Attached files

| file | filename |

|---|---|

| EX-3.7 - SUPPLIER AGREEMENT - TOA Holdings, Inc. | supplieragreement_bjk37.pdf |

| EX-3.8 - JOINT VENTURE AGREEMENT - TOA Holdings, Inc. | jvagreement38.pdf |

| EX-99.2 - PRO FORMA STATEMENTS - TOA Holdings, Inc. | proforma.htm |

| EX-3.6 - CONSENT TO ISSUANCE OF NEW STOCK - TOA Holdings, Inc. | seriesa36.htm |

| EX-3.3 - STOCK PURCHASE AGREEMENT - TOA Holdings, Inc. | spajapanhd33.htm |

| EX-3.5 - HISTORICAL RECORDS OF TOA SHOKO JAPAN - TOA Holdings, Inc. | register35japan.htm |

| EX-3.4 - STOCK EXTENSION AGREEMENT - TOA Holdings, Inc. | stockextensionagreement34.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 9, 2013

TOA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 46-0992328 |

(State or Other Jurisdiction of Incorporation) |

(IRS Employer Identification No.) |

| C/O Toa Shoko, 1-1-36, Nishiawaji, Higashiyodogawa-ku Osaka 533-0031, Japan | 533-0031 | |

| (Address of principal executive offices) | (Zip Code) |

C/O Toa Shoko, 1-1-9-716, Nishiawaji, Higashiyodogawa-ku Osaka 533-0031, Japan

(Former Address of principal executive offices)

Telephone: +81-6-6325-5035

(Registrant's telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

-1-

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” or “should,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

All dollar amounts used throughout this Report are in United States dollars, unless otherwise stated. All amounts in Japanese yen used throughout this Report are preceded by JPY, for example JPY 500, is referring to 500 Japanese yen.

-2-

Table of Contents

| Page | |

| Item 1.01 Entry into a Material Definitive Agreement | 4 |

| Item 2.01 Completion of Acquisition or Disposition of Assets | 4 |

| BUSINESS | 5-7 |

| RISK FACTORS | 8-12 |

| FINANCIAL INFORMATION | 13 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 13 |

| DIRECTORS AND EXECUTIVE OFFICER | 13 |

| EXECUTIVE COMPENSATION | 14 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 15 |

| LEGAL PROCEEDINGS | 16 |

| RECENT SALES OF UNREGISTERED SECURITIES | 16 |

| DESCRIPTION OF SECURITIES | 16 |

| INDEMNIFICATION OF OFFICERS AND DIRECTORS | 17 |

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 17 |

| END OF FORM 8-K DISCLOSURE | 17 |

| FINANCIAL STATEMENTS | 18A-F |

| EXHIBITS AND SIGNATURES | 19 |

-3-

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On April 1, 2013, Hajime Abe entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with TOA Holdings, Inc., a Delaware corporation. Pursuant to the Agreement, Hajime Abe will transfer to TOA Holdings, Inc., 1,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on July 6, 2013, TOA Holdings, Inc. owns a 100% interest in the issued and outstanding shares of our common stock. TOA Holdings, Inc. is the controlling shareholder of the Company.

As described below, TOA-Japan conducts trading business. It is anticipated that following the closing of the Stock Purchase Agreement, the Company will change its business focus to that of TOA-Japan.

A copy of the Stock Purchase Agreement is attached hereto and is hereby incorporated by this reference. All references to the Stock Purchase Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

As described above, effective July 6, 2013, the Company and Mr. Hajime Abe closed the transactions contemplated by the Stock Purchase Agreement, and TOA-Japan became a wholly-owned subsidiary of the Company.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed a Stock Purchase Agreement, which caused the Company to cease being defined as a “shell company” under the Securities Act of 1933, as amended. Item 2.01(f) of Form 8-K requires that if a registrant was a shell company, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the closing of the Stock Purchase Agreement, except that information relating to periods prior to the date of the Stock Purchase Agreement only relates to the Company, unless otherwise specifically indicated.

-4-

BUSINESS

Corporate History

The Company was incorporated under the laws of the State of Delaware on September 11, 2012, with an objective to acquire, or merge with, an operating business. As of December 29, 2012, the Company had not yet commenced any operations.

On January 18, 2013, Jeffrey DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of Gold Bullion Acquisition, Inc. (the “Registrant” or “Company”), entered into a Share Purchase Agreement with Hajime Abe, C/O Toa Shoko, 1-1-36, Nishiawaji, Higashiyodogawa- ku, Osaka 533-0031, Japan. Pursuant to the Agreement, Mr. DeNunzio transferred to Hajime Abe, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of $34,900.

