Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TIDEWATER INC | d561321d8k.htm |

| EX-99.2 - EX-99.2 - TIDEWATER INC | d561321dex992.htm |

GHS 100

Energy Conference GHS 100 Energy Conference

Joseph M. Bennett

EVP & Chief IRO

June 25, 2013

June 25, 2013

Exhibit 99.1 |

FORWARD-LOOKING

STATEMENTS

In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act

of 1995, the Company notes that certain statements set forth in this presentation

provide other than historical information and are forward looking. The actual

achievement of any forecasted results, or the unfolding of future economic or business

developments in a way anticipated or projected by the Company, involve numerous risks

and uncertainties that may cause the Company’s actual performance to be materially

different from that stated or implied in the forward-looking statement. Among those

risks and uncertainties, many of which are beyond the control of the Company, include,

without limitation, fluctuations in worldwide energy demand and oil and gas prices; fleet

additions by competitors and industry overcapacity; changes in capital spending by customers

in the energy industry for offshore exploration, development and production; changing

customer demands for different vessel specifications, which may make some

of our older vessels

technologically obsolete for certain customer projects or in certain markets; uncertainty of

global financial market conditions and difficulty accessing credit or capital; acts of

terrorism and piracy; significant weather conditions; unsettled political conditions,

war, civil unrest and governmental actions, such as expropriation or enforcement of

customs or other laws that are not well-developed or consistently enforced,

especially in higher political risk countries where we operate; foreign currency

fluctuations; labor changes proposed by international conventions; increased regulatory

burdens and oversight; and enforcement of laws related to the environment, labor and foreign

corrupt practices. Readers should consider all of these risks factors, as well as other

information contained in the Company’s form 10-K’s and

10-Q’s. TIDEWATER

601 Poydras Street, Suite 1500

New Orleans, LA 70130

Phone:

504.568.1010

|

Fax:

504.566.4580

Web site address:

www.tdw.com

Email:

