Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Homeowners of America Holding Corp | v350179_ex23-1.htm |

As filed with the Securities and Exchange Commission on July 22, 2013

Registration No. 333-189686

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Homeowners

of America Holding Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 6331 | 57-1219329 | ||

| (State or Other | (Primary Standard Industrial | (I.R.S. Employer | ||

| Jurisdiction of Incorporation or | Classification Code Number) | Identification Number) | ||

| Organization) |

Homeowners of America Holding

Corporation

1333 Corporate Drive, Suite 325

Irving, TX 75038

(972) 607-4241

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal

Executive Officers)

Spencer W. Tucker

President and Chief Executive Officer

Homeowners of America Holding

Corporation

1333 Corporate Drive, Suite 325

Irving, TX 75038

(972) 607-4241

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

William N. Haddad, Esq.

Reed Smith LLP

599 Lexington Avenue

New York, NY 10022

(212) 521-5400

(212) 521-5450 (facsimile)

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 Exchange Act. (Check one)

| ¨ Large accelerated filer | ¨ Accelerated filer |

| ¨ Non-accelerated files (Do not check if a smaller reporting company) | x Smaller reporting company |

CALCULATION OF REGISTRATION FEE

| Title | ||||||||||||||||

| of Each Class | Proposed | |||||||||||||||

| of Securities | Proposed | Maximum | ||||||||||||||

| to Be | Amount To Be | Maximum Offering | Aggregate Offering | Amount | ||||||||||||

| Registered | Registered(1) | Price Per Share | Price | of Registration Fee | ||||||||||||

| Common Stock, par value $0.0001 per share | 15,739,182 | $ | 0.50 | $ | 7,869,591 | $ | 1,073.41 | (3) | ||||||||

| (1) | Pursuant to Rule 416 of the Securities Act of 1933, as amended, this Registration Statement also registers such additional shares of common stock as may become issuable to prevent dilution as a result of stock splits, stock dividends or similar transactions. |

| (2) | Based on a price of $0.50 per share (the exercise price of the registrant’s proposed stock options to be issued upon the effective date of this Registration Statement). |

| (3) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 22, 2013

15,739,182 Shares

Common Stock

This prospectus relates to the resale by selling stockholders named herein of up to an aggregate of 15,739,182 shares of common stock, par value $0.0001 per share, of Homeowners of America Holding Corporation.

There is no public market for our common stock. We intend to seek a qualification for our common stock to be quoted on the Over-the-Counter Bulletin Board; however, no assurance can be given as to our success in qualifying for quotation on the OTCBB. The selling stockholders may sell their shares of our common stock at a fixed price of $0.50 per share (the exercise price of our proposed stock options to be issued upon the effective date of this Registration Statement) until our common stock is quoted on the OTCBB, and thereafter in a variety of transactions as described under the heading “Plan of Distribution” beginning on page 66, including transactions on any stock exchange, market or facility on which our common stock may be traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices. We have no basis for estimating either the number of shares of our common stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold.

All of the shares of common stock are being sold by the selling stockholders named in this prospectus. We will not receive any of the proceeds from the sale of the shares of common stock being sold by the selling stockholders. We are bearing all of the expenses in connection with the registration of the shares of common stock, but all selling and other expenses incurred by the selling stockholders, including commissions and discounts, if any, attributable to the sale or disposition of the shares will be borne by them.

We are an ‘‘emerging growth company’’ as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for future filings.

You should read this prospectus, the applicable prospectus supplement, if any, and other offering materials carefully before you invest.

An investment in our common stock involves substantial risks. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013

TABLE OF CONTENTS

Prospectus

| Page | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| SUMMARY | 2 |

| RISK FACTORS | 6 |

| USE OF PROCEEDS | 18 |

| DIVIDEND POLICY | 18 |

| DETERMINATION OF OFFERING PRICE | 18 |

| DILUTION | 18 |

| CAPITALIZATION | 19 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 20 |

| BUSINESS | 29 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 46 |

| SELLING SHAREHOLDERS | 48 |

| MANAGEMENT | 50 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 55 |

| DESCRIPTION OF SECURITIES | 56 |

| FEDERAL INCOME TAX CONSEQUENCES | 62 |

| PLAN OF DISTRIBUTION | 66 |

| LEGAL MATTERS | 68 |

| EXPERTS | 68 |

| WHERE YOU CAN FIND MORE INFORMATION | 68 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. These forward looking statements include statements about our expectations, beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies or prospects. All statements other than statements of historical fact included in this prospectus, including statements regarding our future activities, events or developments, including such things as future revenues, product development, market acceptance, responses from competitors, capital expenditures (including the amount and nature thereof), business strategy and measures to implement strategy, competitive strengths, goals, expansion and growth of our business and operations, plans, references to future success, projected performance and trends, and other such matters, are forward-looking statements. The words “believe,” “expect,” “intend,” “anticipates,” or “propose,” and other similar words and phrases, are intended to identify forward-looking statements. The forward-looking statements made in this prospectus are based on certain historical trends, current conditions and expected future developments as well as other factors we believe are appropriate in the circumstances. These statements relate only to events as of the date on which the statements are made and we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking statements made in this prospectus are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Whether actual results will conform to our expectations and predictions is subject to a number of risks and uncertainties that may cause actual results to differ materially. Risks and uncertainties, the occurrence of which could adversely affect our business, include the risks identified in this prospectus under the caption “Risk Factors” beginning on page 6.

| - 1 - |

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus, including the section entitled “Risk Factors,” and our financial statements and the notes thereto before deciding to invest in our common stock. Unless the context otherwise requires, the terms “we”, “our”, “ours” and “us”, refer to Homeowners of America Holding Corporation, a Delaware corporation.

