Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ameris Bancorp | d575050d8k.htm |

2

Quarter 2013

Investor Presentation

nd

Exhibit 99.1 |

2

Cautionary Statements

This presentation contains certain performance measures

determined by methods other than in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). Management of Ameris Bancorp (the

“Company”) uses these non-GAAP measures in its analysis of

the Company’s performance. These measures are useful when

evaluating the underlying performance and efficiency of the

Company’s operations and balance sheet. The Company’s

management believes that these non-GAAP measures provide a

greater understanding of ongoing operations, enhance

comparability of results with prior periods and demonstrate the

effects of significant gains and charges in the current period.

The Company’s management believes that investors may use

these non-GAAP financial measures to evaluate the Company’s

financial performance without the impact of unusual items that

may obscure trends in the Company’s underlying performance.

These disclosures should not be viewed as a substitute for

financial measures determined in accordance with GAAP, nor

are they necessarily comparable to non-GAAP performance

measures that may be presented by other companies. Tangible

common equity and Tier 1 capital ratios are non-GAAP

measures. The Company calculates the Tier 1 capital using

current call report instructions. The Company’s management

uses these measures to assess the quality of capital and believes

that investors may find them useful in their evaluation of the

Company. These capital measures may, or

may not be necessarily comparable to similar capital measures

that may be presented by other companies.

This presentation may contain statements that constitute

“forward-looking

statements”

within

the

meaning

of

Section

27A of the Securities Act of 1933, as amended, and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended. The words “believe”, “estimate”, “expect”,

“intend”, “anticipate”

and similar expressions and variations thereof

identify certain of such forward-looking statements, which speak

only as of the dates which they were made. The Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks and uncertainties and that

actual results may differ materially from those indicated in the

forward-looking statements as a result of various factors.

Readers are cautioned not to place undue reliance on these

forward-looking statements and are referred to the Company’s

periodic filings with the Securities and Exchange Commission for

a summary of certain factors that may impact the Company’s

results of operations and financial condition. |

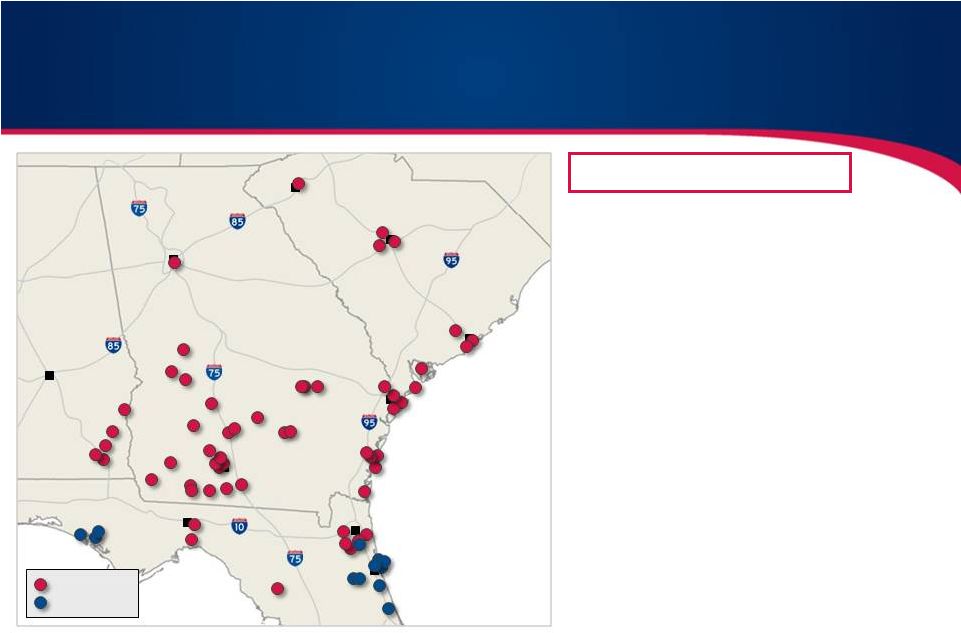

Corporate

Profile 3

•

Headquartered in Moultrie, Georgia

•

Founded in 1971 as American Banking Company

•

Historically grown through acquisitions of smaller

banks in areas close to existing operations

•

Recently announced merger with Prosperity (St.

Augustine, FL) adds 12 Florida offices and $750

million in assets

•

Recent growth through de novo expansion strategy

and 10 FDIC-assisted transactions

•

Four state footprint with 57 offices

•

Approximately 838 FTEs managing 200,000 core

customer accounts |

4

Management and Board Ownership of Approximately 7%

Experienced Management Team

Name, Position

Experience

(Banking / Ameris)

Edwin W. Hortman Jr.

