Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chelsea Therapeutics International, Ltd. | v349586_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Chelsea Therapeutics International, Ltd. | v349586_ex99-1.htm |

Chelsea Therapeutics Corporate Overview July 2013 © 2004 - 2013 Chelsea Therapeutics, Inc.

Forward - Looking Statements This presentation is being provided for informational and discussion purposes . This presentation is not intended to provide and should not be relied upon as investment advice or an opinion regarding the appropriateness or suitability of any investment . Nothing herein should be construed to be an offer to sell, or a solicitation of an offer to buy, any securities . This presentation contains forward - looking statements regarding future events including our intention to pursue the development of Northera . These statements are subject to risks and uncertainties that could cause the actual events or results to differ materially . These include reliance on key personnel and our ability to attract and/or retain key personnel ; the risk that FDA will not agree that our clinical trial results demonstrate the safety and effectiveness of droxidopa ; the risk that the FDA will not accept our proposal regarding any trial or other data to support a new drug application ; the risk that the FDA does not accept the resubmitted NDA for Northera for filing and that the FDA will not approve the resubmitted NDA ; the risk that our resources will not be sufficient to conduct any study of Northera that will be acceptable to the FDA ; the risk that we cannot complete any additional study for Northera without the need for additional capital ; the risks and costs of drug development and that such development may take longer or be more expensive than anticipated ; our need to raise additional operating capital in the future ; our reliance on our lead drug candidate droxidopa ; risk that we will not be able to obtain regulatory approvals of droxidopa or our other drug candidates for additional indications ; risk of volatility in our stock price, related litigation, and analyst coverage of our stock ; reliance on collaborations and licenses ; intellectual property risks ; our history of losses ; competition ; market acceptance for our products if any are approved for marketing . NASDAQ: CHTP 2

Lead Drug C andidate is Northera (droxidopa) Oral “pro - drug ” of norepinephrine; directly metabolized to form norepinephrine • Replenishes diminished level of natural neurotransmitter, norepinephrine, within the autonomic nervous system • Unique mechanism of action limits side effects seen with other drugs • Only chronic oral therapy treating root cause of NOH Well documented safety and efficacy; marketed in Japan since 1989 • Orthostatic hypotension associated with Parkinson’s Disease • Freezing of gait in Parkinson's Disease • Hypotension associated with dialysis Targeting Symptomatic Neurogenic Orthostatic Hypotension (NOH ) • Significant unmet medical need Northera ™ (droxidopa) NASDAQ: CHTP 3

Neurogenic Orthostatic Hypotension Neurogenic Orthostatic Hypotension (Neurogenic OH or NOH): Sudden, potentially dangerous, fall in blood pressure when standing from a sitting or lying position • Caused by diminished synthesis and/or release of the norepinephrine used by autonomic nerves to regulate vasoconstriction • 500 – 1000 mL of blood shifts to the lower body upon standing • Reduced ability to push blood back to the heart and brain from the lower body • Poor perfusion of the brain leads to dizziness, lightheadedness & syncope • Some patients cannot stand unaided for more than a few minutes a day NASDAQ: CHTP 4

The Neurogenic OH Patient Parkinson’s Disease • Prevalence of disease: 120 cases per 100,000 population • Prevalence of symptomatic Neurogenic OH: approx. 18% Multiple System Atrophy • Prevalence of disease: 1 - 9 cases per 100,000 population • Prevalence of symptomatic Neurogenic OH: approx. 81% Pure Autonomic Failure • Prevalence of disease: 1 - 9 per 100,000 population • Prevalence of symptomatic Neurogenic OH: 100% Symptomatic Neurogenic OH is an orphan disease Affects patients with primary autonomic failure, a group of diseases that includes… NASDAQ: CHTP 5

