Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - MARRONE BIO INNOVATIONS INC | d329931dex32.htm |

| EX-3.4 - EX-3.4 - MARRONE BIO INNOVATIONS INC | d329931dex34.htm |

| EX-4.1 - EX-4.1 - MARRONE BIO INNOVATIONS INC | d329931dex41.htm |

| EX-5.1 - EX-5.1 - MARRONE BIO INNOVATIONS INC | d329931dex51.htm |

| EX-23.1 - EX-23.1 - MARRONE BIO INNOVATIONS INC | d329931dex231.htm |

| EX-10.4 - EX-10.4 - MARRONE BIO INNOVATIONS INC | d329931dex104.htm |

| EX-10.3 - EX-10.3 - MARRONE BIO INNOVATIONS INC | d329931dex103.htm |

| EX-21.1 - EX-21.1 - MARRONE BIO INNOVATIONS INC | d329931dex211.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 22, 2013.

Registration No. 333-189753

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Marrone Bio Innovations, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2870 | 20-5137161 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2121 Second St. Suite A-107

Davis, CA 95618

(530) 750-2800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Pamela G. Marrone, Ph.D.

President and Chief Executive Officer

Marrone Bio Innovations, Inc.

2121 Second St. Suite A-107

Davis, CA 95618

(530) 750-2800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Charles S. Farman, Esq. John W. Campbell, Esq. Alfredo B. D. Silva, Esq. Morrison & Foerster LLP 425 Market Street San Francisco, CA 94105 Tel: (415) 268-7000 Fax: (415) 268-7522 |

Christopher M. Kelly, Esq. Boris Dolgonos, Esq. Jones Day 222 East 41st Street New York, NY 10017 Tel: (212) 326-3939 Fax: (212) 755-7306 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED |

AMOUNT TO BE REGISTERED(1) |

PROPOSED MAXIMUM PRICE PER SHARE |

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(2) |

AMOUNT OF REGISTRATION FEE | ||||

| Common Stock, par value $0.00001 per share |

4,830,000 | $17.00 | $82,110,000.00 | $11,199.81(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 630,000 shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (3) | The registrant previously paid $8,184.00 of this registration fee in connection with the first filing of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 22, 2013.

PRELIMINARY PROSPECTUS

4,200,000 Shares

Marrone Bio Innovations, Inc.

Common Stock

This is an initial public offering of shares of common stock of Marrone Bio Innovations, Inc. All of the shares of common stock are being sold by the company.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $14.00 and $17.00. We have applied to have our shares of common stock listed on the Nasdaq Global Market, subject to notice of issuance, under the symbol “MBII.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and, as such, may elect to comply with certain reduced reporting requirements after this offering.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 17 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE | TOTAL | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discounts and Commissions (1) |

$ | $ | ||||||

| Proceeds to Marrone (Before Expenses) |

$ | $ | ||||||

| (1) | See the section of this prospectus entitled “Underwriting.” |

Delivery of the shares of common stock is expected to be made on or about , 2013. We have granted the underwriters an option for a period of 30 days to purchase an additional 630,000 shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

| Jefferies | Piper Jaffray |

| Stifel |

Roth Capital Partners | |

Preliminary Prospectus dated , 2013.

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 17 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

46 | |||

| 73 | ||||

| 94 | ||||

| 101 | ||||

| 109 | ||||

| 112 | ||||

| 116 | ||||

| 121 | ||||

| 127 | ||||

| 130 | ||||

| 134 | ||||

| 140 | ||||

| 141 | ||||

| 142 | ||||

| F-1 | ||||

i

Table of Contents

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Neither we nor any of the underwriters have done anything that would permit a public offering of the shares of our common stock or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

ii

Table of Contents

This summary highlights information contained in greater detail elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Unless otherwise indicated in this prospectus, “MBI,” “our company,” “we,” “us” and “our” refer to Marrone Bio Innovations, Inc.