Chief Executive Officer

Andrew B. Cheney

EVP & Chief Operating Officer

Dennis J. Zember Jr.

EVP & Chief Financial Officer

Jon S. Edwards

EVP & Chief Credit Officer

Stephen A. Melton

EVP, Chief Risk Officer

Cindi H. Lewis

EVP, Chief Administrative Officer

T. Stan Limerick

EVP, Chief Information Officer

32/14

36/4

20/8

28/13

32/2

36/36

7/1 |

Continue to

Realize the Positive Impacts of our Earnings Strategies: •

Continue to drive double digit growth in loans and low-cost/no-cost funding.

•

Maintain improving slope line on operating efficiency believing that the advantage of

lower costs will make us more competitive at acquiring

higher quality assets. •

Improve credit quality metrics to allow for a return to normalized credit costs in

2014. •

Continue success with current non-interest income strategies; pursue additional

strategies. Complete merger with Prosperity and capitalize on our three acquisition

themes: •

Leverage the existing staff/resources of Ameris Bank to gain significant operating

leverage. •

Accelerate the liquidation of remaining problem assets.

•

Gain a normalized NIM on the incremental assets by restructuring their balance sheet (FHLB

advances and investment portfolio).

5

Current Focus |

6

2 Quarter Update –

Financial Condition

dollars in millions, except per share data

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Change

BALANCE SHEET

Total Assets

$2,920

$2,949

$3,019

$2,862

$2,809

(3.80)

%

S/T assets & investments

546

492

628

461

418

(23.44)

Loans -

noncovered

1,385

1,469

1,499

1,535

1,618

16.84

Loans -

covered

602

546

507

461

444

(26.25)

Reserve for loan losses

26

26

24

23

24

(7.69)

Indemnification asset

204

198

159

161

106

(48.04)

Non-interest bearing deposits

429

465

511

491

475

10.72

Interest bearing deposits

2,116

2,116

2,114

1,999

1,968

(6.99)

Tang Common Equity / Assets

8.41

%

8.27

%

8.23

%

8.83

%

9.15

%

8.80

Tangible Book Value

$10.29

$10.23

$10.39

$10.57

$10.74

4.37

%

nd |

7

2

Quarter Update –

Operating Results

dollars in millions, except per share data

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Change

PERFORMANCE

Net Income

$2,495

$1,903

$4,672

$5,285

$6,678

167.66

%

Net interest income

$28,881

$28,238

$29,559

$28,338

$29,476

2.06

Provision for loan losses

$7,225

$6,540

$4,442

$2,923

$4,165

(42.35)

Non-interest income

$8,875

$9,831

$11,582

$11,188

$11,385

28.28

Mortgage revenues

3,006

3,740

4,768

4,464

5,001

66.37

Service charges on deposits

4,770

5,121

5,299

4,837

4,695

(1.57)

Non-interest expense

$26,623

$28,810

$29,791

$28,884

$26,688

0.24

Salaries & Benefits

12,125

13,766

15,785

13,806

13,381

10.36

Occupancy & DP costs

5,785

5,939

6,907

5,501

5,814

0.50

OREO and problem loan expense

3,423

3,706

2,548

4,844

2,349

(31.38)

Return on Avg Assets

0.34%

0.26%

0.63%

0.74%

0.95%

181.48

Return on Avg TCE

4.18%

3.19%

7.89%

8.54%

10.77%

157.70

Diluted earnings per share

0.07

0.04

0.15

0.20

0.26

271.43

Net interest margin (TE)

4.66%

4.52%

4.72%

4.79%

4.96%

6.44

Efficiency ratio (ex credit costs)

61.45%

65.94%

66.22%

60.82%

59.57%

(3.06)

Net Overhead (ex credit costs)

1.96%

2.07%

2.07%

1.80%

1.84%

(6.00)

%

nd |

8

dollars in millions, except per share data

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Change

CREDIT QUALITY

(1)

Non-performing assets

80,818

75,550

78,735

77,910

71,696

(11.29)

Non-accrual loans

44,421

38,225

38,885

37,476

31,811

(28.39)

OREO

36,397

37,325

39,850

40,434

39,885

9.58

NPAs / Assets

2.77

%

2.56

%

2.61

%

2.72

%

2.55

%

(7.94)

Classified Assets / Capital

32.05

%

31.44

%

33.45

%

31.7

%

28.7

%

(10.45)

Reserves / Loans

1.92

%

1.80

%

1.63

%

1.57

%

1.56

%

(18.75)