NOH: Current Therapeutic Landscape NASDAQ: CHTP 6 Midodrine (ProAmatine ®) … available in generic form • Alpha agonist - undifferentiated pressor effect with troublesome side effects • Black box warning for supine hypertension…22% at 10 mg dose • Paresthesia (tingling, pricking or numbness of skin (scalp)… 18% • Piloerection (goose bumps, hair standing on end )… 13% • Poor patient persistence and compliance • Poor penetration of PD market • Never satisfied FDA’s requirement to demonstrate symptomatic improvement • FDA agreement - As of Dec 2011 Shire is required to conduct two milestone - driven efficacy trials to demonstrate symptomatic benefit with a submission deadline of Sept 2014. Fludrocortisone ( Florinef ®) … available in generic form • Synthetic corticosteroid indicated for treatment of Addison's disease • Water and Salt retention is one of the side effects • Extensively utilized off - label for Orthostatic Hypotension

Existing Symptomatic NOH Market Market size: • Approximately 145K patients taking midodrine and/or fludrocortisone for NOH (2010 data) • Growing market with aging US population NO existing promotion or Pharma sponsored awareness programs Concentrated prescriber base: • Small identified group of Neurology + Cardiology + PCP prescribers NASDAQ: CHTP 0 100,000 200,000 300,000 400,000 500,000 600,000 2006 2007 2008 2009 2010 2011 2012 Midodrine Annual Total Rx* 232 MDs = 10% 3700 MDs 50% Midodrine Prescribers 7

Northera: US Commercial Opportunity in NOH Projected US sales potential of $300 - $375 million within 3 - 5 years of launch Assumptions: • Differentiated product label would allow for an attractive US Pricing Model • Majority of payers will cover but with high co - pays and/or as second line to generic midodrine • Relatively limited Sales Force and Promotional Requirements • Peak sales projections equate to capturing 15 - 20% of market (of existing treated patients) • Midodrine remains on the market with no form of restriction NASDAQ: CHTP 8

Regulatory Landscape Complete Response Letter (CRL) • Requirement for an additional clinical study showing efficacy to support Study 301 • Inconsistencies in the overall findings (failure of Study 302, 303) • Disproportionate contribution of specific clinical sites to the overall results of Study 301 • Cited need for evidence of durability of effect FDA Feedback Post - CRL • Study 306B could serve as confirmatory study • Short term endpoint acceptable for approval review • Durability could potentially be verified post - approval NASDAQ: CHTP 9

NDA Resubmission: Basis for Approval Accelerated Approval; allows durability to be proven post - approval • Proposed two complementary post - market trials • Study 1 – Long term (12 week) study, n~450. Planned initiation in Q4, 2013 • Study 2 – Design to be discussed with FDA during review and initiated post - approval Two adequate, well controlled, positive Phase III studies demonstrating short - term effectiveness • Study 301 and 306B provide independent substantiation for each other • Alleviates potential concerns with individual study results or design • Reduces the importance of smaller studies (Study 302, 303) for the development program overall • Study 306B results consistent with the overall Study 306 (A+B) • Highly consistent data across multiple endpoints NASDAQ: CHTP 10

Two Independent Studies: Highly Consistent Efficacy Mean +SEM Improvement OHSA Item #1 from Baseline to Week 1 NASDAQ: CHTP 11

Two Independent Studies: Highly Consistent Efficacy Proportion of Patients with ≥50% Improvement in OHSA Item 1 at Week 1 NASDAQ: CHTP 12