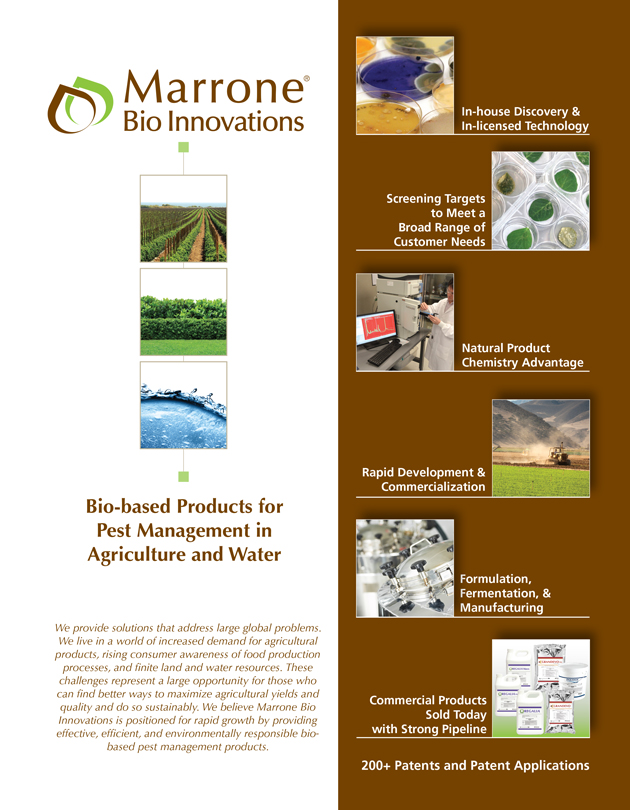

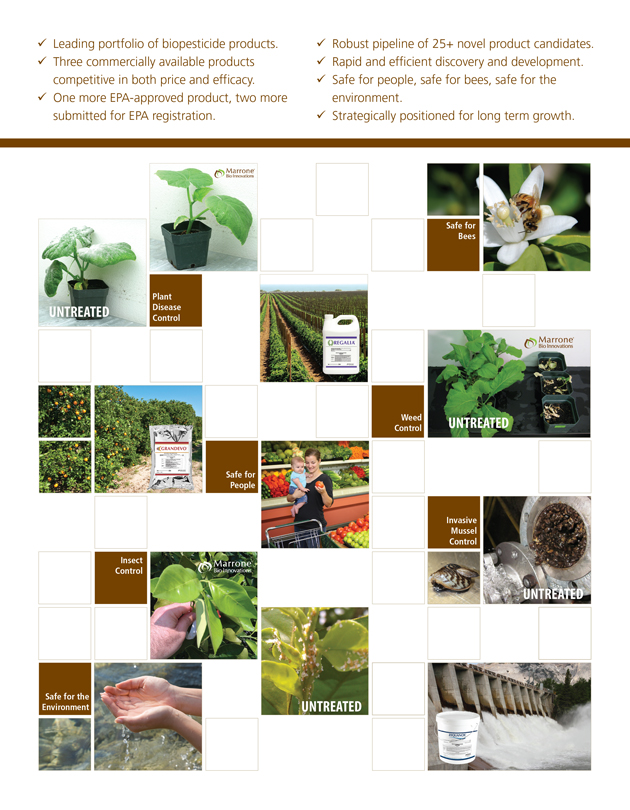

Our Company

We make bio-based pest management and plant health products. Bio-based products are comprised of naturally occurring microorganisms, such as bacteria and fungi, and plant extracts. We target the major markets that use conventional chemical pesticides, including certain agricultural and water markets, where our bio-based products are used as substitutes for, or in conjunction with, conventional chemical pesticides. We also target new markets for which there are no available conventional chemical pesticides, the use of conventional chemical pesticides may not be desirable or permissible because of health and environmental concerns or the development of pest resistance has reduced the efficacy of conventional chemical pesticides. All of our current products are approved by the U.S. Environmental Protection Agency, or EPA, and registered as “biopesticides,” or biological pesticides based on microorganisms, plants and other natural products. We believe our current portfolio of products and our pipeline address the growing global demand for effective, efficient and environmentally responsible products.

Our three currently commercialized product lines target two core end markets: crop protection and water treatment. Crop protection products consist of herbicides (for weed control), fungicides (for plant disease control), nematicides (for parasitic roundworm control), insecticides (for insect and mite control) and plant growth regulators that growers use to increase crop yields, improve plant health, manage pest resistance and reduce chemical residues. Our products can be used in both conventional and organic crop production. We currently sell two crop protection product lines, Regalia, for plant disease control and plant health, and Grandevo, for insect and mite control, to growers of specialty crops such as grapes, citrus, tomatoes, vegetables, nuts, leafy greens and ornamental plants. We have also initiated targeted sales of Regalia for large-acre row crops such as corn, cotton and soybeans. Water treatment products target invasive water pests across a broad range of applications, including hydroelectric and thermoelectric power generation, industrial applications, drinking water, aquaculture, irrigation and recreation. Our current water treatment product line, Zequanox, which is being marketed and sold directly to U.S. power and industrial companies, selectively kills invasive mussels that cause significant infrastructure and ecological damage.

In addition to our current two core end markets, we are also taking steps through strategic collaborations to commercialize products for other non-crop pest management markets. These products may be different formulations of our crop protection products that are specifically targeted for industrial and institutional, turf and ornamental, home and garden and animal health uses such as controlling grubs, cockroaches, flies and mosquitoes in and around schools, parks, golf courses and other public-use areas.

The agricultural industry is increasingly dependent on effective and sustainable pest management practices to maximize yields and quality in a world of increased demand for agricultural products, rising consumer awareness of food production processes and finite land and water resources. Although we have only recently begun commercializing our products, we believe that our competitive strengths, including our commercially available products, robust pipeline of novel product candidates, proprietary technology and product development process, commercial relationships and industry experience, position us for rapid growth by providing solutions for these global trends.

1

Table of Contents

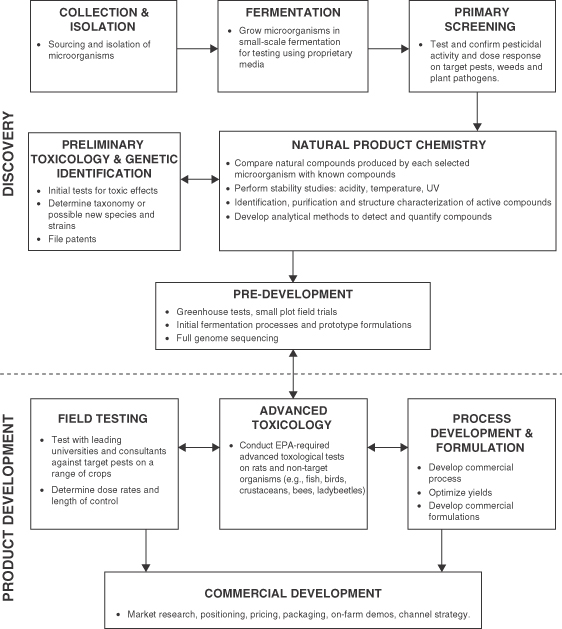

Our Technology and Product Development Process

Our proprietary technology comprises a sourcing process for microorganisms and plant extracts, an extensive proprietary microorganism collection, microbial fermentation technology, screening technology and a process to identify and characterize natural compounds with pesticidal, or pest controlling, activity. Our technology enables us to isolate and screen naturally occurring microorganisms and plant extracts in a highly efficient manner and to identify those that may have novel, effective and safe pest management or plant health promoting characteristics. We then analyze and characterize the structures of compounds either produced by selected microorganisms or found in plant extracts to identify product candidates for further development and commercialization. As of June 30, 2013, we have screened more than 18,000 microorganisms and 350 plant extracts, and we have identified multiple product candidates that display activity against insects, nematodes, weeds, plant diseases and invasive species such as zebra and quagga mussels, aquatic weeds and algae. We also have produced a collection of microorganisms from taxonomic groups that research suggests may enhance nutrient uptake in plants, reduce stress and otherwise increase plant growth. Our product candidates come from our own discovery and development as well as in-licensed technology from universities, corporations and governmental entities.

Our proprietary product development process includes several important components. For all our product candidates, we develop an analytical method to detect the quantity of the active natural product compounds that are produced by the microorganism or that are extracted from plants. For microbial products, we develop unique proprietary fermentation processes that increase the active natural compounds produced by the microorganisms. We also scale-up fermentation volumes to maximize yields consistently in each batch. Similarly, for our plant extract-based products, we develop a manufacturing process that increases the amount of active natural compounds extracted from plant materials. Our deep understanding of natural product chemistry allows us to develop formulations that optimize the efficacy and stability of compounds produced by microorganisms or plants. Products are not released for sale unless the quantity of the compounds meets our desired efficacy specifications. These methods allow us to produce products that are highly effective and of a consistent quality on a commercial scale.

These product formulations are tailored to meet customers’ needs and display enhanced performance characteristics such as effectiveness, shelf life, compatibility with other pesticides and ease of use. Our senior management’s numerous years of experience in the development of commercial products and formulations have resulted in a highly efficient product development process, which allows us to rapidly commercialize new products.