Reserves / NPLs

58.98

%

67.76

%

60.67

%

62.39

%

76.13

%

29.08

Net Charge-offs

8,561

5,987

6,399

2,814

2,860

(66.59)

as a % of average loans

2.52

%

1.65

%

1.75

%

0.76

%

0.74

%

(70.63)

New Non-accrual loans

15,325

11,829

15,687

8,113

5,749

(62.49)

2

Quarter Update –

Credit Quality

nd |

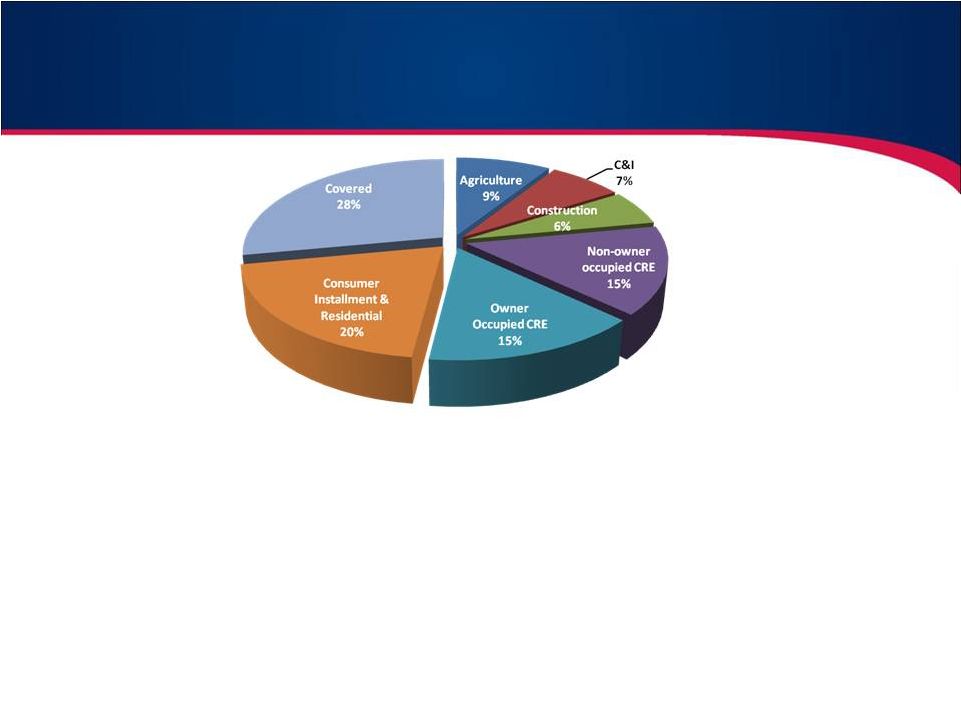

•

Diversified loan portfolio across five regions

–

Inland Georgia –

50%

–

Coastal Georgia –

14%

–

Alabama –

8%

•

In-house lending limit of $10.0 million versus $75 million legal limit

–

7 loans greater than $5 million

•

Loan participations less than 1.00% of total loans

•

Aggressive management of concentrations of credit

•

Top 25 relationships

are only 10.8% of total loans, with avg. DSC of 1.98% and LTV

of 63.4%

9

–

South Carolina –

15%

–

Florida –

13%

Loan Portfolio Detail |

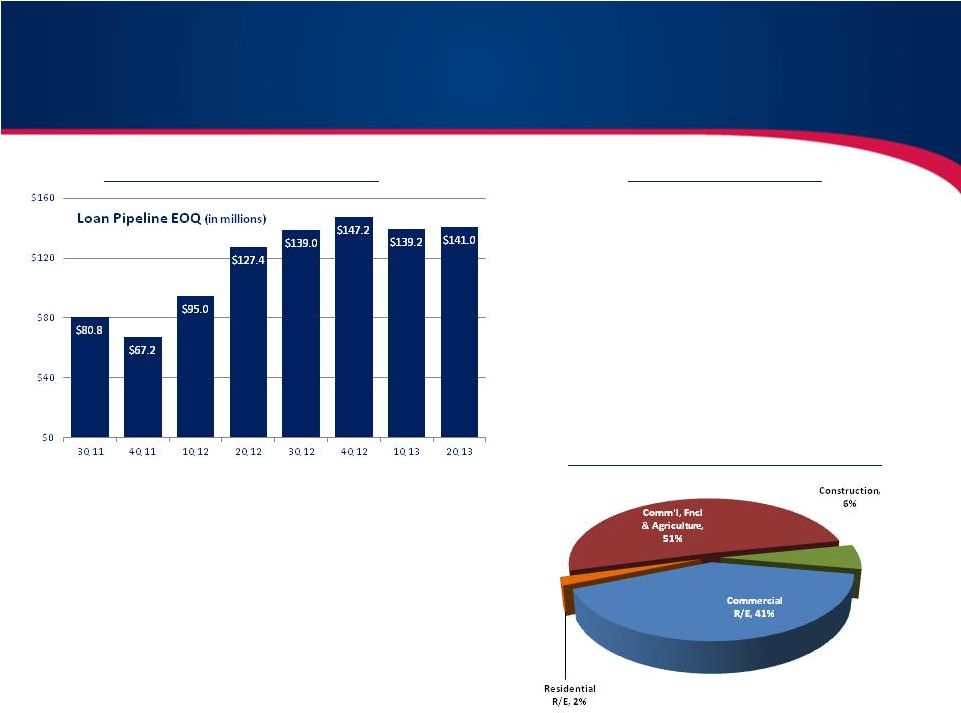

•

Leveraging presence in new markets (top five markets

account for 70% of pipeline: Atlanta, Jacksonville,

Columbia, Savannah, Charleston

•

Upgrading production positions in key markets: limited

changes to expense base but higher levels of quality

production

•

Expanding Mortgage Strategy: Jumbo mortgages,

