Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lincolnway Energy, LLC | a8k-july2013newsletter.htm |

NEVADA, IOWA Volume IX, Issue 2 July 2013 INSIDE THIS EDITION Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Office: 515-232-1010 Fax: 515-663-9335 www.lincolnwayenergy.com Ethanol has grown into a force in the U.S. Fuel system and has been a major factor in lifting the futures of the American farmer. We have grown from a small additive to 10 percent of the U.S. fuel supply. The oil industry, in the same period of time, has seen demand for gasoline drop due to im- provement in automotive technology and consequently has focused on at least stop- ping increased ethanol use at this level - or even potentially rolling it back. This is a real dog fight and at stake are both future growth of our industry and stability of the whole grain farming sector. The primary objectives of the RFS were to reduce U.S. petroleum imports and consumption, diversify the energy supply with cleaner fuels, and introduce competi- tion in the fuel marketplace monopolized by oil throughout modern history. The program is succeeding on all counts. Monte Shaw, executive director of the Iowa Renewable Fuels Association, said, “Renewable fuels benefit the American consumer by lowering gas prices, creating American jobs, and decreasing our depen- dence on foreign oil.” A 2012 study released by the Center for Agriculture and Rural Development at Iowa State University says without ethanol UNDER ATTACK AND MAKING HISTORY By Eric Hakmiller, President and CEO in the marketplace, pump prices would ac- tually be $1.69 more per gallon across the Midwest. Iowa continues to lead on renewable fuels production. There are 41 ethanol refiner- ies in Iowa, including Lincolnway Energy, and together they are able to produce over 3.7 billion gallons of clean burning etha- nol each year. According to the U.S. Energy Information Administration, even with expanding do- mestic crude oil production, Americans will continue to spend roughly $300 bil- lion a year on oil imports. And it’s impor- tant to note the majority of these imports come from politically unstable and hostile regions. We have made a dent in the use of petro- leum to the benefit of our current environ- ment and that of our children. Still, this has taken marketshare from oil refineries who have lased out with outlandish claims, ob- solete data, and pseudo-science. This has served to cloud the issue and pull the at- tention away for their ecnomic losses. Issues like food versus fuel are a prime example of clouding the issue. Accord- ing to Matt Erickson, an economist with continued on page 3 Under Attack and Making History Unit Trading Forward Looking Statements Lincolnway Energy Financial Results Welcome Eric Hakmiller 1 1 2 2 3 UNIT TRADING February: 50 units @ $475/unit 5 units @ $450/unit 12 units @ $400/unit 57 units @ $375/unit March: No sales April: 25 units @ $470/unit May: No sales Exhibit 99