Following the closing of this share purchase transaction, Mr. Hajime Abe owns a 100% interest in the issued and outstanding shares of our common stock. Mr. Hajime Abe is the controlling shareholder of Gold Bullion Acquisition, Inc. Commensurate with the closing, Gold Bullion Acquisition filed with the Delaware Secretary of State, a Certificate of Amendment to change the name of Registrant to TOA Holdings, Inc.

On January 22, 2013, Mr. DeNunzio resigned as our President, Secretary, Treasurer and Director, such resignation is to be effective ten days after the filing and mailing of an Information Statement required by Rule 14f-1 under the Securities Exchange Act of 1934, as amended. The resignation was not the result of any disagreement with us on any matter relating to our operations, policies or practices.

On January 22, 2013, Mr. Hajime Abe was appointed as Director, President, Secretary and Treasurer, to hold such office ten days after the filing and mailing of an Information Statement required by Rule 14f-1 under the Securities Exchange Act of 1934, as amended.

On January 22, 2013, the Company was informed that our registered independent public accountant, Peter Messineo, CPA, of Palm Harbor Florida (“PM”) declined to stand for re-appointment. PM has merged his firm into the registered firm of Drake and Klein CPAs PA.

On January 22, 2013, the Company engaged Drake, Klein, Messineo, CPAs PA (“DKM”) of Clearwater, Florida, as its new registered independent public accountant.

On April 1, 2013, Hajime Abe entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with TOA Holdings, Inc., a Delaware corporation. Pursuant to the Agreement, Hajime Abe will transfer to TOA Holdings, Inc., 1,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on July 6, 2013, TOA Holdings, Inc. owns a 100% interest in the issued and outstanding shares of our common stock. TOA Holdings, Inc. is the controlling shareholder of the Company.

On April 22, 2013, the Company issued 1,000,000 shares of restricted Series A preferred stock valued at $100 to Hajime Abe as director’s compensation.

On April 22, 2013, the Company issued 20,000,000 shares of restricted common stock valued at $2,000 to Hajime Abe as director’s compensation.

On April 23, 2013 Hajime Abe sold 31,600,000 shares of restricted common stock to 328 shareholders.

On June 2, 2013, TOA-Japan entered into Exclusive Supplier Agreement (the “Exclusive Supplier Agreement”) with BJK GLOVAL LTD., a Bangladesh Corporation whose address is Gulfeshan Plaza, Suite No-(M9Floor), 8 Shahid Sangbadik Selina Parvin, Road-Baro Mogbazar, Dhaka-1217, Bangladesh ("BJK") which controls and manages national construction projects, manufacturing projects and projects of development of infrastructure in Republic of Bangladesh (“Projects”)

On June 28, 2013, the Company engaged Messineo & Co, CPAs, LLC (“M&Co”) of Clearwater, Florida, as its new registered independent public accountant. Peter Messineo, CPA, of Palm Harbor Florida (“PM”) has removed himself from Drake Klein CPA’s and now does business as Messineo & Co, CPAs, LLC.

-5-

Business Information of TOA-Japan

TOA-Japan was initially formed as an Osaka, Japan Corporation on January 28, 2013.

TOA-Japan is a trading company engaged in a range of global business activities including worldwide trading of various commodities, organizing and coordinating industrial projects, and assisting in the procurement of raw materials and equipment, and assisting in the client’s marketing. Our trading activities as a trading company include the sale, distribution, purchase, marketing, supply of and dealing in a wide variety of products and services, as a principal or an agent, including electronics, chemicals, food products and general merchandise.

Competition

The industry in which TOA-Japan competes is highly competitive. Our main competitors are other Japanese trading companies. Moreover, all of our potential business partners, for supply of products and services; or for establishment of joint venture operations, could also be competitors. To ensure our competitiveness, we strive to continue to successfully acquire new customers and meet the changing needs of our customers and suppliers worldwide. Analysis of competitive position by operating segment is provided in “Products and Services and Principal Activities by Reportable Operating Segments” below and also see “Item 3.D. Risk Factors.”

Because we are a small company with a limited operating history, we are at a competitive disadvantage against the large and well-capitalized companies in Japan. Therefore, our primary method of competition involves promoting the benefits of using our services over those of our competitors, including the price, delivery, quality and effectiveness of our services.