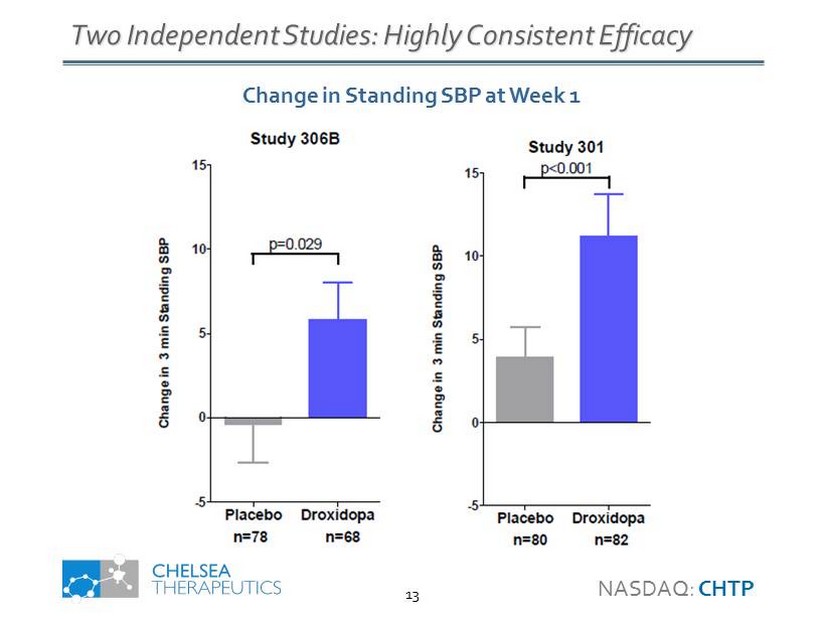

Two Independent Studies: Highly Consistent Efficacy Change in Standing SBP at Week 1 NASDAQ: CHTP 13

Study 306B: Striking Reduction in Falls Droxidopa also associated with a reduction in fall related injuries • 25.6% of placebo patients injured • 16.9% of droxidopa patients injured Includes debilitating injuries in Placebo patients • Traumatic Brain Injury • Fibula Fracture • Facial Bones Fracture • Not observed in droxidopa patients Neither falls nor fall related injuries were statistically significant Cumulative Patient Falls 232 391 498 586 716 46 76 101 140 229 0 100 200 300 400 500 600 700 800 By End of Titration By Week 1 By Week 2 By Week 4 By Week 8 32. 1 60.9 62. 3 52.6 Droxidopa n = 69 Placebo, n = 78 NASDAQ: CHTP 14 Placebo D roxidopa

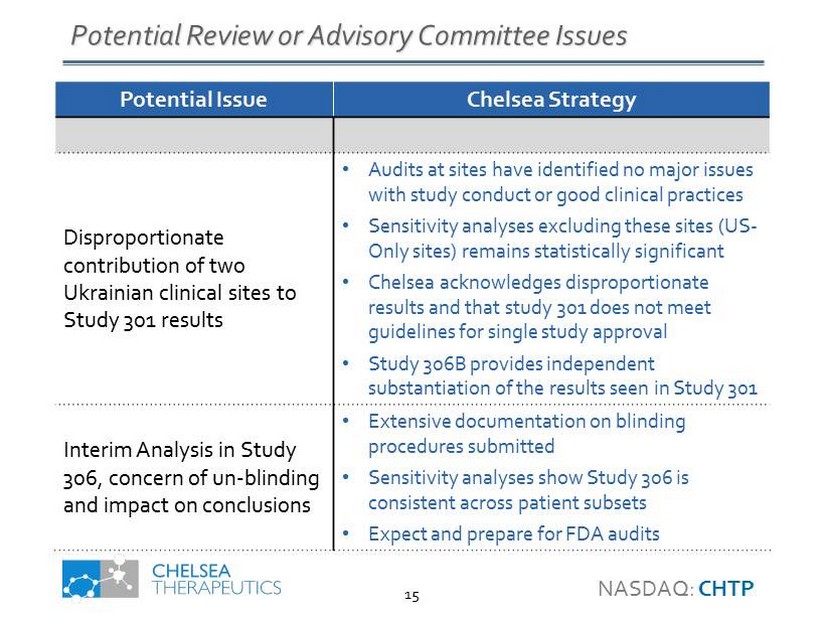

Potential Review or Advisory Committee Issues Potential Issue Chelsea Strategy Disproportionate contribution of two Ukrainian clinical sites to Study 301 results • Audits at sites have identified no major issues with study conduct or good clinical practices • Sensitivity analyses excluding these sites (US - Only sites) remains statistically significant • Chelsea acknowledges disproportionate results and that study 301 does not meet guidelines for single study approval • Study 306B provides independent substantiation of the results seen in Study 301 Interim Analysis in Study 306, concern of un - blinding and impact on conclusions • Extensive documentation on blinding procedures submitted • Sensitivity analyses show Study 306 is consistent across patient subsets • Expect and prepare for FDA audits NASDAQ: CHTP 15

