Attached files

| file | filename |

|---|---|

| EX-4.8 - EX-4.8 - Clearday, Inc. | d547153dex48.htm |

| EX-23.1 - EX-23.1 - Clearday, Inc. | d547153dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 8, 2013

Registration No. 333-189006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SUPERCONDUCTOR TECHNOLOGIES INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3663 | 77-0158076 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

460 Ward Drive

Santa Barbara, CA 93111-2356

(805) 690-4500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey A. Quiram

President and Chief Executive Officer

Superconductor Technologies Inc.

460 Ward Drive

Santa Barbara, CA 93111-2356

(805) 690-4500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Ben D. Orlanski, Esq. Matthew S. O’Loughlin, Esq. Manatt, Phelps & Phillips, LLP 11355 West Olympic Blvd. Los Angeles, California 90064 (310) 312-4000 (310) 312-4224 — Facsimile |

Michael F. Nertney, Esq. New York, New York 10017 (212) 370-1300 (212) 370-7889 — Facsimile |

(Approximate date of commencement of proposed sale to the public) As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee | ||

| Units consisting of: |

$12,000,000 | $1,636.80 | ||

| (i) Common Stock, $0.001 par value |

— | — | ||

| (ii) Warrants to purchase Common Stock (2) |

— | — | ||

| Common Stock issuable upon exercise of Warrants to purchase Common Stock (3) |

$15,000,000 | $2,046.00 | ||

| Total |

$27,000,000 | $3,682.80(4) | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). The registration fee for the common stock underlying the warrants is calculated assuming an exercise price under the warrants of 125% of the offering price of the units being offered. |

| (2) | No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act. |

| (3) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (4) | $1,637 previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 8, 2013

PRELIMINARY PROSPECTUS

$12,000,000

Units consisting of One share of Common Stock and

Two Warrants to Purchase One-Half of a share of Common Stock

( shares of Common Stock Underlying the Warrants)

We are offering $12,000,000 of units with each unit consisting of one share of our common stock, par value $0.001 per share, and two warrants, each to purchase up to 0.5 of a share of common stock. We are also offering an aggregate of up to shares of our common stock issuable from time to time upon exercise of the warrants. The warrants will have an initial exercise price of $ per share and one warrant will be exercisable for a period of two years and the other warrant will be exercisable for a period of five years, but in each case not prior to the date that is one year and one day from their date of issuance. The units will not be certificated. The shares of common stock and the warrants will be immediately separable and issued separately. Each unit will be sold to investors at a price of $ .

Our common stock is currently listed on the NASDAQ Capital Market under the symbol “SCON.” On July 3, 2013, the reported closing price per share of our common stock was $3.12. The warrants will not be listed on any national securities exchange.

Investing in our securities involves a high degree of risks. See “Risk Factors” beginning on page 11 to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit (One Share and two Warrants each to Purchase 0.5 of a Share) |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriter for certain of its expenses. In addition, we have agreed to issue to the underwriter warrants to purchase our common stock. See “Underwriting” on page 29 of this prospectus for a description of the compensation payable to the underwriter. |

Delivery of the shares and warrants will take place on or about , 2013, subject to satisfaction of certain conditions.

Ladenburg Thalmann & Co. Inc.

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

| i | ||||

| i | ||||

| 1 | ||||

| 9 | ||||

| 11 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 28 | ||||

| 29 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 33 |

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the underwriter has not, authorized any person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the documents incorporated by reference is accurate only as of their respective dates. Superconductor Technologies Inc.’s business, financial condition, results of operations and prospects may have changed since such dates.

We further note that the representations, warranties and covenants made by us in any document that is filed as an exhibit to the registration statement of which this prospectus is a part and in any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, the terms “Superconductor Technologies Inc.,” the “Company,” “we,” “us,” “our” and similar terms used in this prospectus refer to Superconductor Technologies Inc. and its subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and may incorporate by reference, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Exchange Act. These forward-looking statements relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. Other statements contained in this prospectus that are not historical facts are also forward-looking statements. We have tried, wherever possible, to identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “expect,” “anticipate,” “intend” “plan,” “believe,” “seek,” “estimate” and other comparable terminology. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections.

Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| • | our limited cash and a history of losses; |

| • | our ability to raise sufficient capital to fund our operations, and the impact on our strategic initiatives of any inability to raise such funds; |

| • | the impact of any such financing activity on the level of our stock price; |

| • | our limited number of potential customers; |

| • | decreases in average selling prices for our products; |

| • | rapidly advancing technology in our target markets; |

| • | our need to overcome additional technical challenges in attaining milestones to develop and manufacture commercial lengths of our Conductus® HTS wire; |

| • | customer acceptance of our HTS wire; |

| • | the impact of competitive products, technologies and pricing; |

i

Table of Contents

| • | the limited number of suppliers for some of our components; |

| • | no significant backlog from quarter to quarter; |

| • | fluctuations in sales and product demand from quarter to quarter, which can be significant; |

| • | our proprietary rights, while important to our business, are difficult and costly to protect; |

| • | manufacturing capacity constraints and difficulties; |

| • | cost and uncertainty from compliance with environmental regulations; and |

| • | local, regional, and national and international economic conditions and events, and the impact they may have on us and our customers. |

We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented in this prospectus or the documents incorporated by reference herein or therein, or those that we may make orally or in writing from time to time, are based upon management’s beliefs and assumptions and are made based on information available to us as of the time made and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on known results and trends at the time they are made, to anticipate future results or trends.

ii

Table of Contents

This summary highlights information contained elsewhere or incorporated by reference into this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section contained in this prospectus, and our consolidated financial statements and the related notes and the other documents incorporated by reference into this prospectus.

Business Overview

We are a leading company in high temperature superconductor (HTS) materials and related technologies and have a strategic focus on the commercialization of second generation HTS (2G HTS) wire for “Smart Grid” and other power applications. HTS materials have the unique ability to conduct various signals or energy (e.g., electrical current or radio frequency (RF) signals) with little or no resistance when cooled to “critical” temperatures. Electric currents that flow through conventional conductors encounter resistance that requires power to overcome and generates heat. HTS materials can substantially improve the performance characteristics of electrical systems, reducing power loss, lowering heat generation and decreasing electrical noise. Commercial use of HTS materials requires a number of cutting edge technologies, including development of HTS materials, specialized manufacturing expertise to create uniform thin layers of these materials, and technologies to maintain an extremely low temperature environment for HTS applications (although the critical temperatures for HTS materials are “high” compared with traditional superconductors, they are still extremely cold by other standards).

