Attached files

| file | filename |

|---|---|

| EX-4.9 - EX-4.9 - Q Therapeutics, Inc. | d545757dex49.htm |

| EX-23.1 - EX-23.1 - Q Therapeutics, Inc. | d545757dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 5, 2013

File No: 333-189495

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

Q THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

2834

(Primary Standard Industrial

Classification Code Number)

20-3708500

(I.R.S. Employer

Identification Number)

615 Arapeen Drive, Suite 102

Salt Lake City, UT 84108

Phone: (801) 582-5400

Fax: (801) 582-5401

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven Borst

Chief Financial Officer

615 Arapeen Drive, Suite 102

Salt Lake City, UT 84108

Phone: (801) 582-5400

Fax: (801) 582-5401

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Kevin J. Ontiveros, Esq.

Life Science Law, PC

1885 West 2100 South.

Salt Lake City, UT 84119

T: (801) 839-3502

F: (801) 503-9255

As soon as practicable after this Registration Statement is declared effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee (1) | ||||

| Common stock, par value $0.0001 per share |

Up to 5,000,000 shares | |||||||

| Warrants to purchase shares of common stock (2) |

Up to 1,250,000 warrants | |||||||

| Common stock issuable upon exercise of warrants |

Up to 1,250,000 shares | |||||||

| Total |

$ 5,000,000 | $682.00 (3) | ||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | The securities registered also include such indeterminate number of shares of common stock as may be issued upon exercise of warrants pursuant to the antidilution provisions of the warrants. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (or the “SEC”), acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the United States Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

DATED JULY 5, 2013

PROSPECTUS (Subject to Completion)

Q THERAPEUTICS, INC.

5,000,000 Shares of Common Stock

and

Warrants to Purchase up to 1,250,000 Shares of Common Stock

This is Q Therapeutics, Inc.’s initial public offering of Units, consisting of 5,000,000 shares of common stock and warrants to acquire an aggregate of up to 1,250,000 shares of common stock of Q Therapeutics. The warrants will be immediately exercisable and will expire on the fourth anniversary of their issuance date. We expect the initial public offering price to be between $[ ] and $[ ] per Unit. Each Unit consists of one share of common stock and one warrant exercisable for a quarter (.25) of a share of common stock. No Units will be issued, however, and purchasers will receive only shares of common stock and warrants.

Our common stock is presently not traded or quoted on any market or securities exchange, but we intend to apply to have our common stock quoted on the OTC Bulletin Board under the symbol “QCEL”. Public trading of our common stock may never materialize or even if materialized, be sustained.

WE ARE AN “EMERGING GROWTH COMPANY” UNDER THE FEDERAL SECURITIES LAWS AND WILL BE SUBJECT TO REDUCED PUBLIC COMPANY REPORTING REQUIREMENTS. THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 6.

| Public offering price per Unit |

$ | $ | ||||||

| Underwriting discounts and commissions payable by us (1) (2) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ |

| (1) | For the purpose of estimating the underwriter’s fees, we have assumed that the underwriter will receive its maximum commission on all sales made in the offering. The underwriter will also be entitled to reimbursement of expenses up to a maximum of $[ ]. |

| (2) | We estimate the total expenses of this offering, excluding the underwriter fees, will be approximately $[ ]. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, underwriter fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering set forth above. See “Underwriting” beginning on page 27 of this prospectus for more information on this offering and the underwriter arrangements. |

MLV & Co. LLC has agreed to act as our underwriter in connection with this offering. The underwriter is not purchasing the securities offered by us, and is not required to sell any specific number or dollar amount of securities, but will use its best efforts to arrange for the sale of the securities offered by us.

All costs associated with the registration will be borne by us. As there is no minimum purchase requirement, no funds are required to be placed in escrow, trust or similar arrangement and all net proceeds will be available to us at closing for use as set forth in “Use of Proceeds” beginning on page 27.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Sole Book-Running Manager

The date of this prospectus is , 2013.

Table of Contents

Table of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the Securities and Exchange Commission and incorporated by reference herein, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or our future performance. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this prospectus, including the matters set forth under the captions “Risk Factors” and in our other filings with the Securities and Exchange Commission (SEC). These risks and uncertainties could cause our actual results to differ materially from those indicated in the forward-looking statements. We undertake no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this prospectus reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Related to the Company’s Business” above, as well as those discussed elsewhere in this prospectus. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. We file reports with the SEC. You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549 on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

Table of Contents

This prospectus summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you should consider before investing in our common stock and warrants to purchase common stock. You should carefully read the entire prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and notes thereto before making an investment decision. In this prospectus, unless the context requires otherwise, references to “Q,” “we,” “us,” or “the Company” refer to Q Therapeutics, Inc. and its consolidated subsidiaries.

Company Overview

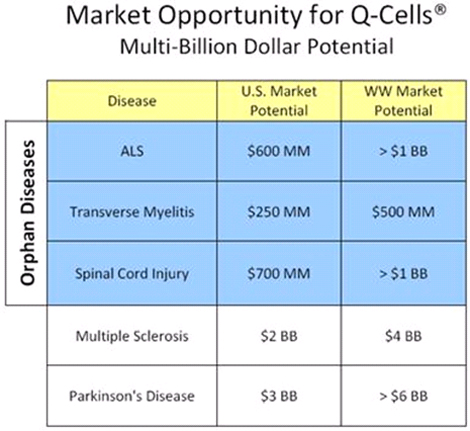

Q Therapeutics, Inc. is a biotechnology company focused on the field of regenerative medicine. We are developing novel and proprietary cell-based therapies to treat severe, often life-threatening neurodegenerative diseases, with a first clinical program to be launched in Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease) in early 2014.