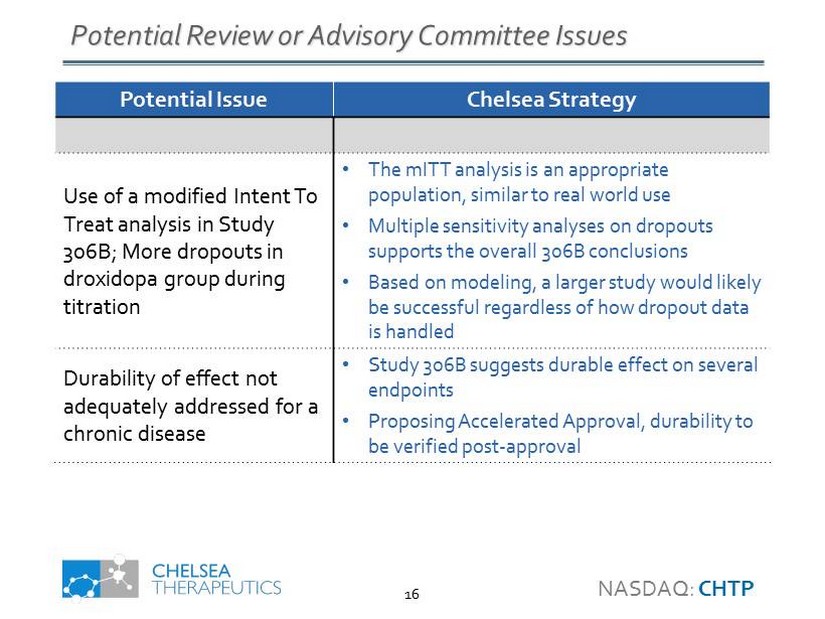

Potential Review or Advisory Committee Issues Potential Issue Chelsea Strategy Use of a modified Intent To Treat analysis in Study 306B; More dropouts in droxidopa group during titration • The mITT analysis is an appropriate population, similar to real world use • Multiple sensitivity analyses on dropouts supports the overall 306B conclusions • Based on modeling, a larger study would likely be successful regardless of how dropout data is handled Durability of effect not adequately addressed for a chronic disease • Study 306B suggests durable effect on several endpoints • Proposing Accelerated Approval, durability to be verified post - approval NASDAQ: CHTP 16

Durability: Suggestion of Durable Clinical Benefit • Study 306 was designed to capture durable (8 week) clinical benefit • Meta - analyses of Study 306 (A+B) show suggestion of durable benefit • Trends favoring droxidopa on most endpoints • Statistical significance in certain analyses • Appears 306AB (n=197 in Full Analysis Set) was underpowered to show treatment benefits at Week 8 • Chelsea proposes to verify durable clinical benefits post - approval NASDAQ: CHTP 17

Durability: OHSA Item 1 (Dizziness) Mean Changes (Study 306AB) -3 -2.5 -2 -1.5 -1 -0.5 0 BL 1 2 3 4 5 6 7 8 Weeks of Stable Dose 5.1 3.4 3.6 3.1 3.6 p =0.077 Placebo Droxidopa Mean Change in OHSA Item 1 Baseline to Week 8 ** *p<0.05 **p<0.01 NASDAQ: CHTP 18

Durability: OHSA Item 1 (Dizziness) Responders , Week 8 (Study 306AB) 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 ≥ 1 Unit ≥ 2 Unit ≥ 3 Unit ≥ 4 Unit ≥ 25% ≥ 50% Placebo (N=92) Droxidopa (N=84) Percentage of Patients Improvement From Baseline * * *p<0.05 NASDAQ: CHTP 19

Durability: Standing Systolic BP Mean Changes (Study 306AB) -4 -2 0 2 4 6 8 10 12 BL 1 2 3 4 5 6 7 8 Weeks of Stable Dose 5.1 3.4 3.6 3.1 3.6 Placebo Droxidopa Mean Change in Lowest Standing SBP Baseline to Week 8 ** *p<0.05 **p<0.01 NASDAQ: CHTP 20