wholesale, warehouse LOC

•

Leveraging Agricultural expertise: better yields than in

CRE due to limited competition

•

Specialty lines of business that would diversify loan

portfolio

•

Yields on current production approximately

5.01%

•

2/3

rds

of production is with existing customers –

higher rates (40bps-50bps from relationships)

•

Diversified

loan

types

–

not

solely

chasing

CRE

or competing with low rates that do not

compensate for term or quality

10

Loan Portfolio –

strong loan pipelines

Consistent Loan Pipelines¹

Lending

Strategies

Pipeline

Opportunities

by

Type

1 –

Loan pipeline amounts consist of all loans management has deemed a 75% or better likelihood of

closing. |

11

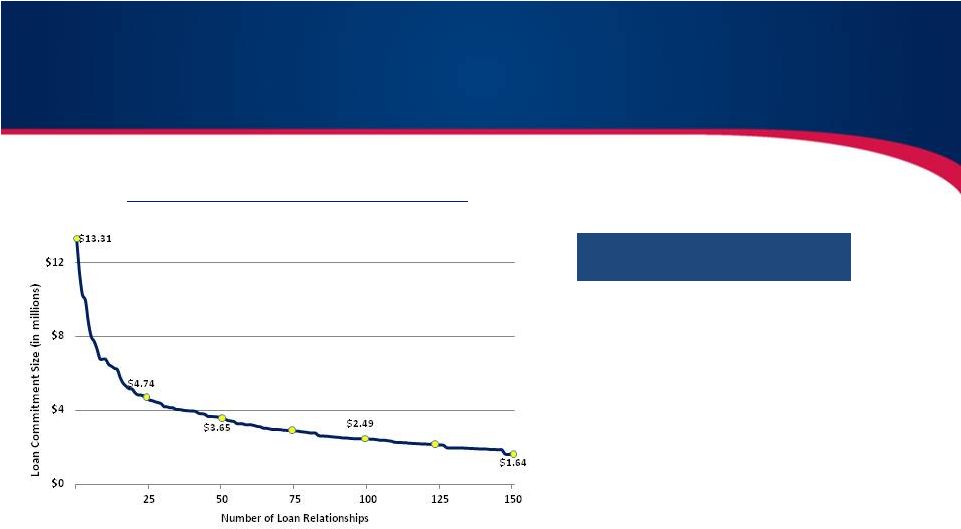

•

$13.3 million

-

Largest Relationship has over 3.0x debt coverage, backed by taxing authority of one of

our local markets.

•

1.98x

–

Weighted average debt coverage of our 25 largest relationships.

•

63% -

Weighted average loan to value on our 25 largest relationships.

Loan Portfolio

Diversified through smaller relationships as well

Portfolio

comprised

of

smaller

relationships

Relationship

Totals

in

Legacy

Portfolio

(in

millions)

