Attached files

| file | filename |

|---|---|

| 8-K - DFS FORM 8-K - Discover Financial Services | a2q138k.htm |

| EX-99.2 - EXHIBIT 99.2 - Discover Financial Services | dfs20130630ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - Discover Financial Services | dfs-earningsreleasex2q13ex.htm |

July 23, 2013 ©2013 DISCOVER FINANCIAL SERVICES 2Q13 Financial Results Exhibit 99.3

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discoverfinancial.com) and the SEC’s website (www.sec.gov). Company financial data presented herein is based on a calendar year. As previously reported, the Company changed its fiscal year end from November 30 to December 31 of each year, effective beginning with the 2013 fiscal year. For more information, see the Company's Current Report on Form 8-K dated March 5, 2013, which includes the Company's financial results on a calendar-year basis for each quarter in 2012 and 2011, as well as the twelve months ended December 31, 2012, 2011 and 2010, and is available on the Company’s website and the SEC’s website. The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to the comparable GAAP figures are included at the end of this presentation, which is available on the Company’s website and the SEC’s website. The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended November 30, 2012 and under “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2013, which are filed with the SEC and available at the SEC's website. The Company does not undertake to update or revise forward-looking statements as more information becomes available. 2

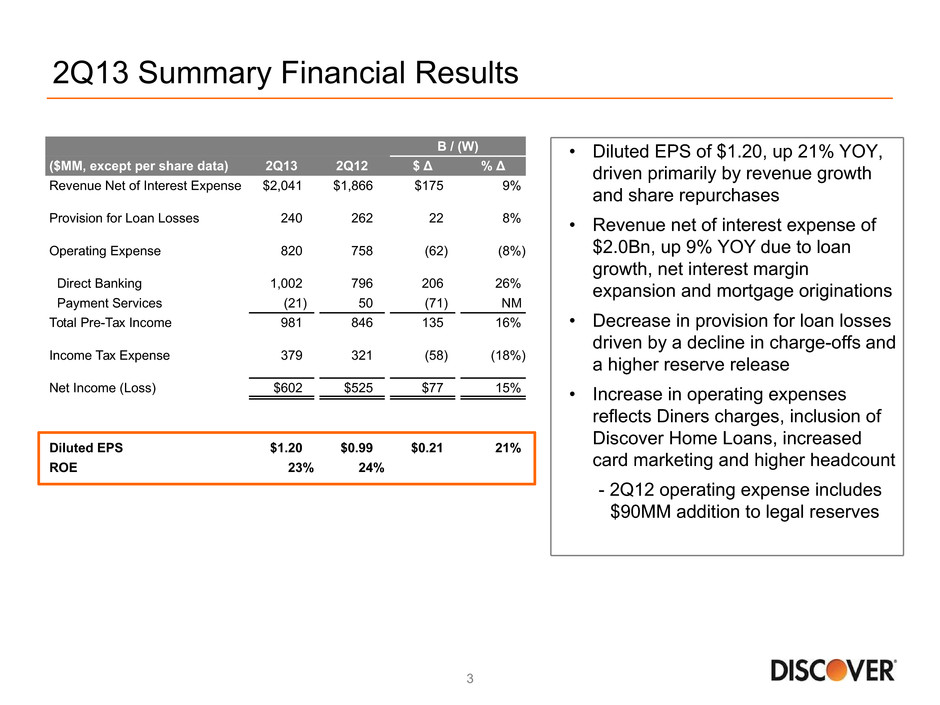

B / (W) ($MM, except per share data) 2Q13 2Q12 $ Δ % Δ Revenue Net of Interest Expense $2,041 $1,866 $175 9% Provision for Loan Losses 240 262 22 8% Operating Expense 820 758 (62) (8%) Direct Banking 1,002 796 206 26% Payment Services (21) 50 (71) NM Total Pre-Tax Income 981 846 135 16% Income Tax Expense 379 321 (58) (18%) Net Income (Loss) $602 $525 $77 15% Diluted EPS $1.20 $0.99 $0.21 21% ROE 23% 24% 2Q13 Summary Financial Results • Diluted EPS of $1.20, up 21% YOY, driven primarily by revenue growth and share repurchases • Revenue net of interest expense of $2.0Bn, up 9% YOY due to loan growth, net interest margin expansion and mortgage originations • Decrease in provision for loan losses driven by a decline in charge-offs and a higher reserve release • Increase in operating expenses reflects Diners charges, inclusion of Discover Home Loans, increased card marketing and higher headcount - 2Q12 operating expense includes $90MM addition to legal reserves 3