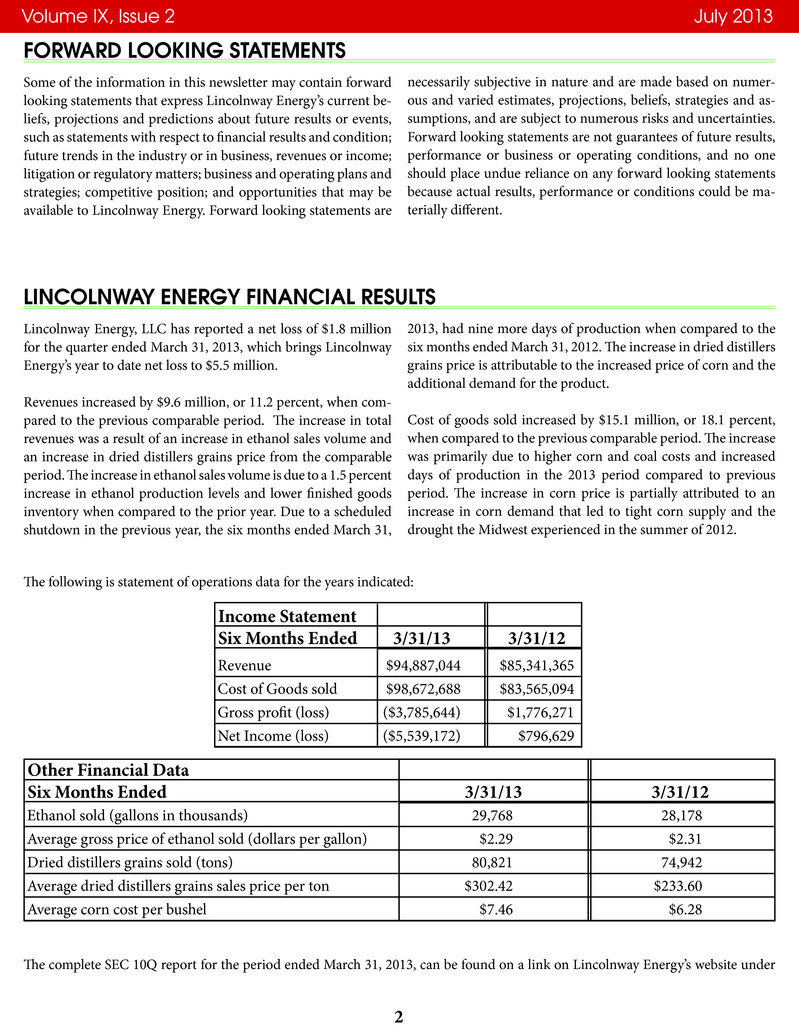

Some of the information in this newsletter may contain forward looking statements that express Lincolnway Energy’s current be- liefs, projections and predictions about future results or events, such as statements with respect to financial results and condition; future trends in the industry or in business, revenues or income; litigation or regulatory matters; business and operating plans and strategies; competitive position; and opportunities that may be available to Lincolnway Energy. Forward looking statements are LINCOLNWAY ENERGY FINANCIAL RESULTS Lincolnway Energy, LLC has reported a net loss of $1.8 million for the quarter ended March 31, 2013, which brings Lincolnway Energy’s year to date net loss to $5.5 million. Revenues increased by $9.6 million, or 11.2 percent, when com- pared to the previous comparable period. The increase in total revenues was a result of an increase in ethanol sales volume and an increase in dried distillers grains price from the comparable period. The increase in ethanol sales volume is due to a 1.5 percent increase in ethanol production levels and lower finished goods inventory when compared to the prior year. Due to a scheduled shutdown in the previous year, the six months ended March 31, Volume IX, Issue 2 July 2013 FORWARD LOOKING STATEMENTS 2013, had nine more days of production when compared to the six months ended March 31, 2012. The increase in dried distillers grains price is attributable to the increased price of corn and the additional demand for the product. Cost of goods sold increased by $15.1 million, or 18.1 percent, when compared to the previous comparable period. The increase was primarily due to higher corn and coal costs and increased days of production in the 2013 period compared to previous period. The increase in corn price is partially attributed to an increase in corn demand that led to tight corn supply and the drought the Midwest experienced in the summer of 2012. 2 necessarily subjective in nature and are made based on numer- ous and varied estimates, projections, beliefs, strategies and as- sumptions, and are subject to numerous risks and uncertainties. Forward looking statements are not guarantees of future results, performance or business or operating conditions, and no one should place undue reliance on any forward looking statements because actual results, performance or conditions could be ma- terially different. The complete SEC 10Q report for the period ended March 31, 2013, can be found on a link on Lincolnway Energy’s website under The following is statement of operations data for the years indicated: Income Statement Six Months Ended 3/31/13 3/31/12 Revenue $94,887,044 $85,341,365 Cost of Goods sold $98,672,688 $83,565,094 Gross profit (loss) ($3,785,644) $1,776,271 Net Income (loss) ($5,539,172) $796,629 Other Financial Data Six Months Ended 3/31/13 3/31/12 Ethanol sold (gallons in thousands) 29,768 28,178 Average gross price of ethanol sold (dollars per gallon) $2.29 $2.31 Dried distillers grains sold (tons) 80,821 74,942 Average dried distillers grains sales price per ton $302.42 $233.60 Average corn cost per bushel $7.46 $6.28