Market Overview

The electric power industry is facing many challenges that threaten the ability of utilities and other electricity providers to deliver reliable and efficient power. Electricity providers in industrialized nations are struggling to replace an aging grid infrastructure while keeping pace with the addition of new alternative energy sources and managing increasing electricity demand. In emerging nations, electricity demand and the need for additional grid infrastructure is increasing. Electricity providers are focused on providing “future-proof” technologies that provide efficient, reliable and cost effective power. Due to these and many other challenges facing electricity providers, infrastructure enhancements are planned to improve the safety, reliability and survivability of electric power systems. These enhancements are focused on creating a decentralized Smart Grid by enabling real-time management, improving power transmission and distribution efficiency, and reducing carbon emissions through renewable energy.

A number of existing and emerging power equipment solutions are required for energy generation, storage, and transmission and distribution improvement. Conventional equipment is inherently inefficient compared to emerging technologies because the conventional power infrastructure is typically copper-based in the form of stranded copper wire used in power cables, coils for circuit breakers, transformers, motors and generators. Using copper as the conductor has limitations that include lower power density and inefficiency. The power density limitation of copper increases the amount of wire required to support high current. The higher the current the larger the amount of copper needed, increasing size and weight. We believe that conventional equipment cannot adequately support the new Smart Grid infrastructure or the increased power demand. Advanced transmission and distribution technologies are necessary to enhance Smart Grid efficiency, real-time management, throughput, and reliability.

Existing, centralized power grids utilizing legacy, copper-based systems are prime targets for change through disruptive technology. New, emerging, economical, high performance superconducting technologies have become a viable alternative to conventional, copper-based solutions by providing unique benefits targeting Smart Grid infrastructure improvement. Superconductivity is an exceptional characteristic of certain materials to exhibit no electrical resistance when cooled to very low temperatures. Without resistance, superconducting wire

1

Table of Contents

has been shown to carry many times the current of an equivalent size of copper wire. Superconducting power devices are extremely efficient, providing an efficiency rating of 95 to 99%. These attributes can translate into significant reductions of cost, size and weight for motors, generators and power cables.

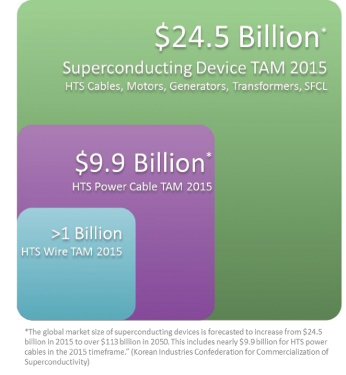

We believe that superconducting technologies will play a crucial role in the electric power industry: from power generation (including offshore superconducting wind turbine generators) to transmission and distribution (including high power superconducting cables, superconducting fault current limiters (SFCLs), superconducting magnetic energy storage (SMES), and superconducting transformers) and device use (including superconducting industrial motors, generators and condensers). Rapid technology development, proof of concept demonstrations and limited commercial deployments are underway for all of these superconducting power applications. HTS wire may replace conventional copper and aluminum conductors to help create distributed grid architecture. This would relieve many stranded grid assets and provide an efficient, adaptive or “self-healing” grid architecture that is well suited for the future Smart Grid. According to a 2012 report by the Korean Industries Confederation for Commercialization of Superconductivity, or the 2012 Report, the global market for superconducting devices is forecast to increase from $24.5 billion in 2015 to over $113 billion in 2050. We believe a material portion of this global market for superconducting devices will consist of sales of second generation HTS wire, or 2G HTS wire, for applications in generation, distribution, storage, conversion and end-use devices. We seek to supply 2G HTS wire to each of these sub-markets within the global market for superconducting devices. For example, the 2012 Report forecasts that by 2015 the sub-market for HTS power cable, the primary component of which is HTS wire, will be $9.9 billion. We believe that the market for the HTS wire within the power cable sub-market will exceed $1 billion by 2015. In addition to this opportunity in the power cable sub-market (which we refer to as the distribution sub-market), we believe that meaningful market opportunities exist for sales of our 2G HTS wire within each of the other sub-markets (generation, storage, conversion and end-use devices) comprising the overall global superconducting device market.

Total Addressable Market (TAM) for Superconducting Devices

2

Table of Contents

Strategic Initiatives

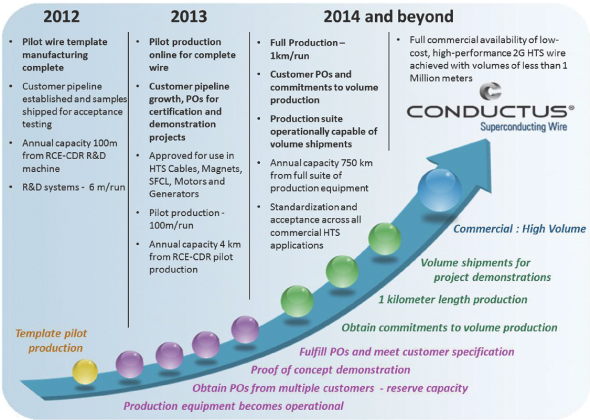

We are leveraging our leadership in superconducting technologies, extensive intellectual property, and High Temperature Superconducting (HTS) manufacturing expertise to develop and produce Conductus® superconducting wire; giving STI access to attractive opportunities in high growth markets. Our novel, cost-effective superconducting growth technique, which has been improved over the last decade in full production within our wireless business, offers a strong competitive advantage when applied in the production of our Conductus® 2G HTS wire. This critical experience allows us to minimize our time to market and increase wire performance, while at the same time leverages our proven, high-yield and low-cost manufacturing process. Our Conductus® 2G HTS wire development roadmap is carefully aligned with market opportunities: including HTS power cables, superconducting fault current limiters and superconducting rotating machines like motors and generators.

In 2010, our strategic direction shifted from producing HTS wireless devices to the development of Conductus® 2G HTS wire. The current HTS wireless electronics infrastructure market is forecast as low growth, while HTS wire markets are expected to be large for the foreseeable future. Our goal by the end of 2013 is to produce commercial grade, high-performance Conductus® 2G HTS wire. Our strategy is to deploy kilometer length HTS wire production capability that will meet multiple customer specifications in 2014 to secure near-term revenue. We plan to increase our manufacturing volume to track anticipated market demand in 2014-2016.