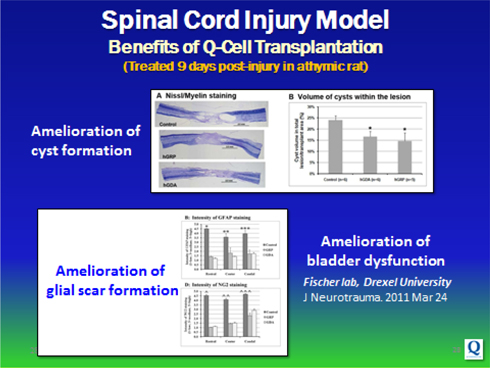

Upon successful completion of our ALS program, we anticipate broadening our clinical program to additional neurodegenerative indications including Transverse Myelitis, Spinal Cord Injury, Stroke, Parkinson’s, Multiple Sclerosis and Alzheimer’s disease.

Q Therapeutics’ differentiated approach leverages on the scientific findings and intellectual property developed by our co-founder Mahendra Rao, M.D., Ph.D., during his tenure at the University of Utah and as Head of the Stem Cell Section at the National Institutes of Health (NIH). A global leader in glial stem cell biology, Dr. Rao was one of the first scientists to identify and seek patent coverage on stem cells and their progeny cells found in the Central Nervous System (CNS).

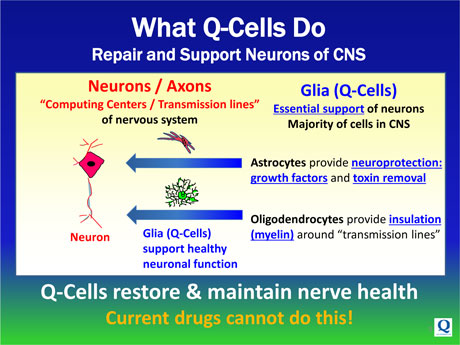

The Rationale for Q-Cells®

Neurodegenerative diseases are by nature complex and treatment modalities that have historically focused on single mechanisms of action have failed to show meaningful clinical benefits.

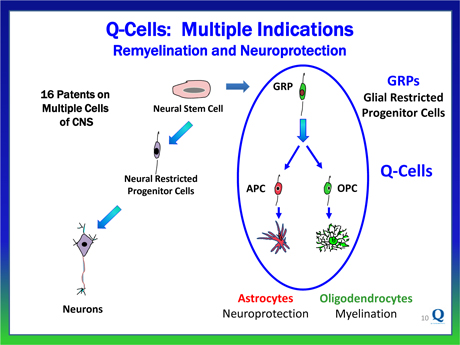

Understanding the multi-factorial nature of these processes, Q Therapeutics’ patented cell-based platform takes a more holistic approach and leverages on utilizing human glial restricted progenitor cells (GRPs) and their progeny cells in the treatment of neurodegenerative diseases.

Glial cells are the naturally occurring cells in the brain and spinal cord that serve to protect the health and function of neurons. In many neurodegenerative diseases, these native glial cells become diseased and subsequently die. When this occurs, the myriad repair functions that glial cells normally provide are lost, and the result is neuronal damage and destruction.

Q Therapeutics has trademarked the glial restricted progenitor cells (GRPs) together with their progeny, under the name of Q-Cells®.

By enhancing the natural cellular machinery that enables healthy CNS systems to function, the administration of Q-Cells® is expected to maintain and / or restore the integrity of existing neurons and protect their function and survival.

We own exclusive worldwide rights to issued patents and numerous patent applications covering Q-Cells® and their production through an agreement with the University of Utah, augmented by internally developed intellectual property. The patent portfolio includes 16 issued patents whose claims cover composition of matter, methods of production and methods of use of multiple cell types of the CNS (including Q-Cells®) as well as cells of the peripheral nervous system, giving us a strong intellectual property position. This patent portfolio provides proprietary protection until 2030.

The Process and Differentiation

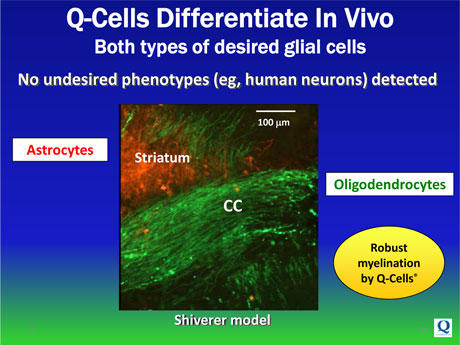

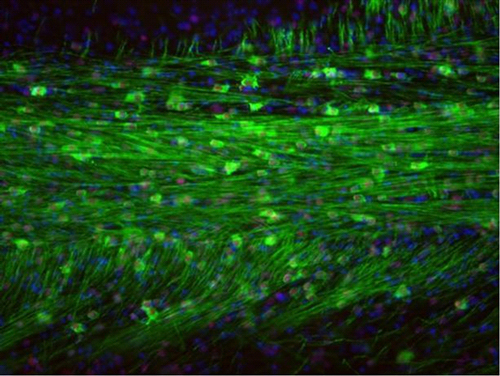

Q-Cells® are administered into the brain and spinal cord. Once administered, Q-Cells® predictably replicate and migrate within the CNS before fully differentiating into two mature glial cell subtypes, specifically:

| • | Oligodendrocytes, which form the insulating myelin layer around the axons of neurons, enabling their normal function for signal transmission, and |

| • | Astrocytes, which protect and support neurons and axons through several pathways including the production of essential growth factors, other trophic factors and the removal of destructive toxins. |

1

Table of Contents

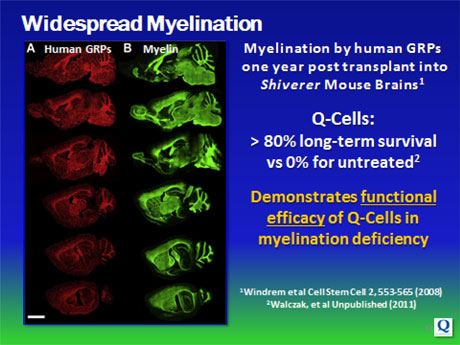

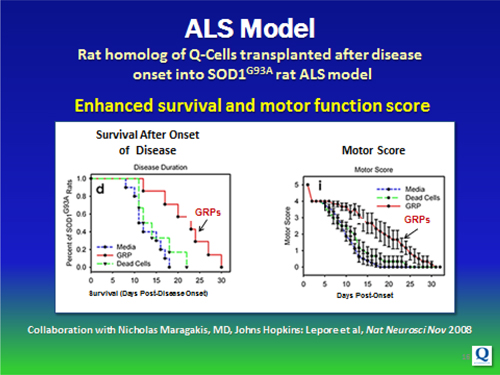

Our pre-clinical research has demonstrated the ability of newly formed astrocytes and oligodendrocytes, derived from glial or Q-Cells®, to repair and / or salvage neurons by tapping into the CNS’ natural support mechanism. The resulting effect has been modifying the course of these diseases, improving function and extending life span, in some instances.