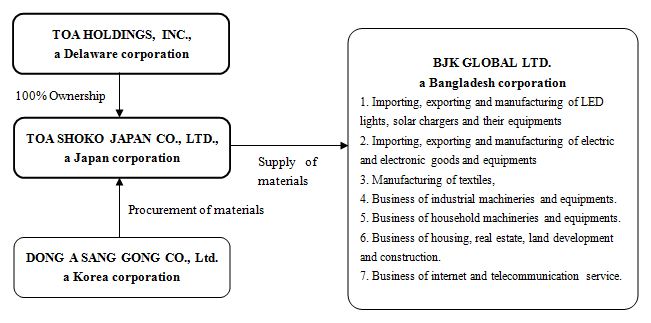

Projects in Bangladesh

On June 2, 2013, TOA-Japan entered into Exclusive Supplier Agreement with BJK GLOVAL LTD., a Bangladesh Corporation whose address is Gulfeshan Plaza, Suite No-(M9Floor), 8 Shahid Sangbadik Selina Parvin, Road-Baro Mogbazar, Dhaka-1217, Bangladesh ("BJK") which controls and manages national construction projects, manufacturing projects and projects of development of infrastructure in Republic of Bangladesh (“Projects”)

BJK GLOVAL LTD.

BJK was incorporated on May 21, 2013 to control and manage national projects as the joint venture company among Bangladeshi, Japanese and Korean.

| i. | Capital | 4,000,000 TK. (*1) | |||

| ii. | Issued and outstanding shares | 40,000 shares | |||

| iii | Ownership | Bangladeshi party | 8,000 shares (20%) | ||

| Japanese party | 8,000 shares (20%) | ||||

| Korean party | 24,000 shares (60%) | ||||

| iv. | Nature of business | 1. Importing, exporting and manufacturing of LED lights, solar chargers and their equipments | |||

| 2. Importing, exporting and manufacturing of electric and electronic goods and equipments | |||||

| 3. Manufacturing of textiles, | |||||

| 4. Business of industrial machineries and equipments. | |||||

| 5. Business of household machineries and equipments. | |||||

| 6. Business of housing, real estate, land development and construction. | |||||

| 7. Business of internet and telecommunication service. | |||||

| v. | Directors | Chairman | Hajime Abe | Japan | |

| Vice-chairman | Benjar Ahmed | Bangladesh | |||

| Managing Director | Mahabubul Haque | Korea | |||

| Deputy Managing Director | Hyangyong Seo | Korea | |||

| Kazi Showkot Hossain | Bangladesh | ||||

| Director | Gyungmee Ji | Korea | |||

| K.M. Zillur Rahmen | Bangladesh | ||||

| MD. Ashraful Hoque | Bangladesh | ||||

*1 One dollar is about equivalent to 87.8 TK. as of July 8, 2013.

-6-

Supplier

The Company has its supplier, Dong A Sang Gong Co., Ltd, a Korea corporation ("Dong A Sang Gong "). Dong A Sang Gong conduct worldwide trading business and have had business transactions in Asian countries. Mr. Hajime Abe who is our President and CEO is 49% of the owner of the outstanding shares of common stock of Dong A Sang Gong and hold the Chairman of Dong A Sang Gong concurrently.

Outline of the structure of our business

Plan of Operations for the Next 12 Months

| Planned Actions | Estimated Cost to Complete |

| Purchase products for Projects in Bangladesh. | $1,000,000 |

| Develop and increase new products for trading. | $200,000 |

| Increase customers. | $200,000 |

| Recruit, train and establish additional corporate sales agents in Japan. | $100,000 |

| Perform financial strategies. | $300,000 |

| TOTAL | $1,800,000 |

TOA-Japan will need to raise additional funding to complete the Plan of Operations set forth above. Currently TOA-Japan has only enough cash on hand to pay for its current level of day to day operations and the Securities and Exchange Commission reporting requirements the Company will become subject to as a result of the closing of the Stock Purchase Agreement.

TOA-Japan has budgeted the need for approximately $1,800,000 of additional funding during the next 12 months to affect the Plan of Operations set forth above and pay costs and expenses associated with the filing requirements with the Securities and Exchange Commission, which funding may not be available on favorable terms, if at all. If TOA-Japan is unable to raise adequate working capital it will be restricted in the implementation of its business plan.

Moving forward, we plan to seek out additional debt financing to pay costs and expenses associated with our filing requirements with the Securities and Exchange Commission and conduct our exploration activities (as described herein); however, we do not currently have any specific plans to raise such additional financing at this time. The sale of additional equity securities, if undertaken by the Company and if accomplished, may result in dilution to our shareholders. We cannot assure you, however, that future financing will be available in amounts or on terms acceptable to us, or at all.

Employees

The Company has no full-time employees and four part-time employees as of July 9, 2013.

-7-

RISK FACTORS

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations in the future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our products, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

The Company, being a Developmental Stage Company has not generated any revenues since our inception in September 2012.