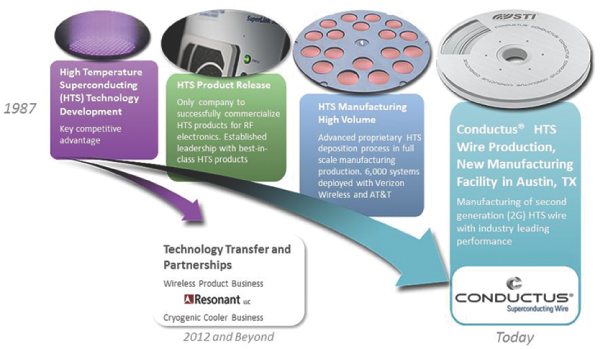

Company History of Superconducting Innovation

While substantial production and business challenges remain before our anticipated commercial product launch, we believe we have made, and continue to make, significant technical and commercial progress. In 2012, we demonstrated industry leading performance in current density for our Conductus® HTS wire, attaining a

3

Table of Contents

critical performance milestone for HTS power cable applications. A number of potential customers, who are leading multi-national industrial companies, have tested and qualified our wire for other demanding grid device applications. We have a number of product requests for delivery of Conductus® HTS wire for evaluation and qualification. In the first quarter of 2013, we completed the installation of our pilot production HTS wire manufacturing equipment in our new Advanced Manufacturing Center of Excellence (AMCE) in Austin, Texas. Requests from customers for our wire to complete product evaluations continues to grow as our wire has now been tested and approved for use in the following target applications: HTS power cables, superconducting high-field magnets, SFCLs, and superconducting motors and generators.

Conductus® HTS Wire Development Milestones

Our Wireless Business

In addition to our core strategic initiative relating to our Conductus® HTS wire platform, we also have on-going business activities relating to RF filters and cryocoolers.

RF Filters. Conventional RF filters are fabricated primarily from aluminum blocks with hollow cavities, resonators, and tuning elements incorporated to make a frequency specific filter. Our filter structures resemble a circuit on a semiconductor using a circuit that is etched into HTS materials that are deposited on a wafer. Our unique and innovative circuits allow us to utilize the characteristics of the HTS materials for this application. We have also developed unique tuning methods that allow us to produce a frequency specific filter. We have also contributed some specialized intellectual property in exchange for a minority ownership position in Resonant LLC, a company formed to commercialize our innovative Reconfigurable Resonance™ technology for the mobile communication products industry.

4

Table of Contents

Cryocoolers. HTS circuits need to be cooled to the critical temperature that enables the superconducting properties of the materials to be utilized. To meet this need, we developed a unique cryocooler that can efficiently and reliably cool the circuit to the critical temperature (77 degrees Kelvin). As a result, our wireless products are maintenance free and reliable enough to be deployed for many years.

Our current revenue comes from the manufacture and sale of high performance infrastructure products for wireless communication applications. We have three current product lines, SuperLink®, AmpLink®, and SuperPlex; all of which relate to wireless base stations. We sell most of our current commercial products to a small number of wireless carriers in the United States, including AT&T and Verizon Wireless. We derived 96% of our commercial product revenues from Verizon Wireless and AT&T in 2012 and 2011. Demand for wireless communications equipment fluctuates dramatically and unpredictably and recently demand for our products has been trending downward. The wireless communications infrastructure equipment market is extremely competitive and is characterized by rapid technological change, new product development, product obsolescence, evolving industry standards and price erosion over the life of a product. We face constant pressures to reduce prices. Consequently, we expect the average selling prices of our products will continue decreasing over time. We expect these trends to continue and they may cause significant fluctuations in our quarterly and annual revenues. Our commercial operations are subject to a number of significant risks. See “Risk Factors.”

Our Competitive Advantage

We consider our unique manufacturing systems to be the critical success factor for our Conductus® wire business plan and competitive positioning. We have developed a proprietary Reactive Co-Evaporation and Cyclical Deposition Reaction (RCE-CDR) deposition technique that allows us to precisely control growth rates, the relative proportions of metals and the chamber temperature. The process further allows us to precisely control and make the refinements necessary for high-yield, high-output manufacturing. Utilizing this tightly controlled process and revolutionary RCE-CDR deposition method we increased production yield of our Rare Earth Barium Copper Oxide (ReBCO) wafers to 99.5%. In addition, because we can control the factors that determine the structure of the HTS crystal being grown, we are able to make innovative changes to the crystal to optimize its performance for various applications. We have been adapting this proprietary manufacturing process to the production of 2G HTS wire over the past several years.

Our Proprietary Technology

Our development efforts over the last 25 years have yielded an extensive patent portfolio as well as critical trade secrets, unpatented technology and proprietary knowledge. We enter into confidentiality and non-disclosure agreements with our employees, suppliers and consultants to protect our proprietary information. Like almost all technology companies, we remain subject to a number of risks related to our ability to protect our proprietary technology. Our development efforts (including those described above under Strategic Initiatives) can take a significant number of years to commercialize, and we must overcome significant technical barriers and deal with other significant risks. See “Risk Factors.”

Our Corporate Information

Our executive offices are located at 9101 Wall Street, Austin, Texas 78754 and at 460 Ward Drive, Santa Barbara, California 93111, and our telephone number is (805) 690-4500. We were incorporated in Delaware on May 11, 1987. Additional information about us is available on our website at www.suptech.com. The information contained on or that may be obtained from our website is not, and shall not be deemed to be, a part of or incorporated into this prospectus. Our common stock is currently traded on the NASDAQ Capital Market under the symbol “SCON.”

5

Table of Contents

Risk Factors

An investment in our common stock involves certain risks. You should carefully consider the risks described under “Risk Factors” beginning on page 11 of this prospectus, as well as other information included or incorporated by reference into this prospectus, including our consolidated financial statements and the notes thereto, before making an investment decision.

6

Table of Contents

The Offering

The following summary contains basic information about the offering and the common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the common stock and the warrants, please refer to the sections of this prospectus titled “Description of Capital Stock” and “Description of Securities We Are Offering.”

| Securities offered by us |

• $12,000,000 of units. |

| Each unit consists of |

| (i) | one share of common stock and |

| (ii) | two warrants per share of common stock with each warrant representing the right to purchase up to 0.5 of a share of common stock. |

| The shares of common stock and warrants are immediately separable and will be issued separately. |

| • | Up to shares of common stock issuable upon exercise of the warrants issued as part of the units. |

| Offering Price: |

$ per unit. |

| Description of the warrants |

Each warrant will entitle the holder to purchase up to 0.5 of a share of common stock. The warrants will have an initial exercise price of $ per share and will be exercisable one year and one day from their date of issuance. One warrant will be exercisable for a period of one year following the date that such warrant is initially exercisable and the other warrant will be exercisable for a period of five years following the date that such warrant is initially exercisable. |

| Notwithstanding anything herein to the contrary, a warrant may not be exercised by the holder to the extent that the holder, together with its affiliates, would beneficially own, after such exercise more than 4.99% of the shares of common stock then outstanding (subject to the right of the holder to increase or decrease such beneficial ownership limitation upon not less than 61 days prior notice provided that such limitation cannot exceed 9.99%). |

| Common stock to be outstanding immediately after this offering |

shares of common stock (1)(2) |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes. General corporate purposes may include capital expenditures. See “Use of Proceeds.” |

| Market for our common stock |

Our common stock is quoted and traded on the NASDAQ Capital Market under the symbol “SCON.” |

| No Market for Warrants |

There is no established public trading market for our warrants, and we do not intend to apply to list the warrants on any securities exchange or automated quotation system |