connect@tdw.com

2 |

Key

Takeaways Key Takeaways

•

Focus on safety, compliance & operating excellence

•

“The Tide is Turning”–

continued improvement

in

working rig count is positively impacting deepwater and

jackup support vessels globally

•

History of earnings growth and solid returns

•

Unmatched scale and scope of operations

•

World’s largest and newest OSV fleet provides basis for

continued earnings growth

•

Strong balance sheet allows us to continue to act upon

available opportunities, such as recent Troms

acquisition

3 |

Safety

Record

Rivals

Leading Companies

4 |

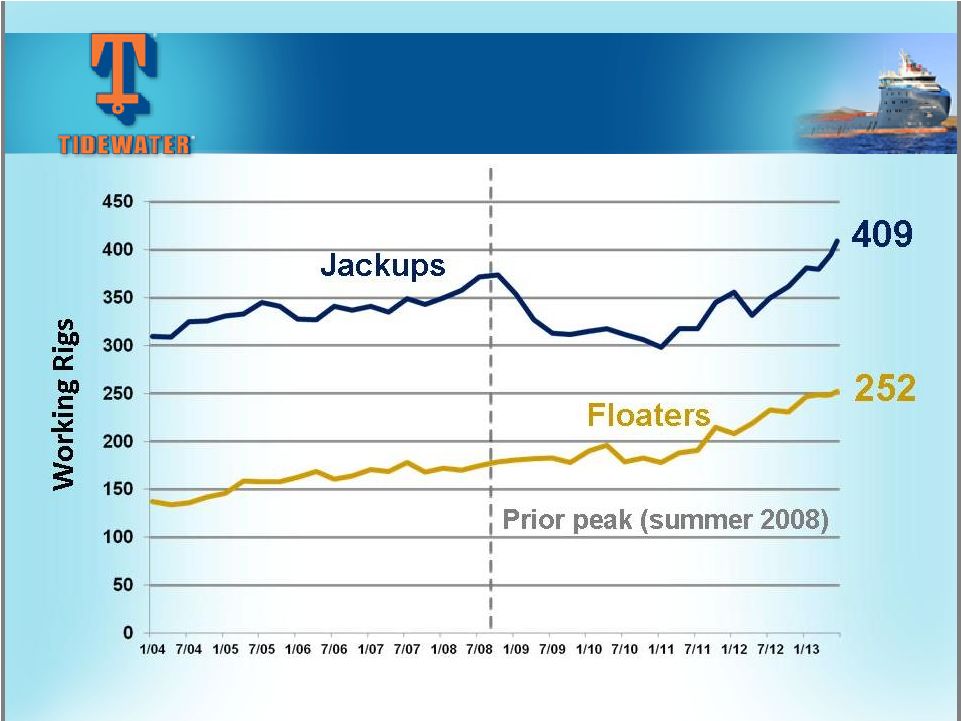

Working

Offshore Rig Trends Working Offshore Rig Trends

Source:

ODS-Petrodata

Note: 46 “Other”

rigs, along with the Jackups and Floaters, provide a total working rig count of 707

in mid-June 2013. 5 |

Drivers of

our Business Drivers of our Business

“Peak to Present”

“Peak to Present”

Source:

ODS-Petrodata

and

Tidewater

July 2008

(Peak)

Jan. 2011

(Trough)

June

2013

Working Rigs

603

538

707

Rigs Under

Construction

186

118

214

OSV Global

Population

2,033

2,599

2,981

OSV’s Under

Construction

736

367

450

OSV/Rig Ratio

3.37

4.83

4.22

6 |

Source: ODS-Petrodata and Tidewater

As of May 2013, there are approximately 468 additional AHTS and PSV’s

(~16% of the global fleet) under construction.

Global fleet is estimated at 2,952 vessels, including ~750

vessels that are 25+ yrs old (26%). 7

The Worldwide OSV Fleet

The Worldwide OSV Fleet

(Includes

(Includes

AHTS

AHTS

and

and

PSVs

PSVs

only)

only)

Estimated

as

of

mid-June

2013 |

Tidewater’s Active Fleet

Tidewater’s Active Fleet

As of March 31, 2013

As of March 31, 2013

Year Built

8 |

Vessel

Population by Owner Vessel Population by Owner

(AHTS and PSVs only)

(AHTS and PSVs only)

Estimated

as

of

mid-June

2013

Source:

ODS-Petrodata

and

Tidewater

9 |

History

of

Earnings

Growth

and

Solid

Through-Cycle

Returns

**

EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge.

EPS in Fiscal 2006 is exclusive of the $.74 per share after tax gain from the

sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of $.37 per share of after

tax gains from the sale of 14 offshore tugs. EPS in Fiscal 2010 is

exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit

related to favorable resolution of tax litigation and a $0.22 per share charge for

the proposed settlement with the SEC of the company’s FCPA matter. EPS in Fiscal

2011 is exclusive of total $0.21 per share charges for settlements with DOJ

and Government of Nigeria for FCPA matters, a $0.08 per share charge related to participation in a multi-company U.K.-based pension plan and a $0.06

per share impairment charge related to certain vessels. EPS in Fiscal 2012 is

exclusive of $0.43 per share goodwill impairment charge. 10

|

Global

Strength Global Strength

Unique global footprint; 50+ years of Int’l experience

Unmatched scale and scope of operations

Strength of International business complements U.S.

activity

Secular growth

Longer contracts

Better utilization

Higher day rates

Solid customer base of NOC’s and IOC’s

11 |

Our

Global Footprint Our Global Footprint

Vessel Distribution by Region

Vessel Distribution by Region

(excludes

stacked

vessels

-

as

of

3/31/13)

In 4Q FY 2013, ~9% of vessel revenue was generated in the U.S. by < 15 vessels;

however, ~15 other U.S.-flagged vessels are currently operating in

International regions that could be re-deployed to the U.S. GOM. In addition, Tidewater has

currently under construction five additional U.S.-flagged deepwater PSVs.