Specifically, glial / Q-Cells® have been shown to halt neuronal degeneration and support neuronal health (demonstrated in ALS models; relevant to Parkinson’s disease); as well as provide myelin repair functions for diseases or injuries involving demyelination (relevant to MS, Transverse Myelitis, Cerebral Palsy and Spinal Cord Injury).

We believe that our approach, which leverages on salvaging and bolstering the function of the natural cellular mechanism of the CNS and existing neurons, represents a faster and more efficient approach to treat acutely debilitating neurodegenerative diseases than do alternative stem cell approaches. Specifically, Q-Cells® are mature progenitor cells at an advanced stage of differentiation versus the more primitive, less differentiated, neural stem cells, which carry the risk of producing aberrant neuronal connections and harmful neuron formation.

Also, Q-Cells® are native to the normal central nervous system, act locally and remain in the CNS. This is in contrast to Mesenchymal Stem Cells (derived from bone marrow blood or fat) that act systemically and are short-lived after transplantation. Finally, Q-Cells® appear to produce lasting benefits in animal models of disease.

Clinical Trial Plans – ALS

We have chosen ALS as the lead clinical indication for Q-Cells® for several reasons:

| • | Animal and human ALS disease data have shown glial cells to be defective in affected subjects |

| • | Benefits have been obtained in animal studies with transplanted healthy glial cells |

| • |

Q-Cells® produce both astrocytes and oligodendrocytes (glial cells) in animal models |

| • |

Q-Cells® may be able to functionally replace diseased astrocytes and oligodendrocytes, thereby reducing motor neuron death and slowing or halting disease progression |

| • | The unmet medical need for an effective treatment for this fatal disease is substantial. |

In January 2012, we held a pre-Investigational New Drug (IND) meeting with the Food and Drug Administration (FDA) to discuss Q-Cells® for the treatment of ALS. The FDA required that we complete definitive GLP safety studies in preparation for our first-in-man clinical trial.

In December 2012, we initiated these studies which will serve to demonstrate the local biodistribution of Q-Cells® within the CNS, among other parameters. Final data from these ongoing GLP safety studies is expected during the fourth quarter of 2013. To date, we have seen no safety issues associated with the administration of Q-Cells®. We plan to complete all requisite GLP pre-clinical safety and device studies during the second half of 2013 with the intention of submitting our IND to the FDA shortly thereafter.

Phase 1/2a Design

In early 2014, we intend to initiate a Phase 1/2a open label study at Emory University School of Medicine and Johns Hopkins University School of Medicine; both institutions with a leadership position in ALS clinical research.

We anticipate commencing enrollment in 12-15 ALS patients. It is anticipated that the two-site trial will be completed in 18-24 months pursuant to the initiation of enrollment.

The endpoints of the trial include safety of Q-Cells® administration as a primary measure, with surrogate measures of efficacy as secondary endpoints. These secondary endpoints will be measured using tests for muscle integrity (electrical impedance myography), muscle strength (handheld dynamometry), and respiratory function (forced vital capacity), as well as overall physical condition and function (ALSFRS-R).

2

Table of Contents

Given the open label nature of the trial, we expect to read out data starting in second half of 2014.

Upon completion of the initial Phase 1/2a portion of the trial, we plan to meet with FDA to discuss an extended Phase 2a trial consisting of up to 20 additional patients. We have had ongoing discussions with investigators at the University of California at San Francisco and the University of California at San Diego, as both have demonstrated interest in participating in an expanded trial.

Future Clinical Trial and Product Development Efforts

Following the initiation of our clinical trial with Q Cells® in ALS, we plan to pursue additional orphan indications, to demonstrate Q-Cells®’ benefit in Transverse Myelitis and Spinal Cord Injury. We believe focusing on demonstrating Q Cells® in severe diseases with orphan populations (and exclusivity) will enable us to attain an accelerated commercialization path while maintaining capital efficiency. We expect that this strategy will also enable us to enter into strategic partnerships with larger biotechnology, pharmaceutical or cell therapy companies to conduct trials for larger indications, including Multiple Sclerosis, Stroke, Parkinson’s and Alzheimer’s disease.

Historical Financing

Since inception, we have raised approximately $18 million in equity financing. In 2008, Invitrogen, Inc. (now Life Technologies, Inc.) invested $2.6 million into our platform. More recently, in 2011, Cephalon (now Teva Pharmaceutical Industries Ltd.), conducted extensive diligence prior to making an equity investment of $3.7 million into Q, following their 2010 investment in Mesoblast Ltd., another cell therapy company.

We have also benefitted from over $4 million of non-dilutive grant funding, predominantly from the National Institutes of Health (NIH).

These funds have enabled us to conduct studies in 5 distinct pre-clinical models of neurodegenerative disease including ALS, Multiple Sclerosis, Transverse Myelitis, Spinal Cord Injury and Myelination. The results of this work have been published in peer-reviewed journals including Nature Neuroscience, Cell Stem Cell, Regenerative Medicine, Glia, and the Journal of Neurotrauma. In addition, we have expanded our IP portfolio both through in house development and in-licensing, developed GLP/GMP manufacturing processes and worked closely with FDA to support our proposed IND filing in ALS.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”) enacted into law on April 5, 2012, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not applicable to emerging growth companies. Many of these exemptions are also available to smaller reporting companies like us that have less than $75 million of worldwide common equity held by non-affiliates. Absent unforeseeable changed circumstances, however, we will not take advantage of those exemptions that are available to us solely as a result of our status as an emerging growth company, except with respect to allowable pre-offering communications in any future securities offerings.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the Securities Act) for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision not to take advantage of the extended transition period for complying with new or revised accounting standards is irrevocable.

