Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - BMC SOFTWARE INC | d572917dex312.htm |

| EX-31.1 - EX-31.1 - BMC SOFTWARE INC | d572917dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-16393

BMC Software, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 74-2126120 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 2101 CityWest Boulevard Houston, Texas |

77042-2827 | |

| (Address of principal executive offices) | (Zip Code) |

(713) 918-8800

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $.01 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was approximately $6,429,383,000 at September 30, 2012 based upon the closing sale price of the Common Stock on the NASDAQ Stock Market reported on such date.

As of July 25, 2013, there were 141,929,434 outstanding shares of Common Stock, par value $.01, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended March 31, 2013 (the “Original Form 10-K”) of BMC Software, Inc. filed with the Securities and Exchange Commission (the “SEC”) on May 9, 2013. This Form 10-K/A is being filed to include certain information that was to be incorporated by reference from our definitive proxy statement (pursuant to Regulation 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) for our 2013 Annual Meeting of Stockholders (the “2013 Proxy Statement”). This Form 10-K/A hereby amends and restates in their entirety Items 10 through 14 of Part III of the Original Form 10-K as well as the cover page to remove the statement that information is being incorporated by reference from the 2013 Proxy Statement.

Except as otherwise expressly noted herein and the filing of related certifications, this Form 10-K/A does not amend any other information set forth in the Original Form 10-K, and we have not updated disclosures contained therein to reflect any events that occurred at a date subsequent to the date of the Original Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and our other filings with the SEC.

Unless the context requires otherwise, all references to “BMC Software,” “BMC,” “we,” “our” and “us” mean BMC Software, Inc., a Delaware corporation, and one or more of its subsidiaries.

Table of Contents

BMC Software, Inc.

Form 10-K/A

| 10-K/A PART AND ITEM NO. |

Page | |||||

| PART III |

||||||

| ITEM 10. | 2 | |||||

| ITEM 11. | 13 | |||||

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

40 | ||||

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

43 | ||||

| ITEM 14. | 44 | |||||

| PART IV |

||||||

| ITEM 15. | 47 | |||||

1

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

DIRECTORS

The size of our Board of Directors (the “Board”) is currently set at 13 directors. Each director is elected annually to serve until the next Annual Meeting of Stockholders (the “Annual Meeting”) and until his or her successor is elected and qualified. Each of the directors listed below was elected by the stockholders at the last Annual Meeting.

| Name |

Age | Position and Office Held |

Director Since |

|||||

| Robert E. Beauchamp |

53 | Director – Chairman of the Board, President and Chief Executive Officer |

2001 | |||||

| Jon E. Barfield |

61 | Director – Independent, Lead Director | 2001 | |||||

| Gary L. Bloom |

52 | Director – Independent | 2007 | |||||

| John M. Dillon |

63 | Director – Independent | 2012 | |||||

| Meldon K. Gafner |

65 | Director – Independent | 1987 | |||||

| Mark J. Hawkins |

54 | Director – Independent | 2010 | |||||

| Stephan A. James |

66 | Director – Independent | 2010 | |||||

| P. Thomas Jenkins |

53 | Director – Independent | 2004 | |||||

| Louis J. Lavigne, Jr |

65 | Director – Independent | 2008 | |||||

| Kathleen A. O’Neil |

61 | Director – Independent | 2002 | |||||

| Alex Pinchev |

63 | Director – Independent | 2012 | |||||

| Carl James (Jim) Schaper |

61 | Director – Independent | 2012 | |||||

| Tom C. Tinsley |

60 | Director – Independent | 1997 | |||||

Director Information and Qualifications

Listed below are the biographies of each director. The biographies include information regarding each individual’s service as a director of the Company, business experience and principal occupations for at least the past five years, director positions at public companies held currently or at any time during the past five years, and the experiences, qualifications, attributes or skills that led the Corporate Governance & Nominating Committee (the “Governance Committee”) to recommend, and the Board to determine, that the person should serve as a director for the Company. In addition to the information presented below regarding each director's specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our directors have a reputation for integrity, sound judgment and excellent analytical skills. Each of our directors has demonstrated business acumen and a commitment of service to the Company and our Board and complements the attributes and skills of the other directors.

Robert E. Beauchamp. Mr. Beauchamp has served as Chairman of the Board since October 2008 and has served as our President and Chief Executive Officer and a member of the Board since January 2001. He brings to these positions a thorough understanding of our business with experience in key areas, including business strategy, research and development, marketing and sales. Mr. Beauchamp joined us in 1988, dedicating six years to the sales organization and progressing from senior account representative to sales manager. While in sales he gained a solid understanding of the business issues our customers face on a daily basis. He joined our marketing organization in 1994, becoming Vice President, Strategic Marketing & Development in 1996, and subsequently assumed responsibility for our mergers and acquisitions efforts. Prior to his selection as President and Chief Executive Officer, he further developed his knowledge of our Company and the software business as Senior Vice President of Product Management and Development. Mr. Beauchamp has been active and served on the boards of numerous non-profit, industry and civic organizations during his career and currently serves on the board of National Oilwell Varco, Inc., a public company, and as a member of the Board of Regents for Baylor University.

As the Company’s Chief Executive Officer for the past 12 years and an employee of the Company with increasing levels of responsibility for nearly 25 years, Mr. Beauchamp brings to the Board extensive knowledge of the software industry and an in-depth understanding of all aspects of the Company, including its customers, operations, competitive landscape and key business drivers.

2

Table of Contents

Jon E. Barfield. Mr. Barfield has served as our Lead Director since January 2010 and has been a director since 2001. Mr. Barfield is President and Chief Executive Officer of LJ Holdings Investment Company LLC, a private investment company. In March 2012, he retired from The Bartech Group, Inc. (“Bartech”) where he served since 1981 as President and from 1995 to March 2012 as Chairman and President, of this industry-leading professional services firm, with headquarters in Southfield, Michigan, delivering talent management and managed service provider solutions to Global 1000 firms. Bartech employs and manages the daily work assignments for more than 26,000 associates and more than $2 billion in procurement for major employers around the world, making Bartech one of the largest, independent talent management and managed service provider firms in the United States. During the past five years, he previously served as a director of Motorola Mobility Holdings, Inc. and National City Corp. He has been a director of CMS Energy since August 2005.

A graduate of Princeton University and Harvard Law School, Mr. Barfield brings to the Board legal knowledge and experience, having practiced corporate and securities law at Sidley Austin LLP. His qualifications to serve as a director stem primarily through his experiences as a senior leader, and his varied service as a director with considerable experience regarding legal risk oversight and risk management, financial reporting, attracting and retaining key talent and related human resources experience, corporate governance and mergers and acquisitions (“M&A”).

Gary L. Bloom. Mr. Bloom has been a director since 2007. Mr. Bloom is currently the President and Chief Executive Officer of MarkLogic Corporation, a privately held software company, having assumed this role in May 2012. From March 2010 until January 2012, he served as Chief Executive Officer of eMeter, Inc., a privately held software company that was acquired by Siemens Corporation in January 2012. From December 2006 to December 2009, Mr. Bloom was a consultant of Texas Pacific Group, a global private investment firm. Mr. Bloom served as Vice Chairman and President of Symantec Corporation from July 2005 to March 2006. Mr. Bloom joined Symantec through its merger with VERITAS Software Corporation, where he served as President and Chief Executive Officer from November 2000 to January 2002, and Chairman, President and Chief Executive Officer from January 2002 to July 2005. Mr. Bloom joined VERITAS after a 14-year career with Oracle Corporation, rising to the rank of Executive Vice President. During the past five years, Mr. Bloom served on the board of Taleo Corporation until it was acquired by Oracle in April 2012.

