Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ONEOK INC /NEW/ | solitaireconferencecallprese.pdf |

| 8-K - OKE ANNOUNCES ONE GAS - ONEOK INC /NEW/ | okeannouncesonegas.htm |

| EX-99.1 - OKE ANNOUNCES ONE GAS NEWS RELEASE - ONEOK INC /NEW/ | okeannouncesonegasnewsrele.htm |

Creating Two Independent, Highly Focused Energy Companies July 25, 2013

Page 2 Forward-Looking Statements Statements contained in this presentation that include company expectations or predictions should be considered forward-looking statements that are covered by the safe harbor provisions of the Securities Act of 1933 and the Securities and Exchange Act of 1934. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. For additional information that could cause actual results to differ materially from such forward-looking statements, refer to ONEOK’s and ONEOK Partners’ Securities and Exchange Commission filings.

Page 3 Transaction Overview • The ONEOK board unanimously authorized management to pursue a plan to separate the Natural Gas Distribution business into a new standalone publicly traded company – Company to be called ONE Gas, Inc. (NYSE: “OGS”) – 100% regulated natural gas utility in Oklahoma, Kansas and Texas with more than 2 million customers – one of the largest in the United States – Pro-rata, tax-free distribution of OGS shares to OKE shareholders • ONEOK, Inc. (OKE) to become pure-play general partner – Consisting of general partner and limited partner interests – Higher dividend anticipated • No impact to ONEOK Partners, L.P. (OKS) • Expect separation to be completed during the first quarter 2014 • No shareholder vote required Unlocking Shareholder Value Attractive, Independent, Highly Focused Energy Companies

Page 4 Strategic Rationale • Enhances strategic and financial strength and flexibility, and growth potential of both businesses • Sharpen management focus on distinct strategic goals • Resolve the internal competition for capital by: – Allowing ONEOK to increase return to shareholders through higher dividends – Allowing ONE Gas to sustain lower risk, stable performance through continued investment in and growth of rate base • Increase transparency of each business resulting in better comparisons with relevant peers • Attract more focused investor base • Valuation uplift expected as both businesses will likely trade on valuation metrics in line with their peers Why do it? Significant Value Creation Potential

Page 5 Separation Benefits Benefits ONEOK, Inc. (OKE) ONE Gas, Inc. (OGS) Capital Allocation • Focus on cash flow generation and growth • Anticipate higher dividend • Limited capital expenditures • Continued focus on internal growth and acquisitions through OKS • Expect lower cost of capital, reflecting lower risk profile • Continue to invest in and grow its rate base Investor Alignment • Attracts shareholders desiring higher dividends associated with pure-play GPs • Attract shareholders desiring stable, low-risk cash flow associated with utilities Valuation • Expected to be valued on a cash flow and dividend yield basis, in line with peers • Expected to be valued on a price/earnings (P/E) multiple basis, in line with peers Capital Allocation, Investor Alignment and Valuation

Page 6 Current Structure Structure Tax-free Transaction Future Structure GP/LP Interests + LDC Existing ONEOK Debt Remaining ONEOK Debt ONEOK, Inc. Oklahoma Natural Gas Kansas Gas Service Texas Gas Service General Partner Limited Partner Interests New Debt Spin off ONEOK, Inc. ONE Gas, Inc. Energy Services Accomplished via a tax-free, pro-rata dividend of ONE Gas shares to existing OKE shareholders

Page 7 Future ONE Gas • Only publicly traded, 100% regulated natural gas distribution utility – Three contiguous states • Maintain conservative financial policies – Prudent capital investments to promote steady rate base growth – Expect investment-grade credit ratings higher than current OKE ratings – Financial metrics necessary to maintain or improve credit ratings – Utilize capital markets to maintain capital ratios and credit ratings – Dividend payout target consistent with peers Highlights Kansas City Wichita Tulsa Oklahoma City Austin El Paso