7

Table of Contents

| (1) | The number of shares of common stock outstanding immediately after the closing of this offering is based on 4,751,284 shares of common stock outstanding as of June 29, 2013, and, as of that date, excluded: |

| • | 447,100 shares of our common stock issuable upon conversion of the 536,520 shares of outstanding Series A Convertible Preferred Stock, or Series A Preferred Stock (The conversion of our Series A Preferred Stock is subject to certain limitations. See “Description of Capital Stock – Preferred Stock – Series A Convertible Preferred Stock” on page 26 of this prospectus); |

| • | 137,534 shares of our common stock issuable upon exercise of stock options under our stock plans at a weighted average exercise price of $35.56 per share; |

| • | 443,409 shares of our common stock issuable upon exercise of warrants at a weighted average exercise price of $15.58 per share. |

| (2) | Excludes the shares of common stock that may be issued under the warrants to be issued in this offering (none of which are exercisable until the date that is one year and one day from the closing date of this offering). |

Recent Events

In June 2013 we announced that Resonant Inc., a spin-out from Superconductor Technologies Inc., raised $7 million from outside investors in a private placement. Resonant was spun-out in July 2012 to leverage Reconfigurable Resonance™ (RcR) technology developed by the Company for advanced wireless applications. This funding enables Resonant to continue to commercialize RcR technology for the rapidly growing mobile communications industry. After the June 2013 investment, Resonant’s management and new investors own the majority of equity and equity equivalents, and we hold a convertible note that would represent a minority position in Resonant’s fully diluted equity on an as converted basis. While we remain highly focused on our 2G HTS wire program, we will also continue to pursue alternatives, such as the Resonant spin-out, to extract value from our substantial intellectual properties unrelated to our 2G HTS wire. In connection with the spin out, we contributed patents to Resonant to form a company to assist mobile device manufacturers as they attempt to keep up with the growth of mobile data demand from next generation mobile devices and we also contributed a product development agreement with a global leader in mobile communications products to bring to market RcR technology. Resonant was founded as a company separate from Superconductor Technologies Inc. and is controlled by its own board and management.

On March 11, 2013, we effected a 1-for-12 reverse stock split of our common stock, or the Reverse Stock Split. As a result of the Reverse Stock Split, every twelve shares of our pre-Reverse Stock Split common stock were combined and reclassified into one share of our common stock. The Reverse Stock Split did not change the authorized number of shares or the par value of our common stock. Certain of the information contained in the documents incorporated by reference in this prospectus present information on our common stock on a pre-Reverse Split basis.

8

Table of Contents

SUMMARY SELECTED CONSOLIDATED FINANCIAL INFORMATION

You should read the summary selected consolidated financial information presented below in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and our financial statements and the notes to those consolidated financial statements appearing in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which is incorporated by reference in this prospectus.

The following tables set forth selected consolidated financial data for us at and for each of the years in the five-year period ended December 31, 2012 and at and for the three month periods ending March 30, 2013 and March 31, 2012.

The summary statement of operations data for the years ended December 31, 2012, 2011 and 2010, and the summary statement of financial condition data as of December 31, 2012 and 2011, have been derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which is incorporated by reference in this prospectus. The summary statement of operations data for the years ended December 31, 2009 and 2008 and the summary statement of financial condition data as of December 31, 2010, 2009 and 2008 have been derived from our audited consolidated financial statements that are not included nor incorporated by reference into this prospectus.

| Three Months Ended March 30, 2013 and March 31, 2012 |

Years Ended December 31, | |||||||||||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||||

| (Amounts and numbers in thousands, except per share amounts) | ||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||||||

| Net commercial product revenues |

$ | 776 | $ | 344 | $ | 3,237 | $ | 3,416 | $ | 6,548 | $ | 7,239 | $ | 6,768 | ||||||||||||||

| Government and other contract revenues |

— | 55 | 222 | 83 | 1,999 | 3,577 | 4,525 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total net revenues |

776 | 399 | 3,459 | 3,499 | 8,547 | 10,816 | 11,293 | |||||||||||||||||||||

| Costs and expenses: |

||||||||||||||||||||||||||||

| Cost of commercial product revenues |

226 | 844 | 3,850 | 5,434 | 7,732 | 9,102 | 8,911 | |||||||||||||||||||||

| Cost of government and other contract revenues |

— | 52 | 165 | 79 | 1,180 | 2,552 | 3,649 | |||||||||||||||||||||

| Other research and development |

1,438 | 1,161 | 5,030 | 5,325 | 5,067 | 4,399 | 3,394 | |||||||||||||||||||||

| Selling, general and administrative |

1,345 | 1,348 | 5,440 | 6,322 | 6,684 | 6,925 | 8,151 | |||||||||||||||||||||

| Restructuring expenses and impairment charges |

— | — | — | — | — | — | 141 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total costs and expenses |

3,009 | 3,405 | 14,485 | 17,160 | 20,663 | 22,978 | 24,246 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss from operations |

(2,233 | ) | (3,006 | ) | (11,026 | ) | (13,661 | ) | (12,116 | ) | (12,162 | ) | (12,953 | ) | ||||||||||||||

| Other income (expense), net |

(175 | ) | 18 | 98 | 278 | 148 | (817 | ) | 252 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |

$ | (2,408 | ) | $ | (2,988 | ) | $ | (10,928 | ) | $ | (13,383 | ) | $ | (11,968 | ) | $ | (12,979 | ) | $ | (12,701 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic and diluted net loss per common share (1) |

(0.58 | ) | (1.01 | ) | (3.34 | ) | (5.05 | ) | (6.15 | ) | (7.85 | ) | (9.29 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Weighted average number of shares outstanding (1) |