We are a development stage company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Since our inception in September 2012, we have yet to generate any revenues, and currently have only limited operations, as we are presently in the planning stage of our business development as an exploration stage company. These factors raise substantial doubt about our ability to continue as a going concern. We may not be able to generate any revenues in the future and as a result the value of our common stock may become worthless. There are no assurances that we will be successful in raising additional capital or successfully developing and commercializing our products and become profitable.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small developing company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

We were incorporated in Delaware in September of 2012. We have no significant assets or financial resources. The likelihood of our success must be considered in light of the expenses and difficulties in development of worldwide clients, recruiting and keeping clients and obtaining financing to meet the needs of our plan of operations. Since we have a limited operating history we may not be profitable and we may not be able to generate sufficient revenues to meet our expenses and support our anticipated activities.

Our limited operating history makes it difficult for us to accurately forecast net sales and appropriately plan our expenses.

We have a limited operating history in the trading industry. As a result, it is difficult to accurately forecast our net sales and plan our operating expenses. We base our current and future expense levels on our operating forecasts and estimates of future net sales. Net sales and operating results are difficult to forecast because they generally depend on the volume and timing of the orders we receive, which are uncertain. Some of our expenses are fixed, and, as a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected shortfall in net sales. This inability could cause our net income in a given quarter to be lower than expected.

Our operations are concentrated in Bangladesh, which could harm our business, results of operations and financial condition if activity levels in this country decline.

Various types of businesses worldwide sometimes expose us to risks associated with regional political and economic instabilities. Furthermore, our business activities may be exposed to concentration risk in particular industries located in Bangladesh.

As a result, declining levels of trading activities or asset volumes in this country could have a disproportionately negative effect on our business, results of operations and financial condition.

-8-

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• Demand for our trading products;

• Our ability to retain existing customers or encourage repeat purchases;

• Our ability to manage our product mix and inventory;

• General economic conditions;

• Advertising and other marketing costs;

• Costs of expanding or enhancing our trading products.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our future success is dependent, in part, on the performance and continued service of Hajime Abe, our President and CEO. Without their continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Hajime Abe, our President and CEO. We currently do not have an employment agreement with Mr. Abe. The loss of his services would delay our business operations substantially.

Our current officers and directors do not have experience in the global trading business.

Although management has extensive business experience, they do not have enough experience in the global trading business. Therefore, without industry-specific experience, their business experience may not be enough to effectively start-up and maintain a global trading company. As a result, the implementation of our business plan may be delayed, or eventually, unsuccessful.

Our future success is dependant on our implementation of our business plan. We have many significant steps still to take.

Our success will depend in large part in our success in achieving several important steps in the implementation of our business plan, including the following: acquiring business information, development of clients, development of suppliers, implementing order processing and customer service capabilities, and management of business process . If we are not successful, we will not be able to implement or expand our business plan.

Our success depends upon our ability to attract and hire key personnel. Since many of our personnel will be required to be bilingual, or to have other special skills, the pool of potential employees may be small and in high demand by our competitors. Our inability to hire qualified individuals will negatively affect our business, and we will not be able to implement or expand our business plan.

Our business is greatly dependent on our ability to attract key personnel. We will need to attract, develop, motivate and retain highly skilled technical employees. Competition for qualified personnel is intense and we may not be able to hire or retain qualified personnel. Our management has limited experience in recruiting key personnel which may hurt our ability to recruit qualified individuals. If we are unable to retain such employees, we will not be able to implement or expand our business plan.

If we can not effectively increase and enhance our sales and marketing capabilities, we may not be able to increase our revenues.

We need to further develop our sales and marketing capabilities to support our commercialization efforts. If we fail to increase and enhance our marketing and sales force, we may not be able to enter new or existing markets. Failure to recruit, train and retain new sales personnel, or the inability of our new sales personnel to effectively market and sell our products, could impair our ability to gain market acceptance of our products.

Shareholders who hold unregistered shares of our common stock are subject to resale restrictions pursuant to Rule 144, due to our status as a former “Shell Company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we were previously a “shell company” pursuant to Rule 144 prior to the effectiveness of the Stock Purchase Agreement, described above, and as such, sales of our securities pursuant to Rule 144 are not able to be made until 1) we have ceased to be a “shell company” (which we believe we have in connection with the consummation of the Stock Purchase Agreement); 2) we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” (i.e., information similar to that which would be found in a Form 10 Registration Statement filing with the SEC – which we are filing in this report) has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because none of our non-registered securities can be sold pursuant to Rule 144, until at least a year after the date of this report any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after we cease to be a “shell company” and have complied with the other requirements of Rule 144, as described above. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

-9-

Our current Chief Executive Officer and President, Hajime Abe, beneficially owns approximately or has the right to vote 77.8% of our outstanding common stock and preferred stock. As a result, he will have the ability to control substantially all matters submitted to our stockholders for approval including:

• Election of our board of directors;

• Removal of any of our directors;

• Amendment of our Certificate of Incorporation or bylaws; and

• Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership and position, he is able to influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by him could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Mr. Abe's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Our growth will place significant strains on our resources.

