Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - CONTROL4 CORP | a2215893zex-5_1.htm |

| EX-23.1 - EX-23.1 - CONTROL4 CORP | a2215893zex-23_1.htm |

| EX-3.1.1 - EX-3.1.1 - CONTROL4 CORP | a2215893zex-3_11.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 22, 2013

Registration No. 333-189736

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Control4 Corporation

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3670 (Primary Standard Industrial Classification Code Number) |

42-1583209 (I.R.S. Employer Identification Number) |

11734 S. Election Road

Salt Lake City, Utah 84020

(801) 523-3100

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Martin Plaehn

President and Chief Executive Officer

11734 S. Election Road

Salt Lake City, Utah 84020

(801) 523-3100

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||||

William J. Schnoor Richard A. Kline Michael J. Minahan Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 (650) 752-3100 |

Greg Bishop General Counsel, Chief Compliance Officer and Corporate Secretary 11734 S. Election Road Salt Lake City, Utah 84020 (801) 523-3100 |

Eric C. Jensen Andrew S. Williamson Cooley LLP 3175 Hanover Street Palo Alto, California 94304 (650) 843-5000 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a small reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.0001 per share |

4,600,000 | $17.00 | $78,200,000 | $10,667 | ||||

|

||||||||

- (1)

- Includes

600,000 shares of common stock that the underwriters may purchase to cover overallotments, if any.

- (2)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended.

Includes offering price of additional shares that the underwriters have the option to purchase.

- (3)

- The registrant previously paid $8,184 of the registration fee with the initial filing of this registration statement.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 19, 2013

PROSPECTUS

4,000,000 Shares

Common Stock

This is Control4 Corporation's initial public offering. We are selling 4,000,000 shares of our common stock.

We expect the public offering price to be between $15.00 and $17.00 per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will trade on The NASDAQ Global Market under the symbol "CTRL".

We are an "emerging growth company" as defined in the Jumpstart our Business Startups Act of 2012 and, therefore, may comply with certain reduced public company reporting requirements.

Investing in the common stock involves risks that are described in the "Risk Factors" section beginning on page 15 of this prospectus.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount(1) |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

- (1)

- See "Underwriting" for a description of the compensation payable to the underwriters.

The underwriters may also exercise their option to purchase up to an additional 600,000 shares from us at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2013.

| BofA Merrill Lynch | Raymond James |

| Canaccord Genuity | Cowen and Company | Needham & Company |

The date of this prospectus is , 2013.

You should rely only on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us and delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. We do not take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in a jurisdiction outside the United States are required to inform themselves about, and to observe any restrictions as to, this offering and the distribution of this prospectus applicable to that jurisdiction.

i

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under "Risk Factors," "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Overview

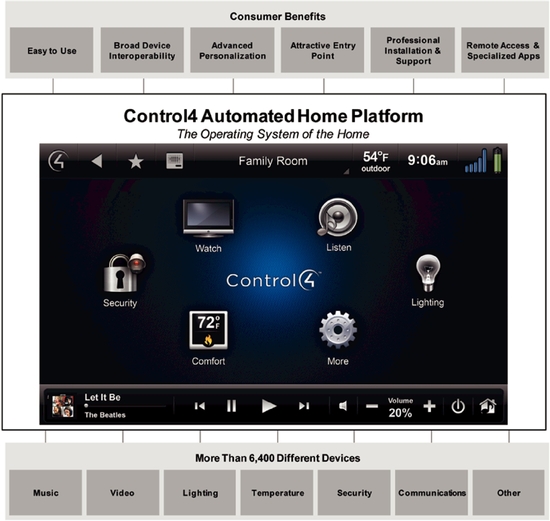

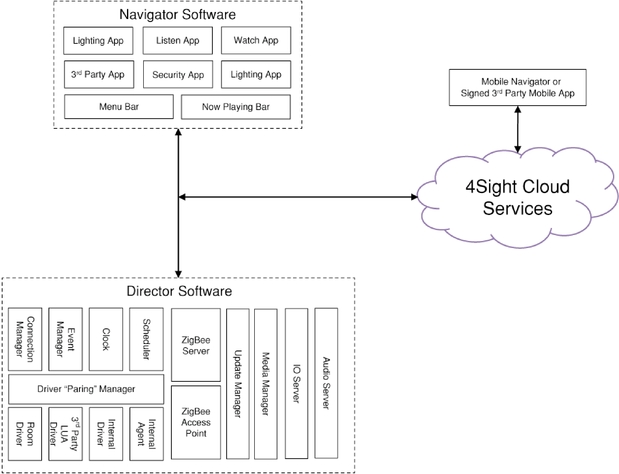

Control4 is a leading provider of automation and control solutions for the connected home. We unlock the potential of connected devices, making entertainment systems easier to use, homes more comfortable and energy efficient, and families more secure. We provide our consumers with the ability to integrate music, video, lighting, temperature, security, communications and other functionalities into a unified home automation solution that enhances our consumers' daily lives. More than 75% of our consumers have integrated two or more of these functionalities with our solution. At the center of our solution is our advanced software platform, which we provide through our products that interface with a wide variety of connected devices that are developed both by us and by third parties.

Our solution functions as the operating system of the home, making connected devices work together to control, automate and personalize the homes of our consumers. For example, our solution can be configured so that:

- •

- A half hour before you wake up in the morning, the thermostat adjusts to heat up the house, the lights slowly become

brighter and the shades gradually open;

- •

- As you leave for work, one push of a button locks the doors, arms the security system, turns off all the lights, powers

down all non-essential devices and adjusts the temperature settings to the "away" mode;

- •

- When you return home in the evening, the push of a button opens your garage door, unlocks the door and adjusts the

thermostat to your preferred temperature;

- •

- When you are ready to watch a movie, instead of having to use several remotes, a single interface—be it a

touch screen, smartphone, tablet or simple remote—provides you with easy control of your entire entertainment system. As the movie starts, the window blinds close, the lights dim and the

temperature adjusts to keep your family comfortable; and

- •

- When it is time for bed, the press of a "goodnight" button closes the blinds, turns off the lights, locks the doors, arms the security system and turns off all televisions and game consoles.

