Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2013

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 333-08322

KANSAS CITY SOUTHERN DE MÉXICO, S.A. DE C.V.

(Exact name of Company as specified in its charter)

Kansas City Southern of Mexico

(Translation of Registrant’s name into English)

Mexico |  | 98-0519243 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

Montes Urales 625 Lomas de Chapultepec 11000 Mexico, D.F. Mexico (Address of Principal Executive Offices) | ||||

(5255) 9178-5686

(Company’s telephone number, including area code)

No Changes

(Former name, former address and former fiscal year, if changed since last report.)

______________________________________________________________

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer x Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of June 30, 2013: 4,785,510,235

Kansas City Southern de México, S.A. de C.V. meets the conditions set forth in General Instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this Form with the reduced disclosure format.

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Form 10-Q

June 30, 2013

Index

Page | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

2

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Form 10-Q

June 30, 2013

PART I—FINANCIAL INFORMATION

Item 1. | Financial Statements |

Introductory Comments

The unaudited Consolidated Financial Statements included herein have been prepared by Kansas City Southern de México, S.A. de C.V. (“KCSM” or the “Company”) pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). For the purposes of this report, unless the context otherwise requires, all references herein to “KCSM” and the “Company” shall mean Kansas City Southern de México, S.A. de C.V. and its subsidiaries. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) have been condensed or omitted pursuant to such rules and regulations. The Company believes that the disclosures are adequate to enable a reasonable understanding of the information presented. The Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this Form 10-Q should be read in conjunction with the consolidated financial statements and the related notes, as well as Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. Results for the three and six months ended June 30, 2013, are not necessarily indicative of the results expected for the full year ending December 31, 2013.

3

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss)

Three Months Ended | Six Months Ended | ||||||||||||||

June 30, | June 30, | ||||||||||||||

2013 | 2012 | 2013 | 2012 | ||||||||||||

(In millions) (Unaudited) | |||||||||||||||

Revenues | $ | 266.5 | $ | 248.2 | $ | 521.8 | $ | 493.4 | |||||||

Operating expenses: | |||||||||||||||

Compensation and benefits | 31.4 | 28.6 | 60.0 | 63.7 | |||||||||||

Purchased services | 33.7 | 36.7 | 69.5 | 72.9 | |||||||||||

Fuel | 44.6 | 39.2 | 86.6 | 78.7 | |||||||||||

Equipment costs | 18.9 | 18.7 | 38.9 | 36.8 | |||||||||||

Depreciation and amortization | 25.3 | 22.4 | 49.9 | 44.5 | |||||||||||

Materials and other | 19.6 | 13.1 | 34.3 | 24.4 | |||||||||||

Elimination of deferred statutory profit sharing liability, net | — | (43.0 | ) | — | (43.0 | ) | |||||||||

Total operating expenses | 173.5 | 115.7 | 339.2 | 278.0 | |||||||||||

Operating income | 93.0 | 132.5 | 182.6 | 215.4 | |||||||||||

Equity in net earnings of unconsolidated affiliate | 0.4 | 0.7 | 1.1 | 1.5 | |||||||||||

Interest expense | (14.5 | ) | (22.2 | ) | (36.0 | ) | (44.7 | ) | |||||||

Debt retirement costs | (109.9 | ) | — | (109.9 | ) | — | |||||||||

Foreign exchange gain (loss) | (17.5 | ) | (2.8 | ) | (4.6 | ) | 0.1 | ||||||||

Other expense, net | — | — | (0.1 | ) | (0.1 | ) | |||||||||

Income (loss) before income taxes | (48.5 | ) | 108.2 | 33.1 | 172.2 | ||||||||||

Income tax expense (benefit) | (13.1 | ) | 36.8 | 14.3 | 64.0 | ||||||||||

Net income (loss) | (35.4 | ) | 71.4 | 18.8 | 108.2 | ||||||||||

Other comprehensive income (loss), net of tax: | |||||||||||||||

Foreign currency translation adjustments, net of tax of $0.0 million for all periods presented | (0.7 | ) | (0.7 | ) | (0.1 | ) | 0.2 | ||||||||

Other comprehensive income (loss) | (0.7 | ) | (0.7 | ) | (0.1 | ) | 0.2 | ||||||||

Comprehensive income (loss) | $ | (36.1 | ) | $ | 70.7 | $ | 18.7 | $ | 108.4 | ||||||

See accompanying notes to consolidated financial statements.

4

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Consolidated Balance Sheets

June 30, 2013 | December 31, 2012 | ||||||

(In millions, except share amounts) | |||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 15.8 | $ | 9.2 | |||

Accounts receivable, net | 115.9 | 109.9 | |||||

Related company receivables | 0.2 | 40.0 | |||||

Materials and supplies | 49.5 | 32.9 | |||||

Deferred income taxes | 43.8 | 42.8 | |||||

Other current assets | 97.5 | 79.0 | |||||

Total current assets | 322.7 | 313.8 | |||||

Investments | 12.6 | 13.1 | |||||

Property and equipment (including concession assets), net | 2,617.9 | 2,522.3 | |||||

Other assets | 34.0 | 60.3 | |||||

Total assets | $ | 2,987.2 | $ | 2,909.5 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Debt due within one year | $ | 19.2 | $ | 18.8 | |||

Accounts payable and accrued liabilities | 95.2 | 87.4 | |||||

Related company payables | 9.4 | 6.9 | |||||

Total current liabilities | 123.8 | 113.1 | |||||

Long-term debt | 989.0 | 938.0 | |||||

Related company debt | 169.1 | 178.3 | |||||

Deferred income taxes | 136.4 | 131.6 | |||||

Other noncurrent liabilities and deferred credits | 12.0 | 10.3 | |||||

Total liabilities | 1,430.3 | 1,371.3 | |||||

Commitments and contingencies | — | — | |||||

Stockholders’ equity: | |||||||

Common stock, 4,785,510,235 shares authorized, issued without par value | 286.1 | 286.1 | |||||

Additional paid-in capital | 243.6 | 243.6 | |||||

Retained earnings | 1,030.5 | 1,011.7 | |||||

Accumulated other comprehensive loss | (3.3 | ) | (3.2 | ) | |||

Total stockholders’ equity | 1,556.9 | 1,538.2 | |||||

Total liabilities and stockholders’ equity | $ | 2,987.2 | $ | 2,909.5 | |||

See accompanying notes to consolidated financial statements.

5

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Consolidated Statements of Cash Flows

Six Months Ended | |||||||

June 30, | |||||||

2013 | 2012 | ||||||

(In millions) (Unaudited) | |||||||

Operating activities: | |||||||

Net income | $ | 18.8 | $ | 108.2 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 49.9 | 44.5 | |||||

Deferred income taxes | 3.8 | 45.8 | |||||

Equity in net earnings of unconsolidated affiliate | (1.1 | ) | (1.5 | ) | |||

Deferred compensation | — | 7.3 | |||||

Elimination of deferred statutory profit sharing liability | — | (47.8 | ) | ||||

Distributions from unconsolidated affiliate | 1.5 | 2.3 | |||||

Debt retirement costs | 109.9 | — | |||||

Changes in working capital items: | |||||||

Accounts receivable | (6.3 | ) | (18.1 | ) | |||

Related companies | 71.9 | 2.5 | |||||

Materials and supplies | (15.0 | ) | 1.7 | ||||

Other current assets | (29.6 | ) | (1.5 | ) | |||

Accounts payable and accrued liabilities | 6.5 | 0.8 | |||||

Other, net | 1.9 | 3.2 | |||||

Net cash provided by operating activities | 212.2 | 147.4 | |||||

Investing activities: | |||||||

Capital expenditures | (78.4 | ) | (71.6 | ) | |||

Acquisition of equipment under operating lease | (66.5 | ) | — | ||||

Proceeds from disposal of property | 1.4 | 4.2 | |||||

Other, net | (0.4 | ) | (0.4 | ) | |||

Net cash used for investing activities | (143.9 | ) | (67.8 | ) | |||

Financing activities: | |||||||

Proceeds from issuance of long-term debt | 927.8 | — | |||||

Proceeds from related company debt | 52.5 | — | |||||

Repayment of long-term debt | (882.1 | ) | (8.9 | ) | |||

Repayment of related company debt | (59.4 | ) | (41.8 | ) | |||

Debt costs | (100.5 | ) | — | ||||

Net cash used for financing activities | (61.7 | ) | (50.7 | ) | |||

Cash and cash equivalents: | |||||||

Net increase during each period | 6.6 | 28.9 | |||||

At beginning of year | 9.2 | 15.7 | |||||

At end of period | $ | 15.8 | $ | 44.6 | |||

See accompanying notes to consolidated financial statements.

6

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Notes to Consolidated Financial Statements

1. | Accounting Policies, Interim Financial Statements and Basis of Presentation |

In the opinion of the management of KCSM, the accompanying unaudited consolidated financial statements contain all adjustments necessary for a fair presentation of the results for interim periods. All adjustments made were of a normal and recurring nature. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. These consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. The results of operations for the three and six months ended June 30, 2013, are not necessarily indicative of the results to be expected for the full year ending December 31, 2013.

2. | Elimination of Deferred Statutory Profit Sharing Liability, Net |

During the second quarter of 2012, Kansas City Southern (“KCS”) completed an organizational restructuring whereby all employees of KCSM became employees of KCSM Servicios, S.A. de C.V. (“KCSM Servicios”), a wholly-owned subsidiary of KCS. KCSM Servicios provides employee services to KCSM, and KCSM pays KCSM Servicios market-based rates for these services. The effective date of this organizational restructuring was May 1, 2012.

Mexican employees are entitled to receive statutory profit sharing. The related cash payment to employees is based on an employer’s net profit determined under accounting principles prescribed in Mexican law, rather than its net profit determined under U.S. GAAP. U.S. GAAP requires the recording of deferred liabilities or assets for financial reporting purposes on the differences between the amounts determined under the two different accounting principles.

