Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - Liquid Holdings Group, Inc. | d484709dex32.htm |

| EX-3.1 - EX-3.1 - Liquid Holdings Group, Inc. | d484709dex31.htm |

| EX-23.2 - EX-23.2 - Liquid Holdings Group, Inc. | d484709dex232.htm |

| EX-23.1 - EX-23.1 - Liquid Holdings Group, Inc. | d484709dex231.htm |

| EX-10.29 - EX-10-29 - Liquid Holdings Group, Inc. | d484709dex1029.htm |

| EX-10.27 - EX-10.27 - Liquid Holdings Group, Inc. | d484709dex1027.htm |

| EX-10.28 - EX-10.28 - Liquid Holdings Group, Inc. | d484709dex1028.htm |

| EX-10.26 - EX-10.26 - Liquid Holdings Group, Inc. | d484709dex1026.htm |

Table of Contents

Registration No. 333-187859

As filed with the Securities and Exchange Commission on July 5, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIQUID HOLDINGS GROUP, LLC

(to be converted into Liquid Holdings Group, Inc.)

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 45-5070568 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

800 Third Avenue

39th Floor

New York, NY 10022

(212) 293-1836

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian Storms

Chief Executive Officer

Liquid Holdings Group, LLC

800 Third Avenue

39th Floor

New York, NY 10022

(212) 293-1836

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Glenn R. Pollner Edwin M. O’Connor Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, NY 10166 Tel: (212) 351-4000 Fax: (212) 351-4035 |

Jose Ibietatorremendia General Counsel Liquid Holdings Group, LLC 800 Third Avenue 39th Floor New York, NY 10022 (212) 293-1836 |

Edward F. Petrosky James O’Connor Sidley Austin LLP 787 Seventh Avenue New York, NY 10019 Tel: (212) 839-5300 Fax: (212) 839-5599 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

Liquid Holdings Group, LLC, the registrant whose name appears on the cover page of this registration statement, is a Delaware limited liability company. Prior to the effectiveness of this registration statement, Liquid Holdings Group, LLC will reorganize through a conversion into a Delaware corporation and change its name from Liquid Holdings Group, LLC to Liquid Holdings Group, Inc. In connection with the reorganization, all of our outstanding common units will convert into shares of common stock of Liquid Holdings Group, Inc. Unless otherwise indicated or the context otherwise requires, all information in this prospectus is presented giving effect to this reorganization and the related conversion of our common units into shares of our common stock at a ratio of 10,606.81 shares of common stock for each common unit. Shares of the common stock of Liquid Holdings Group, Inc. are being offered by the prospectus that forms a part of this registration statement.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated July 5, 2013

Shares

Common Stock

This is our initial public offering and, prior to this offering, there has been no public market for our common stock. We are offering shares of our common stock and the selling stockholders named in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

We anticipate that the initial public offering price per share will be between $ and $ . We expect to list our common stock on the NASDAQ Global Market under the symbol “LIQD.”

Brian Ferdinand, one of our founders and Vice Chairman of the Board and Head of Corporate Strategy, and Douglas Von Allmen, a beneficial owner of more than 10% of our common stock, have indicated an interest in purchasing an aggregate of up to $ million of our shares of common stock in this offering at the initial public offering price. Because indications of interest are not binding agreements or commitments to purchase, these stockholders may elect to purchase a different amount of shares or not to purchase any shares in this offering.

After the completion of this offering our principal stockholders, executive officers and directors will hold % of the voting power of all outstanding shares of our common stock, or % if Messrs. Ferdinand or Von Allmen purchase an aggregate of $ million of our shares of common stock in this offering.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and are eligible for certain reduced public company reporting requirements.

Investing in our common stock involves significant risks. You should carefully read and consider the risk factors described in this prospectus before making a decision to purchase our common stock. See “Risk Factors” beginning on page 15 of this prospectus.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting” for disclosure regarding the underwriting discount and certain expenses payable to the underwriter by us. |

We have granted the underwriter a 30-day option to purchase up to additional shares of our common stock at the initial public offering price, less the underwriting discount, solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common stock only in book-entry form through the facilities of The Depository Trust Company on or about , 2013, subject to customary closing conditions.

Prospectus dated , 2013

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 15 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| Unaudited Pro Forma Condensed Consolidated Financial Statement |

50 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |||

| 89 | ||||

| 93 | ||||

| 109 | ||||

| 117 | ||||

| 127 | ||||

| 131 | ||||

| 137 | ||||

| 142 | ||||

| 145 | ||||

| 149 | ||||

| 152 | ||||

| 152 | ||||

| 152 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize be delivered to you. We, the selling stockholders and the underwriter have not authorized anyone to provide you with additional or different information. If anyone provides you with additional or different information, you should not rely on it. We, the selling stockholders and the underwriter are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. You should assume that the information in this prospectus is accurate only as of the date on the cover page, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition, liquidity and results of operations may have changed since the date of this prospectus.

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment decision, including the information presented under the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes thereto included elsewhere in this prospectus.

Unless otherwise expressly stated or the context otherwise requires, the terms “we,” “us,” “our,” “Liquid Holdings Group,” “LHG” and “Company,” refer, prior to the reorganization discussed below, to Liquid Holdings Group, LLC, and, after the reorganization, to Liquid Holdings Group, Inc., in each case including its subsidiaries and predecessor and acquired entities.

Our Company

Overview

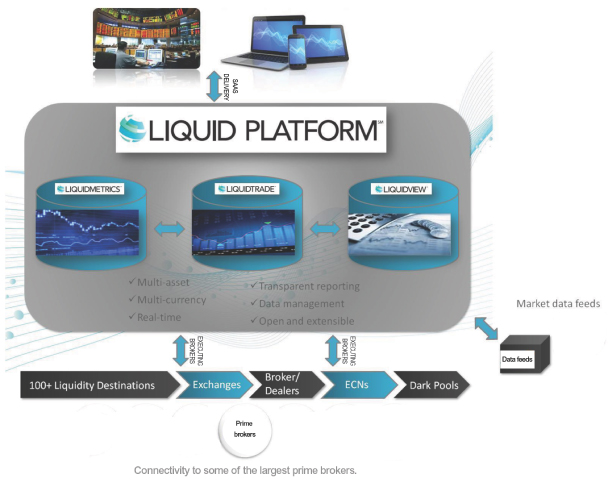

Liquid Holdings Group has developed and provides proprietary next generation software technology that seamlessly integrates trading, real-time risk management, accounting, reporting and administration tools in a single platform for the financial services community. Our current and prospective customers include small to mid-sized hedge fund managers, asset managers, wealth management offices, family offices and financial institutions. We deliver our technology efficiently, quickly and securely as a Software as a Service, or SaaS, solution through the “cloud,” or as a software installation on our customers’ premises. The advanced feature set of our platform includes customizable and rapidly deployable multi-asset class trading software coupled with real-time risk management, accounting and reporting capabilities.