Our Business

Overview

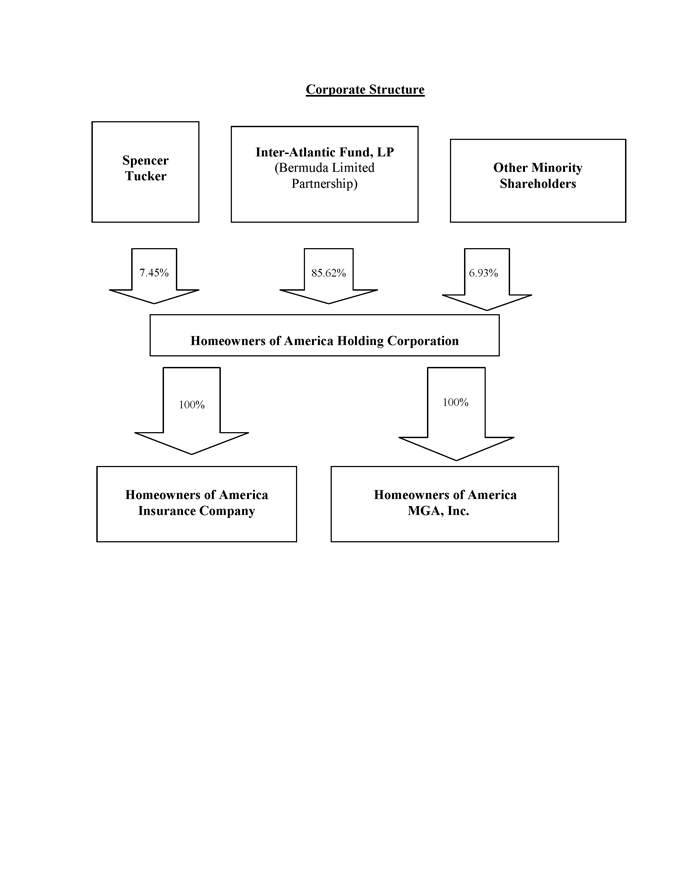

Homeowners of America Holding Corporation is a property and casualty insurance holding company incorporated in Delaware in 2005. In May of 2006 we began selling property and casualty insurance products in Texas through our subsidiary, Homeowners of America Insurance Company. We currently offer products in Texas only. Our products are sold to the public through independent insurance agents. At present we offer homeowners, dwelling fire and extended coverage, tenant, and condominium owners policies.

We had, until recently, offered private passenger automobile policies to homeowners in Texas. The Texas private passenger automobile business is currently being non-renewed. The Texas private passenger automobile program was discontinued because we were unable to capture a sufficient portion of the market at pricing which we deemed adequate to cover our expenses and provide a margin for profits.

As of March 31, 2013 we had 56,911 policyholders, total assets of $67,344,137 and stockholders’ equity of $5,509,103. Of the 56,911 policyholders, 489 were private passenger automobile policyholders. The balance, 56,422, were Texas residential property policyholders.

We offer products with competitive prices in segments of the business that have proven long-term profitability. We are heavily invested in automated underwriting tools and use a variety of underwriting methods to select risks. Efficiency is achieved through automation. All business is sourced and processed through internet-enabled applications. Our user-friendly agent portal enables agents to rapidly quote and issue policies. Automation, a highly responsive and experienced underwriting and customer service staff, and local knowledge of the market all give us a competitive advantage.

In 2010, we formed a managing general agency, Homeowners of America MGA, Inc., or HAMGA. HAMGA provides underwriting, policy administration and claims services to our insurance company.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and will continue to be an emerging growth company until: (i) the last day of our fiscal year following the fifth anniversary of this prospectus, (ii) the date on which we become a large accelerated filer, or (iii) the date on which we have issued an aggregate of $1 billion in non-convertible debt during the preceding 3 years. As an emerging growth company, we are entitled to rely on certain scaled disclosure requirements and other exemptions, including an exemption from the requirement to provide an auditor attestation to management’s assessment of its internal controls as required by Section 404(b) of the Sarbanes-Oxley Act of 2002. We may at any time voluntarily elect to cease to avail ourselves of the scaled disclosure and other exemptions available to us as an emerging growth company, and have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. See the risk factor entitled “We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act which allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.” As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

The JOBS Act is intended to reduce the regulatory burden on emerging growth companies. As long as we qualify as an emerging growth company, we will also, among other things:

| · | be exempt from the “say on pay” provisions (requiring a non-binding vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act, or Dodd-Frank Act, and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers; | |

| · | be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended and instead provide a reduced level of disclosure concerning executive compensation; and | |

| · | be exempt from any rules that may be adopted by the Public Company Oversight Board, or PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor's report on the financial statements. |

Although we are still evaluating the JOBS Act, we currently intend to take advantage of all of the reduced regulatory and reporting requirements that will be available to us so long as we qualify as an emerging growth company.

Notwithstanding the above, we are also currently a “smaller reporting company” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a smaller reporting company, at such time are we cease being an emerging growth company, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an emerging growth company or a smaller reporting company. Specifically, similar to emerging growth companies, smaller reporting companies are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports.

Our Market and Opportunity

On December 31, 2012, HAIC’s market share for Texas homeowners business was estimated by SNL Financial at .65% of an estimated $6.4 billion market, expressed in terms of premiums. SNL ranked HAIC as the 19th largest Texas homeowners company in terms of Texas premiums.

| - 2 - |

The Texas residential property market is dominated by large, national insurance companies that market through captive agents. However, the Texas market is large enough, at $6.4 billion, to accommodate a smaller company providing local knowledge and service, able to focus its attention on the more profitable segments of the Texas market and the needs of Texas independent agents.

Further, as a consequence of the catastrophic losses in Texas over the last several years, a large part of the Texas residential property market is experiencing a degree of dysfunction, which creates an opportunity for a smaller company to select business in profitable segments.

In recent years, including 2008, 2009, 2011 and 2012, Texas has experienced numerous catastrophic severe convective thunderstorms, among other catastrophes. In 2011 and 2012 alone, thunderstorms have caused insureds catastrophic losses estimated at $5.36 billion. This has created a hard market in North Texas (where many of these storms have occurred) for residential property insurance as companies begin to withdraw, restrict sales, and increase prices.

The Texas Gulf Coast continues to be a hard market as well for residential property products for similar reasons, but related more to anticipated hurricane losses as well as losses sustained during hurricane Ike.

Competitive Strengths

All of our business is sourced through internet-enabled applications. Our agents use the internet to quote and issue policies, conduct other transactions, and look up policyholder information. The agent portal or interface, and the actions required by the agents, are designed to be simple and rapid to use. Our commitment to technology has enabled us to grow rapidly without a loss in efficiency, while providing our agents with a highly satisfactory transactional experience.

Although automated underwriting tools are used extensively to qualify and price policies, some polices cannot be automatically underwritten, as they are outside the acceptable “underwriting box”. To support our agents and our policyholders, we have local, experienced, and responsive underwriting and customer service personnel. Our timely responsiveness to our agents and the underwriting support we give them is an important component of our business philosophy. We consider our relationships with our agents to be excellent as a result.

Our management team has many years of insurance experience in Texas. Our knowledge of the Texas market helps us to better identify those market segments known by us to produce superior profit opportunities, and to avoid those that do not. Our pricing philosophy is to maximize profit margins within credible segments of the market while avoiding segments of the market where opportunities for profit are limited. This allows us to set prices competitively within self-selected (based on price) market segments.

We have long-standing relationships with a large number of successful and productive independent agents in Texas. Many of these relationships predate the founding of our company.