As a result of the organizational restructuring, KCSM’s obligation to pay statutory profit sharing terminated on the effective date. Accordingly, in the second quarter of 2012, KCSM recognized a $43.0 million net reduction to operating expense. This reduction includes the elimination of $47.8 million of the deferred statutory profit sharing liability, net of $4.8 million of transaction costs. KCSM Servicios became obligated to pay statutory profit sharing to its employees beginning on the effective date of the organizational restructuring.

3. | Property and Equipment (including Concession Assets) |

Property and equipment, including concession assets, and related accumulated depreciation and amortization are summarized below (in millions):

June 30, 2013 | December 31, 2012 | ||||||

Land | $ | 76.9 | $ | 76.9 | |||

Concession land rights | 141.2 | 141.2 | |||||

Road property | 2,297.0 | 2,244.1 | |||||

Equipment | 632.7 | 552.5 | |||||

Technology and other | 33.6 | 31.6 | |||||

Construction in progress | 47.6 | 50.4 | |||||

Total property | 3,229.0 | 3,096.7 | |||||

Accumulated depreciation and amortization | 611.1 | 574.4 | |||||

Property and equipment (including concession assets), net | $ | 2,617.9 | $ | 2,522.3 | |||

Concession assets, net of accumulated amortization of $437.3 million and $413.3 million, totaled $1,942.8 million and $1,916.5 million at June 30, 2013 and December 31, 2012, respectively.

4. | Fair Value Measurements |

Assets and liabilities recognized at fair value are required to be classified into a three-level hierarchy. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs include quoted prices for similar assets and liabilities in active markets and inputs other than quoted prices that are observable for the asset or liability. Level 3 inputs are unobservable inputs for the asset or liability and include situations where there is little, if any, market activity for the asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value

7

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value in its entirety requires judgment and considers factors specific to the asset or liability.

The Company’s derivative financial instruments are measured at fair value on a recurring basis and consist of foreign currency forward contract agreements, which are classified as Level 2 instruments. The Company determines the fair value of its derivative financial instrument positions based upon pricing models using inputs observed from actively quoted markets and also takes into consideration the contract terms as well as other inputs, including forward interest rate curves and market currency exchange rates. The fair value of the foreign currency forward contract liabilities was $5.0 million as of June 30, 2013.

The Company’s short-term financial instruments include cash and cash equivalents, accounts receivable and accounts payable. The carrying value of the short-term financial instruments approximates their fair value.

The fair value of the Company’s debt, including related company debt, is estimated using quoted market prices when available. When quoted market prices are not available, fair value is estimated based on current market interest rates for debt with similar maturities and credit quality. The fair value of the Company’s debt was $1,152.8 million and $1,240.9 million at June 30, 2013 and December 31, 2012, respectively. The carrying value was $1,177.3 million and $1,135.1 million at June 30, 2013 and December 31, 2012, respectively. If the Company’s debt were measured at fair value, the fair value measurements of the individual debt instruments would have been classified as either Level 1 or Level 2 in the fair value hierarchy.

5. | Derivative Instruments |

In general, the Company enters into derivative transactions in certain situations based on management’s assessment of current market conditions and perceived risks. Management intends to respond to evolving business and market conditions and in doing so, may enter into such transactions as deemed appropriate.

Credit Risk. As a result of the use of derivative instruments, the Company is exposed to counterparty credit risk. The Company manages this risk by limiting its counterparties to large financial institutions which meet the Company’s credit rating standards and have an established banking relationship with the Company. As of June 30, 2013, the Company did not expect any losses as a result of default of its counterparties.

Foreign Currency Forward Contracts. The Company has net U.S. dollar-denominated liabilities (primarily debt) which, for Mexican income tax purposes, are subject to periodic revaluation based on changes in the value of the U.S. dollar against the Mexican peso. This revaluation creates fluctuations in the Company’s income tax expense and the amount of income taxes paid. During the first half of 2013, the Company entered into foreign currency forward contracts with an aggregate notional amount of $325.0 million to hedge its exposure to this risk. These contracts mature on December 31, 2013, and obligate the Company to purchase a total of Ps.4,202.3 million at a weighted average exchange rate of Ps.12.93 to each U.S. dollar. The Company has not designated these forward contracts as hedging instruments for accounting purposes. The foreign currency forward contracts are measured at fair value each period and any change in fair value is recognized in foreign exchange gain (loss) within the consolidated statements of comprehensive income (loss).

The following table presents the fair value of derivative instruments included in the consolidated balance sheets (in millions):

Derivative Liability | ||||||||||

Balance Sheet Location | June 30, 2013 | December 31, 2012 | ||||||||

Derivatives not designated as hedging instruments: | ||||||||||

Foreign currency forward contracts | Accounts payable and accrued liabilities | $ | 5.0 | $ | — | |||||

Total derivatives not designated as hedging instruments | 5.0 | — | ||||||||

Total derivative liability | $ | 5.0 | $ | — | ||||||

8

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

The following table presents the amounts affecting the consolidated statements of comprehensive income (loss) for the three months ended June 30 (in millions):

Location of Gain/(Loss) Recognized in Income on Derivative | Amount of Gain/(Loss) Recognized in Income on Derivative | |||||||||

Derivatives not designated as hedging instruments: | 2013 | 2012 | ||||||||

Foreign currency forward contracts | Foreign exchange loss | $ | (14.1 | ) | $ | — | ||||

Total | $ | (14.1 | ) | $ | — | |||||

The following table presents the amounts affecting the consolidated statements of comprehensive income (loss) for the six months ended June 30 (in millions):

Location of Gain/(Loss) Recognized in Income on Derivative | Amount of Gain/(Loss) Recognized in Income on Derivative | |||||||||

Derivatives not designated as hedging instruments: | 2013 | 2012 | ||||||||

Foreign currency forward contracts | Foreign exchange loss | $ | (5.0 | ) | $ | — | ||||

Total | $ | (5.0 | ) | $ | — | |||||

6. | Long-Term Debt |

12½% Senior Notes. On April 1, 2013, the Company redeemed all of the remaining $98.1 million aggregate principal amount of the 12½% senior unsecured notes due April 1, 2016 (the “12½% Senior Notes”) at a redemption price equal to 106.250% of the principal amount. The Company redeemed the 12½% Senior Notes using $65.0 million of borrowings under the revolving credit facility and available cash.

8.0% Senior Notes, 65/8% Senior Notes and 61/8% Senior Notes. On April 10, 2013, KCSM commenced a cash tender offer for the 8.0% senior unsecured notes due February 1, 2018 (the “8.0% Senior Notes”), the 65/8% senior unsecured notes due December 15, 2020 (the “65/8% Senior Notes”) and the 61/8% senior unsecured notes due June 15, 2021 (the “61/8% Senior Notes”). In addition, KCSM concurrently commenced consent solicitations to amend the indentures governing the 8.0% Senior Notes and 65/8% Senior Notes to eliminate substantially all of the restrictive covenants and certain events of default contained therein, which became operative on May 3, 2013.

Through May 8, 2013, KCSM purchased $237.2 million principal amount of the tendered 8.0% Senior Notes, $181.0 million principal amount of the tendered 65/8% Senior Notes and $149.7 million principal amount of the tendered 61/8% Senior Notes (collectively, the “Senior Notes Tendered”) in accordance with the terms and conditions of the tender offer using a portion of the proceeds received from the issuance of $275.0 million principal amount of 2.35% senior unsecured notes due May 15, 2020 (the “2.35% Senior Notes”) and $450.0 million principal amount of 3.0% senior unsecured notes due May 15, 2023 (the “3.0% Senior Notes”).

Subsequent to the expiration of the cash tender offer, through June 26, 2013, KCSM purchased an additional $7.9 million principal amount of the 61/8% Senior Notes and redeemed the remaining $4.0 million outstanding principal amount of the 65/8% Senior Notes. On July 2, 2013, KCSM purchased an additional $1.0 million principal amount of the 61/8% Senior Notes.

2.35% Senior Notes. On May 3, 2013, KCSM issued $275.0 million principal amount of 2.35% Senior Notes, which bear interest semiannually at a fixed annual rate of 2.35%. The 2.35% Senior Notes were issued at a discount to par value, resulting in a $0.3 million discount and a yield to maturity of 2.368%. KCSM used the net proceeds from the issuance of the 2.35% Senior Notes and the 3.0% Senior Notes to purchase the Senior Notes Tendered, pay all fees and expenses incurred in connection with the 2.35% Senior Notes and 3.0% Senior Notes offerings and the tender offers, to finance the purchase of certain leased equipment and for other general corporate purposes. The 2.35% Senior Notes are redeemable at KCSM’s option, in whole or in part, prior to April 15, 2020, by paying the greater of either (i) 100% of the principal amount of the 2.35% Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the then-current U.S. Treasury rate plus 20 basis points, plus accrued interest and any additional amounts to but excluding the redemption date. On or after April 15, 2020, the 2.35% Senior Notes may be redeemed at KCSM’s option, in whole or in part at any time at a redemption price equal to 100% of the principal

9

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

amount plus any accrued and unpaid interest. In addition, the notes are redeemable, in whole but not in part, at KCSM’s option at their principal amount, plus any accrued unpaid interest in the event of certain changes in the Mexican withholding tax rate.