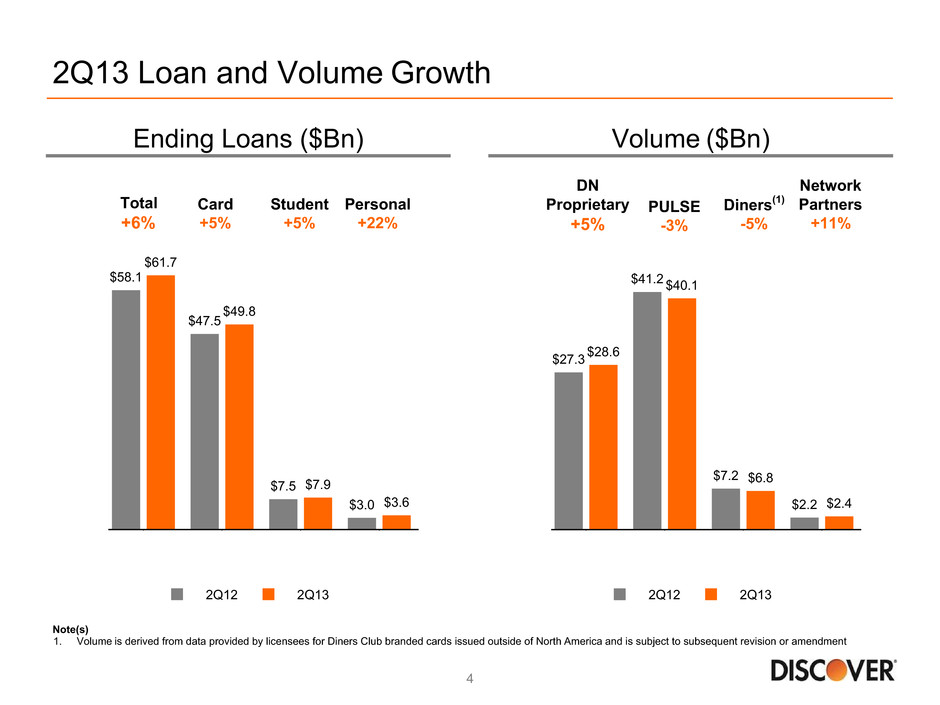

2Q12 2Q13 0 10 20 30 40 50 60 70 Total Card Student Personal $61.7 $49.8 $7.9 $3.6 $58.1 $47.5 $7.5 $3.0 2Q12 2Q13 0 10 20 30 40 50 DN Proprietary PULSE Diners(1)Network Partners $28.6 $40.1 $6.8 $2.4 $27.3 $41.2 $7.2 $2.2 2Q13 Loan and Volume Growth 4 Volume ($Bn)Ending Loans ($Bn) Note(s) 1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Total +6% Card +5% Student +5% Personal +22% PULSE -3% Diners(1) -5% Network Partners +11% DN Proprietary +5%