We are a Texas-based company focusing on residential property business. As such, we can spend virtually all of our time researching and developing ways to improve our core business. This specialization, our use of technology, and our relatively small size, allow us to swiftly identify and react to opportunities and changes in the Texas market. If and when we expand into additional significant markets, we will staff the Company with personnel who are intimately familiar with each new market.

Competitive Weaknesses

We are a new company competing against larger, well-established companies. Most of our competitors and all of the large competitors that dominate the personal lines insurance market in Texas and elsewhere are well-recognized and respected brands, such as State Farm, Allstate, Farmers, Nationwide, Travelers, USAA, Liberty Mutual, and others. These companies are known to independent agents and consumers alike. These brands continue to advertise heavily on television and through other media, while we do not.

Most of our competitors, again all the large, well-known brands, have a satisfactory financial stability rating from A.B. Best of B+ or higher, whereas we are not rated by A.M. Best and must rely on our Demotech, Inc. rating to compete. This puts us in an inferior competitive position as A.M. Best is better known and more highly regarded among independent agents, lenders, and consumers. A Demotech, Inc. rated company is generally acceptable to lenders throughout the United States, but Demotech tends to be unknown to independent agents in many parts of the United States, especially those who market insurance products away from the Gulf and Atlantic coasts.

Unlike our established competitors we must rely heavily on reinsurers for financial support in order to achieve our revenue objectives. This reliance may adversely affect our ability to compete price-wise, should our reinsurance costs significantly increase.

Our larger competitors have the advantage of spreading their risks over a more diverse insurance product offering and broader geographical markets than we can. This can give them a competitive advantage through efficient allocation of risks and costs as well as reduced operating costs through economies of scale.

Further, the ability of our main competitors to be able to offer a number of consumer focused insurance products including private passenger automobile, personal liability umbrellas and even life, health as well as various commercial coverages and other financial services products while we offer only residential property coverage, appeals to consumers who prefer to consolidate their insurance solutions with a single supplier. Broader product offerings also make our competitors more appealing to independent agents.

Our Strategies

Our long-term strategy in the Houston metropolitan area is to increase the proportion of business we write there. We believe that hard-market conditions in that area present an unusual opportunity to write business with a greater profit potential. At the same time, we must also limit growth in Gulf Coast counties in order to avoid undue exposure to hurricane risks or uneconomical increases in our cost of reinsurance. We are exploring ways to utilize our MGA to take greater advantage of the existing Houston market. HAMGA is positioned to write business with unaffiliated insurers, which would allow us to generate fee income without the attendant underwriting risks.

| - 3 - |

We will continue to manage our business through automated and non-automated selective underwriting processes and through creative pricing and product design. This allows us to attract and select the most potentially profitable segments of the market.

We will continue to take advantage of technological changes. As an example, with the help of our technology provider, IDMI, Inc., we are developing a “consumer portal”, which will enable consumers to make payments, view their policy information, and conduct other transactions through the internet. We are also developing, along with IDMI, a “direct business” portal, which would allow us to quote prices to potential customers shopping the internet. In Texas our intent is to use this means to drive new business to our agents. If and when we expand beyond Texas, we may also use this portal to do business directly with policyholders.

Our long-term growth strategy includes continued growth of our Texas residential property business and expansion of our residential property business into other states, but within the constraints imposed by our pricing philosophy, our competitors, and our capital resources.

Corporate Information

Our principal executive offices are located at 1333 Corporate Drive, Suite 325, Irving, TX 75038 and our telephone number is (972) 607-4241. Our website address is www.hoaic.com. Information contained on our website or that can be accessed through our website does not constitute a part of this prospectus and is not incorporated herein by reference.

| - 4 - |

The Offering

| Common stock offered by the selling stockholders: | 15,739,182 shares, including 14,839,182 shares of common stock issuable upon the conversion of our Series A Preferred Stock and Series B Preferred Stock, and the conversion of convertible promissory notes. | |

| Common stock outstanding: | 15,739,182 shares as of the effective date of the Registration Statement, excluding shares of common stock issuable upon exercise of outstanding warrants and stock options. | |

| Trading market: | There is currently no market for our common stock and we can offer no assurances that a market for our shares of common stock will develop in the future. We intend to seek a qualification for our common stock to be quoted on the OTCBB; however, no assurance can be given as to our success in qualifying for quotation on the OTCBB. | |

| Price per share: | If our common stock is quoted on the OTCBB, it will be sold at prevailing market prices or privately negotiated prices. | |

| Use of proceeds: | We will not receive any of the proceeds from the sale or other disposition of the shares of common stock offered hereby. | |

| Risk factors: | We are subject to a number of risks that you should be aware of before you decide to purchase our common stock. These risks are discussed more fully in the section captioned “Risk Factors,” beginning on page 6 of this prospectus. |

| - 5 - |

RISK FACTORS

An investment in our securities involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below together with the other information included in this prospectus before purchasing our securities in this offering. If any of the possibilities described as risks below actually occurs, our operating results and financial condition would likely suffer and the trading price of our securities could fall, causing you to lose some or all of your investment in the securities we are offering. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Risks Related to Our Business

Because our insurance subsidiary currently conducts business in only one state, any single catastrophic event or other condition affecting losses in that particular state could adversely affect our insurance subsidiary’s business, financial condition, and results of operations.

Our insurance subsidiary conducts business in only one state, the State of Texas. While our insurance subsidiary actively manages its exposure to catastrophic events through its underwriting process and the purchase of reinsurance, a single catastrophic event, destructive weather pattern, general economic trend, regulatory development or other condition specifically affecting the State of Texas could have a disproportionately adverse impact on our insurance subsidiary’s business, financial condition, and results of operations. In addition, the fact that our insurance subsidiary’s business is concentrated in the State of Texas subjects it to increased exposure to certain catastrophic events and destructive weather patterns such as severe thunderstorms, hurricanes, tropical storms, and floods. Changes in the prevailing regulatory, legal, economic, political, demographic, competitive, and other conditions in the State of Texas could also make it less attractive for our insurance subsidiary to do business in the State of Texas and would have a more pronounced effect on our insurance subsidiary than it would on other insurance companies that are more geographically diversified. Because our insurance subsidiary’s business is concentrated in this manner, the occurrence of one or more catastrophic events or other conditions affecting losses in the State of Texas could have an adverse effect on its business, financial condition, and results of operations.

Our results may fluctuate based on many factors including cyclical changes in the insurance industry.

