Attached files

| file | filename |

|---|---|

| 8-K - PLUG POWER INC | esplugpower8k.htm |

Plug Power

Investor Presentation

June 2013

The content of this presentation is

PLUG POWER INC. PROPRIETARY AND CONFIDENTIAL.

Copyright 2013 by Plug Power Inc. 11

This communication contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are based on

current expectations that are subject to certain assumptions, risks and

uncertainties, any of which are difficult to predict, are beyond our control and

that may cause our actual results to differ materially from the expectations in

our forward-looking statements including the risk that we may not have

sufficient cash to fund our operations to profitability and that we may be

required to seek strategic alternatives, including but not limited to a

potential business combination or a sale of the company; that unit orders will

not ship, be installed and/or convert to revenue, in whole or in part;

development of our products may take longer and cost more than we expect and we

may not be able to raise the necessary capital to fund such development costs;

we may not

be able to increase the margin on the sale of our products as much as expected

or at all; our actual net cash used for operating expenses may exceed our

projected net cash for operating expenses; the fuel and fueling infrastructures

for our products may not be available or may cost more than expected; our

GenDrive systems may not reach wider market acceptance; we may not be able to

establish and maintain necessary relationships with third parties for product

development, manufacturing, distribution and servicing and the supply of key

products components; components and parts for our products may not be available

or may cost more than expected; we may be unable to develop commercially viable

products; we may be unable to reduce product and manufacturing costs; we may be

unable to successfully expand our product lines; we may be unable to improve

system reliability for GenDrive; we may suffer price competition and competition

from other traditional and alternative energy companies; we may be unable to

manufacture products on a large-scale commercial basis; we may be unable to

protect our intellectual property; compliance with current and future

governmental regulations may be costly; and other risks and uncertainties

discussed under "Item IA-Risk Factors" in our annual report on Form 10-K for the

fiscal year ended December 31, 2012, filed with the Securities and Exchange

Commission ("SEC") on April 1, 2013 and as amended on April 30, 2013, and the

reports we file from time to time with the SEC. Plug Power does not intend to,

and undertakes no duty to update any forward-looking statements as a result of

new information or future events.

This communication contains forward-looking statements within the meaning of the

Private Securities Litigation

Reform Act of 1995, including but not limited to expectations regarding revenues

and product orders and shipments for 2011. These statements are based on current

expectations that are subject to certain assumptions, risks and uncertainties,

any of which are difficult to predict, are beyond our control and that may cause

our actual results to differ materially from the expectations in our

forward-looking statements including, but not limited to: the risk that we

continue to incur losses and might never achieve or maintain profitability, the

risk that the additional capital we expect we will need to raise to fund our

operations beyond the first quarter of 2012 may not be available; our lack of

extensive experience in manufacturing and marketing products may impact our

ability to manufacture and market products on a profitable and large-scale

commercial basis; the risk that unit orders will not ship, be installed and/or

converted to revenue, in whole or in part; the risk that pending orders may not

convert to purchase orders, in whole or in part; the risk that our continued

failure to comply with NASDAQ’s listing standards may severely limit our ability

to raise additional capital; the cost and timing of developing, marketing and

selling our products and our ability to raise the necessary capital to fund such

costs; the ability to achieve the forecasted gross margin on the sale of our

products; the actual net cash used for operating expenses may exceed the

projected net cash for operating expenses; the cost and availability of fuel and

fueling infrastructures for our products; market acceptance of our GenDrive

systems; our ability to establish and maintain relationships with third parties

with respect to product development, manufacturing, distribution and servicing

and the supply of key product components; the cost and availability of

components and parts for our products; our ability to develop commercially

viable products; our ability

to reduce product and manufacturing costs; our ability to successfully expand

our product lines; our ability to improve system reliability for our GenDrive

systems; competitive factors, such as price competition and competition from

other traditional and alternative energy companies; our ability to protect our

intellectual property; the cost of complying with current and future federal,

state and international governmental regulations; and other risks and

uncertainties discussed under "Item IA-Risk Factors" in our annual report on

Form 10-K for the fiscal year ended December 31,

2010, filed with the Securities and Exchange Commission ("SEC") on March 31,

2011, and the reports we file from time to time with the SEC. Plug Power does

not intend to, and undertakes no duty to update any forward-looking statements

as a result of new information or future events.

2

We Are Plug Power

Leader in development and production of clean, commercial energy solutions for

the material handling industry

• Headquarters in Latham, New York with over 140 employees

• Founded in June 1997

• World class manufacturing facility in NY

• 152 issued patents

• Over 4,000 units in the field with over 10 M

hours runtime

• Premier System Integrator of PEM fuel cells

3

Plug Power: Poised for

Profitability

Today’s focus: material handling market

• Endorsed via an investment by Air Liquide, a leading industrial gas firm

• Significant and new customers are buying

• Quality problems behind us

• EBITDA profitability within reach

• Success in materials transport is generating interest (and development funds)

from adjacent markets

This is the first step toward Plug Power’s long-term goal to displace lead-acid

batteries and diesel engines in a broad array of mobile applications.