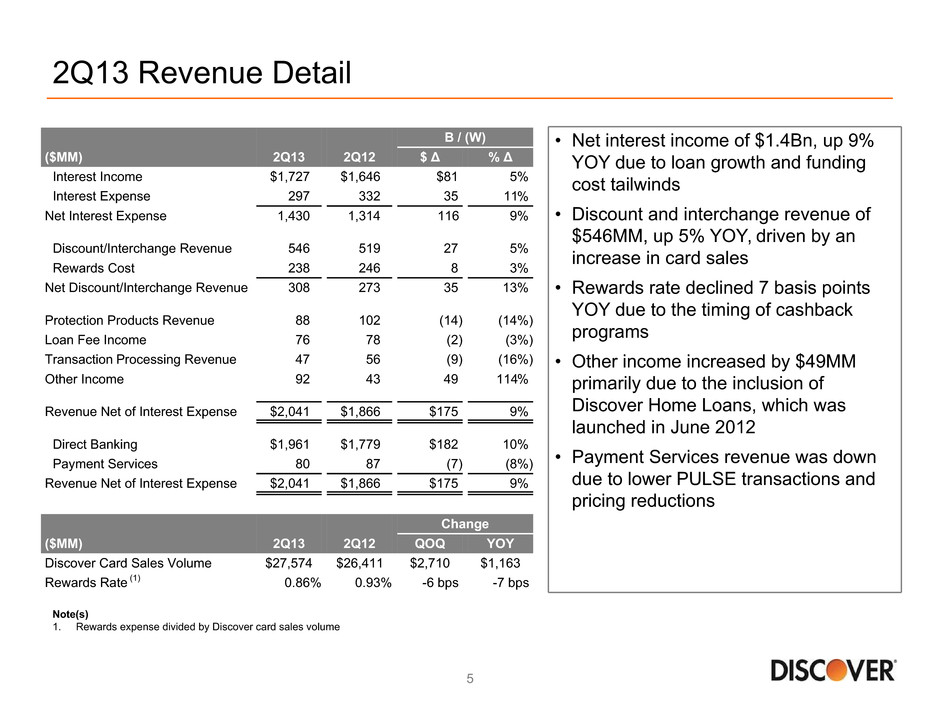

2Q13 Revenue Detail • Net interest income of $1.4Bn, up 9% YOY due to loan growth and funding cost tailwinds • Discount and interchange revenue of $546MM, up 5% YOY, driven by an increase in card sales • Rewards rate declined 7 basis points YOY due to the timing of cashback programs • Other income increased by $49MM primarily due to the inclusion of Discover Home Loans, which was launched in June 2012 • Payment Services revenue was down due to lower PULSE transactions and pricing reductions Note(s) 1. Rewards expense divided by Discover card sales volume 5 B / (W) ($MM) 2Q13 2Q12 $ Δ % Δ Interest Income $1,727 $1,646 $81 5% Interest Expense 297 332 35 11% Net Interest Expense 1,430 1,314 116 9% Discount/Interchange Revenue 546 519 27 5% Rewards Cost 238 246 8 3% Net Discount/Interchange Revenue 308 273 35 13% Protection Products Revenue 88 102 (14) (14%) Loan Fee Income 76 78 (2) (3%) Transaction Processing Revenue 47 56 (9) (16%) Other Income 92 43 49 114% Revenue Net of Interest Expense $2,041 $1,866 $175 9% Direct Banking $1,961 $1,779 $182 10% Payment Services 80 87 (7) (8%) Revenue Net of Interest Expense $2,041 $1,866 $175 9% Change ($MM) 2Q13 2Q12 QOQ YOY Discover Card Sales Volume $27,574 $26,411 $2,710 $1,163 Rewards Rate (1) 0.86% 0.93% -6 bps -7 bps

