Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d574173d8k.htm |

1

The Mosaic Company

Investor Presentation

Third Calendar Quarter, 2013

Exhibit 99.1 |

2

Safe Harbor Statement

Safe Harbor

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future financial and operating results. Such statements are based upon the current

beliefs and expectations of The Mosaic Company’s management and are subject to significant

risks and uncertainties. These risks and uncertainties include but are not limited to the predictability and

volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and

transportation markets that are subject to competitive and other pressures and economic and

credit market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international trade risks; changes

in government policy; changes in environmental and other governmental regulation, including greenhouse gas

regulation, implementation of the numeric water quality standards for the discharge of nutrients into

Florida waterways or possible efforts to reduce the flow of excess nutrients into the

Mississippi River basin or the Gulf of Mexico; further developments in judicial or

administrative proceedings, or complaints that Mosaic’s operations are adversely impacting

nearby farms, business operations or properties; difficulties or delays in receiving, increased costs

of or challenges to necessary governmental permits or approvals or increased financial

assurance requirements; resolution of global tax audit activity; the effectiveness of the

Company’s processes for managing its strategic priorities; the ability of Mosaic,

Ma’aden and SABIC to agree upon definitive agreements relating to the prospective Northern

Promise joint venture, the final terms of any such definitive agreements, the ability of the

joint venture to obtain project financing in acceptable amounts and upon acceptable terms, the

future success of current plans for the joint venture and any future changes in those plans;

adverse weather conditions affecting operations in Central Florida or the Mississippi River basin or the Gulf

Coast of the United States, and including potential hurricanes, excess rainfall or drought; actual

costs of various items differing from management’s current estimates, including, among

others, asset retirement, environmental remediation, reclamation or other environmental

regulation, or Canadian resources taxes and royalties; brine inflows at Mosaic’s

Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions

involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic

events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties

reported from time to time in The Mosaic Company’s reports filed with the Securities and

Exchange Commission. Actual results may differ from those set forth in the forward-looking

statements.

|

3

Well positioned to benefit from projected positive long term fundamentals

Largest combined phosphate and potash player in the world

High quality assets

Scale

Geographically diverse

Leading position in premium products

Strong financial track record

Robust operating cash flows

Clearly outlined capital priorities

Experienced management team focused on execution and operational

excellence

Investment Highlights |

The Food Story Remains

Compelling •

Pent up demand with 2012/13

US Corn exports down 54%

year-to-date

•

The likely case builds back

one-half of the inventory

drawdown this year

•

Agricultural commodity prices

likely to remain elevated in

2013/14

Considerations

607

579

494

406

469

462

426

437

514

570

548

536

502

350

400

450

500

550

600

650

00/01

02/03

04/05

06/07

08/09

10/11

12/13F

Mil Tonnes

World Grain & Oilseed Stocks

Historical

2013/14 Range

2013/14 Medium Scenario

USDA

Source: USDA and Mosaic

4

2013/14 Grain and Oilseed Scenario Assumptions

Low

Medium

High

Harvested Area Change

1.25%

1.50%

1.75%

Yield Deviation from Trend *

Largest Negative

0.00

Largest Positve

Demand Growth

2.50%

3.25%

3.75%

* Largest deviation from the 13-year trend 2000-2012 in MT HA |

5

Limited

arable land

Mosaic’s Role in Feeding the World

Optimum use of crop nutrients is essential

to growing the food the world needs today

and tomorrow

Crop nutrients directly account for 40 to 60

percent of crop yields

World population is expected reach

9+ billion people by 2050*

* Source: IHS Global Insight

Need to

Improve

Yield

Population

Growth

Long-Term

Sustainability |

6

Focused on Phosphate & Potash

Mosaic is in great position to be

the world’s leading crop nutrition company

Agriculture

Crop

Nutrition

Phosphate

& Potash

•

Attractive sector

•

Best business

within agriculture

•

Most compelling

nutrients |

7

Top 4 Global Potash Producer

Potash: The Regulator

Obtained through underground or

solution mining

80 percent of reserves in Canada

and Russia

Over a century of reserves

10.7 million tonnes of operational

capacity

One of the largest potash producers

in the world

Potash expansions:

•

~$3 billion in capital, 3 million tonnes

•

On time, on scope, on budget

•

Delaying future 2 million tonne

projects

55-57

Source: Fertecon and Mosaic

0

10

20

30

40

50

60

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

13F

Million tonnes KCL

World Muriate of Potash Shipments

China

North Am

Brazil

India

Indo/Malay

Other

Estimated long-term growth 2.5 to 3.5 percent |

8

The Leading Global Phosphates Producer

Phosphate: The Energizer

Sedimentary and igneous

formations

Large economically viable reserves:

North Africa, Western China,

Central Florida and Russia

Largest producer of concentrated

phosphate crop nutrients with 12

percent of world capacity

Over 35 years of rock reserves

Low cost manufacturer

Premium products

Global distribution facilities

JV in Peru and announced

Saudi Arabia JV

63-65

Source: Fertecon and Mosaic

Estimated long-term growth 2.5 to 3.0 percent

0

10

20

30

40

50

60

70

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

13F

Million tonnes

DAP/MAP/TSP

World Processed Phosphate Shipments

China

India

North Am

Brazil

Europe/FSU

Other |

9

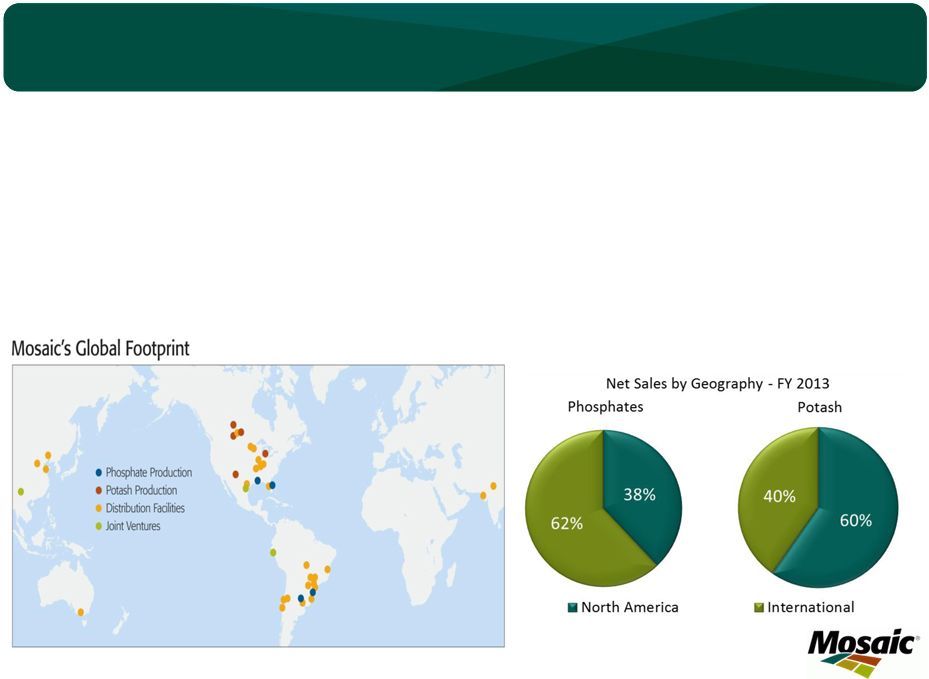

A Global Presence

•

Ship product to approximately 40 countries

•

Member of Canpotex and PhosChem

export associations

•

Balance seasonal demand to improve

operating efficiency

•

Market intelligence to improve decision

making

Mines and Chemical plants in stable

geopolitical regions

Global distribution capabilities with local

presence provides additional flexibility to

maximize cash flow generation: |

10

MicroEssentials

®

Growth

Source: Mosaic

North America

Brazil

MicroEssentials

®

Share of Phosphate Sales (Fiscal Year)