Through his 25 years of software company experience, including as a former Chief Executive Officer of a publicly traded software company, and service on other public software company boards, Mr. Bloom brings to the Board extensive knowledge of the software industry and specific insights into the operational and strategic issues facing the Company. Mr. Bloom also brings to the Board technology M&A experience both as a Chief Executive Officer and as a board member.

John M. Dillon. Mr. Dillon has been a director since July 2012. Since January 2009, Mr. Dillon has served as the Chief Executive Officer of Engine Yard, Inc., the leading cloud platform for automating and developing Ruby on Rails and PHP applications. From 2002 to 2008, Mr. Dillon served as Chief Executive Officer for Navis, Inc., a private company specializing in software systems for operating large marine container terminals and distribution centers. Before Navis, he served as Chief Executive Officer for Salesforce.com and as President and Chief Executive Officer of Hyperion Solutions. Mr. Dillon began his career as a Systems Engineer for Electronic Data Systems Corporation (“EDS”) and then moved into a variety of sales management positions for various high-tech companies, including Oracle Corporation. Mr. Dillon served on active duty in the nuclear submarine service for five years before beginning his civilian career. Mr. Dillon holds a Bachelor’s degree in Engineering from the United States Naval Academy and an MBA from Golden Gate University. Mr. Dillon currently serves on the board of TransAct Technologies Incorporated and Centerpointe Community Bank, both public companies. During the past five years, Mr. Dillon served on the board of Epicor Software, a public company.

With his engineering background, numerous executive positions with leading technology companies and current position as Chief Executive Officer of a cloud-based software development company, Mr. Dillon brings to the Board extensive knowledge of research and development organizations, software development and the technology industry generally.

Meldon K. Gafner. Mr. Gafner is a private investor. For the past five years, he has been self-employed as a consultant in the communications technology field. From 1988 to 1997, he served in various leadership roles, including as Chief Executive Officer and Vice Chairman, with ComStream Corporation, a privately held manufacturer of high-speed satellite earth stations for data distribution.

As a result of his professional experiences, Mr. Gafner possesses knowledge and experience in management of companies focusing on technology-driven innovation. Mr. Gafner has also served for more than 20 years on the Board affording institutional continuity and industry knowledge accumulated through various industry and economic cycles and through the Company’s growth during that period.

3

Table of Contents

Mark J. Hawkins. Mr. Hawkins has been a director since 2010. Mr. Hawkins has served as Executive Vice President and Chief Financial Officer of Autodesk, Inc. since April 2009. Prior to joining Autodesk, Mr. Hawkins served as Chief Financial Officer and Senior Vice President of Finance and Information Technology at Logitech International S.A. from April 2006 to April 2009. He was employed by Dell Inc. in various finance roles from 2000 to 2006, most recently serving as Vice President of Finance for worldwide procurement and logistics. Prior to joining Dell, Mr. Hawkins was employed by Hewlett-Packard Company for 18 years in finance and business-management roles.

As a Chief Financial Officer of a publicly traded software company, Mr. Hawkins brings to the Board global financial management expertise in the technology industry, including experience in the areas of accounting, capital markets and information technology management.

Stephan A. James. Mr. James has been a director since 2010. Mr. James is the former Chief Operating Officer of Accenture Ltd., and served as Vice Chairman of Accenture Ltd. from 2001 to 2004. He also served in the advisory position of International Chairman of Accenture from August 2004 to 2006. Mr. James serves as a director of the following public companies: Fidelity National Information Services, Inc. and Navigant Consulting, Inc. Within the past five years, Mr. James also served as a director of Metavante Technologies, Inc., a public company.

Mr. James brings to the Board valuable and extensive business and strategic experience in the management and operations of a large, complex international technology-based professional services and outsourcing organization. In addition, Mr. James possesses significant public company board experience.

P. Thomas Jenkins. Mr. Jenkins has been a director since 2004. Mr. Jenkins currently serves as Executive Chairman of the Board and Chief Strategy Officer of Open Text Corporation, a publicly traded software company and a leader in providing enterprise content management. Mr. Jenkins was appointed Chief Strategy Officer of Open Text in 2005. He served as Chief Executive Officer of Open Text from 1997 to 2005. From 1994 to 1997, Mr. Jenkins held progressive executive positions with Open Text. In addition to his Open Text responsibilities, Mr. Jenkins is the Chair of the federal centre of excellence Canadian Digital Media Network. He is also an appointed member of the Social Sciences and Humanities Research Council of Canada.

Mr. Jenkins brings to the Board a wealth of executive knowledge and extensive business strategy, operational and global management experience in the software industry.

Louis J. Lavigne, Jr. Mr. Lavigne has been a director since 2008. Mr. Lavigne is currently Managing Director of Lavrite, LLC, a management consulting firm specializing in the areas of corporate finance, accounting growth and strategy management. Mr. Lavigne retired in March 2005 as Executive Vice President and Chief Financial Officer of Genentech, Inc. He served as Genentech’s Chief Financial Officer from 1988 to 2005. Mr. Lavigne became the Controller in May 1983 and an officer of Genentech in February 1984. Mr. Lavigne serves as a director and as Chairperson of the board of Accuray Incorporated and as a director of Allergan, Inc. and Depomed, Inc., all public companies. Mr. Lavigne previously served on our Board from October 2004 to February 2007. Mr. Lavigne also serves as a trustee of Babson College and Children’s Hospital Oakland. He is also a Board Member and Audit Committee Chair of NovoCure and SafeNet, private companies.

As a former Chief Financial Officer of a large, complex publicly traded company and a current and former member of numerous public company boards, Mr. Lavigne brings to the Board financial expertise and extensive experience in business operations, strategy, accounting and public company governance.

Kathleen A. O'Neil. Ms. O’Neil has been a director since 2002. She is the President and Chief Executive Officer of Liberty Street Advisors, LLC, a company that she founded in 2001. Liberty Street Advisors, LLC advises public and private companies on corporate governance, risk management and strategy development. Prior to her work at Liberty Street Advisors, Ms. O’Neil was employed at IBM as General Manager of the company’s Global Financial Markets Infrastructure Group from January 2001 to September 2001. Prior to joining IBM, Ms. O’Neil functioned for 24 years at the Federal Reserve Bank of New York in a series of executive roles including Chief Financial Examiner, Chief Operations Officer, Chief Financial Officer, Chief Administrative Officer and Chief Risk Officer. Ms. O’Neil is lead independent director of the board of directors of Guidance Software, a public company. Ms. O’Neil also chairs the board of trustees of the Motley Fool Funds Trust and is a member of the board of directors of MetLife Bank, N.A., a subsidiary of MetLife, Inc.

As a result of Ms. O’Neil’s professional experiences, she provides the Board with financial expertise, experience in risk management, executive managerial experience and extensive knowledge of corporate governance.

4

Table of Contents

Alex Pinchev. Mr. Pinchev has been a director since September 2012. From January 2012 to May 2013, he served as President and Chief Executive Officer of Acronis, Inc., a leading provider of data protection and disaster recovery software. From 2008 to 2011, Mr. Pinchev served as President of Global Sales, Services & Field Marketing at Red Hat, Inc. Prior to that, he served as Executive Vice President of Worldwide Sales at Red Hat from 2003 to 2008. During his career, Mr. Pinchev has held senior executive roles at numerous technology companies, including MRO Software, Interchip and MainControl Inc. where he was chairman, CEO and founder. Mr. Pinchev currently serves on the board of Logi Analytics, a private technology company.