4,152 | 2,965 | 3,269 | 2,652 | 1,945 | 1,654 | 1,367 | |||||||||||||||||||||

9

Table of Contents

| March 30, 2013 and March 31, 2012 |

December 31, | |||||||||||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||||

| (Amounts and numbers in thousands, except per share amounts) | ||||||||||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 1,656 | $ | 9,530 | $ | 3,634 | $ | 6,165 | $ | 6,069 | $ | 10,365 | $ | 7,569 | ||||||||||||||

| Working capital |

1,132 | 9,143 | 3,059 | 7,161 | 7,655 | 12,557 | 12,253 | |||||||||||||||||||||

| Total assets |

9,952 | 11,455 | 12,029 | 12,949 | 12,569 | 18,126 | 19,358 | |||||||||||||||||||||

| Long-term debt, including current portion |

663 | 593 | 674 | 628 | 608 | 576 | 521 | |||||||||||||||||||||

| Total stockholders’ equity |

$ | 8,050 | $ | 15,001 | $ | 10,292 | $ | 11,175 | $ | 10,896 | $ | 16,241 | $ | 17,552 | ||||||||||||||

| (1) | All per share information (other than information as of March 30, 2013) has been retroactively adjusted to reflect the 1-for-12 reverse stock split of our common stock that was effective on March 11, 2013. |

10

Table of Contents

Investment in our securities involves a high degree of risk. You should carefully consider the risks described below, as well as those risks described in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each contained in our most recent Annual Report on Form 10-K for the year ended December 31, 2012, which has been filed with the SEC and is incorporated herein by reference in its entirety, as well as other information in this prospectus or in any other documents incorporated by reference. Each of the risks described in these sections and documents could adversely affect our business, financial condition, results of operations and prospects, and could result in a complete loss of your investment. This prospectus and the incorporated documents also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned above.

Risks Related to Our Business

We have a history of losses and may never become profitable.

In each of our last five years, we have experienced significant net losses and negative cash flows from operations. For the three-month period ended March 30, 2013, we incurred a net loss of $2.4 million and had negative cash flows from operations of $1.8 million. In 2012, we incurred a net loss of $10.9 million and had negative cash flows from operations of $8.2 million. In 2011, we incurred a net loss of $13.4 million and had negative cash flows from operations of $10.0 million. Our independent registered public accounting firm has included in its audit reports an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. If we fail to increase our revenues, we may not achieve and maintain profitability and may not meet our expectations or the expectations of financial analysts who report on our stock.

We need to raise additional capital, and if we are unable to raise capital our ability to implement our current business plan and ultimately our viability as a company could be adversely affected.

At March 30, 2013 and December 31, 2012, we had $1.7 million and $3.6 million, respectively, in cash and cash equivalents. Our cash resources will not be sufficient to fund our business for at least the next twelve months. We believe the key factors to our future liquidity will be our ability to successfully use our expertise and our technology to generate revenues in various ways, including commercial operations, joint ventures and licenses. Because of the expected timing and uncertainty of these factors, we will need to raise funds to meet our working capital needs.

Additional financing may not be available on acceptable terms or at all. If we issue additional equity securities to raise funds, the ownership percentage of our existing stockholders would be reduced. New investors may demand rights, preferences or privileges senior to those of existing holders of common stock and could also require that we issue warrants in connection with sales of our stock. If we cannot raise any needed funds, we might be forced to make further substantial reductions in our operating expenses, which could adversely affect our ability to implement our current business plan and ultimately our viability as a company.

Our strategic initiative to develop a new wire platform may not prove to be successful.

We have spent a considerable amount of resources in developing a new wire platform for power applications. Substantial technical and business challenges remain before we have a commercially successful product introduction. We may not be able to overcome these challenges in a timely or cost effective manner, if at all. Such a failure could adversely impact our prospects, liquidity, stock price and carrying value of our fixed assets.

11

Table of Contents

There are numerous technological challenges that must be overcome in order for our Conductus HTS wire to become commercially successful and our ability to address such technological challenges may adversely affect our ability to gain customers.

Our superconducting wire product is in the middle stages of development, and in the early stages of commercialization. There are a number of technological challenges to overcome for broad commercialization of HTS wire. First, the current HTS wire market is supply constrained. Current producers cannot manufacture sufficient wire to meet demand; customers cannot purchase long-length wire with any reasonable confidence or guaranteed volume; and electric utilities and other electricity providers lack confidence in product availability which leads to delays in their deployment roadmap. Secondly, HTS wire performance is currently below what many customers require. Many power applications require high performance wire with high current carrying capacity, mechanical durability, electrical integrity with low AC losses and minimal splices. Producing high performance HTS wire has proven difficult, especially at volumes required for large scale deployment. Thirdly, high demand for premium performance wire available in very low volume results in a high wire price that narrows the market and limits commercial viability. Delays in our HTS wire development, as a result of technological challenges or other factors, may result in the introduction or commercial acceptance of our HTS wire products later than expected.

The commercial uses of superconducting wire and superconducting wire related products are limited today, and a broad commercial market may not develop.

Even if the technological hurdles are overcome, there is no certainty that a robust commercial market for unproven HTS wire products will come to fruition. To date, commercial use of HTS wire has been limited to small feasibility demonstrations, and these projects are largely subsidized by government authorities. While customer demand is high and market forecasts project large revenue opportunity for superconducting wire in power applications, the market may not develop and superconducting wire might never achieve long term, broad commercialization. In such an event, we would not be able to commercialize our HTS wire initiative and our business could be adversely impacted.

We have limited experience marketing and selling superconducting wire products, and our failure to effectively market and sell our superconducting wire solutions would lower our revenue and cash flow.

We have little experience marketing and selling our superconducting wire. Once our superconducting wire is ready for commercial use, we will have to hire and develop a marketing and sales team that will effectively demonstrate the advantages of our product over both more traditional products and competing superconducting products or other adjacent technologies. We may not be successful in our efforts to market this new technology.

We rely on a small group of customers for the majority of our commercial wireless revenues, and the loss of any one of these customers could adversely affect our business.

We sell most of our wireless products to a small number of wireless carriers. We derived 96% of our commercial product revenues from Verizon Wireless and AT&T in 2012 and 2011. This is up from 92% in 2010.

Demand for wireless communications equipment fluctuates dramatically and unpredictably and recently has been trending downward. As a result of this downward trend, we have managed our inventory to historically low levels, which may result in longer delivery lead times, which may not be acceptable to our customers. If this downward trend continues we may be compelled to refocus our manufacturing away from wireless products altogether

In addition, the market for HTS wire would also consist of a small number of customers and would face similar challenges to those we face in our wire business.

12

Table of Contents

We expect decreases in average selling prices, requiring us to reduce product costs in order to achieve and maintain profitability.