Consistent Results Across Studies -4 -3 -2 -1 0 1 2 3 4 Change in Dizziness/Lightheadedness Study 301 Study 306 Study 360A Study 302 Study 302 Study 360B Induction Designs Withdrawal Designs Favors Placebo Favors Droxidopa p<0.001 n=162 p=0.008 n=197 p=ns n=50 p<0.018 n=147 p=ns n=101 p=ns n=75 NASDAQ: CHTP 21

Strong Safety Profile Across Multiple Studies Study 301/302 1 - 2 wk double - blind Study 306AB 8 - 10 wk double - blind Study 303/304 ~1 year open label NORTHERA (N=131) PLACEBO (N=132) NORTHERA (N=114) PLACEBO (N=108) NORTHERA (N=422) % % % % % Patients with AEs 22.9 23.5 79.8 80.6 76.1 Patients with SAEs 0 0.8 4.4 3.7 24.9 Patients with AEs Leading to Discontinuation 0 1.5 10.5 4.6 14.9 NASDAQ: CHTP 22

Strong Safety Profile Across Multiple Studies AEs ≥5% in either group of Study 301/302 or 306 Study 301/302 1 - 2 wk double - blind Study 306AB 8 - 10 wk double - blind Study 303/304 ~1 year open label NORTHERA (N=131) PLACEBO (N=132) NORTHERA (N=114) PLACEBO (N=108) NORTHERA (N=422) % % % % % Headache 6.1 3.0 13.2 7.4 13.3 Dizziness 3.8 1.5 9.6 4.6 10.0 Nausea 1.5 1.5 8.8 4.6 6.4 Fatigue 1.5 2.3 7.0 5.6 7.1 Hypertension 1.5 0 7.0 0.9 4.5 Excoriation 0 0.8 5.3 7.4 2.6 Contusion 0 0 5.3 11.1 4.5 Skin Laceration 0.8 0 4.4 9.3 4.7 Edema 0 1.5 4.4 5.6 3.3 Fall 0.8 6.8 N/A N/A 23.5 Diarrhea 0.8 0.8 3.5 7.4 3.6 BP Increased 0 0 3.5 6.5 1.7 Back Pain 0 0 5.6 2.6 7.3 NASDAQ: CHTP 23

Study 306AB: Incidence of Supine Hypertension NORTHERA (N=114) PLACEBO (N=108) N (%) N (%) SBP > 200 mmHg 4 (3.5%) 1 (0.9%) SBP > 180 mmHg 9 (7.9%) 5 (4.6%) SBP > 160 mmHg 33 (28.9%) 26 (24.1%) Note: Incidence of supine hypertension defined by 3 consecutive blood pressure measurements during Orthostatic Standing Test at any study visit NASDAQ: CHTP 24

Clinical & Regulatory Milestones • July 3, 2013: Resubmitted Northera NDA: • Data from new supportive Phase III studies (306A/B ) • Final open - label safety extension study data (304) • Expanded 650 patient safety database • New bioequivalence study to support the 300 mg dose • 4Q2013: Begin New Clinical Study of Northera: • Address guidance regarding potential need to verify durability of effect in post - marketing setting • Include short - term clinical endpoints should the Agency require an additional trial for approval • Potential for Cardiovascular and Renal Drug Advisory Committee • Expected 1Q2014 PDUFA Date: • NDA subject to 6 - month review period from date of submission NASDAQ: CHTP 25

Key Financial Information Cash and Cash Equivalents at 3/31/13 $25.1 million • We anticipate this will cover our operating expenses into Q3 - 2014 • Cash usage includes costs for NDA filing and starting a new study in Q4 - 2013 • Costs related to NDA approval and commercialization are not included Capitalization at 4/25/13: Shares Outstanding 67,085,154 Stock options issued & outstanding 7,772,959 Warrants outstanding 250,000 Fully diluted shares 75,108,113 NASDAQ: CHTP 26

Chelsea Therapeutics Corporate Overview July 2013 © 2004 - 2013 Chelsea Therapeutics, Inc.