As a result of his computer science background and three decades in the technology industry, including holding numerous senior executive sales positions, Mr. Pinchev provides the Board with expertise in software sales, global operations, managing growth, building strategic customer relationships and software company management generally.

Carl James (Jim) Schaper. Mr. Schaper has been a director since July 2012. Since December 2010, Mr. Schaper has served as Chairman of the Board of Directors of Infor Global Solutions (“Infor”). In June 2002, Mr. Schaper founded Infor and served as Chairman, President and CEO of Infor from 2002 to December 2010. Mr. Schaper also serves as an operating partner of Golden Gate Capital, a private equity investment firm. Previously, he served as the Chairman and CEO of Primis Corporation. Prior to Primis, he served as the Chief Operating Officer of Medaphis Corporation. In addition to these roles, Mr. Schaper has served as the Chief Operating Officer of Dun and Bradstreet Software. Mr. Schaper serves on the board of Q2ebanking Software, a privately held company.

With over 30 years of experience in the technology industry, Mr. Schaper brings to the Board an extensive background in software company management, mergers and acquisitions, and corporate finance as well as board experience. The Board benefits from Mr. Schaper’s industry knowledge and experience managing and growing a global software company.

Tom C. Tinsley. Mr. Tinsley has been a director since 1997. He is an Advisory Director with General Atlantic Partners, a private equity investment firm. He previously served as a Partner of General Atlantic Partners from 2001 to December 2010 and as a Special Advisor to General Atlantic Partners from 1999 to 2001. Mr. Tinsley joined Baan Company N.V. in November 1995 as President and Chief Operating Officer and served in that position until June 1999. Prior to joining Baan, he was a Director at McKinsey & Company, Inc., where he was employed for 18 years. Mr. Tinsley serves on the board of Net 1 UEPS Technologies, Inc., a public company, and Intermedia, a privately held company.

Mr. Tinsley brings to the Board managerial experience in the software industry and, by virtue of his 15 years of service on the Board, extensive knowledge of the Company. The Board also values and benefits from Mr. Tinsley’s experience in evaluating, investing in and acquiring technology companies.

EXECUTIVE OFFICERS

Certain information concerning our executive officers as of the date of this Form 10-K/A is set forth below, except that information concerning Mr. Beauchamp is set forth above under “Directors.”

| Name |

Age | Position | ||

| Paul Avenant |

48 | Senior Vice President of Solutions | ||

| Kia Behnia |

42 | Senior Vice President, Chief Technology Officer | ||

| Brian Bergdoll |

55 | Senior Vice President of Sales | ||

| Kenneth W. Berryman |

45 | Senior Vice President, Strategy and Corporate Development | ||

| Hollie S. Castro |

44 | Senior Vice President, Administration | ||

| D. Stephen Goddard, Jr |

57 | Senior Vice President, Business Operations | ||

| William D. Miller |

62 | Chief Operating Officer | ||

| H. Carv Moore |

56 | Senior Vice President of Sales | ||

| Stephen B. Solcher |

52 | Senior Vice President, Chief Financial Officer | ||

| Patrick K. Tagtow |

46 | Senior Vice President, General Counsel and Secretary | ||

| T. Cory Bleuer |

43 | Vice President, Controller and Chief Accounting Officer |

5

Table of Contents

Paul Avenant is Senior Vice President of Solutions. He oversees the company’s five product lines, including Service Support, Data Center Automation & Cloud Management, Workload Automation, Performance & Availability and Data Management. From 2011 to 2012, he served as Senior Vice President, President of Enterprise Service Management (“ESM”) business unit. From 2010 to 2011, Mr. Avenant served as Senior Vice President of ESM-Solutions and brand management and was responsible for product strategy, research and development, customer support and marketing. Under his leadership, BMC Atrium was developed and established as service-driven architecture of Business Service Management. He joined BMC in 2004 as Vice President of R&D after spending nearly nine years at Hewlett-Packard Company. He has more than 20 years experience, including numerous leadership roles in the network, systems and service management market segment.

Mr. Behnia was appointed Senior Vice President and Chief Technology Officer in 2011. Mr. Behnia joined BMC in 2004 through the acquisition of Marimba, Inc., where he served as CTO. Initially serving as a vice president and corporate software architect with us, Mr. Behnia was promoted to Vice President – Chief Architect in 2005 and to Senior Vice President – Platform Architect in 2010. Mr. Behnia has more than 19 years experience in enterprise service, infrastructure and application management.

Mr. Bergdoll is Senior Vice President of Sales. Mr. Bergdoll joined BMC Software in 1986. He has held numerous sales, marketing and strategy management positions at BMC. During his tenure, he has led various teams dealing with the company’s largest customers. He most recently led worldwide sales, software consulting and marketing for the Mainframe Services Management (“MSM”) business unit. Before joining BMC Software, Mr. Bergdoll worked for seven years at IBM in various sales and sales management positions.

Mr. Berryman was appointed Senior Vice President, Strategy and Corporate Development in September 2010. Prior to joining us, Mr. Berryman served in various leadership roles at Symantec Corporation from 2007 to 2010, including most recently as Senior Vice President, Strategy and Emerging Businesses. From 2002 to 2007, Mr. Berryman was a partner at McKinsey & Company, and he served as a consultant at McKinsey from 1997 to 2002. Mr. Berryman was a research scientist at Princeton University from 1995 to 1997.

Ms. Castro was appointed Senior Vice President, Administration in September 2009. Prior to joining us, Ms. Castro served as Senior Vice President of Corporate Services for Talisman Energy from October 2008 to September 2009. She was the CEO of Global Rainmakers Coaching and Consulting from July 2006 to October 2008. From October 2000 to July 2006, Ms. Castro served as Vice President, Human Resources for Cisco Systems, Inc. She also served as an HR executive for General Electric Company from August 1996 to October 2000.

Mr. Goddard was appointed Senior Vice President, Business Operations in November 2008. Prior to this appointment, Mr. Goddard served as Vice President, Assurance from April 2007 to October 2008. He joined us in July 2003 and served in management positions in both Finance and IT. Prior to joining us, Mr. Goddard was with Arthur Andersen for 25 years, serving in various client serving and leadership positions including as the Gulf Coast Managing Partner.

Mr. Miller was appointed Chief Operating Officer in May 2013. Previously, from 2008 to 2013, he served as Senior Vice President, President of MSM. He served as Senior Vice President, General Manager, MSM from February 2007 to October 2008. Mr. Miller served as Vice President, General Manager, MSM from April 2006 to February 2007. Mr. Miller joined us in July 2002 and served in various senior management positions in our mainframe business unit, including General Manager from April 2004 to April 2006. Mr. Miller joined Bindview Development as Senior Vice President of Sales and Services in July 2000 and was promoted to Chief Operating Officer in October 2001 before joining us. Mr. Miller left IBM in 2000 after working with IBM for 21 years in various technical and sales positions and was Vice President, EMEA, Industrial Sector for his last assignment at IBM.

Mr. Moore was appointed Senior Vice President of Sales in 2012. Mr. Moore has more than 25 years of executive and sales leadership experience. Prior to joining BMC, he was senior vice president of Sun Microsystems’ global software business and responsible for driving worldwide software product and services sales in more than 160 countries. In previous roles, Moore served as president of four market-leading companies including SeeBeyond, Novell, Cambridge Technology Partners and Excell Data Corporation. He has also held executive and sales positions at IBM and Digital Equipment Corporation.