Rank

Total O/S

% of total

Top 10

$ 90.6

5.94%

Top 50

$ 275.3

18.06%

Top 100

$ 421.7

27.63%

Top 200

$ 612.0

40.10%

Top 300

$ 738.4

48.38% |

12

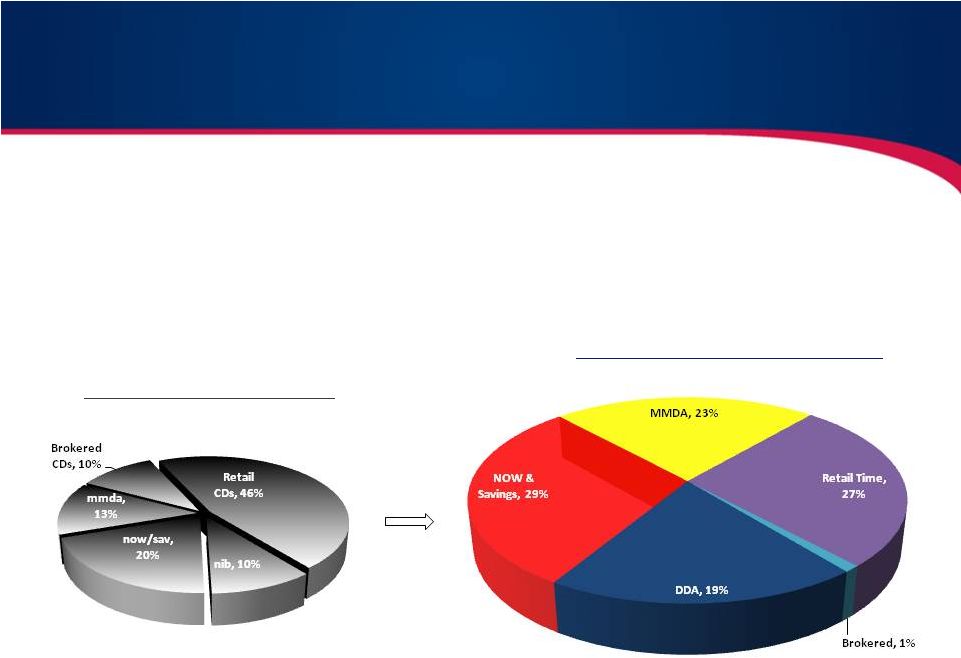

•

$0.44 per share –

Additional earnings embedded in today’s Balance Sheet vs. 2008.

Today’s deposit mix would have reduced interest expense by 30% in 2008, or $16.0

million. •

Built significant value in our core deposit base

•

Focused largely on “Non-Rate Sensitive”

deposits

Significant Value in Deposit Portfolio

Future revenue opportunity is large, and growing

Deposit Composition –

6/30/13

Deposit Composition –

12/31/08 |

13

FDIC Indemnification Asset

Managing towards the end of loss share protection

I/A

–

Indemnification

Asset

for

reimbursement

on

expected

losses

from

the

FDIC

1-

Months remaining to collect remainder of indemnification asset is a weighted average based on

the indemnification asset at 6/30/2013.

2

-

Current

Estimate

of

losses

includes

all

losses

incurred

to

date

as

well

as

reimbursable

expenses

plus

expected

losses

not

incurred for

which there is a corresponding indemnification asset. Original estimate of losses

includes gross losses identified in due diligence and 10% for workout expenses.

Classifieds

Maturing

After L/S

All Loans

Bank

Original I/A

(000's)

Current I/A

(000's)

% of Original

I/A

Remaining

Months to

Collect

Original

Estimate of

Losses (000's)

Current

Estimate of

Losses (000's)