As an emerging growth company, the Company is exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002. Section 404(a) requires issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the independent registered public accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

3

Table of Contents

As an emerging growth company, the Company is also exempt from Section 14A and B of the Exchange Act which require shareholder approval of executive compensation and golden parachutes.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.0 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1.0 billion in non-convertible debt during the preceding three year period.

Corporate History and Information

Q Therapeutics, Inc. was incorporated in the state of Delaware on March 28, 2002. On October 13, 2011, Q Therapeutics merged with Q Acquisition, Inc., a Delaware corporation and a wholly owned subsidiary of Grace 2, Inc. On November 2, 2011, Grace 2 changed its name to Q Holdings, Inc. and on December 10, 2012 it changed its name to Q Therapeutics, Inc. Our headquarters are located at 615 Arapeen Drive, Suite 102, Salt Lake City, Utah 84108. Our telephone number is (801) 582-5400. Our website is http://www.qthera.com. The information contained on or accessible though our website is not part of this prospectus, other than documents that we file with the SEC that are incorporated by reference into this prospectus.

4

Table of Contents

| The Issuer: | Q Therapeutics, Inc., a Delaware corporation | |

| Securities Being Offered: | Up to 5,000,000 shares of our common stock, par value $0.0001 per share and warrants to purchase up to 1,250,000 shares of common stock. Each warrant may be exercised at any time on or after the date that the warrant is issued until the fourth anniversary date at an exercise price of $ per share of common stock, subject to adjustment. This prospectus also relates to the offering of shares of common stock issuable upon exercise of warrants. | |

| Common stock outstanding as of July 5, 2013: | 24,811,833 shares | |

| Common stock to be outstanding after the offering assuming the sale of all shares covered hereby and no exercise of warrants for the shares covered by this prospectus: | 29,811,833 shares | |

| Common stock to be outstanding after the offering assuming the sale of all shares covered hereby and the exercise of all warrants for the shares covered by this prospectus: | 31,061,833 shares | |

| Use of Proceeds: | Assuming we sell [ ] units, we estimate that we will receive up to [$ ] million in net proceeds from the sale of the securities in this offering, assuming an initial public offering price of [$ ] per unit (which is the midpoint of the price range set forth on the cover page of this prospectus) and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. However, this is a best efforts offering, with no maximum or minimum, and there is no assurance that we will receive significant proceeds or enough proceeds to continue as a going concern and we may need to curtail or cease our operations. We intend to use the net proceeds from the sale of the securities for the clinical development of our Phase 1/2a study, for working capital needs, capital expenditures, and other general corporate purposes. See “Use of Proceeds” for more information. | |

| Dividend policy: | We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying cash dividends on our common stock. | |

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. | |

| Proposed OTC trading symbol | QCEL | |

5

Table of Contents

An investment in our common stock and our warrants to purchase common stock involves a high degree of risk. In addition to the other information in this prospectus, you should carefully consider the following factors in evaluating us and our business before purchasing the shares of common stock and our warrants to purchase common stock offered hereby. This prospectus contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below, as well as those discussed elsewhere in this prospectus, including the documents incorporated by reference.

RISKS RELATED TO THE COMPANY’S BUSINESS

Our business is at an early stage of development, and we may fail to develop and commercialize our potential product candidates.

Our business is at an early stage of development in that we do not yet have potential product candidates in clinical trials or on the market and we have not filed an Investigational New Drug, or IND, application with the FDA for any of our potential product candidates. Our ability to develop potential product candidates that progress to and through clinical trials is subject to our ability to, among other things:

| • | succeed in our research and development efforts; |

| • | select therapeutic compounds or cell therapies for development that have acceptable safety and efficacy profiles; |

| • | obtain required regulatory approvals; |

| • | finance, or obtain additional financing for, our clinical trials; |

| • | manufacture potential product candidates; and |

| • | collaborate successfully with clinical trial sites, academic institutions, physician investigators, clinical research organizations and other third parties; and achieve adequate enrollment of subjects. |

We have a history of losses and anticipate future losses, and continued losses could impair our ability to sustain operations.

We have incurred operating losses every year since our incorporation in 2002. As of March 31, 2013, our accumulated deficit was $20,991,557. Losses have resulted principally from costs incurred in connection with our research and development activities and from general and administrative expenses associated with our operations. We expect to incur additional operating losses and, as our development efforts continue and clinical testing activities, if any, commence our operating losses may increase in size.

Substantially all of our revenues to date have been from grants or license/research agreements. We may be unsuccessful in obtaining any new grants or entering into new license agreements that result in revenues. We do not expect that the revenues generated from any of these arrangements will be sufficient alone to continue or expand our research or development activities and otherwise sustain our operations.

Our ability to continue or expand our research and development activities and otherwise sustain our operations is dependent on our ability, alone or with others, to, among other things, manufacture and market therapeutic products. We also expect to experience negative cash flows from operating activities for the foreseeable future as we fund our operating losses and capital expenditures. This will result in decreases in our working capital, total assets and stockholders’ equity, which may not be offset by future financings. We will need to generate significant revenues to achieve profitability. In order to achieve profitability, we must

6

Table of Contents

develop products that can be commercialized by us or through our future collaborations. Our ability to generate revenues and become profitable will depend on our ability, alone or with potential collaborators, to successfully complete the development of our products in a timely and capital efficient manner. We may not be able to generate these revenues, and we may never achieve profitability. Our failure to achieve profitability could negatively impact the market price of our common stock. Even if we do become profitable, we cannot assure you that we would be able to sustain or increase profitability on a quarterly or annual basis.

We will need additional capital to conduct our operations and develop our potential product candidates, and our ability to obtain the necessary funding is uncertain.