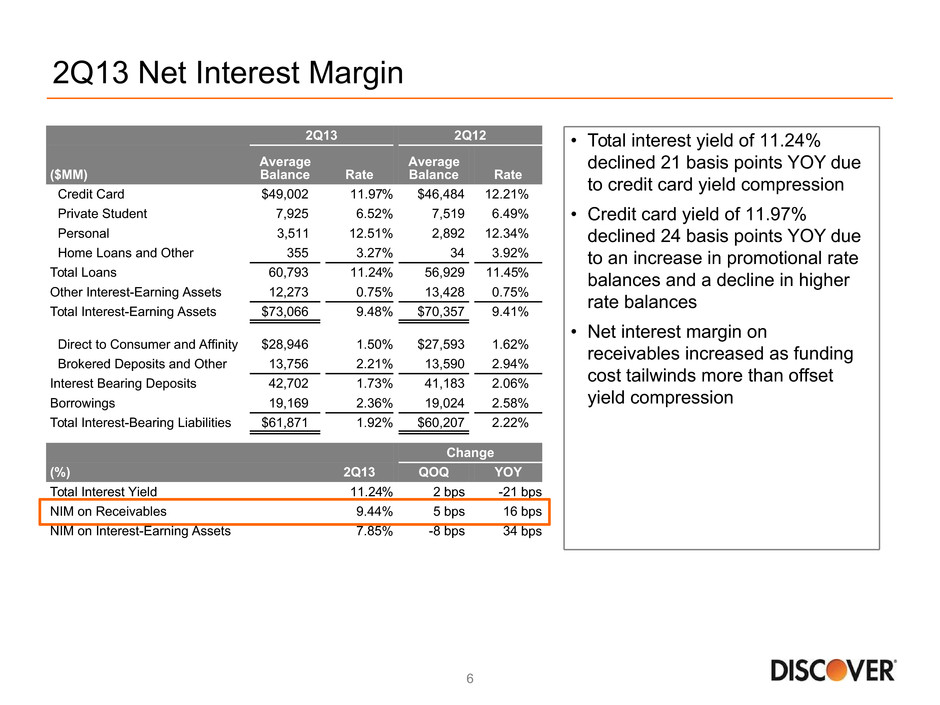

2Q13 Net Interest Margin 6 • Total interest yield of 11.24% declined 21 basis points YOY due to credit card yield compression • Credit card yield of 11.97% declined 24 basis points YOY due to an increase in promotional rate balances and a decline in higher rate balances • Net interest margin on receivables increased as funding cost tailwinds more than offset yield compression 2Q13 2Q12 ($MM) Average Balance Rate Average Balance Rate Credit Card $49,002 11.97% $46,484 12.21% Private Student 7,925 6.52% 7,519 6.49% Personal 3,511 12.51% 2,892 12.34% Home Loans and Other 355 3.27% 34 3.92% Total Loans 60,793 11.24% 56,929 11.45% Other Interest-Earning Assets 12,273 0.75% 13,428 0.75% Total Interest-Earning Assets $73,066 9.48% $70,357 9.41% Direct to Consumer and Affinity $28,946 1.50% $27,593 1.62% Brokered Deposits and Other 13,756 2.21% 13,590 2.94% Interest Bearing Deposits 42,702 1.73% 41,183 2.06% Borrowings 19,169 2.36% 19,024 2.58% Total Interest-Bearing Liabilities $61,871 1.92% $60,207 2.22% Change (%) 2Q13 QOQ YOY Total Interest Yield 11.24% 2 bps -21 bps NIM on Receivables 9.44% 5 bps 16 bps NIM on Interest-Earning Assets 7.85% -8 bps 34 bps