We believe that our platform’s comprehensive, real-time approach provides a distinctive offering to our customers. We believe our comprehensive approach creates efficiencies for our customers by reducing the number of service provider relationships the customer needs to manage and maintain and by reducing the level of information technology, or IT, personnel necessary to support and integrate those multiple applications.

Our platform offers the following features and capabilities:

| • | A Single, Consolidated Portfolio View. We offer a single trade, order and position management solution for multiple asset classes such as equities, options, futures, fixed income securities and foreign exchange markets, or FX. Our customers can aggregate positions, exposures and risk metrics across all of their portfolios and asset classes on a single screen in real time. With our platform there is no need to purchase or integrate several external programs to consolidate risk management, accounting and reporting functions across asset classes. |

| • | Broker, Execution and Clearing Firm Neutral. We provide our customers with the independence to select their preferred broker execution venues and clearing relationships. Our technology is able to connect our customers seamlessly to prime brokers and over 100 liquidity destinations, including broker-dealers, private alternative trading systems/platforms, or dark pools, and other electronic communication networks, or ECNs. We do not monetize, sell or take the opposing side of our customers’ order flow, nor do we act as a market maker. Our technology allows our customers to be “broker neutral” in their choice of where a trade is executed, how the trade is sent to the market and which broker executes and clears the trade. We have established connectivity with some of the most recognized prime brokers and banking platforms in the world, offering our customers the ability to access these relationships for capital introduction and execution services globally. |

1

Table of Contents

| • | Real-Time Portfolio Risk Management and Scenario Analysis. The architecture of our platform enables our customers to perform highly complex computations of risk and project probabilistic scenarios using data feeds in real time. This allows our customers to quantify the probability of portfolio risk based on variables that they input to simulate a macro or micro event based on historical market events. It also enables users to calculate theoretical values instantly for over a dozen historic market events and crashes to simulate portfolio performance in times of market volatility. Our platform automatically routes trade data to our risk management system for real-time analysis. We believe most of our competitors offer this type of analysis only on an end-of-day or as-requested basis. |

| • | Accounting and Reporting Management, Fee Management and Transaction Cost Analysis. Our accounting and reporting database was designed to reconcile a vast number of trades and their associated fees and transaction costs, giving traders and managers a clear and concise view of their portfolio accounting, including exchange/ECN fees, “soft dollar” arrangements, and brokerage and accounting adjustments. Our flexible and scalable architecture allows traders, operations personnel and senior management to view customized reports on an individual, group or enterprise wide basis. |

We have branded our risk metrics platform as LiquidMetrics, our trading platform as LiquidTrade and our accounting platform as LiquidView, together constituting the Liquid Platform.

For the period from April 24, 2012 through December 31, 2012, our total revenues were $2.3 million (of which $1.3 million related to the over-the-counter brokerage operations of certain of our subsidiaries which we ceased on June 1, 2013 and only $1.0 million related to software licensing, which included revenue of $365,606 related to messaging services which we terminated on December 31, 2012). For the three months ended March 31, 2013, our total revenues were $1.8 million (of which $1.1 million related to the over-the-counter brokerage operations). All of our software to date has been delivered as SaaS. We recorded a net loss of $38.2 million, or $41.4 million on a pro forma basis, and negative cash flows from operations of $6.4 million for the period from April 24, 2012 through December 31, 2012. We recorded a net loss of $5.1 million, or $4.5 million on a pro forma basis, and negative cash flows from operations of $2.7 million for the three months ended March 31, 2013.

Our Competitive Strengths

Our strengths include:

| • | State of the Art Technology. Our technology platform utilizes a state of the art flexible and scalable framework-based technology architecture that integrates order, trade, execution, real-time risk and portfolio management functions as well as accounting and reporting software for multiple asset classes on a single platform. Our platform is flexible and highly customizable, allowing our customers to match the use of our platform with their specific business processes and workflows. The flexibility of our platform also allows our customers to deploy our technology offerings individually or in any combination. |

| • | Cross-Asset, Multi-Currency, Broker, Execution and Clearing Firm Neutral Platform. We have designed a cross-asset, multi-currency, broker, execution and clearing firm neutral platform providing our customers with access to over 100 sources of liquidity, including connectivity to top-tier investment banks and prime brokers. Using industry standard protocols, our platform has the ability, following basic certification procedures, to connect to any prime broker, exchange, dark pool or institution globally. We are able to efficiently integrate and interconnect our platform with the existing infrastructure of these institutions. |

| • | SaaS Delivery. We are able to deliver our technology platform to customers using a SaaS delivery model. SaaS delivery increases efficiency, reduces customer infrastructure costs and accelerates deployment. The SaaS capability allows our customers to deliver our platform to their employees and other end-users within days or even hours of our completing the sales cycle. Our SaaS delivery model |

2

Table of Contents

| enables us to realize and provide efficiencies and economies of scale in delivering and supporting our software in the following ways: |

| • | Our centralized server-based delivery of software makes installation, upgrades and support easy to implement and gives us the ability to control the user experience and quality of service; |

| • | The economics inherent in deploying our software makes SaaS delivery beneficial for both us and our customers by optimizing the utilization of servers and reducing fixed costs; and |

| • | SaaS delivery enables our customers to deliver our technology to their employees and other end-users on any device, anywhere, anytime, thereby giving them greater flexibility in how and where they use our technology platform. |

| • | Strong and Experienced Management and Board of Directors. Our seasoned management team has, individually and collectively, decades of experience in delivering innovative technology and working in the financial services community. Our senior management team and Board of Directors includes the former Chairman and Chief Executive Officer of UBS Global Asset Management (Americas) Inc. and Marsh Inc., a former Partner and Managing Director of ECHOtrade LLC, or ECHOtrade, a high volume, 400-manager proprietary algorithmic trading firm and the former Chairman of the New York Mercantile Exchange, or NYMEX. |

| • | Continued Innovation Through Collaborative Product Development. The majority of the features in our platform were designed in collaboration with existing and prospective clients based on their specific functionality requests. |

Our Strategy

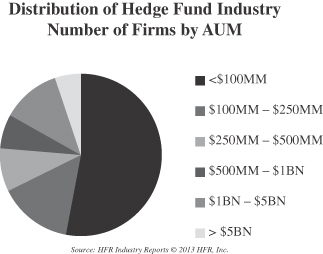

We intend to position ourselves as a provider of value-added software solutions that integrate trading, real-time risk management, accounting, reporting and administration tools for multiple asset classes on a single platform. We believe our unique software design allows us to deliver a comprehensive suite of products and services at a price point that is lower than that currently offered by our competitors for comparable products and services. The following are key elements of our strategy:

| • | Bringing a combination of an integrated technology platform, competitive pricing and efficient product delivery that is disruptive to the current marketplace; |