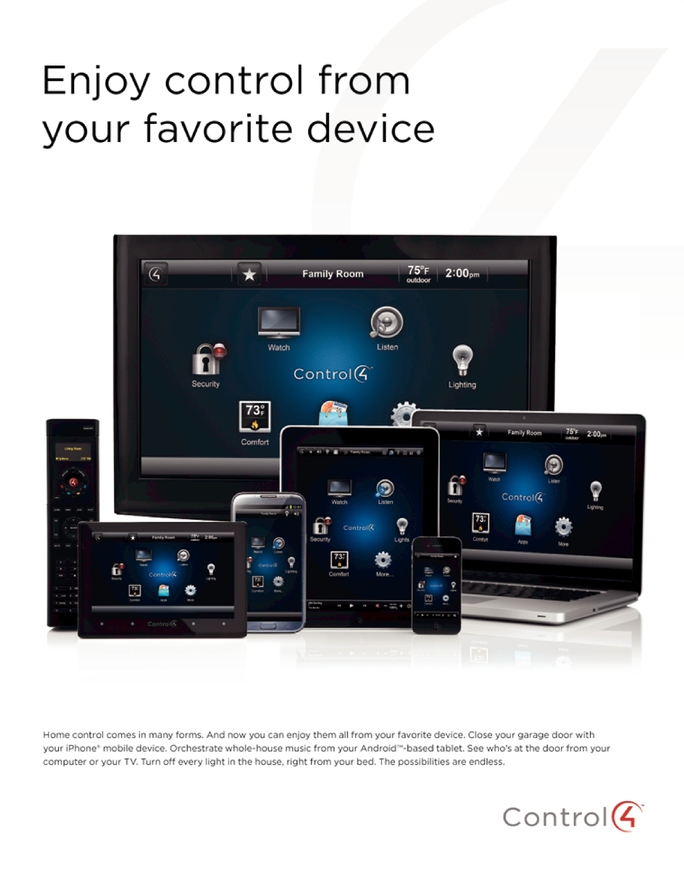

At the center of the Control4 product line is the Control4 Home Operating System, which we refer to as the C4 OS. We embed our C4 OS in a range of products, including controller appliances, interfaces and connected devices that interact with various music, video, lighting, temperature, security, communications and other devices. We offer our 4Sight subscription service, which allows consumers to control and monitor their homes remotely from their smartphone, tablet or laptop, and allows our dealers to perform remote diagnostic services. For example, 4Sight allows a consumer to remotely unlock the front door to let in a repairman, to turn on the air conditioning on the way home, and to monitor the home security cameras from a smartphone. In addition, our 4Store application marketplace offers a range of third-party applications for use with our products. We derive virtually all of our revenue from the sale of products that contain our proprietary software, and a smaller portion from software licensing and annual service subscriptions.

1

We were founded in 2003 to deliver a home automation solution to the mainstream market by enabling consumers to unify their connected devices into a personalized system at an accessible and affordable entry point. Based on our analysis, through March 31, 2013, we estimate that we have automated more than 120,000 homes representing cumulative sales of more than 275,000 of our controller appliances, the brain of the connected home. We sell and deliver our solutions through an extensive worldwide dealer and distributor network and have solutions installed in 81 countries. Our top 100 dealers represented 24% of our total revenue in 2012.

We generated revenue of $74.9 million, $93.4 million and $109.5 million in 2010, 2011 and 2012, respectively, and $26.6 million for the three months ended March 31, 2013. We had a net loss of $16.3 million, $3.9 million and $3.7 million in 2010, 2011 and 2012, respectively, and $1.5 million for the three months ended March 31, 2013.

Our Industry

Market Opportunity

Consumers are becoming more reliant on network-aware devices in their everyday lives, contributing to the creation of a large opportunity in the mainstream home automation market. Growth in smart devices, such as smartphones and tablets, and the ubiquity of wireless networks have combined to create the "connected consumer." These consumers are seeking a connected home with expanded capabilities in the form of networks, connected devices and smart systems.

Historically, the home automation market was primarily comprised of luxury systems that were so expensive that only wealthy consumers could afford the programming and installation costs. As consumer awareness of home automation grows and expectations for interoperable and more affordable solutions increase, the mainstream segment of the home automation market is expected to expand rapidly. According to ABI Research, the mainstream segment of the home automation market was estimated to be a $571 million market in 2012 and a $2.6 billion market by 2017, representing a CAGR of 35%, as consumers look for centralized solutions to provide personalized control and automation of their homes.

Consumer Requirements

For mainstream consumers to embrace a home automation solution, we believe that the solution must have the following attributes:

- •

- Easy to

Use. Accustomed to easy-to-use smartphones, consumers want a simple, unified, yet powerful and innovative

interface for the unique set of devices and systems they have in their homes;

- •

- Interoperable. Consumers are looking for a single solution with the ability to manage

their network of current and future devices, regardless of manufacturer, technology or communication protocol;

- •

- Personalized and

Flexible. Consumers want to be able to easily personalize the behavior of the devices in their homes to reflect their own lifestyles and

preferences—now and into the future—providing flexibility as their needs and lifestyles change;

- •

- Affordable and

Future-Proof. Consumers want a home automation solution that delivers rich functionality at an affordable price point and that adapts to

changing needs over time without significant cost or disruption; and

- •

- Accessible Service and Support. Consumers are looking for solutions that are supported by local trained specialists who can provide both responsive initial consultation and installation, as well as ongoing service and support.

2

Limitations of Traditional Approaches

The home automation market has traditionally been comprised of:

- •

- Luxury

Installations. Generally found in the highest end segment of the market, these systems and installations are typically complex, lengthy,

inflexible and expensive;

- •

- Managed

Services. Generally provided by a cable, telephone or security provider, these services come as a non-personalized,

one-size-fits-all service with narrow capabilities and recurring monthly charges; and

- •

- Point Products. Generally supplied by companies focused on a discrete function within the home, these products typically lack interoperability with other devices.

Our Solution

The Control4 solution, built around our advanced software platform, sits at the center of the fast-growing mainstream segment of the home automation market. Our solution functions as the operating system of the home, integrating music, video, lighting, temperature, security, communications and other devices into a unified automation solution that enhances our consumers' daily lives. Our solution provides the consumer with the following key benefits:

- •

- Easy to

Use. Our solution is designed to be simple and intuitive. For example, our easy-to-use interfaces can be as

advanced as a smartphone, tablet, in-wall touch panel, television or multi-function remote control, or as simple as a single button or switch;

- •

- Broad Device

Interoperability. Our open and flexible solution provides consumers with access to a broad universe of over 6,400 discrete third-party

devices. With our solution, consumers can connect and automate the devices they already own—as well as the devices they purchase in the future—and have the confidence that all

of those devices will interoperate as seamlessly as if they were made by the same manufacturer;

- •

- Advanced

Personalization. Our adaptable solution enables consumers to personalize the features and functionality of their Control4 system. Our

modular design also enables the smooth integration of new third-party products to meet the evolving needs of our consumers as their lifestyles change;

- •

- Attractive Entry

Point. According to ABI Research, the typical luxury home automation installation can cost $60,000 or more for whole-home systems. With

our solution, consumers can start with a single-room multi-media automation experience for about $1,000 and scale to an integrated solution with an average cost of $26,000;

- •

- Professional Installation and Support Through Our Global Dealer

Network. We have built a global network of over 2,800 active direct dealers and distributors to help consumers develop and install their

customized home automation experiences with the Control4 solution; and

- •

- Remote Access and Specialized Apps. We have developed complementary services and applications offerings to provide consumers more access, control and enhanced functionality over their automated homes.