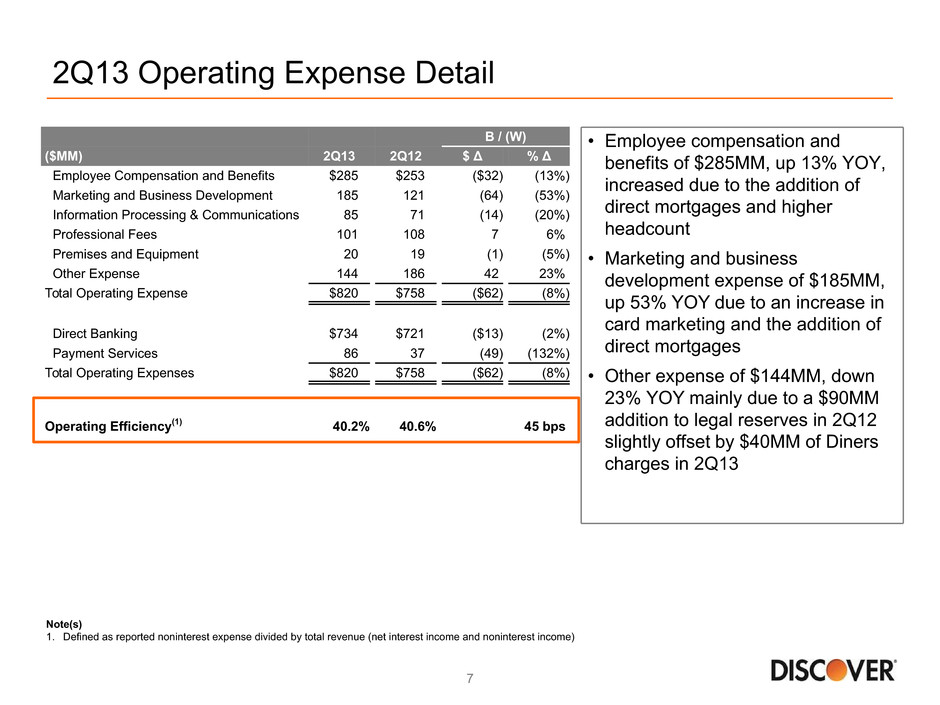

B / (W) ($MM) 2Q13 2Q12 $ Δ % Δ Employee Compensation and Benefits $285 $253 ($32) (13%) Marketing and Business Development 185 121 (64) (53%) Information Processing & Communications 85 71 (14) (20%) Professional Fees 101 108 7 6% Premises and Equipment 20 19 (1) (5%) Other Expense 144 186 42 23% Total Operating Expense $820 $758 ($62) (8%) Direct Banking $734 $721 ($13) (2%) Payment Services 86 37 (49) (132%) Total Operating Expenses $820 $758 ($62) (8%) Operating Efficiency(1) 40.2% 40.6% 45 bps 2Q13 Operating Expense Detail 7 • Employee compensation and benefits of $285MM, up 13% YOY, increased due to the addition of direct mortgages and higher headcount • Marketing and business development expense of $185MM, up 53% YOY due to an increase in card marketing and the addition of direct mortgages • Other expense of $144MM, down 23% YOY mainly due to a $90MM addition to legal reserves in 2Q12 slightly offset by $40MM of Diners charges in 2Q13 Note(s) 1. Defined as reported noninterest expense divided by total revenue (net interest income and noninterest income)