We face pressure to reduce prices and accordingly, the average selling price of our existing products has decreased over the years. We anticipate customer pressure on our product pricing will continue for the foreseeable future. In our HTS wire initiative, wire is currently being sold at $250- 400/kiloampere-meter (kA-m). At this price, HTS wire represents more than half the cost of the end device. A price reduction is required for long term commercialization. Cryogenic systems, including cryocoolers and cryostats, have been developed but will also need to be cost optimized as HTS wire becomes available in volume. We have plans to further reduce the manufacturing cost of our products, but there is no assurance that our future cost reduction efforts will keep pace with price erosion. We will need to further reduce our manufacturing costs through engineering improvements and economies of scale in production and purchasing in order to achieve adequate gross margins. We may not be able to achieve the required product cost savings at a rate needed to keep pace with competitive pricing pressure. Additionally, we may be forced to discount future orders or may never reach commercial viability. If we fail to reach our cost saving objectives or we are required to offer future discounts, our business may be harmed.

We face competition with respect to various aspects of our technology and product development.

Our current wireless products compete on the basis of performance, functionality, reliability, pricing, quality, and compliance with industry standards. With respect to our HTS materials, we compete with American Superconductor, SuperPower, SuNam, and THEVA, among others. Our current and potential competitors with respect to our wireless business include conventional RF filter manufacturers, including Alcatel-Lucent, Powerwave, and RFS and both established and newly emerging companies developing similar or competing HTS technologies. In addition, we currently supply components and license technology to several companies that may eventually decide to manufacture or design their own HTS components, rather than purchasing or licensing our technology. If we are unable to compete successfully against our current or future competitors, then our business and results of operations will be adversely affected.

We may not be able to compete effectively against alternative technologies.

Our products also compete with a number of alternative approaches and technologies. Some of these alternatives may be more cost effective or offer better performance than our products and we may not succeed in competing against these alternatives.

We currently rely on specific technologies and may not successfully adapt to the rapidly changing market environments.

We must overcome technical challenges to commercialize our HTS wire. If we are able to so, we will need to attain customer acceptance of our HTS wire, and we cannot ensure that such acceptance will occur. We will have to continue to develop and integrate advances to our core technologies. We will also need to continue to develop and integrate advances in complementary technologies. We cannot guarantee that our development efforts will not be rendered obsolete by research efforts and technological advances made by others. Wireless telecommunication equipment is characterized by rapidly advancing technology. Our wireless business success depends upon our ability to keep pace with advancing wireless technology, including materials, processes and industry standards.

We experience significant fluctuations in sales and operating results from quarter to quarter.

Our quarterly results fluctuate due to a number of factors, including:

| • | the lack of any contractual obligation by our customers to purchase their forecasted demand for our products; |

13

Table of Contents

| • | variations in the timing, cancellation, or rescheduling of customer orders and shipments; and |

| • | high fixed expenses that may disproportionately impact operating expenses, especially during a quarter with a sales shortfall. |

The nature of our business requires that we promptly ship products after we receive orders. This means that we typically do not have a significant backlog of unfilled orders at the start of each quarter. Our major customers generally have no contractual obligation to purchase forecasted amounts and may cancel orders, change delivery schedules or change the mix of products ordered with minimal notice and minimal penalty. As a result of these factors, we may not be able to accurately predict our quarterly sales. Any shortfall in sales relative to our quarterly expectations or any delay of customer orders would adversely affect our revenues and results of operations.

Order deferrals and cancellations by our customers, declining average sales prices, changes in the mix of products sold, increases in inventory and finished goods, delays in the introduction of new products and longer than anticipated sales cycles for our products have, in the past, adversely affected our results of operations. Despite these factors, we maintain significant finished goods, work-in-progress and raw materials inventory to meet estimated order forecasts. If our customers purchase less than the forecasted amounts or cancel or delay existing purchase orders, there will be higher levels of inventory that face a greater risk of obsolescence. If our customers desire to purchase products in excess of the forecasted amounts or in a different product mix, there may not be enough inventory or manufacturing capacity to fill their orders.

Due to these and other factors, our past results may not be reliable indicators of our future performance in our wireless business, and has no predictive value as to our HTS wire initiative. Future revenues and operating results may not meet the expectations of stock analysts and investors. In either case, the price of our common stock could be materially adversely affected.

We depend on the capital spending patterns of our customers, and if capital spending is decreased or delayed, our business may be harmed.

Any substantial decrease or delay in capital spending patterns from our customers may harm our business. Demand from customers for our products depends to a significant degree upon the amount and timing of capital spending by these customers for constructing, rebuilding or upgrading their systems. Their capital spending patterns depend on a variety of factors, including access to financing, the status of federal, local and foreign government regulation and deregulation, overall demand, competitive pressures and general economic conditions. In addition, capital spending patterns can be subject to some degree of seasonality, with lower levels of spending in the first and third calendar quarters, based on annual budget cycles.

The current worldwide uncertainty may adversely affect our business, operating results and financial condition.

The United States and global economies continue to experience a financial downturn, with some financial and economic analysts predicting that the global economy may be entering into a prolonged economic downturn characterized by high unemployment, limited availability of credit, increased rates of default and bankruptcy and decreased consumer and business spending. These developments could negatively affect our business, operating results and financial condition in a number of ways. For example, current or potential customers may delay or decrease spending with us or may not pay us, or may delay paying us for previously purchased products. In addition, this downturn has had, and may continue to have, an unprecedented negative impact on the global credit markets. Credit has tightened significantly, resulting in financing terms that are less attractive to borrowers, and in many cases, the unavailability of certain types of debt financing. If this crisis continues or worsens, and if we are required to obtain financing in the near term to meet our working capital or other business needs, we may not be able obtain that financing. Further, even if we are able to obtain the financing we need, it may be on terms that are not favorable to us, with increased financing costs and restrictive covenants.

14

Table of Contents

Our reliance on a limited number of suppliers and the long lead time of components for our products could impair our ability to manufacture and deliver our systems on a timely basis.

A number of components used in our products are available from a limited number of outside suppliers due to unique designs as well as certain quality and performance requirements. There are components that we source from a single vendor due to the present volume. In addition, key components of our conventional products are manufactured by a sole foreign manufacturer. Our reliance on sole or limited source suppliers involves certain risks and uncertainties, many of which are beyond our control. These include the possibility of a shortage or the discontinuation of certain key components. Any reduced availability of these parts or components when required could impair our ability to manufacture and deliver our systems on a timely basis and result in the delay or cancellation of orders, which could harm our business.