Current

Estimate as a

% of Original

NBV

I/A

NBV

I/A

on

loans

AUB

24,200

1,691

7.0%

14.2

33,275

25,826

77.6%

1,028

39

21,607

1,691

USB

21,640

2,153

10.0%

15.2

29,755

39,095

131.4%

3

-

20,746

2,042

SCB

22,400

2,550

11.4%

21.2

30,800

28,811

93.5%

620

14

35,596

2,305

FBJ

11,307

4,236

37.5%

27.2

15,547

10,819

69.6%

12

50

24,069

4,068

TBC

22,807

3,885

17.0%

28.2

31,360

27,310

87.1%

132

62

34,318

2,565

DBT

112,404

23,512

20.9%

28.2

160,577

135,173

84.2%

1,105

368

105,182

21,895

HTB

49,485

10,511

21.2%

35.1

68,042

52,364

77.0%

1,094

625

65,165

7,762

OGB

45,488

12,319

27.1%

35.1

62,546

34,770

55.6%

216

78

59,194

9,160

CBG

52,664

18,889

35.9%

42.2

72,413

48,780

67.4%

1,565

662

77,848

17,210

362,395

79,746

22.0%

32.6

504,315

402,949

79.9%

5,775

1,899

443,725

68,699 |

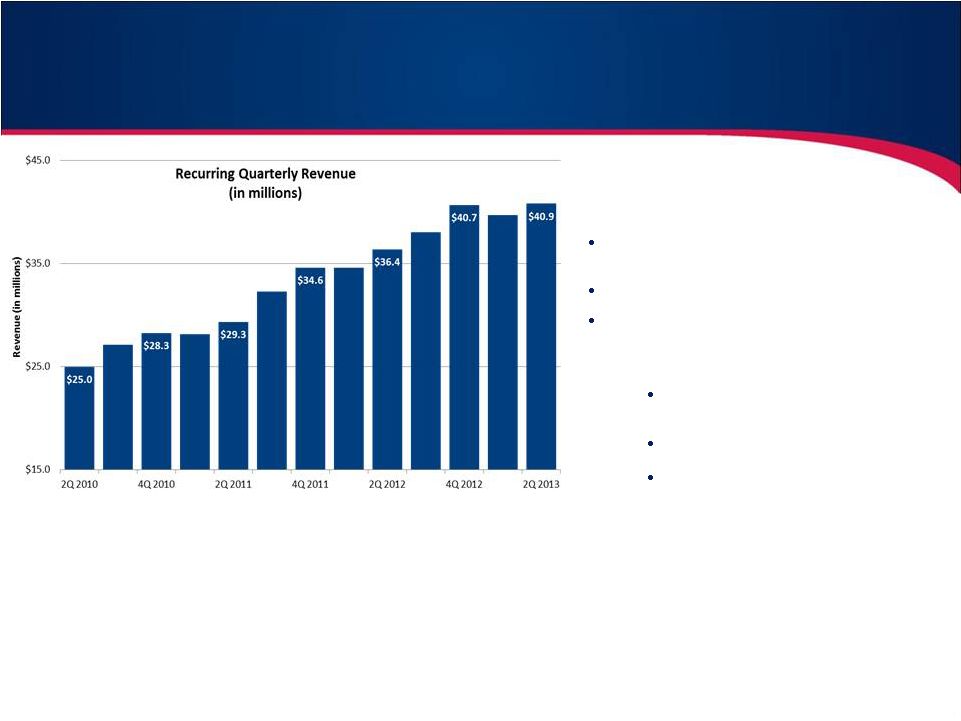

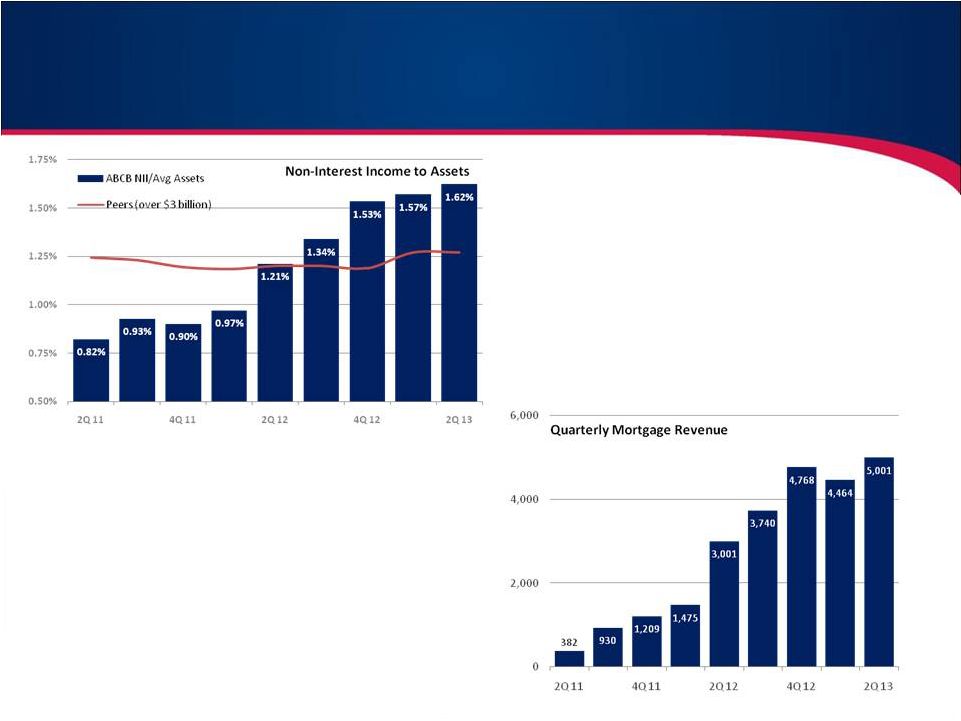

•

2012 -

2013 revenue gains boosted by growing loan portfolio and success in

non-interest income strategies.