We will require substantial capital resources in order to conduct our operations and develop our potential product candidates. The timing and degree of any future capital requirements will depend on many factors, including:

| • | the accuracy of the assumptions underlying our estimates for our capital needs for the remainder of the 2013 year end and beyond; |

| • | the magnitude and scope of our research and development programs; |

| • | the progress we make in our research and development programs, pre-clinical development and clinical trials; |

| • | our ability to establish, enforce and maintain strategic arrangements for research, development, clinical testing, manufacturing and marketing; |

| • | the number and type of potential product candidates that we pursue; |

| • | the time and costs involved in obtaining regulatory approvals and clearances; and |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims. |

We do not have any committed sources of capital. Additional financing through strategic collaborations, public or private equity financings, debt financing, capital lease transactions or other financing sources may not be available on acceptable terms, or at all. The receptivity of the public and private equity markets to proposed financings is substantially affected by the general economic, market and political climate and by other factors which are unpredictable and over which we have no control. Additional equity financings, if we obtain them, could result in significant dilution to our shareholders. Further, in the event that additional funds are obtained through arrangements with collaborative partners, these arrangements may require us to relinquish rights to some of our technologies, potential product candidates or proposed products that we would otherwise seek to develop and commercialize ourselves. If sufficient capital is not available, we may be required to delay, reduce the scope of or eliminate one or more of our programs, any of which could have a material adverse effect on our business.

Our business is dependent on limited potential product candidates.

At present, our ability to progress as an entity is significantly dependent on our first product candidate for neurodegenerative diseases, with the initial clinical indication for ALS, which is, currently in pre-clinical development. If we are successful with filing an IND and the FDA approves the application, we do not expect to commence human clinical trials before 2014. Any pre-clinical, regulatory or other development that significantly delays or prevents us from commencing or subsequently completing any of our trials, any material safety issue or adverse side effect to any study participant in these future trials, or the failure of trials to show the results expected would likely depress our stock price significantly and could prevent us from raising the additional capital we will need to further develop our cellular technologies. Moreover, any material adverse occurrence in our first clinical trials

7

Table of Contents

could substantially impair our ability to initiate clinical trials to test our cell therapies in other potential indications. Also, any material adverse event in clinical trials from other companies using cell therapy products could have a material adverse impact on our ability to carry out clinical trials. This, in turn, could adversely impact our ability to raise additional capital and pursue our planned research and development efforts.

Our business relies on cell therapy technologies that we may not be able to commercially develop.

We have concentrated the majority of our research on cell therapy technologies. Our ability to generate revenue and operate profitably will depend on being able to develop these technologies for human applications. These are emerging technologies and have limited human applications. We cannot guarantee that we will be able to develop our technologies or that such development will result in products with any commercial utility or value. We anticipate that the commercial sale of such products and royalty/licensing fees related to the technology will be our future primary sources of revenues. If we are unable to develop our technologies, we may never realize significant revenue.

Our product development programs are based on novel technologies and are inherently risky.

We are subject to the risks of failure inherent in the development of products based on new technologies. The novel nature of these therapies creates significant challenges in regard to product development and optimization, manufacturing, government regulation, third-party reimbursement and market acceptance. For example, the pathway to regulatory approval for cell-based therapies, including our potential product candidates, may be more complex and lengthy than the pathway for conventional drugs. These challenges may prevent us from developing and commercializing products on a timely or profitable basis, or at all.

We currently have no internal manufacturing capability and we intend to rely upon third-party manufacturers for our cells.

We currently have no internal manufacturing capability, and will rely extensively on licensees, strategic partners or third-party contract manufacturers or suppliers. Should we be forced to manufacture our cell therapy product, we cannot give you any assurance that we will be able to develop an internal manufacturing capability or procure alternative third-party suppliers. Moreover, we cannot give you any assurance that any contract manufacturers or suppliers we procure will be able to supply our product in a timely or cost effective manner or in accordance with applicable regulatory requirements or our specifications. We are presently working with the University of Utah’s Cell Therapy & Regenerative Medicine Facility (CTRM) in the production of Q-Cells. We will need to change manufacturers at some point in the future in order to manufacture a product for commercial sale, among other things. When that change to a new manufacturer is made, it will likely entail additional expense to achieve technology transfer and validation, which could cause delays in manufacturing and product development activities.

Restrictions on the use/development of human cell technology may adversely affect our business.

We base our research and development on the use of human cells obtained from human tissue. The U.S. federal and state governments and other jurisdictions impose restrictions on the acquisition and use of human tissue, including those incorporated in federal Good Tissue Practice (GTP) regulations. These regulatory and other constraints could prevent us from obtaining cells and other components of our products in the quantity or of the quality needed for their development or commercialization. These restrictions change from time to time and may become more onerous. Additionally, we may not be able to identify or develop reliable sources for the cells necessary for our potential products - that is, sources that follow all state and federal laws and guidelines for cell procurement. Certain components used to manufacture our cell potential product candidates will need to be manufactured in compliance with the FDA’s Good Manufacturing Practices (GMP). Accordingly, we will need to enter into supply agreements with companies that manufacture these components to GMP standards. There is no assurance that we will be able to enter into any such agreements.

8

Table of Contents

Noncompliance with applicable requirements both before and after approval, if any, can subject us, our third-party suppliers and manufacturers and our other collaborators to administrative and judicial sanctions, such as, among other things, warning letters, fines and other monetary payments, recall or seizure of products, criminal proceedings, suspension or withdrawal of regulatory approvals, interruption or cessation of clinical trials, total or partial suspension of production or distribution, injunctions, limitations on or the elimination of claims we can make for our products, refusal of the government to enter into supply contracts or fund research, or government delay in approving or refusal to approve new drug applications.

Our inability to complete pre-clinical and clinical testing and receive regulatory approvals will impair our viability.

No assurances can be given that we will be able to commence clinical trials for any of our potential product candidates or that any clinical trials will be completed or result in a successful outcome. If regulatory authorities do not approve our products or if we fail to maintain regulatory compliance, we would be unable to commercialize our therapeutic products, and our business and results of operations would be materially harmed.

Positive results from pre-clinical studies should not be relied upon as evidence that our clinical trials will succeed. Even if our potential product candidates achieve positive results in pre-clinical studies, we will be required to demonstrate through clinical trials that the potential product candidates are safe and effective for use in a diverse population before we can seek regulatory approvals for their commercial sale. There is typically an extremely high rate of attrition from the failure of potential product candidates as they proceed through clinical trials. If any product candidate fails to demonstrate sufficient safety and efficacy in any clinical trial, then we would experience potentially significant delays in, or be required to abandon, development of that product candidate. If we delay or abandon our development efforts of any of our potential product candidates, then we may not be able to generate sufficient revenues to become profitable, and our operations could be materially harmed.