3

Our Growth Strategy

Our goal is to be the leading global provider of mainstream home automation solutions and the operating system of choice for the home. The following are key elements of our growth strategy:

- •

- Enhance Our Software Platform and

Products. We intend to continue to invest in our software platform to develop new products, features and capabilities that deliver

exceptional performance and value to our consumers;

- •

- Strengthen and Expand Our Global Dealer

Network. We plan to continue to expand, train, support and optimize our global certified dealer network to ensure that we have

sufficient geographic coverage across both existing and new markets;

- •

- Increase Penetration of Our North America Core

Market. We intend to continue to focus sales and marketing resources to increase penetration of the residential market in North America;

- •

- Expand Our Focus on Adjacent

Markets. We plan to continue making investments to capitalize on opportunities outside the residential market, including in the light

commercial, multi-dwelling unit and hospitality markets, and internationally;

- •

- Enhance Our Solution with Services and

Apps. We intend to continue to enhance our 4Sight subscription services and to support third-party apps via our 4Store application

marketplace to deliver more functionality and value to our consumers;

- •

- Pursue Technology Licensing

Opportunities. We plan to expand our licensing activities to leverage third-party distribution channels, grow our partner relationships,

and simplify the home automation experience for dealers and consumers; and

- •

- Pursue Strategic Acquisitions. We intend to identify, acquire and integrate strategic technologies, assets and businesses that we believe will enhance the overall strength of our business.

Risks Related to Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in "Risk Factors" immediately following this prospectus summary. These risks include, but are not limited to, the following:

- •

- We have incurred operating losses in the past, may incur operating losses in the future, and may not achieve or maintain

profitability;

- •

- The markets in which we participate are highly competitive and many companies, including large technology companies,

broadband and security service providers and other managed service providers, are actively targeting the home automation market. Our failure to differentiate ourselves and compete successfully with

these companies would make it difficult for us to add and retain consumers, and would reduce or impede the growth of our business;

- •

- Consumers may choose to adopt point products that provide control of a discrete home function rather than adopting our

unified home automation solution. If we are unable to increase market awareness of the benefits of our unified solution, our revenue may not continue to grow, or it may decline;

- •

- Many of the competitors in our market, including providers of luxury integrated solutions with long operating histories, established markets, broad user bases and proven consumer acceptance, may be successful in expanding into the mainstream home automation market, which may harm our growth and future prospects;

4

- •

- Since we rely on third-party dealers and distributors to sell and install our solutions, we do not have a direct sales

pipeline, which makes it difficult for us to accurately forecast future sales and correctly predict manufacturing requirements;

- •

- Our quarterly results of operations have fluctuated and may continue to fluctuate. As a result, we may fail to meet or

exceed the expectations of investors or securities analysts, which could cause our stock price to decline; and

- •

- If we are unable to develop new solutions, sell our solutions into new markets or further penetrate our existing markets, our revenue may not grow as expected.

Corporate Information

We were incorporated in Delaware in 2003. Our principal executive offices are located at 11734 South Election Road, Suite 200, Salt Lake City, Utah 84020, and our telephone number is (801) 523-3100. Our principal website address is www.control4.com. Information contained on our website does not constitute a part of, and is not incorporated by reference into, this prospectus.

Control4, the Control4 logo, 4Sight, 4Store and Control4 MyHome are registered trademarks or trademarks of Control4 Corporation in the United States and, in certain cases, in other countries. This prospectus contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of these companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; or the last day of the fiscal year ending after the fifth anniversary of our initial public offering.

5

Common stock offered by Control4 Corporation |

4,000,000 shares | |

Common stock to be outstanding after the offering |

22,094,267 shares |

|

Option to purchase additional shares offered by Control4 Corporation. |

600,000 shares |

|

Use of Proceeds |

The net proceeds to us from this offering will be approximately $57.0 million (or approximately $65.9 million if the underwriters' option to purchase additional shares is exercised in full), based upon an assumed initial public offering price of $16.00 share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, including working capital and capital expenditures. We intend to use $2.25 million of the net proceeds from this offering to pay off the remaining amounts owed under a litigation settlement agreement. We may also use a portion of the net proceeds from this offering for acquisitions of complementary technologies, assets or businesses. |

|

Risk Factors |

See "Risk Factors" and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

Proposed NASDAQ Global Market trading symbol |

"CTRL" |

The number of shares of our common stock to be outstanding after the completion of this offering is based on:

- •

- 17,801,035 shares outstanding as of March 31, 2013;

- •

- 76,964 shares of common stock, on an as-converted basis, issuable upon the net exercise of a warrant to

purchase 182,666 shares of preferred stock outstanding as of March 31, 2013 at an exercise price of $9.26, which would terminate upon this offering in accordance with its terms; and

- •

- 216,268 shares of common stock issuable upon the net exercise of warrants to purchase 541,235 shares of common stock outstanding as of March 31, 2013 at a weighted average exercise price of $9.61, which would terminate upon this offering in accordance with their terms.

The number of shares of our common stock to be outstanding after the completion of this offering excludes:

- •

- 4,609,466 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2013 at a weighted average exercise price of $5.56 per share of which 21,246

6

- •

- 389,782 shares of common stock issuable upon the exercise of options that were granted after March 31, 2013, with

an exercise price of $11.28 per share;

- •

- 11,715 shares of common stock, on an as-converted basis, issuable upon the exercise of warrants to purchase preferred

stock outstanding as of March 31, 2013 at a weighted average exercise price of $7.71 per share that will remain outstanding following this offering if not exercised; and

- •

- 2,200,000 shares reserved for future issuance under our 2013 Stock Option and Incentive Plan, as well as shares originally reserved for issuance under our 2003 Equity Incentive Plan, but which may become available for awards under our 2013 Stock Option and Incentive Plan, which plan will become effective in connection with this offering and contains provisions that will automatically increase its share reserve each year, as more fully described in "Executive Compensation—Employee Benefit Plans."

shares of common stock were issued upon the exercise of options with a weighted average exercise price of $5.93 after March 31, 2013;

Except for historical financial statements or as otherwise indicated, information in this prospectus reflects or assumes the following:

- •

- A 1-for-5.2 reverse stock split effected on July 18, 2013;

- •

- The filing of our amended and restated certificate of incorporation immediately prior to the closing of this offering;

- •

- The conversion of all of our outstanding preferred stock into an aggregate of 15,293,960 shares of common stock

immediately prior to the closing of this offering;

- •

- No exercise after March 31, 2013 of outstanding options or warrants; and

- •

- No exercise of the underwriters' option to purchase additional shares.