•

2013-2015 strategy demands:

•

Diversification of revenue with more emphasis on highly profitable

non-interest income LOB’s that enhance ROA and reduce burden on

capital leverage

•

Protect our advantage from strong net interest margins with emphasis on

creating a highly favorable funding mix

14

Earnings –

Continued Growth in Revenue

Revenue growth through this cycle with

opportunistic strategies:

15%+ compounded annual growth rate in

total revenue over the last three

years Revenue has grown faster than earning

assets Significant amount of assets that

will be deployed over the next

3 years that will

significantly boost revenue and earnings >30% - CGR for mortgage related

revenue

>21% - CGR for debit interchange fees

>8% - CGR for analysis and overdraft

fees

|

15

(1)

Maturity and Repricing Opportunity are amounts and yields maturing in the designated

quarter (2)

Ameris Bank net interest margin on a fully taxable-equivalent basis, excludes H/C level

TRUPs .

Loans

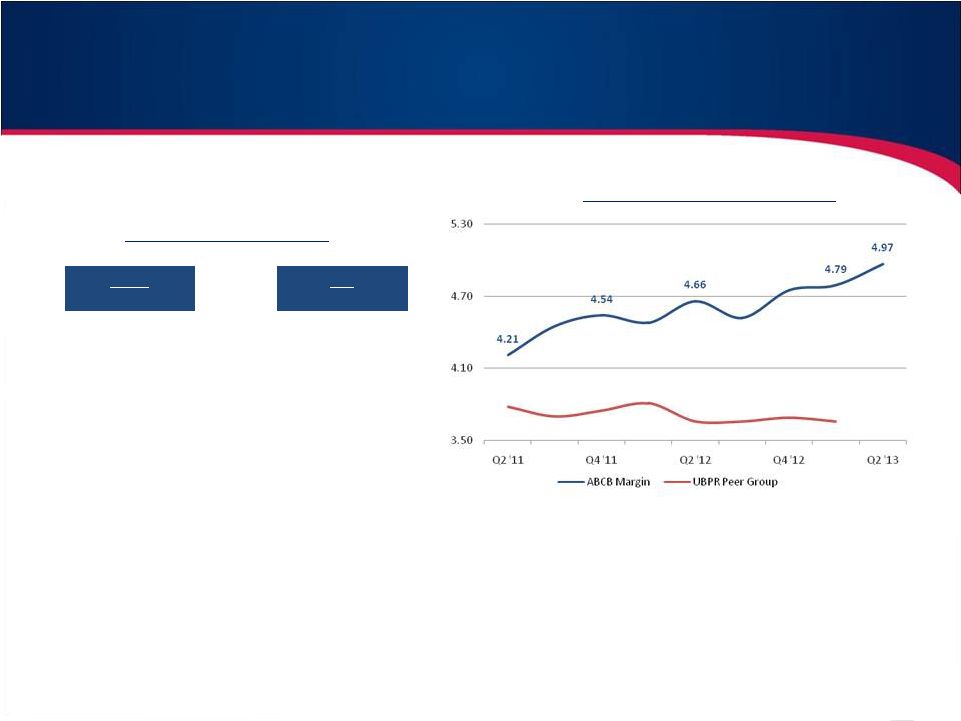

CDs

Quarter

Yield

Quarter

Yield

Q4 '11

5.38%

Q4 '11

0.67%

Q1 '12

5.48%

Q1 '12

0.65%

Q2 '12

5.45%

Q2 '12

0.54%

Q3 '12

5.28%

Q3 '12

0.51%

Q4 '12

5.11%

Q4 '12

0.44%

Q1 '13

5.13%

Q1 '13

0.49%

Q2 '13

5.01%

Q2 '13

0.42%

•

79.6% of lost revenue from loan repricing covered by CD renewal savings.

•

Management expects limited dilution (5-10bps) in NIM from balance sheet repricing and

believes volume expansion can more than offset revenue impacts.

Earnings -

Net Interest Margin

Net Interest Margin

(2)

(%)

“Acquisition Yields” |

16

Serious about building strength and diversification in non-

interest income sources

•

Moving away from deposit charges

•

Researching unique lines of business

•

Momentum in our numbers coming from mortgage

revenue; we believe we can duplicate that strategy

with other LOBs by hiring expertise

Earnings –

Non-Interest Income

2Q 2013 Mortgage Stats:

•

•

•

•

Pretax profit of 32.2% of fee revenue. Believe this is

sustainable in the short-term, trending to industry

average long-term.

70%

purchase

business

vs.

64%

in

the

2

quarter

of

2012.

28% Government

72% Conventional

nd |

17

Details regarding the recently announced Corporate Restructuring:

•

Closed 13 branches

since mid-2012.

•

Reduced

banking

division

and

corporate

headcount

by

85

since

3Q

2012.

(11.2%

of

workforce)

•

To date, we have

retained 75%+ of the loans and deposits.