2

Table of Contents

Our Products

The table below summarizes our current portfolio of EPA-approved bio-based pest management and plant health products, as well as products submitted to the EPA for registration.

| NAME |

MARKET |

TARGET |

USE |

STAGE | ||||

| Regalia | Crop Protection | Plant Disease/ Plant Health | Protects against fungal and bacterial diseases and enhances yields. | Commercially Available | ||||

| Grandevo | Crop Protection | Insects and Mites | Kills a broad range of sucking and chewing insects through feeding. | Commercially Available | ||||

| Zequanox | Water Treatment | Invasive Mussels | Kills invasive mussels that restrict critical “in-pipe” water flow in industrial and power facilities and harm recreational “open waters.” | Commercially Available for In-Pipe; Submitted for EPA Registration for Open Water | ||||

| Opportune | Crop Protection, Home, Turf | Weeds | Controls weeds non-selectively pre-emergence and selectively post- emergence. | EPA-Approved; Not Yet Commercially Available | ||||

| Venerate | Crop Protection, Home, Turf, Animal Health | Insects and Mites | Kills a broad range of sucking and chewing insects on contact. | Submitted for EPA Registration | ||||

| MBI-011 | Crop Protection, Home, Turf | Weeds | Kills a broad range of weeds and acts as a “burndown” herbicide (controls weed foliage) | Submitted for EPA Registration | ||||

In addition to the above products, our pipeline consists of product candidates in various stages of development, those close to EPA submission and early-stage discoveries.

The Value Proposition of Our Pest Management Products

Our products are highly effective and generally designed to be compatible with existing pest control equipment and infrastructure. This allows them to be used as substitutes for, or in conjunction with, conventional chemical pesticides. We believe that compared with conventional chemical pesticides, our products:

| n | Are competitive in both price and efficacy; |

| n | Provide viable alternatives where conventional chemical pesticides and genetically modified crops are subject to regulatory restrictions; |

| n | Comply with market-imposed requirements for pest management programs by food processors and retailers; |

| n | Are environmentally friendly; |

3

Table of Contents

| n | Meet stringent organic farming requirements; |

| n | Improve worker productivity by shortening field re-entry times after spraying and allowing spraying up to the time of harvest; |

| n | Are exempt from residue restrictions applicable to conventional chemical pesticides in both the agriculture and water markets; and |

| n | Are less likely to result in the development of pest resistance. |

In addition, our experience has shown that when our products are used in conjunction with conventional chemical pesticides, they can:

| n | Increase the effectiveness of conventional chemical pesticides while reducing their required application levels; |

| n | Increase levels of pest control and consistency of control; |

| n | Increase crop yields; |

| n | Increase crop quality, including producing crops with higher levels of protein, better taste and color and more attractive flowers; and |

| n | Delay the development of pest resistance to conventional chemical pesticides. |

Our Sales and Distribution Platform

We are currently selling our crop protection product lines, Regalia and Grandevo, in the United States through leading agricultural distributors such as Crop Production Services, Helena and Wilbur Ellis. These are the same distributors that the major agrichemical companies use for distributing conventional chemical pesticides.

We have entered into various strategic agreements to facilitate the distribution of our products in international markets. We have signed exclusive international distribution agreements for Regalia with FMC (for markets in Latin America) and Syngenta (for markets in Africa, Europe and the Middle East). We have also signed a technology evaluation and development agreement with Scotts Miracle-Gro under which we have granted Scotts Miracle-Gro first rights to negotiate for exclusive worldwide commercialization rights with respect to bio-based pest management and plant health products we jointly develop for the consumer lawn and garden market.

Our water treatment product line, Zequanox, is currently being marketed and sold directly to U.S. power and industrial companies. We are also in discussions with several leaders in water treatment technology and applications regarding potential arrangements to sell Zequanox in international markets.

Our Competitive Strengths

Commercially Available Products. We have three commercially available product lines, Regalia, Grandevo and Zequanox. We believe these product lines provide us the foundation for continuing to build one of the leading portfolios of bio-based pest management products.

Robust Pipeline of Novel Product Candidates. Our pipeline of early stage discoveries and new product candidates extends across a variety of product types for different end markets, including herbicides, fungicides, nematicides, insecticides, algaecides (for algae control), molluscicides (for mussel and snail control) and plant growth regulators. Our product candidates are both developed internally and sourced from third parties.

Rapid and Efficient Development Process. We believe we can develop and commercialize novel and effective products faster and at a lower cost than many other developers of pest management products. For example, we have moved each of Regalia, Grandevo and Zequanox through development, EPA approval and U.S. market launch in approximately four years at a cost of $6 million or less. In comparison, a report from Phillips McDougall, an independent research firm, shows that the average cost for major agrichemical companies to bring a new crop protection product to market is over $250 million, and those products have historically taken an average of nearly ten years to move through development, regulatory approval and market launch.

4

Table of Contents

Proprietary Discovery Process. Our discovery process allows us to efficiently discover microorganisms and plant extracts that produce or contain compounds that display a high level of pesticidal activity against various pests. We then use various analytical chemistry techniques to identify and characterize the natural product chemistry of the compounds, which we optimize and patent. As of June 30, 2013, we have identified over 25 candidates for product development from the more than 18,000 microorganisms and 350 plant extracts in our database. Five of our product candidates, one of which is EPA-approved and one of which has been submitted to the EPA for approval, are what we believe to be newly identified microorganism species. We believe that three of our product candidates produce novel compounds that we identified, and four of our product candidates have been found to have, or produce compounds with, a novel mode of action. Our proprietary discovery process is protected by patents on the microorganisms, their natural product compounds and their uses for pest management, as well as a patent application we have filed on a screening process to identify enzyme-inhibiting herbicides. We also maintain trade secrets related to the discovery, formulation, process development and manufacturing capabilities.

Sourcing and Commercialization Expertise. We use our technical and commercial development expertise to evaluate early-stage discoveries by third parties to determine commercial viability, secure promising technologies through in-licensing and add considerable value to these in-licensed product candidates. Our efficient development process and significant experience in applying natural product chemistry has led universities, corporations and government entities to collaborate with us to develop or commercialize a number of their early-stage discoveries. As with our internally discovered products, early-stage products we source and commercialize are subject to our own patents and trade secrets related to our added value in characterizing, formulating, developing and manufacturing marketable products.

Existing Agreements with Global Market Leaders. We have strategic agreements with global market leaders across agricultural and consumer retail markets. We have signed exclusive international distribution agreements for Regalia with Syngenta in Africa, Europe and the Middle East and with FMC in Latin America. We also have a technology evaluation and development agreement with Scotts Miracle-Gro, which grants it a right of first access to the active ingredients in our full portfolio of bio-based pest management and plant health products for use in its consumer lawn and garden products.

Management Team with Significant Industry Experience. Over the last seven years, we have built a management team that has deep experience in bio-based pest management products and the broader agriculture industry. Our executive officers and key employees average 28 years of experience and include individuals who have led sales and marketing organizations, top scientists and industry experts, some of whom have served in leadership roles at large multinational corporations and governmental agencies, commercialized multiple products, brought multiple products through EPA, state and foreign regulatory processes, filed and received patents, led groundbreaking research studies and published numerous scientific articles.

Our Growth Strategy

We are an early stage company, having commenced operations in June 2006. We have invested, and will continue to invest, significant resources to develop our commercially available products and product pipeline, and to develop the manufacturing capabilities to produce these products at commercial levels. Although we have incurred substantial losses in recent periods as a result of these expenditures and expect to incur additional losses for the next several years, we believe the following strategies position us for long-term growth.