3.0% Senior Notes. On May 3, 2013, KCSM issued $450.0 million principal amount of the 3.0% Senior Notes, which bear interest semiannually at a fixed annual rate of 3.0%. The 3.0% Senior Notes were issued at a discount to par value, resulting in a $1.9 million discount and a yield to maturity of 3.048%. KCSM used the net proceeds from the issuance of the 3.0% Senior Notes and the 2.35% Senior Notes to purchase the Senior Notes Tendered, pay all fees and expenses incurred in connection with the 2.35% Senior Notes and 3.0% Senior Notes offerings and the tender offers, to finance the purchase of certain leased equipment and for other general corporate purposes. The 3.0% Senior Notes are redeemable at KCSM’s option, in whole or in part, prior to February 15, 2023, by paying the greater of either (i) 100% of the principal amount of the 3.0% Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the then-current U.S. Treasury rate plus 20 basis points, plus accrued interest and any additional amounts to but excluding the redemption date. On or after February 15, 2023, the 3.0% Senior Notes may be redeemed at KCSM’s option, in whole or in part at any time at a redemption price equal to 100% of the principal amount plus any accrued and unpaid interest. In addition, the notes are redeemable, in whole but not in part, at KCSM’s option at their principal amount, plus any accrued unpaid interest in the event of certain changes in the Mexican withholding tax rate.

The 2.35% Senior Notes and 3.0% Senior Notes are denominated in U.S. dollars; are unsecured, unsubordinated obligations; rank pari passu in right of payment with KCSM’s existing and future unsecured, unsubordinated obligations and are senior in right of payment to KCSM’s future subordinated indebtedness. In addition, the senior notes include certain covenants which are customary for these types of debt instruments issued by borrowers with similar credit ratings.

Revolving Credit Facility. During the second quarter of 2013, the Company borrowed $65.0 million against the revolving credit facility for the redemption of the 12½% Senior Notes. As of June 30, 2013, the outstanding amount under the revolving credit facility was $10.0 million. As of December 31, 2012, KCSM had no amount outstanding under the revolving credit facility.

Related Company Revolving Credit Agreement. The Kansas City Southern Railway Company (“KCSR”), as a lender, and KCSM, as a borrower, entered into a Revolving Credit Agreement effective as of June 7, 2013 (the “Revolving Agreement”), pursuant to the terms of which KCSM may borrow up to $100.0 million from KCSR on a revolving basis at any time during the term of the Revolving Agreement. The Revolving Agreement is unsecured and terminates on December 31, 2018. As of June 30, 2013, KCSM had borrowed $52.5 million under the terms of the Revolving Agreement at a weighted average interest rate of 1.48%.

Debt Retirement Costs. The Company recognized debt retirement costs of $109.9 million during the second quarter of 2013 related to the tender and call premiums as well as the write-off of unamortized debt issuance costs and the original issue discounts as a result of the refinancing activities described above.

7. | Commitments and Contingencies |

Concession Duty. Under KCSM’s 50-year railroad concession from the Mexican government (the “Concession”), KCSM paid concession duty expense of 0.5% of gross revenues for the first 15 years of the Concession period, and on June 24, 2012, KCSM began paying 1.25% of gross revenues, which is effective for the remaining years of the Concession. For the three and six months ended June 30, 2013, the concession duty expense, which is recorded within materials and other in operating expenses, was $3.4 million and $6.8 million, respectively, compared to $1.4 million and $2.7 million for the same periods in 2012.

Litigation. The Company is a party to various legal proceedings and administrative actions, all of which, except as set forth below, are of an ordinary, routine nature and incidental to its operations. KCSM aggressively defends these matters and has established liability provisions, which management believes are adequate to cover expected costs. Although it is not possible to predict the outcome of any legal proceeding, in the opinion of management, other than those proceedings described in detail below, such proceedings and actions should not, individually or in the aggregate, have a material adverse effect on the Company’s consolidated financial statements.

10

Kansas City Southern de México, S.A. de C.V. and Subsidiaries

Notes to Consolidated Financial Statements—(Continued)

Environmental Liabilities. The Company’s operations are subject to Mexican federal and state laws and regulations relating to the protection of the environment through the establishment of standards for water discharge, water supply, emissions, noise pollution, hazardous substances and transportation and handling of hazardous and solid waste. The Mexican government may bring administrative and criminal proceedings, impose economic sanctions against companies that violate environmental laws and temporarily or even permanently close non-complying facilities.

The risk of incurring environmental liability is inherent in the railroad industry. As part of serving the petroleum and chemicals industry, the Company transports hazardous materials and has a professional team available to respond to and handle environmental issues that might occur in the transport of such materials.

The Company performs ongoing reviews and evaluations of the various environmental programs and issues within the Company’s operations and, as necessary, takes actions intended to limit the Company’s exposure to potential liability. Although these costs cannot be predicted with certainty, management believes that the ultimate outcome of identified matters will not have a material adverse effect on the Company’s consolidated financial statements.

Certain Disputes with Ferromex. KCSM and Ferrocarril Mexicano, S.A. de C.V. (“Ferromex”) use certain trackage rights, haulage rights and interline services (the “Services”) provided by each other. The rates to be charged after January 1, 2009, were agreed to pursuant to the Trackage Rights Agreement, dated February 9, 2010 (the “Trackage Rights Agreement”), between KCSM and Ferromex. The rates payable for these Services for the period beginning in 1998 through December 31, 2008, are still not resolved. KCSM is currently involved in discussions with Ferromex regarding the amounts payable to each other for the Services for this period. If KCSM cannot reach an agreement with Ferromex for rates applicable for Services which were provided prior to January 1, 2009, which are not subject to the Trackage Rights Agreement, the Secretaría de Comunicaciones y Transportes (“Secretary of Communications and Transportation” or “SCT”) is entitled to set the rates in accordance with Mexican law and regulations. KCSM and Ferromex both initiated administrative proceedings seeking a determination by the SCT of the rates that KCSM and Ferromex should pay each other in connection with the Services. The SCT issued rulings in 2002 and 2008 setting the rates for the Services, and both KCSM and Ferromex challenged these rulings. Although KCSM and Ferromex have challenged these matters based on different grounds and these cases continue to evolve, management believes the amounts recorded related to these matters are adequate.

While the outcome of these matters cannot be predicted with certainty, the Company does not believe that, when resolved, these disputes will have a material effect on its consolidated financial statements.

Contractual Agreements. In the normal course of business, the Company enters into various contractual agreements related to commercial arrangements and the use of other railroads’ or governmental entities’ infrastructure needed for the operations of the business. The Company is involved or may become involved in certain disputes involving transportation rates, product loss or damage, charges and interpretations related to these agreements. While the outcome of these matters cannot be predicted with certainty, the Company does not believe that, when resolved, these disputes will have a material effect on its consolidated financial statements.

Credit Risk. The Company continually monitors risks related to economic changes and certain customer receivables concentrations. Significant changes in customer concentration or payment terms, deterioration of customer creditworthiness or further weakening in economic trends could have a significant impact on the collectability of KCSM’s receivables and its operating results. If the financial condition of KCSM’s customers were to deteriorate and result in an impairment of their ability to make payments, additional allowances may be required. The Company has recorded provisions for uncollectability based on its best estimate at June 30, 2013.

Income Tax. Tax returns filed for periods after 2006 remain open to examination by the taxing authorities. KCSM’s 2007 tax return is currently under examination by the Servicio de Administracion Tributaria (the “SAT”), the Mexican equivalent of the U.S. Internal Revenue Service. The Company received an audit assessment for the year ended December 31, 2005, from the SAT. The Company initiated administrative proceedings with the SAT, and if a settlement is not reached, the matter will be litigated. The Company believes it has strong legal arguments in its favor and more likely than not will prevail in challenging the 2005 assessment. The Company believes that an adequate provision has been made for any adjustment (taxes and interest) that will be due for all open years. However, an unexpected adverse resolution could have a material effect on the consolidated financial statements in a particular quarter or fiscal year.

11

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The discussion below, as well as other portions of this Form 10-Q, contain forward-looking statements that are not based upon historical information. Readers can identify these forward-looking statements by the use of such verbs as “expects,” “anticipates,” “believes” or similar verbs or conjugations of such verbs. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date of this Form 10-Q. However, such statements are dependent on and, therefore, can be influenced by, a number of external variables over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; revocation of KCSM’s concession; the termination of, or failure to renew, agreements with customers, other railroads and third parties; interest rates; access to capital; disruptions to the Company’s technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; credit risk of customers and counterparties and their failure to meet their financial obligations; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents along KCSM’s rail network, facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; loss of key personnel; labor difficulties, including strikes and work stoppages; insufficiency of insurance to cover lost revenue, profits or other damages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic conditions; political and economic conditions in Mexico and the level of trade between Mexico and the United States; and the outcome of claims and litigation involving the Company or its subsidiaries. For more discussion about each risk factor, see Part I, Item 1A –“Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, which is on file with the U.S. Securities and Exchange Commission (File No. 333-08322) and any updates contained herein. Readers are strongly encouraged to consider these factors when evaluating forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the timing when, or by which, such performance or results will be achieved. As a result, actual outcomes or results could materially differ from those indicated in forward-looking statements. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements.

This discussion is intended to clarify and focus on Kansas City Southern de México, S. A. de C.V.’s (“KCSM” or the “Company”) results of operations, certain changes in its financial position, liquidity, capital structure and business developments for the periods covered by the consolidated financial statements included under Item 1 of this Form 10-Q, and has been abbreviated pursuant to General Instruction H(2)(a) of Form 10-Q. This discussion should be read in conjunction with those consolidated financial statements and the related notes and is qualified by reference to them.

Critical Accounting Policies and Estimates

The Company’s discussion and analysis of its financial position and results of operations is based upon its consolidated financial statements. The preparation of these consolidated financial statements requires estimation and judgment that affect the reported amounts of revenue, expenses, assets and liabilities. The Company bases its estimates on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the accounting for assets and liabilities that are not readily apparent from other sources. If the estimates differ materially from actual results, the impact on the consolidated financial statements may be material. The Company’s critical accounting policies are disclosed in the 2012 Annual Report on Form 10-K.