Mr. Solcher was appointed Senior Vice President and Chief Financial Officer in December 2005. From August 2005 to December 2005, Mr. Solcher served as our interim Chief Financial Officer. Prior to this appointment, Mr. Solcher had served as our Vice President of Finance and Treasurer for more than five years. Mr. Solcher joined us in 1991 as Assistant Treasurer.

Mr. Tagtow was appointed Senior Vice President, General Counsel and Secretary in November 2011. Mr. Tagtow served as our interim general counsel from May 2011 until he was appointed to his current position in November 2011. Prior to being named General Counsel, he served as BMC’s Vice President of Litigation from 2007 to 2011 with responsibility for global litigation management, legal and regulatory enterprise risk management and our compliance and ethics program. Mr. Tagtow joined us in 1999 as Legal Counsel from the law firm of Haynes and Boone, L.L.P. where he practiced commercial and employment litigation.

6

Table of Contents

Mr. Bleuer was appointed Vice President, Controller and Chief Accounting Officer in August 2006. Prior to joining us, Mr. Bleuer was the Vice President and Controller of EMC Corporation’s Captiva Software group from December 2005 to July 2006 and was Vice President and Corporate Controller of Captiva Software Corporation from February 2005 to December 2005. Prior to joining Captiva Software Corporation, Mr. Bleuer was with Fair Isaac Corporation serving as the Corporate Controller from August 2004 to February 2005 and as Director, Corporate Finance and Accounting from August 2002 to August 2004. From June 2000 to August 2002, Mr. Bleuer served as Corporate Controller of HNC Software Inc.

7

Table of Contents

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, among others, to file with the SEC and the NASDAQ Stock Market (the “NASDAQ”) an initial report of ownership of our $.01 par value common stock (“Common Stock”) on a Form 3 and to report changes in ownership on a Form 4 or a Form 5. Persons subject to Section 16(a) are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file related to transactions in our Common Stock. Under SEC rules, certain forms of indirect ownership and ownership of our Common Stock by certain family members are covered by these reporting requirements. As a matter of practice, our administrative staff assists our directors and executive officers in preparing initial ownership reports and reporting ownership changes and typically files these reports on their behalf.

Based on a review of the copies of such forms in our possession,

and on written representations from reporting persons, we believe that during fiscal 2013 all of our executive officers and directors filed the required reports on a timely basis under

Section 16(a).

CORPORATE GOVERNANCE

Code of Conduct

The Board has adopted a Code of Conduct (the “Code”) for the Company. The Board requires all directors, officers and employees to adhere to the Code in addressing the legal, regulatory and ethical issues encountered in conducting their work. This includes our principal executive officer and principal financial and accounting officers. A copy of the Code can be viewed on the corporate commitment section of our website at www.bmc.com and is available in print upon request to Corporate Secretary, BMC Software, Inc., 2101 CityWest Blvd., Houston, TX 77042. Among other matters, the Code is reasonably designed to promote:

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; |

| • | full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or furnish to, the SEC and in other public communications made by us; |

| • | compliance with applicable governmental laws, rules and regulations; |

| • | the prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; and |

| • | accountability for adherence to the Code. |

We maintain procedures for administering and reviewing potential issues under the Code, including procedures that allow employees to raise issues or report potential or actual violations anonymously. We also conduct periodic awareness training on various ethics and compliance-related topics.

Corporate Governance Principles and Board Matters

Corporate governance is typically defined as the system that allocates duties and authority among a company’s stockholders, board of directors and management. The stockholders elect the Board and vote on extraordinary matters. The Board is the Company’s governing body, responsible for hiring, overseeing and evaluating management, particularly the Chief Executive Officer, and management runs the Company’s day-to-day operations. The nominees for election include nine independent directors, as defined by the rules of the NASDAQ, and our President and Chief Executive Officer. The Board’s principal responsibility is to promote the best interests of our stockholders by providing guidance and oversight for the management of our business and affairs.

The Board has adopted Corporate Governance Guidelines (the “Guidelines”), and the Governance Committee is responsible for overseeing these Guidelines and making recommendations to the Board concerning corporate governance matters. The Guidelines can be viewed on our website at http://investors.bmc.com. Among other matters, the Guidelines include the following:

| • | Membership on our Board will be predominantly non-employee directors who, at a minimum, meet the criteria for independence required by the NASDAQ. |

| • | The Board has adopted additional independence criteria set forth in the Guidelines. |

| • | Each regularly scheduled Board meeting will include an executive session of the independent directors; the Lead Director presides during such executive sessions. |

| • | The Board conducts an annual evaluation of itself, its committees and each individual director. |

8

Table of Contents

| • | When the Chairman is not independent, the Board will appoint an independent director to serve as Lead Director. The Chairman and the Lead Director are reviewed annually as part of the Board’s evaluation process and are subject to removal or rotation at the discretion of the Board. |

| • | The Board expects our directors and officers to exhibit the highest standards of ethical behavior and to set an ethical tone for the Company. |

| • | To effectively discharge their oversight duties, the Board has direct access to management. |

| • | All members of the Board stand for election on an annual basis. |

The Guidelines contain a guideline that generally, a director will not be nominated to stand for election at an Annual Meeting if he or she would be age 70 or older at the time of the election; provided, that such director has had the opportunity to serve at least five years as a director.

Board Leadership Structure and Lead Director

Mr. Beauchamp serves as both our Chairman of the Board and our Chief Executive Officer. The Board has no policy mandating the combination or separation of the roles of Chairman and Chief Executive Officer and believes the matter of Board leadership structure should be discussed and considered from time to time. At this time, the Board believes that Mr. Beauchamp is the director best situated to serve as Chairman of the Board. He is the director most familiar with the Company's business and industry and most capable of effectively identifying strategic priorities and leading the Board's discussion of strategy and business operations. The Board believes that Mr. Beauchamp’s service in the combined role of Chairman and Chief Executive Officer promotes unified leadership and direction for the Board and the executive management team and allows for greater focus on executing the Company's strategic initiatives and business plans.

The Board is committed to ensuring strong independent oversight of management and leadership of the Board. Accordingly, our Corporate Governance Guidelines provide that when the Chairman is not independent, the Board will appoint an independent director to serve as Lead Director. Mr. Barfield has served as Lead Director since January 2010. The Board believes this role of Lead Director adequately addresses the need for leadership and organizational structure for the independent directors.

The Corporate Governance Guidelines provide that the Chairman shall consult with the Lead Director, committee chairs and other directors when preparing the agendas for Board meetings. The Chairman and the Lead Director share the following duties and responsibilities:

| • | monitoring the quality, quantity and timeliness of the flow of information between management and the Board; although management is responsible for the preparation of most materials for the Board, the Chairman or Lead Director may request specific or additional material; |

| • | interviewing, along with the members of the Governance Committee and other independent directors to the extent practical, all Board candidate finalists; and |

| • | consulting with the Governance Committee with respect to the membership of the various Board committees and the selection of the committee chairs. |

The Lead Director has the following duties and responsibilities:

| • | developing the agenda for, and moderating executive sessions of, the Board’s independent directors; |

| • | acting as principal liaison between the independent directors and the Chairman and/or Chief Executive Officer on matters discussed in executive sessions; |

| • | the option of calling meetings of the full Board or just the independent directors of the Board, in addition to the executive sessions held during regularly scheduled Board meetings; |

| • | presiding at any meeting of the Board or stockholders at which the Chairman is not present; |

| • | advising and consulting with the Chairman and the chair of each Board committee as to the appropriate information, agendas and schedules of Board and Board committee meetings (the Lead Director is encouraged to attend those Board committee meetings at which critical issues are to be decided); |

| • | approving, in consultation with other independent directors, the retention and compensation of consultants who report directly to the Board; |

| • | in conjunction with one of the Board committee chairs, reviewing with the Chief Executive Officer the Chief Executive Officer’s performance evaluation, including a review of the Chief Executive Officer’s performance as Chairman, conducted by the independent directors; and |

| • | with the assistance of the Governance Committee, reviewing each individual director’s performance annually, and discussing the details of each director’s review with him or her. |

9

Table of Contents

Board Oversight of Risk Management

The Board of Directors, as a whole and through the various committees of the Board, oversees the Company's risk management processes, including operational, financial, legal and regulatory, strategic and reputational risks. Enterprise risk management is an integral part of the Company’s risk management and strategic planning processes. The Audit Committee plays a leading role in assisting the Board in its oversight of risk management. In addition, the oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide visibility to the Board about the identification, assessment and management of critical risks and management’s risk mitigation strategies.