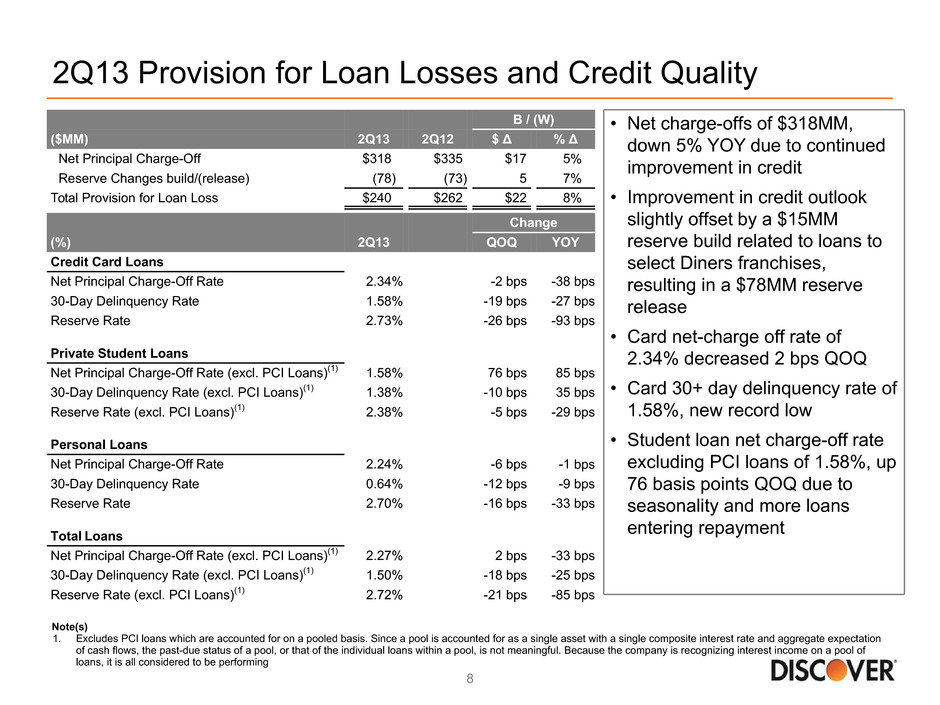

2Q13 Provision for Loan Losses and Credit Quality 8 • Net charge-offs of $318MM, down 5% YOY due to continued improvement in credit • Improvement in credit outlook slightly offset by a $15MM reserve build related to loans to select Diners franchises, resulting in a $78MM reserve release • Card net-charge off rate of 2.34% decreased 2 bps QOQ • Card 30+ day delinquency rate of 1.58%, new record low • Student loan net charge-off rate excluding PCI loans of 1.58%, up 76 basis points QOQ due to seasonality and more loans entering repayment Note(s) 1. Excludes PCI loans which are accounted for on a pooled basis. Since a pool is accounted for as a single asset with a single composite interest rate and aggregate expectation of cash flows, the past-due status of a pool, or that of the individual loans within a pool, is not meaningful. Because the company is recognizing interest income on a pool of loans, it is all considered to be performing B / (W) ($MM) 2Q13 2Q12 $ Δ % Δ Net Principal Charge-Off $318 $335 $17 5% Reserve Changes build/(release) (78) (73) 5 7% Total Provision for Loan Loss $240 $262 $22 8% Change (%) 2Q13 QOQ YOY Credit Card Loans Net Principal Charge-Off Rate 2.34% -2 bps -38 bps 30-Day Delinquency Rate 1.58% -19 bps -27 bps Reserve Rate 2.73% -26 bps -93 bps Private Student Loans Net Principal Charge-Off Rate (excl. PCI Loans)(1) 1.58% 76 bps 85 bps 30-Day Delinquency Rate (excl. PCI Loans)(1) 1.38% -10 bps 35 bps Reserve Rate (excl. PCI Loans)(1) 2.38% -5 bps -29 bps Personal Loans Net Principal Charge-Off Rate 2.24% -6 bps -1 bps 30-Day Delinquency Rate 0.64% -12 bps -9 bps Reserve Rate 2.70% -16 bps -33 bps Total Loans Net Principal Charge-Off Rate (excl. PCI Loans)(1) 2.27% 2 bps -33 bps 30-Day Delinquency Rate (excl. PCI Loans)(1) 1.50% -18 bps -25 bps Reserve Rate (excl. PCI Loans)(1) 2.72% -21 bps -85 bps

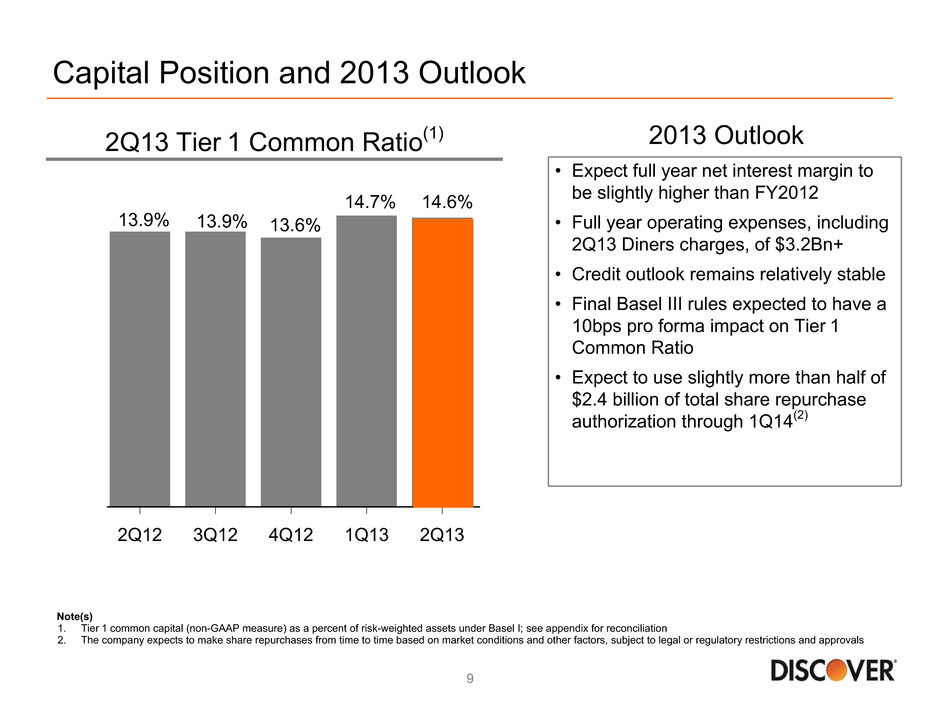

0 2 4 6 8 10 12 14 2Q12 3Q12 4Q12 1Q13 2Q13 Capital Position and 2013 Outlook 9 • Expect full year net interest margin to be slightly higher than FY2012 • Full year operating expenses, including 2Q13 Diners charges, of $3.2Bn+ • Credit outlook remains relatively stable • Final Basel III rules expected to have a 10bps pro forma impact on Tier 1 Common Ratio • Expect to use slightly more than half of $2.4 billion of total share repurchase authorization through 1Q14(2) Note(s) 1. Tier 1 common capital (non-GAAP measure) as a percent of risk-weighted assets under Basel I; see appendix for reconciliation 2. The company expects to make share repurchases from time to time based on market conditions and other factors, subject to legal or regulatory restrictions and approvals 2Q13 Tier 1 Common Ratio(1) 2013 Outlook 13.9% 13.9% 13.6% 14.7% 14.6%

