Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXA CORP | d565365d8k.htm |

©

Exa Corporation Confidential

Investor Presentation

July 2013

Exhibit 99.1 |

Safe

Harbor Statement ©

Exa Corporation Confidential

2

Today’s presentation includes forward-looking statements intended to

qualify for the Safe

Harbor

from

liability

established

by

the

Private

Securities

Litigation

Reform

Act

of 1995.These forward-looking statements, including statements regarding our

financial expectations, demand for our solutions and growth in our markets,

are subject to risks, uncertainties and other factors that could cause

actual results to differ materially from those suggested by our

forward-looking statements. These factors include, but are not

limited to, the risk factors described in our Annual Report on Form

10-K for the year ended January 31, 2013, as filed with the SEC on April 9,

2013. Forward-looking information in this presentation represents our outlook

as of today, and we do not undertake any obligation to update these

forward-looking statements.

During

today's

presentation

we

may

refer

to

our

Adjusted

EBITDA.

This

is

a

non-

GAAP financial measure that has been adjusted for certain non-cash and other

items, and that is not computed in accordance with generally accepted

accounting principles. The GAAP measure most comparable to Adjusted EBITDA

is our net income (loss). A reconciliation of our historical Adjusted

EBITDA to our net income (loss) is included in our Form 10-K filed with

the SEC. . |

Company Overview

Leading Provider of Software that Enables

Simulation-Driven Product Design

Vehicle

Manufacturers

as Customers

90+

14 of the top 15 passenger

vehicle manufacturers

240+

Years of

Revenue Growth

10+

EBITDA positive past 3 years

Highly recurring and visible

business model

Employees

Global

Offices

10

HQ in Burlington, MA

Detroit, Japan, Germany,

Korea, France, China

3

©

Exa Corporation Confidential

Aerodynamics

Thermal Acoustics |

©

Exa Corporation Confidential

4

Highly-Visible, Consumption-based

Licensing Model

Proprietary, Market Leading Technology

Growing Multi-billion Dollar Market

Opportunity in Transportation Alone

Tangible, Immediate Value Proposition

Experienced Management Team

Top-tier Global Customers

Key Investment Highlights |

Transportation Market

Requirements ©

Exa Corporation. All rights reserved.

5

Aerodynamics

Aerodynamics

Faster Turnaround

Faster Turnaround

Time

Time

Weight Reduction

Weight Reduction

Fewer Prototypes

Fewer Prototypes

Increased

Increased

Automation

Automation

New Powertrains

New Powertrains

Efficiency2

Simulation-based

Simulation-based

Design

Design

Source: EPA

(1) The United States passenger car and light truck CAFE standard continues to rise to 56.2

MPG by 2025 (1)

0

10

20

30

40

50

60

1975

1985

1995

2005

2015

2025

U.S. CAFE |

Traditional Development Process

©

Exa Corporation. All rights reserved.

6

Expensive ($bn),

Expensive ($bn),

cumbersome

cumbersome

& time-consuming

& time-consuming

Brute-force

Brute-force

approach

approach |

Exa‘s Vehicle Development Process

©

Exa Corporation. All rights reserved.

7

Days

Geometric Complexity

Accurate Results

Proprietary Algorithms |

Global Customer Base

©

Exa Corporation Confidential

8

Passenger Vehicle

Truck & Off-Highway

Supplier/Other

Aerospace |

How

JLR Uses Exa’s PowerFLOW The Problem

Reduce joint fleet CO2 to meet global

emissions target by 2020+

Portfolio Diversification

Reduce cost of prototypes

Enable digital sign-off

9

©

Exa Corporation Confidential

The Results

Thermal Mgmt & Aerodynamic prototypes

eliminated prior to production tooling release

Further elimination opportunities for

Aeroacoustics & water mgmt in development |

Customer Case Studies

10

©

Exa Corporation. All rights reserved.