12 |

The

Largest Modern OSV The Largest Modern OSV

Fleet in the Industry

Fleet in the Industry

Vessel Count (2)

Total Cost (2)

Deepwater PSVs

88

$2,155m

Deepwater AHTSs

11

$358m

Towing Supply/Supply

109

$1,632m

Other

56

$285m

TOTALS:

264

$4,430m

(1)

.

At 3/31/13, 231 new vessels were in our fleet with ~6.2 year average age

Vessel Commitments

Jan.

’00

–

March

‘13

(1)

$3,830m (86%) funded through 3/31/13

(2)

Vessel count and total cost is net of 24 vessel dispositions ($222m of original

cost) 13 |

…..

and More to Come ….. and More to Come

Count

Deepwater PSVs

21

Deepwater AHTSs

-

Towing Supply/Supply

6

Other

5

Total

32

Vessels Under Construction*

As

of

March

31,

2013

Estimated delivery schedule –

11 in FY ’14, 15 in FY ’15 and 6 thereafter.

CAPX of $311m in FY ’14, $219m in FY ‘15 and $69m in FY

’16. 14 |

Strong

Financial Position Strong Financial Position

Provides Strategic Optionality

Provides Strategic Optionality

As of March 31, 2013

Cash & Cash Equivalents

$41 million

Total Debt

$1,000 million

Shareholders Equity

$2,562 million

Net Debt / Net Capitalization

27%

Total Debt / Capitalization

28%

~$380 million of available liquidity as of 3/31/13, including $340 million of unused

capacity under committed bank credit facilities.

15 |

Total

Revenue and Margin Total Revenue and Margin

Fiscal 2008-2013

Fiscal 2008-2013

Note: Vessel operating margin is defined as vessel revenue less

vessel operating expenses

16 |

New

Vessel Trends by Vessel Type New Vessel Trends by Vessel Type

Deepwater PSVs

Deepwater PSVs

$138 million, or 43%, of Vessel Revenue in Q4 Fiscal 2013

17 |

$114 million, or 35%, of Vessel Revenue in Q4 Fiscal 2013

New Vessel Trends by Vessel Type

New Vessel Trends by Vessel Type

Towing Supply/Supply Vessels

Towing Supply/Supply Vessels

18 |

Potential

for Future Potential for Future

Earnings Acceleration

Earnings Acceleration

Average Day rates

$17,458

*

$19,204

(+ 10%)

$21,124

(+ 10%)