7

SUMMARY CONSOLIDATED FINANCIAL DATA

We have derived the summary consolidated statements of operations data for the fiscal years ended December 31, 2010, 2011 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary consolidated statements of operations data for the three months ended March 31, 2012 and March 31, 2013 and our consolidated balance sheet data as of March 31, 2013 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. The unaudited interim financial statements reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for the fair presentation of the financial statements. Our historical results are not necessarily indicative of our future results. The following summary consolidated financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| |

Years Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(In thousands, except per share data) |

|||||||||||||||

Consolidated Statements of Operations Data: |

||||||||||||||||

Revenue |

$ | 74,925 | $ | 93,376 | $ | 109,512 | $ | 22,628 | $ | 26,571 | ||||||

Cost of revenue |

43,357 | 50,534 | 57,225 | 12,466 | 13,550 | |||||||||||

Cost of revenue—inventory purchase commitment |

— | — | 1,840 | — | — | |||||||||||

Gross margin |

31,568 | 42,842 | 50,447 | 10,162 | 13,021 | |||||||||||

Operating expenses: |

||||||||||||||||

Research and development |

15,922 | 19,211 | 20,310 | 4,813 | 6,066 | |||||||||||

Sales and marketing |

22,491 | 17,546 | 20,182 | 5,038 | 5,605 | |||||||||||

General and administrative |

8,876 | 9,805 | 10,150 | 2,532 | 2,828 | |||||||||||

Litigation settlement |

— | — | 2,869 | — | — | |||||||||||

Total operating expenses |

47,289 | 46,562 | 53,511 | 12,383 | 14,499 | |||||||||||

Loss from operations |

(15,721 | ) | (3,720 | ) | (3,064 | ) | (2,221 | ) | (1,478 | ) | ||||||

Interest and other expense, net |

(544 | ) | (165 | ) | (518 | ) | (462 | ) | (49 | ) | ||||||

Loss before income taxes |

$ | (16,265 | ) | $ | (3,885 | ) | $ | (3,582 | ) | $ | (2,683 | ) | $ | (1,527 | ) | |

Income tax (expense) benefit |

— | — | (141 | ) | — | 56 | ||||||||||

Net loss |

$ | (16,265 | ) | $ | (3,885 | ) | $ | (3,723 | ) | $ | (2,683 | ) | $ | (1,471 | ) | |

Net loss per common share, basic and diluted |

$ | (9.93 | ) | $ | (2.02 | ) | $ | (1.58 | ) | $ | (1.19 | ) | $ | (0.59 | ) | |

Weighted-average number of shares, basic and diluted |

1,638 | 1,923 | 2,360 | 2,249 | 2,502 | |||||||||||

Pro forma net loss per common share, basic and diluted (unaudited)(1) |

$ | (0.21 | ) | $ | (0.08 | ) | ||||||||||

Pro forma weighted-average number of common shares, basic and diluted (unaudited) |

17,947 | 18,089 | ||||||||||||||

Other Non-GAAP Financial Data: |

||||||||||||||||

Adjusted gross margin |

$ | 31,596 | $ | 42,891 | $ | 52,365 | $ | 10,179 | $ | 13,037 | ||||||

Adjusted gross margin percentage |

42.2% | 45.9% | 47.8% | 45.0% | 49.1% | |||||||||||

Adjusted operating income (loss) |

$ | (14,252 | ) | $ | (1,707 | ) | $ | 4,514 | $ | (1,490 | ) | $ | (640 | ) | ||

- (1)

- Pro forma net loss per common share has been calculated assuming the conversion of all outstanding shares of our preferred stock as of March 31, 2013 into 15,293,960 shares of common stock and the net exercise of outstanding warrants to purchase 723,901 shares of capital stock into an aggregate of 293,232 shares of common stock as of March 31, 2013 prior to the completion of this offering.

8

Stock-based compensation expense included in the consolidated statements of operations data above was as follows:

| |

Years Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(In thousands) |

|||||||||||||||

Cost of revenue |

$ | 28 | $ | 49 | $ | 78 | $ | 17 | $ | 16 | ||||||

Research and development |

249 | 492 | 704 | 130 | 236 | |||||||||||

Sales and marketing |

546 | 523 | 580 | 144 | 184 | |||||||||||

General and administrative |

646 | 949 | 1,507 | 440 | 402 | |||||||||||

Total stock-based compensation expense |

$ | 1,469 | $ | 2,013 | $ | 2,869 | $ | 731 | $ | 838 | ||||||

Reconciliation of Non-GAAP Financial Data

Adjusted Gross Margin

A reconciliation of Adjusted gross margin to gross margin, the most directly comparable GAAP financial measure, is presented below:

| |

Years Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(Dollars in thousands) |

|||||||||||||||

Gross margin |

$ | 31,568 | $ | 42,842 | $ | 50,447 | $ | 10,162 | $ | 13,021 | ||||||

Stock-based compensation expense included in cost of revenue |

28 | 49 | 78 | 17 | 16 | |||||||||||

Cost of revenue—inventory purchase commitment |

— | — | 1,840 | — | — | |||||||||||

Adjusted gross margin |

$ | 31,596 | $ | 42,891 | $ | 52,365 | $ | 10,179 | $ | 13,037 | ||||||

Adjusted gross margin percentage |

42.2% | 45.9% | 47.8% | 45.0% | 49.1% | |||||||||||

To provide investors with additional information regarding our financial results, we have disclosed in the table above and within this prospectus Adjusted gross margin, a non-GAAP financial measure. We have included Adjusted gross margin in this prospectus because Adjusted gross margin is a key measure used by our management and board of directors to understand and evaluate our operating performance and trends, to prepare and approve our annual budget, and to develop short- and long-term operational plans.

Adjusted gross margin is defined as gross margin less stock-based compensation expense and loss on inventory purchase commitment. Management believes that the use of Adjusted gross margin provides consistency and comparability with our past and future performance, facilitates period-to-period comparisons and also facilitates comparisons with other companies.

Management believes that it is useful to exclude stock-based compensation expense from gross margin because the amount of such expense in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude loss on inventory purchase commitment because it is an expense that arose from our commitment to purchase energy-related products from our contract manufacturing partner that we will not use due to our decision to discontinue our energy product line for utility customers. We have not incurred that type of expense in past periods and we believe that past and future periods are more comparable if we exclude that expense from gross margin.

9

Our use of Adjusted gross margin has limitations as an analytical tool and you should not consider it in isolation or a substitute for our analysis of our results as reported under GAAP. Some of these limitations are:

- •

- Adjusted gross margin does not reflect the potentially dilutive impact of equity-based compensation; and

- •

- Although we have not incurred significant loss on purchase commitments in the past, there is no guarantee that we will not incur those expenses in the future and therefore Adjusted gross margin may not be indicative of future performance.

Because of these limitations, you should consider Adjusted gross margin alongside other financial performance measures.