Board committees consider risks within their respective areas of oversight responsibility and the respective committee chairs advise the Board of any significant risks and management’s response via periodic committee reports to the full Board. In particular, the Audit Committee focuses on financial risk, including internal controls, and legal and regulatory compliance risks. The Compensation Committee considers risks relating to the Company's compensation programs and policies, and the Mergers and Acquisitions Committee reviews risks relating to potential acquisitions, investments and divestitures.

Board Meetings and Committee Composition

The Board and its committees meet throughout the year on a set schedule and also hold special meetings and act by written consent from time to time as appropriate. Our quarterly in-person Board meeting agendas include executive sessions for the non-employee directors (all of whom are independent directors) to meet without management present. The Lead Director, who is an independent director, presides over these executive sessions. In fiscal 2013, the Board met in person four times and held 31 telephonic Board meetings. The independent directors met in executive session at the conclusion of each of the in-person meetings. Each Board member attended at least 75% of the total number of meetings of the Board and the committees on which he or she serves. Each director is encouraged to be present at Annual Meetings of stockholders. At the 2012 Annual Meeting, all of the directors were in attendance.

The Board currently has, and appoints the members of, standing Audit, Compensation, Corporate Governance & Nominating and Mergers and Acquisitions Committees. Each committee has a written charter approved by the Board. These charters are available on our website at http://investors.bmc.com. We will also furnish copies of any charter upon request. Requests for copies should be directed to Corporate Secretary, BMC Software, Inc., 2101 CityWest Blvd., Houston, Texas 77042. Each of the committee charters requires that its membership be comprised solely of independent directors.

The current members of the committees are identified in the following table.

| Director |

Audit | Compensation | Corporate Governance & Nominating |

Mergers and Acquisitions | ||||

| Jon E. Barfield |

X | X | ||||||

| Gary L. Bloom |

X | X | ||||||

| John M. Dillon |

X | |||||||

| Meldon K. Gafner |

X | X | ||||||

| Mark J. Hawkins |

X | X | ||||||

| Stephan A. James |

Chair | X | ||||||

| P. Thomas Jenkins |

X | Chair | ||||||

| Louis J. Lavigne, Jr |

Chair | X | ||||||

| Kathleen A. O’Neil |

X | Chair | ||||||

| Alex Pinchev |

X | X | ||||||

| Carl James Schaper |

X | |||||||

| Tom C. Tinsley |

X | X |

As a non-independent director, Mr. Beauchamp does not serve on any of the Board committees.

10

Table of Contents

Audit Committee. The Audit Committee has been established to assist the Board in fulfilling its responsibility to oversee (i) the integrity of our financial statements, financial reporting process and systems of internal controls regarding finance and accounting, (ii) our legal and regulatory compliance, (iii) the quality and integrity of our risk management processes, (iv) the qualifications, engagement, compensation and independence of the independent registered public accounting firm, their conduct of the annual audit of our financial statements and their engagement to provide any other services, (v) the performance of our internal audit function and independent registered public accounting firm and (vi) our capital structure and financing activities. The Audit Committee has the sole authority to retain, compensate, direct, oversee and terminate our independent registered public accounting firm. The Audit Committee operates pursuant to a charter, which can be viewed on our website at http://investors.bmc.com. The Board has determined that each of the members of the Audit Committee qualifies as an “audit committee financial expert” as defined by the regulations of the SEC, and each of the members meets the independence criteria for audit committee members as defined by the NASDAQ and the SEC. No member of the Audit Committee serves on more than three public company audit committees. In fiscal 2013, the Audit Committee held eight meetings. The report of the Audit Committee begins on page 46.

Compensation Committee. The Compensation Committee’s primary function is to support the Board in fulfilling its oversight responsibilities relating to senior management performance, compensation and succession. In this regard, the Board and Compensation Committee align total compensation for the Chief Executive Officer and other senior executives with the long-term interests of stockholders. The Compensation Committee’s duties include: making recommendations to the Board with respect to all compensation plans covering executive officers, administering our equity plans, reviewing our employee benefits and reviewing our Compensation Discussion and Analysis disclosure. The Compensation Committee operates pursuant to a charter, which can be viewed on our website at http://investors.bmc.com. In fiscal 2013, the Compensation Committee held six meetings. The “Compensation Discussion and Analysis” section, which begins on page 13, contains information on the roles of the Compensation Committee, the Board, executive officers and outside consultants in determining or recommending executive compensation.

Corporate Governance & Nominating Committee. The Governance Committee assists the Board in fulfilling its responsibility to our stockholders, potential stockholders and investment community by (i) identifying individuals qualified to become directors and selecting, or recommending that the Board select, the candidates for all directorships to be filled by the Board or by the stockholders, (ii) developing and recommending to the Board a set of corporate governance principles applicable to the Company and (iii) otherwise providing leadership on corporate governance issues to ensure that the corporate governance system of the Company performs well. The duties of the Governance Committee include annually reviewing and reassessing the adequacy of our Corporate Governance Guidelines, managing the Board’s annual evaluation process, monitoring director independence and overseeing outside director compensation. In addition, the Governance Committee assesses the appropriate balance of skills, characteristics and perspectives required for an effective Board; identifies, screens and recommends qualified director candidates; and periodically reassesses the adequacy of the Board’s size. Although the Governance Committee does not have a formal policy with respect to diversity, it seeks to have a Board of Directors that represents a diversity of backgrounds, skills and experience. The Governance Committee assesses its achievement of diversity through the review of Board composition as part of the Board's annual self-assessment process. The Governance Committee operates pursuant to a charter, which can be viewed on our website at http://investors.bmc.com. The Governance Committee identifies director candidates through a variety of means, including recommendations from other Board members and management. From time to time, the Governance Committee utilizes third-party search consultants to identify director candidates. The Governance Committee will consider all stockholder recommendations for candidates for the Board; any such recommendations should be sent to the Governance Committee, c/o Corporate Secretary, BMC Software, Inc., 2101 CityWest Blvd., Houston, TX 77042, and should include the recommended candidate’s name, biographical data and qualifications. The Governance Committee’s minimum qualifications and specific qualities, knowledge and skills required for directors are set forth in Section 12 of our Corporate Governance Guidelines, which can be viewed on our website at http://investors.bmc.com. The Governance Committee evaluates all potential candidates in the same manner regardless of the source of the recommendation. The Governance Committee’s review is typically based on any written materials provided with respect to the potential candidate. The Governance Committee determines whether the candidate meets our minimum qualifications and specific qualities, knowledge and skills for directors and whether requesting additional information or an interview is appropriate. In fiscal 2013, the Governance Committee held ten meetings.