The Company is currently in the exploration stage, with only limited operations, and has not generated any revenues since inception in September 2012. The Company's growth, if any, is expected to place a significant strain on the Company's managerial, operational and financial resources. Moving forward, the Company's systems, procedures or controls may not be adequate to support the Company's operations and/or the Company may be unable to achieve the rapid execution necessary to successfully implement its business plan. The Company's future operating results, if any, will also depend on its ability to add additional personnel commensurate with the growth of its operations, if any. If the Company is unable to manage growth effectively, the Company's business, results of operations and financial condition will be adversely affected.

As we are a public reporting company, we will incur significant costs in connection with compliance with Section 404 Of the Sarbanes Oxley Act, and our management will be required to devote substantial time to new compliance initiatives.

We are subject to among other things, the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, and will incur significant legal, accounting and other expenses in connection with such requirements. The Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") and new rules subsequently implemented by the SEC have imposed various new requirements on public companies, including requiring changes in corporate governance practices. As such, our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. In addition, the Sarbanes-Oxley Act requires, among other things, that we report on the effectiveness of our internal controls for financial reporting and disclosure of controls and procedures. Our compliance with Section 404 will require that we incur additional accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that we only have three officers and Directors, who have no experience as officers or Directors of a reporting company, such lack of experienced personnel may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identify deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

-10-

Our officers and Directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

While we rely heavily on Hajime Abe, he lacks experience in and with the reporting and disclosure obligations of publicly-traded companies and with serving as an officer or Director of a publicly-traded company. Such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders. Consequently, our operations, future earnings and ultimate financial success could suffer irreparable harm due to our officers and directors ultimate lack of experience in our industry and with publicly-traded companies and their reporting requirements in general. Additionally, due to the fact that all of our officers and Directors are currently located in Japan; having employment outside of the Company; and lacking experience with companies in our industry, we may be unable to successfully implement our business plan, and/or manage our future growth if any. Our officers and Directors do not currently believe that their outside employment affects the day to day operations of the Company. While the Company believes that the time and resources that our officers and Directors are able to provide to the Company, and/or which they may be willing to provide to us in the future, as well as our outside consultants are adequate to support the Company’s business plan, our operations and growth (if any) may be adversely affected by the fact that our officers and Directors are located in another country, only being able to provide a limited number of hours of service to the Company per week and/or their outside employment.

There is uncertainty as to our ability to enforce civil liabilities both in and outside of the United States due to the fact that our officers, Directors and certain of our assets are not located in the United States.

Our office is not located in the United States. Our officers and Directors are located in Japan and the operations and assets of TOA-Japan are located in Japan. As a result, it may be difficult for shareholders to effect service of process within the United States on our officers and Directors. In addition, investors may have difficulty enforcing judgments based upon the civil liability provisions of the securities laws of the Unites States or any state thereof, both in and outside of the United States.

Risks Relating To the Company’s Securities

We may never have a public market for our common stock or that the common stock will ever trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTC Bulletin Board. In addition, it is possible that, such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issuance additional shares of our common stock which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock, of which 40,000,000 shares are issued and outstanding as of July 9, 2013. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of "blank check" preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Currently, our series A preferred stock entitles the holder thereof to 100 votes on all matters upon which the holders of the common stock of the Company are entitled to vote. Series A Preferred Stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

If we become registered with the SEC, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

-11-

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and NYSE AMEX Equities exchanges and the NASDAQ Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the NASDAQ Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

If we become a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases but lower during the first year of being public because our overall business volume will be lower, and we will not yet be subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

-12-

FINANCIAL INFORMATION

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following summarizes the factors affecting the operating results and financial condition of the Company following the closing of the Stock Purchase Agreement. This discussion should be read together with the financial statements of TOA-Japan and the notes to financial statements included elsewhere in this current report. In addition to historical financial information, the following discussion and analysis contain forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors, including those discussed under “Risk Factors” and elsewhere in this report. We encourage you to review our “Cautionary Note Regarding Forward-Looking Statements and Industry Data” at the front of this current report, and our “Risk Factors” set forth above.

Results of Operations of TOA Shoko Japan Co., Ltd.