4

Customer Base Continues to Grow

• 44 total site deployments with 24 different customers

• 29 brownfield sites

• 15 greenfield sites

• More than 4,000 units shipped

• ~8,000 fills per day by customer

• More than 4,600 kg of H2 dispensed per year

• Our present customers own over 250,000 forklift trucks

5

We Sell Operational and Capital Savings with Environmental Benefits

GenDrive Products Operational and Capital Savings

Class 1 Suite

Sit-down Lift Trucks

Improve Productivity by up to 15%

via

No Battery Changing

Constant Performance throughout the shift

Class 2 Suite

Stand-up Reach Trucks

Save Commercial Space by eliminating the Battery Room

Complete Product Set eliminates the need for Lead Acid Batteries in a facility

Class 3 Suite

Rider Pallet Trucks

Reduce Carbon Footprint by up to

80%

6

Customer Success in

Manufacturing

• Largest consumer product company in the world

• Deployed in California, Louisiana, Pennsylvania and North Carolina

• 342 GenDrive units, total

• P&G operates 34 plants in the US and close to

100 plants world-wide

• Modified standard products for P&G fleet strengthening the relationship for

future sales

• In 2010 announced sustainability initiative of powering plants with 100%

renewable energy

7

Customer Success in Food

• Second largest food retailer in North America

• First deployment in Compton, CA

• 174 GenDrive units

• Kroger operates ~30 large distribution centers nationwide

• Distribution center conditions include freezer environments reaching -25

degrees F

• New sites being considered are estimated to reduce Kroger’s carbon footprint

from fork trucks by 31%, on average

8

Customer Success in Retail

• Largest retailer and employer in the world

• Deployed in Ohio, Alberta and Ontario

• 509 GenDrive units, total

• Walmart operates 100+ distribution centers with close to 20,000 forklift

trucks and approximately

15,000 units in stores in North America

• Plug Power designed and built hydrogen piping and dispensing system to

generate revenue from H2

• Expected greenhouse gas reduction (WCH facility) up to 72% compared to

batteries charged from grid

9

HyPulsion JV is Bearing Fruit

• HyPulsion, Joint Venture between Plug Power and Air Liquide, has completed one

year of business and product development activities

• Foundation is laid – will ship product in 2013

• Market opportunity greater than North

America

• 9 CE certified products with multiple configurations available for deployment

in 2013

• Collaboration projects in place with 8 fork lift OEMs

• Includes Jungheinrich, Toyota

Material Handling, Linde

10

Plug Power’s material

handling business

• Business works because we offer customer a solution to improve their business

• Constant performance – no battery droop

• Hydrogen refueling in less than 2 minutes

Market Opportunity*

$2,100M

• Improved productivity, lower operating costs and reduced GHG

• Elimination of battery room – 6-7% additional space

• Full suite of fuel cell product to meet material handling customer needs

$3,300M

$4,479M

$4,285M

$5,706M

• Over 90% of the fuel cell market in the material handling industry**

*Sources: Analysis of 2009 Industrial Truck Association presentation, JVIA, and

ongoing management discussions with OEM’s

Assumes fuel cell ASP of ~$28k for Class 1, 2, 4 and 5 and ~$12k for Class 3

forklifts