Mergers and Acquisitions Committee. The Mergers and Acquisitions Committee (the “M&A Committee”) is appointed by the Board to review and assess, and assist management and the Board in reviewing and assessing, potential acquisitions, strategic investments and divestitures. The duties of the M&A Committee include providing guidance to management and the Board with respect to our acquisition, investment and divestiture strategies; assisting management and the Board with identifying acquisition, investment and divestiture opportunities; and overseeing management’s and the Board’s due diligence process with respect to proposed acquisitions, investments and divestitures. The M&A Committee operates pursuant to a charter, which can be viewed on our website at http://investors.bmc.com. In fiscal 2013, the M&A Committee held five meetings.

11

Table of Contents

Communications from Stockholders to the Board

The Board is receptive to direct communication with stockholders and recommends that stockholders and other interested parties initiate any communications with the Board in writing and send them in care of the Corporate Secretary. Stockholders can send communications by email to directors@bmc.com, by fax to (713) 918-1110 or by mail to Corporate Secretary, BMC Software, Inc., 2101 CityWest Blvd., Houston, Texas 77042. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specifically intended Board recipient should be noted in the communication. Communications to the Board must include the number of shares owned by the stockholder as well as the stockholder’s name, address, telephone number and email address, if any. The Board has instructed the Corporate Secretary, prior to forwarding any correspondence, to review such correspondence and, pursuant to Board policy, not to forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere within the Company for review and possible response. A more detailed disclosure regarding our Board communication process is available on our website at http://investors.bmc.com.

12

Table of Contents

| ITEM 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) describes the principles of our executive compensation program, how we applied those principles in compensating our most senior officers for fiscal 2013 and how we use our compensation program to drive and reward excellent performance.

Named Executive Officers

This CD&A explains how our compensation programs are designed and operate in practice with respect to our executives and specifically the following Named Executive Officers (“NEOs”):

| • | Robert E. Beauchamp, President and Chief Executive Officer; |

| • | Stephen B. Solcher, Senior Vice President, Chief Financial Officer; |

| • | Paul Avenant, Senior Vice President of Solutions; |

| • | Kia Behnia, Senior Vice President, Chief Technology Officer; and |

| • | William D. Miller, Chief Operating Officer. |

Executive Summary

Our key executive compensation decisions for fiscal 2013 included the following:

| • | Continuing the use of performance-based equity grants based on our Total Shareholder Return (“TSR”) relative to that of the NASDAQ-100 Index (“QQQ”) as a component of our Named Executive Officers’ compensation to maintain the pay for performance relationship of our executive compensation program; |

| • | Updating the peer group of companies which we utilize to make competitive executive compensation comparisons; improving the match to, and focusing more on companies in our sector with similar size; |

| • | Utilizing measures (bookings, operating margin and TSR) within our incentive programs to closely link stockholder interests and operational success to executive compensation; |

| • | Maintaining a position of competitive base salaries and minimal perquisites; |

| • | Being judicious in the use of equity awards, aligned with institutional investor advisory group burn rate policies; and |

| • | Not providing tax gross-ups on any portion of our executives’ current or potential compensation, with the exception of certain taxable relocation expenses. |

We believe that our actions in fiscal 2013 show that we have closely linked pay to performance.

Below are some of the key business successes we achieved in fiscal 2013:

| • | Our total revenue increased 1.4% to $2.2 billion year-over-year; |

| • | Our SaaS business increased its customer base by over 80 percent year-over-year and now has more than 600 active SaaS customers; and |

| • | Cloud-related license bookings totaled more than $100 million, increasing 35 percent year-over-year. |

Despite these operating results, our overall financial performance was below several of our internal targets. Reflecting the significant emphasis our compensation program places on performance-based rewards, these factors negatively impacted the compensation of our NEOs, as intended by the design of the compensation programs.

Pay for Performance Link

For fiscal 2013 our incentive plans paid out below target as detailed below.

Cash-based Short-term Incentive Plan (“STIP”): Our CEO earned only 54.1% of his target short-term incentive pay, based on Company attainment against pre-established bookings and non-GAAP operating margin targets, while all NEOs earned an average of 56.7% of their target short-term incentive pay based on Company attainment against pre-established bookings and non-GAAP operating margin targets. For further discussion of the short-term incentive payouts, see “Compensation Elements - Short-term Incentives.”

13

Table of Contents

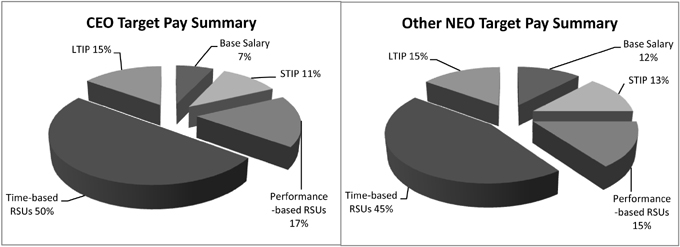

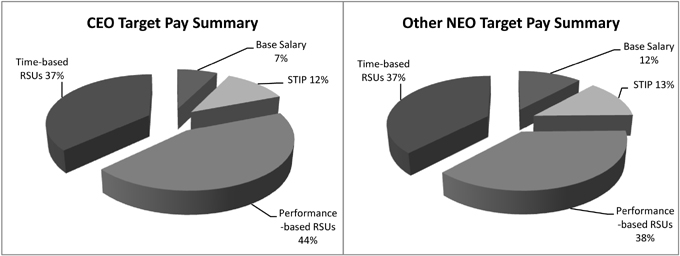

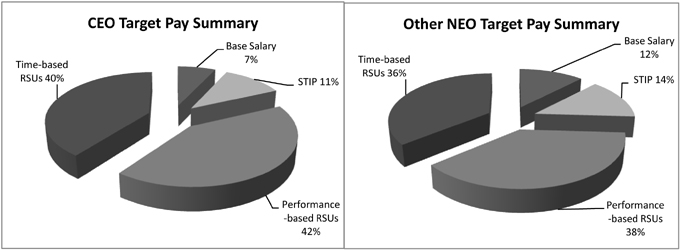

Cash-based Long-Term Incentive Plan (“LTIP”): In April 2010, we granted three-year cash-based long-term incentive plan awards to three of our current NEOs: Messrs. Beauchamp, Solcher and Miller. The awards would have vested, if at all, based on achievement of certain TSR levels relative to the NASDAQ-100 Index from fiscal 2011 through fiscal 2013. From the fiscal 2011 LTIP award made in April 2010, our CEO received no payout from his $1.9 million target. Mr. Solcher and Mr. Miller also received no payout from their April 2010 LTIP awards. We suspended granting long-term cash incentives since April 2010, and there are no more outstanding LTIP cash awards. Since such time, we have granted all of our long-term incentives to our executive officers in the form of equity, with 50% or more of the aggregate value of these grants for our NEOs being in the form of performance-based RSUs during fiscal 2013. For further discussion of the cash-based long-term incentive payouts, see “Compensation Elements – Long-term Incentives.”

Equity-based Long-Term Incentives: Of the target number of performance-based RSUs granted in December 2010, our CEO vested in only 30% of the target number of shares (7,254 of the 24,181 target shares) due to our TSR performance compared to the NASDAQ-100 Index. Mr. Miller and Mr. Solcher also only vested in 30% of their target number of shares. For further discussion of the equity-based long-term incentive payouts, see “Compensation Elements - Long-term Incentives.”