The Problem

Demand for more fuel efficient trucks

Top buying requirement

The Results

24% reduction in aerodynamic drag

12% improvement in fuel economy

~$5,600 annual fuel savings per vehicle |

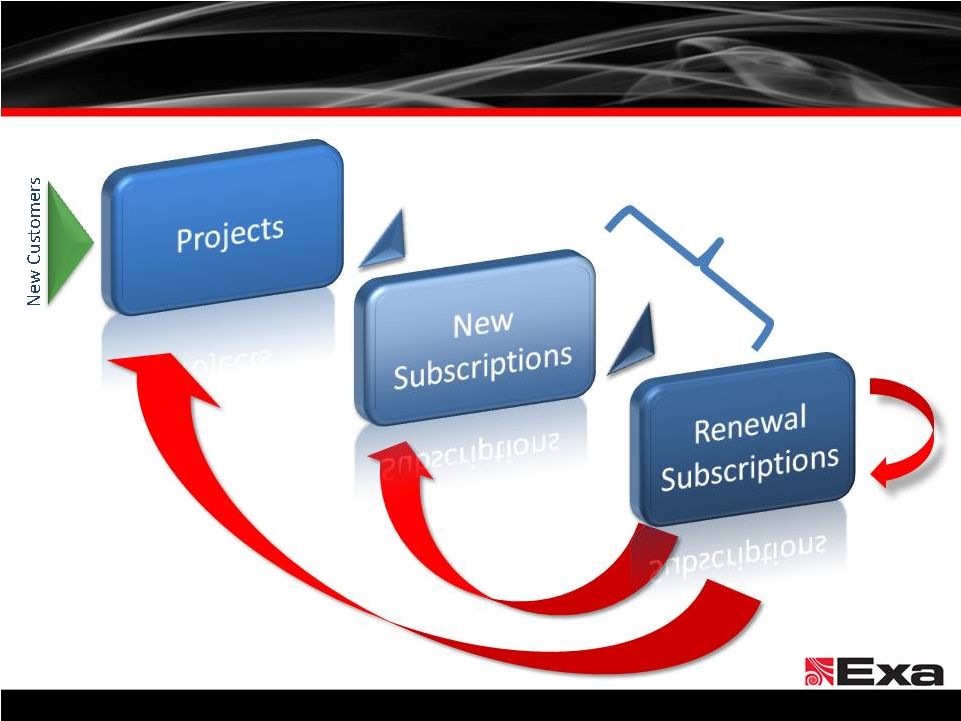

Customer Engagement Model

©

Exa Corporation Confidential

11

Annual

Annual

Renewals

Renewals

Deeper

Deeper

Deployment

Deployment

Upgrades

Upgrades

New

New

Applications

Applications

Capacity-Based Licensing

Capacity-Based Licensing

OnDemand

OnDemand

or On Premise

or On Premise |

PowerFLOW Product

Suite (Consumption-based License)

12

©

Exa Corporation Confidential

Simulation Preparation

(User-based License)

Simulation

Simulation Analysis

(User-based License)

PowerDELTA

®

Import, sort and organize CAD model

Apply parametric mesh features

Generate surface meshes & check quality

PowerFLOW

®

Automatic fluid discretization

Automatic multi-processor

parallelized simulation

~80% of license revenue

PowerINSIGHT

™

Streamline & automate the

results generation,

analysis, and reporting process

PowerCASE

™

Set up simulation case parameters

& boundary conditions

PowerCLAY

®

Morph mesh real-time

for rapid design iteration

& optimization

PowerTHERM

®

Fully-coupled 3D

conduction

& radiation solver

PowerCOOL

®

Fully-coupled

cooling system

model

PowerACOUSTICS

®

Analyze and predict acoustic noise

transmission to the interior

PowerVIZ

®

Analyze results and flow structures

with interactive 3D data

visualization, movies, & graphs

Design Iterations |

©

Exa Corporation Confidential

13

Highest Degree of Simulation Accuracy

Deep Domain Expertise

Faster Turnaround Time

Return on Investment

Differentiated Go-to-market Strategy

Why We Win |

Growth Strategy

©

Exa Corporation Confidential

14

•

Migrating from

physical to digital-

based approaches

Penetrate New

Geographies

Enable

Additional

Applications &

Solutions

Add New

Customers in

Ground

Transportation

Explore New

Verticals

Deepen Existing

Customer Base

Selectively

Pursue

Acquisitions

•

Identify new

applications to

address customer

needs

•

Significantly

underpenetrated

•

Adjacent markets

•

Expanding

presence in BRIC

•

Core technology is

extendable to

Aerospace, Oil &

Gas and Power

Generation

among others

•

Complementary

businesses &

technologies |

Key

Financial Highlights ©

Exa Corporation Confidential

15

Strong, Consistent Revenue Growth

Recurring & Predictable Business Model

Profitable & Cash Flow Positive

Attractive Long-term Model |

Consistent Revenue Growth

©

Exa Corporation Confidential

16

Note: We changed from a December 31 calendar year-end to a January 31st fiscal

year-end at the end of December 2006. 8.0

12.8

16.3

20.3

28.0

34.1

35.6

37.9

45.9

48.9

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Revenue ($M) |

History of Profitability

17

©

Exa Corporation Confidential

Adjusted EBITDA Margin

Adjusted EBITDA ($M)