Adjusted Operating Income

A reconciliation of Adjusted operating income (loss) to loss from operations, the most directly comparable GAAP financial measure, is presented below:

| |

Years Ended December 31, | Three Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(In thousands) |

|||||||||||||||

Loss from operations |

$ | (15,721 | ) | $ | (3,720 | ) | $ | (3,064 | ) | $ | (2,221 | ) | $ | (1,478 | ) | |

Stock-based compensation expense |

1,469 | 2,013 | 2,869 | 731 | 838 | |||||||||||

Cost of revenue—inventory purchase commitment |

— | — | 1,840 | — | — | |||||||||||

Litigation settlement |

— | — | 2,869 | — | — | |||||||||||

Adjusted operating income (loss) |

$ | (14,252 | ) | $ | (1,707 | ) | $ | 4,514 | $ | (1,490 | ) | $ | (640 | ) | ||

To provide investors with additional information regarding our financial results, we have disclosed in the table above and within this prospectus Adjusted operating income, a non-GAAP financial measure. We have included Adjusted operating income in this prospectus because Adjusted operating income is a key measure used by our management and board of directors to understand and evaluate our operating performance and trends. We use it to prepare and approve our annual budget and to develop short- and long-term operational plans.

Adjusted operating income is defined as operating income less stock-based compensation expense, loss on inventory purchase commitment and litigation settlement expense. Management believes that the use of Adjusted operating income provides consistency and comparability with our past and future performance, facilitates period-to-period comparisons and also facilitates comparisons with other companies.

Management believes that it is useful to exclude stock-based compensation expense from operating income because the amount of such expense in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude loss on inventory purchase commitment because it is an expense that arose from our commitment to purchase energy-related products from our contract manufacturing partner that we will not use due to our decision to discontinue our energy product line for utility customers. We have not incurred that type of expense in past periods and we believe that past and future periods are more comparable if we exclude that expense from operating income.

We believe it is useful to exclude litigation settlement expense from operating income because that expense was related to two separate legal settlements that were resolved in 2012. Those settlements are not indicative of past or future operating performance. We believe that past and future periods are more comparable if we exclude that expense from operating income.

10

Our use of Adjusted operating income has limitations as an analytical tool and you should not consider it in isolation or as a substitute for our analysis of our results as reported under GAAP. Some of these limitations are:

- •

- Adjusted operating income does not reflect the potentially dilutive impact of equity-based compensation;

- •

- Although we have not incurred significant loss on purchase commitments in the past, there is no guarantee that we will not

incur those expenses in the future and therefore Adjusted operating income may not be indicative of future performance; and

- •

- We are involved in litigation matters from time to time and we may incur litigation settlement expenses in future periods and, therefore, Adjusted operating income may not be indicative of future performance.

Because of these limitations, you should consider Adjusted operating income alongside other financial performance measures.

11

Consolidated Balance Sheet Data

The following table sets forth our summary consolidated balance sheet data as of March 31, 2013:

- •

- On an actual basis;

- •

- On a pro forma basis to reflect the conversion of all outstanding shares of our preferred stock into 15,293,960 shares of

our common stock, which will occur immediately prior to the closing of this offering assuming our valuation prior to this offering is at least $225 million and the net proceeds to us from this

offering are not less than $35 million, the net exercise of outstanding warrants to purchase 723,901 shares of capital stock into an aggregate of 293,232 shares of common stock as of

March 31, 2013, the corresponding reclassification of our warrant liability to additional paid-in capital, which will occur immediately prior to the closing of this offering unless earlier

exercised or expired, and the filing of our post-offering amended and restated certificate of incorporation, which will occur immediately prior to the closing of this offering; and

- •

- On a pro forma as adjusted basis to reflect the pro forma adjustments described above and (i) our receipt of the net proceeds from our sale of 4,000,000 shares of common stock in this offering at an assumed initial public offering price of $16.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the payment of the remaining amount owed under a litigation settlement agreement.

| |

As of March 31, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro forma | Pro forma as adjusted(1) |

|||||||

| |

(In thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 14,573 | $ | 14,573 | $ | 69,343 | ||||

Property and equipment, net |

3,566 | 3,566 | 3,566 | |||||||

Working capital, excluding deferred revenue |

21,582 | 21,582 | 76,868 | |||||||

Total assets |

49,455 | 49,455 | 104,225 | |||||||

Redeemable convertible preferred stock |

116,313 | — | — | |||||||

Total stockholders' equity (deficit) |

(93,204 | ) | 23,685 | 80,515 | ||||||

- (1)

- A $1.00 increase (decrease) in the assumed initial public offering price of $16.00 per share, the midpoint of the range set forth on the cover page of this prospectus, would increase (decrease) cash and cash equivalents and each of working capital, excluding deferred revenue, total assets and total stockholders' equity (deficit) by $3.7 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions payable by us. Each increase or decrease of 1.0 million shares in the number of shares offered by us would increase or decrease cash and cash equivalents and each of working capital, excluding deferred revenue, total assets and total stockholders' equity (deficit) by $14.9 million assuming that the assumed price per share remains the same, and after deducting estimated underwriting discounts and commissions payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

12

Recent Developments

The estimated ranges of our financial results and operating metrics below as of and for the three months ended June 30, 2013 are preliminary, based upon our estimates and are subject to completion of financial and operating closing procedures. We have begun our normal quarterly closing and review procedures for the three months ended June 30, 2013; however, given the timing of these estimates, final results as of and for the three months ended June 30, 2013 may differ from our estimated results, including as a result of the quarter-end closing procedures or review adjustments. The summary information below is not a comprehensive statement of our financial results or operating metrics for this period and our actual results and metrics may differ from the estimated ranges due to the completion of our financial and operating closing procedures and/or adjustments and other developments that may arise before the results for this period are finalized. These estimates should not be viewed as a substitute for full interim financial statements prepared in accordance with GAAP that have been reviewed by our auditors. In addition, these estimates as of and for the three months ended June 30, 2013, are not necessarily indicative of the results to be achieved for the remainder of 2013 or any future period. This information should be read in conjunction with the financial statements and the related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" for prior periods included elsewhere in this prospectus.

The following are preliminary estimates for the three months ended June 30, 2013:

| |

As of or for the Three Months Ended June 30, 2013 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|||||||

| |

(Dollars in thousands) |

|||||||||

GAAP Disclosure: |

||||||||||

Revenue |

$ | 32,000 | — | $ | 32,500 | |||||

Gross margin |

$ | 16,100 | — | $ | 16,600 | |||||

Gross margin as a percentage of revenue |

50.3% | — | 51.1% | |||||||

Operating income |

$ | 1,100 | — | $ | 1,800 | |||||

Cash and cash equivalents |

$ | 18,100 | ||||||||

Other Non-GAAP Financial Data:(1) |

||||||||||

Adjusted gross margin |

||||||||||

Gross margin |

$ | 16,100 | — | $ | 16,600 | |||||

Stock-based compensation expense included in cost of revenue |

15 | — | 15 | |||||||

Cost of revenue—inventory purchase commitment |

(180 | ) | — | (180 | ) | |||||

Adjusted gross margin |

$ | 15,935 | — | $ | 16,435 | |||||

Adjusted gross margin percentage |

49.8% | — | 50.5% | |||||||

Adjusted operating income |

||||||||||

Operating income |

$ | 1,100 | — | $ | 1,800 | |||||

Stock-based compensation expense |

850 | — | 850 | |||||||

Cost of revenue—inventory purchase commitment |

(180 | ) | — | (180 | ) | |||||

Adjusted operating income |

$ | 1,770 | — | $ | 2,470 | |||||

- (1)

- See

"—Reconciliation of Non-GAAP Financial Data" above for statements disclosing the reasons why our management believes that

presentation of the non-GAAP financial measures provide useful information to investors regarding our financial condition and results of operations and the additional purposes for which our management

uses the non-GAAP financial measures.