The insurance business historically has been a cyclical industry characterized by periods of intense price competition due to excessive underwriting capacity, as well as periods when shortages of capacity permitted an increase in pricing and, thus, more favorable underwriting profits. An increase in premium levels is often over time offset by an increasing supply of insurance capacity, either by capital provided by new entrants or by the commitment of additional capital by existing insurers, which may cause prices to decrease. Any of these factors could lead to a significant reduction in premium rates, less favorable policy terms and fewer opportunities to underwrite insurance risks, which could have a material adverse effect on our results of operations and cash flows. In addition to these considerations, changes in the frequency and severity of losses suffered by insureds and insurers may affect the cycles of the insurance business significantly. These factors may also cause the price of our common stock to be volatile.

We cannot predict whether market conditions will improve, remain constant or deteriorate. Negative market conditions may impair our ability to write insurance at rates that we consider appropriate relative to the risk assumed. If we cannot write insurance at appropriate rates, our ability to transact business would be materially and adversely affected.

Increased competition, competitive pressures, industry developments and market conditions could affect the growth of our business and adversely impact our financial results.

The property and casualty insurance industry is cyclical and, during times of increased capacity, highly competitive. We compete not only with other stock companies but also with mutual companies, other underwriting organizations and alternative risk sharing mechanisms. Our principal competitors cannot be easily classified. Our principal lines of business are written by numerous other insurance companies. Competition for any one account may come from very large, well-established national companies, smaller regional companies, other specialty insurers in our field, and other companies that write insurance only in Texas. Many of these competitors have greater financial resources, larger agency networks and greater name recognition than our company. We compete for business not only on the basis of price, but also on the basis of financial strength, types of coverages offered, availability of coverage desired by customers, commission structure and quality of service. We may have difficulty continuing to compete successfully on any of these bases in the future. Competitive pressures coupled with market conditions may affect our rate of premium growth and financial results.

| - 6 - |

Our ability to compete in the property and casualty insurance industry and our ability to expand our business may be negatively affected by the fact that we are not rated by A.M. Best. We are Rated by Demotech, Inc. Mortgage companies and independent agents operating in the state of Texas generally accept a Demotech rating. However, in some states, mortgage companies require homeowners to obtain property insurance from an insurance company with a certain minimum A.M. Best rating. Further, some independent agents are reluctant to do business with a company that is not rated by A.M. Best. As a result, the minimum A.M. Best rating requirement may prevent us from expanding our business into other states or into certain independent agencies, which may in turn limit our ability to compete with large, national insurance companies and certain regional insurance companies.

In addition, industry developments could further increase competition in our industry. These developments could include:

| · | an influx of new capital in the marketplace as existing companies attempt to expand their businesses and new companies attempt to enter the insurance business as a result of better pricing and/or terms; |

| · | programs in which state-sponsored entities provide property insurance in catastrophe-prone areas or other alternative markets types of coverage; |

| · | changing practices caused by the Internet, which has led to greater competition in the insurance business; |

| · | changes in Texas’ regulatory climate; and |

| · | the passage of federal proposals for an optional federal charter that would allow some competing insurers to operate under regulations different or less stringent than those applicable to our insurance subsidiary. |

These developments and others could make the property and casualty insurance marketplace more competitive by increasing the supply of insurance available.

If competition limits our ability to write new business at adequate rates, our future results of operations would be adversely affected.

If our actual losses from insured claims exceed our loss reserves, our financial results would be adversely affected.

We record reserves for specific claims incurred and reported and reserves for claims incurred but not reported. The estimates of losses for reported claims are established judgmentally on an individual case basis. Such estimates are based on our particular experience with the type of risk involved and our knowledge of the circumstances surrounding each individual claim. Reserves for reported claims consider our estimate of the ultimate cost to settle the claim, including investigation and defense of the claim, and may be adjusted for differences between costs originally estimated and costs re-estimated or incurred. Reserves for incurred but not reported claims are based on the estimated ultimate cost of settling claims, including the effects of inflation and other social and economic factors, using past experience adjusted for current trends and any other factors that would modify past experience. We use a variety of statistical and actuarial techniques to analyze current claim costs, frequency and severity data, and prevailing economic, social and legal factors. While management believes that amounts included in the consolidated financial statements are adequate, there can be no assurance that future changes in loss development, favorable or unfavorable, will not occur. The estimates are periodically reviewed and any changes are reflected in current operations.

| - 7 - |

Our objective is to set reserves that are adequate and represent management’s best estimate; that is, the amounts originally recorded as reserves should at least equal the ultimate cost to investigate and settle claims. However, the process of establishing adequate reserves is inherently uncertain, and the ultimate cost of a claim may vary materially from the amounts reserved. We regularly monitor and evaluate loss and loss adjustment expense reserve development to verify reserve adequacy. Any adjustment to reserves is reflected in underwriting results for the accounting period in which the adjustment is made.

Due to the uncertainties discussed above, the ultimate losses may vary materially from current loss reserves which could have a material adverse effect on our future financial condition, results of operations and cash flows. To date, loss reserves have been adequate to cover losses incurred, including losses incurred but not reported. We have had no difficulty in establishing and maintaining adequate reserves for losses.

The effects of emerging claim and coverage issues on our business are uncertain.

As industry practices and legal, judicial, social and other environmental conditions change, unexpected and unintended issues related to claims and coverage may emerge. These issues may adversely affect our business by either extending coverage beyond our underwriting intent or by increasing the number or size of claims. In some instances, these changes may not become apparent until some time after we have issued insurance contracts that are affected by the changes. As a result, the full extent of liability under our insurance contracts may not be known for many years after a contract is issued and renewed, and our financial position and results of operations may be adversely affected.

If we are unable to expand our business because our capital must be used to pay greater than anticipated claims, our financial results may suffer.

Our future growth will depend on our ability to expand the number of insurance policies we write in Texas, to expand the kinds of insurance products we offer, and to expand the geographic markets in which we do business, all balanced by the business risks we choose to assume and cede. Unexpected catastrophic events in our market areas, such as the severe thunderstorms experienced in Texas in recent years, may result in greater claims losses than anticipated, which could require us to limit or halt our growth while we redeploy our capital to pay these unanticipated claims unless we are able to raise additional capital.

We may require additional capital in the future which may not be available or may only be available on unfavorable terms.