Potential lead drug compounds or other potential product candidates and technologies require significant pre-clinical and clinical testing prior to regulatory approval in the United States and other countries. Our potential product candidates may prove to have undesirable and unintended side effects or other characteristics adversely affecting their safety, efficacy or cost-effectiveness that could prevent or limit their commercial use. In addition, our potential product candidates may not prove to be more effective for treating disease or injury than current therapies. Accordingly, we may have to delay or abandon efforts to research, develop or obtain regulatory approvals to market our potential product candidates. In addition, we will need to determine whether any of our potential products can be manufactured in commercial quantities at an acceptable cost. Our research and development efforts may not result in a product that can be or will be approved by regulators or marketed successfully. Competitors may have proprietary rights that prevent us from developing and marketing our products or they may sell similar, superior or lower cost products. Adverse results in research or clinical trials of others with cell therapy products may adversely affect regulatory or financial areas that could hinder our ability to continue with our clinical development. Because of the significant scientific, regulatory and commercial milestones that must be reached for any of our development programs or potential product candidates to be successful, any program or product candidate may be abandoned, even after we have expended significant resources, such as our investments or prospective investments in cell therapy technologies, which could adversely affect our business and materially and adversely affect our stock price.

The science and technology of stem and progenitor cell biology are relatively new. There is no precedent for the successful commercialization of therapeutic potential product candidates being developed by Q Therapeutics based on these technologies. Therefore, our development programs are particularly risky and uncertain. In addition, we, and/or our collaborators must undertake significant research and development activities to develop potential product candidates based on these technologies, which will require additional funding that may take years to accomplish, and may never result in successfully commercializing any of our potential product candidates.

9

Table of Contents

Our business is subject to ethical and social concerns and restrictions on use of stem or progenitor cells could prevent us from developing or gaining acceptance for commercially viable products based upon such technology and adversely affect the market price of our common stock.

The use of human cells for research and therapy has been the subject of debate regarding ethical, legal and social issues. Negative public attitudes toward cell therapy could result in greater governmental regulation of such therapies, which could harm our business. For example, concerns regarding such possible regulation could impact our ability to attract collaborators and investors. Existing and potential U.S. government regulation of human tissue may lead researchers to leave the field of stem and progenitor cell research or the country altogether, in order to assure that their careers will not be impeded by restrictions on their work. Similarly, these factors may induce graduate students to choose other fields less vulnerable to changes in regulatory oversight, thus exacerbating the risk that we may not be able to attract and retain the scientific personnel we need in the face of competition among pharmaceutical, biotechnology and health care companies, universities and research institutions for what may become a shrinking class of qualified individuals.

Some of our most important programs involve the use of progenitor cells that are derived from human fetal cadaver tissue. The use of these progenitor cells can give rise to ethical and social issues regarding elective termination of pregnancy and the appropriate use of tissue derived therefrom. Some political and religious groups have voiced opposition to these technologies and practices. We use progenitor cells, and may use stem cells, derived from fetal cadaver tissue. Our research related to these derivatives may become the subject of adverse commentary or publicity, which could significantly harm the market price of our common stock. Changes in federal or state laws regulating rights to elective terminations of pregnancy may adversely impact our ability to procure tissue for manufacturing our products.

We are not using cells derived from embryonic stem cells. Government imposed restrictions with respect to use of embryos in research and development still could have a negative material effect on our business, including reducing interest in the cell therapy field overall and reducing interest in financing our business, impairing our ability to establish critical partnerships and collaborations.

These potential effects and others may result in a decrease in the market price of our common stock.

We operate in leased facilities and cannot be assured that these facilities will be available to us upon expiration of our current lease.

We occupy laboratory and office space in facilities leased from a commercial landlord, and we have added improvements to these facilities at our own expense to meet our laboratory needs. Our lease agreement for this space has expired and we are presently in negotiations with the landlord on the terms of a new lease agreement. The landlord has continued to accept lease payments which we have been paying at the rate we expect to be charged in the new lease. We cannot be assured that we will be able to agree on terms with the landlord for continuing in the space and that we will remain in the same space. If we need to move to a new facility, this will require additional expense to add the improvements needed for our operations, as well as delay our development activities until we are fully operational in a new space.

We may engage in acquisitions or strategic transactions or make investments that could result in significant changes or management disruption and fail to enhance stockholder value.

We may engage in acquisitions or strategic transactions or make investments with the goal of maximizing stockholder value. We may acquire businesses, in-license new technologies for development, enter into joint

10

Table of Contents

ventures or other strategic transactions, and purchase equity and debt securities, including minority interests in publicly traded and private companies, non-investment-grade debt securities, equity and debt mutual and exchange-traded funds, and corporate bonds/notes. Some of our strategic investments may entail a high degree of risk and will not become liquid until more than one year from the date of investment, if at all. Any or all of our acquisitions or strategic investments that we may undertake in the future may not generate financial returns or result in increased adoption or continued use of our technologies. In addition, our other investments may not generate financial returns or may result in losses due to market volatility, the general level of interest rates and inflation expectations. In some cases, we may be required to consolidate or record our share of the earnings or losses of those companies. Our share of any losses will adversely affect our financial results until we exit from or reduce our exposure to these investments. Achieving the anticipated benefits of acquisitions depends in part upon our ability to integrate the acquired businesses in an efficient and effective manner. The integration of companies that have previously operated independently may result in significant challenges, and we may be unable to accomplish the integration smoothly or successfully. We cannot assure you that the integration of acquired businesses with our business will result in the realization of the full benefits anticipated by us to result from the acquisition. We may not derive any commercial value from the acquired technology, products and intellectual property or from future technologies and products based on the acquired technology and/or intellectual property, and we may be subject to liabilities that are not covered by indemnification protection we may obtain.