13

We estimate total revenue to be in a range from $32.0 million to $32.5 million for the three months ended June 30, 2013, compared to $27.6 million for the three months ended June 30, 2012. We estimate our Core revenue will be in a range from $31.5 million to $31.9 million for the three months ended June 30, 2013. The estimated increase in total revenue is in the range of $4.4 million to $4.9 million, or 16% to 18%, compared to revenue for the three months ended June 30, 2012. The estimated increase was primarily due to the net increase in the number of direct dealers selling our products and an increase in sales from existing dealers in both North America and internationally.

We estimate gross margin to be in a range from $16.1 million to $16.6 million for the three months ended June 30, 2013, compared to $13.3 million for the three months ended June 30, 2012. As a percentage of revenue, we estimate gross margin for the three months ended June 30, 2013 to be in a range from 50.3% to 51.1%, compared to 48.1% for the three months ended June 30, 2012. During the three months ended June 30, 2013, we reduced our reserve for inventory purchase commitments by approximately $180,000, as our proceeds from liquidating the underlying inventory and our ability to consume common components exceeded our original estimates. As a result, our gross margin percentage is higher than it otherwise would have been. We expect our adjusted gross margin percentage to be in the range from 49.8% to 50.5%. The estimated increase in adjusted gross margin percentage from 48.2% in the three months ended June 30, 2012 to between 49.8% and 50.5% in the three months ended June 30, 2013 was due to higher prices charged for our controller appliances and associated software, higher sales of third-party products sold through our online distribution platform, lower component costs and lower fixed manufacturing overhead expenses as a percentage of revenue.

We expect the favorable impact on our gross margin as a percentage of revenue related to higher prices for our controller appliances and associated software to continue in future periods; however, the impact will decline as software sold separately for use with legacy controller appliances will diminish over time.

We expect the positive impact on our gross margin as a percentage of revenue resulting from increased sales of third-party products sold through our online distribution platform to continue in future periods; however, the impact will diminish as the growth rate of that revenue stabilizes in future periods.

We expect product component cost reductions to continue to have a positive impact on our gross margin as a percentage of revenue as those reductions are the result of negotiated price decreases with our manufacturing partners that are not short-term in nature.

The impact of lower manufacturing overhead as a percentage of revenue on our gross margin percentage will vary depending on manufacturing overhead spending in that period. In the three months ended June 30, 2013, we received a credit for duties paid in previous periods. We expect credits received in future periods, and the related favorable impact on our gross margin percentage, will be less significant in future periods.

We estimate our operating income for the three months ended June 30, 2013 to be between $1.1 million and $1.8 million compared to $369,000 for the three months ended June 30, 2012 and our adjusted operating income to be between $1.8 million and $2.5 million for the three months ended June 30, 2013 compared to $1.0 million for the three months ended June 30, 2012. The increase in estimated operating income was due to higher revenue and higher gross margin percentages offset by higher operating expenses.

We expect our cash balance at June 30, 2013 to be $18.1 million compared to $14.6 million at March 31, 2013 and $18.7 million at December 31, 2012. The $600,000 expected decrease in cash for the first half of 2013 was due to $2.1 million in purchases of property and equipment, which was offset by $700,000 in cash generated from operations and $800,000 in net proceeds from notes payable and common stock option exercises.

14

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We have incurred operating losses in the past, may incur operating losses in the future, and may not achieve or maintain profitability.

We began our operations in 2003. For substantially all of our history, we have experienced net losses and negative cash flows from operations. As of March 31, 2013, we had an accumulated deficit of $107.1 million. We expect our operating expenses to increase in the future as we expand our operations. Furthermore, as a public company, we will incur additional legal, accounting and other expenses that we did not incur as a private company. If our revenue does not grow to offset these increased expenses, we will not become profitable. We may incur significant losses in the future for a number of reasons, including without limitation the other risks and uncertainties described in this prospectus. Additionally, we may encounter unforeseen operating or legal expenses, difficulties, complications, delays and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance will be harmed.

The markets in which we participate are highly competitive and many companies, including large technology companies, broadband and security service providers and other managed service providers, are actively targeting the home automation market. Our failure to differentiate ourselves and compete successfully with these companies would make it difficult for us to add and retain consumers, and would reduce or impede the growth of our business.

The market for automation and control solutions for the connected home is increasingly competitive and global. Many large technology companies have expanded into the connected home market by developing their own solutions, or by acquiring other companies with home automation solution offerings. For example, Microsoft Corporation recently acquired id8 Group R2 Studios Inc., a home entertainment technology company. These large technology companies already have broad consumer awareness and sell a variety of devices for the home, and consumers may choose their offerings instead of ours, even if we offer superior products and services. Similarly, many managed service providers, such as cable TV, telephone and security companies, are beginning to offer services that provide device control and automation capability within the home for an additional monthly service fee. For example, Comcast is expanding its Xfinity service to provide residential security, energy and automation services. These managed service providers have the advantage of leveraging their existing consumer base, network of installation and support technicians and name recognition to gain traction in the home automation market. In addition, consumers may prefer the monthly service fee with little to no upfront cost offered by some of these managed service providers over a larger upfront cost with little to no monthly service fees.

We expect competition from these large technology companies and managed service providers to increase in the future. This increased competition could result in pricing pressure, reduced sales, lower margins or the failure of our solutions to achieve or maintain broad market acceptance. To remain competitive and to maintain our position as a leading provider of automation and control solutions for the connected home, we will need to invest continuously in product development, marketing, customer service and support and product delivery infrastructure. We may not have

15

sufficient resources to continue to make the investments in all of the areas needed to maintain our competitive position. In addition, most of our competitors have longer operating histories, greater name recognition, larger consumer bases and significantly greater financial, technical, sales, marketing and other resources than us, which may provide them with an advantage in developing, marketing or servicing new solutions. Increased competition could reduce our market share, revenue and operating margins, increase our operating costs, harm our competitive position and otherwise harm our business and results of operations.