TOA-Japan was incorporated on January 28, 2013. As of March 31, 2013, TOA-Japan generated no revenues and $515 of deficits from inception.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

As of July 9, 2013, the Company has 40,000.000 shares of common stock and 1,000,000 shares of preferred stock issued and outstanding, which number of issued and outstanding shares of common stock and preferred stock have been used throughout this report.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares Preferred Stock Are Able to Vote | Total Voting Shares | Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors | |||||

| Hajime Abe | 8,510,000 | 21.2% | 1,000,000 | 100.0% | 77.5% |

| 5% Shareholders | |||||

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

DIRECTORS AND EXECUTIVE OFFICERS

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of the Company and TOA-Japan following the consummation of the Stock Purchase Agreement are provided below:

| NAME | AGE | POSITION | |||||

| Hajime Abe | 61 | President, Chief Executive Officer, and Director | |||||

Hajime Abe

Mr. Hajime Abe began his career in 1969 as an employee of Nissan Motor Company as a car salesman. Following this, in 1974, he incorporated Abe Motor Sales Co., Ltd., a Japan Corporation. A decade later in 1989, he incorporated Koa Commerce Co., Ltd. a Japan Corporation and in 1993 incorporated another Japanese company known as World Liberty Co., Ltd. More recently, in 2007 Mr. Abe incorporated the Japanese company IKL Holdings Co., Ltd. and in 2010 was appointed as President and Director of Oidon Co., Ltd, a Wyoming Corporation that he recently resigned from this past July, 2012. On January 28, 2013, he was appointed as the Chairman of Dong A Sang Gong Co., Ltd, a Korea corporation ("Dong A Sang Gong "). On January 28, 2013, he incorporated TOA Shoko Japan, a Japan corporation. On May 21, 2013, he was appointed as the Chairman of BJK GLOVAL LTD., a Bangladesh corporation.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the functions of such committees can be adequately performed by the Director(s).

Audit Committee Financial Expert

Our board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert" as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the functions of an audit committee can be adequately performed by the Board of Directors. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Directors and our executive officers have not been involved in any of the following events during the past ten years:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

-13-

EXECUTIVE COMPENSATION

Summary Compensation Table:

Name and principal position (a) |

Year ended September 30 (b) |

Salary ($) (c) |

Bonus ($) (d) |

Stock Awards ($) (e) |

Option Awards ($) (f) |

Non-Equity Incentive Plan Compensation ($) (g) |

Nonqualified Deferred Compensation Earnings ($) (h) |

All Other Compensation ($) (i) |

Total ($) (j) |

||||||||||||||||||||||||

Hajime Abe, President |

2013 (1) | - | - | 2,100 (2) | - | - | - | - | 2,100- | ||||||||||||||||||||||||

(1) On January 18, 2013 , Mr. DeNunzio, as the Company’s then sole Director appointed Hajime Abe as Directors of the Company. Immediately thereafter, Mr. DeNunzio resigned as an officer and Director of the Company and the Board of Directors of the Company appointed Mr. Abe as the President ,Chief Executive Officer, Secretary and Treasurer of the Company.

2) On April 22, 2013, the Company issued 1,000,000 shares of Series A preferred stock and 20,000,000 shares of restricted common stock valued at $100 and $2,000 to Hajime Abe as director’s compensation.

Compensation of Directors

The table below summarizes all compensation of our directors as of July 9, 2013.

| DIRECTOR COMPENSATION | ||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Hajime Abe (1) | - | 2,100 (1) |

- | - | - | - | 2,100 | |||||||||||||||||||||

(1) On April 22, 2013, the Company issued 1,000,000 shares of Series A preferred stock and 20,000,000 shares of restricted common stock valued at $100 and $2,000 to Hajime Abe as director’s compensation.

Summary of Compensation

TOA Holdings, Inc. was incorporated in September 2012 and has paid $2,100 as stock compensation to our sole Director to date.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors.

-14-

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executive or any future executives a salary, and/or issue them shares of common stock issued in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock based compensation to certain executives which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, in the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On January 18, 2013, Hajime Abe entered into a Share Purchase Agreement (the “Agreement”) with Jeffrey DeNunzio. Pursuant to the Agreement, Mr. DeNunzio transferred to Hajime Abe, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of $34,900.

On April 22, 2013, the Company issued 1,000,000 shares of Series A preferred stock valued at $100 to Hajime Abe as director’s compensation..

On April 22, 2013, the Company issued 20,000,000 shares of restricted common stock valued at $2,000 to Hajime Abe as director’s compensation.

Certain Relationships and Related Transactions Related to TOA-Japan

On January 28, 2013, TOA-Japan was incorporated under Japanese Companies Act with a purpose to conduct trading business. Mr. Hajime Abe was appointed as Director and President of TOA-Japan.

On April 1, 2013, Hajime Abe entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with TOA Holdings, Inc., a Delaware corporation. Pursuant to the Agreement, Hajime Abe will transfer to TOA Holdings, Inc., 1,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on July 6, 2013, TOA Holdings, Inc. owns a 100% interest in the issued and outstanding shares of our common stock. TOA Holdings, Inc. is the controlling shareholder of the Company.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transaction.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company's internal accounting controls, practices and policies.