•

Future efficiency efforts include:

•

RE-engineering loan production and loan maintenance systems

•

Continued downsizing of SAD department commensurate with problem

assets

•

Continue evaluating branch network for underperforming offices or markets

Earnings -

Corporate Restructure & Improved Efficiency

Three Months Ended

Six Months Ended

Jun.

Mar.

Dec.

Sept.

Jun.

Jun.

Jun.

2013

2013

2012

2012

2012

2013

2012

Total Operating Expenses

26,688

28,884

29,791

28,810

26,623

55,572

60,869

Less: Credit related expenses

(2,349)

(4,844)

(2,548)

(3,706)

(3,423)

(7,193)

(16,162)

Less: Mortgage related expenses

(4,717)

(3,721)

(3,589)

(2,958)

(1,861)

(8,438)

(3,344)

Core

Operating

Expenses

-

Ameris

Bank

19,622

20,319

23,654

22,146

21,339

39,941

41,363

Reported Efficiency Ratio

65.32%

72.76%

71.85%

75.68%

70.51%

68.98%

65.63%

Operating efficiency net of credit costs

59.57%

60.56%

65.70%

65.94%

61.45%

60.05%

61.49% |

M&A

Opportunities (Significant opportunity building in our 4-State Footprint)

Southeast Banking Statistics show positive and

negative trends.

(Data

for

563

banks

smaller

than

Ameris

Bank

in

our

four

states)

Improving Ratios:

20%

–

Banks with Texas ratios still over 75%. Down from 28%

one year ago.

18%

–

Banks with capital ratios below 8.00% T1 Leverage.

Down from 22% one year ago. (virtually all from deleveraging)

8%

–

Improvement in the median ROAA (from 0.53% to

0.57%)

Indicators that Consolidation is necessary:

60%

–

Banks with less revenue in 1Q 2013 compared to 1Q

2012.

58%

–

Banks with worse efficiency ratios in 1Q 2013

compared to 1Q 2012.

59%

–

Banks with smaller loan books today than in 1Q

2012.

62%

–

Banks that failed to expand the distance between

net interest income and non-interest expense.

•

Improvement in credit quality and capital levels

of targets and the earnings and multiples of

acquirers should produce continued ramp in

M&A.

•

More banks are shrinking than growing. Fierce

competition for higher quality assets being won

by those that can afford it (those with better

efficiency and funding sources)

•

Too few banks have come to grips with need for

better efficiency. Because growth is constrained,

M&A is evaluated positively against branch

closures, reduction in force strategies, etc.

18 |

Pro Forma

Highlights (1)

•

Natural market extension

adds meaningful scale

•

Improves the value of our

franchise

•

Exceptional pro forma

financial profile

Financial data as of most recent quarter available

(1)

Excludes purchase accounting adjustments

Assets

……………………………

$3.6

billion

Loans

……………………………

2.5

Deposits

……………………………

3.0

Branches

……………………………

69

Acquisition of Prosperity Banking Company -

Proforma

19

Charleston

Columbia

Greenville

Atlanta

Montgomery

Moultrie

Tallahassee

Savannah

Jacksonville

St. Augustine

Ameris

Prosperity |

•

Adds to our growing Northeast Florida presence

•

Higher-growth Florida markets represent a natural connection with our current

footprint •

Opportunity to become one of a few mid-sized community banks in the Jacksonville

MSA •

20+% accretive to EPS

•

Manageable tangible book value dilution and earnback period

approximately 3.25 years •

Ameris to remain “well-capitalized”

•

Market extension with like-minded community bank

•

Leverages management experience in Northeast Florida

•

Experienced

Southeast

acquiror

–

10

deals

in

the

last

4

years

•

Thorough due diligence process completed with 75% of the loan portfolio

and 100% of OREO reviewed

Franchise

Accretive

Financially

Accretive

Low-Risk

Acquisition of Prosperity Banking Company -

Rationale

20 |

Acquiror:

Ameris Bancorp (NASDAQ: ABCB)

Target:

Prosperity Banking Company (Private)

Transaction Value:

(1)

$15.7 million

Consideration Mix:

Up to 50% cash at shareholder election

Per Share Consideration:

3.125 shares ABCB stock or $41.50 in cash per each Prosperity share

Price / Tangible Book Value (%):

88.7%

Capital Raise:

No additional capital required to complete the transaction

Required Approvals:

Customary Regulatory and Prosperity shareholder approvals

Expected Closing:

Late third quarter of 2013

(1)

Assumes stock consideration of 100%; based on ABCB's closing price of $13.32 as of 5/1/13 and

a fixed exchange ratio of 3.1250x Prosperity common shares outstanding of 377,960 as of

12/31/12 Acquisition of Prosperity Banking Company -

Terms

21 |

First Quarter 2013

Investor Presentation |