Continue to Develop and Commercialize New Products in Both Existing and New Markets. Our goal is to rapidly and efficiently develop, register and commercialize new products each year, with the goal of developing a full suite of pest management and plant health products. For example, while our current crop protection products address plant diseases and insects, we intend to provide products that can also control nematodes and weeds as well as products for improving fertilizer efficiency and reducing drought stress. We are also currently screening for water treatment products that control algae and aquatic weeds to complement Zequanox, our invasive mussel control product line.

5

Table of Contents

Expand Applications of Our Existing Product Lines. We have identified opportunities to broaden the commercial applications and expand the use of our existing product lines into several key end markets, including large-acre row crop applications, seed treatment, irrigation, aquaculture and animal health. We believe these opportunities could help to drive significant growth for our company.

Accelerate Adoption of New Products, Product Applications and Product Lines. Our goal is to provide growers with complete and effective solutions to a broad range of pest management needs that can be used individually, together and in conjunction with conventional chemical pesticides to maximize yield and quality. We believe we will be able to leverage relationships with existing distributors as well as growers’ positive experiences using our Regalia and Grandevo product lines to accelerate adoption of new products, product applications and product lines. We will also continue to target early adopters of new pest management technologies with controlled product launches and to educate growers and water resource managers about the benefits of bio-based pest management products through on-farm and in-facility demonstrations to accelerate commercial adoption of our products. We believe that these strategies and the strength of our products have led to an adoption rate for Grandevo for use in U.S. specialty crops that would outpace that of leading chemical insecticides.

Leverage Existing Distribution Arrangements and Develop New Relationships. To expand the availability of our products, we intend to continue to use relationships with conventional chemical pesticide distributors in the United States and leverage the international distribution capabilities under our existing strategic collaboration and distribution agreements. We intend to form new strategic relationships with other market-leading companies in our target markets and regions to expand the supply of our products globally. For example, we have engaged new distributors to launch Regalia in Canada for specialty crops, in the United States for turf and ornamental plants and in parts of the Midwest United States for row crops. We have also engaged a distributor to launch Grandevo in the United States for turf and ornamental plants.

Develop and Expand Manufacturing Capabilities. We currently use third-party manufacturers to produce our products on a commercial scale. To date, these arrangements have allowed us to focus our time and direct our capital towards discovering and commercializing new product candidates. We are repurposing a manufacturing facility that we purchased in July 2012 and plan to further expand capacity at this facility using a portion of the proceeds from this offering. While expenses incurred relating to the manufacturing facility have and will continue to contribute to losses in the near term, we believe there are considerable advantages in having our own manufacturing capabilities such as allowing us to better manage scale-up processes and institute process changes more efficiently, protecting our intellectual property and helping to lower our manufacturing costs.

Pursue Strategic Collaborations and Acquisitions. We intend to continue collaborating with chemical manufacturers to develop products that combine our bio-based pest management products with their technologies, delivering more compelling product solutions to growers. We also may pursue acquisition and in-licensing opportunities to gain access to later-stage products and technologies that we believe would be a good strategic fit for our business and would create additional value for our stockholders.

Industry Overview

Pest management is an important global industry serving the crop protection and water treatment markets that we currently target and the other non-crop markets that we plan to target such as industrial and institutional, professional turf and ornamental, home and garden and animal health. Today, most markets rely on conventional chemical pesticides. In agricultural markets, particularly large-acre row crops, conventional chemical pesticides are supplemented by the use of genetically modified crops that contain herbicide tolerance and pesticidal properties. Agranova, an independent market research firm, estimated that global agrichemical sales for the crop protection market were $50.0 billion in 2012, which represented an increase of 8.2% from 2011. The market for treatment of fruits and vegetables, the largest current users of bio-based pest management and plant health products, accounted for $16.2 billion of this total. Other agricultural applications, notably crops such as corn, soybeans, rice, cotton and cereals, which we expect will become increasingly important users of bio-based products,

6

Table of Contents

accounted for $24.7 billion of the total. In addition, Agrow, an independent market research firm, estimated that the global non-crop market for pesticides was $21.0 billion in 2009.

While conventional chemical pesticides are often effective in controlling pests, some of these chemicals are acutely toxic, some are suspected carcinogens and the use of some chemical pesticides has been shown to have other harmful effects on the environment, humans, animals and beneficial insects. These health and environmental concerns have prompted stricter legislation around the use of conventional chemical pesticides, particularly in Europe, where the use of some highly toxic chemical pesticides is banned or severely limited and the importation of produce is subject to strict regulatory standards on pesticide residues. In addition, the European Union has passed the Sustainable Use Directive, which requires EU-member countries to reduce the use of conventional chemical pesticides and to use alternative pest management methods, including bio-based pest management products. Over the past two decades, U.S. regulatory agencies have also developed stricter standards and regulations. Furthermore, a growing shift in consumer preference towards organic and sustainable food production has led many large, global food retailers to require their supply chains to implement these practices, including the use of bio-based pest management and fertilizer solutions, water and energy efficiency practices, and localized food product sourcing. For example, in 2010, Wal-Mart announced its global sustainable agriculture goals to require sustainable best practices throughout its global food supply chain. Aside from the health and environmental concerns, conventional chemical pesticide users face additional challenges such as pest resistance and reduced worker productivity, as workers may not return to the fields for a certain period of time after treatment. Similar risks and hazards are also prevalent in the water treatment market, as chlorine and other chemicals used to control invasive water pests contaminate and endanger natural waterways.

As the use of conventional chemical pesticides meets increased opposition from government agencies and consumers, and the efficacy of bio-based pest management products becomes more widely recognized among growers, bio-based pest management products are gaining popularity and represent a strong growth sector within the global pesticide market. Bio-based pest management products include “biopesticides,” which the EPA registers in two major categories: (1) microbial pesticides, which contain a microorganism such as a bacterium or fungus as the active ingredient; and (2) biochemical pesticides, which are naturally occurring substances with a non-toxic mode of action such as insect sex pheromones, certain plant extracts and fatty acids.

We believe many bio-based pest management products perform as well as or better than conventional chemical pesticides. When used in alternation or in spray tank mixtures with conventional chemical pesticides, bio-based pest management products can increase crop yields and quality over chemical-only programs. Agricultural industry reports, as well as our own research, indicate that bio-based pest management products can affect plant physiology and morphology in ways that may improve crop yield and can increase the efficacy of conventional chemical pesticides. In addition, pests rarely develop resistance to bio-based pest management products due to their complex modes of action. Likewise, bio-based pest management products have been shown to extend the product life of conventional chemical pesticides and limit the development of pest resistance, a key issue facing users of conventional chemical pesticides, by eliminating pests that survive conventional chemical pesticide treatments. Most bio-based pest management products are listed for use in organic farming, providing those growers with compelling pest control options to protect yields and quality. Given their generally lower toxicity compared with many conventional chemical pesticides, bio-based pest management products can add flexibility to harvest timing and worker re-entry times and improve worker safety. Many bio-based pest management products are also exempt from conventional chemical residue tolerances, which are permissible levels of chemical residue at time of harvest set by governmental agencies. Bio-based pest management products may not be subject to restrictions by food retailers and governmental agencies limiting chemical residues on produce, which enables growers to export to wider markets.