In addition, the purchase of some of our key components involves long lead times and, in the event of unanticipated increases in demand for our solutions, we may be unable to obtain these components in sufficient quantities to meet our customers’ requirements. We do not have guaranteed supply arrangements with any of these suppliers, do not maintain an extensive inventory of parts or components and customarily purchase sole or limited source parts and components pursuant to purchase orders. Business disruptions, quality issues, production shortfalls or financial difficulties of a sole or limited source supplier could materially and adversely affect us by increasing product costs, or eliminating or delaying the availability of such parts or components. In such events, our inability to develop alternative sources of supply quickly and on a cost-effective basis could impair our ability to manufacture and deliver our systems on a timely basis and could harm our business.

Our reliance on a limited number of suppliers exposes us to quality control issues.

Our reliance on certain single-source and limited-source components exposes us to quality control issues if these suppliers experience a failure in their production process or otherwise fail to meet our quality requirements. A failure in single-source or limited-source components or products could force us to repair or replace a product utilizing replacement components. If we cannot obtain comparable replacements or effectively return or redesign our products, we could lose customer orders or incur additional costs, which could have a material adverse effect on our gross margins and results of operations.

Our ability to protect our patents and other proprietary rights is uncertain, exposing us to possible losses of competitive advantage.

Our efforts to protect our proprietary rights may not succeed in preventing infringement by others or ensure that these rights will provide us with a competitive advantage. Pending patent applications may not result in issued patents and the validity of issued patents may be subject to challenge. Third parties may also be able to design around the patented aspects of the products. Additionally, certain of the issued patents and patent applications are owned jointly with third parties. Because any owner or co-owner of a patent can license its rights under jointly-owned patents or applications, inventions made by us jointly with others are not subject to our exclusive control. Any of these possible events could result in losses of competitive advantage.

We depend on specific patents and licenses to technologies, and we will likely need additional technologies in the future that we may not be able to obtain.

We utilize technologies under licenses of patents from others for our products. These patents may be subject to challenge, which may result in significant litigation expense (which may or may not be recoverable against future royalty obligations). Additionally, we continually try to develop new products, and, in the course of doing so, we may be required to utilize intellectual property rights owned by others and may seek licenses to do so. Such licenses may not be obtainable on commercially reasonable terms, or at all. It is also possible that we may inadvertently utilize intellectual property rights held by others, which could result in substantial claims.

15

Table of Contents

Intellectual property infringement claims against us could materially harm results of operations.

Our products incorporate a number of technologies, including high-temperature superconductor technology, technology related to other materials, and electronics technologies. Our patent positions, and that of other companies using high-temperature superconductor technology, is uncertain and there is significant risk that others, including our competitors or potential competitors, have obtained or will obtain patents relating to our products or technologies or products or technologies planned to be introduced by us.

We believe that patents may be or have been issued, or applications may be pending, claiming various compositions of matter used in our products. We may need to secure one or more licenses of these patents. There can be no assurances that such licenses could be obtained on commercially reasonable terms, or at all. We may be required to expend significant resources to develop alternatives that would not infringe such patents or to obtain licenses to the related technology. We may not be able to successfully design around these patents or obtain licenses to them and may have to defend ourselves at substantial cost against allegations of infringement of third party patents or other rights to intellectual property. In those circumstances, we could face significant liabilities and also be forced to cease the use of key technology.

Other parties may have the right to utilize technology important to our business.

We utilize certain intellectual property rights under non-exclusive licenses or have granted to others the right to utilize certain intellectual property rights licensed from a third party. Because we may not have the exclusive rights to utilize such intellectual property, other parties may be able to compete with us, which may harm our business.

Because competition for target employees is intense, we may be subject to claims of unfair hiring practices, trade secret misappropriation or other related claims.

Companies in the wireless telecommunications and HTS wire industries whose employees accept positions with competitors frequently claim that competitors have engaged in unfair hiring practices, trade secret misappropriation or other related claims. We may be subject to such claims in the future as we seek to hire qualified personnel, and such claims may result in material litigation. If this should occur, we could incur substantial costs in defending against these claims, regardless of their merits.

Our success depends on the attraction and retention of senior management and technical personnel with relevant expertise.

As a competitor in a highly technical market, we depend heavily upon the efforts of our existing senior management and technical teams. The loss of the services of one or more members of these teams could slow product development and commercialization objectives. Due to the specialized nature of our products, we also depend upon our ability to attract and retain qualified technical personnel with substantial industry knowledge and expertise. Competition for qualified personnel is intense, and we may not be able to continue to attract and retain qualified personnel necessary for the development of our business.

Regulatory changes could substantially harm our business.

Certain regulatory agencies in the United States and other countries set standards for operations within their territories. Equipment marketed for use within their territories must meet specific technical standards. Our ability to sell our products is impacted by regulatory changes and requirements and depends on the ability of our customers to obtain and retain the necessary approvals and licenses. HTS wire is subject to a regulatory regime, which may become more strictly regulated if the market grows. Any failure or delay in obtaining necessary approvals could harm our business.

16

Table of Contents

We may acquire or make investments in companies or technologies that could cause loss of value to stockholders and disruption of business.

We may explore opportunities to acquire companies or technologies in the future. Other than the acquisition of Conductus, Inc. in 2002 and our minority investment in Resonant LLC in 2012, we have not made any such acquisitions or investments to date and, therefore, our ability as an organization to make acquisitions or investments is unproven. An acquisition entails many risks, any of which could adversely affect our business, including:

| • | failure to integrate operations, services and personnel; |

| • | the price paid may exceed the value eventually realized; |

| • | loss of share value to existing stockholders as a result of issuing equity securities to finance an acquisition; |

| • | potential loss of key employees from either our then current business or any acquired business; |

| • | entering into markets in which we have little or no prior experience; |

| • | diversion of financial resources and management’s attention from other business concerns; |

| • | assumption of unanticipated liabilities related to the acquired assets; and |

| • | the business or technologies acquired or invested in may have limited operating histories and may be subjected to many of the same risks to which we are exposed. |

In addition, future acquisitions may result in potentially dilutive issuances of equity securities, or the incurrence of debt, contingent liabilities or amortization expenses or charges related to goodwill or other intangible assets, any of which could harm our business. As a result, if we fail to properly evaluate and execute acquisitions or investments, our business and prospects may be seriously harmed.

If we are unable to implement appropriate controls and procedures to manage our potential growth, we may not be able to successfully offer our products and implement our business plan.

Our ability to successfully offer our products and implement our business plan in a rapidly evolving market requires an effective planning and management process. Growth in future operations would place a significant strain on management systems and resources. We expect that we would need to improve our financial and managerial controls, reporting systems and procedures, and would need to expand, train and manage our work force worldwide. Furthermore, we expect that we would be required to manage multiple relationships with various customers and other third parties.

Compliance with environmental regulations could be especially costly due to the hazardous materials used in the manufacturing process. In addition, we could incur expenditures related to hazardous material accidents.