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure may create uncertainty regarding compliance matters. New or changed laws, regulations and standards are subject to varying interpretations in many cases. As a result, their application in practice may evolve over time. We are committed to maintaining high standards of corporate governance and public disclosure. Complying with evolving interpretations of new or changed legal requirements may cause us to incur higher costs as we revise current practices, policies and procedures, and may divert management time and attention from product development and revenue generation to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation might also be harmed.

We are subject to the reporting requirements of federal securities laws, which can be expensive and may divert management’s time and Company resources from other projects, thus impairing our ability to grow.

We are an SEC reporting company and, accordingly, subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the Sarbanes-Oxley Act). The costs of preparing and filing annual, quarterly and current reports, proxy statements and other information with the SEC, and furnishing audited reports to shareholders are high and will put pressure on our cash resources.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures.

11

Table of Contents

We are an “emerging growth company,” and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups, or JOBS, Act enacted in April 2012, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years following the completion of this offering, although, if we have more than $1.0 billion in annual revenue, if the market value of our common stock that is held by non-affiliates exceeds $700 million as of June 30 of any year, or we issue more than $1.0 billion of non-convertible debt over a three-year period before the end of that five-year period, we would cease to be an “emerging growth company” as of the following December 31. We cannot predict if investors will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock and our stock price may be more volatile. As an “emerging growth company” the JOBS Act allows us to delay adoption of new or revised accounting pronouncements applicable to public companies until such pronouncements are made applicable to private companies. We have elected to use this extended transition period under the JOBS Act. As a result, our financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies, which may make our common stock less attractive to investors.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operations and access to capital. We have not performed an in-depth analysis to determine if historical un-discovered failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs in 2013 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

12

Table of Contents

Compliance with changing regulation of corporate governance and public disclosure, and our management’s inexperience with such regulations will result in additional expenses and creates a risk of non-compliance.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team expects to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities. Management’s inexperience may cause us to fall out of compliance with applicable regulatory requirements, which could lead to enforcement action against us and a negative impact on our stock price.

RISKS RELATING TO OUR COMMON STOCK AND THIS OFFERING

There is currently no trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

To date there has been no trading market for our common stock. We cannot predict how liquid the market for our common stock might become. We intend to apply to have our common stock quoted for trading on the OTC Bulletin Board, however, we cannot be sure that such quotation will be obtained promptly, if at all.

We currently do not satisfy the initial listing standards for any national securities exchange, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remains listed on the OTC Bulletin Board or suspended from the OTC Bulletin Board, the trading price of our common stock could suffer, the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility.

Furthermore, for companies whose securities are traded on the OTC Bulletin Board, it is more difficult (1) to obtain accurate quotations, (2) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (3) to obtain needed capital.

There is no minimum amount required to be raised in the offering, and if we cannot raise sufficient funds from this offering, we may need to curtail or cease operations.

There is not a minimum amount of units that need to be sold in this offering for the Company to access the funds. Therefore, the proceeds of this offering will be immediately available for use by us and we do not have to wait until a minimum number of units have been sold to keep the proceeds from any sales. We cannot assure you that subscriptions for the entire offering will be obtained. We have the right to terminate this offering at any time, regardless of the number of securities we have sold since there is no minimum subscription requirement. Our ability to meet our financial obligations and cash needs, and to achieve our objectives, could be adversely affected if the entire offering is not fully subscribed for and as a result we could be forced to curtail or cease our operations.

A FINRA-registered broker-dealer unaffiliated with the underwriter has submitted an application to FINRA to have our common stock quoted on the OTC Bulletin Board. The application may not be approved by FINRA and as a result our common stock may be difficult for our investors to trade.

A FINRA-registered broker-dealer unaffiliated with the underwriter has submitted an application to FINRA to have our common stock quoted on the OTC Bulletin Board. This FINRA-registered broker-dealer is

13

Table of Contents

expected to act as a market-maker for our common stock. We cannot give any assurances that the application to FINRA submitted by this FINRA broker-dealer will be approved. If our common stock is not quoted on the OTCBB, we intend to have our common stock listed on the OTC Markets, which might make it more difficult for investors to trade their shares.

If and when our common stock becomes publicly traded, our common stock may be deemed a “penny stock,” which would make it more difficult for our investors to sell their shares.

If and when our common stock becomes publicly traded, our common stock may be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on an exchange such as NYSE or NASDAQ. These rules require, among other things, that brokers who trade penny stocks to persons other than established customers complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Investor relations activities, nominal float and supply and demand factors may affect the price of our common stock.

We have engaged an investor relations firm and financial advisory firm to create investor awareness for our Company. These campaigns may include personal, video and telephone conferences with investors and prospective investors in which our business practices are described. We may provide compensation to investor relations and financial advisory firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties based upon publicly available information concerning us. We will not be responsible for the content of analyst reports and other writings and communications by investor relations firms not authored by us or from publicly available information. We do not intend to review or approve the content of such analysts’ reports or other materials based upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, but whether such disclosure is made or complete is not under our control. Our investors may be willing, from time to time, to encourage investor awareness through similar activities. Investor awareness activities may also be suspended or discontinued which may impact the trading market of our common stock.

The SEC and FINRA enforce various statutes and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly in cases where the hallmarks of pump and dump activities may exist, such as rapid share price increases or decreases. We and our shareholders may be subjected to enhanced regulatory scrutiny due to the small number of holders who own the registered shares of our common stock publicly available for resale, and the limited trading markets in which such shares are offered or sold which have often been associated with improper activities concerning penny stocks, such as the OTC BB or the OTC Markets (OTCQB or OTCPink). Until such time as the restricted shares of the Company are registered or available for resale under Rule 144, there will continue to be a small percentage of shares held by a small number of investors, many of whom acquired such shares in privately negotiated purchase and sale transactions that will constitute the entire available trading market. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators with forces that upset the

14

Table of Contents

supply and demand factors that would normally determine trading prices. Securities regulators have often cited thinly traded markets, small numbers of holders, and awareness campaigns as components of their claims of price manipulation and other violations of law when combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide with false or touting press releases. There can be no assurance that our or third-parties’ activities, or the small number of potential sellers or small percentage of stock in the float, or determinations by purchasers or holders as to when or under what circumstances or at what prices they may be willing to buy or sell stock, will not artificially impact (or would be claimed by regulators to have affected) the normal supply and demand factors that determine the price of stock.