In addition to performance attributes, bio-based pest management products registered with the EPA as biopesticides can offer other advantages over conventional chemical pesticides. From an environmental perspective, biopesticides have low toxicity, posing low risk to most non-target organisms, including humans, other mammals, birds, fish and beneficial insects. Biopesticides are biodegradable, resulting in less risk to surface water and groundwater, and generally have low air-polluting volatile organic compounds content.

7

Table of Contents

Because biopesticides tend to pose fewer risks than conventional pesticides, the EPA offers a more streamlined registration process for these products, which generally requires significantly less toxicological and environmental data and a lower registration fee.

Recent Developments

We expect total revenues for the quarter ended June 30, 2013 to be between $4.2 million and $4.5 million, compared to total revenues of $1.5 million for the quarter ended June 30, 2012. We also expect total revenues for the six months ended June 30, 2013 to be between $6.9 million and $7.2 million, compared to total revenues of $3.5 million for the six months ended June 30, 2012. These increases in total revenues are due primarily to the increased acceptance of our products.

We expect cost of product revenues for the quarter ended June 30, 2013 to be between $3.3 million and $3.5 million, compared to cost of product revenues of $0.7 million for the quarter ended June 30, 2012. We also expect cost of product revenues for the six months ended June 30, 2013 to be between $5.1 million and $5.3 million, compared to cost of product revenues of $1.5 million for the six months ended June 30, 2012. These increases in cost of product revenues are due primarily to an increase in product sales.

We expect the gross margin percentage for the quarter ended June 30, 2013 to be between 10% and 20%, compared to a gross margin percentage of 55% for the quarter ended June 30, 2012. We also expect the gross margin percentage for the six months ended June 30, 2013 to be between 20% and 25%, compared to a gross margin percentage of 56% for the six months ended June 30, 2012. These decreases in the gross margin percentage are due primarily to a change in product mix, with Grandevo representing an increased percentage of total sales. We launched the most popular formulation of Grandevo in the summer of 2012. Since Grandevo is early in its life cycle, our gross margins have been negatively affected. However we expect to see a gradual increase in gross margin over the life cycle of each of our products, including Grandevo, as we improve production processes, gain efficiencies and increase product yields.

The preceding estimates of total revenues, cost of product revenues and gross margins for the quarter and six months ended June 30, 2013 are preliminary, based upon our estimates and subject to completion of our quarter-end financial closing procedures. These preliminary estimates have been prepared by and are the responsibility of management and have not been reviewed or audited by our independent registered public accounting firm. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect to these preliminary estimates. Our actual results may differ from these preliminary estimates, which should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in particular “—Key Components of Our Results of Operations” and “—Results of Operations” therein, and our consolidated financial statements and the related notes included elsewhere in this prospectus.

Summary of Risk Factors

Our business is subject to numerous risks, which are described in the section entitled “Risk Factors” immediately following this prospectus summary on page 16. You should carefully consider these risks before making an investment. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our growth strategy, which could cause a decline in the price of our common stock and result in a loss of all or a portion of your investment:

| n | We have a limited operating history and number of commercialized products, have incurred significant losses to date and anticipate continuing to incur losses in the future, and we may not achieve or maintain profitability. |

| n | Our products are in the early stages of commercialization, and our business may fail if we are not able to successfully generate significant revenues from these products. |

| n | Adverse weather conditions and other natural conditions can reduce acreage planted or incidence of crop disease or pest infestations, which can adversely affect our results of operations. |

8

Table of Contents

| n | If our ongoing or future field trials are unsuccessful, we may be unable to obtain regulatory approval of, or commercialize, our products on a timely basis. |

| n | Our inability to obtain regulatory approvals, or to comply with ongoing and changing regulatory requirements, could delay or prevent sales of the products we are developing and commercializing. |

| n | Customers may not adopt our bio-based pest management and plant health products as quickly as we are projecting. |

| n | The high level of competition in the market for pest management products may result in pricing pressure, reduced margins or the inability of our products to achieve market acceptance. |

| n | Our product sales are expected to be seasonal and subject to weather conditions and other factors beyond our control, which may cause our operating results to fluctuate significantly quarterly and annually. |

| n | We rely on third parties for the production of our products. If these parties do not produce our products at a satisfactory quality, in a timely manner, in sufficient quantities or at an acceptable cost, our development and commercialization efforts could be delayed or otherwise negatively impacted. |

| n | We rely on a single supplier based in China for a key ingredient of Regalia. |

| n | If we are unable to maintain and further establish successful relations with the third-party distributors that are our principal customers, or they do not focus adequate resources on selling our products or are unsuccessful in selling them to end users, sales of our products would decline. |

| n | Our intellectual property is integral to our business. If we are unable to protect our patents and proprietary rights in the United States and foreign countries, our business could be adversely affected. |

Corporate Information

We were originally incorporated in the State of Delaware in June 2006 as Marrone Organic Innovations, Inc. Our principal executive offices are located at 2121 Second St. Suite A-107, Davis, CA 95618. Our telephone number is (530) 750-2800. Our website address is www.marronebioinnovations.com. The information that can be accessed through our website is not part of this prospectus, and investors should not rely on any such information in deciding whether to purchase our common stock.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, which we refer to as the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

| n | the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

| n | the last day of the fiscal year following the fifth anniversary of the completion of this offering; |

| n | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and |

| n | the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter). |

The JOBS Act also provides that an “emerging growth company” can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, or the Securities Act, for complying with new or

9

Table of Contents

revised accounting standards. However, we are choosing to “opt out” of such extended transition period, and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for companies that are not “emerging growth companies.” Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Trade Names

Except as context otherwise requires, references in this prospectus to our product lines, such as Regalia, refer collectively to all formulations of the respective product line, such as Regalia Maxx or Regalia SC, and all trade names under which our distributors sell such product lines internationally, such as Sakalia.

Our logos, “Grandevo®,” “OpportuneTM,” “Regalia®,” “VenerateTM,” “Zequanox®” and other trade names, trademarks or service marks of Marrone Bio Innovations, Inc. appearing in this prospectus are the property of Marrone Bio Innovations, Inc. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies.