-15-

LEGAL PROCEEDINGS

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

RECENT SALES OF UNREGISTERED SECURITIES

On April 1, 2013, Hajime Abe entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with TOA Holdings, Inc., a Delaware corporation. Pursuant to the Agreement, Hajime Abe will transfer to TOA Holdings, Inc., 1,000,000 shares of our common stock which represents all of our issued and outstanding shares in consideration of 1,000,000 JPY ($10,089 USD). Following the closing of the share purchase transaction on July 6, 2013, TOA Holdings, Inc. owns a 100% interest in the issued and outstanding shares of our common stock. TOA Holdings, Inc. is the controlling shareholder of the Company.

On April 23, 2013, Mr. Hajime Abe entered into stock purchase agreements with Japanese 328 new shareholders (“Japanese Shareholders”). Pursuant to these agreements, Mr. Abe sold 31,600,000 shares of common stock of the Company to Japanese.

We claim an exemption from registration afforded by Section 4(2) and/or Regulation S of the Securities Act of 1933, as amended ("Regulation S") for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

DESCRIPTION OF SECURITIES

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.001 par value per share (“Preferred Stock”). As of the date of this filing and taking into account the Share Transactions, we have 40,000,000 shares of Common Stock and 1,000,000 of Preferred Stock issued and outstanding.

Common Stock

The holders of outstanding shares of Common Stock are entitled to receive dividends out of assets or funds legally available for the payment of dividends of such times and in such amounts as the board from time to time may determine. Holders of Common Stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders. There is no cumulative voting of the election of directors then standing for election. The Common Stock is not entitled to pre-emptive rights and is not subject to conversion or redemption. Upon liquidation, dissolution or winding up of our company, the assets legally available for distribution to stockholders are distributable ratably among the holders of the Common Stock after payment of liquidation preferences, if any, on any outstanding payment of other claims of creditors.

Preferred Stock

Shares of Preferred Stock may be issued from time to time in one or more series, each of which shall have such distinctive designation or title as shall be determined by our Board of Directors (“Board of Directors”) prior to the issuance of any shares thereof. Preferred Stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof, as shall be stated in such resolution or resolutions providing for the issue of such class or series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then outstanding shares of our capital stock entitled to vote generally in the election of the directors, voting together as a single class, without a separate vote of the holders of the Preferred Stock, or any series thereof, unless a vote of any such holders is required pursuant to any Preferred Stock Designation. Currently, our series A preferred stock entitles the holder thereof to 100 votes on all matters upon which the holders of the common stock of the Company are entitled to vote. Series A Preferred Stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions.

Options and Warrants

None.

Convertible Notes

None.

-16-

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Delaware Corporation Law and our Certificate of Incorporation, allow us to indemnify our officers and Directors from certain liabilities and our Bylaws, as amended (“Bylaws”), state that we shall indemnify every (i) present or former Director, advisory Director or officer of us and (ii) any person who while serving in any of the capacities referred to in clause (i) served at our request as a Director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise. (each an “Indemnitee”).

Our Bylaws provide that the Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that he is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise, against expenses (including attorneys fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with which action, suit or proceeding, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, that he had reasonable cause to believe that his conduct was unlawful.

Except as provided above, our Certificate of Incorporation provides that a Director shall be liable to the extent provided by applicable law, (i) for breach of the director's duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of the DELAWARE CORPORATION LAW or (iv) for any transaction from which the director derived an improper personal benefit. If the DELAWARE CORPORATION LAW hereafter is amended to authorize the further elimination or limitation of the liability of directors, then the liability of a director of the Corporation, in addition to the limitation on personal liability provided herein, shall be limited to the fullest extent permitted by the amended DELAWARE CORPORATION LAW. Neither any amendment to or repeal of this Article 7, nor the adoption of any provision hereof inconsistent with this Article 7, shall adversely affect any right or protection of any director of the Corporation existing at the time of, or increase the liability or alleged liability of any director of the Corporation for or with respect to any acts or omissions of such director occurring prior to or at the time of such amendment.

Neither our Bylaws, nor our Certificate of Incorporation include any specific indemnification provisions for our officer or Directors against liability under the Securities Act of 1933, as amended. Additionally, insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the "Act") may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Financial Statements of TOA-Japan, including audited information from inception through March 31, 2013 and pro forma for the Stock Purchase Agreement that had occurred on February 1, 2013, are attached hereto and disclosed in Item 9.01 of this Form 8-k and incorporated herein by this reference.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE

None.