Our future capital requirements depend on many factors, including our ability to write new business successfully and to establish premium rates and reserves at levels sufficient to cover losses. To the extent that our present capital is insufficient to meet future operating requirements or to cover losses, we may need to raise additional funds through financings or curtail our growth. Based on our current operating plan, we believe current capital together with our anticipated retained earnings will support our operations without the need to raise additional capital. However, we cannot provide any assurance in that regard, since many factors will affect our capital needs and their amount and timing, including our growth, profitability, and the availability of reinsurance, as well as possible acquisition opportunities, market disruptions and other unforeseeable developments. If we had to raise additional capital, equity or debt financing may not be available at all or may be available only on terms that are not favorable to us. In the case of equity financings, dilution to our stockholders could result, and in any case such securities may have rights, preferences and privileges that are senior to those of existing stockholders. If we cannot obtain adequate capital on favorable terms or at all, our business, financial condition or results of operations could be materially adversely affected. At present we have adequate capital to meet current levels of new business production and anticipated growth within the markets we serve and the products we offer. However, additional capital may be needed if we decide to expand operations into additional states or if we decide to immediately and significantly reduce our need for and reliance on reinsurance.

| - 8 - |

Our financial results may be negatively affected by the fact that a portion of our income is generated by the investment of our company’s capital and surplus, premiums and loss reserves.

A portion of our income is, and likely will continue to be, generated by the investment of our company’s capital and surplus, premiums and loss reserves. The amount of income so generated is a function of our investment policy, available investment opportunities, and the amount of capital and surplus, premium and loss reserves invested. As we continue to grow and to deploy our capital, the proportion of income invested will decrease, and investment income will make up a smaller percentage of our net revenue. Currently, all of our capital is invested in money market funds or in bank deposits (i.e., certificates of deposit) that mature in no more than eighteen months. Fluctuating interest rates and other economic factors make it impossible to estimate accurately the amount of investment income that will be realized. In fact, we may realize losses on our investments.

We have exposure to unpredictable catastrophes, which can materially and adversely affect our financial results.

We write insurance policies that cover homeowners, condominium owners, and tenants for losses that result from, among other things, catastrophes. We are therefore subject to claims arising out of catastrophes that may have a significant effect on our business, results of operations, and/or financial condition. Catastrophes can be caused by various events, including hurricanes, tropical storms, tornadoes, windstorms, earthquakes, hailstorms, explosions, power outages, fires and by man-made events, such as terrorist attacks. The incidence and severity of catastrophes are inherently unpredictable. The extent of losses from a catastrophe is a function of both the total amount of insured exposure in the area affected by the event, the type of catastrophe and the severity of the event. Our policyholders are currently concentrated in Texas, which is especially subject to adverse weather conditions such as severe thunderstorms, hurricanes and tropical storms. Insurance companies are not permitted to reserve for catastrophes until such event takes place. Therefore, although we attempt to manage our exposure to catastrophes through our underwriting process and the purchase of reinsurance protection, an especially severe catastrophe or series of catastrophes could exceed our reinsurance protection and may have a material adverse impact on our results of operations and financial condition. See the risk factor below entitled “Although we follow the industry practice of reinsuring a portion of our risks, our costs of obtaining reinsurance may increase and we may not be able to successfully alleviate risk through reinsurance arrangements” for a discussion of our reinsurance coverage.

Industry trends, such as increased litigation against the insurance industry and individual insurers, the willingness of courts to expand covered causes of loss, rising jury awards, and the escalation of loss severity may contribute to increased costs and to the deterioration of the reserves of our insurance subsidiary.

Litigation against property and casualty insurance insurers in Texas has increased in recent years. The propensity of policyholders and third party claimants to litigate and the willingness of courts to expand causes of loss and the size of awards may render the loss reserves of our insurance subsidiary inadequate for current and future losses.

Although we follow the industry practice of reinsuring a portion of our risks we may not be able to successfully alleviate risk through reinsurance arrangements.

Reinsurance is the practice of transferring part of an insurance company’s liability and premium under an insurance policy to another insurance company. We use reinsurance arrangements to limit and manage the amount of risk we retain, to stabilize our underwriting results and to increase our underwriting capacity. Our reinsurance structure is comprised of numerous reinsurance companies with varying levels of participation providing coverage for loss and loss adjustment expense, or LAE, at pre-established minimum and maximum amounts. In accordance with our minimum requirements, our amount of reinsurance coverage is determined by subjecting our homeowner exposures to statistical forecasting models that are designed to quantify a catastrophic event in terms of the amount of our probable maximum loss from a storm of severity that occurs once in every 100 years or greater. Our amount of losses retained (our deductible) in connection with a catastrophic event is determined by market capacity, pricing conditions and surplus preservation. Losses incurred in connection with a catastrophic event below the minimum and above the maximum are the responsibility of our insurance subsidiary. For the 2012-2013 treaty period, we retain an aggregate of $300,000 in loss and LAE for each of the first two catastrophic events. We have purchased reinsurance treaties to insure our insurance subsidiary to the standard which consists of first and second event coverage greater than the 1- in -100 year level, as required by us. We purchased coverage totaling $65 million of aggregate loss and LAE. Single catastrophe losses and LAE exceeding $65 million are our responsibility. For the 2013 – 2014 treaty period, which began on April 1, 2013, we retain an aggregate of $400,000 in loss and LAE for each of the first two catastrophic events. We have purchased reinsurance treaties to insure our insurance subsidiary to the standard which consists of first and second event coverage greater than 1-in 100 year level, as required by us. We purchased coverage totaling $80.0 million of aggregate loss and LAE. Single catastrophe losses and LAE exceeding $80.0 million are our responsibility.

Although we follow the industry practice of reinsuring a portion of our risk through various types of reinsurance programs, including quota share, excess of loss and catastrophe excess of loss, we may not be able to successfully alleviate risk through such reinsurance arrangements. The pricing for these types of reinsurance is based on both on the experience of HAIC’s book of business as well as the overall experience of the global property and casualty insurance industry. The cost of the quota share reinsurance is reflected in the amount of the ceding commission allowance reinsurers pay HAIC of the production of the business. Should the allowance offered to HAIC by reinsurers not reflect the actual cost of producing the business, this would create a risk to the current business model and adversely affect the business. Both types of excess of loss reinsurance used by HAIC allows the sharing of losses on both a per risk and per occurrence basis, allowing HAIC to underwrite larger amounts of business than it would be able to, without this coverage. Reinsurers charge for this type of coverage by taking a percentage of the premium earned on each policy included in the program. The rising cost of this type of coverage, which could limit HAIC’s ability to obtain adequate levels of coverage could limit HAIC’s ability to write policies with certain risk limits and or limit its ability to take on additional business over concerns of risk concentration. Both instances would mean a reduction in business volume and would adversely affect the operating results of the company.

| - 9 - |

We face a risk of non-availability of reinsurance, which could materially and adversely affect our ability to write business and our results of operations and financial condition.

Market conditions beyond our control, such as the amount of capital in the reinsurance market and natural and man-made catastrophes, determine the availability and cost of the reinsurance protection we purchase. We cannot be assured that reinsurance will remain continuously available to the same extent and on the same terms and rates as are currently available. If we are unable to maintain our current level of reinsurance or purchase new reinsurance protection in amounts that are considered sufficient, we may have to accept an increase in our net exposures and we may have to reduce our insurance writings. Either of these potential developments could have a material adverse effect on our financial position, results of operations and cash flows.