Page 8 Future ONEOK • Free cash flow driven by ONEOK Partners’ GP and LP distributions to ONEOK, with limited capital expenditures and interest expense requirements • Cash flow supported by investment-grade MLP with predominantly fee-based earnings • Expected dividend increase to create additional value for shareholders • Debt reduction funded by proceeds from ONE Gas debt offering • Continued focus on internal growth and acquisitions through OKS • Future capital raises expected to occur at OKS Highlights

Page 9 Current OKE Post-spin OKE OGS Combined OKE/OGS Post Spin Post-spin Dividend Growth Illustration Expected Impact to Current OKE Shareholders* • Higher OKE dividend anticipated post spin consistent with peer group – Distributes majority of free cash flow • OGS to pay dividend consistent with peer group – Retain a portion of cash flows to reinvest in rate base or future growth = Post-spin OKE shareholders are expected to receive separate cash dividends from OKE and OGS that together are more than the current, pre- spin OKE dividend Dividend Growth Current OKE shareholders expected to receive higher dividends * Chart not to scale - for illustrative purposes only + + =

Page 10 Experienced Management Teams Terry Spencer President and CEO Derek Reiners SVP, CFO and Treasurer Steve Lake SVP, General Counsel and Asst. Secretary Rob Martinovich EVP, Commercial Wes Christensen SVP, Operations Pierce Norton President and CEO Curtis Dinan SVP, CFO and Treasurer Joe McCormick SVP, General Counsel and Asst. Secretary Caron Lawhorn SVP, Commercial Greg Phillips SVP, Operations ONEOK, Inc. and ONEOK Partners – John Gibson, Non-Executive Chairman ONE Gas, Inc. – John Gibson, Non-Executive Chairman

Page 11 Timeline • No shareholder approval required • Submit IRS ruling request - filed • Board authorization - approved • Complete necessary regulatory filings – third quarter 2013 • December 2013 – March 2014 – Obtain regulatory approvals including: Private letter ruling from IRS Kansas Corporation Commission – Final ONEOK board approval – Transition affected employees to new roles – Complete ONE Gas debt offering – Complete ONE Gas spinoff of common stock Completion Expected by End of First Quarter 2014

Page 12 Summary • Enhances strategic and financial strength and flexibility, and growth potential of both entities • Resolves the internal competition for capital • Attracts a more focused investor base • Allows each entity to trade on valuation metrics more consistent with its lines of business • Anticipates OKE increasing return to shareholders through higher dividends • Increases transparency of each company Highly Focused Energy Companies

Page 13 Appendix

Page 14 $38 $55 $79 $95 $115 $136 $201 $274 $107 $147 $173 $183 $189 $197 $236 $274 2006 2007 2008 2009 2010 2011 2012 2013G* GP interest LP interest How OKS Growth Benefits OKE • ONEOK Partners’ growth projects are expected to drive continued ONEOK Partners distribution growth • Two-thirds of every incremental ONEOK Partners EBITDA dollar, at current ownership level, flows to ONEOK in cash as ONEOK Partners distributions increase • LP distributions to ONEOK are predominantly tax deferred ONEOK’s Source of Growth Distributions Paid to ONEOK ($ in Millions) 21% CAGR $145 $202 $252 $278 $304 $333 $437 $548 *Feb. 25, 2013 guidance

Page 15 Natural Gas Distribution • Third largest pure-play, publicly traded natural gas distribution company • Currently eighth largest U.S. natural gas distributor – Largest in Oklahoma and Kansas; third largest in Texas – More than 2 million customers served – Rate base: $2.2 billion* Asset Overview Kansas City Wichita Tulsa Oklahoma City Austin El Paso Kansas Oklahoma Texas Customer Base Approximately 70% of state’s natural gas customers Approximately 87% of state’s natural gas customers Approximately 14% of state’s natural gas customers Regulation Kansas Corporation Commission (three commissioners appointed by the governor to four-year staggered terms) Oklahoma Corporation Commission (three commissioners elected to six-year staggered terms) “Home Rule” with 10 jurisdictions (Texas Railroad Commission has appellate authority) Customer Count 641,000 854,000 633,000 *Consistent with utility ratemaking in each jurisdiction