** FuelCells Bulletin, September 2010

North America Europe Japan China ROW

11

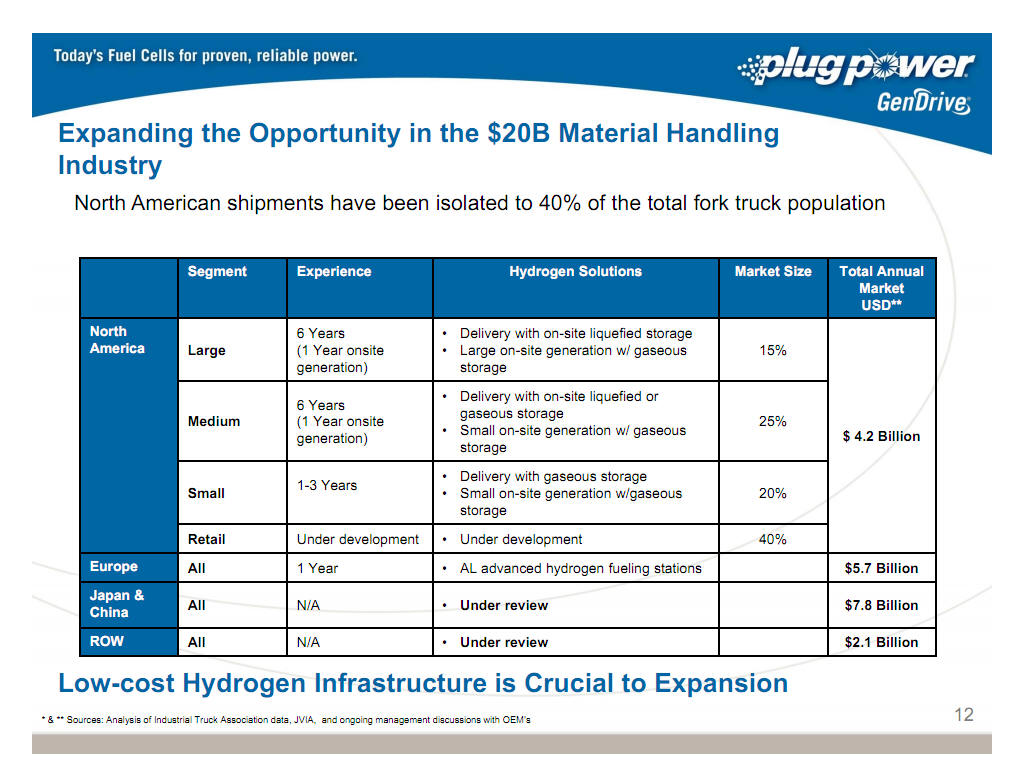

Expanding the Opportunity in the $20B Material Handling Industry

North American shipments have been isolated to 40% of the total fork truck

population

Segment Experience Hydrogen Solutions Market Size Total Annual Market USD**

North America Large

Medium

6 Years

(1 Year onsite generation)

6 Years

(1 Year onsite generation)

• Delivery with on-site liquefied storage

• Large on-site generation w/ gaseous storage

• Delivery with on-site liquefied or gaseous storage

• Small on-site generation w/ gaseous storage

15%

25%

$ 4.2 Billion

Small 1-3 Years

• Delivery with gaseous storage

• Small on-site generation w/gaseous storage

20%

Retail Under development • Under development 40%

Europe All 1 Year • AL advanced hydrogen fueling stations $5.7 Billion

Japan &

China All N/A • Under review $7.8 Billion

ROW All N/A • Under review $2.1 Billion

Low-cost Hydrogen Infrastructure is Crucial to Expansion

* & ** Sources: Analysis of Industrial Truck Association data, JVIA, and ongoing

management discussions with OEM’s

12

Continuing to Drive down Costs

Product

• We continue delivering cost reductions

• Costs are falling in line

$35,000

$30,000

$25,000

Weighted Average Cost: HP and LP Products

• Averaging ~10% year over year reductions ($ / unit) from 2010 - 14

• Higher volumes, sourcing strategies, and manufacturing improvements driving

progress

Service

• We continue enhancing our service

• Averaging ~25% year over year reductions ($ / unit) 2010 – 14

• Key component performance improvements, improved supplier relationships, and

higher purchasing volumes are turning the business around

$20,000

$15,000

$10,000

$5,000

$0

$1,200

$1,000

$800

$600

$400

$200

$0

2010 2014

Service Cost vs Growing Installed Base

2010 2014

Qtrly Cost / Unit # Units

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

Future Market Expansion

• Targeting adjacent markets that have the same dynamics as materials handling

• Ground Support Equipment – 60,000 units deployed

• Big Rig Transportation Refrigeration Units – 290,000 units deployed

• Range extenders for heavy-duty electric vehicles

• President Obama target: 1M electric vehicles by 2015

• Significant development funds provided by external agencies

• DOE development grant for Charlatte CTE5 BTTs -

$2.5 million

• New York SERDA – $250K for TRUs

• Planned application for DOE RFP regarding range extenders

Charlatte BTT

Transportation Refrigeration Unit

Heavy Duty Electric Car

14

2014 Business Targets

• Ship over 3,000 Units to 20 manufacturing facilities or distribution centers

• Achieve 70M USD in Revenue

• Achieve 25% Gross Margin and 5% EBITDAS

• Deploy first systems for deployment in ground support equipment and

transportation refrigeration trucks

15

Summary

• Plug Power is the premier system integrator for PEM fuel cells

• Air Liquide now a key strategic investor and joined board of directors

• Compelling customer experience with Fortune

500 client list – 4,000 units to 23 firms

• Large Market Opportunity – over 6M forklift trucks deployed globally

• Targeting EBITDAS Breakeven in Q2/Q3 2014

• Material handling success is the first step to our goal of profitably

displacing diesel engines and batteries with fuel cells in a wide array of

mobile applications

16