Appendix

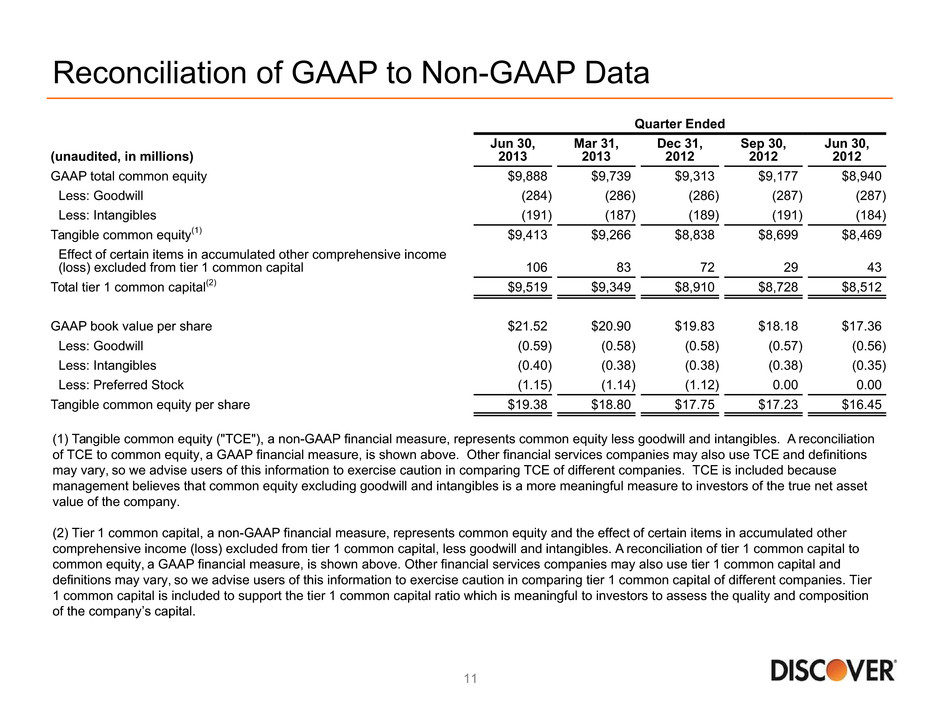

Reconciliation of GAAP to Non-GAAP Data 11 (1) Tangible common equity ("TCE"), a non-GAAP financial measure, represents common equity less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so we advise users of this information to exercise caution in comparing TCE of different companies. TCE is included because management believes that common equity excluding goodwill and intangibles is a more meaningful measure to investors of the true net asset value of the company. (2) Tier 1 common capital, a non-GAAP financial measure, represents common equity and the effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common capital, less goodwill and intangibles. A reconciliation of tier 1 common capital to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use tier 1 common capital and definitions may vary, so we advise users of this information to exercise caution in comparing tier 1 common capital of different companies. Tier 1 common capital is included to support the tier 1 common capital ratio which is meaningful to investors to assess the quality and composition of the company’s capital. Quarter Ended (unaudited, in millions) Jun 30, 2013 Mar 31, 2013 Dec 31, 2012 Sep 30, 2012 Jun 30, 2012 GAAP total common equity $9,888 $9,739 $9,313 $9,177 $8,940 Less: Goodwill (284) (286) (286) (287) (287) Less: Intangibles (191) (187) (189) (191) (184) Tangible common equity(1) $9,413 $9,266 $8,838 $8,699 $8,469 Effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common capital 106 83 72 29 43 Total tier 1 common capital(2) $9,519 $9,349 $8,910 $8,728 $8,512 GAAP book value per share $21.52 $20.90 $19.83 $18.18 $17.36 Less: Goodwill (0.59) (0.58) (0.58) (0.57) (0.56) Less: Intangibles (0.40) (0.38) (0.38) (0.38) (0.35) Less: Preferred Stock (1.15) (1.14) (1.12) 0.00 0.00 Tangible common equity per share $19.38 $18.80 $17.75 $17.23 $16.45