Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | d574184d8k.htm |

| EX-99.2 - EX-99.2 - IDEX CORP /DE/ | d574184dex992.htm |

Second Quarter 2013 Earnings Release

July 23, 2013

IDEX PROPRIETARY & CONFIDENTIAL

Exhibit 99.1 |

2

IDEX PROPRIETARY & CONFIDENTIAL

Agenda

IDEX Outlook

Q2 Financial Performance

Q2 Segment Performance

Fluid & Metering

Health & Science

Fire & Safety / Diversified

Guidance Update

Q&A |

3

Replay Information

•

Dial toll–free: 855.859.2056

•

International: 404.537.3406

•

Conference ID: #26074056

•

Log on to: www.idexcorp.com

IDEX PROPRIETARY & CONFIDENTIAL |

4

IDEX PROPRIETARY & CONFIDENTIAL

This presentation

and

discussion

will

include

forward-

looking

statements.

Our actual

performance

may

differ

materially

from

that

indicated

or

suggested

by

any

such

statements.

There

are

a

number

of

factors

that

could cause those differences, including those presented in our most

recent annual report and other company filings with the SEC.

Cautionary Statement Under the Private Securities Litigation Reform Act

|

5

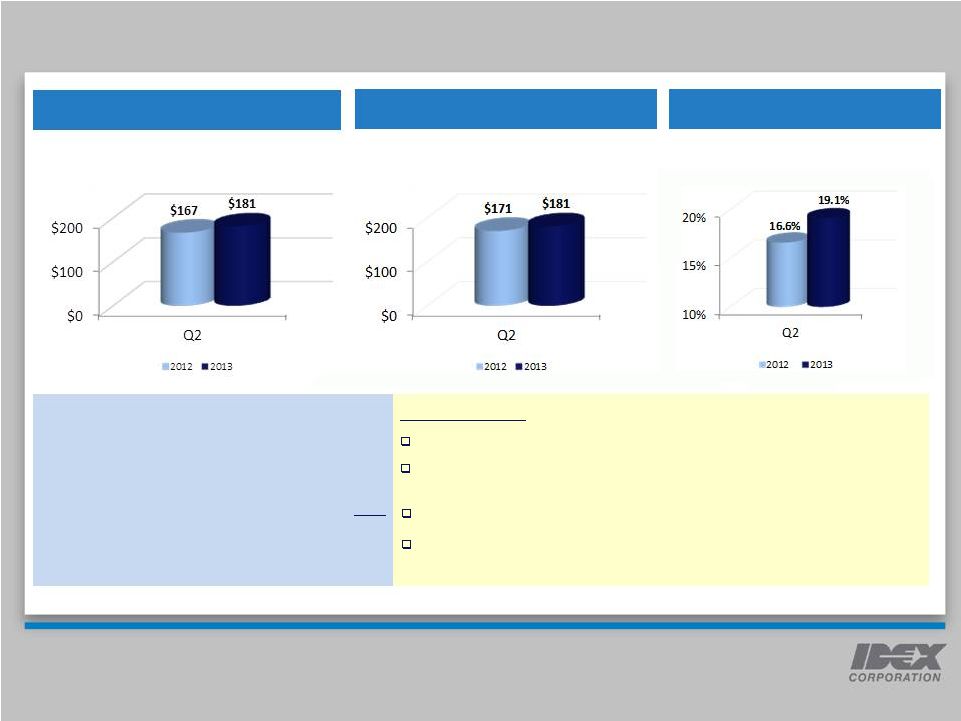

IDEX Q2 Financial Performance

Revenue

Organic: 2% growth

70 bps expansion

46% growth

13% growth

EPS*

Operating Margin*

Free Cash Flow

* Q2

2012

EPS

/

Operating

Margin

data

adjusted

for

restructuring

expenses

($2.6M)

Outstanding EPS, Margin & FCF performance

IDEX PROPRIETARY & CONFIDENTIAL |

6

IDEX PROPRIETARY & CONFIDENTIAL

Fluid & Metering

Orders

Revenue

Q2 Sales Mix:

Organic

7%

Acquisition

0%

Fx

0%

Total

7%

Q2

Summary:

Organic: 7% growth

280 bps expansion

Organic: 10% growth

Operating Margin*

* Q2 2012 Operating Margin data adjusted for restructuring expense

Q2 Operating margin of 24.9% up 280 bps

Municipal water services showing signs of stabilization in North

America

Ag orders pushed out of Q1 were realized in Q2

Energy continues to see benefit of rebounding LPG market in North America

Operating margin improved 280 bps on volume strength, the

continued benefit of cost-out actions and disciplined management

Excellent improvement in organic orders and revenue, driven by

strength in Energy and Ag |

7

Health & Science

Orders

Revenue

Organic: 2% decline

250 bps expansion

Organic: 1% growth

Operating Margin*

* Q2 2012 Operating Margin data adjusted for restructuring expense

Q2 Sales Mix:

Organic

-2%

Acquisition

9%

Fx

-1%

Total

6%

Q2

Summary:

Successfully managed costs to deliver margin expansion

Organic sales declined year-over-year, but grew 2 percent sequentially

Operating margins expanded 250 basis points on the strength of focused

cost-out initiatives

Scientific Fluidics has strengthened in North America and Europe

Optics & Photonics operating margins have improved while order activity

remains challenged

IDEX PROPRIETARY & CONFIDENTIAL |

8

Fire & Safety/Diversified

Orders

Revenue

Organic: 1% decline

270 bps decline

Organic: 3% growth

Operating Margin*

* Q2 2012 Operating Margin data adjusted for restructuring expense

Q2 Sales Mix:

Organic

-1%

Acquisition

0%

Fx

0%

Total

-1%

Q2

Summary:

facility consolidation

IDEX PROPRIETARY & CONFIDENTIAL

FSG continues to drive exceptional profitability improvements after

Op margin decline due to a charge associated with a facility closure

Strong organic order growth contributions from FSG and Dispensing

X-Smart product continues to gain traction in emerging markets

FSG & Rescue seeing pickup in Eastern European and Chinese markets

|

9

IDEX PROPRIETARY & CONFIDENTIAL

Outlook: 2013 Guidance Summary

Q3 2013

•

EPS

estimate

range:

$0.72

–

$0.74

•

Organic

revenue

growth

~

3

–

4%

•

Positive revenue impact from acquisition of ~ 2%

•

Operating margin ~ 19%

FY 2013

–

Organic revenue growth ~ 3%

–

Positive revenue impact from acquisition of ~ 2%

–

Operating margin ~ 19%

–

Negative Fx impact ~ 1% to sales

–

Tax rate ~ 29%

–

Cap Ex ~ $36 -

$38M

–

Free Cash Flow will significantly exceed net income

–

Continued share repurchases

–

EPS estimate excludes future acquisitions and associated costs and charges

•

EPS estimate

range:

$2.93

–

$2.98

•

Other modeling items |

10

IDEX PROPRIETARY & CONFIDENTIAL

Q&A |