Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Avery Dennison Corp | a13-16929_18k.htm |

| EX-99.1 - EX-99.1 - Avery Dennison Corp | a13-16929_1ex99d1.htm |

Exhibit 99.2

|

|

Second Quarter 2013 Financial Review and Analysis (preliminary, unaudited) Supplemental Presentation Materials Unless otherwise indicated, the discussion of the company’s results is focused on its continuing operations, and comparisons are to the same period in the prior year. Results reflect classification of Office and Consumer Products (OCP) and Designed and Engineered Solutions (DES) as discontinued operations. July 23, 2013 |

|

|

Certain statements contained in this document are "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements, and financial or other business targets, are subject to certain risks and uncertainties. Actual results and trends may differ materially from historical or anticipated results depending on a variety of factors, including but not limited to risks and uncertainties relating to the following: fluctuations in demand affecting sales to customers; the financial condition and inventory strategies of customers; changes in customer order patterns; worldwide and local economic conditions; fluctuations in cost and availability of raw materials; our ability to generate sustained productivity improvement; our ability to achieve and sustain targeted cost reductions; impact of competitive products and pricing; loss of significant contracts or customers; collection of receivables from customers; selling prices; business mix shift; changes in tax laws and regulations, and uncertainties associated with interpretations of such laws and regulations; outcome of tax audits; timely development and market acceptance of new products, including sustainable or sustainably-sourced products; investment in development activities and new production facilities; fluctuations in foreign currency exchange rates and other risks associated with foreign operations; integration of acquisitions and completion of pending dispositions; amounts of future dividends and share repurchases; customer and supplier concentrations; successful implementation of new manufacturing technologies and installation of manufacturing equipment; disruptions in information technology systems; successful installation of new or upgraded information technology systems; volatility of financial markets; impairment of capitalized assets, including goodwill and other intangibles; credit risks; our ability to obtain adequate financing arrangements and maintain access to capital; fluctuations in interest and tax rates; fluctuations in pension, insurance and employee benefit costs; impact of legal and regulatory proceedings, including with respect to environmental, health and safety; changes in governmental laws and regulations; changes in political conditions; impact of epidemiological events on the economy and our customers and suppliers; acts of war, terrorism, and natural disasters; and other factors. We believe that the most significant risk factors that could affect our financial performance in the near-term include: (1) the impact of economic conditions on underlying demand for our products; (2) competitors' actions, including pricing, expansion in key markets, and product offerings; and (3) the degree to which higher costs can be offset with productivity measures and/or passed on to customers through selling price increases, without a significant loss of volume. For a more detailed discussion of these and other factors, see “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial Condition” in the company’s 2012 Form 10-K, filed on February 27, 2013 with the Securities and Exchange Commission, and subsequent quarterly reports on Form 10-Q. The forward-looking statements included in this document are made only as of the date of this document, and the company undertakes no obligation to update these statements to reflect subsequent events or circumstances, other than as may be required by law. |

|

|

Use of Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures as defined by SEC rules. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to, the comparable GAAP financial measures. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, including limitations associated with these non-GAAP financial measures, are provided in the financial schedules accompanying the earnings news release for the quarter. (See Attachments A-2 through A-5 to news release dated July 23, 2013.) The company’s non-GAAP financial measures exclude the impact of certain events, activities or strategic decisions. The accounting effects of these events, activities or decisions, which are included in the GAAP financial measures, may make it difficult to assess the underlying performance of the company in a single period. By excluding certain accounting effects, both positive and negative, of certain items (e.g., restructuring costs, asset impairments, legal settlements, certain effects of strategic transactions and related costs, loss from debt extinguishments, loss from curtailment and settlement of pension obligations, gains or losses on sale of certain assets and other items), the company believes that it is providing meaningful supplemental information to facilitate an understanding of the company’s core operating results and liquidity measures. These non-GAAP financial measures are used internally to evaluate trends in the company’s underlying businesses, as well as to facilitate comparison to the results of competitors for a single period. While some of the items excluded from GAAP financial measures may recur, they tend to be disparate in amount, frequency, and timing. The company uses the following non-GAAP financial measures in this presentation: Organic sales change refers to the increase or decrease in sales excluding the estimated impact of currency translation, product line exits, acquisitions and divestitures; Adjusted operating margin refers to earnings before interest expense and taxes, excluding restructuring costs and other items, as a percentage of sales; Adjusted tax rate refers to the anticipated full year GAAP tax rate adjusted for certain events; Adjusted net income refers to reported net income adjusted for the tax-effected restructuring costs and other items; Adjusted EPS refers to as reported net income per common share, assuming dilution, adjusted for the tax-effected restructuring costs and other items; and Free cash flow refers to cash flow from operations, less payments for property, plant, and equipment, software and other deferred charges, plus proceeds from sale of property, plant and equipment, plus (minus) net proceeds from sales (purchases) of investments, plus discretionary contributions to pension plan utilizing proceeds from divestitures. Free cash flow excludes uses of cash that do not directly or immediately support the underlying business (such as discretionary debt reductions, dividends, share repurchases, and certain effects of acquisitions and divestitures). This document has been furnished (not filed) on Form 8-K with the SEC and may be found on the company’s website at www.investors.averydennison.com. |