1.7%

3.3%

5.5%

6.9%

9.3%

>10%

0%

2%

4%

6%

8%

10%

12%

2008

2009

2010

2011

2012

2013

0.7%

0.7%

1.7%

4.0%

5.0%

>6%

0%

1%

2%

3%

4%

5%

6%

7%

2008

2009

2010

2011

2012

2013 |

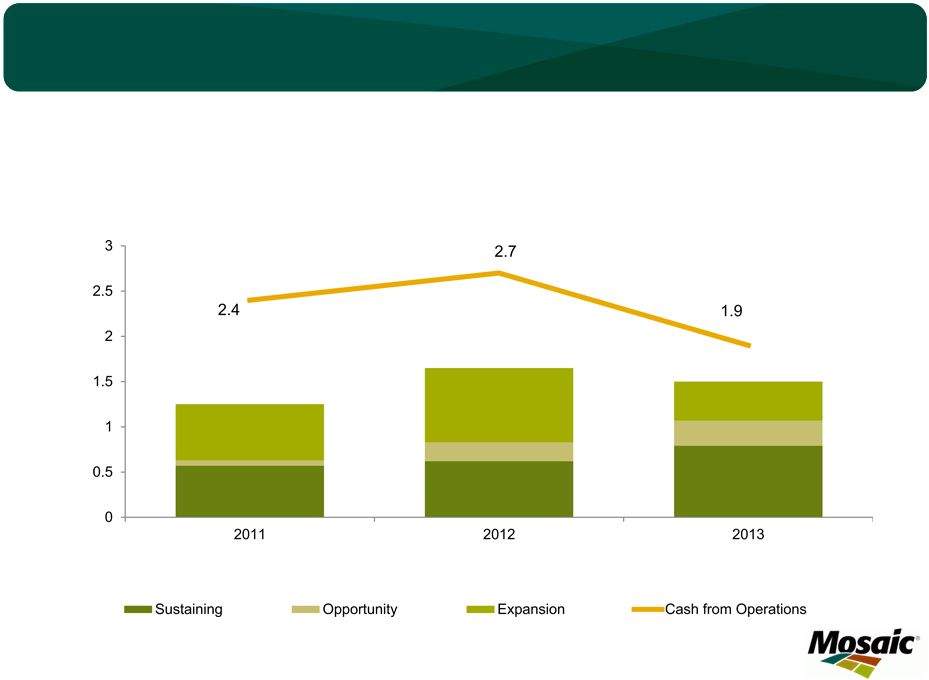

11

Operating Cash Flow vs. Investments

$ In Billions

CAPITAL EXPENDITURES

AND NET OPERATING CASH FLOW |

12

Investing for Growth

The company expects to generate appropriate risk-adjusted

returns for each investment.

* Not fully approved investments

Calendar year

$ in billions

$0.0

$0.5

$1.0

$1.5

2013

2014

2015

2016

Potash Mines

Ma'aden JV

Ammonia Plant*

International & Supply Chain* |

13

Surplus Cash & Capacity

*See additional detail on reconciliation at back of slides

$2 billion of Excess Cash

$3 billion of Debt Capacity

Share Repurchases

ARO Escrow

Strategic Investments |

14

Our Strategic Priorities

People

Growth

Market Access

Innovation

Total Shareholder

Return |

2013 –

A Year of Success!

New safety record

Potash expansions on track on budget

Benefits of tolling agreement reversion

Northern Promise JV (Saudi Arabia)

Continued

MicroEssentials

momentum

South Fort Meade productivity

AEIS –

a stepping stone to new permits

Strategic review completion and capital philosophy

rollout

Accomplishments

Focused on:

execution and

delivering results

15

® |

16

Strategic Priority: Shareholder Value

Our TSR goal:

Top 3 among 10 global crop nutrient peers

Execute our

strategy

Deliver

strong value

Return

capital to

shareholders |

Supplemental Mosaic Information |

18

Potash Segment Highlights

In millions, except MOP price

Q4 FY13

Q3 FY13

Q4 FY12

Net sales

$1,031

$758

$1,037

Gross Margin

$489

$308

$514

Percent of net sales

47%

41%

50%

Operating earnings

$445

$216

$464

Sales volumes

2.6

1.8

2.0

Production volume

2.5

2.0

1.9

Production operating rate

95%

78%

85%

Avg MOP selling price

$368

$385

$455

1.

Net sales were roughly flat year over year as record potash sales volumes were

offset by lower realized prices. Decline in realized prices was driven

by both lower market prices for MOP, as well as higher mix of international

volumes which are mostly standard grade.

2.

Operating earnings decline was driven by lower realized prices, as well as higher

labor and depreciation expenses, partially offset by higher volumes.