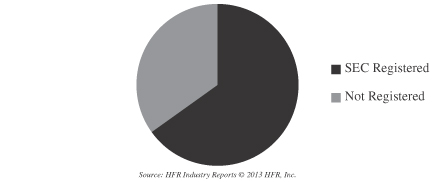

| • | Providing a superior product and an economical solution to underserved segments of the financial services community such as small to mid-sized hedge fund managers, asset managers, wealth management offices and family offices; |

| • | Providing larger financial institutions with an attractive, cost-effective and integrated solution for internal use and licensing to their clients; |

| • | Growing our market share through internal development and selective acquisitions; |

| • | Extending our global reach by entering into additional international and developing markets in which we believe there will be demand for our products and services; and |

| • | Leveraging relationships with independent third-party asset allocators to accelerate the distribution of our technology. |

Risks Affecting Us

Our business is subject to numerous significant risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. You should carefully read the

3

Table of Contents

section titled “Risk Factors” for a detailed explanation of these risks before investing in our common stock. These risks include, but are not limited to, the following:

| • | We have a very limited operating history, which makes it difficult to evaluate our current business and future prospects, and may substantially increase the risk of your investment; |

| • | We have generated very little revenue and have experienced significant net losses and negative cash flows from operations to date, and may not be able to generate meaningful revenue, operate profitably or generate positive cash flows on a consistent basis or at all; |

| • | We face significant competition for customers from other providers of technology solutions to participants in the financial services community. If prospective customers are reluctant to switch from their existing service providers and adopt our products and services, our sales will not grow or may decline, we could be materially and adversely affected and our stock price could decline significantly; |

| • | If we do not accurately predict, prepare for and respond promptly to rapidly evolving technological and market developments and changing customer needs, our business and prospects may be negatively impacted, potentially materially; |

| • | We currently have a limited number of customers, most of which to date have been generated as a result of pre-existing relationships of these customers with our founders and entities affiliated with them. We may not be successful in attracting new customers. In addition, the loss of or events affecting one or more of our customers could materially and adversely affect us and cause our stock price to decline significantly; |

| • | A systemic or systematic market event that impacts the various market participants with whom we interact could materially and adversely affect us and cause our stock price to decline significantly; |

| • | If we fail to remediate our current material weaknesses and deficiencies in our internal control over financial reporting or we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected, our reputation could be harmed and our stock price could decline significantly; |

| • | We depend on our senior management team and the loss of one or more key employees, the failure of new executive officers to integrate with our management team or our failure to attract and retain other highly qualified personnel in the future, could have a negative impact on our business; |

| • | Defects, errors or vulnerabilities in our products or services or the failure of our products or services to perform could materially and adversely affect us and cause our stock price to decline significantly; |

| • | We may be unable to obtain patent rights that effectively protect our integrated technology platform and our other intellectual property rights may not be sufficient to effectively protect our products and technology, which could subject us to increased competition that could negatively impact our business; |

| • | Our current research and development efforts may not produce successful products and services or features that result in significant revenue, cost savings or other benefits in the near future, if at all, which could materially and adversely affect us and cause our stock price to decline significantly; and |

| • | Our failure to obtain the capital necessary to expand our operations and invest in new products and services could reduce our ability to compete and materially and adversely affect us and cause our stock price to decline significantly. |

Our Formation Transactions

We were formed on January 17, 2012 with the intention of being the holding company to acquire and own a group of companies. We are the successor control entity of the Liquid predecessor companies, which we refer to as the Liquid Predecessor Companies. The Liquid Predecessor Companies are not a legal entity but rather a

4

Table of Contents

combination of certain entities and operations formed to continue and expand our organization in developing and operating a proprietary next generation technology platform that streamlines and unifies the entire trade and risk management process for the financial services community. The Liquid Predecessor Companies are Liquid Prime Holdings LLC, Liquid Prime Services, Inc., Liquid Partners, LLC and Liquid Trading Holdings Limited. See the section titled “Certain Relationships and Related Party Transactions—Formation Transactions” for more information on these transactions.

Acquisition History. We acquired the entities and technology that comprise our business pursuant to the following transactions:

Liquid Prime Holdings LLC. Liquid Prime Holdings LLC, or Liquid Prime Holdings, owns Liquid Prime Services, Inc., or Liquid Prime Services. Liquid Prime Services (f/k/a Taconic Capital Group Inc.) is a broker-dealer registered with the Securities and Exchange Commission, or SEC, and a member of the Financial Industry Regulatory Authority, Inc., or FINRA. The ownership of a registered broker-dealer enables us to facilitate ancillary execution services as a derivative of our technology business, which may allow us to leverage our institutional relationships by providing agency brokerage services in order to pass on savings for execution services to our clients. Additional services provided by Liquid Prime Services include the facilitation of broker assisted over-the-counter transactions on our clients’ behalf. On June 1, 2013, we ceased over-the-counter brokerage operations for Liquid Prime Services. Going forward, Liquid Prime Services will continue to be a key component of our business strategy by providing agency brokerage services and facilitating the introduction of client assets to custody banking relationships. We do not expect the cessation of the over-the-counter brokerage operations of Liquid Prime Services to impact our ability to provide agency brokerage services and facilitate the introduction of client assets to custody banking relationships. Liquid Prime Holdings was initially formed in 2011 by Brian Ferdinand, our Vice Chairman of the Board and Head of Corporate Strategy and one of our founders. On April 24, 2012, Mr. Ferdinand contributed all of the outstanding interests in Liquid Prime Holdings to us, which contribution became effective upon regulatory approval received on October 5, 2012.

Liquid Partners, LLC. Liquid Partners, LLC (f/k/a Centurion Capital Group, LLC, or Centurion Capital Group), or Liquid Partners, was acquired to provide us with access to a customer base for our business and a select group of experienced traders and fund managers. The customers that were introduced to us by Liquid Partners have utilized our platform and generated valuable user feedback in the beta testing and development of our technology. We acquired Liquid Partners through a series of related transactions beginning in December 2011 and continuing through May and July 2012 from the members of Liquid Partners, including Edward Feigeles, a former member of our Board of Directors, and an entity controlled by Douglas J. Von Allmen, a holder of more than 10% of our common stock.

Liquid Trading Institutional LLP. Liquid Trading Institutional LLP, or Liquid Trading Institutional, is a U.K. Financial Conduct Authority, or FCA, registered broker-dealer. The ownership of an FCA-registered broker-dealer enables us to facilitate ancillary execution services in the U.K. as a derivative of our technology business, which may allow us to leverage our institutional relationships by providing introductory brokerage services in order to pass on savings for execution services to our clients. Prior to its acquisition by us, Liquid Trading Institutional was controlled by Mr. Ferdinand and Robert Keller, another of our founders and a former member of our Board of Directors. We acquired Liquid Trading Institutional pursuant to contribution agreements entered into with entities controlled by Messrs. Ferdinand and Keller on April 24, 2012 and an entity controlled by an unrelated third party on June 5, 2012, which contribution became effective upon regulatory approval received on July 2, 2012.