|

|

Second Quarter Overview Results in line with company’s expectations Sales up approx. 5% on organic basis driven by higher volume Operating margin, as reported, improved 180 basis points as the benefit of productivity initiatives, higher volume, and a gain on sale of assets more than offset higher employee-related expenses and the impact of changes in product mix Adjusted operating margin improved 110 basis points Reported EPS (including discontinued operations) of $0.68 Adjusted EPS (non-GAAP, continuing operations) of $0.71 Solid first half free cash flow from continuing operations Restructuring program achieved annualized savings of $105 million Returned $205 million of cash to shareholders in the first half, including the repurchase of 3.5 million shares for $149 million OCP and DES sale completed July 1; expect net proceeds of approx. $400 million Narrowed adjusted EPS guidance to $2.50 to $2.70, an increase of 28% to 38% compared to prior year |

|

|

2Q12 3Q12 4Q12 1Q13 2Q13 Organic Sales Change 3.7% 6.1% 6.7% 3.7% 5.0% Currency Translation (4.4%) (6.7%) (1.5%) 0.3% (0.6%) Reported Sales Change* (0.6%) (0.5%) 5.0% 3.9% 4.2% Sales Trend Analysis *Totals may not sum due to rounding and other factors. |

|

|

Segment Sales and Margin Analysis 2Q13 Reported Organic Sales Growth: Pressure-sensitive Materials 3% 4% Retail Branding and Information Solutions 7% 8% Other specialty converting businesses (1%) 6% Continuing Operations 4% 5% Adjusted As Reported (Non-GAAP) 2Q13 2Q12 2Q13 2Q12 Operating Margin: Pressure-sensitive Materials 10.5% 8.7% 10.7% 9.4% Retail Branding and Information Solutions 5.6% 5.8% 7.1% 6.0% Other specialty converting businesses (14.9%) (17.9%) (14.9%) (14.7%) Continuing Operations 8.0% 6.2% 8.0% 6.9% |

|

|

Second Quarter Segment Overview PRESSURE-SENSITIVE MATERIALS (PSM) Reported sales of $1.11 bil., up approx. 3% compared to prior year Sales up approx. 4% on organic basis Label and Packaging Materials sales up mid-single digits on organic basis Combined sales for Graphics, Reflective, and Performance Tapes up low single digits on organic basis Operating margin improved 180 basis points to 10.5% as the benefit of productivity initiatives, higher volume, and lower restructuring costs more than offset the impact of changes in product mix. Adjusted operating margin improved 130 basis points. RETAIL BRANDING AND INFORMATION SOLUTIONS (RBIS) Reported sales of $420 mil., up approx. 7% compared to prior year Sales up approx. 8% on organic basis Operating margin declined 20 basis points to 5.6% due to higher restructuring costs. Adjusted operating margin improved 110 basis points as the benefit of productivity initiatives and higher volume more than offset higher employee-related expenses. |

|

|

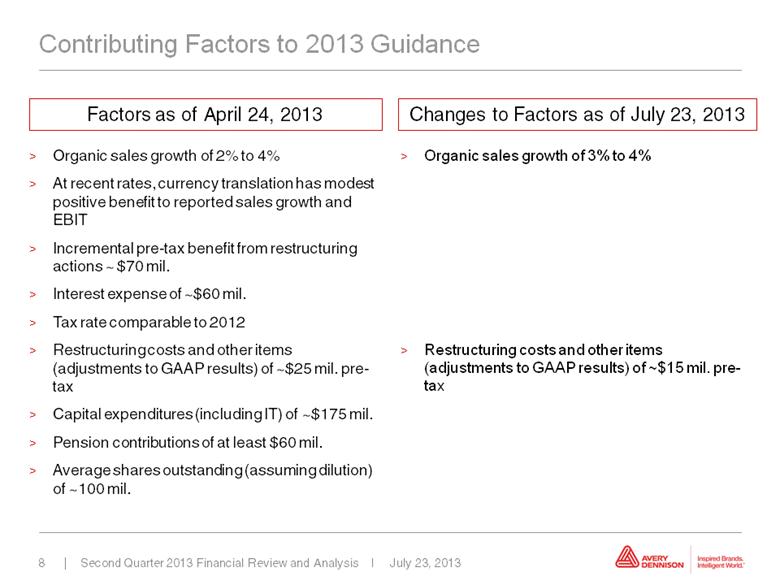

Contributing Factors to 2013 Guidance Organic sales growth of 2% to 4% At recent rates, currency translation has modest positive benefit to reported sales growth and EBIT Incremental pre-tax benefit from restructuring actions ~ $70 mil. Interest expense of ~$60 mil. Tax rate comparable to 2012 Restructuring costs and other items (adjustments to GAAP results) of ~$25 mil. pre-tax Capital expenditures (including IT) of ~$175 mil. Pension contributions of at least $60 mil. Average shares outstanding (assuming dilution) of ~100 mil. Organic sales growth of 3% to 4% Restructuring costs and other items (adjustments to GAAP results) of ~$15 mil. pre-tax Factors as of April 24, 2013 Changes to Factors as of July 23, 2013 |

|

|

2013 EPS and Free Cash Flow Guidance (continuing operations) Add Back: Estimated restructuring costs and other items, net of gain on sale of assets ~ $0.10 Adjusted EPS (non-GAAP) Reported EPS $2.40 - $2.60 Free Cash Flow $275 mil. - $315 mil. $2.50 - $2.70 |

|

|

[LOGO] © 2011 Avery Dennison Corporation. All rights reserved. Avery Dennison and all other Avery brands, product names and codes are trademarks of Avery Dennison Corporation. All other brands and product names are trademarks of their respective owners. Fortune 500 is a trademark of Time, Inc. Personal and company names and other information on samples depicted are fictitious. Any resemblance to actual names and addresses is purely coincidental. Inspired Brands. Intelligent World.TM |