Second Quarter Analysis

The Company reported a net loss of $35.4 million for the three months ended June 30, 2013, compared to net income of $71.4 million for the same period in 2012. This decrease is attributable to $109.9 million of debt retirement costs recognized in 2013 and the elimination of $43.0 million of deferred statutory profit sharing liability recognized in 2012.

The Company reported a 7% increase in revenues, a 6% increase in revenue per carload/unit and a 1% increase in carloads/unit volumes during the three months ended June 30, 2013, as compared to the same period in 2012. Revenues increased for all commodity groups, other than agriculture and minerals, driven by the effect of fluctuations in the value of the Mexican peso against the U.S. dollar, fuel surcharge and positive pricing impacts, partially offset by commodity mix due to the unfavorable impact from agriculture and minerals. Agriculture and minerals revenues decreased by $11.9 million due to a 28% decrease in import grain volumes resulting from the severe drought conditions experienced in the Midwestern region of the United States during 2012.

12

Operating expenses increased 50% during the three months ended June 30, 2013, as compared to the same period in 2012, due to the elimination of $43.0 million of deferred statutory profit sharing liability as a result of the organizational restructuring in the second quarter of 2012. In addition, operating expenses increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar for operating expenses denominated in Mexican pesos. Operating expenses as a percentage of revenues increased to 65.1% for the three months ended June 30, 2013, as compared to 46.6% for the same period in 2012. This increase is attributable to the elimination of the deferred statutory profit sharing liability in 2012.

KCSM’s revenues and operating expenses are affected by fluctuations in the value of the Mexican peso against the U.S. dollar. Based on the volume of revenue and expense transactions denominated in Mexican pesos, revenue and expense fluctuations generally offset, with insignificant net impacts to operating income.

During the second quarter of 2013, the Company refinanced a significant portion of its existing debt at lower interest rates and extended the debt maturities. As a result of the refinancing, the Company recognized debt retirement costs of $109.9 million for the quarter for the tender and call premiums as well as the write-off of unamortized debt issuance costs and the original issue discounts.

Results of Operations

The following summarizes KCSM’s consolidated statements of comprehensive income (loss) components (in millions):

Three Months Ended | Change Dollars | ||||||||||

June 30, | |||||||||||

2013 | 2012 | ||||||||||

Revenues | $ | 266.5 | $ | 248.2 | $ | 18.3 | |||||

Operating expenses | 173.5 | 115.7 | 57.8 | ||||||||

Operating income | 93.0 | 132.5 | (39.5 | ) | |||||||

Equity in net earnings of unconsolidated affiliate | 0.4 | 0.7 | (0.3 | ) | |||||||

Interest expense | (14.5 | ) | (22.2 | ) | 7.7 | ||||||

Debt retirement costs | (109.9 | ) | — | (109.9 | ) | ||||||

Foreign exchange loss | (17.5 | ) | (2.8 | ) | (14.7 | ) | |||||

Income (loss) before income taxes | (48.5 | ) | 108.2 | (156.7 | ) | ||||||

Income tax expense (benefit) | (13.1 | ) | 36.8 | (49.9 | ) | ||||||

Net income (loss) | $ | (35.4 | ) | $ | 71.4 | $ | (106.8 | ) | |||

Six Months Ended | Change Dollars | ||||||||||

June 30, | |||||||||||

2013 | 2012 | ||||||||||

Revenues | $ | 521.8 | $ | 493.4 | $ | 28.4 | |||||

Operating expenses | 339.2 | 278.0 | 61.2 | ||||||||

Operating income | 182.6 | 215.4 | (32.8 | ) | |||||||

Equity in net earnings of unconsolidated affiliate | 1.1 | 1.5 | (0.4 | ) | |||||||

Interest expense | (36.0 | ) | (44.7 | ) | 8.7 | ||||||

Debt retirement costs | (109.9 | ) | — | (109.9 | ) | ||||||

Foreign exchange gain (loss) | (4.6 | ) | 0.1 | (4.7 | ) | ||||||

Other expense, net | (0.1 | ) | (0.1 | ) | — | ||||||

Income before income taxes | 33.1 | 172.2 | (139.1 | ) | |||||||

Income tax expense | 14.3 | 64.0 | (49.7 | ) | |||||||

Net income | $ | 18.8 | $ | 108.2 | $ | (89.4 | ) | ||||

13

Revenues

The following summarizes revenues (in millions), carload/unit statistics (in thousands) and revenue per carload/unit:

Revenues | Carloads and Units | Revenue per Carload/Unit | ||||||||||||||||||||||||||||

Three Months Ended June 30, | Three Months Ended June 30, | Three Months Ended June 30, | ||||||||||||||||||||||||||||

2013 | 2012 | % Change | 2013 | 2012 | % Change | 2013 | 2012 | % Change | ||||||||||||||||||||||

Chemical and petroleum | $ | 53.7 | $ | 44.5 | 21 | % | 25.5 | 23.6 | 8 | % | $ | 2,106 | $ | 1,886 | 12 | % | ||||||||||||||

Industrial and consumer products | 63.4 | 60.0 | 6 | % | 41.1 | 40.7 | 1 | % | 1,543 | 1,474 | 5 | % | ||||||||||||||||||

Agriculture and minerals | 37.8 | 49.7 | (24 | %) | 21.4 | 26.4 | (19 | %) | 1,766 | 1,883 | (6 | %) | ||||||||||||||||||

Energy | 8.2 | 6.6 | 24 | % | 7.6 | 7.3 | 4 | % | 1,079 | 904 | 19 | % | ||||||||||||||||||

Intermodal | 55.0 | 46.8 | 18 | % | 123.4 | 119.9 | 3 | % | 446 | 390 | 14 | % | ||||||||||||||||||

Automotive | 43.0 | 36.1 | 19 | % | 22.8 | 21.3 | 7 | % | 1,886 | 1,695 | 11 | % | ||||||||||||||||||

Carload revenues, carloads and units | 261.1 | 243.7 | 7 | % | 241.8 | 239.2 | 1 | % | $ | 1,080 | $ | 1,019 | 6 | % | ||||||||||||||||

Other revenue | 5.4 | 4.5 | 20 | % | ||||||||||||||||||||||||||

Total revenues (i) | $ | 266.5 | $ | 248.2 | 7 | % | ||||||||||||||||||||||||

(i) Included in revenues: | ||||||||||||||||||||||||||||||

Fuel surcharge | $ | 42.9 | $ | 35.0 | ||||||||||||||||||||||||||

Revenues | Carloads and Units | Revenue per Carload/Unit | ||||||||||||||||||||||||||||

Six Months Ended June 30, | Six Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||

2013 | 2012 | % Change | 2013 | 2012 | % Change | 2013 | 2012 | % Change | ||||||||||||||||||||||

Chemical and petroleum | $ | 103.2 | $ | 91.5 | 13 | % | 49.2 | 47.5 | 4 | % | $ | 2,098 | $ | 1,926 | 9 | % | ||||||||||||||

Industrial and consumer products | 130.2 | 120.6 | 8 | % | 84.2 | 82.0 | 3 | % | 1,546 | 1,471 | 5 | % | ||||||||||||||||||

Agriculture and minerals | 70.9 | 100.5 | (29 | %) | 40.6 | 54.5 | (26 | %) | 1,746 | 1,844 | (5 | %) | ||||||||||||||||||

Energy | 15.2 | 13.0 | 17 | % | 14.7 | 14.3 | 3 | % | 1,034 | 909 | 14 | % | ||||||||||||||||||

Intermodal | 105.2 | 89.0 | 18 | % | 237.9 | 229.4 | 4 | % | 442 | 388 | 14 | % | ||||||||||||||||||

Automotive | 87.6 | 70.6 | 24 | % | 46.8 | 42.0 | 11 | % | 1,872 | 1,681 | 11 | % | ||||||||||||||||||

Carload revenues, carloads and units | 512.3 | 485.2 | 6 | % | 473.4 | 469.7 | 1 | % | $ | 1,082 | $ | 1,033 | 5 | % | ||||||||||||||||

Other revenue | 9.5 | 8.2 | 16 | % | ||||||||||||||||||||||||||

Total revenues (i) | $ | 521.8 | $ | 493.4 | 6 | % | ||||||||||||||||||||||||

(i) Included in revenues: | ||||||||||||||||||||||||||||||

Fuel surcharge | $ | 81.8 | $ | 68.4 | ||||||||||||||||||||||||||

Freight revenues include revenue for transportation services and fuel surcharges. For the three months ended June 30, 2013, revenues and carload/unit volumes increased 7% and 1%, respectively, compared to the same period in 2012. For the six months ended June 30, 2013, revenues and carloads/unit volumes increased 6% and 1%, respectively, compared to the same period in 2012. Revenues increased for all commodity groups, other than agriculture and minerals, which decreased $11.9 million and $29.6 million for the three and six months ended June 30, 2013, respectively, due to a 28% and 33% decrease, respectively, in import grain volumes resulting from the severe drought conditions experienced in the Midwestern region of the United States during 2012. Revenue per carload/unit increased by 6% and 5% for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to positive pricing impacts, fuel surcharge and the effect of fluctuations in the value of the Mexican peso against the U.S. dollar, partially offset by commodity mix.

14

KCSM’s fuel surcharge is a mechanism to adjust revenue based upon changing fuel prices. Fuel surcharge is calculated using a fuel price from a prior time period that can be up to 60 days earlier. In a period of volatile fuel prices or changing customer business mix, changes in fuel expense and fuel surcharge may differ.