Liquid Futures, LLC. Liquid Futures, LLC, or Liquid Futures, is an independent introducing broker registered with the U.S. Commodity Futures Trading Commission, or CFTC, and is a member of the National Futures Association, or NFA. The ownership of an independent introducing broker enables us to facilitate ancillary execution services as a derivative of our technology business, which may allow us to leverage our

5

Table of Contents

institutional relationships by providing agency brokerage services in order to pass on savings for execution services to our clients. Additional services provided by Liquid Futures include the facilitation of broker assisted over-the-counter transactions on our clients’ behalf. On March 26, 2013, Liquid Futures changed its status from a non-clearing FCM to an independent introducing broker. We believe this transition will have little to no impact on Liquid Futures’ business operations and the services it can provide to its customers; however, it has reduced the amount of regulatory capital that the entity is required by the CFTC to maintain. On June 1, 2013, we ceased over-the-counter brokerage operations for Liquid Futures. Going forward, Liquid Futures will continue to be a key component of our business strategy by providing agency brokerage services and facilitating the introduction of client assets to custody banking relationships. We do not expect the cessation of the over-the-counter brokerage operations of Liquid Futures to impact our ability to provide agency brokerage services and facilitate the introduction of client assets to custody banking relationships. We are considering consolidating Liquid Futures and Liquid Prime Services into a single entity. Such a consolidation would enable Liquid Futures and Liquid Prime Services to streamline their regulatory costs and consolidate their net capital, permit our customers to sign a single account agreement to conduct both futures and securities trading, and permit the consolidated entity to enter into a single clearing agreement to facilitate both futures and securities trades. Liquid Futures was initially formed in 2011 as a non-clearing futures commission merchant, or FCM, by Richard Schaeffer, one of our founders and a member of our Board of Directors, and Mr. Ferdinand. Messrs. Schaeffer and Ferdinand subsequently contributed all of their interests in Liquid Futures to us on April 24, 2012, which contribution became effective upon regulatory approval received on May 9, 2012.

Fundsolve Limited. Through our acquisition of Fundsolve Limited, or Fundsolve, we acquired our risk management technology. We acquired Fundsolve on July 31, 2012 pursuant to a share purchase agreement with Fundsolve’s equity holders, including Darren Davy, who subsequently became one of our directors. Prior to our acquisition, Fundsolve operated as a portfolio risk management company serving mid- to large-sized hedge funds with its proprietary risk management technology.

Tragara Alpha Partners, LLC. We acquired certain intellectual property assets forming a component of our trading technology, including an algorithmic trading program, from Tragara Alpha Partners, LLC, or Tragara Alpha Partners, owned by Samuel Gaer, our former Chief Executive Officer and a former member of our Board of Directors, on April 27, 2012.

LiquidView. We acquired the LiquidView software tool, which forms a component of our accounting technology, from entities controlled by Messrs. Ferdinand and Keller on July 30, 2012.

Green Mountain Analytics, LLC. Through our acquisition of Green Mountain Analytics, LLC, or GMA, we acquired the foundation of our trading technology. Prior to our acquisition, GMA was a financial software development company serving a diverse set of trading fund demographics with its proprietary trading technology. Messrs. Ferdinand and Keller initially acquired their equity positions in GMA in 2008 and together acquired a majority, but non-controlling, interest in GMA in 2011. We subsequently acquired GMA on August 27, 2012.

Capital Raising History. In addition to the acquisition transactions described above, prior to this offering, we have completed several capital raising transactions. The first of these transactions was a $4.3 million sale of common stock consummated through LTI, LLC (an entity formed by our founders, Messrs. Schaeffer, Ferdinand and Keller, for the purpose of raising this capital), or LTI, in September 2011. We acquired LTI in September 2012, in exchange for the issuance of an aggregate of 495,821 shares of common stock to the members of LTI (including 174,995 shares of common stock to Mr. Feigeles). The second of these transactions was a $12.5 million sale of our common stock to an entity controlled by Mr. Von Allmen in July 2012. In that transaction, we issued 1,239,986 shares of common stock to Mr. Von Allmen and, prior to December 25, 2012, we issued to Mr. Von Allmen 242,020 additional shares of common stock pursuant to the terms of our subscription agreement with Mr. Von Allmen. We also raised an additional $3.3 million in the aggregate through six additional

6

Table of Contents

transactions completed in January 2013, February 2013 and March 2013 (including transactions in which we issued 59,918 shares of common stock to Victor R. Simone, Jr., one of our directors, and 183,773 shares of common stock to Jay Bernstein, one of our directors). In addition, in April 2013, we issued 720,498 shares of common stock to an entity controlled by Mr. Von Allmen in consideration for his continued financial support and commitment to our development and growth.

Ownership of our Principal Stockholders, Executive Officers and Directors

Immediately following the completion of this offering, our principal stockholders, executive officers and directors will, in the aggregate, hold approximately % of the voting power of all outstanding shares of our common stock, or % if Messrs. Ferdinand or Von Allmen purchase an aggregate of $ million of our shares of common stock in this offering.

Corporate Information

We were formed as a Delaware limited liability company on January 17, 2012 and began operations on April 24, 2012. Our headquarters are located at 800 Third Avenue, 39th Floor, New York, New York 10022, and our telephone number at that address is (212) 293-1836. Prior to the effectiveness of the registration statement of which this prospectus forms a part, we will reorganize as a Delaware corporation and change our name from Liquid Holdings Group, LLC to Liquid Holdings Group, Inc. Such transaction is referred to in this prospectus as the LLC Reorganization. In connection with the LLC Reorganization, all of our outstanding common units will convert into shares of common stock of Liquid Holdings Group, Inc. Unless otherwise indicated or the context otherwise requires, all information in this prospectus is presented giving effect to this reorganization and the related conversion of our common units into shares of our common stock at a ratio of 10,606.81 shares of common stock for each common unit. Our website address is www.liquidholdings.com. Information contained on, or that can be accessed through, our website is not a part of, nor incorporated into, this prospectus. “Liquid Platform,” “LiquidMetrics,” “LiquidTrade” and “LiquidView” are trademarks and service marks of Liquid Holdings Group, LLC. This prospectus also contains trademarks, service marks and tradenames of other companies.

7

Table of Contents

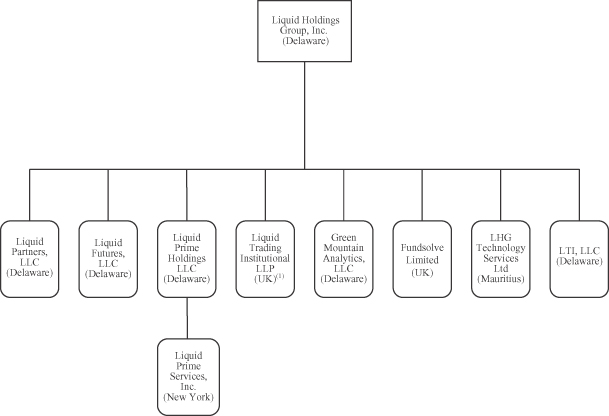

Organizational Chart

The following diagram depicts our corporate structure immediately following completion of this offering. We hold 100% of the ownership interest in each of our subsidiaries except as otherwise indicated below. See the section titled “Principal and Selling Stockholders” for a list of our principal stockholders and their relevant percentage ownership interest in us:

| (1) | Pursuant to a contractual agreement, Liquid Trading Institutional LLP has two B Members that are responsible for certain operational functions of Liquid Trading Institutional LLP for which the B Members receive fixed compensation. The B Members are not otherwise entitled to any other distributions or other compensation from Liquid Trading Institutional LLP. |