Fourth quarter highlights: |

19

Phosphates Segment Highlights

In millions, except DAP price

Q4 FY13

Q3 FY13

Q4 FY12

Net sales

$1,670

$1,502

$1,789

Gross Margin

$290

$266

$322

Percent of net sales

17%

18%

18%

Operating earnings

$198

$197

$224

Sales volumes

2.9

2.6

2.9

NA

production

volume

2.1

2.1

2.1

Finished product operating rate

85%

87%

86%

Avg DAP selling price

$483

$496

$494

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

Fourth quarter highlights:

1.

(a)

Gross margin and operating earnings decline was driven by lower realized prices,

higher ammonia costs and higher plant spending, partially offset by lower

phosphate rock and sulfur costs. |

20

Category

Guidance –

Calendar Q3 2013

Potash

Q3

Sales

volume

1.8

–

2.1

million

tonnes

Q3

MOP

selling

price

$330

-

360

per

tonne

Q3 Gross margin rate in the mid to high 30

percent range

Q3 Operating rate below 75 percent

Turnaround days

Curtailing production at the Colonsay mine

Canadian Resource Taxes

and Royalties

$60 -

80 million

Brine Management

$50 -

60 million

Financial Guidance Summary |

21

Category

Guidance –

Calendar Q3 2013

Phosphates

Q3

Sales

volume

2.9

–

3.3

million

tonnes

Q3

DAP

selling

price

$430

-

$465

per

tonne

Q3 Operating rate in the mid 80 percent range

Q3 Gross margin rate to be flat with last quarter

Corporate

Total SG&A –

Q3CY13

$95 -

105 million

CAPEX & Investments –

7 month

$900 million to $1.1 billion

Effective Tax Rate –

7 month

Mid 20-percent range, excluding notable items

Financial Guidance Summary |

22

Potash Expansion

•

Expansions on time,

on budget

•

Postpone

indefinitely

remaining two

million tonne

expansions

0

2

4

6

8

10

12

14

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

FISCAL YEAR

CUMULATIVE CAPACITY ADDITIONS

MILLION TONNES

CONSTRUCTION IN PROGRESS

REVERSION OF TOLLING AGREEMENT

EXISTING AND CONSTRUCTION COMPLETE |

Market Data and Outlook |

24

Farmers will need to harvest record

area and reap ever increasing yields in

order for global grain and oilseed supply

to keep pace with projected demand

The Food Story by the Numbers

The Food Story by the Numbers

•

Steady and predictable demand growth

•

Population and per capital income key

drivers

•

Our long term forecasts consistent with

those from several other sources

Long Term Grain and Oilseed Demand

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

80

85

90

95

00

05

10

15

20

25

30

50

Mil Tonnes

Source: USDA and Mosaic

World Grain and Oilseed Use

Actual for U.S. Ethanol

Actual

Forecast for U.S. Ethanol

Forecast

1.75

2.00

2.25

2.50

2.75

3.00

3.25

3.50

3.75

750

775

800

825

850

875

900

925

950

80

85

90

95

00

05

10

15

20

25

30

MT Ha

Mil Ha

Source: USDA and Mosaic

World Harvested Area and Average Yield

Actual Area

Forecast Area

Actual Yield

Required Yield

1980-10 Yield Trend

24 |

25

Crop Nutrient Affordability Near Record Levels

•

Revenue per acre

matters!

•

Strong farm income even

with lower commodity

prices

•

Near record crop nutrient

affordability

Considerations

0.50

0.75

1.00

1.25

1.50

1.75

05

06

07

08

09

10

11

12

13

Plant Nutrient Affordability

Plant Nutrient Price Index / Crop Price Index

Affordability Metric

Average

Source: Green Markets, CME,

USDA, AAPFCO, Mosaic |

26

North America

Fears of large drought-related declines prove unfounded

Outstanding fall and spring application seasons

Outstanding North American shipments

Source: Mosaic Estimates |

27

Brazil

Record Brazilian shipments and P&K import forecasts for 2013

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12E

13F

Mil Tonnes

Brazil Processed Phosphate Import Demand

TSP

MAP/MES

DAP

Source: Fertecon, ANDA and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12E