The following discussion provides an analysis of revenues by commodity group:

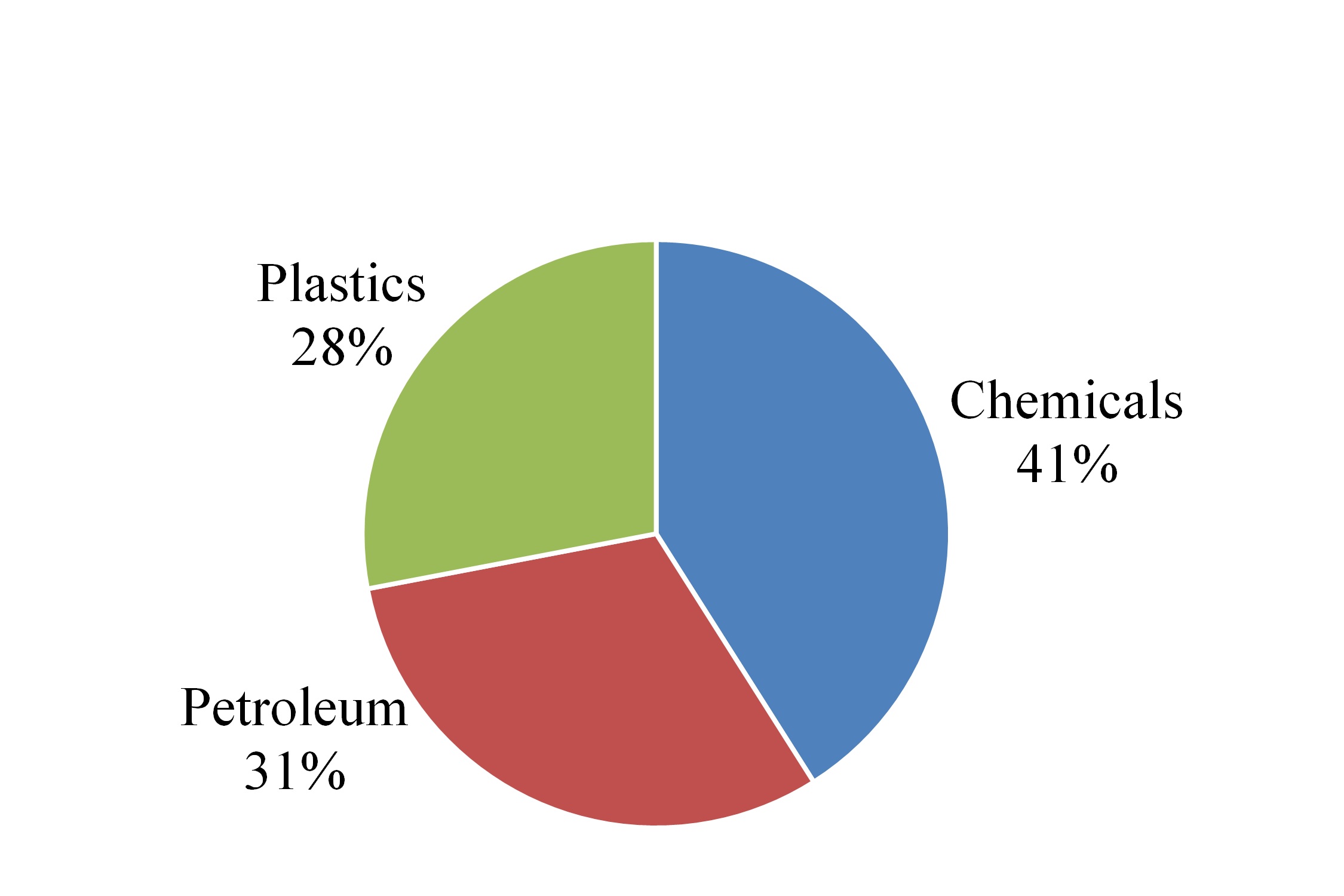

Revenues by commodity group for the three months ended June 30, 2013 | |

Chemical and petroleum. Revenues increased $9.2 million for the three months ended June 30, 2013, compared to the same period in 2012, due to a 12% increase in revenue per carload/unit and an 8% increase in carload/unit volumes. Revenues increased $11.7 million for the six months ended June 30, 2013, compared to the same period in 2012, due to a 9% increase in revenue per carload/unit and a 4% increase in carload/unit volumes. Revenues increased due to positive pricing impacts for petroleum and plastics and volume increased due to the recovery of a portion of a customer’s lost business. In addition, revenues increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar. |  |

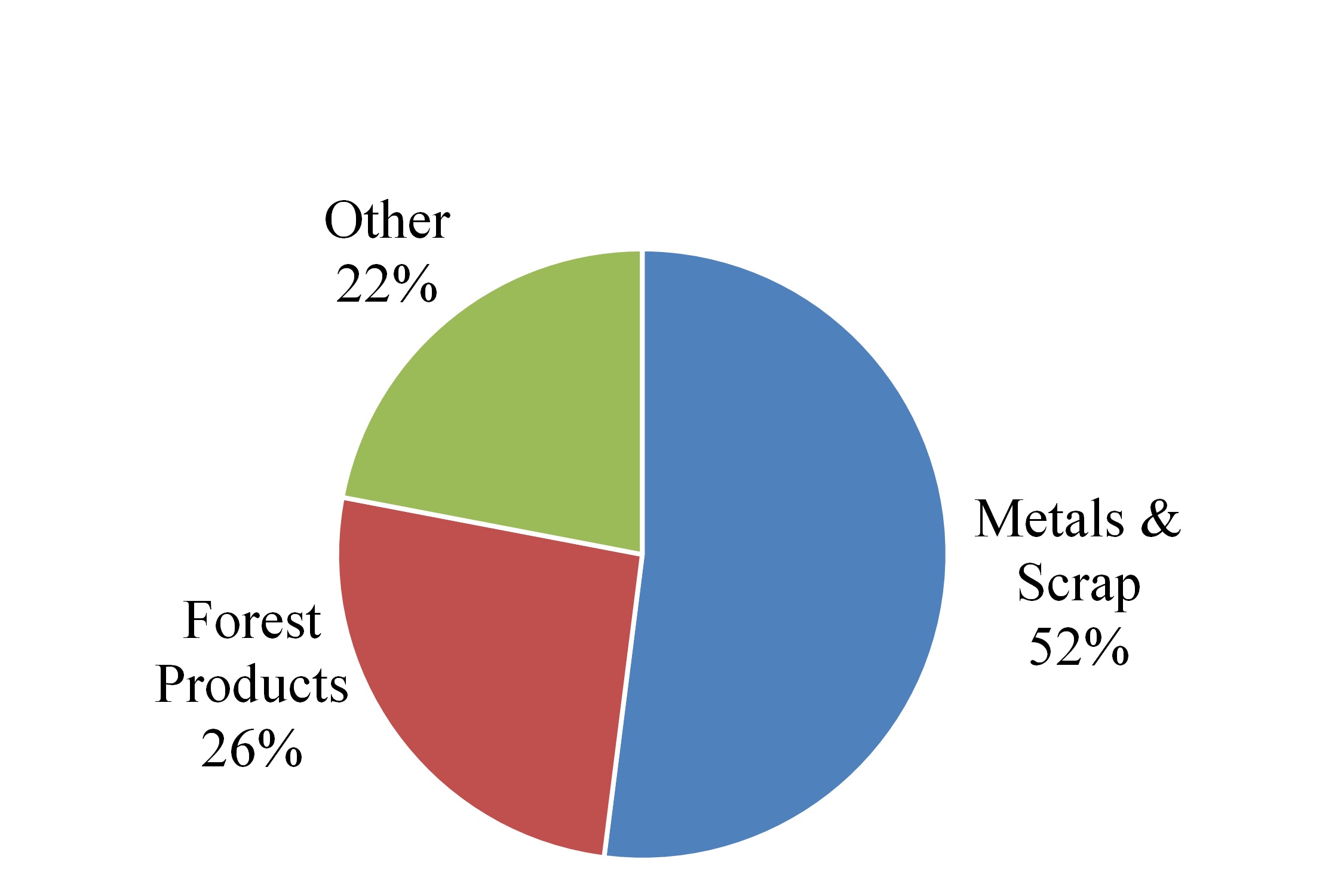

Industrial and consumer products. Revenues increased $3.4 million for the three months ended June 30, 2013, compared to the same period in 2012, due to a 5% increase in revenue per carload/unit and a 1% increase in carload/unit volumes. Revenues increased $9.6 million for the six months ended June 30, 2013, compared to the same period in 2012, due to a 5% increase in revenue per carload/unit and a 3% increase in carload/unit volumes. Metals and scrap revenues increased due to a high demand for slab and steel coil driven by strength in the automotive and oil and gas industries. Pulp and paper revenues increased due to inventory restocking due to short-term market pricing. In addition, revenues increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar. |  |