We face a risk of non-collectability of reinsurance, which could materially and adversely affect our business, results of operations and/or financial condition.

As is common practice within the insurance industry, we transfer a portion of the risks insured under our policies to other companies through the purchase of reinsurance. This reinsurance is maintained to protect our insurance subsidiary against the severity of losses on individual claims, unusually serious occurrences in which a number of claims produce an aggregate extraordinary loss and catastrophic events. Although reinsurance does not discharge our insurance subsidiary from its primary obligation to pay for losses insured under the policies it issues, reinsurance does make the assuming reinsurer liable to the insurance subsidiary for the reinsured portion of the risk. A credit exposure exists with respect to ceded losses to the extent that any reinsurer is unable or unwilling to meet the obligations assumed under the reinsurance contracts. The collectability of reinsurance is subject to the solvency of the reinsurers, interpretation of contract language and other factors. We are selective with regard to our reinsurers, placing reinsurance with those reinsurers with strong financial strength ratings from A.M. Best, Standard & Poor’s, or a combination thereof, although the financial condition of a reinsurer may change based on market conditions. We perform credit reviews on our reinsurers, focusing on, among other things, financial condition, stability, trends and commitment to the reinsurance business. We may require assets in trust, letters of credit or other acceptable collateral to support balances due from reinsurers not authorized to transact business in the applicable jurisdictions. It has not always been standard business practice to require security for balances due; therefore, certain balances are not collateralized. A reinsurer’s insolvency or inability to make payments under the terms of a reinsurance contract could have a material adverse effect on our results of operations and financial condition.

The failure of the risk mitigation strategies we utilize could have a material adverse effect on our financial condition or results of operations.

We utilize a number of strategies to mitigate our risk exposure including:

| · | engaging in vigorous underwriting; |

| · | carefully evaluating terms and conditions of our policies; |

| · | focusing on our risk aggregations by geographic zones, credit exposure and other bases; and |

| · | ceding insurance risk to reinsurance companies. |

However, there are inherent limitations in all of these tactics. No assurance can be given that an event or series of unanticipated events will not result in loss levels which could have a material adverse effect on our financial condition or results of operations.

The failure of any of the loss limitation methods we employ could have a material adverse effect on our financial condition or our results of operations.

Various provisions of our policies, such as limitations or exclusions from coverage which have been negotiated to limit our risks, may not be enforceable in the manner we intend. At the present time, we employ a variety of endorsements to our policies that limit exposure to known risks, including but not limited to weather exclusions relating to homes in close proximity to the coast line.

| - 10 - |

While our insurance product exclusions and limitations reduce the loss exposure to us and help eliminate known exposures to certain risks, it is possible that a court or regulatory authority could nullify or void an exclusion or legislation could be enacted modifying or barring the use of such endorsements and limitations in a way that would adversely effect our loss experience, which could have a material adverse effect on our financial condition or results of operations.

We may be unable to attract and retain qualified employees.

We depend on our ability to attract and retain experienced underwriting talent and other skilled employees who are knowledgeable about our business. If the quality of our underwriters and other personnel decreases, we may be unable to maintain our current competitive position in the specialized markets in which we operate and be unable to expand our operations, which could adversely affect our results.

Because we have relatively few employees, the loss of, or failure to attract, key personnel could also significantly impede the financial plans, growth, marketing and other objectives of our insurance subsidiary. Our insurance subsidiary’s success depends to a substantial extent on the ability and experience of the members of its senior management team. Our insurance subsidiary believes that its ability to grow and future success will depend in large part on its ability to attract and retain additional skilled and qualified personnel and to expand, train and manage its employees. Our insurance subsidiary may not be successful in doing so, because the competition for experienced personnel in the insurance industry is intense. We have employment agreements with some but not all key personnel.

To date we have had no difficulty attracting qualified personnel to support our operations. None of our personnel have indicated that they will resign or retire.

Our information technology systems may fail or suffer a loss of security which could adversely affect our business.

Our business is highly dependent upon the successful and uninterrupted functioning of our computer and data processing systems. We rely on these systems to perform actuarial and other modeling functions necessary for writing business, as well as to handle our policy administration process (i.e., quoting and issuing our policies, billing and applying payments, the printing and mailing of our policies, endorsements, renewal notices, etc). The failure of these systems could interrupt our operations. This could result in a material adverse effect on our business results.

The development and expansion of our business is dependent upon the successful development and implementation of advanced computer and data processing systems. The failure of these systems to function as planned could slow our growth and adversely affect our future business volume and results of operations. We license the software used in our policy administration process (PTS) from a third party, IDMI, Inc. IDMI also maintains PTS. In addition, we outsource the hosting and operating of our policy administration system with another third party, Primoris, Inc. Primoris Services, L.L.C., an affiliate of IDMI, hosts PTS on its servers located in Warner Robbins, GA, with a mirror processor hosting both system and policy records in Atlanta, GA. Through this “mirror processing environment” the Company has established a data security protocol which provides instant “off-site” back-up of both its operating software and data. In addition, the Company has offsite storage of the IDMI operating software with Iron Mountain Intellectual Property Management, Inc.

The Company’s insurance subsidiary is highly dependent on the successful and uninterrupted functioning of its computer systems. We rely on these systems to quote and underwrite our business, bill premium and issue policies to customers as well as provide financial data. The failure of the system through natural disaster and or power outages could disrupt our operations and could result in a material adverse effect on our business. The Company has addressed this risk through the establishment of back up facilities for data and source code built to DOD anti-terrorism force protection codes, at one of the most physically secure commercial data centers in the country. The Company will enhance its backup / data recovery capabilities by bringing on-line the mirror processing systems.

The license and maintenance agreement with IDMI may be terminated by us with 45 days written notice or by IDMI in the event of a material breach of the agreement (such as non-payment) by us. If termination of the IDMI agreement occurs, we may be required to spend significant capital and other resources to purchase and implement PTS or a replacement software system, and to staff and support the technologists that would be needed to maintain and operate our processing system. Alternatively, we could outsource our policy administration process with another third party, which would also require significant expenditures.

The hosting and operating agreement with Primoris may be terminated by us with 90 days written notice or by Primoris in the event of a material breach by us of the agreement. If termination of this agreement occurs, we may be required to spend significant capital and other resources to purchase and implement the hardware needed to host and operate PTS, and possibly to staff and support the technologists that would be needed to maintain and operate our processing system. Alternatively, we could outsource our PTS hosting and operating functions with another third party, which could also require significant expenditures.

| - 11 - |

Any failure on the part of a third party to properly maintain our policy administration system (PTS), or to host and operate PTS could lead to material litigation, undermine our reputation in the marketplace, impair our image and negatively affect our financial results.