FINANCIAL STATEMENTS AND EXHIBITS

Financial Statements and Exhibits are referenced in Item 9.01 of this Form 8-k and are incorporated herein.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

We file reports with the SEC. These reports, including annual reports, quarterly reports as well as other information we are required to file pursuant to securities laws. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

END OF FORM 8-K DISCLOSURE

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES.

See “Recent Sales of Unregistered Securities”, above.

ITEM 5.03 AMENDMENTS TO CERTIFICATE OF INCORPORATION; CHANGE IN FISCAL YEAR

On January 22, 2013, the Company’s Board of Directors approved to change the name of the Company from “Gold Bullion Acquisition, Inc.” to TOA Holdings, Inc.” The name change was also approved by a majority shareholder vote without conducting a shareholders’ meeting as permitted by the Delaware Corporation Act. On January 22, 2013, we filed a Certificate of Amendment with the Delaware Secretary of State. The effective date of the name change shall be upon the acceptance of the Certificate of Amendment with the Secretary of State of the State of Delaware.

ITEM 5.06. CHANGE IN SHELL COMPANY STATUS.

Upon the closing of the Stock Purchase Agreement (as described in Item 1.01 and 2.01, above), we ceased our status as a “shell company,” as defined in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”). Additionally, in connection with the closing of the Stock Purchase Agreement, the Company changed its business focus to that of TOA-Japan, worldwide trading of various commodities, organizing and coordinating industrial projects, assisting in the procurement of raw materials and equipment, and assisting in the client’s marketing as were contemplated by its previous business plan. Accordingly, we have set forth above the information, including the information with respect to our new operations that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting our common stock in this Report on Form 8-K, above.

-17-

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

TOA SHOKO JAPAN CO., LTD.

(A Development Stage Entity)

INDEX TO FINANCIAL STATEMENTS

| Pages | ||

| Report of Independent Registered Public Accounting Firm as of March 31, 2013 and for the period from January 28, 2013 (inception) to March 31, 2013. | 18A | |

| Balance Sheet at March 31, 2013 (audited) | 18B | |

| Statements of Operations for the period ending March 31, 2013 and January 28, 2013 (inception) to March 31, 2013 (audited) | 18C | |

| Statements of Changes in Stockholders’ Equity for the period ending March 31, 2013 and January 28, 2013 (inception) to March 31, 2013 (audited) | 18D

| |

| Statements of Cash Flows for the period ending March 31, 2013 and January 28, 2013 (inception) to March 31, 2013 (audited) | 18E | |

| Notes to Audited Financial Statements | 18F |

Messineo & Co, CPAs LLC 2451 N McMullen Booth Rd - Ste. 309 Clearwater, FL 33759-1362 T: (727) 421-6268 F: (727) 674-0511 |

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of:

TOA Shoko Japan Co., Ltd.

We have audited the accompanying balance sheet of TOA Shoko Japan Co., Ltd. as of March 31, 2013 and the related statements of operations, stockholders' equity and cash flows for the year then ended and for the period from January 28, 2013 (inception) to March 31, 2013. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of TOA Shoko Japan Co., Ltd. as of March 31, 2013, and the results of its operations and its cash flows for the year then ended, and for the period from January 28, 2013 (inception) to March 31, 2013, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company had a comprehensive net loss, negative cash flow from operating activities, and is still in the development stage. These conditions raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Messineo & Co. CPAs, LLC

Clearwater, Florida

June 12, 2013

-18A-

| TOA SHOKO JAPAN CO., LTD. | |||

| (A Development Stage Company) | |||

| BALANCE SHEET | |||

| As of | |||

| March 31, 2013 | |||

| ASSETS | |||

| Current Assets | |||

| Cash and cash equivalents | $ | 10,617 | |

| TOTAL CURRENT ASSETS | $ | 10,617 | |

| TOTAL ASSETS | $ | 10,617 | |

COMMITMENTS AND CONTINGENCIES (Note 7) |

|||

| LIABILITIES | |||

| Current Liabilities | |||

| Taxes payable | $ | 123 | |

| TOTAL CURRENT LIABILITIES | $ | 123 | |

| TOTAL LIABILITIES | $ | 123 | |

| Stockholders’ Equity (Deficit) | |||

| Common stock (No par value , 10,000,000 shares authorized, | |||

| 1,000,000 shares issued and outstanding | |||

| as of March 31, 2013) | $ | 11,008 | |

| Deficit accumulated during the development stage | (124) | ||

| Accumulated other comprehensive income: | |||

| Foreign currency translation adjustment | (390) | ||

| TOTAL SHAREHOLDER EQUITY | $ | 10,494 | |

| TOTAL LIABILITIES AND SHAREHOLDER EQUITY | $ | 10,617 | |

The accompanying notes are an integral part of these financial statements

-18B-

| TOA SHOKO JAPAN CO., LTD. | |||