Volume IX, Issue 2 July 2013 3 Welcome Eric Hakmiller Hi, my name is Eric Hakmiller and I want to say how much I appreciate the chance to work with everyone here at Lincol- nway Energy. I have been in the grain processing business now for 25 years and worked with both corn and soybeans. I have made or sold everything from high fructose corn syrup and soy protein isolates to rapeseed bypass meal and industrial grade lecithins in markets all over the world. I have been working in the US biofuels market for the last six years and have really come to love this industry. My path into the grain business was not a standard one in that, after graduating from the University of Maine with a degree in Economics, I went to work for American Maize while living in California. American Maize was the last of the family owned wet millers and had a traditional corn wet mill in Hammond, Indi- ana, and produced high fructose corn syrup in Dimmitt, Texas, and Decatur, Alabama. I started selling commodity sweeteners to the fruit canning industry and the soft drink industry on the west coast. This was a great place to learn the business, the value of working for your customers, the importance of knowing how the commodity markets worked and how to survive in an industry where margins were very thin. Over the next six years I settled into life in California. I met and married my wife, Rhonda, a native Californian and took more and more commercial responsibility with American Maize. This brought us an opportunity to move to Chicago and work out of the CBOT. I would manage all the national accounts for the com- pany, doing on a national scale what I was able to do in California. Chicago turned out much like I had hoped with an opportunity to learn more about the markets and to build a team of my own. The company was sold to a European wet miller called Cerestar which presented an opportunity to learn how the business was done in other parts of the world. Soon they offered me a chance to move to the parent company in Paris, France. By now my fam- ily had grown by three (with the youngest only three months old) but we packed up and headed to Europe. We truly loved Paris and spent three great years there. Here I learned the soy business with Central Soya and also worked with Provimi, a global animal feed operation. Soon though, the con- solidation pressures that have been working in agriculture caught up with us again and the company was sold to Bunge Limited. I moved back the US and started working with Central Soya in a division that made protein for human consumption just in time for that division to be rolled into a DuPont joint venture. By now we were located in Saint Louis and our family had grown to four children. I eventually returned to Bunge, first spending a year running their German operations and then coming back to Saint Louis to run the biofuels operation. After all the moves both in businesses and places, I feel I have found a home in biofuels. I like the technology and the markets and feel we as an industry are giving something important to the country. We are in a struggle today with those who for their own personal reasons want to roll back our energy policy to the 1960s but feel in the end we will prevail. I look forward to working with Lincolnway in that process and want to thank you all for giving me this opportunity. I am looking forward to this very much. the American Farm Bureau, they are off base. “Within every one dollar purchase of food, about 11 cents goes to the farm and agribusiness share, 89 cents goes to the marketing, processing, energy, packaging, transport, trade, servicing, advertising, labor and anything else required to get that food onto your plate. So there are a lot of variables that need to be considered when we talk about food prices.” Erickson also pointed out the other benefits of the RFS. “The Re- newable Fuels Standard allows us to become energy independent from foreign sources that do supply the majority of the oil across the world. When you look at renewable fuels, it’s just that. It’s renewable. It can be grown year after year after year and having a farmer or rancher supply that energy source, it’s a great thing.” Your voice needs to be heard as the Farm Bill is debated in Wash- ington, DC. I encourage you to contact our Federal Representa- tives and Senators with your support for a strong, effective Re- newable Fuels Standard which has proven greatly beneficial to our state and nation. Please feel free to call me directly at the plant if you are interested in seeing who in Washington needs to be contacted. Thank you for being involved, engaged, and in- vested in Lincolnway Energy. continued from page 1

Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Volume IX, Issue 2 July 2013 COME JOIN US ON THE WEB! If you haven’t already, please give us your e-mail address. This way you can receive the full color newsletter via e-mail and we can save on postage. E-mail your request to us at info@lincolnwayenergy.com.