13F

Mil Tonnes

KCl

Brazil Muriate of Potash Imports

Source: Fertecon,

IFA and Mosaic

27 |

India

•

Indian Nutrient Based Subsidy program

increased the farm price of:

-

MOP by 280%

-

DAP by 160%

-

But left the price of urea flat

•

Subsidy changes cause a serious

nutrient imbalance

-

Over application of N

-

Under application of P&K

-

Target N-P-K ratio: 1-.50-.25

-

Actual N-P-K ratio: 1-.40-.13

•

Implies target vs. actual use gap of:

-

3.1 mmt of MOP

-

2.8 mmt of DAP

Subsidy Changes Stunt P&K Demand Growth |

29

•

Positive demand outlook

-

2.3%-3.1% CAGR

-

Most likely scenario: Shipments

increase from 58 mmt in 2010 to

75 mmt in 2020

•

New capacity outpaces

demand growth in near term

-

Demand growth stunted by India

-

China builds its last plants

-

Ma’aden I reaches capacity

-

New OCP granulation units and

first Jorf Lasfar hubs on line

-

Ma’aden and OCP account for

75% of non-Chinese additional

capacity this decade

•

How quickly demand absorbs

new capacity depends on:

-

Ag commodity prices and the pace

of demand growth

-

Chinese production and exports

-

Performance of Ma’aden I

-

Timing of Ma’aden II

-

Timing of OCP JPH developments

P: Will supply keep pace with demand?

Source: Mosaic Estimates

-2.5

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

20.0

22.5

11

12

13

14

15

16

17

18

19

20

Mil Tonnes

DAP/MAP/TSP

Most Likely Phosphate Capacity vs. Shipment Scenarios

Cumulative Change 2010-20

Other

India (JV Acid)

China

Ma'aden

OCP (P 1&2 + JPH 1&2)

OCP (JPH 3&4)

Shipments

-

Low

(2.3%

CAGR)

Shipments

-

Medium (2.6% CAGR)

Shipments

-

High

(3.1%

CAGR)

Long Term Prospects |

30

K: Will demand keep pace with supply?

•

Positive demand outlook

-

3.3%-3.4% CAGR

-

Most likely scenario: MOP

shipments increase from 53 mmt

in 2010 to 71 mmt in 2020

•

Significant new capacity this

decade (most likely scenario):

-

MOP operational capacity

increases from 60 mmt in 2010 to

80-81 mmt KCl in 2020

-

Potential brownfields account for

80% of the projected increase

-

Potential greenfield projects from

large mining or plant nutrient

companies for strategic reasons

•

How quickly demand absorbs

new capacity depends on:

-

Ag commodity prices and the pace

of demand growth

-

Timing of later stage brownfield

expansions in Canada and FSU

-

Timing of potential greenfield

developments

Source: Mosaic Estimates

-2

0

2

4

6

8

10

12

14

16

18

20

22

24

11

12

13

14

15

16

17

18

19

20

Mil Tonnes KCl

Most Likely Potash Capacity vs. Shipment Scenarios

Cumulative Change 2011-20

Canada Brownfield

FSU Brownfield

Other Brownfield

Eurochem

-

Russia

K&S -

Legacy

BHP

-

Jansen Lake (after 2020)

PRC

-

Argentina (after 2020)

Shipments

Low

-

2.3%

CAGR

Shipments

Medium

-

2.9%

CAGR

Shipments High

-

3.4% CAGR

Long Term Prospects |

|

Selected Non-GAAP Financial Measures and Reconciliations

As of May 31, 2012

US$ Millions

US$ Millions

FY12

FY11

FY10

FY09

FY08

Net earnings

1,930

$

2,515

$

827

$

2,350

$

2,083

$

+ Interest (income) expense, net

(19)

5

50

43

91

+ Income tax expense (benefit)

711

753

347

649

715

+ Depreciation, depletion & amortization

508

447

445

361

358

EBITDA

3,130

$

3,720

$

1,669

$

3,403

$

3,247

$

Short Term Debt

43

$

Long Term Debt

1,011

Unfunded Pension Obligations

89

Lease Obligations (Annual Rental Expense x 6)

480

Total Adjusted Debt *

1,623

$

* Estimated based on written description of rating agency methodology

EBITDA 5-Year Average

3,034

$

32 |