8

Table of Contents

The Offering

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Over-allotment option |

We have granted the underwriter a 30-day option to purchase up to additional shares of our common stock at the same price, and on the same terms, solely to cover over-allotments, if any. |

| Common stock to be outstanding after this offering |

shares (or shares, if the underwriter exercises its over-allotment option in full). |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ million, or approximately $ million if the underwriter exercises its over-allotment option in full, at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, after deducting the underwriting discount and estimated offering expenses payable by us. We will not receive any of the net proceeds from the sale of shares of our common stock in this offering by the selling stockholders. |

| We intend to use the net proceeds from this offering for investments in our technology and our sales and marketing functions, and for working capital and general corporate purposes, which may include acquisitions of complementary businesses, products or technologies. |

| As described in the section titled “Use of Proceeds,” a portion of the proceeds will be used to repay loans from Mr. Schaeffer and Mr. Ferdinand, to purchase shares of our common stock from Mr. Storms and to make payments to Messrs. Ferdinand, Schaeffer and Keller pursuant to contractual obligations. |

| Dividends on common stock |

We have not declared or paid any cash dividends on our common stock since our inception and do not anticipate paying any cash dividends on our common stock in the foreseeable future. |

| Proposed NASDAQ Global Market symbol |

“LIQD”

Brian Ferdinand, one of our founders and our Vice Chairman of the Board and Head of Corporate Strategy, and Douglas Von Allmen, a beneficial owner of more than 10% of our common stock, have indicated an interest in purchasing an aggregate of up to $ million of our shares of common stock in this offering at the initial public offering price. Because indications of interest are not binding agreements or commitments to purchase, these stockholders may elect to purchase a different amount of shares or not to purchase any shares in this offering.

9

Table of Contents

The number of shares of common stock to be outstanding after this offering presented above and, unless otherwise expressly indicated or the context otherwise requires, elsewhere in this prospectus, gives effect to the following in connection with the consummation of this offering:

| • | the issuance of 626,808 shares, 840,002 shares, and 371,575 shares of common stock to Messrs. Schaeffer, Ferdinand and Gaer, respectively, pursuant to the incentive units they currently hold; |

| • | the issuance of additional shares of common stock to Mr. Ferdinand pursuant to the anti-dilution terms of the incentive units granted to him on December 18, 2012, representing 4% of the aggregate issued and outstanding units of the Company as of the date of such grant, after giving effect to such grant, which specify that Mr. Ferdinand is entitled to an additional grant of common equity interests immediately following the consummation of this offering in order to preclude the dilution of the 4% grant; |

| • | the issuance of shares of common stock to Fundsolve’s former equity holders pursuant to our share purchase agreement in respect of our acquisition of Fundsolve, equivalent to 1% of the number of our common shares to be outstanding upon completion of this offering; and |

| • | the purchase of shares of common stock from Brian Storms, our Chairman of the Board and Chief Executive Officer, as described in the section titled “Use of Proceeds.” |

The number of shares of common stock issuable to Mr. Ferdinand in respect of his December 18, 2012 incentive unit award and to Fundsolve’s former equity owners in connection with the consummation of this offering is dependent upon the number of shares sold by us in this offering. As a result, if we increase or decrease the number of shares sold by us in this offering, the number of shares issuable to Mr. Ferdinand and Fundsolve’s former equity owners will change such that, following completion of this offering, the number of shares issued to Fundsolve’s former equity owners is equivalent to 1% of the number of our common shares to be outstanding upon completion of this offering (including the shares being sold by us in this offering and not including shares that may be sold pursuant to any exercise of the underwriter’s over-allotment option) and the number of shares issued to Mr. Ferdinand is equivalent to 4% of the number of our common shares to be outstanding upon completion of this offering (including the shares being sold by us in this offering and not including shares that may be sold pursuant to any exercise of the underwriter’s over-allotment option), less 840,002 shares previously issued to Mr. Ferdinand pursuant to his incentive units. For example, if we were to increase the number of shares of common stock sold by us in this offering by 500,000 shares, the number of shares issuable to Mr. Ferdinand and Fundsolve’s former equity owners would be shares and the number of shares of common stock outstanding upon completion of this offering would be shares (or shares, if the underwriter exercises its over-allotment option in full). If we were to decrease the number of shares of common stock sold by us in this offering by 500,000 shares, the number of shares issuable to Mr. Ferdinand and Fundsolve’s former equity owners would be shares and the number of shares of common stock outstanding upon completion of this offering would be shares (or shares, if the underwriter exercises its over-allotment option in full).

In this prospectus, unless otherwise indicated or the context otherwise requires, the number of shares of common stock outstanding and the other information based thereon assumes our reorganization from a Delaware limited liability company into a Delaware corporation prior to the effectiveness of the registration statement of which this prospectus forms a part and the concurrent conversion of all of our outstanding common units into shares of our common stock at a ratio of 10,606.81 shares of common stock for each common unit, but does not reflect:

| • | any exercise by the underwriter of its over-allotment option to purchase up to additional shares of our common stock from us; |

| • | additional shares of common stock issuable under outstanding but unvested restricted stock units, or RSUs; |

10

Table of Contents

| • | additional shares underlying options granted to our employees; |

| • | additional shares underlying options granted to three of our employees having an aggregate value of $650,000 calculated using the Black-Scholes option pricing model on the date of this offering; |

| • | additional shares of our common stock reserved for future issuance under our 2012 Amended and Restated Stock Incentive Plan, or Stock Incentive Plan; and |

| • | the potential issuance of up to shares by us of common stock to a single beneficial owner pursuant to the terms of a transfer agreement entered into on May 1, 2013, the terms of which entitle the shares held by this beneficial owner to anti-dilution protection for the period beginning May 1, 2013, and ending on the earliest of immediately prior to the consummation of this offering or January 1, 2015. |

On April 24, 2012, Liquid Holdings Group, LLC executed a Limited Liability Company Agreement, or the LLC Agreement, and authorized two classes of common units, Class A Common Units and Non-dilutive Common Units. Both classes had the same privileges, preferences, duties, obligations and rights, except that the Non-dilutive Common Units had anti-dilution rights. On October 22, 2012, Liquid Holdings Group, LLC amended its LLC Agreement to redesignate all outstanding Non-dilutive Common Units and Class A Common Units as Common Units. Unless otherwise indicated or the context otherwise requires, all common share amounts in this prospectus for dates prior to October 22, 2012 retroactively reflect the redesignation of all issuances as Common Units.

11

Table of Contents

Summary Financial Data

The following tables set forth summary financial data on a pro forma and historical basis for Liquid Holdings Group, LLC.

You should read the following summary historical and pro forma financial data in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the unaudited pro forma condensed consolidated financial statements and related notes, the consolidated financial statements and the accompanying notes of Liquid Holdings Group, LLC, the combined financial statements and accompanying notes of Liquid Predecessor Companies, and the historical financial statements of certain other entities acquired by us and included elsewhere in this prospectus.