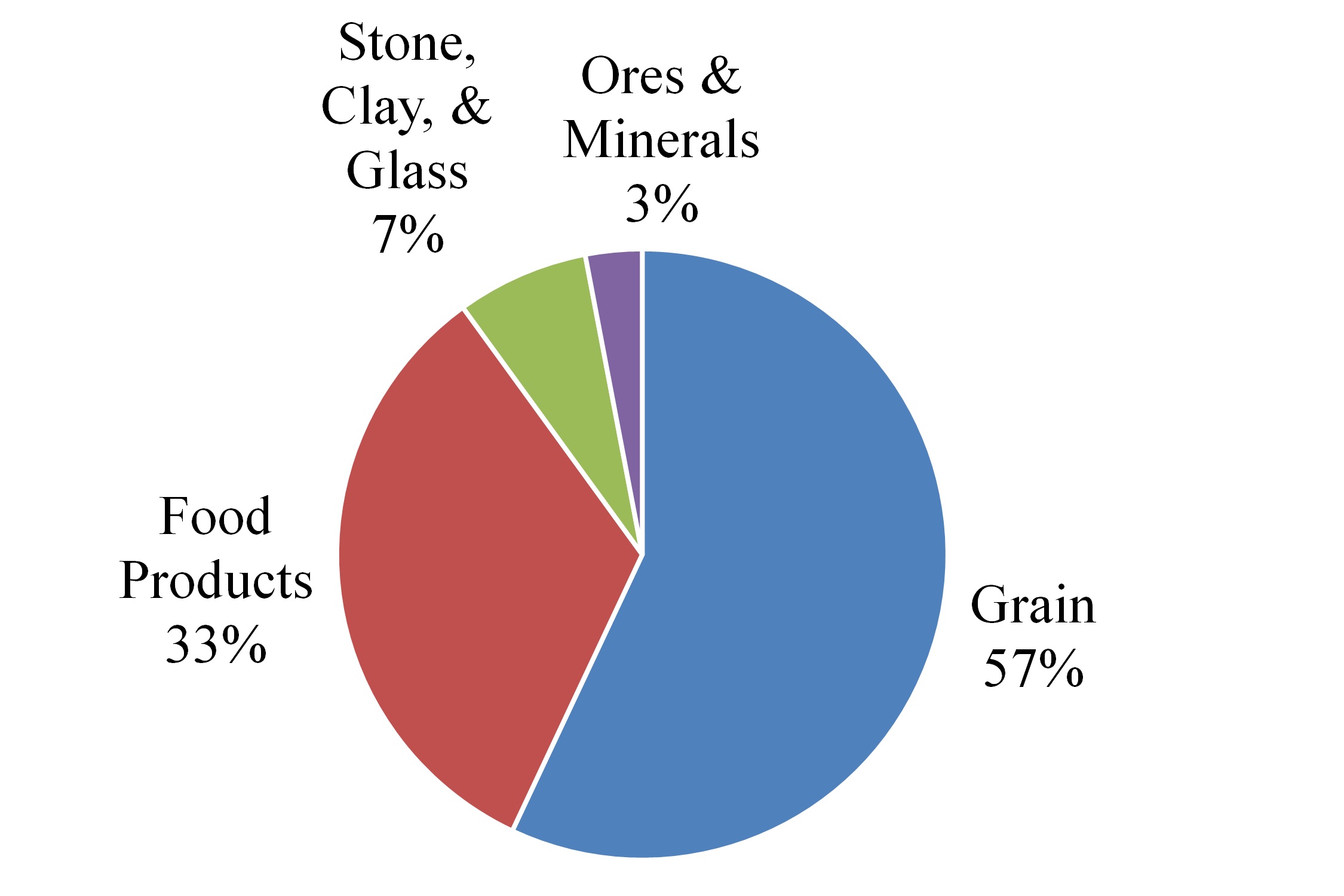

Agriculture and minerals. Revenues decreased $11.9 million for the three months ended June 30, 2013, compared to the same period in 2012, due to a 19% decrease in carload/unit volumes and a 6% decrease in revenue per carload/unit. For the six months ended June 30, 2013, revenues decreased $29.6 million due to a 26% decrease in carload/unit volumes and a 5% decrease in revenues per carload/unit. Import grain volumes decreased 28% and 33% for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, as a result of the severe drought conditions experienced in the Midwestern region of the United States during 2012. |  |

15

Revenues by commodity group for the three months ended June 30, 2013 | |

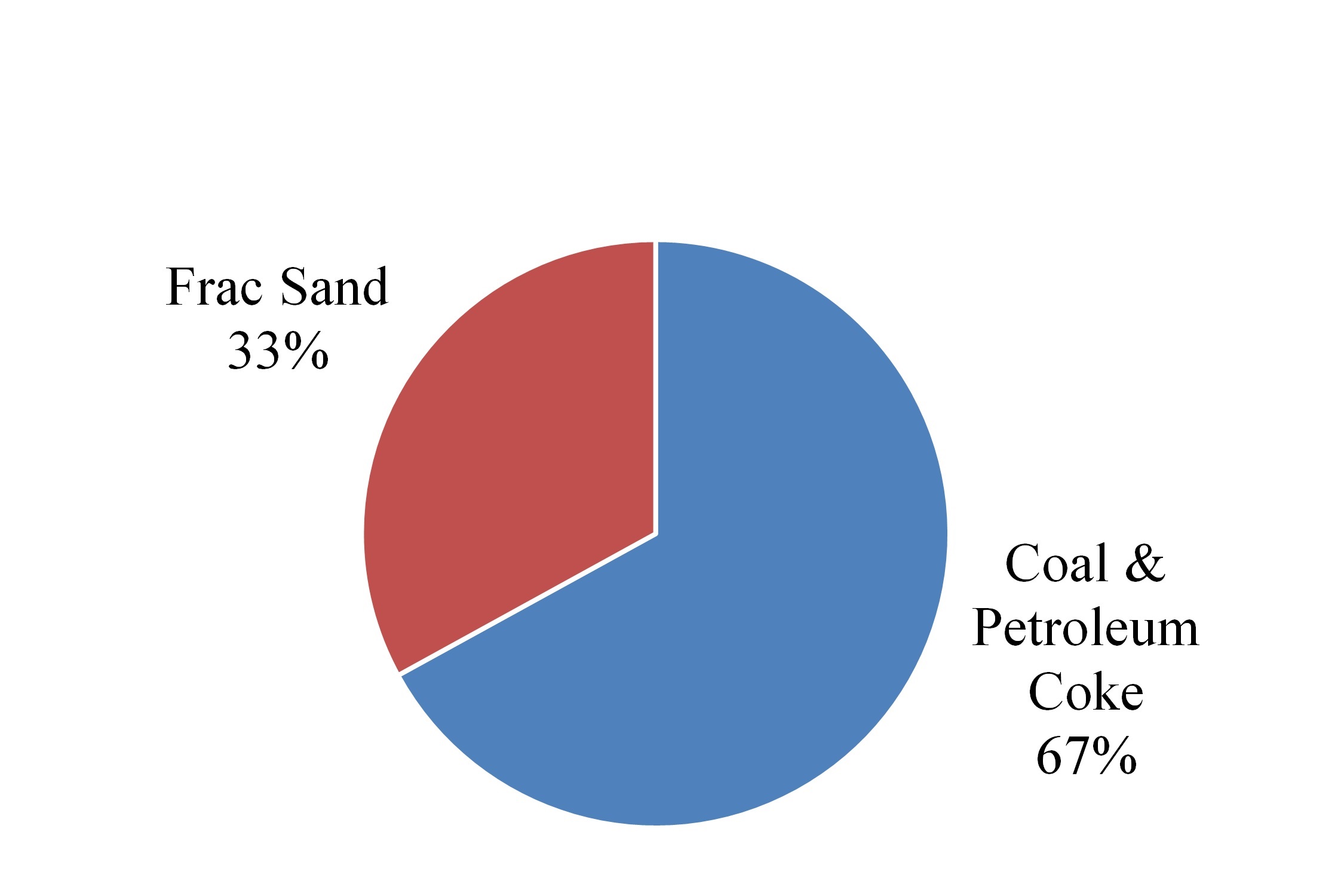

Energy. Revenues increased $1.6 million for the three months ended June 30, 2013, compared to the same period in 2012, due to a 19% increase in revenue per carload/unit due to pricing and a 4% increase in carload/unit volumes. Revenues increased $2.2 million for the six months ended June 30, 2013, compared to the same period in 2012, due a 14% increase in revenue per carload/unit due to pricing and a 3% increase in carload/unit volumes. In addition, revenues increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar. |  |

Intermodal. Revenues increased $8.2 million for the three months ended June 30, 2013, compared to the same period in 2012, due to a 14% increase in revenue per carload/unit and a 3% increase in carload/unit volumes. Revenues increased $16.2 million for the six months ended June 30, 2013, compared to the same period in 2012, due to a 14% increase in revenue per carload/unit and a 4% increase in carload/unit volumes. The increase in revenue per carload/unit is due to increases in pricing and fuel surcharge. The increase in volume was driven by conversion of cross border general commodity truck traffic to rail.

Automotive. Revenues increased $6.9 million for the three months ended June 30, 2013, compared to the same period in 2012, due to an 11% increase in revenue per carload/unit and a 7% increase in carload/unit volumes. Revenues increased $17.0 million for the six months ended June 30, 2013, compared to the same period in 2012, due to 11% increases in revenue per carload/unit and in carload/unit volumes. The growth was driven by new business, increased import/export volume through the Port of Lazaro Cardenas and strong year-over-year growth in North American automobile sales for Original Equipment Manufacturers. In addition, revenues increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar.

Operating Expenses

Operating expenses, as shown below (in millions), increased $57.8 million and $61.2 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to the elimination of deferred statutory profit sharing liability as a result of the organizational restructuring in the second quarter of 2012. In addition, operating expenses increased due to the effect of fluctuations in the value of the Mexican peso against the U.S. dollar for operating expenses denominated in Mexican pesos.

KCSM pays KCSM Servicios, a wholly-owned subsidiary of KCS, market-based rates for employee services. For comparative purposes, amounts paid to KCSM Servicios are classified according to the nature of the services provided to KCSM and the market-based premium paid to KCSM Servicios is included within materials and other expense.