Our stock price may be volatile.

The stock market in general, and the stock prices of technology-based and biotechnology / biopharmaceutical stocks in particular, have experienced volatility that often has been unrelated to the operating performance of any specific public company. The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| • | changes in our industry; competitive pricing pressures; our ability to obtain working capital financing; additions or departures of key personnel; |

| • | limited public float in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock; |

| • | sales of our common stock; |

| • | our ability to execute our business plan; |

| • | operating results that fall below expectations; |

| • | loss of any strategic relationship; |

| • | regulatory developments; |

| • | changes in federal or state healthcare-related laws; |

| • | economic and other external factors; |

| • | period-to-period fluctuations in our financial results; |

| • | challenges and/or invalidation of key patents; and |

| • | the inability to develop or acquire new or needed technology. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our shareholders sell substantial amounts of our common stock in the public market, including shares issued in past private offerings, upon the effectiveness of the registration statement required to be filed, or upon the expiration of any statutory holding period, under Rule 144, or upon expiration of lock-up periods applicable to outstanding shares, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an overhang and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are

15

Table of Contents

occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. Certain shares of common stock held by current and former officers and directors, founders, and institutional shareholders of Q are subject to a lock-up agreement prohibiting sales of such shares for a period of 12 months from July 17, 2012. Following such date, all of those shares will become freely tradable, subject to securities laws and SEC regulations regarding sales by insiders.

Our undesignated preferred stock may inhibit potential acquisition bids; this may adversely affect the market price for our common stock and the voting rights of holders of our common stock.

Our Certificate of Incorporation provides our Board of Directors with the authority to issue up 10,000,000 shares of undesignated preferred stock and to determine or alter the rights, preferences, privileges and restrictions granted to or imported upon these shares without further vote or action by our shareholders. As of the date of this filing, no shares of preferred stock have been designated and the Board of Directors still has authority to designate and issue up to 10,000,000 shares of preferred stock in one or more classes or series. The issuance of shares of preferred stock may delay or prevent a change in control transaction without further action by our shareholders. As a result, the market price of our common stock may be adversely affected. In addition, if we issue preferred stock in the future that has preference over our common stock with respect to the payment of dividends or upon our liquidation, dissolution or winding up, or if we issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of our common stock or the market price of our common stock could be adversely affected.

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our Board of Directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

Because our directors and executive officers are among our largest shareholders, they can exert significant control over our business and affairs and have actual or potential interests that may depart from those of subscribers in our previous private offerings.

Our directors and executive officers own or control a significant percentage of the common stock. Additionally, the holdings of our directors and executive officers may increase in the future upon vesting or other maturation of exercise rights under any of the options or warrants they may hold or in the future be granted or if they otherwise acquire additional shares of our common stock. The interests of such persons may differ from the interests of our other stockholders. As a result, in addition to their board seats and offices, such persons have significant influence over and control all corporate actions requiring stockholder approval, irrespective of how the Company’s other stockholders, may vote, including the following actions: to elect or defeat the election of our directors; to amend or prevent amendment of our Certificate of Incorporation or By-Laws; to effect or prevent a merger, sale of assets or other corporate transaction; and to control the outcome of any other matter submitted to our stockholders for vote. Such person’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

16

Table of Contents

RISKS RELATED TO CLINICAL AND COMMERCIALIZATION ACTIVITIES

Delays in the commencement of clinical testing of our current and potential product candidates could result in increased costs to us and delay our ability to generate revenues.

The commencement of clinical trials can be delayed for a variety of reasons, including delays in:

| • | obtaining adequate financing; |

| • | demonstrating sufficient safety and efficacy to obtain regulatory clearance to commence a clinical trial; |

| • | manufacturing sufficient quantities or producing products meeting our quality standards of a product candidate; |

| • | obtaining an injection device or methodology meeting our quality standards; |

| • | obtaining approval of an Investigational New Drug (IND) application or proposed trial design from the FDA; |

| • | reaching agreement on acceptable terms with our collaborators on all aspects of the clinical trial, including the contract research organizations (CROs) and the trial sites; and |

| • | obtaining Institutional Review Board (IRB) approval to conduct a clinical trial at a prospective site. |

In addition, clinical trials may be delayed due to insufficient patient enrollment, which is a function of many factors, including the size and nature of the patient population, the nature of the protocol, the proximity of patients to clinical sites, other competing clinical trials in the same disease indication, the availability of effective treatments for the relevant disease, and the eligibility criteria for the clinical trial. Delays in commencing clinical testing of our potential product candidates could prevent or delay us from obtaining approval for our potential product candidates.

We do not have experience as a company in conducting clinical trials, or in other areas required for the successful commercialization and marketing of our potential product candidates.

We have no experience as an entity in conducting either early stage or large-scale, late stage clinical trials. We cannot be certain that planned clinical trials will begin or be completed on time, if at all. Large-scale trials would require either additional financial and management resources, or reliance on third-party clinical investigators, pharmaceutical partners, CROs and/or consultants. Relying on third-party clinical investigators, pharmaceutical partners or CROs may force us to encounter delays that are outside of our control. Any such delays could have a material adverse effect on our business.

We also do not currently have marketing and distribution capabilities for our potential product candidates. Developing an internal sales and distribution capability would be an expensive and time-consuming process. We may enter into agreements with third parties that would be responsible for marketing and distribution. However, these third parties may not be capable of successfully selling any of our potential product candidates. The inability to commercialize and market our potential product candidates could materially adversely affect our business.

Obtaining regulatory approvals to market our potential product candidates in the United States and other countries is a costly and lengthy process and we cannot predict whether or when we will be permitted to commercialize our potential product candidates.

Federal, state and local governments in the United States and governments in other countries have significant regulations in place that govern many of our activities and may prevent us from creating commercially viable products from our discoveries. The regulatory process, particularly for biopharmaceutical potential product candidates like ours, is uncertain, can take many years and requires the expenditure of substantial resources.

17

Table of Contents