10

Table of Contents

| Common stock offered by us |

4,200,000 shares |

| Common stock to be outstanding after this offering |

16,918,560 shares (or 17,548,560 shares if the underwriters exercise their option to purchase additional shares in full) |

| Use of proceeds |

We intend to use the net proceeds from this offering primarily for capital expenditures, including to further expand capacity at our manufacturing facility, working capital and other general corporate purposes. See “Use of Proceeds.” |

| Directed share program |

The underwriters have reserved for sale, at the initial public offering price, up to approximately 300,000 shares of our common stock being offered for sale to certain persons and entities that have relationships with us. We will offer these shares to the extent permitted under applicable regulations in the United States and in various countries. The number of shares available for sale to the general public in this offering will be reduced to the extent these persons purchase reserved shares. These shares will not be subject to any lock-up arrangement with any underwriters, except to the extent purchased by our officers or directors, who have already entered into lock-up agreements. See “Shares Eligible for Future Sale—Lock-Up and Market Stand-Off Agreements.” Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares. |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of the factors you should consider carefully before deciding to invest in our common stock. |

| Proposed Nasdaq symbol |

MBII |

The number of shares of our common stock to be outstanding after this offering is based on 12,718,560 shares outstanding as of March 31, 2013, on an as-converted basis, and excludes:

| n | 2,040,406 shares of common stock issuable upon the exercise of outstanding options with a weighted-average exercise price of $3.98 per share; |

| n | 137,324 shares of common stock issuable upon exercise of outstanding warrants with an exercise price of $10.85 per share, based upon an assumed initial public offering price equal to the midpoint of the range set forth on the cover of this prospectus; and |

| n | 1,975,640 shares of common stock that will be available for future grant under our 2013 Stock Incentive Plan, which will become effective prior to the completion of this offering, including options to purchase 65,440 shares of common stock we intend to grant to our employees and management effective as of the date of this offering at an exercise price per share equal to the initial public offering price, and additional shares of common stock that will be available for future grant under the automatic increase provisions of our 2013 Stock Incentive Plan (see “Executive Compensation—Employee Benefit and Stock Plans—2013 Stock Incentive Plan”). |

Except as otherwise indicated, all information in this prospectus assumes:

| n | a 1-for-3.138458 reverse stock split effective immediately prior to the completion of the offering; |

| n | the filing of our amended and restated certificate of incorporation immediately prior to the completion of this offering; |

11

Table of Contents

| n | the automatic conversion into an aggregate of 8,513,473 shares of common stock immediately prior to the completion of this offering of all outstanding shares of our preferred stock, including shares of Series B convertible preferred stock issued upon the full exercise of warrants outstanding as of March 31, 2013; |

| n | the issuance of 99,187 shares of common stock, based on an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, at the completion of this offering, upon the net exercise of all outstanding warrants to purchase shares of Series A and Series C convertible preferred stock, which have been exercised effective upon the completion of this offering; |

| n | the issuance of 31,100 shares of common stock, based on an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, at the completion of this offering, upon the net exercise of outstanding warrants to purchase common stock will be automatically exercised upon the completion of this offering in accordance with their terms; |

| n | the issuance of 2,805,859 shares of common stock, based on an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, at the completion of this offering, upon the conversion of all outstanding convertible notes, including principal and interest, to the extent accrued as of March 31, 2013, will be automatically converted upon the completion of this offering in accordance with their terms; |

| n | no other issuance or exercise of options or warrants subsequent to March 31, 2013; and |

| n | no exercise of the underwriters’ option to purchase up to 630,000 additional shares of common stock from us at the initial public offering price. |

In addition, all information in this prospectus assumes the receipt of cash proceeds from the issuance of convertible notes and promissory notes, the issuance of warrants to purchase shares of common stock, and the related cancellation of a portion of an existing convertible note, all occurring after March 31, 2013, excluding the effects of the initial accounting for these transactions. We are in the process of determining the accounting impacts of these transactions on our consolidated financial position and results of operations, and as certain analyses will require fair value measurements, we have engaged a third-party valuation firm to assist with estimating the fair values of applicable components of these transactions. The fair value analyses have not been completed. See Note 16 to our audited consolidated financial statements for further detail regarding these transactions.

12

Table of Contents

The following tables summarize the financial data for our business. You should read this summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and related notes, all included elsewhere in this prospectus.

We have derived the statements of operations data for the fiscal years ended December 31, 2012 and 2011 from our audited consolidated financial statements and related notes included elsewhere in this prospectus. We have derived the statements of operations data for the fiscal year ended December 31, 2010 from our audited consolidated financial statements not included in this prospectus. We have derived the statements of operations data for the three months ended March 31, 2013 and 2012 and the balance sheet data as of March 31, 2013 from our unaudited interim condensed consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

13

Table of Contents

Statements of Operations Data:

| FISCAL YEAR | THREE MONTHS ENDED MARCH 31, |

|||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (In thousands, except per share data) |

||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Product |

$ | 6,961 | $ | 5,194 | $ | 3,697 | $ | 2,649 | $ | 1,956 | ||||||||||

| License (1) |

179 | 57 | — | 81 | 43 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

7,140 | 5,251 | 3,697 | 2,730 | 1,999 | |||||||||||||||

| Cost of product revenues |

4,333 | 2,172 | 1,738 | 1,795 | 860 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

2,807 | 3,079 | 1,959 | 935 | 1,139 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

12,741 | 9,410 | 5,563 | 3,283 | 2,733 | |||||||||||||||

| Non-cash charge associated with a convertible note |

|

3,610 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| |||||

| Selling, general and administrative |

10,294 | 6,793 | 4,353 | 2,847 | 2,322 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

26,645 | 16,203 | 9,916 | 6,130 | 5,055 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(23,838 | ) | (13,124 | ) | (7,957 | ) | (5,195 | ) | (3,916 | ) | ||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income |

16 | 22 | 22 | 1 | 2 | |||||||||||||||

| Interest expense |

(2,466 | ) | (88 | ) | (102 | ) | (1,985 | ) | (56 | ) | ||||||||||

| Change in estimated fair value of financial instruments (2) |

(12,461 | ) | 1 | — | (3,563 | ) | (15 | ) | ||||||||||||

| Other income (expense) |

(45 | ) | 9 | 1 | (7 | ) | 1 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense), net |

(14,956 | ) | (56 | ) | (79 | ) | (5,554 | ) | (68 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income taxes |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (38,794 | ) | $ | (13,180 | ) | $ | (8,036 | ) | $ | (10,749 | ) | $ | (3,984 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Deemed dividend, convertible notes |

(2,039 | ) | — | — | — | (1,253 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to common shareholders |