Three Months Ended | ||||||||||||||

June 30, | Change | |||||||||||||

2013 | 2012 | Dollars | Percent | |||||||||||

Compensation and benefits | $ | 31.4 | $ | 28.6 | $ | 2.8 | 10 | % | ||||||

Purchased services | 33.7 | 36.7 | (3.0 | ) | (8 | %) | ||||||||

Fuel | 44.6 | 39.2 | 5.4 | 14 | % | |||||||||

Equipment costs | 18.9 | 18.7 | 0.2 | 1 | % | |||||||||

Depreciation and amortization | 25.3 | 22.4 | 2.9 | 13 | % | |||||||||

Materials and other | 19.6 | 13.1 | 6.5 | 50 | % | |||||||||

Elimination of deferred statutory profit sharing liability, net | — | (43.0 | ) | 43.0 | (100 | %) | ||||||||

Total operating expenses | $ | 173.5 | $ | 115.7 | $ | 57.8 | 50 | % | ||||||

16

Six Months Ended | ||||||||||||||

June 30, | Change | |||||||||||||

2013 | 2012 | Dollars | Percent | |||||||||||

Compensation and benefits | $ | 60.0 | $ | 63.7 | $ | (3.7 | ) | (6 | %) | |||||

Purchased services | 69.5 | 72.9 | (3.4 | ) | (5 | %) | ||||||||

Fuel | 86.6 | 78.7 | 7.9 | 10 | % | |||||||||

Equipment costs | 38.9 | 36.8 | 2.1 | 6 | % | |||||||||

Depreciation and amortization | 49.9 | 44.5 | 5.4 | 12 | % | |||||||||

Materials and other | 34.3 | 24.4 | 9.9 | 41 | % | |||||||||

Elimination of deferred statutory profit sharing liability, net | — | (43.0 | ) | 43.0 | (100 | %) | ||||||||

Total operating expenses | $ | 339.2 | $ | 278.0 | $ | 61.2 | 22 | % | ||||||

Compensation and benefits. Compensation and benefits increased $2.8 million for the three months ended June 30, 2013, compared to the same period in 2012, due to fluctuations in the value of the Mexican peso against the U.S. dollar, and annual salary rate increases. Compensation and benefits decreased $3.7 million for the six months ended June 30, 2013, compared to the same period in 2012, due to a $7.3 million reduction in deferred statutory profit sharing expense as a result of the organizational restructuring in 2012. This decrease was partially offset by fluctuations in the value of the Mexican peso against the U.S. dollar and annual salary rate increases.

Purchased services. Purchased services expense decreased $3.0 million and $3.4 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to a decrease in track and equipment maintenance expenses, partially offset by an increase in security services expense. Track maintenance expense decreased due to the termination of a maintenance contract as a result of in-sourcing of certain maintenance activities and the timing of maintenance activities.

Fuel. Fuel expense increased $5.4 million and $7.9 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to higher diesel fuel prices as the average price per gallon, including the unfavorable impact of fluctuations in the value of the Mexican peso against the U.S. dollar, was $3.00 and $2.94 for the three and six months ended June 30, 2013, respectively, compared to $2.49 and $2.52 for the same periods in 2012. These increases were partially offset by lower consumption.

Equipment costs. Equipment costs increased $0.2 million and $2.1 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to an increase in the use of other railroads’ freight cars as a result of increased automotive traffic volumes. Equipment costs are expected to decrease on a quarterly basis by approximately $1.6 million as a result of the acquisition of 30 locomotives in June 2013, which were previously leased by the Company under an operating lease agreement.

Depreciation and amortization. Depreciation and amortization expense increased $2.9 million and $5.4 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to a larger asset base. Depreciation and amortization expense is expected to increase on a quarterly basis by approximately $0.9 million as a result of the acquisition of 30 locomotives in June 2013, which were previously leased by the Company under an operating lease agreement.

Materials and other. Materials and other expense increased $6.5 million and $9.9 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to an increase in casualty and concession duty expenses. KCSM paid concession duty expense of 0.5% of gross revenues for the first 15 years of the Concession period and on June 24, 2012, KCSM began paying 1.25% of gross revenues, which is effective for the remaining years of the Concession. In addition, materials and other expense increased for the six months ended June 30, 2013, compared to the same period in 2012, due to the market-based premium for employee services paid to KCSM Servicios, S.A. de C.V. (“KCSM Servicios”) as a result of the organizational restructuring in the second quarter of 2012.

Elimination of deferred statutory profit sharing liability, net. As a result of the organizational restructuring in the second quarter of 2012, KCSM’s obligation to pay statutory profit sharing terminated as of May 1, 2012 and accordingly, KCSM recognized a $43.0 million net reduction to operating expense. This reduction includes the elimination of $47.8 million of the deferred statutory profit sharing liability, net of $4.8 million of transaction costs.

17

Non-Operating Income and Expenses

Equity in net earnings of unconsolidated affiliate. Equity in earnings from the operations of Ferrocarril y Terminal del Valle de Mexico, S.A. de C.V. decreased $0.3 million and $0.4 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to higher track maintenance costs.

Interest expense. Interest expense decreased $7.7 million and $8.7 million for the three and six months ended June 30, 2013, respectively, compared to the same periods in 2012, due to lower average interest rates as a result of the Company’s refinancing activities. During the three and six months ended June 30, 2013, the average debt balances were $1,112.9 million and $1,106.6 million, respectively, compared to $1,189.5 million and $1,203.2 million, for the same periods in 2012. Average interest rates during the three and six months ended June 30, 2013 were 5.2% and 6.4%, respectively, compared to 7.4%, for the same periods in 2012. Interest expense is expected to decrease on a quarterly basis by approximately $9.2 million as a result of the refinancing activities in the second quarter of 2013.

Debt retirement costs. Debt retirement costs were $109.9 million for the three and six months ended June 30, 2013. During the second quarter of 2013, KCSM recognized debt retirement costs of $109.9 million related to the tender and call premiums as well as the write-off of unamortized debt issuance costs and the original issue discounts associated with the purchase and redemption of various senior notes refinanced. The Company did not incur debt retirement costs during the first half of 2012.

Foreign exchange gain (loss). Fluctuations in the value of the Mexican peso against the U.S. dollar resulted in a foreign exchange loss of $17.5 million and $4.6 million for the three and six months ended June 30, 2013, respectively, compared to a foreign exchange loss of $2.8 million and a gain of $0.1 million for the same periods in 2012. For the three end six months ended June 30, 2013, foreign exchange gain (loss) includes a loss of $14.1 million and $5.0 million, respectively, on foreign currency forward contracts.

Other expense, net. Other expense, net, was flat for the three and six months ended June 30, 2013, compared to the same periods in 2012.

Income tax expense (benefit). Income tax benefit was $13.1 million for the three months ended June 30, 2013, compared to income tax expense of $36.8 million for the same period in 2012. For the six months ended June 30, 2013, income tax expense was $14.3 million, compared to $64.0 million for the same period in 2012. The effective income tax rates were 27.0% and 43.2% for the three and six months ended June 30, 2013, respectively, compared to 34.0% and 37.2% for the same periods in 2012. The variances in income tax expense (benefit) were due to the decrease in pre-tax income. The effective tax rate variances were due to the reversal in the second quarter of 2013 of a previously recognized benefit as a result of a court ruling and foreign exchange rate fluctuations.

Liquidity and Capital Resources

Overview

In recent years, KCSM has improved its financial strength and flexibility by extending debt maturities, increasing liquidity and reducing interest expense. As a result, the Company received investment grade credit ratings from rating agencies as described in the Credit Ratings section below. This improved credit profile allowed the Company to refinance a significant portion of its existing debt at lower interest rates and extend debt maturities during the second quarter of 2013. The Company estimates annualized pre-tax interest savings as a result of this refinancing to be approximately $37.0 million.

Though KCSM’s cash flows from operations are sufficient to fund operations, capital expenditures and debt service, the Company may, from time to time, incur debt to refinance existing indebtedness, buy out operating leases, or to fund equipment additions or new investments. On June 30, 2013, total available liquidity (the unrestricted cash balance plus revolving credit facility availability) was $253.3 million.

12½% Senior Notes. On April 1, 2013, the Company redeemed all of the remaining $98.1 million aggregate principal amount of the 12½% senior unsecured notes due April 1, 2016 (the “12½% Senior Notes”) at a redemption price equal to 106.250% of the principal amount. The Company redeemed the 12½% Senior Notes using $65.0 million of borrowings under the revolving credit facility and cash on hand.

18

8.0% Senior Notes, 65/8% Senior Notes and 61/8% Senior Notes. On April 10, 2013, KCSM commenced a cash tender offer for the 8.0% senior unsecured notes due February 1, 2018 (the “8.0% Senior Notes”), the 65/8% senior unsecured notes due December 15, 2020 (the “65/8% Senior Notes”) and the 61/8% senior unsecured notes due June 15, 2021 (the “61/8% Senior Notes”). In addition, KCSM concurrently commenced consent solicitations to amend the indentures governing the 8.0% Senior Notes and 65/8% Senior Notes to eliminate substantially all of the restrictive covenants and certain events of default contained therein, which became operative on May 3, 2013.

Through May 8, 2013, KCSM purchased $237.2 million principal amount of the tendered 8.0% Senior Notes, $181.0 million principal amount of the tendered 65/8% Senior Notes and $149.7 million principal amount of the tendered 61/8% Senior Notes (collectively, the “Senior Notes Tendered”) in accordance with the terms and conditions of the tender offer using a portion of the proceeds received from the issuance of $275.0 million principal amount of 2.35% senior unsecured notes due May 15, 2020 (the “2.35% Senior Notes”) and $450.0 million principal amount of 3.0% senior unsecured notes due May 15, 2023 (the “3.0% Senior Notes”).

Subsequent to the expiration of the cash tender offer, through June 26, 2013, KCSM purchased an additional $7.9 million principal amount of the 61/8% Senior Notes and redeemed the remaining $4.0 million outstanding principal amount of the 65/8% Senior Notes. On July 2, 2013, KCSM purchased an additional $1.0 million principal amount of the 61/8% Senior Notes.