In addition, a security breach of our computer systems could damage our reputation or result in liability. We retain confidential information regarding our business dealings in our computer systems. We may be required to spend significant capital and other resources to protect against security breaches or to alleviate problems caused by such breaches. It is critical that these facilities and infrastructure remain secure. Despite the implementation of security measures, this infrastructure may be vulnerable to physical break-ins, computer viruses, programming errors, attacks by third parties or similar disruptive problems. In addition, we could be subject to liability if hackers were able to penetrate our network security or otherwise misappropriate confidential information.

We rely on independent agents to write our insurance policies, and if we are not able to attract and retain independent agents, our revenues would be negatively affected.

We write insurance policies through approximately 800 independent agents in Texas, some of whom write a significant amount of business with us. We rely on these independent agents as the only source for our property insurance policies.

Many of our competitors also rely on independent agents. As a result, we must compete with other insurers for independent agents’ business. Our competitors may offer a greater variety of insurance products, lower premiums for insurance coverage, or higher commissions to their agents. If our products, pricing and commissions do not remain competitive, we may find it more difficult to attract business from independent agents to sell our products. A material reduction in the amount of our products that independent agents sell would negatively affect our revenues. To date we have not experienced difficulty attracting new independent agents to support our new business and growth objectives.

We are only rated by Demotech, Inc. and do not have a rating from A.M. Best. The Demotech rating alone may not be sufficient to allow us to expand into parts of the United States where Demotech is not as well known or as widely used.

We are not rated by A.M. Best, although we are rated “A, Excellent” by Demotech, Inc. We have never been reviewed by A.M. Best and do not intend to seek a rating from A.M. Best until we believe we can secure a minimum rating of B+, that being the minimum accepted by most lenders as well as many independent agents. Our analysis, applying known A.M. Best rating criteria, shows that we will need additional capital before we can qualify for an acceptable A.M. Best rating. Unlike Demotech, A.M. Best tends to penalize companies that are highly leveraged, i.e. that utilize reinsurance to support premium writings. HAIC has a gross premium to capital ratio of approximately 7.6 to 1, although our net premium to capital ratio is less than 1-to-1. We would need to reduce our gross ratio to approximately 2-to-1, either by increasing capital (the denominator) or decreasing premium writings (the numerator). Capital is expected to grow over time, but in order to achieve our premium revenue objectives and maintain size efficiency, we must continue to rely on reinsurers to ameliorate risks and provide financial support. In summary, we do not plan to give up revenues or efficiency of size as a means to qualify for an acceptable A.M. Best rating. Our Demotech rating has proved satisfactory to date in attracting an acceptable amount of business from independent agent and satisfies lenders as to our financial stability.

A rating by A.M Best is more widely accepted by lenders, independent agents and consumers than a Demotech rating. A.M. Best has been the rating standard relied upon to rate insurance companies in the United States for many years. The Demotech rating alone may not be sufficient to allow us to expand into parts of the United States where Demotech is not as well known or as widely used. However, Demotech’s rating has been sufficient in Texas and we expect it to be sufficient in expansion states that the Company has under study.

Our success depends on our ability to accurately price the risks we underwrite.

The results of our operations and the financial condition of our insurance subsidiary depend on our ability to underwrite and set premium rates accurately for a wide variety of risks. Rate adequacy is necessary to generate sufficient premiums to pay losses, LAE and underwriting expenses and to earn a profit. In order to price our products accurately, we must collect and properly analyze a substantial amount of data; develop, test and apply appropriate rating formulas; closely monitor and timely recognize changes in trends; and project both severity and frequency of losses with reasonable accuracy. Our ability to undertake these efforts successfully, and as a result price our products accurately, is subject to a number of risks and uncertainties, some of which are outside our control, including:

| · | the availability of sufficient reliable data and our ability to properly analyze available data; |

| · | the uncertainties that inherently characterize estimates and assumptions; |

| · | our selection and application of appropriate rating and pricing techniques; |

| · | changes in legal standards, claim settlement practices, and restoration costs; and |

| · | legislatively imposed consumer initiatives. |

A failure to adequately price risks will negatively affect future underwriting profits. We could also overprice risks, which could reduce our sales volume and competitiveness. In either event, the profitability of our insurance subsidiary could be materially and adversely affected.

| - 12 - |

We will incur additional costs as a result of being a public company, which could reduce our profits.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission, have required changes in the corporate governance practices of public companies, including rules requiring public companies to include a report of management on the company’s internal control over financial reporting in their annual reports on Form 10-K. Compliance with these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. We cannot predict or estimate the amount of additional costs we may incur or the timing of such costs, which could increase our operating costs and reduce our profits.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act which allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

We are an emerging growth company as defined in the JOBS Act, and will continue to be an emerging growth company until: (i) the last day of our fiscal year following the fifth anniversary of this prospectus, (ii) the date on which we become a large accelerated filer, or (iii) the date on which we have issued an aggregate of $1 billion in non-convertible debt during the preceding 3 years. As an emerging growth company, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Risks Related to Regulation of our Insurance Operations

As an insurance holding company, we are currently subject to regulation by the State of Texas and in the future may become subject to regulation by certain other states or a federal regulator.

All states regulate insurance holding company systems. State statutes and administrative rules generally require each insurance company in the holding company group to register with the department of insurance in its state of domicile and to furnish information concerning the operations of the companies within the holding company system which may materially affect the operations, management or financial condition of the insurers within the group. As part of its registration, each insurance company must identify material agreements, relationships and transactions with affiliates, including without limitation loans, investments, asset transfers, transactions outside of the ordinary course of business, certain management, service, and cost sharing agreements, reinsurance transactions, dividends, and consolidated tax allocation agreements.

Insurance holding company regulations generally provide that transactions between an insurance company and its affiliates must be fair and equitable, allocated between the parties in accordance with customary accounting practices, and fully disclosed in the records of the respective parties. Many types of transactions between an insurance company and its affiliates, such as transfers of assets among such affiliated companies, certain dividend payments from insurance subsidiaries and certain material transactions between companies within the system, may be subject to prior notice to, or prior approval by, state regulatory authorities. If we are unable to obtain the requisite prior approval for a specific transaction, we would be precluded from taking the action which could adversely affect our operations.