We are subject to a number of federal, state and local governmental regulations related to the use, storage, discharge and disposal of toxic, volatile or otherwise hazardous chemicals used in our business. Current or future laws and regulations could require substantial expenditures for preventative or remedial action, reduction of chemical exposure, waste treatment or disposal. Any failure to comply with present or future regulations could result in fines being imposed, suspension of production or interruption of operations. In addition, these regulations could restrict our ability to expand or could require us to acquire costly equipment or incur other significant expense to comply with environmental regulations or to clean up prior discharges.

In addition, although we believe that our safety procedures for the handling and disposing of hazardous materials comply with the standards prescribed by state and federal regulations, there is always the risk of accidental contamination or injury from these materials. To date, we have not incurred substantial expenditures for preventive action with respect to hazardous materials or for remedial action with respect to any hazardous materials accident, but the use and disposal of hazardous materials involves risk that we could incur substantial expenditures for such

17

Table of Contents

preventive or remedial actions. If such an accident were to occur, we could be held liable for resulting damages. The liability in the event of an accident or the costs of such remedial actions could exceed our resources or otherwise have a material adverse effect on our financial condition, results of operations or cash flows.

The reliability of market data included in our public filings is uncertain.

Since we operate in a rapidly changing market, we have in the past, and may from time to time in the future, include market data from industry publications and our own internal estimates in some of the documents we file with the SEC. The reliability of this data cannot be assured. Industry publications generally state that the information contained in these publications has been obtained from sources believed to be reliable, but that its accuracy and completeness is not guaranteed. Although we believe that the market data used in our filings with the Securities and Exchange Commission is and will be reliable, it has not been independently verified. Similarly, internal company estimates, while believed by us to be reliable, have not been verified by any independent sources.

Our international operations expose us to certain risks.

In 2007, we formed a joint venture with Hunchun Baoli Communication Co. Ltd. (“BAOLI”) to manufacture and sell our SuperLink interference elimination solution in China. In additional to facing many of the risks faced by our domestic business, if that joint venture or any other international operation we may have is to be successful, we (together with any joint venture partner) must recruit the necessary personnel and develop the facilities needed to manufacture and sell the products involved, learn about the local market (which may be significantly different from our domestic market), build brand awareness among potential customers and compete successfully with local organizations with greater market knowledge and potentially greater resources than we have. We must also obtain a number of critical governmental approvals from both the United States and the local country governments on a timely basis, including those related to any transfers of our technology. We must establish sufficient controls on any foreign operations to ensure that those operations are operated in accordance with our interests, that our intellectual property is protected and that our involvement does not inadvertently create potential competitors. There can be no assurance that these conditions will be met. Even if they are met, the process of building our international operations could divert financial resources and management attention from other business concerns. Finally, our international operations will also be subject to the general risks of international operations, such as:

| • | changes in exchange rates; |

| • | international political and economic conditions; |

| • | changes in government regulation in various countries; |

| • | trade barriers; |

| • | adverse tax consequences; and |

| • | costs associated with expansion into new territories. |

Risks Related to the Offering

Our stock price is volatile.

The market price of our common stock has been, and we expect will continue to be, subject to significant volatility. The value of our common stock may decline regardless of our operating performance or prospects. Factors affecting our market price include:

| • | our perceived prospects and liquidity; |

| • | progress or any lack of progress (or perceptions related to progress) in timely overcoming the remaining substantial technical and commercial challenges related to our HTS wire initiative; |

18

Table of Contents

| • | variations in our operating results and whether we have achieved key business targets; |

| • | changes in, or our failure to meet, earnings estimates; |

| • | changes in securities analysts’ buy/sell recommendations; |

| • | differences between our reported results and those expected by investors and securities analysts; |

| • | announcements of new contracts by us or our competitors; |

| • | market reaction to any acquisitions, joint ventures or strategic investments announced by us or our competitors; and |

| • | general economic, political or stock market conditions. |

Recent events have caused stock prices for many companies, including ours, to fluctuate in ways unrelated or disproportionate to their operating performance. The general economic, political and stock market conditions that may affect the market price of our common stock are beyond our control. The market price of our common stock at any particular time may not remain the market price in the future.

We have a significant number of outstanding warrants and options, and future sales of the shares obtained upon exercise of these options or warrants could adversely affect the market price of our common stock.

As of March 30, 2013, we had outstanding options exercisable for an aggregate of 137,534 shares of common stock at a weighted average exercise price of $35.56 per share and warrants to purchase up to 443,409 shares of our common stock at a weighted average exercise price of $15.58 per share. We have registered the issuance of all the shares issuable upon exercise of the options and warrants, and they will be freely tradable by the exercising party upon issuance. The holders may sell these shares in the public markets from time to time, without limitations on the timing, amount or method of sale. As our stock price rises, the holders may exercise their warrants and options and sell a large number of shares. This could cause the market price of our common stock to decline.

We also have an aggregate of 536,520 shares of our Series A Convertible Preferred Stock, or Series A Preferred Stock, outstanding which can be converted (under certain conditions) into an additional 447,100 shares of our common stock so long as the number of shares of our common stock beneficially owned by BAOLI and its affiliates following such conversion does not exceed 9.9% of our outstanding common stock. All of these shares are “restricted securities” as defined under Rule 144 under the Securities Act. See the section in the accompanying prospectus entitled “Description of Capital Stock – Preferred Stock.”

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We have not designated the amount of net proceeds from this offering to be used for any particular purpose. Accordingly, our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our profitability or market value.

Our corporate governance structure may prevent our acquisition by another company at a premium over the public trading price of our shares.

It is possible that the acquisition of a majority of our outstanding voting stock by another company could result in our stockholders receiving a premium over the public trading price for our shares. Provisions of our restated certificate of incorporation and bylaws, each as amended, and of Delaware corporate law could delay or

19

Table of Contents

make more difficult an acquisition of our company by merger, tender offer or proxy contest, even if it would create an immediate benefit to our stockholders. For example, our restated certificate of incorporation does not permit stockholders to act by written consent, and our bylaws generally require ninety days advance notice of any matters to be brought before the stockholders at an annual or special meeting.

In addition, our board of directors has the authority to issue up to 2,000,000 shares of preferred stock and to determine the terms, rights and preferences of this preferred stock, including voting rights of those shares, without any further vote or action by the stockholders. At March 30, 2013, 1,388,477 shares of preferred stock remained unissued. The rights of the holders of common stock may be subordinate to, and adversely affected by, the rights of holders of preferred stock that may be issued in the future. The issuance of preferred stock could also make it more difficult for a third party to acquire a majority of our outstanding voting stock, even at a premium over our public trading price.