA is EBITDA adjusted to exclude

discontinued operations, gain/loss from early extinguishment of debt and net income

attributable to noncontrolling interests. The Company has from time to time sold

noncontrolling interests in certain of its subsidiaries or acquired subsidiaries with existing

noncontrolling interest ownership positions. The Company believes that it is useful to

present adjusted EBITDA because it excludes the portion of EBITDA attributable to these

third party interests and clarifies for investors the Company’s portion of EBITDA

generated by continuing operations. The Company uses adjusted EBITDA as a measure of

liquidity. The Company has included this measure because it believes it provides investors with

additional information about the Company’s ability to incur and service debt and make

capital expenditures. Adjusted EBITDA is the basis for a key component in the

determination of the Company’s compliance with some of the covenants under the

Company’s senior secured credit facility, as well as to determine the interest rate

and commitment fee payable under the senior secured credit facility.

Adjusted EBITDA is not a measurement of financial performance or liquidity under generally

accepted accounting principles. It should not be considered in isolation or as a

substitute for net income, operating income, cash flows from operating, investing or

financing activities, or any other measure calculated in accordance with generally

accepted accounting principles. The items excluded from adjusted EBITDA are

significant components in understanding and evaluating financial performance and

liquidity. This calculation of adjusted EBITDA may not be comparable to similarly

titled measures reported by other companies. |

27

27

27

27

Unaudited Supplemental Information Continued

Unaudited Supplemental Information Continued

The following table reconciles ADJUSTED EBITDA, as defined, to net cash provided by operating

activities as derived directly from the condensed consolidated financial statements (in

thousands): 2012

2011

Adjusted EBITDA

1,977,715

$

1,836,650

$

Interest expense, net

(622,933)

(644,410)

Provision for income taxes

(157,502)

(137,653)

Loss from operations of entities sold, net of taxes

(466)

(7,769)

Other non-cash expenses, net

70,174

70,959

Net changes in operating assets and liabilities,

net of effects of acquisitions and divestitures

13,132

144,131

Net cash provided by operating activities

1,280,120

$

1,261,908

$

Year Ended

December 31, |