Page 16 $117 $174 $189 $210 $225 $198 $216 $227 2006 2007 2008 2009 2010 2011 2012 2013G Natural Gas Distribution • Goal: Minimize the gap between allowed and actual returns* – 2013 allowed return on equity (ROE): 9.9% – 2013 ROE estimate: 8.3% Financial Highlights ($ In Millions) CAGR = 10% Operating Income *ROE calculations are consistent with utility ratemaking in each jurisdiction **Feb. 25, 2013 guidance *** Higher share-based expenses *** **

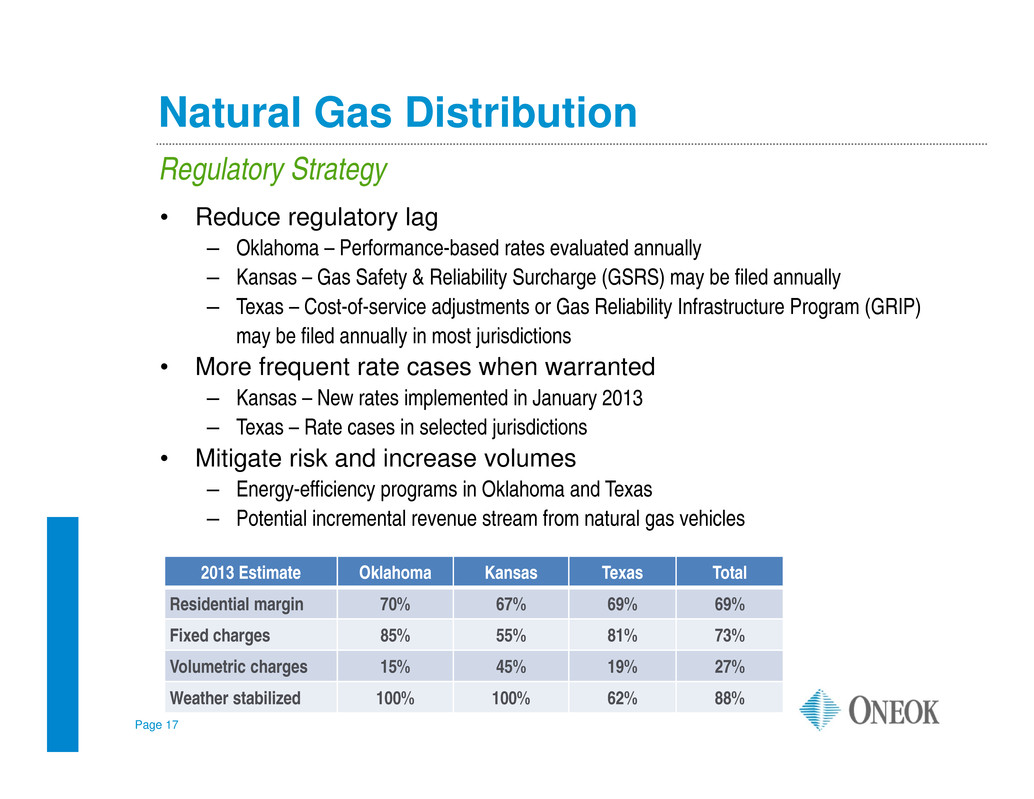

Page 17 Natural Gas Distribution • Reduce regulatory lag – Oklahoma – Performance-based rates evaluated annually – Kansas – Gas Safety & Reliability Surcharge (GSRS) may be filed annually – Texas – Cost-of-service adjustments or Gas Reliability Infrastructure Program (GRIP) may be filed annually in most jurisdictions • More frequent rate cases when warranted – Kansas – New rates implemented in January 2013 – Texas – Rate cases in selected jurisdictions • Mitigate risk and increase volumes – Energy-efficiency programs in Oklahoma and Texas – Potential incremental revenue stream from natural gas vehicles Regulatory Strategy 2013 Estimate Oklahoma Kansas Texas Total Residential margin 70% 67% 69% 69% Fixed charges 85% 55% 81% 73% Volumetric charges 15% 45% 19% 27% Weather stabilized 100% 100% 62% 88%