83.8%*

85.0%

90.0%

~$4.95

EPS

~$7.45

EPS

~$12.25

EPS

283 vessel assumption (231 current new vessels + 32 under construction + 20

additional new vessels next year). * 3/31/13 quarterly actual

stats This info is not meant to be a

prediction of future earnings

performance, but simply an

indication of earning sensitivities

resulting from future fleet

additions and reductions and

varying operating assumptions

~$500M+

EBITDA

+$650M

EBITDA

+$930M

EBITDA

19 |

GHS 100

Energy Conference GHS 100 Energy Conference

Joseph M. Bennett

EVP & Chief IRO

June 25, 2013

June 25, 2013 |

Appendix

Appendix

21 |

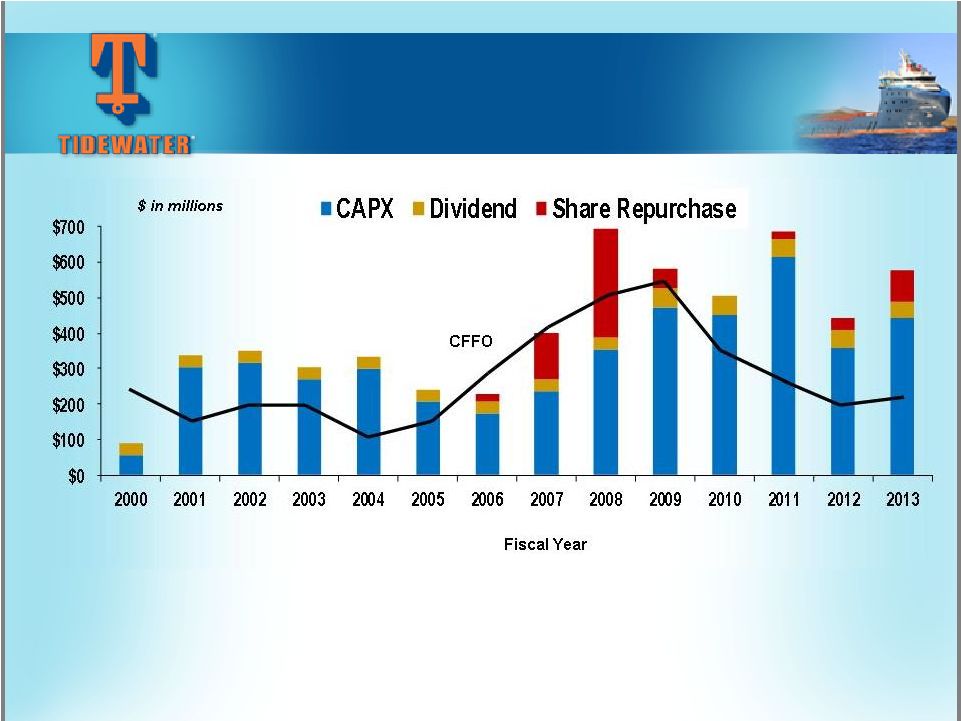

Fleet

Renewal & Expansion Funded Fleet Renewal & Expansion Funded

by CFFO through Fiscal 2013

by CFFO through Fiscal 2013

Over a 14-year period, Tidewater has invested $4.6 billion in CapEx, and paid

out ~$1.2 billion through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.8

billion and $749 million, respectively

22 |

$29

million, or 9%, of Vessel Revenue in Q4 Fiscal 2013 New Vessel Trends by Vessel

Type New Vessel Trends by Vessel Type

Deepwater AHTS

Deepwater AHTS

23 |

New Fleet

Driving Results New Fleet Driving Results

Vessel Revenue ($)

Average Fleet Count

229

Average

Active

New

Vessels

in

Q4

2013

$325 million Vessel Revenue in Q4 2013

(93% from New Vessels)

24 |

Cyclical

Upturn should Cyclical Upturn should

Drive Margin Expansion

Drive Margin Expansion

Vessel Cash Operating Margin ($)

Vessel Cash Operating Margin (%)

$139 million Vessel Margin in Q4

FY2013

(99%

from

New

Vessels)

Q4 FY2013 Vessel Margin: 43%

25 |

Vessel

Utilization by Segment Vessel Utilization by Segment

26 |

Vessel

Dayrates by Segment Vessel Dayrates by Segment

Impact of $7.4 million of retroactive revenue recorded in September 2012 quarter is excluded

from 9/12 average dayrates and included in the respective March 2012 and June 2012

quarterly average dayrates. 27 |

Current

Revenue Mix Current Revenue Mix

Quality of Customer Base

Quality of Customer Base

Super Majors

38%

NOC's

21%

Others

41%

Our top 10 customers in Fiscal 2013 (4 Super Majors, 2 NOC’s,

3 IOC’s and 1 independent) accounted for 58% of our revenue

28 |

Financial

Strategy Focused on Financial Strategy Focused on

Creating Long-Term

Creating Long-Term

Shareholder Value

Shareholder Value

Maintain

Maintain

Financial Strength

Financial Strength

EVA-Based Investments

EVA-Based Investments

On Through-cycle Basis

On Through-cycle Basis

Deliver Results

Deliver Results

29 |