Our insurance subsidiary currently operates only in the State of Texas. In the future, our insurance subsidiary may become authorized to transact business in other states and therefore will become subject to the laws and regulatory requirements of those states. These regulations may vary from state to state, and states occasionally may have conflicting regulations. Currently, the federal government’s role in regulating or dictating the policies of insurance companies is limited. However, Congress, from time to time, considers proposals that would increase the role of the federal government in insurance regulation, either in addition to or in lieu of state regulation. The impact of any future federal insurance regulation on our insurance operations is unclear and may adversely impact our business or competitive position.

| - 13 - |

Our insurance subsidiary is subject to extensive regulation which may reduce our profitability or inhibit our growth. Moreover, if we fail to comply with these regulations, we may be subject to penalties, including fines and suspensions, which may adversely affect our financial condition and results of operations.

The insurance industry is highly regulated and supervised. Our insurance subsidiary is subject to the supervision and regulation of the state in which it is domiciled (Texas) and the state(s) in which it does business (currently only Texas). Such supervision and regulation is primarily designed to protect our policyholders rather than our stockholders. These regulations are generally administered by a department of insurance in each state and relate to, among other things:

| · | the content and timing of required notices and other policyholder information; |

| · | the amount of premiums the insurer may write in relation to its surplus; |

| · | the amount and nature of reinsurance a company is required to purchase; |

| · | participation in guaranty funds and other statutorily-created markets or organizations; |

| · | business operations and claims practices; |

| · | approval of policy forms and premium rates; |

| · | standards of solvency, including risk-based capital measurements; |

| · | licensing of insurers and their products; |

| · | restrictions on the nature, quality and concentration of investments; |

| · | restrictions on the ability of our insurance company subsidiary to pay dividends to us; |

| · | restrictions on transactions between insurance company subsidiaries and their affiliates; |

| · | restrictions on the size of risks insurable under a single policy; |

| · | requiring deposits for the benefit of policyholders; |

| · | requiring certain methods of accounting; |

| · | periodic examinations of our operations and finances; |

| · | prescribing the form and content of records of financial condition required to be filed; and |

| · | requiring reserves as required by statutory accounting rules. |

The Texas Department of Insurance and regulators in other jurisdictions where our insurance subsidiary may become licensed conduct periodic examinations of the affairs of insurance companies and require the filing of annual and other reports relating to financial condition, holding company issues and other matters. These regulatory requirements may adversely affect or inhibit our ability to achieve some or all of our business objectives. These regulatory authorities also conduct periodic examinations into insurers’ business practices. These reviews may reveal deficiencies in our insurance operations or differences between our interpretations of regulatory requirements and those of the regulators.

| - 14 - |

In addition, regulatory authorities have relatively broad discretion to deny or revoke licenses for various reasons, including the violation of regulations. In some instances, we follow practices based on our interpretations of regulations or practices that we believe may be generally followed by the industry. These practices may turn out to be different from the interpretations of regulatory authorities. If we do not have the requisite licenses and approvals or do not comply with applicable regulatory requirements, insurance regulatory authorities could preclude or temporarily suspend us from carrying on some or all of our activities or otherwise penalize us. This could adversely affect our ability to operate our business.

The Company's insurance subsidiary, HAIC is not currently subject to any regulatory investigations or settlements.

Finally, changes in the level of regulation of the insurance industry or changes in laws or regulations themselves or interpretations by regulatory authorities could adversely affect our ability to operate our business.

Changes in regulation may reduce our profitability and limit our growth.

We are subject to extensive regulation in the state in which we conduct business (currently only Texas). This regulation is generally designed to protect the interests of policyholders, as opposed to stockholders and other investors in the insurance company or its affiliates, and relates to authorization for lines of business, capital and surplus requirements, investment limitations, underwriting limitations, transactions with affiliates, dividend limitations, trade practices and claims practices, participation in guaranty funds and other statutorily-created markets or organizations, changes in control, premium rates and a variety of other financial and non-financial components of an insurance company’s business. The National Association of Insurance Commissioners (“NAIC”) and state insurance regulators are constantly reexamining existing laws and regulations, generally focusing on modifications to holding company regulations, interpretations of existing laws and the development of new laws.

From time to time, states consider and/or enact laws that may alter or increase state authority to regulate insurance companies and insurance holding companies. States also consider and/or enact laws that impact the competitive environment and marketplace for property and casualty insurance. Texas lawmakers may enact legislation that reduces our profitability, limits our growth, or otherwise adversely affects our operations.

During the past several years, various regulatory and legislative bodies have adopted or proposed new laws or regulations to address the cyclical nature of the insurance industry, catastrophic events and insurance capacity and pricing. These regulations include (i) the creation of “market assistance plans” under which insurers are induced to provide certain coverages, (ii) restrictions on the ability of insurers to rescind or otherwise cancel certain policies in mid-term or to nonrenew policies at their scheduled expirations, (iii) advance notice requirements or limitations imposed for certain policy non-renewals, (iv) limitations upon or decreases in rates permitted to be charged, (v) expansion of governmental involvement in the insurance market, and (vi) increased regulation of insurers’ policy administration and claims handling practices.

Currently, the federal government does not directly regulate the insurance business. However, in recent years the state insurance regulatory framework has come under increased federal scrutiny. Congress and some federal agencies from time to time investigate the current condition of insurance regulation in the United States to determine whether to impose federal regulation or to allow an optional federal charter, similar to banks. In addition, changes in federal legislation and administrative policies in several areas, including changes in the Gramm-Leach-Bliley Act, financial services regulation and federal taxation, can significantly impact the insurance industry and us.

We cannot predict with certainty the effect any enacted, proposed or future state or federal legislation or NAIC initiatives may have on the conduct of our business. Furthermore, there can be no assurance that the regulatory requirements applicable to our business will not become more stringent in the future or result in materially higher costs than current requirements, or that creation of a federal insurance regulatory system will not adversely affect our business or disproportionately benefit our competitors. Changes in the regulation of our business may reduce our profitability, limit our growth or otherwise adversely affect our operations.

| - 15 - |

Our insurance subsidiary is subject to minimum capital and surplus requirements, and our failure to meet these requirements could subject us to regulatory action.

Our insurance subsidiary is subject to risk-based capital standards and other minimum capital and surplus requirements imposed under applicable state laws, including the laws of Texas. The risk-based capital standards, based upon the Risk-Based Capital Model Act adopted by the NAIC, require our insurance subsidiary to report its results of risk-based capital calculations to state departments of insurance and the NAIC. These risk-based capital standards provide for different levels of regulatory attention depending upon the ratio of an insurance company’s total adjusted capital, as calculated in accordance with NAIC guidelines, to its authorized control level risk-based capital. Authorized control level risk-based capital is the number determined by applying the NAIC’s risk-based capital formula, which measures the minimum amount of capital that an insurance company needs to support its overall business operations.