$ | (40,833 | ) | $ | (13,180 | ) | $ | (8,036 | ) | $ | (10,749 | ) | $ | (5,237 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per common share (3): |

||||||||||||||||||||

| Basic and diluted |

$ | (10.35 | ) | $ | (3.39 | ) | $ | (2.10 | ) | $ | (2.70 | ) | $ | (1.34 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares outstanding in computing net loss per common share (3): |

||||||||||||||||||||

| Basic and diluted |

3,945 | 3,888 | 3,832 | 3,980 | 3,915 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net loss per common share (4): |

||||||||||||||||||||

| Basic and diluted |

$ | (2.45 | ) | $ | (0.51 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted-average shares outstanding pro forma (4): |

||||||||||||||||||||

| Basic and diluted |

11,162 | 12,756 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | We receive payments under strategic collaboration and distribution agreements under which we provide third parties with exclusive development, marketing and distribution rights. These payments are initially classified as deferred revenues and recognized as revenues over the exclusivity period. Please see Note 2 to our audited consolidated financial statements for an explanation of the method used to calculate license revenues. |

| (2) | We account for the outstanding warrants exercisable into shares of our Series A, Series B and Series C convertible preferred stock and the outstanding warrants exercisable into a variable number of shares of common stock as liability instruments, as |

14

Table of Contents

| the Series A, Series B and Series C convertible preferred stock and the common stock into which these warrants are convertible are contingently redeemable upon the occurrence of certain events or transactions. In addition, we account for our convertible notes at estimated fair value. We adjust the warrant instruments and convertible notes to fair value at each reporting period with the change in fair value recorded in the consolidated statements of operations. We do not expect these charges to continue after the completion of this offering because the Series B convertible preferred stock warrants have been exercised, the Series A and Series C convertible preferred stock warrants will have been exercised effective as of the completion of this offering, the convertible notes will automatically convert into common stock in accordance with their terms upon the completion of this offering, and the common stock warrants will, in accordance with their terms upon the completion of this offering, either automatically be exercised for shares of common stock or will represent the right to purchase a fixed number of shares. See “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Key Components of Our Results of Operations—Change in Estimated Fair Value of Financial Instruments and Deemed Dividend on Convertible Notes.” |

| (3) | Does not give effect to a 1-for-3.138458 reverse stock split, effective immediately prior to the completion of this offering. |

| (4) | The pro forma net loss per common share data is computed using the weighted-average number of shares of common stock outstanding, after giving effect to the following using the treasury method: |

| n | a 1-for-3.138458 reverse stock split, effective immediately prior to the completion of this offering, |

| n | the conversion (using the if-converted method) of all shares of our convertible preferred stock, including shares issued upon the full exercise of Series B convertible preferred stock warrants outstanding as of the first date of the period, |

| n | the conversion (using the if-converted method) of all outstanding principle and accrued interest of convertible notes into common stock, including the effect of the cancellation of a portion of a convertible note in April 2013, as though the cancellation had occurred on the original date of issuance, |

| n | the conversion (using the if-converted method) of all convertible notes issued subsequent to March 31, 2013 into common stock, as though the conversion had occurred on the first date of the period, |

| n | the net exercise of common stock warrants that will be automatically exercised upon completion of this offering, and |

| n | the net exercise of the Series A and Series C convertible preferred stock warrants into common stock, which have been exercised effective upon completion of this offering. |

Additionally, the net loss used to compute pro forma net loss per common share includes: (i) adjustments related to changes in fair value of financial instruments and (ii) adjustment to reflect the automatic conversion of all outstanding convertible notes into shares of our common stock and excludes the effects of the initial accounting related to the issuance of convertible promissory notes and warrants to purchase shares of common stock and the conversion of a portion of a convertible note into a promissory note all occurring after March 31, 2013. See Note 16 to our audited consolidated financial statements for further detail regarding these transactions. We are in the process of determining the accounting impacts of these transactions on our consolidated financial position and results of operations, and as certain analyses will require fair value measurements, we have engaged a third-party valuation firm to assist with estimating the fair values of applicable components of these transactions. The fair value analyses have not been completed.

As we have losses in all periods presented, all potentially dilutive common shares, comprised of stock options and certain warrants, are anti-dilutive.

Balance Sheet Data:

The balance sheet data as of March 31, 2013 in the table below is presented on an actual basis and on a pro forma basis, giving effect to (i) the automatic conversion into shares of our common stock of all outstanding shares of our preferred stock including shares issued upon the cash exercise of all Series B convertible preferred stock warrants outstanding as of March 31, 2013, (ii) the issuance of shares of common stock upon the net exercise, at the completion of this offering and based upon an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, of all outstanding Series A and Series C convertible preferred stock warrants, which have been exercised effective upon the completion of this offering, (iii) the receipt of cash proceeds from the issuance of convertible notes and promissory notes with warrants to purchase shares of common stock, and the related cancellation of a portion of an existing convertible note, all occurring after March 31, 2013, excluding the effects of the initial accounting for these transactions, (iv) the issuance of shares of common stock, based on an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, at the completion of this offering, upon the net exercise of outstanding warrants to purchase common stock which will be automatically

15

Table of Contents

exercised upon the completion of this offering in accordance with their terms, (v) the issuance of shares of common stock, based on an assumed initial public offering price equal to the midpoint of the price range set forth on the cover of this prospectus, at the completion of this offering, upon the conversion of all outstanding convertible notes, including principal and interest, to the extent accrued as of March 31, 2013, will be automatically converted upon the completion of this offering in accordance with their terms, and (vi) the reclassification of the preferred stock and common stock warrant liabilities to total stockholders’ (deficit) equity, as if each of the above had occurred at March 31, 2013. We are in the process of determining the accounting impacts of the transactions discussed in the foregoing clause (iii) on our consolidated financial position and results of operations, and as certain analyses will require fair value measurements, we have engaged a third-party valuation firm to assist with estimating the fair values of applicable components of these transactions. The fair value analyses have not been completed. See Note 16 to our audited consolidated financial statements for further detail regarding these transactions.

| AS OF MARCH 31, 2013 | ||||||||

| ACTUAL | PRO FORMA (1) | |||||||

| (In thousands) | ||||||||

| (Unaudited) | ||||||||

| Cash and cash equivalents |

$ | 1,791 | $ | 12,067 | ||||

| Working capital (deficit) (2) |

(21,582 | ) | 16,660 | |||||

| Total assets |

17,839 | 28,022 | ||||||

| Debt and capital leases, net of unamortized debt discount of $237 actual and pro forma |

8,358 | 13,308 | ||||||

| Convertible notes |

46,037 | — | ||||||

| Common stock warrant liability |

316 | — | ||||||

| Preferred stock warrant liability |

1,883 | — | ||||||

| Total liabilities |

62,972 | 19,686 | ||||||

| Convertible preferred stock |

39,612 | — | ||||||

| Total stockholders’ (deficit) equity |

(84,745 | ) | 8,336 | |||||

| (1) | A $1.00 increase or decrease in the assumed initial public offering price of $15.50 per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, cash and cash equivalents, total assets and total stockholders’ (deficit) equity by $3.9 million, assuming the number of shares offered by us, as set forth on the cover of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and the estimated offering expenses payable by us. An increase or decrease of 100,000 shares in the number of shares sold in this offering by us would increase or decrease, as applicable, cash and cash equivalents, total assets and total stockholders’ (deficit) equity from this offering by $1.4 million, assuming an initial public offering price of $15.50 per share, the midpoint of the price range set forth on the cover of this prospectus, and after deducting the estimated underwriting discounts and commissions and the estimated offering expenses payable by us. |

| (2) | Working capital (deficit) is defined as total current assets minus total current liabilities. |

16

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as other information in this prospectus, before deciding whether to invest in shares of our common stock. The occurrence of any of the events described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the trading price of our common stock may decline and you may lose all or part of your investment.

Risks Relating to Our Business and Strategy

We have a limited operating history and number of commercialized products, have incurred significant losses to date and anticipate continuing to incur losses in the future, and we may not achieve or maintain profitability.

We are an early stage company with a limited operating history, and we only recently began commercializing our products. We have incurred operating losses since our inception in June 2006, and we expect to continue to incur operating losses for the foreseeable future. At March 31, 2013, we had an accumulated deficit of $86.3 million. For the year ended December 31, 2012 and the three months ended March 31, 2013, we had a net loss of $38.8 million and $10.7 million, respectively. As a result, we will need to generate significant revenues to achieve and maintain profitability. If our revenues grow slower than anticipated, or if operating expenses exceed expectations, then we may not be able to achieve profitability in the near future or at all, which may depress our stock price.

Through March 31, 2013, we have derived substantially all of our revenues from sales of Regalia and Grandevo. In addition, we have derived revenues from strategic collaboration and development agreements for the achievement of testing validation, regulatory progress and commercialization events, and from sales of other products. Accordingly, there is only a limited basis upon which to evaluate our business and prospects. Our future success depends, in part, on our ability to market and sell other products, as well as our ability to increase sales of Regalia, Grandevo and Zequanox. An investor in our stock should consider the challenges, expenses, and difficulties we will face as a company seeking to develop and manufacture new types of products in a relatively established market. We expect to derive future revenues primarily from sales of Regalia, Grandevo, Zequanox and other products, but we cannot guarantee the magnitude of such sales, if any. We expect to continue to devote substantial resources to expand our research and development activities, further increase manufacturing capabilities and expand our sales and marketing activities for the further commercialization of Regalia, Grandevo, Zequanox and other product candidates. We expect to incur additional losses for the next several years and may never become profitable.

Our products are in the early stages of commercialization, and our business may fail if we are not able to successfully generate significant revenues from these products.

Our future success will depend in part on our ability to commercialize the bio-based pest management and plant health product candidates we are developing. Our initial sales of our latest formulation of Regalia and our initial formulation of Grandevo occurred in the fourth quarter of 2009 and the fourth quarter of 2011, respectively, and we began selling Zequanox in the second half of 2012. Our near-term development focus is on Opportune, which received EPA approval in April 2012, and Venerate, which has been submitted for EPA registration. In addition, as of June 30, 2013, we have identified over 25 additional product candidates using our proprietary discovery process, and we currently are focusing our development and commercialization efforts on three of these product candidates.

Successful development of our product candidates will require significant additional investment, including costs associated with research and development, completing field trials and obtaining regulatory approval, as well as the ability to manufacture our products in large quantities at acceptable costs while also preserving high product quality. Difficulties often encountered in scaling up production include problems involving production yields, quality control and assurance, shortage of qualified personnel, production costs and process controls. In addition, we are subject to inherent risks associated with new products and technologies. These risks include the possibility that any product candidate may:

| n | be found unsafe; |

| n | be ineffective or less effective than anticipated; |

| n | fail to receive necessary regulatory approvals; |

17

Table of Contents

| n | be difficult to competitively price relative to alternative pest management solutions; |

| n | be harmful to consumers, growers, farm workers or the environment; |

| n | be harmful to crops when used in conjunction with conventional chemical pesticides; |

| n | be difficult or impossible to manufacture on an economically viable scale; |

| n | be subject to supply chain constraints for raw materials; |

| n | fail to be developed and accepted by the market prior to the successful marketing of similar products by competitors; |

| n | be impossible to market because it infringes on the proprietary rights of third parties; or |

| n | be too expensive for commercial use. |

Adverse weather conditions and other natural conditions can reduce acreage planted or incidence of crop disease or pest infestations, which can adversely affect our results of operations.

Production of the crops on which our products are typically applied is vulnerable to extreme weather conditions such as heavy rains, hurricanes, hail, floods, tornadoes, freezing condition, drought, fires and floods. Weather conditions can be impacted by climate change resulting from global warming, including changes in precipitation patterns and the increased frequency of extreme weather events, or other factors. Unfavorable weather conditions can reduce both acreage planted and incidence (or timing) of certain crop diseases or pest infestations, each of which may reduce demand for our products. For example, in 2012, the United States experienced nationwide abnormally low rainfall or drought, reducing the incidence of fungal diseases such as mildews, and these conditions have been present in some of our key markets in 2013 as well. We believe these conditions have reduced industry-wide sales of fungicides in 2012 and 2013 relative to prior years, inhibiting growth in sales of Regalia, a biofungicide. These factors have created and can continue to create substantial volatility relating to our business and results of operations.

If our ongoing or future field trials are unsuccessful, we may be unable to obtain regulatory approval of, or commercialize, our products on a timely basis.

The successful completion of multiple field trials in domestic and foreign locations on various crops and water infrastructures is critical to the success of our product development and marketing efforts. If our ongoing or future field trials are unsuccessful or produce inconsistent results or unanticipated adverse side effects on crops or on non-target organisms, or if we are unable to collect reliable data, regulatory approval of our products could be delayed or we may be unable to commercialize our products. In addition, more than one growing or treatment season may be required to collect sufficient data and we may need to collect data from different geographies to prove performance for customer adoption. Although we have conducted successful field trials on a broad range of crops, we cannot be certain that additional field trials conducted on a greater number of acres, or on crops for which we have not yet conducted field trials, will be successful. Moreover, the results of our ongoing and future field trials are subject to a number of conditions beyond our control, including weather-related events such as drought or floods, severe heat or frost, hail, tornadoes and hurricanes. Generally, we pay third parties such as growers, consultants and universities, to conduct field tests on our behalf. Incompatible crop treatment practices or misapplication of our products by these third parties could impair the success of our field trials.

Our inability to obtain regulatory approvals, or to comply with ongoing and changing regulatory requirements, could delay or prevent sales of the products we are developing and commercializing.

The field testing, manufacture, sale and use of pest management products, including Regalia, Grandevo, Zequanox and other products we are developing, are extensively regulated by the EPA and state, local and foreign governmental authorities. These regulations substantially increase the time and cost associated with bringing our products to market. If we do not receive the necessary governmental approvals to test, manufacture and market our products, or if regulatory authorities revoke our approvals, do not grant approvals in a timely manner or grant approvals subject to restrictions on their use, we may be unable to sell our products in the United States or other jurisdictions, which would result in our future revenues being less than anticipated.