We have presented the condensed consolidated balance sheet data as of December 31, 2012 and March 31, 2013 (unaudited) and the condensed consolidated statement of operations and comprehensive loss data for the period ended December 31, 2012 and the three months ended March 31, 2013 on an unaudited pro forma basis and for the period from April 24, 2012 to December 31, 2012 and the three months ended March 31, 2013 (unaudited) on a historical basis based on the unaudited pro forma consolidated combined financial statements and related notes and the consolidated financial statements and the accompanying notes of Liquid Holdings Group, LLC included elsewhere in this prospectus.

| Liquid Holdings Group, LLC | ||||||||||||||||

| For

the Period From April 24, 2012 to December 31, 2012 |

For the Three Months Ended March 31, 2013 (Unaudited) |

Pro Forma For the Period Ended December 31, 2012 (1) (2) (Unaudited) |

Pro Forma For the Three Months Ended March 31, 2013 (3) (4) (Unaudited) |

|||||||||||||

| Condensed Consolidated Statement of Operations and Comprehensive Loss Data: |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Brokerage activities |

$ | 1,295,248 | $ | 1,145,852 | $ | — | $ | — | ||||||||

| Software services |

1,032,534 | 616,612 | 1,459,192 | 616,612 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

2,327,782 | 1,762,464 | 1,459,192 | 616,612 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cost of revenues: |

||||||||||||||||

| Brokerage activities |

817,559 | 747,247 | 12,909 | 485 | ||||||||||||

| Software services |

690,190 | 577,160 | 1,289,689 | 577,160 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenues |

1,507,749 | 1,324,407 | 1,302,598 | 577,645 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross margin |

820,033 | 438,057 | 156,594 | 38,967 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Compensation |

28,333,420 | 2,087,456 | 28,588,445 | 2,045,562 | ||||||||||||

| Consulting |

3,081,002 | 324,732 | 3,115,754 | 324,732 | ||||||||||||

| Depreciation and amortization |

2,761,703 | 1,824,342 | 7,645,174 | 1,812,169 | ||||||||||||

| Impairment of goodwill and intangible assets |

1,550,652 | — | 1,558,039 | — | ||||||||||||

| Other |

3,136,097 | 1,358,075 | 3,592,516 | 1,151,523 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

38,862,874 | 5,594,605 | 44,499,928 | 5,333,986 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(38,042,841 | ) | (5,156,548 | ) | (44,343,334 | ) | (5,295,019 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

| Liquid Holdings Group, LLC | ||||||||||||||||

| For

the Period From April 24, 2012 to December 31, 2012 |

For the Three Months Ended March 31, 2013 (Unaudited) |

Pro Forma For the Period Ended December 31, 2012 (1) (2) (Unaudited) |

Pro Forma For the Three Months Ended March 31, 2013 (3) (4) (Unaudited) |

|||||||||||||

| Non-operating income (expenses): |

||||||||||||||||

| Registration rights penalty expense |

(1,674,704 | ) | — | (1,674,704 | ) | — | ||||||||||

| Gain on contingent consideration payable |

1,545,000 | — | 1,545,000 | — | ||||||||||||

| Unrealized gain (loss) on contingent consideration payable |

129,000 | (34,619 | ) | 129,000 | (34,619 | ) | ||||||||||

| Other, net |

(306,659 | ) | 9,877 | (306,659 | ) | 9,877 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total non-operating (expense) income, net |

(307,363 | ) | (24,742 | ) | (307,363 | ) | (24,742 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(38,350,204 | ) | (5,181,290 | ) | (44,650,697 | ) | (5,319,761 | ) | ||||||||

| Income tax benefit |

104,340 | 71,975 | 3,289,396 | 791,725 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(38,245,864 | ) | (5,109,315 | ) | (41,361,301 | ) | (4,528,036 | ) | ||||||||

| Other comprehensive income (losses): |

||||||||||||||||

| Foreign currency translation |

(18,073 | ) | 14,559 | (18,073 | ) | 14,559 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive loss |

$ | (38,263,937 | ) | $ | (5,094,756 | ) | $ | (41,379,374 | ) | $ | (4,513,477 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per common unit: |

||||||||||||||||

| Basic |

(2.46 | ) | (0.26 | ) | (2.67 | ) | (0.23 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

(2.46 | ) | (0.26 | ) | (2.67 | ) | (0.23 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common units: |

||||||||||||||||

| Basic |

15,517,444 | 19,966,153 | 15,517,444 | 19,966,153 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

15,517,444 | 19,966,153 | 15,517,444 | 19,966,153 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2012 |

March 31, 2013 (Unaudited) |

December 31, 2012 Pro Forma as Adjusted for this Offering (2)(5) (Unaudited) |

March 31, 2013 Pro Forma as Adjusted for this Offering (4)(5) (Unaudited) |

|||||||||||||

| Condensed Consolidated Balance Sheet Data: |

||||||||||||||||

| Assets: |

||||||||||||||||

| Cash and cash equivalents |

$ | 1,380,078 | $ | 4,166,196 | $ | $ | ||||||||||

| Note receivable from related party—QuantX |

2,250,000 | — | ||||||||||||||

| Other intangible assets, net of amortization |

18,740,125 | 16,956,594 | ||||||||||||||

| Goodwill |

13,182,936 | 13,182,936 | ||||||||||||||

| Other assets |

6,395,492 | 8,301,106 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 41,948,631 | $ | 42,606,832 | $ | $ | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities and equity: |

||||||||||||||||

| Contingent consideration payable |

$ | 1,561,000 | $ | 1,595,619 | $ | $ | ||||||||||

| Other liabilities |

4,012,402 | 5,924,140 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

5,573,402 | 7,519,759 | ||||||||||||||

| Equity |

36,375,229 | 35,087,073 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities and equity |

$ | 41,948,631 | $ | 42,606,832 | $ | $ | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | The pro forma December 31, 2012 column reflects (i) the acquisition of Liquid Futures as if it had occurred on January 1, 2012, (ii) the acquisition of Fundsolve as if it had occurred on January 1, 2012, (iii) the acquisition of Liquid Prime Holdings as if it had occurred on January 1, 2012, (iv) the acquisition of LTI as if it had occurred on January 1, 2012, (v) the acquisition of GMA as if it had occurred on January 1, 2012, (vi) the acquisition of Liquid Partners as if it had occurred on January 1, 2012, (vii) the elimination of intercompany transactions, (viii) the |