FYE Jan 31

FYE Jan 31

Note: Please see Appendix for detailed definition and reconciliation of Adjusted EBITDA to the

comparable GAAP financial measure of net income (loss). We define EBITDA as net

income (loss), excluding depreciation and amortization, interest expense, other income (expense), foreign exchange gain (loss) and

provision for income taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash

share-based compensation expense. |

60%+ of our

annual revenue was attributable to contracts in place at

the beginning of the fiscal year

Annual consumption-based licenses

Increased consumption of simulation

capacity drives growth

Delivered on-premise or on-demand

Ratable revenue recognition

Project revenue is primarily derived

from simulation capacity

18

©

Exa Corporation Confidential

Highly Recurring & Predictable Model

Note: We compute our license revenue renewal rate for any fiscal

year by identifying the customers from whom we derived license revenue in the prior fiscal

year and dividing the dollar amount of license revenue that we receive in the current

fiscal year from those customers by the dollar amount of license revenue we received

from them in the prior fiscal year. Revenue Visibility

FY13 |

©

Exa Corporation Confidential

19

Revenue Mix

Note: Data as of FY 2013 |

Managing

business with focus on revenue growth combined with steady improvement in Adjusted

EBITDA margin Continue to invest in Sales team to deepen existing customer

penetration and add new customers

Improve

margins

due

to

operating

leverage,

especially

in

R&D

and

G&A

Targeting long-term adjusted EBITDA margin in low to mid 20% range

20

©

Exa Corporation. All rights reserved.

Target Model |

Appendix

©

Exa Corporation Confidential |

©

Exa Corporation Confidential

22

*See Appendix

Key Financial Metrics

FY11

FY12

FY13

1Q14

Revenue

License

$30.6

$38.8

$41.2

$10.7

Project

7.3

7.2

7.7

1.8

Total Revenue

$37.9

$45.9

$48.9

$12.5

Revenue Growth

6%

21%

6%

11%

Operating Expenses

Cost of Revenues

9.9

12.1

14.2

3.7

Sales & Marketing

6.1

6.2

7.1

2.1

Research & Development

12.8

14.5

16.7

4.4

General & Administrative

6.0

8.1

9.0

2.8

Non

-GAAP Operating Income*

$3.4

$5.7

$3.3

($0.1)

Adj. EBITDA*

$4.8

$7.2

$4.9

$0.3 |

Note:

To supplement our consolidated financial statements, which are presented on a GAAP basis, we

disclose Non-GAAP Operating Income and Adjusted EBITDA, non-GAAP The GAAP

measures most comparable to Non-GAAP Operating Income and Adjusted EBITDA are GAAP income from operations and GAAP net income (loss), respectively.

Reconciliations of these non-GAAP financial measures to the corresponding GAAP measures

are included above. We define non-GAAP operating income as GAAP operating income

excluding non-cash, stock-based compensation expense and amortization of acquired intangible assets. We

define EBITDA as net income (loss), excluding depreciation and amortization, interest

expense, and other income (expense), foreign exchange gain (loss) and provision for income

taxes. We define Adjusted EBITDA as EBITDA, excluding non-cash share-based

compensation expense. Adjusted EBITDA and Non-GAAP Operating Income

–

Definitions and Reconciliations

23

©

Exa Corporation. All rights reserved.

Non-GAAP Operating Income

April 30,

July 31,

October 31,

January 31,

April 30,

(In thousands)

2011

2012

2013

2012

2012

2012

2013

2013

Operating (loss) income

3,116

$

5,035

$

1,960

$

373

$

887

$

891

$

(191)

$

(457)

$

Add back:

Stock based compensation expense

281

636

924

241

234

235

214

245

Amortization of acquired intangible assets

0

65

383

97

97

98

91

88

Non-GAAP operating income

3,397

$

5,736

$

3,267

$

711

$

1,218

$

1,224

$

114

$

(124)

$

Year Ended January 31,

Three Months Ended

Adjusted EBITDA Reconciliation

April 30,

July 31,

October 31,

January 31,

April 30,

(In thousands)

2011

2012

2013

2012

2012

2012

2012

2013

Net (loss) Income

691

$

14,138

$

763

$

62

$

882

$

159

$

(340)

$

(541)

$

Depreciation and amortization

1,356

1,502

2,009

409

423

489

688

496

Interest expense, net

1,411

1,284

1,631

412

409

402

408

377

Other (income) expense

(10)

213

(529)

(66)

(445)

(2)

(16)

(2)

Foreign exchange loss (gain)

198

106

(17)

0

(326)

115

194

(37)

Provision for income tax

826

(10,706)

112

(35)

367

217

(437)

(254)

EBITDA

4,472

6,537

3,969

782

1,310

1,380

497

39

281

636

924

241

234

235

214

245

Adjusted EBITDA

4,753

$

7,173

$

4,893

$

1,023

$

1,544

$

1,615

$

711

$

284

$

Year Ended January 31,

Non-cash, share based

compensation expense

Three Months Ended

measures that exclude certain amounts. These non-GAAP measures are not in accordance with,

or an alternative for, generally accepted accounting principles in the United States. |

Ground Transportation Applications

©

Exa Corporation Confidential

24 |