Consumers may choose to adopt point products that provide control of discrete home functions rather than adopting our unified home automation solution. If we are unable to increase market awareness of the benefits of our unified solution, our revenue may not continue to grow, or it may decline.

Many vendors have emerged, and may continue to emerge, to provide point products with advanced functionality for use in the home, such as a thermostat that can be controlled by an application on a smartphone. We expect more and more consumer electronic and consumer appliance products to be network-aware and connected—each very likely to have its own smart device (phone or tablet) application. Consumers may be attracted to the relatively low costs of these point products and the ability to expand their home control solution over time with minimal upfront costs, despite some of the disadvantages of this approach. While we have built our solution to be flexible and support third-party point products, these products may reduce the revenue we receive for each installation. It is therefore important that we have technical expertise and provide attractive top quality products in many areas, such as lighting and video, and establish broad market awareness of these solutions. If a significant number of consumers in our target market choose to adopt point products rather than our unified automation solution, then our business, financial condition and results of operations will be harmed, and we may not be able to achieve sustained growth or our business may decline.

Many of the competitors in our market, including providers of luxury integrated installations with long operating histories, established markets, broad user bases and proven consumer acceptance, may be successful in expanding into the mainstream home automation market, which may harm our growth and future prospects.

Many companies with which we directly compete have been operating in this industry for many years and, as a result, have established significant name recognition in the home automation industry. For example, Crestron, a provider of luxury integrated installations, has been in business for over 40 years and has become an established presence in the home automation industry. Another provider of luxury integrated installations is Savant Systems, which provides home automation based on the Apple iOS operating platform. To the extent these providers are able to develop more affordable products that compete more directly with our solution, our growth may be constrained and our business could suffer. In addition, given the strong growth potential of the market, we expect there to be many new entrants in the future.

Since we rely on third-party dealers and distributors to sell and install our solutions, we do not have a direct sales pipeline, which makes it difficult for us to accurately forecast future sales and correctly predict manufacturing requirements.

We depend on our dealer and distributor network to sell and install our solution. As a result, we do not develop or control our sales pipeline, making it difficult for us to predict future sales. In addition, because the production of certain of our products requires long lead times, we enter into agreements for the manufacture and purchase certain of our products well in advance of the time in which those products will be sold. These contracts are based on our best estimates of our near-term product needs. If we underestimate consumer demand, we may forego revenue opportunities, lose market share and damage our relationships. Conversely, if we overestimate consumer demand, we may purchase more inventory than we are able to sell at any given time, or at all. If we fail to accurately

16

estimate demand for our products, we could have excess or obsolete inventory, resulting in a decline in the value of our inventory, which would increase our costs of revenues and reduce our liquidity. Our failure to accurately manage inventory relative to demand would adversely affect our results of operations.

We have relatively limited visibility regarding the consumers that ultimately purchase our products, and we often rely on information from third-party dealers and distributors to help us manage our business. If these dealers and distributors fail to provide timely or accurate information, our ability to quickly react to market changes and effectively manage our business may be harmed.

We sell our solutions through dealers and distributors. These dealers and distributors work with consumers to design, install, update and maintain their home automation installations. While we are able to track orders from dealers and distributors and have access to certain information about the configurations of their Control4 systems that we receive through our controller appliances, we also rely on dealers and distributors to provide us with information about consumer behavior, product and system feedback, consumer demographics, buying patterns and information on our competitors. We use this channel sell-through data, along with other metrics, to assess consumer demand for our solutions, develop new products, adjust pricing and make other strategic business decisions. Channel sell-through data is subject to limitations due to collection methods and the third-party nature of the data and thus may not be complete or accurate. In addition, to the extent we collect information directly from consumers, for example through surveys that we conduct, the consumers who supply this sell-through data self select and vary by geographic region and from period to period, which may impact the usefulness of the results. If we do not receive consumer information on a timely or accurate basis, or if we do not properly interpret this information, our ability to quickly react to market changes and effectively manage our business may be harmed.

Our quarterly results of operations have fluctuated and may continue to fluctuate. As a result, we may fail to meet or exceed the expectations of investors or securities analysts, which could cause our stock price to decline.

Our quarterly revenue and results of operations may fluctuate as a result of a variety of factors, many of which are outside of our control. If our quarterly revenue or results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including:

- •

- Demand for and market acceptance of our solutions;

- •

- Our ability to increase, retain and incentivize the certified dealers and distributors that market, sell, install and

support our solutions;

- •

- The ability of our contract manufacturers to continue to manufacture high-quality products, and to supply

sufficient products to meet our demands;

- •

- The timing and success of introductions of new products, solutions or upgrades by us or our competitors and the entrance

of new competitors;

- •

- The strength of regional, national and global economies;

- •

- The impact of natural disasters or manmade problems such as terrorism;

- •

- Changes in our business and pricing policies or those of our competitors;

- •

- Competition, including entry into the industry by new competitors and new offerings by existing competitors;

- •

- The impact of seasonality on our business;

17

- •

- Issues related to introductions of new or improved products such as shortages of prior generation products or

short-term decreased demand for next generation products;

- •

- The amount and timing of expenditures, including those related to expanding our operations, increasing research and

development, introducing new solutions or paying litigation expenses; and

- •

- Changes in the payment terms for our solutions.

Due to the foregoing factors and the other risks discussed in this prospectus, you should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance. You should not consider our recent revenue growth as indicative of our future performance.

If we are unable to develop new solutions, sell our solutions into new markets or further penetrate our existing markets, our revenue may not grow as expected.

Our ability to increase sales will depend in large part on our ability to enhance and improve our solutions, to introduce new solutions in a timely manner, to sell into new markets and to further penetrate our existing markets. The success of any enhancement or new product or solution depends on several factors, including the timely completion, introduction and market acceptance of enhanced or new solutions, the ability to attract, retain and effectively train sales and marketing personnel, the ability to develop relationships with dealers and distributors and the effectiveness of our marketing programs. Any new product or solution we develop or acquire may not be introduced in a timely or cost-effective manner, and may not achieve the broad market acceptance necessary to generate significant revenue. Any new markets into which we attempt to sell our solutions, including new vertical markets and new countries or regions, may not be receptive. Our ability to further penetrate our existing markets depends on the quality of our solutions and our ability to design our solutions to meet consumer demand. Moreover, we are frequently required to enhance and update our solutions as a result of changing standards and technological developments, which makes it difficult to recover the cost of development and forces us to continually qualify new solutions with our consumers. If we are unable to successfully develop or acquire new solutions, enhance our existing solutions to meet consumer requirements, sell solutions into new markets or sell our solutions to additional consumers in our existing markets, our revenue may not grow as expected.

Our success depends, in part, on our ability to develop and expand our global network of dealers and distributors.

We have developed a global network of over 2,800 active direct dealers and 27 distributors to sell, install and support our solutions. We rely on our dealers and distributors to provide consumers with a successful Control4 home automation experience. In some cases, dealers may choose not to offer our solution and instead offer a product from one of our competitors or, in other cases, the dealer may simply discontinue its operations. In order to continue our growth and expand our business, it is important that we continue to add new dealers and distributors and maintain most of our existing relationships. We must also work to expand our network of dealers and distributors to ensure that we have sufficient geographic coverage and technical expertise to address new markets and technologies. While it is difficult to estimate the total number of available dealers in our markets, there are a finite number of dealers that are able to perform the types of technical installations required for home automation systems. In the event that we saturate the available dealer pool, or if market or other forces cause the available pool of dealers to decline, it may be increasingly difficult to grow our business. As consumers' home automation options grow, it is important that we enhance our dealer footprint by broadening the expertise of our dealers, working with larger and more sophisticated dealers and expanding the mainstream consumer products our dealers offer. If we are unable to expand our network of dealers and distributors, our business could be harmed.

18

We rely on our dealers and distributors to sell our solution, and if our dealers and distributors fail to perform, our ability to sell and distribute our products and services will be limited, and our results of operations may be harmed.

Substantially all of our revenue is generated through the sales of our solution by our dealers and distributors. Our dealers and distributors are independent businesses that voluntarily sell our products as well as the products of other companies to consumers. We provide our dealers and distributors with specific training and programs to assist them in selling our products, but we cannot assure that these steps will be effective. We have observed, and expect to continue to observe, high volatility in the monthly, quarterly and annual sales performance of individual dealers and distributors. Although we can make estimated forecasts of cumulative sales of large numbers of dealers and distributors, we cannot assure their accuracy collectively nor individually. Accordingly, we may not be able to reduce or slow our spending quickly enough if our actual sales fall short of our expectations. As a result, we expect that our revenues, results of operations and cash flows may fluctuate significantly on a quarterly basis. We believe that period-to-period comparisons of our revenues, results of operations and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

Our dealers and distributors may be unsuccessful in marketing, selling, and supporting our products and services. If we are unable to develop and maintain effective sales incentive programs for our third-party dealers and distributors, we may not be able to incentivize them to sell our products to consumers and, in particular, to larger businesses and organizations. Our dealers and distributors may also market, sell and support products and services that are competitive with ours, and may devote more resources to the marketing, sales, and support of such competitive products. Our dealers and distributors may have incentives to promote our competitors' products to the detriment of our own, or may cease selling our products altogether. Our agreements with our dealers and distributors may generally be terminated for any reason by either party with advance notice. We cannot assure you that we will retain these dealers and distributors, or that we will be able to secure additional or replacement dealers and distributors. Further, if we alter our sales process in a region by switching from a distributor to a direct dealer model, our sales may be impacted leading up to or in connection with such change in sales process. In addition, while we take certain steps to protect ourselves from liability for the actions of our dealers and distributors, consumers may seek to recover amounts from us for any damages caused by dealers in connection with system installations, or the failure of a system to perform properly due to an incorrect installation by a dealer. In addition, our dealers and distributors may use our name and our brand in ways we do not authorize, and any such improper use may harm our reputation or expose us to liability for their actions.

If we fail to effectively manage our existing sales channels, if our dealers or distributors are unsuccessful in fulfilling the orders for our products, or if we are unable to enter into arrangements with, and retain a sufficient number of, high quality dealers and distributors in each of the regions in which we sell products, and keep them motivated to sell our products, our results of operations may be harmed. The termination of our relationship with any significant dealer or distributor may also adversely impact our sales and results of operations.

We have entered into several strategic arrangements and intend to pursue additional strategic opportunities in the future. If the intended benefits from our strategic relationships are not realized, our growth and results of operations may be harmed.

We are in the process of growing our relationships with strategic partners in order to attempt to reach markets that we cannot currently address cost-effectively and to increase awareness of our solution. If these relationships do not develop in the manner we intend, our future growth could be impacted. Furthermore, the termination of our relationship with a partner may cause us to incur expenses without corresponding revenue, incur a termination penalty and harm our sales and results of

19

operations. For example, in 2012, we discontinued energy products for utility customers and, in connection with that decision, we incurred an expense related to an inventory purchase commitment and paid a fee to our counterparty to terminate the arrangement. Any loss of a major partner or distribution channel or other channel disruption could harm our results of operations and make us more dependent on alternate channels, damage our reputation, increase pricing and promotional pressures from other partners and distribution channels, increase our marketing costs, or harm buying and inventory patterns, payment terms or other contractual terms.

If we do not maintain the compatibility of our solutions with third-party products and applications that our consumers use, demand for our solutions could decline.

Our solutions are designed to interoperate with a wide range of other third-party products, including products in the areas of music, video, lighting, temperature and security. If we do not support the continued integration of our solutions with third-party products and applications, including through the provision of application programming interfaces that enable data to be transferred readily between our solutions and third-party products and applications, demand for our solutions could decline and we could lose sales. We will also be required to make our solutions compatible with new or additional third-party products and applications that are introduced into the markets that we serve. To help us meet this challenge, we have developed our Simple Device Discovery Protocol, or SDDP, designed to enable our devices to recognize and control third-party products by embedding software in such products at the manufacturer, making it easier for dealers and consumers to add them to their Control4 systems. Although we are making SDDP available on a royalty-free basis to product manufacturers, its adoption is not yet substantial, and may not achieve greater or broad market acceptance. In addition, companies that provide popular point solutions have and may continue to eliminate or restrict our ability to control and be compatible with these products. For example, a thermostat company has restricted the interoperability of its products with our solutions. As a result, we may not be successful in making our solutions compatible with these third-party products and applications, which could reduce demand for our solutions. In addition, if prospective consumers require customized features or functions that we do not offer, then the market for our solutions may be harmed.

Our inability to adapt to technological change could impair our ability to remain competitive.

The market for home automation and control solutions is characterized by rapid technological change, frequent introductions of new products and evolving industry standards. Our ability to attract new consumers and increase revenue from existing consumers will depend in significant part on our ability to anticipate changes in industry standards and to continue to enhance or introduce existing solutions on a timely basis to keep pace with technological developments. We are currently changing several aspects of our operating system, and may utilize Android open source technology in the future, which may cause difficulties including compatibility, stability and time to market. The success of this or any enhanced or new product or solution will depend on several factors, including the timely completion and market acceptance of the enhanced or new product or solution. Similarly, if any of our competitors implement new technologies before we are able to implement them, those competitors may be able to provide more effective products than ours, possibly at lower prices. Any delay or failure in the introduction of new or enhanced solutions could harm our business, results of operations and financial condition.

20

We currently rely on contract manufacturers to manufacture our products and component vendors to supply parts used in our products. The majority of our components are supplied by a single source. Any disruption in our supply chain, or any our failure to successfully manage our relationships with our contract manufacturers or component vendors could harm our business.