13

Table of Contents

| elimination of messaging services for Liquid Holdings Group, LLC, as if such services ceased effective January 1, 2012 and (ix) the elimination of over-the-counter brokerage operations for Liquid Prime Services and Liquid Futures as if such activity ceased effective January 1, 2012. |

| (2) | The adjustments in these columns do not give effect to the issuance of 3,208,728 shares of our common stock subsequent to December 31, 2012 and the issuance of shares of our common stock that will occur in connection with the consummation of this offering. We expect that we will incur additional non-cash expense charges of approximately $ in connection with certain of these issuances and other transactions that occurred subsequent to December 31, 2012. |

| (3) | The pro forma March 31, 2013 column reflects the elimination of over-the-counter brokerage operations for Liquid Primes Services and Liquid Futures as if such activity ceased effective January 1, 2013. |

| (4) | The adjustments in these columns do not give effect to the issuance of 2,561,285 shares of our common stock subsequent to March 31, 2013 and the issuance of shares of our common stock that will occur in connection with the consummation of this offering. We expect that we will incur additional non-cash expense charges of approximately $ in connection with certain of these issuances and other transactions that occurred subsequent to March 31, 2013. |

| (5) | The pro forma as adjusted for this offering column gives effect to the pro forma adjustments set forth in footnote (1) above for December 31, 2012 and footnote (3) above for March 31, 2013, and the receipt of estimated net proceeds from this offering, based on an assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and the use of such proceeds as outlined in the section titled “Use of Proceeds.” |

14

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including the historical and pro forma financial statements and the related notes contained elsewhere in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks or uncertainties actually occur, our business, financial condition, results of operations, liquidity, cash flows and prospects could be materially and adversely affected. As a result, the price of our common stock could decline significantly and you could lose all or part of your investment in our common stock. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risk Related to Our Business and Our Industry

We have a very limited operating history, which makes it difficult to evaluate our current business and future prospects, and may substantially increase the risk of your investment.

We were formed on January 17, 2012 and commenced operations on April 24, 2012. We have a very limited history of selling our products and services to third parties. Our limited operating history makes it difficult to evaluate our business and future prospects. This difficulty may be further exacerbated by the limited historical financial information and other financial and operating data available with respect to our business. Among other things, our historical financial statements included in this prospectus primarily reflect our start-up operations, and may not be reflective of our business going forward. We have encountered and will continue to encounter risks and difficulties frequently experienced by new and rapidly growing companies in evolving industries, including the risks described in this prospectus. If we do not address and manage these risks successfully, our business could be materially and adversely affected and our stock price could decline significantly.

We have generated very little revenue and have experienced significant net losses and negative cash flows from operations to date, and may not be able to generate meaningful revenue, operate profitably or generate positive cash flows on a consistent basis or at all.

We have generated very little revenue to date. From April 24, 2012, the date on which we commenced operations, through December 31, 2012, we generated revenue of $2.3 million (of which $1.3 million related to the over-the-counter brokerage operations of certain of our subsidiaries which we ceased on June 1, 2013 and only $1.0 million related to software licensing, which included revenue of $365,606 related to messaging services which we terminated on December 31, 2012) and incurred a net loss of $38.2 million, or $41.4 million on a pro forma basis, and had negative cash flows from operations of $6.4 million. For the three months ended March 31, 2013, we generated revenue of $1.8 million (of which $1.1 million related to the over-the-counter brokerage operations) and incurred a net loss of $5.1 million, or $4.5 million on a pro forma basis, and had negative cash flows from operations of $2.7 million. We anticipate that our operating expenses will increase substantially in the foreseeable future as we continue to enhance our product and service offerings, broaden our customer base, expand our operations, hire additional employees, continue to develop our technology and operate as a publicly traded company. Our expenses may be greater than we currently anticipate, and we may not succeed in generating sufficient revenues to offset these higher expenses. We incurred non-cash expense charges of approximately $1.0 million for the three months ended March 31, 2013 and expect that we will incur additional non-cash expense charges of approximately $ in each case related to the issuance of additional equity and other transactions in our equity subsequent to March 31, 2012 and additional equity to be issued in connection with the consummation of this offering. These costs will be incurred in the quarter in which the relevant equity issuances occur. See the section titled “Description of Capital Stock—Authorized Capitalization.” Our revenue growth may slow or our revenue could decline for a number of reasons, including less demand for our products or services than we anticipate, competition, our failure to capitalize on growth opportunities or other factors. If we are unable to meaningfully increase our revenue, we may not be able to operate profitably or generate positive cash flows on a consistent basis. If we are unable to effectively address these risks and challenges as we encounter them, we could be materially and adversely affected and our stock price could decline significantly.

15

Table of Contents

We face significant competition for customers from other providers of technology solutions to participants in the financial services community. If prospective customers are reluctant to switch from their existing service providers and adopt our products and services, our sales will not grow or may decline, we could be materially and adversely affected and our stock price could decline significantly.

Many of our potential customers have invested substantial personnel and financial resources to design and operate their trading, risk management, accounting, reporting and administration systems and technologies, and have established relationships with other providers. This may make them reluctant to add new components to their networks, particularly from other vendors such as us. We have only recently started selling our products and services to third parties and marketplace acceptance of our products and services is uncertain. Potential customers that use legacy products and services for their trading, risk management, accounting, reporting and administration needs may believe that these products and services sufficiently achieve their purpose. In addition, an organization’s existing vendors or new vendors with broad product and service offerings may be able to offer concessions to our potential customers that we are not able to match. Accordingly, organizations may continue allocating their resources and information technology budgets for legacy products and services and may not switch to our products and services. If our products and services do not find widespread marketplace acceptance, then our sales may not grow or may decline, which could materially and adversely affect us and cause our stock price to decline significantly.

We face significant competition for the types of products and services that we offer and may be unable to compete effectively for market share.

Our future success depends significantly upon our ability to gain and increase our market share, to maintain and increase our revenues from new and existing customers and to sell additional products and product enhancements to new and existing customers. The market for the types of products and services that we offer is intensely competitive. Our current and potential future competition principally comes from:

| • | software development firms and vendors who create global trading networks and risk management, accounting, reporting and administrative tools and make them available to brokers, hedge funds, and other investment management clients and financial institutions; |

| • | fund administrators who provide accounting and administration software and services to brokers, hedge funds and other investment management clients and financial institutions; and |

| • | broker-dealers who, in an effort to satisfy the demands of their customers for hands-on electronic trading facilities, universal access to markets, smart routing, better trading tools and lower commissions and financing rates, provide such facilities and product enhancements to their hedge fund and other investment management clients. |

Our competitors may develop products that are superior to our platform in terms of quality, ease of use, security, reliability or cost or may achieve greater market acceptance. Our competitors or potential competitors may have significantly greater financial, technical and marketing resources and access to capital than we do. As a result, they may be able to respond more quickly to new or emerging technologies and to changes in customer demands, or to devote greater resources to the development, promotion and sale of their products and services than we can. We may be unable to compete successfully against current or future competitors, which could materially and adversely affect us and cause our stock price to decline significantly.

If functionality similar or superior to that offered by our products and services is developed by competitors, it could materially and adversely affect us and cause our stock price to decline significantly.