2.35% Senior Notes. On May 3, 2013, KCSM issued $275.0 million principal amount of 2.35% Senior Notes, which bear interest semiannually at a fixed annual rate of 2.35%. The 2.35% Senior Notes were issued at a discount to par value, resulting in a $0.3 million discount and a yield to maturity of 2.368%. KCSM used the net proceeds from the issuance of the 2.35% Senior Notes and the 3.0% Senior Notes to purchase the Senior Notes Tendered, pay all fees and expenses incurred in connection with the 2.35% Senior Notes and 3.0% Senior Notes offerings and the tender offers, to finance the purchase of certain leased equipment and for other general corporate purposes. The 2.35% Senior Notes are redeemable at KCSM’s option, in whole or in part, prior to April 15, 2020, by paying the greater of either (i) 100% of the principal amount of the 2.35% Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the then-current U.S. Treasury rate plus 20 basis points, plus accrued interest and any additional amounts to but excluding the redemption date. On or after April 15, 2020, the 2.35% Senior Notes may be redeemed at KCSM’s option, in whole or in part at any time at a redemption price equal to 100% of the principal amount plus any accrued and unpaid interest. In addition, the notes are redeemable, in whole but not in part, at KCSM’s option at their principal amount, plus any accrued unpaid interest in the event of certain changes in the Mexican withholding tax rate.

3.0% Senior Notes. On May 3, 2013, KCSM issued $450.0 million principal amount of the 3.0% Senior Notes, which bear interest semiannually at a fixed annual rate of 3.0%. The 3.0% Senior Notes were issued at a discount to par value, resulting in a $1.9 million discount and a yield to maturity of 3.048%. KCSM used the net proceeds from the issuance of the 3.0% Senior Notes and the 2.35% Senior Notes to purchase the Senior Notes Tendered, pay all fees and expenses incurred in connection with the 2.35% Senior Notes and 3.0% Senior Notes offerings and the tender offers, to finance the purchase of certain leased equipment and for other general corporate purposes. The 3.0% Senior Notes are redeemable at KCSM’s option, in whole or in part, prior to February 15, 2023, by paying the greater of either (i) 100% of the principal amount of the 3.0% Senior Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the then-current U.S. Treasury rate plus 20 basis points, plus accrued interest and any additional amounts to but excluding the redemption date. On or after February 15, 2023, the 3.0% Senior Notes may be redeemed at KCSM’s option, in whole or in part at any time at a redemption price equal to 100% of the principal amount plus any accrued and unpaid interest. In addition, the notes are redeemable, in whole but not in part, at KCSM’s option at their principal amount, plus any accrued unpaid interest in the event of certain changes in the Mexican withholding tax rate.

The 2.35% Senior Notes and 3.0% Senior Notes are denominated in U.S. dollars; are unsecured, unsubordinated obligations; rank pari passu in right of payment with KCSM’s existing and future unsecured, unsubordinated obligations and are senior in right of payment to KCSM’s future subordinated indebtedness. In addition, the senior notes include certain covenants which are customary for these types of debt instruments issued by borrowers with similar credit ratings.

Revolving Credit Facility. During the second quarter of 2013, the Company borrowed $65.0 million against the revolving credit facility for the redemption of the 12½% Senior Notes. As of June 30, 2013, the outstanding amount under the revolving credit facility was $10.0 million. As of December 31, 2012, KCSM had no amount outstanding under the revolving credit facility.

19

Related Company Revolving Credit Agreement. The Kansas City Southern Railway Company (“KCSR”), as a lender, and KCSM, as a borrower, entered into a Revolving Credit Agreement effective as of June 7, 2013 (the “Revolving Agreement”), pursuant to the terms of which KCSM may borrow up to $100.0 million from KCSR on a revolving basis at any time during the term of the Revolving Agreement. The Revolving Agreement is unsecured and terminates on December 31, 2018. As of June 30, 2013, KCSM had borrowed $52.5 million under the terms of the Revolving Agreement at a weighted average interest rate of 1.48%.

Debt Retirement Costs. The Company recognized debt retirement costs of $109.9 million during the second quarter of 2013 related to the tender and call premiums as well as the write-off of unamortized debt issuance costs and the original issue discounts as a result of the refinancing activities described above.

The Company believes, based on current expectations, that cash and other liquid assets, operating cash flows, access to debt capital markets and other available financing resources will be sufficient to fund anticipated operating expenses, capital expenditures, debt service costs and other commitments in the foreseeable future. The Company’s current financing instruments contain restrictive covenants which limit or preclude certain actions; however, the covenants are structured such that the Company has sufficient flexibility to conduct its operations. The Company was in compliance with all of its debt covenants as of June 30, 2013.

For additional discussion of the agreements representing the indebtedness of KCSM, see “Item 8 Financial Statements and Supplemental Data – Note 7. Long-Term Debt” in KCSM’s Annual Report on Form 10-K for the year ended December 31, 2012.

KCSM’s operating results and financing alternatives can be unexpectedly impacted by various factors, some of which are outside of its control. For example, if KCSM were to experience a reduction in revenues or a substantial increase in operating costs or other liabilities, its earnings could be significantly reduced, increasing the risk of non-compliance with debt covenants. Additionally, KCSM is subject to external factors impacting debt and capital markets and its ability to obtain financing under reasonable terms is subject to market conditions. Volatility in capital markets and the tightening of market liquidity could impact KCSM’s access to capital. Further, KCSM’s cost of debt can be impacted by independent rating agencies which assign debt ratings based on certain factors including credit measurements such as interest coverage and leverage ratios, liquidity and competitive position.

Credit Ratings. Three credit rating agencies provide their views of the Company’s outlook and ratings. Standard & Poor’s Rating Services (“S&P”) rates the senior unsecured debt and corporate credit of KCSM as investment grade. Moody’s Investor Service (“Moody’s”) rates KCSM’s senior unsecured debt as investment grade. Fitch Ratings (“Fitch”) has assigned an investment grade Issuer Default Rating to KCSM and rates the senior unsecured debt as investment grade. Ratings and outlooks change from time to time and can be found on the websites of S&P, Moody’s and Fitch.

Cash Flow Information

Summary cash flow data follows (in millions):

Six Months Ended | |||||||

June 30, | |||||||

2013 | 2012 | ||||||

Cash flows provided by (used for): | |||||||

Operating activities | $ | 212.2 | $ | 147.4 | |||

Investing activities | (143.9 | ) | (67.8 | ) | |||

Financing activities | (61.7 | ) | (50.7 | ) | |||

Net increase in cash and cash equivalents | 6.6 | 28.9 | |||||

Cash and cash equivalents beginning of year | 9.2 | 15.7 | |||||

Cash and cash equivalents end of period | $ | 15.8 | $ | 44.6 | |||

20

Cash flows from operating activities increased $64.8 million for the six month period ended June 30, 2013, compared to the same period in 2012, primarily due to an increase in changes in working capital items, resulting mainly from the timing of certain payments and receipts. Net cash used for investing activities increased $76.1 million, due to an increase in capital expenditures and the acquisition of equipment under operating lease. Additional information regarding capital expenditures is provided below. Net cash used for financing activities increased $11.0 million due to debt refinancing activities and associated debt cost payments incurred during the second quarter of 2013, and related company debt activity.

Capital Expenditures

KCSM’s cash flows from operations are sufficient to fund capital expenditures; however, the Company may, from time to time, use external sources of cash (principally bank debt, public debt and private debt) to fund capital expenditures.

The following table summarizes capital expenditures by type (in millions):

Six Months Ended | |||||||

June 30, | |||||||

2013 | 2012 | ||||||

Roadway capital program | $ | 53.8 | $ | 48.7 | |||

Equipment | 15.4 | 5.5 | |||||

Information technology | 2.3 | 1.8 | |||||

Capacity | 1.9 | 1.8 | |||||

Other | 5.8 | 3.4 | |||||

Total capital expenditures (accrual basis) | 79.2 | 61.2 | |||||

Change in capital accruals | (0.8 | ) | 10.4 | ||||

Total cash capital expenditures | $ | 78.4 | $ | 71.6 | |||

Acquisition of equipment under operating lease | $ | 66.5 | $ | — | |||

For 2013, internally generated cash flows, excess proceeds from debt refinancing activities and other borrowings are expected to fund cash capital expenditures and the acquisition of equipment under operating lease, which are currently estimated at approximately $250.0 million.

Other Matters

KCSM Servicios union employees are covered by one labor agreement, which was signed on June 23, 1997, between KCSM and the Sindicato de Trabajadores Ferrocarrileros de la República Mexicana (“Mexican Railroad Union”), for a term of fifty years, for the purpose of regulating the relationship between the parties. Approximately 80% of KCSM Servicios employees are covered by this labor agreement. The compensation terms under this labor agreement are subject to renegotiation on an annual basis and all other benefits are subject to negotiation every two years. In July of 2013, the negotiation of compensation terms and all other benefits was initiated with the Mexican Railroad Union. The anticipated resolution of this negotiation is not expected to have a material impact to the consolidated financial statements. The union labor negotiations with the Mexican Railroad Union have not historically resulted in any strike, boycott or other disruption in KCSM’s business operations.

Item 3. | Quantitative and Qualitative Disclosures about Market Risk |

Omitted pursuant to General Instruction H(2)(c) of Form 10-Q.

Item 4. | Controls and Procedures |

(a) Disclosure Controls and Procedures.

As of the end of the period for which this Quarterly Report on Form 10-Q is filed, the Company’s President and Executive Representative and Chief Financial Officer have each reviewed and evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). Based on that evaluation, the President and Executive Representative and Chief Financial

21

Officer have each concluded that the Company’s current disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and include controls and procedures designed to ensure that information required to be disclosed by the Company in such reports is accumulated and communicated to the Company’s management, including the President and Executive Representative and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

(b) Changes in Internal Control over Financial Reporting.

There have not been any changes in the Company’s internal control over financial reporting that occurred during the second quarter of 2013 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

22

PART II—OTHER INFORMATION

Item 1. | Legal Proceedings |

For information related to the Company’s legal proceedings, see Note 7 “Commitments and Contingencies,” under Part I, Item 1, of this quarterly report on Form 10-Q.

Item 1. | Risk Factors |

There were no material changes during the quarter to the Risk Factors disclosed in Item 1A, “Risk Factors,” in KCSM’s Annual Report on Form 10-K for the year ended December 31, 2012.

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |