Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WILSHIRE BANCORP INC | a13-16600_18k.htm |

| EX-2.1 - EX-2.1 - WILSHIRE BANCORP INC | a13-16600_1ex2d1.htm |

| EX-10.1 - EX-10.1 - WILSHIRE BANCORP INC | a13-16600_1ex10d1.htm |

| EX-99.3 - EX-99.3 - WILSHIRE BANCORP INC | a13-16600_1ex99d3.htm |

| EX-99.2 - EX-99.2 - WILSHIRE BANCORP INC | a13-16600_1ex99d2.htm |

| EX-99.1 - EX-99.1 - WILSHIRE BANCORP INC | a13-16600_1ex99d1.htm |

Exhibit 99.4

|

|

Acquisition of Saehan Bancorp July 15, 2013 |

|

|

SAFE HARBOR STATEMENT This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. Statements concerning future performance, events, or any other guidance on future periods constitute forward-looking statements that are subject to a number of risks and uncertainties that might cause actual results to differ materially from stated expectations. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed transaction involving Wilshire and Saehan including future financial and operating results, Wilshire’s or Saehan’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: (i) the ability to obtain the requisite Saehan shareholder approvals; (ii) the risk that Wilshire or Saehan may be unable to obtain governmental and regulatory approvals required for the transaction, or required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could cause the parties to abandon the transaction; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) the timing to consummate the proposed transaction; (v) the risk that the businesses will not be integrated successfully; (vi) the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; (vii) disruption from the transaction making it more difficult to maintain relationships with customers, employees or vendors; (viii) the diversion of management time on transaction-related issues; (ix) general worldwide economic conditions and related uncertainties; (x) the effect of changes in governmental regulations; (xi) credit risk associated with an obligor’s failure to meet the terms of any contract with the bank or to otherwise perform as agreed; (xii) interest risk involving the effect of a change in interest rates on both the bank’s earnings and the market value of the portfolio equity; (xiii) liquidity risk affecting the bank’s ability to meet its obligations when they come due; (xiv) price risk focusing on changes in market factors that may affect the value of traded instruments in “mark-to-market” portfolios; (xv) transaction risk arising from problems with service or product delivery; (xvi) compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards; (xvii) strategic risk resulting from adverse business decisions or improper implementation of business decisions; (xviii) reputation risk that adversely affects earnings or capital arising from negative public opinion; (xix) terrorist activities risk that results in loss of consumer confidence and economic disruptions; (xx) economic downturn risk resulting in deterioration in the credit markets; (xxi) greater than expected noninterest expenses; (xxii) excessive loan losses; and (xxiii) other factors we discuss or refer to in the “Risk Factors” section of our most recent Annual Report on Form 10-K filed with the SEC. Additional risks and uncertainties are identified and discussed in Wilshire’s reports filed with the SEC and available at the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of the particular statement and Wilshire undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. ADDITIONAL INFORMATION ABOUT THE PROPOSED MERGER AND WHERE TO FIND IT This communication relates to a proposed merger between Wilshire and Saehan that will become the subject of a registration statement, which will include a proxy statement/prospectus, to be filed with the SEC that will provide full details of the proposed merger and the attendant benefits and risks. This communication is not a substitute for the proxy statement/prospectus or any other document that Wilshire or Saehan may file with the SEC or send to their shareholders in connection with the proposed merger. Investors and security holders are urged to read the registration statement on Form S-4, including the definitive proxy statement/prospectus, and all other relevant documents filed with the SEC or sent to shareholders as they become available because they will contain important information about the proposed merger. All documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents by contacting Wilshire’s Corporate Secretary, at Wilshire Bancorp, Inc., 3200 Wilshire Boulevard, Los Angeles, California 90010, or via e-mail at alexko@wilshirebank.com. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. PARTICIPANTS IN THE SOLICITATION Wilshire, Saehan and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed mergers. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. 2 |

|

|

TRANSACTION HIGHLIGHTS Attractive, manageable and scarce in-market fill-in consolidation opportunity strengthens our competitive position as one of the premier Korean American community banks Attractive core deposit base including 34.8% non-interest bearing deposits and increases Wilshire’s CA franchise size by 28% in terms of deposit Complementary business models, customers, products, geography and knowledge of each other Enhances franchise value through synergies, improved profitability and scale in key markets Ability to unlock value both on the balance sheet and income statement Attractive adjusted pricing for financially compelling deal with significant synergies Significant operating synergies due to considerable branch network and operational overlaps 8 (80%) of Saehan’s branches and the headquarters are within 1 mile of a Wilshire branch Revenue synergies considered and identified but not included in the analysis FY 2014 / FY 2015 estimated earnings accretion: 5.7%(1) / 10.6% Estimated IRR: > 20% TBV dilution of 4.1% (at 3/31/13) with TBV earn-back of –3.1 years Diligence completed with manageable and disciplined integration planned Pro forma company would enjoy strong financials, capital levels, credit metrics Creates value for all stakeholders – shareholders, customers, employees, and communities 3 (1) Excludes one time transaction cost and only 75% of expected operating synergies being realized in 2014 |

|

|

TRANSACTION AND ASSUMPTION OVERVIEW Transaction Value: Agreed $0.4247 per SAEB common share Valued at $0.4446 per SAEB common share or $105.5 million in total consideration(1) Consideration: Under the terms of the merger agreement each Saehan Bancorp share will be converted in to a right to receive, subject to allocation procedures and certain limitations, either (i) 0.06080 shares of WIBC’s common stock or (ii) $0.4247 in cash or (iii) a unit consisting of WIBC common stock and cash. A maximum of 7,210,815 WIBC shares to be issued Exchange Ratio: 0.06080x based on WIBC’s 20-day volume weighted average closing price prior to July 15, 2013 of $6.9856 Credit Mark: 4.67% in a gross loan mark (implies 19.8% in credit cycle losses since 1/1/08(2)) Projections and Cost Synergies: WIBC estimates are street estimates adjusted for the recent announced BankAsiana transaction Merger synergies estimated $12.3 million (pre-tax) Revenue Synergies: Considered and quantified but not included in the analysis DTA Assumption Minimum recovery of $11.5mm assumed(3)– Gross DTA of $26.8mm with 100% valuation allowance today Pro Forma Ownership: 90.8% WIBC / 9.2% SAEB Termination Fee: 4% of deal value Board Representation: None Transaction Costs: $6.8 million pre-tax estimated Other Agreements: Retention Agreements, Director Support and Voting Agreements, Principal Shareholder Agreements Approvals: Regulatory approvals and SAEB shareholder approval Due Diligence: Complete, including extensive loan review Anticipated Closing: December 31, 2013 (1) Based on Wilshire’s most recent closing price. Of $7.64 as of July 12, 2013 Includes cash-out of SAEB options (2) Source: SNL Financial - cumulative quarterly net charge offs as a % of average loans since 1/1/08 plus estimated credit mark on loans in proposed transaction (3) Source: WIBC tax advisor – preliminary estimate with ongoing work to finalize before close. Gross DTA of $26.8mm with 100% valuation allowance today. 4 |

|

|

SAEHAN BANCORP Headquartered in Los Angeles, CA since April 1990 , operating 10 branches in the Los Angeles-Long Beach-Santa Ana MSA and 2 LPOs in Seattle, WA & New York, NY. One of the Top 10 Korean-American focused banks with $542 million in assets and $459 million in deposits Strong capital ratios (TCE% = 10.7% and Total RBC% = 21.7%) and strong reserves of 3.43% Credit quality has improved dramatically since 2009 with NPA/Assets dropping from 15.03% to 1.79% PTPP income poised to increase significantly with excess liquidity deployment, brokered CD runoff and credit quality improvements Source: SNL Financial. Regulatory data as of 3/31/2013 5 Loan Breakdown Deposit Breakdown ($000) 3/31/2013 Balance Percent C&D 3,574 0.9% 1-4 Fam 4,031 1.1% Multifam 40,799 10.7% CRE 292,744 77.0% C&I 38,632 10.2% Cons. & Other 456 0.1% Gross Loans 380,237 100.0% Trans 8.8% MMDA 64.8% Jumbo Time 9.3% Retail Time 17.2% Balance Sheet ($000) 3/31/2013 Total Assets 542,366 Total Net Loans 362,174 Total Deposits 458,765 Total Equity 58,462 Capital Ratios 3/31/2013 Tier 1 Leverage Ratio 13.26% Tier 1 Risk-Based Ratio 20.25% Total Risk Based Ratio 21.66% Tangible Common Equity Ratio 10.73% Book Value Per Share $0.25 Common Shares Outstanding 237,197,874 Stock Price - 7/12/2013 $0.44 Exchange OTCBB C&D 0.9% 1 - 4 Fam 1.1% Multifam 10.7% CRE 77.0% C&I 10.2% Cons. & Other 0.1% ($000) 3/31/2013 Balance Percent Trans 40,234 8.8% MMDA 297,234 64.8% Jumbo Time 42,436 9.3% Retail Time 78,862 17.2% Total Deposits 458,765 100.0% |

|

|

Wilshire Blvd (HQ) La Crescenta Western Olympic Downtown Rowland Hgts Fullerton Irvine Torrance Gardena SAEHAN BRANCH FOOTPRINT 6 |

|

|

KOREAN-AMERICAN MARKET SHARE Highly competitive and limited market place Limited attractive Korean-American potential partners in the market Positions Wilshire as one of the two leaders in the Korean-American banking market Balance % Balance % Balance % BBCN Bancorp (1) 4,946,424 41.2% 5,055,033 39.1% 6,428,426 40.6% Wilshire Bancorp (2) 2,663,186 22.2% 2,775,387 21.4% 3,450,894 21.8% Hanmi Financial 2,061,156 17.2% 2,333,291 18.0% 2,792,396 17.6% Woori Bank America 721,641 6.0% 913,914 7.1% 1,034,405 6.5% Shinhan Bank America 722,311 6.0% 848,537 6.6% 974,955 6.2% Pacific City Corporation 515,104 4.3% 577,275 4.5% 652,511 4.1% CBB Bank 366,926 3.1% 437,979 3.4% 500,992 3.2% Total(3) 11,996,748 100.0% 12,941,416 100.0% 15,834,579 100.0% Total Net Loans Total Deposits Total Assets (Figures In 000's) (1) As reported (2) As pro forma with BankAsiana and Saehan (3) All Korean-American Banks with assets more than $500 million at March 31, 2013 Source: WIBC and SNL Financial regulatory data, 7 |

|

|

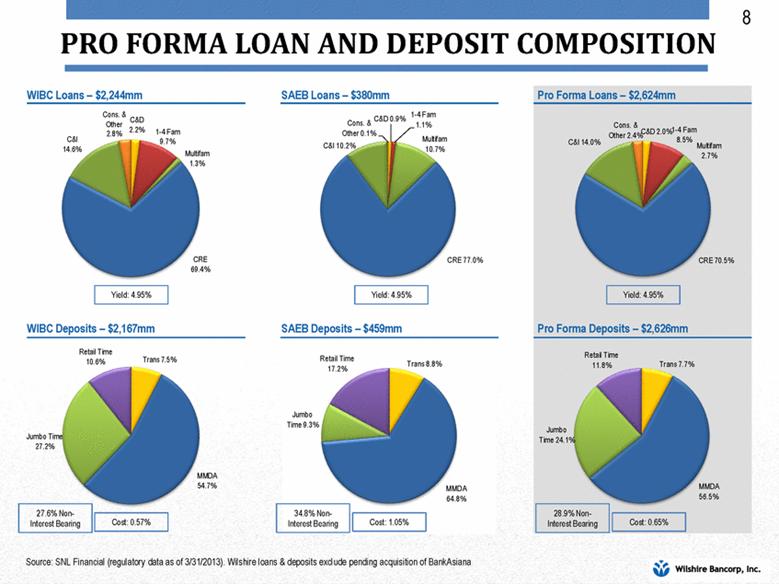

PRO FORMA LOAN AND DEPOSIT COMPOSITION WIBC Loans – $2,244mm SAEB Loans – $380mm Pro Forma Loans – $2,624mm SAEB Deposits – $459mm WIBC Deposits – $2,167mm Pro Forma Deposits – $2,626mm Source: SNL Financial (regulatory data as of 3/31/2013). Wilshire loans & deposits exclude pending acquisition of BankAsiana 27.6% Non-Interest Bearing 34.8% Non-Interest Bearing 28.9% Non-Interest Bearing 8 Yield: 4.95% Cost: 0.57% Yield: 4.95% Cost: 1.05% Yield: 4.95% Cost: 0.65% Trans 7.5% MMDA 54.7% Jumbo Time 27.2% Retail Time 10.6% C&D 0.9% 1 - 4 Fam 1.1% Multifam 10.7% CRE 77.0% C&I 10.2% Cons. & Other 0.1% C&D 2.0% 1 - 4 Fam 8.5% Multifam 2.7% CRE 70.5% C&I 14.0% Cons. & Other 2.4% Trans 8.8% MMDA 64.8% Jumbo Time 9.3% Retail Time 17.2% C&D 2.2% 1 - 4 Fam 9.7% Multifam 1.3% CRE 69.4% C&I 14.6% Cons. & Other 2.8% Trans 7.7% MMDA 56.5% Jumbo Time 24.1% Retail Time 11.8% |

|

|

FINANCIAL RATIONALE Pricing Metrics: Price per Share Market Premium/Discount at 7/12/2013 Price / Tang Book Value Price / Tang Book Value(1) Premium / Core Deposits Premium(1) / Core Deposits Agreed $0.4247 (3.5)% 1.72x 1.44x 10.2% 7.4% At 7/12/2103 $0.4446 1.0% 1.80x 1.51x 11.3% 8.5% Recent Transactions(2) 25.2% 1.54x 1.54x 6.0% 6.0% Attractive Returns: FY 2014 / FY 2015 estimated earnings accretion: 5.4%(3) / 10.3% Estimated IRR: > 20% TBV dilution at 3/31/13: 4.1% Estimated earn-back of TBV: –3.1 years Significant Synergies: Merger synergies estimated $12.3 million of Saehan’s core non-interest expense Significant branch consolidation opportunity given highly overlapping branch networks 8 (80%) of Saehan’s branches and the headquarters are within 1 mile of a Wilshire branch Implied value of estimated cost savings of $102.5 million or $1.29 per share(4) Revenue synergies identified but excluded from this analysis Potential DTA Value Upside Estimated DTA recovery of $11.5mm assumed(1) Any additional tax asset recognized resulting from the deal is credited directly to pro-forma tangible equity on Day 1 and significantly improves adjusted deal multiples and resulting return metrics of the transaction Credit Risk Addressed: Full due diligence completed Estimated 4.67% mark on gross loans Total 19.8% credit cycle losses(5) since 1/1/08 (including estimated mark on loans in proposed transaction) (1) Adjusts TBV for the DTA recapture assumption of $11.5million - Source: WIBC tax advisor to – preliminary estimate with ongoing work to finalize value before close. Gross DTA of $26.8mm with 100% valuation allowance today. (2) Reflects median values of all national bank / thrift transactions since 1/1/2012 with announce deal values, target assets between $500M and $10B. Targets with NPA’s / Assets >4% excluded (3) Excludes one time transaction cost and only 75% of expected operating synergies being realized in 2014 (4) Assumes 78.5 million shares outstanding on a pro forma basis. (5) Source: SNL Financial - cumulative quarterly net charge offs as a % of average loans since 1/1/08 plus estimated credit mark on loans in proposed transaction 9 |

|

|

DEFERRED TAX ASSET OVERVIEW Partial reversal of DTA valuation allowance of $11.5 million enhances tangible book value Financial analysis was based on $11.5 million utilization of DTA The full value of the tax asset is $26.8mm (100% valuation allowance) Any tax asset recognized resulting from the deal is credited directly to pro-forma tangible equity on Day 1 as part of the purchase accounting Deal value to adjusted tangible book value of 1.51x is in line with selected comparable transactions median of 1.54x(1) 1) All national bank / thrift transactions since 1/1/2012 with announce deal values, target assets between $500M and $10B. Excludes those with target NPA’s / Assets greater than 4% 2) DTA recapture assumption of $11.5million of $26.8milion gross DTA - Source: WIBC tax advisor – preliminary assumption and ongoing work to finalize value before close 3) Excludes value of ITM options ($35,700) Source: SNL Financial (as of 3/31/2013) 10 Deal Value $105.5 $105.5 Price per share $0.4446 $0.4446 SAEB Shareholder Equity $58.5 $58.5 Less: Goodwill and Intangibles $0.0 $0.0 SAEB 3/31/2013 Tangible Book Value $58.5 $58.5 Price per share $0.2465 $0.2465 Premium to Reported Tangible Book Value $47.0 $47.0 Price / Reported Tangible Book Value 1.80x 1.80x Adjustments Reversal of DTA Valuation Allowance $11.5 $26.8 SAEB 3/31/2013 Adjusted Tangible Book Value $70.0 $85.3 Price per share $0.2951 $0.3596 Premium to Adjusted Tangible Book Value $35.5 $20.2 Price / Adjusted Tangible Book Value 1.51x 1.24x Reduced DTA Value of $11.5mm (2) Full DTA Value of $26.8mm (2) |

|

|

ESTIMATED CREDIT AND FAIR VALUE MARKS Due diligence completed, including all major business and functional areas Loan Mark Extensive review of loan portfolios including internal loan file reviews, thorough analysis of data provided, and discussions with management Overall credit analysis and individual credit files reviewed onsite by Wilshire banking and credit professionals to assess risk profile and credit mark Reviewed 55% of total portfolio Reviewed all classified and criticized loans above $1 million 3rd party loan study on Saehan credit portfolio Estimated ($17.6mm) gross loan mark (4.67%)(1) Including our estimated credit mark on loans this implies a 19.8% credit cycle losses since 1/1/08(2) Other Core deposit intangible of $4.2 million amortized straight-line over 10 years (1) As a percentage of reported gross loans as of 3/31/2013 - based on preliminary estimates. all numbers subject to revision at close (2) Source: SNL Financial - cumulative quarterly net charge offs as a % of average loans since 1/1/08 plus estimated credit mark on loans in proposed transaction -11 - |

|

|

PRELIMINARY PRO FORMA BALANCE SHEET(1) Wilshire Proforma Proforma ASSETS 3/31/2013 BankAsiana Saehan & Asiana Cash & Securities $490.4 $497.9 $608.3 Gross Loans 2,184.1 2,348.6 2,709.3 ALLL (58.6) (58.6) (58.6) Net Loans 2,125.5 2,290.0 2,650.7 Other Assets 140.5 153.5 206.6 Total Assets $2,756.4 $2,941.4 $3,465.6 LIABILITIES Deposits $2,162.6 $2,327.6 $2,786.4 254.8 265.2 Other Liabilities 240.1 Total Liabilities 2,402.7 2,582.4 3,051.6 Total Equity 353.7 359.0 414.0 Total Liabilities & Equity $2,756.4 $2,941.4 $3,465.6 CAPITAL RATIOS TCE Ratio 12.6% 11.5% 10.4% Tier 1 Leverage Ratio 14.7% 13.9% 12.7% Tier 1 Risk Based Ratio 18.7% 17.2% 16.2% Total Risk Based Ratio 20.0% 18.3% 17.2% Capital ratios and reserves will remain strong Continued capital strength and flexibility Assumed reversal of deferred tax asset valuation allowance of $11.5mm out of a possible $26.8mm Strong combined profitability and both cost and revenue synergies will continue to strengthen the capital ratio’s Source: WIBC, based on preliminary purchase accounting estimates—all numbers subject to revision at close Pro forma for Saehan only. Assumes Wilshire acquisition of Saehan only, excluding BankAsiana ($ million) Proforma Saehan(2) $600.8 2,544.8 (58.6) 2,486.2 193.7 $3,280.7 $2,621.3 250.6 2,871.9 408.8 $3,280.7 11.3% 13.3% 17.4% 18.5% ASSET QUALITY NPAs/ Assets 2.50% 2.43% 2.36% ALLL/ Gross Loans 2.68% 2.49% 2.16% 2.40% 2.30% (1) (2) |

|

|

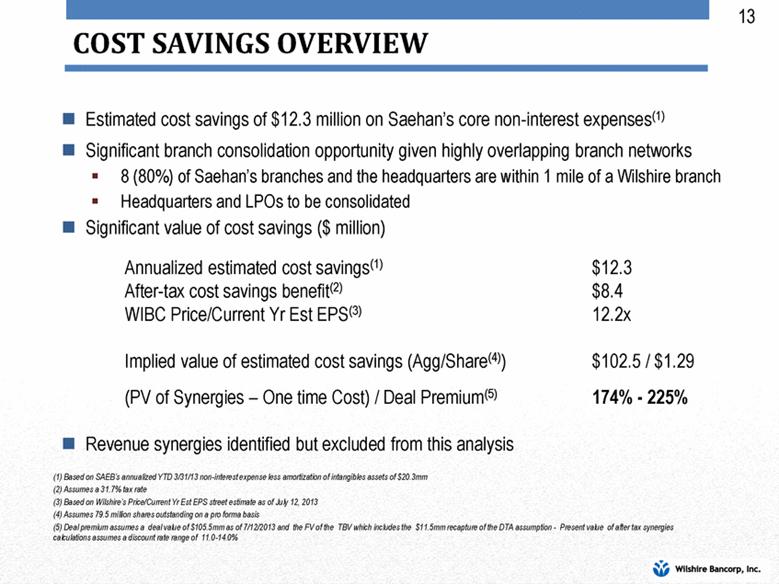

COST SAVINGS OVERVIEW Estimated cost savings of $12.3 million on Saehan’s core non-interest expenses(1) Significant branch consolidation opportunity given highly overlapping branch networks 8 (80%) of Saehan’s branches and the headquarters are within 1 mile of a Wilshire branch Headquarters and LPOs to be consolidated Significant value of cost savings ($ million) Annualized estimated cost savings(1) $12.3 After-tax cost savings benefit(2) $8.4 WIBC Price/Current Yr Est EPS(3) 12.2x Implied value of estimated cost savings (Agg/Share(4)) $102.5 / $1.29 (PV of Synergies – One time Cost) / Deal Premium(5) 174% - 225% Revenue synergies identified but excluded from this analysis (1) Based on SAEB’s annualized YTD 3/31/13 non-interest expense less amortization of intangibles assets of $20.3mm (2) Assumes a 31.7% tax rate (3) Based on Wilshire’s Price/Current Yr Est EPS street estimate as of July 12, 2013 (4) Assumes 79.5 million shares outstanding on a pro forma basis (5) Deal premium assumes a deal value of $105.5mm as of 7/12/2013 and the FV of the TBV which includes the $11.5mm recapture of the DTA assumption - Present value of after tax synergies calculations assumes a discount rate range of 11.0-14.0% 13 |

|

|

MANAGEABLE INTEGRATION Manageable sized transaction in our existing market with known customers, products, services, and knowledge of each other Geographic proximity of Saehan to Wilshire Disciplined integration planned in tandem with BankAsiana Integration management and commitment from top level WIBC executives Handpicked and dedicated integration team Integration to start immediately to maximize customer retention and experience Retention plans in place Integration tailored given intimate knowledge of Saehan Joint internal and external communications Focus carefully on impact of recognizing synergies and unlocking value 14 |

|

|

CONCLUSION Attractive, manageable and scarce in-market fill-in consolidation opportunity strengthens our competitive position as one of the premier Korean American community banks Attractive core deposit base with significant non-interest bearing deposits that increases Wilshire’s CA franchise size Complementary business models, customers, products, geography and knowledge of each other Enhances franchise value through synergies, improved profitability and scale in key markets Ability to unlock value both on the balance sheet and income statement Attractive adjusted pricing for financially compelling deal with significant synergies Diligence completed with manageable and disciplined integration planned Pro forma company would enjoy strong financials, capital levels, credit metrics Creates value for all stakeholders – shareholders, customers, employees, and communities 15 |