Executive Compensation Principles

The Compensation Committee has defined high level executive compensation principles that help shape the structure and levels of pay for our executive officers, including each NEO (see “Compensation Elements”). These principles, which are discussed in more detail below, are to:

| • | Align executive compensation with stockholder interests; |

| • | Connect cash incentives to appropriate short-term measures; |

| • | Attract and retain top talent through equity-based incentive compensation, with a balance of time-based and performance-based vesting; and |

| • | Motivate a balance of short-term performance with long-term organizational health. |

Align executive compensation with stockholder interests

The role our executive officers play in the execution of our business strategy is critical to delivering stockholder return. To be successful, all employees need to understand and deliver results. Our incentive compensation programs are intended to provide for payment on attainment of pre-determined goals that are aligned with stockholder interests and linked to business strategy, key financial measures and stockholder returns. Our compensation programs reward success against those goals for key employees, including our NEOs. We also award equity grants to key employees, including the NEOs, in order to further align their compensation with stockholder interests over the long term.

Connect cash incentives to appropriate short-term measures

Our success partly depends upon our executive officers being focused on the critical strategic and tactical objectives that lead to Company success in the short term. Therefore, performance goals under our short-term incentive compensation programs have been designed to align executive compensation with our business objectives. The design of these compensation programs, the selected performance measures, the targets and the timing of awards and payouts are all geared to drive business performance and stockholder return. During fiscal 2013, performance measures included a combination of bookings and non-GAAP operating margin targets at both corporate and business unit levels to ensure a balanced focus. For fiscal 2014, we continue to utilize a combination of these measures at the total company level.

Attract and retain top talent through equity-based incentive compensation

Our success depends on attracting and retaining top performing individuals. This is especially true for our executive officers, including the NEOs. We believe in using equity grants with a combination of time-based vesting and performance-based vesting as a key tool to motivate long-term performance and to retain a stable, high performing team of executive officers. We have used equity-based compensation to reward executive officers as well as other key employees for their contributions and to motivate their continued commitment to the future. During fiscal 2013, we continued our practice of granting approximately 50% of our executive officers’ equity grant values in performance-based grants (see “Compensation Elements”). As these performance-based grants mature, with 2- and 3-year vesting/TSR attainment measurement periods, they will represent a larger portion of our executive officers’ “realizable pay,” subject to reduction or increase depending on our TSR performance in comparison to the NASDAQ-100 Index.

14

Table of Contents

Motivate a balance of short-term performance with long-term organizational health

The following table illustrates how performance-based compensation elements, each of which is described in greater detail in the next section, link executive compensation for our executive officers, including the NEOs, to Company performance and stockholder return over both short-term and long-term time horizons. It also describes how performance ranges affect payout ranges.

15

Table of Contents

| Program |

Performance Measures |

Timing |

Performance Connection to Pay | |||||

| Short-Term |

Short-Term Incentive Plan (“STIP”) | For Corporate Executives: Corporate Total Bookings and Operating Margin (3)

For BU Executives: Corporate Total Bookings, BU Total Bookings, and BU Operating Margin (3) |

Quarterly measurement periods, paid semi-annually | – 100% payout for achievement of performance targets

– 200% is the maximum payout level for extraordinary achievement

– For each metric, 85% of target is the threshold (the minimum performance level below which no payment is made)

– Measures are directly aligned to the Board-approved operating plan

| ||||

| Discretionary Cash Awards (1) | Individual performance goals | Ad hoc during the fiscal year | – Awards provide a direct link to short-term delivery of business objectives

| |||||

| Long-Term |

Long-Term Cash Incentive Plan (“LTIP”) (4) |

Relative TSR measured against the QQQ | Three-year measurement period | – Payout maximum is capped at 150%

– Threshold performance must be achieved (no worse than 24 points below QQQ TSR) to earn payout

| ||||

| Performance-Based RSUs | Relative TSR measured against the QQQ | Two-and three-year performance targets/measurement periods | – Performance-based RSUs are subject to forfeiture if minimum performance thresholds are not achieved or employment ceases (2)

– Performance-based RSUs will vest to the extent the Board-established TSR goals are achieved |

| (1) | The CEO was not eligible for discretionary cash awards under this program, and no discretionary cash awards were paid to any executive officers during fiscal 2013. |

| (2) | The November 2012 performance-based RSU agreement included a new “rollover” feature that would allow for shares that did not vest in the first tranche at the two-year measurement point to be subject to the performance attainment of the second tranche at the three-year measurement point. Any shares that do not vest at the third-year measurement point will be forfeited. |

| (3) | Bookings represent an internal measure of the committed contract value of license, maintenance and software-as-a-service orders plus delivered professional services revenue. Operating margin represents an internal measure of operating margin, consisting of revenue less internally-calculated operating expenses. Corporate operating margin represents an internal measure of consolidated operating margin, consisting of consolidated revenue less internally-calculated operating expenses. Business unit operating margin represents an internal measure of operating margin for our ESM and MSM business units, consisting of business unit revenue less internally-calculated direct and allocated indirect operating expenses. |

| (4) | No further grants have been made under this program since fiscal 2011. Based on the Company’s TSR relative to the NASDAQ-100 Index at the end of fiscal 2013, the three-year cash-based LTIP awards granted in fiscal 2011 to Messrs. Beauchamp, Solcher and Miller did not vest and were forfeited. |

Determining Executive Compensation (Roles and Process)

Utilizing the principles described above, the independent members of the Board, upon the recommendation of the Compensation Committee, determine the parameters of the executive compensation program, including appropriate target levels and performance measures. The Compensation Committee then administers the specific executive compensation programs for our executive officers, including with respect to matters where approval by our independent Compensation Committee members is appropriate for tax or regulatory reasons. This section discusses, in greater detail, the roles and process underlying the application of our executive compensation principles.

16

Table of Contents

Role of Management

Our CEO attends portions of Compensation Committee meetings from time to time, but does not participate in discussions regarding his own compensation. The Compensation Committee solicits his input from time to time on compensation philosophy, retention, motivation and goal-setting. The CEO provides input to the Compensation Committee for each of his direct reports based on:

| • | Comparison of our pay levels to that of our peer companies described below in the “Market and Peer Company Comparisons” section; |

| • | Assessment of capability and job complexity; and |

| • | An overall assessment of individual performance and contribution. |

The CEO’s input is intended to assist the Compensation Committee’s efforts to balance rewarding performance that delivers to the overall strategy of the business while creating a package that retains key executives over time. Our CEO is also responsible for approving underlying programs that seek to align and deliver performance-related pay for all employees below the executive officer level.

The Chief Financial Officer participates with the CEO and Board in establishing BMC’s operating plan. This operating plan and its key measures form an important foundation for the connection between performance and compensation.

Role of External Advisors

The Compensation Committee works with an external compensation consultant to assist the Compensation Committee in its duties, including providing advice regarding market trends relating to the form and amount of compensation. In fiscal 2013, the Compensation Committee engaged Compensia, Inc. (“Compensia”) as its compensation consultant to provide research, review and advice pertaining to executive compensation. Compensia also provides similar consulting services to our Governance Committee regarding non-employee director compensation. Compensia reports directly to the Compensation Committee (and the Governance Committee with respect to non-employee director compensation) and not to management, is independent from BMC Software and has not provided any other services to BMC Software.

After a thorough review, the Compensation Committee determined that Compensia’s service to the Committee does not raise any conflicts of interest.

Role of the Compensation Committee

The Compensation Committee’s primary function is to support the Board in fulfilling its oversight responsibilities relating to senior management performance, compensation and succession. The Compensation Committee operates pursuant to a charter, which can be viewed on our website at http://investors.bmc.com.

Specifically, the Compensation Committee approves, and recommends to the independent members of the Board for approval, the following for our executive officers, including the NEOs:

| • | The annual base salary levels; |

| • | The short-term incentive opportunity levels and the connection to performance measures; |

| • | The long-term incentive opportunity levels and the connection to performance measures; |

| • | Employment agreements, severance arrangements and change in control agreements/provisions; |

| • | Any special or supplemental benefits or perquisites; and |

| • | Levels, vesting terms and appropriate forms of equity-based compensation. |

The Compensation Committee obtains input from our CEO and management and consults with its compensation consultant as described above to ensure the appropriate information is provided for proper decision-making.

Market and Peer Company Comparisons

In determining the compensation elements and amounts for the executive officers, including the NEOs, the Compensation Committee and our CEO review the compensation practices and levels at certain peer companies. Generally, this peer group analysis is used to ensure that our compensation programs and individual compensation levels are competitive in order to attract and retain high performing talent.

17

Table of Contents

To ensure that our compensation practices and levels remain competitive, the Compensation Committee reconstituted the peer company list for fiscal 2013 to include the following software and technology companies with levels of revenue similar to ours:

| Fiscal 2013 Peer Companies | ||

| Activision Blizzard, Inc. |

Juniper Networks, Inc. | |

| Adobe Systems Incorporated |

NetApp, Inc. | |

| Akamai Technologies, Inc. |

Nuance Communications, Inc. | |

| Autodesk, Inc. |

Parametric Technology Corporation | |

| Brocade Communications Systems, Inc. |

Red Hat, Inc. | |

| CA, Inc. |

Salesforce.com, Inc. | |

| Citrix Systems, Inc. |

Symantec Corporation | |

| Compuware Corporation |

Synopsys, Inc. | |

| Electronic Arts Inc. |

Teradata Corporation | |

| Informatica Corporation |

VMware, Inc. | |

| Intuit Inc. |

||

The above companies fall within a range of approximately one-half to three times our annual revenue. The list reflects the addition of four similarly sized software companies and the removal of one company from our peer company list utilized in fiscal 2012. Based on the nature and scope of their respective businesses, Informatica Corporation, Nuance Communications, Inc., Parametric Technology Corporation, and Red Hat, Inc., were added for fiscal 2013. VeriSign, Inc. was removed from the list due to its revenue size and low employee population in comparison to BMC and the rest of the peer group.

With assistance from management and the Compensation Committee’s external compensation consultant, the Compensation Committee and our CEO review compensation data from the peer company proxy statements and independent survey sources. This exercise is intended to ensure the competitiveness of each compensation component, as well as the total compensation package.

The Compensation Committee does not target pay at a specific target percentile. Rather, when setting each compensation component and total compensation opportunities, the Compensation Committee considers the following factors in addition to competitive market data:

| • | The Company’s overall performance relative to peers and objectives established by the Board; |

| • | Each individual’s skills, job scope, experience and qualifications relative to other similarly-situated executives at peer companies; |

| • | BMC’s internal value for a position relative to other positions or market practices; |

| • | A subjective assessment of each individual’s contributions to the Company’s overall performance, ability to lead his or her business unit or function, work as part of a team and reflect the Company’s core values; and |

| • | BMC’s ability to retain “critical talent.” |

These factors provide the framework for our Compensation Committee’s decision-making. No single factor above is determinative in setting pay levels, nor is the impact of any one factor on the determination of pay levels quantifiable.

We supplemented the compensation data from public disclosures for the peer companies listed above with analysis of data from a survey of executive compensation practices at technology companies conducted by Radford, a subsidiary of Aon Hewitt, neither of which provides advice to the Compensation Committee.

18

Table of Contents

To ensure that our compensation practices and levels remain competitive and appropriate, the Compensation Committee has updated the peer company list for fiscal 2014 to include the following software and technology companies of similar revenue size to us:

| Fiscal 2014 Peer Companies | ||

| Activision Blizzard, Inc. |

Intuit Inc. | |

| Adobe Systems Incorporated |

Juniper Networks, Inc. | |

| Akamai Technologies, Inc. |

Nuance Communications, Inc. | |

| Autodesk, Inc. |

Parametric Technology Corporation | |

| Brocade Communications Systems, Inc. |

Red Hat, Inc. | |

| CA, Inc. |

Salesforce.com, Inc. | |

| Citrix Systems, Inc. |

Synopsys, Inc. | |

| Compuware Corporation |

Teradata Corporation | |

| Electronic Arts Inc. |

VMware, Inc. | |

| Informatica Corporation |

||

The above companies generally fall within a range of approximately one-half to two times our annual revenue. Changes for fiscal 2014, in comparison to our peer companies utilized in fiscal 2013, are the removal of NetApp, Inc. and Symantec Corporation due to their larger revenue scope. The Compensation Committee will continue to use broader technology industry survey data from similarly-sized companies in its assessment of the competitive market as sufficient data is not always available from the peer company list.

Process for Implementing the Philosophy

Beginning in the fourth quarter of our fiscal year and proceeding into the first quarter of the subsequent fiscal year, the Compensation Committee reviews, approves and recommends to the independent members of the Board:

| • | The total pay package for the CEO, including base salary, short-term incentive targets and long-term incentives; |

| • | Changes in any compensation programs for our executive officers, including the NEOs; and |

| • | The performance targets and relationship to payouts of short-term and long-term incentives. |

Following the end of the fiscal year and at predetermined performance periods, the Compensation Committee certifies performance in its administrative capacity under each of the incentive plans and approves the corresponding payouts. It will also review, approve and recommend to the Board any adjustments to performance measures that result from extraordinary business situations such as material acquisitions.

Equity Granting Policies

Each of our equity award plans is administered by the Compensation Committee. Absent an express delegation to another person or group, the Compensation Committee is the body which approves the granting of awards under our equity award plans. Prior to the Compensation Committee granting equity awards to executive officers, the independent members of the Board authorize equity award levels for our executive officers. Except in the case of newly hired executives, we generally do not grant equity awards to executive officers during a black-out period under our Securities Trading Policy. Our equity award plans require that stock options be granted with an exercise price no less than the fair market value of the Common Stock on the date of grant.

19

Table of Contents

Compensation Elements

The following table describes each executive compensation element utilized in fiscal 2013 for our NEOs based on the philosophy and process described above as well as each element’s link to our compensation philosophy.

| Compensation |

Philosophy Statement |

Retain | Reward Short-Term Performance |

Reward Long-Term Performance |

Align to Stockholder Interests | |||||

| Base Salary | We intend to provide base salaries competitive to the market of industry peers and across other industries where appropriate. Base salary maintains a standard of living, is used to compete in the market for talent and forms the foundation for our other reward vehicles. | X | ||||||||

| Short-Term Incentive Plan (“STIP”) |

The STIP rewards specific quarterly performance against business measures set by the Board. Paid semi-annually, the amount of the reward is determined by formula and can vary from 0% to 200% of an individual executive’s target incentive. To achieve top payout, our performance must significantly outperform targets set above external expectations. The minimum performance level to achieve payout is 85% of target for each metric. | X | X | |||||||

| Total Target Cash (Base + STIP) |

We design total target cash elements to ensure a proper balance of cash payouts annually. The mix of base salary and STIP is determined for each executive to encourage the right motivation in the short term. | X | X | X | ||||||

| Long-Term Cash Incentive Plan (“LTIP”) |