Large, well-established providers of trading, risk management, accounting, reporting and administration technologies may introduce features that compete with our platform, either in stand-alone products or as additional features to their existing technologies. In addition, other companies may emerge that offer products and services that compete with those we offer. The introduction by competitors of products and services, or the

16

Table of Contents

announcement of an intent to offer products and services, that include functionality perceived to be similar or superior to that offered by our platform may adversely affect our ability to market and sell our products and services, which could materially and adversely affect us and cause our stock price to decline significantly. Furthermore, even if the functionality offered by these providers is more limited than our products and services, a significant number of organizations may nevertheless subscribe to such limited functionality offered by other providers instead of our products and services, whether because they do not wish to add an additional vendor such as us, for cost reasons, for relationship reasons or otherwise.

We depend on our proprietary technology. Any inability by us to maintain a technological advantage over our competitors could materially and adversely affect us and cause our stock price to decline significantly.

Our success depends on our proprietary technology, which has taken several years to develop and which we believe provides us with a competitive advantage. If our technology becomes more widely adopted in the marketplace, competitors may seek to develop similar or competing technologies, which could adversely affect our business. We have filed an omnibus utility patent application with the U.S. Patent and Trademark Office, or USPTO, containing claims directed to our integrated technology platform. To date, no patent has issued under this application. Adoption or development by competitors of similar or more advanced technologies may require that we devote substantial resources to the development of more advanced or different technology to remain competitive. The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Although we believe we are at the forefront of these developments, we may not be able to keep up with changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future, any of which could materially and adversely affect us and cause our stock price to decline significantly.

If we do not accurately predict, prepare for and respond promptly to rapidly evolving technological and market developments and changing customer needs, our business and prospects may be negatively impacted, potentially materially.

We expect the market for our products and services to continue to evolve rapidly. As a result, our future success will continue to depend upon our ability to develop new products or product enhancements that address the needs of our customers and to respond to changing market standards and practices. The process of developing new technology is complex and uncertain, and if we fail to accurately predict customers’ changing needs and emerging technological trends, our business and prospects could be negatively impacted, potentially materially. We may be required to commit significant resources to developing new products and services before knowing whether our investments will result in products or services that will achieve marketplace acceptance.

The success of new products and services depends on several factors, including appropriate new product definition, timely completion and introduction of these products and services, differentiation of new products from those of our competitors, and marketplace acceptance of these products and services. There can be no assurance that we will successfully identify new sales opportunities, develop and bring new products and services to market in a timely manner, or achieve marketplace acceptance of our products and services, or that products, services and technologies developed by others will not render our products, services or technologies obsolete or noncompetitive.

We currently have a limited number of customers, most of which to date have been generated as a result of pre-existing relationships of these customers with our founders and entities affiliated with them. We may not be successful in attracting new customers. In addition, the loss of or events affecting one or more of our customers could materially and adversely affect us and cause our stock price to decline significantly.

Because we are a newly-formed company, our current customer base is small. For the period from April 24, 2012, the date we commenced operations, through December 31, 2012, a single customer, QuantX Management, LLP (f/k/a Liquid Trading Int’l LLP), or QuantX, a multi-strategy principal-only trading firm with which Messrs. Ferdinand, Schaeffer and Keller are affiliated, represented 34% of our total revenues and 75% of our

17

Table of Contents

software licensing revenues. In addition, for the period from April 24, 2012 through December 31, 2012, all related parties, including QuantX, represented 38% of total revenues and 86% of our software licensing revenues. For the three months ended March 31, 2013, QuantX represented 26% of our total revenues and 76% of our software licensing revenues. In addition, all related parties, including QuantX, represented 30% of total revenues and 87% of our software licensing revenues for the three months ended March 31, 2013. To date, most of our customers have been sourced through relationships with our founders and their respective affiliated or acquired entities. Our customers operate in the volatile global financial markets and are influenced by a number of factors outside of their control, including rising interest rates or inflation, the availability of credit, issues with sovereign and large institutional obligors, changes in laws and regulations, and terrorism or political uncertainty, among others. As a result, any one of our customers may go out of business unexpectedly. In addition, these customers may decide to no longer use our products and services for other reasons which may be out of our control. The loss of or events affecting any one or more of these customers could materially and adversely affect us and cause our stock price to decline significantly.

A systemic or systematic market event that impacts the various market participants with whom we interact could materially and adversely affect us and cause our stock price to decline significantly.

There has been significant disruption and volatility in the global financial markets over the last several years, and many countries, including the United States, have been in an economic slowdown. Increased risk aversion brought about by the financial crisis of 2008 and the resulting global recession, ongoing concerns over sovereign debt levels and the U.S. “flash crash” in May 2010 resulted in the curtailing of trading activity. The global market and economic climate may remain stagnant or continue to deteriorate because of the aforementioned factors as well as other factors beyond our control, including rising interest rates or inflation, a lack of credit, credit issues with sovereign and large institutional obligors, changes in laws or regulations, terrorism or political uncertainty, among others. In the event of deteriorating or stagnant market conditions, there could be a reduction in the types of financial instruments traded or a reduction in trading volumes of financial instruments globally. These factors could cause revenues from our customers to decrease, which could adversely affect our business and operating results, potentially materially. Our profitability may also be adversely affected by our fixed costs and the possibility that we may be unable to reduce other costs within a time frame sufficient to match any decreases in revenue relating to deteriorating conditions. Accordingly, deteriorating or stagnant market conditions could materially and adversely affect us and cause our stock price to decline significantly.

If we fail to remediate our current material weaknesses and deficiencies in our internal control over financial reporting or we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected, our reputation could be harmed and our stock price could decline significantly.

In connection with the preparation of our audited consolidated financial statements for the period from April 24, 2012 to December 31, 2012, our independent registered public accounting firm identified and communicated three material weaknesses in our internal controls over financial reporting to our Board of Directors. A material weakness is a deficiency, or a combination of deficiencies, that creates a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis. The three material weaknesses related to our lack of: (i) internal controls and sufficient personnel to identify, analyze, record and report the accounting effects of the terms of agreements and contracts in accordance with accounting principles generally accepted in the United States, or U.S. GAAP; (ii) internal controls to safeguard and archive records to support amounts recorded in the financial statements; and (iii) policies, procedures and controls to identify, authorize, approve, monitor and account for and disclose related party transactions and arrangements, including those transactions outside the normal course of business, in the financial statements in accordance with U.S. GAAP. These material weaknesses resulted in audit adjustments to our financial statements which were identified by our independent registered public accounting firm.

We have begun taking steps and plan to take additional steps to remediate the underlying causes of our material weaknesses, primarily through the development and implementation of formal policies, improved

18

Table of Contents

processes, upgraded financial accounting systems and documented procedures, as well as the hiring of additional finance personnel. We hired a Chief Financial Officer in September 2012, an accounting manager and a General Counsel in March 2013, and a controller in April 2013, with appropriate knowledge, experience and ability to fulfill our obligations to comply with the accounting, reporting and other requirements applicable to public companies. In addition, we contracted for a new general ledger system in March of 2013 which we believe will enhance our internal controls and reporting capabilities once fully utilized, which we anticipate will occur before the end of 2013. Although we plan to complete this remediation process as quickly as possible, we cannot at this time estimate how long it will take, and our initiatives may not prove to be successful in remediating these material weaknesses.