Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CFCRE Commercial Mortgage Trust 2011-C2 | d561469d8k.htm |

Exhibit 99.1

SUBSERVICING AGREEMENT

between

KEYCORP REAL ESTATE CAPITAL MARKETS, INC.

and

BERKADIA COMMERCIAL MORTGAGE LLC

Key / Berkadia — Subservicing Agreement (Bank of America Loans)

TABLE OF CONTENTS

| ARTICLE I. DEFINITIONS |

1 | |||

| Section 1.01. Defined Terms |

1 | |||

| Section 1.02. Interpretative Matters |

6 | |||

| ARTICLE II. RETENTION AND AUTHORITY OF SUBSERVICER |

6 | |||

| Section 2.01. Servicing Standard; Commencement of Servicing Responsibilities |

6 | |||

| Section 2.02. Subcontractors and Vendors |

6 | |||

| Section 2.03. Authority of Subservicer |

6 | |||

| ARTICLE III. SERVICES TO BE PERFORMED |

8 | |||

| Section 3.01. Services as Subservicer |

8 | |||

| Section 3.02. Portfolio Manager |

13 | |||

| Section 3.03. Maintenance of Errors and Omissions and Fidelity Coverage |

14 | |||

| Section 3.04. Delivery and Possession of Servicing Files |

14 | |||

| Section 3.05. Financial Statements of the Subservicer |

14 | |||

| Section 3.06. Exchange Act Reporting and Regulation AB Compliance |

15 | |||

| Section 3.07. Regulatory Oversight, Compliance and Privacy |

20 | |||

| ARTICLE IV. SUBSERVICER’S COMPENSATION AND EXPENSES |

23 | |||

| Section 4.01. Subservicing Compensation |

23 | |||

| ARTICLE V. KRECM AND THE SUBSERVICER |

23 | |||

| Section 5.01. Subservicer Not to Assign; Merger or Consolidation of the Subservicer |

23 | |||

| Section 5.02. Liability and Indemnification of the Subservicer and KRECM |

24 | |||

| Section 5.03. Representations and Warranties |

27 | |||

| ARTICLE VI. EVENTS OF DEFAULT; TERMINATION |

29 | |||

| Section 6.01. Events of Default |

29 | |||

| Section 6.02. Termination of Agreement |

32 | |||

i

| ARTICLE VII. MISCELLANEOUS PROVISIONS |

34 | |||

| Section 7.01. Amendment; Amendment to any PSA |

34 | |||

| Section 7.02. Governing Law |

34 | |||

| Section 7.03. Notices |

34 | |||

| Section 7.04. Consistency with PSAs; Severability of Provisions |

35 | |||

| Section 7.05. Inspection and Audit Rights |

35 | |||

| Section 7.06. Binding Effect; No Partnership; Counterparts |

36 | |||

| Section 7.07. Protection of Confidential Information |

37 | |||

| Section 7.08. Construction |

37 | |||

| Section 7.09. Sole and Absolute Discretion of KRECM |

37 | |||

| Section 7.10. Exchange Act Rule 17g-5 Procedures |

37 | |||

LIST OF EXHIBITS

| Exhibit A | CMBS Transactions | |

| Exhibit B | Remittance Report | |

| Exhibit C | Property Inspection Report | |

| Exhibit D | Tax, Insurance, UCC and Letter of Credit Certification | |

| Exhibit E | Account Certification | |

| Exhibit F | Sarbanes-Oxley Performance Certification | |

| Exhibit G | Task List | |

| Exhibit H | Transfer Instructions | |

ii

SUBSERVICING AGREEMENT

THIS SUBSERVICING AGREEMENT (as it may be further amended, supplemented or modified, this “Agreement”), dated and effective as of June 24, 2013 (the “Effective Date”) by and between KEYCORP REAL ESTATE CAPITAL MARKETS, INC., an Ohio corporation (together with its successors and assigns permitted under this Agreement, “KRECM”), and BERKADIA COMMERCIAL MORTGAGE LLC, a Delaware limited liability company (together with its successors and assigns permitted under this Agreement, the “Subservicer”).

RECITALS

The following Recitals are a material part of this Agreement:

A. KRECM has acquired the servicing rights with respect to certain Mortgage Loans (as defined below) that are serviced pursuant to each Pooling and Servicing Agreement (each a “PSA”) for the CMBS Transactions (as defined below) .

B. KRECM and the Subservicer desire to enter into an agreement whereby the Subservicer shall perform certain of KRECM’s servicing responsibilities under each PSA with respect to the Mortgage Loans as more specifically set forth in this Agreement.

C. KRECM desires to engage the Subservicer pursuant to this Agreement because the Subservicer is the third largest servicer of commercial mortgage-backed securitization transactions in the United States and is uniquely suited with respect to its staff, facilities, and expertise to provide the services required by KRECM of a subservicer to service the large volume of commercial mortgage loans on the scale and in the context and under the circumstances contemplated by this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual promises contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, KRECM and the Subservicer hereby agree as follows:

ARTICLE I.

DEFINITIONS

Section 1.01. Defined Terms.

All capitalized terms not otherwise defined in this Agreement have the meanings set forth in the applicable PSA, or the respective meaning ascribed to equivalent terms utilized in such PSA, and the following capitalized terms have the respective meanings set forth below:

“Accepted Subservicing Practices”: As defined in Section 2.01.

“Accounts”: The applicable Subservicer Collection Account and Servicing Accounts maintained by the Subservicer under this Agreement, each of which shall be held in the name of “Berkadia Commercial Mortgage LLC on behalf of KeyCorp Real Estate Capital Markets, Inc., as Master Servicer, in trust for the Trustee, as trustee for the registered holders of the applicable Trust [securitization name].”

1

“Additional Form 10-D Disclosure”: To the extent such is required in the applicable transaction, any disclosure in addition to the Distribution Date statement that is required to be included on any Form 10-D filed with the Commission in respect of the Trust.

“Additional Form 10-K Disclosure”: To the extent such is required in the applicable transaction, any disclosure or information that is required to be included on any Form 10-K filed with the Commission in respect of the Trust and required to be disclosed by Subservicer pursuant to the applicable PSA.

“Affiliate”: With respect to any specified Person, any other Person controlling or controlled by or under common control with such specified Person. For the purposes of this definition, “control” when used with respect to any specified Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Agreement”: This Subservicing Agreement, as amended, modified, supplemented or restated by the parties from time to time.

“AML/BSA”: The Anti-Money Laundering and Bank Secrecy Act.

“Applicable Requirements”: As of the time of reference, with respect to the subject matter of this Agreement, all of the following: (i) any federal, state or local constitution, statute, rule, regulation or similar legal requirement applicable to the subservicing of commercial mortgage loans or any related activity; and (ii) Accepted Subservicing Practices.

“Borrower”: The borrower, mortgagor or obligor on the related Mortgage Loan note.

“Borrower Paid Fees”: Any amount collected from a borrower including but not limited to late payment charges, assumption fees, assumption application fees, modification fees, extension fees, fees charged for prepayment, defeasance, lease reviews and any other application fees.

“Claim”: Any claim, demand, or Legal Proceeding in connection with any Mortgage Loan, any PSA (solely with respect to the servicing of any Mortgage Loan), or this Agreement.

“CMBS Transactions”: Each of the Moody’s CMBS Transactions and the Non-Moody’s CMBS Transactions.

“Commission”: The Securities and Exchange Commission or any successor thereto.

“Customer Information”: Nonpublic personally identifiable information with respect to any Mortgage Loan, including but not limited to the borrower under such Mortgage Loan and any principle of such borrower or any guarantor of such Mortgage Loan.

“Defect”: As set forth in the applicable PSA, shall include any document defect, breach of representation or warranty by any seller of a Mortgage Loan, Repurchase Request or Repurchase Request Withdrawal.

“Delegation Agreement”: That certain Servicing Delegation and Reciprocal Deposit Agreement dated as of the date hereof among KRECM, Subservicer, and KeyBank National Association, as the same may be amended, restated, or otherwise modified from time to time.

2

“EDGAR”: The Electronic Data Gathering, Analysis, and Retrieval System of the Commission, which is the computer system for the receipt, acceptance, review and dissemination of documents submitted to the Commission in electronic format.

“Effective Date”: As defined in the preamble to this Agreement.

“Exchange Act”: The Securities Exchange Act of 1934, as amended from time to time.

“Form 8-K Disclosure Information”: To the extent such is required in any PSA, any disclosure or information related to a Reportable Event or that is otherwise required to be included on any Form 8-K filed with the Commission in respect of the Trust.

“Legal Proceeding”: Any judicial, equitable, or administrative action, suit, audit, mediation, arbitration, investigation, or proceeding (public, private, or governmental).

“Losses”: As defined in Section 5.02(f).

“Moody’s CMBS Accounts”: Each Account related to a Moody’s CMBS Transaction.

“Moody’s CMBS Transactions”: The Moody’s rated commercial mortgage-backed securitization transactions

listed on

Exhibit A.

“Mortgage Loan”: Each of the mortgage loans that are the subject of this Agreement and that are subject to a CMBS Transaction.

“Non-Moody’s CMBS Accounts”: Each Account related to a Non-Moody’s CMBS Transaction.

“Non-Moody’s CMBS Transactions”: The commercial mortgage-backed securitization transactions not rated by Moody’s and listed on Exhibit A.

“OCC”: The Office of the Comptroller of the Currency.

“OFAC”: The Office of Foreign Assets Control.

“OFAC Program”: As defined in Section 3.06(d) of this Agreement.

“Officer’s Certificate”: A certificate signed by a Servicing Officer of the Subservicer

“Person”: Any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof.

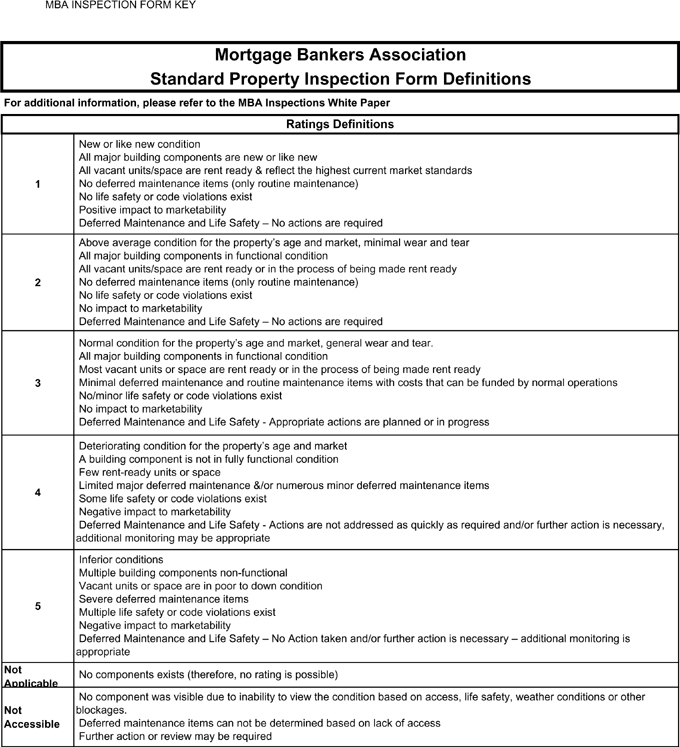

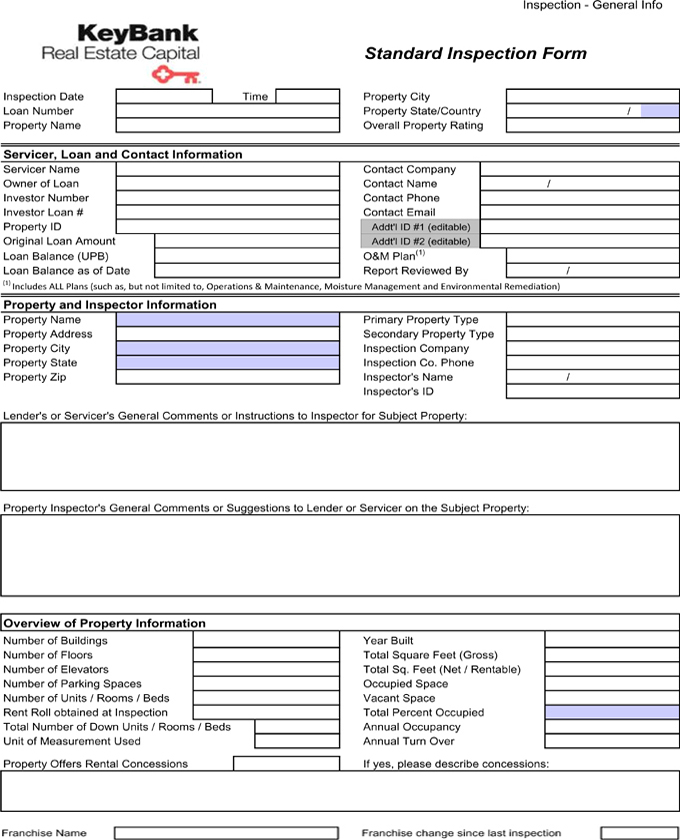

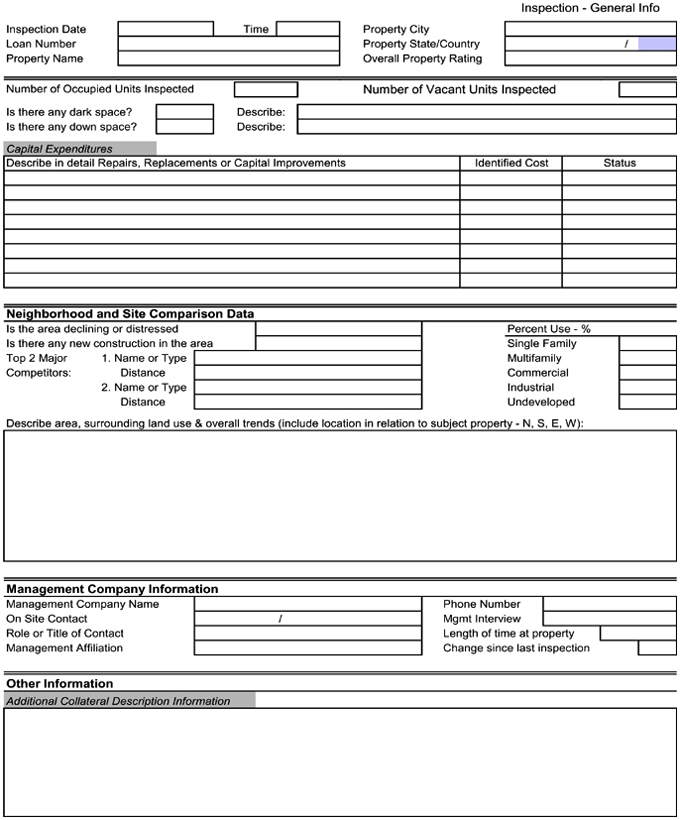

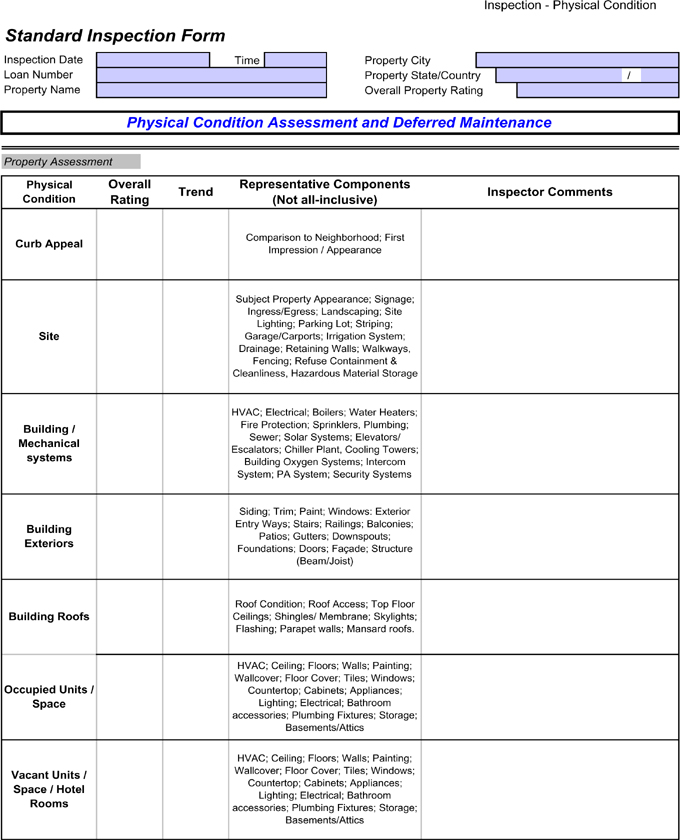

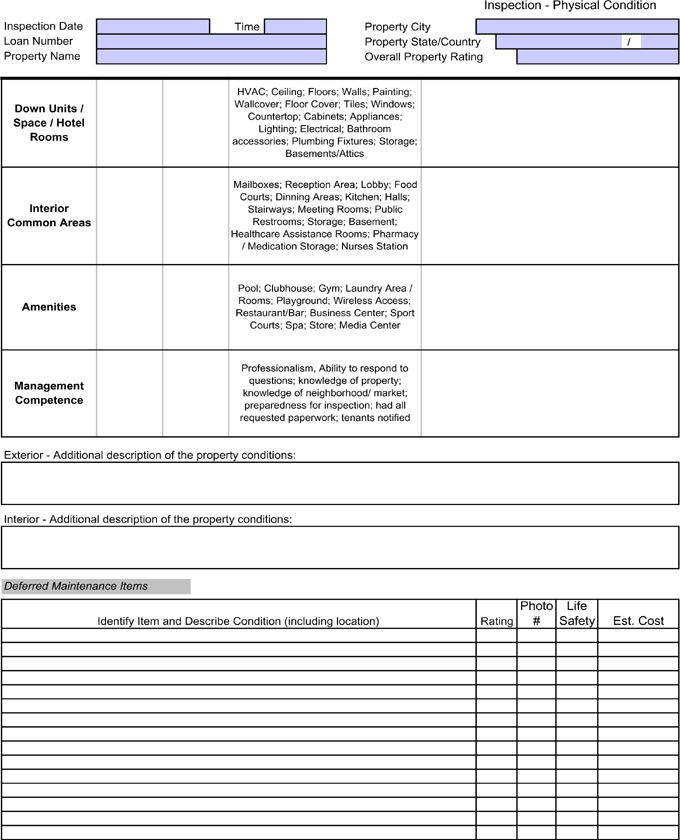

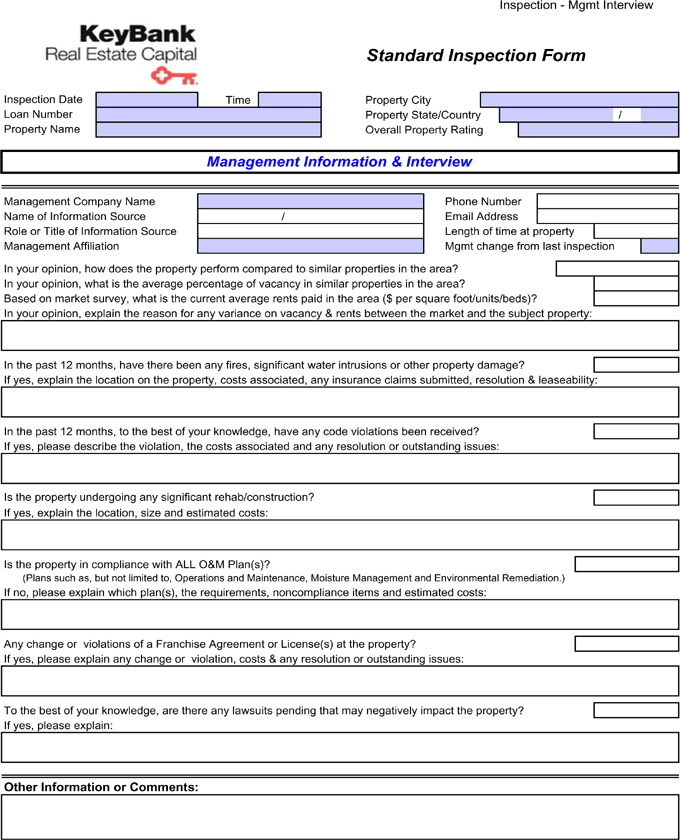

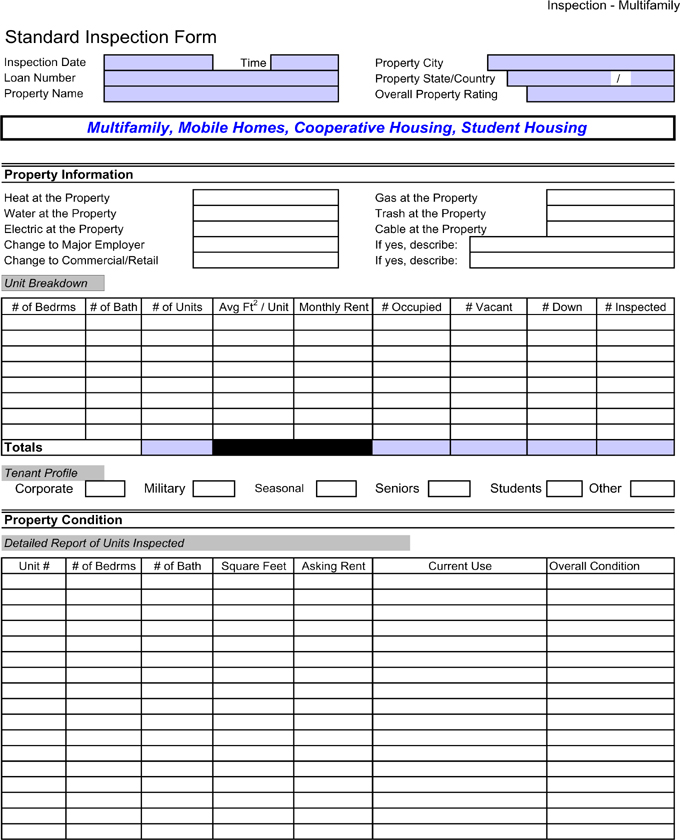

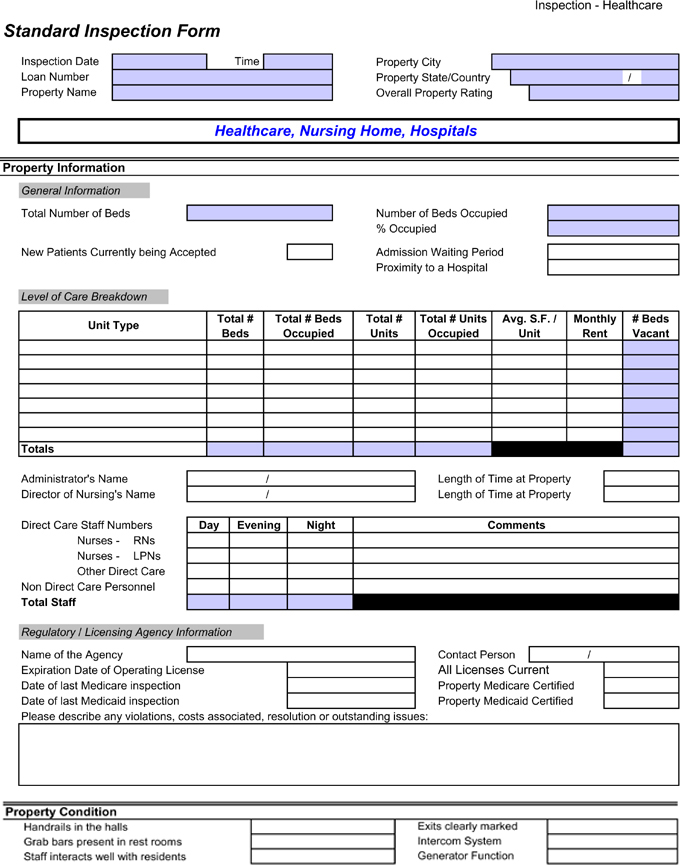

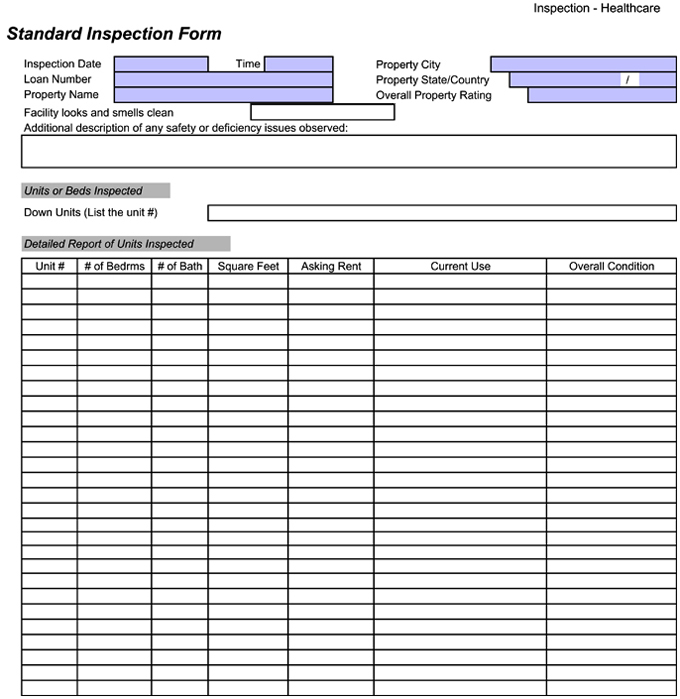

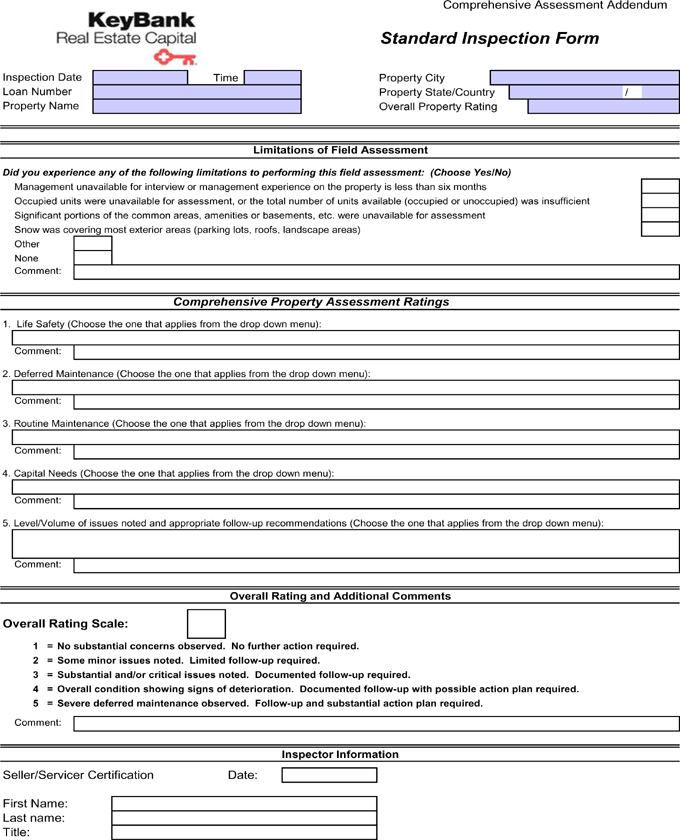

“Property Inspection Report”: A written report of each inspection of a Mortgaged Property performed by the Subservicer, which shall be delivered electronically pursuant to this Agreement substantially in the form attached hereto as Exhibit C (or in such other form as may be reasonably acceptable to KRECM and the Subservicer) and, in any event, shall set forth in detail the condition of the subject Mortgaged Property and specify the occurrence or existence of any sale, transfer or abandonment of, any change in the condition, occupancy or value of, or any waste committed on, the subject Mortgaged Property of which the Subservicer is aware.

“PSA”: As defined in the Recitals to this Agreement.

3

“Qualified Auditor”: All state and federal governmental entities, or an independent third party professional who is not a competitor of Subservicer and who is trained, experienced and qualified to conduct an audit of Subservicer’s OFAC Program and/or AML/BSA Services.

“Regulation AB”: Subpart 229.1100 – Asset-Backed Securities (Regulation AB), 17 C.F.R. §§229.1100-229.1123, as such may be amended from time to time, and subject to such clarification and interpretation as have been provided by the Commission in the adopting release (Asset-Backed Securities, Securities Act Release No. 33-8518, 70 Fed. Reg. 1,506-1,631 (Jan. 7, 2005)) or by the staff of the Commission, or as may be provided by the Commission or its staff from time to time.

“Relevant Servicing Criteria”: The Servicing Criteria applicable to the Subservicer, which are those Servicing Criteria applicable to KRECM as set forth as an Exhibit to the applicable PSA that the Subservicer has agreed to undertake pursuant to this Agreement as set forth on the Task List. With respect to any Servicing Function Participant or other subservicer engaged by the Subservicer, the term “Relevant Servicing Criteria” refers to the items of the Relevant Servicing Criteria applicable to the Subservicer that engaged such Servicing Function Participant or other subservicer that are applicable to such Servicing Function Participant or other subservicer based on the functions it has been engaged to perform.

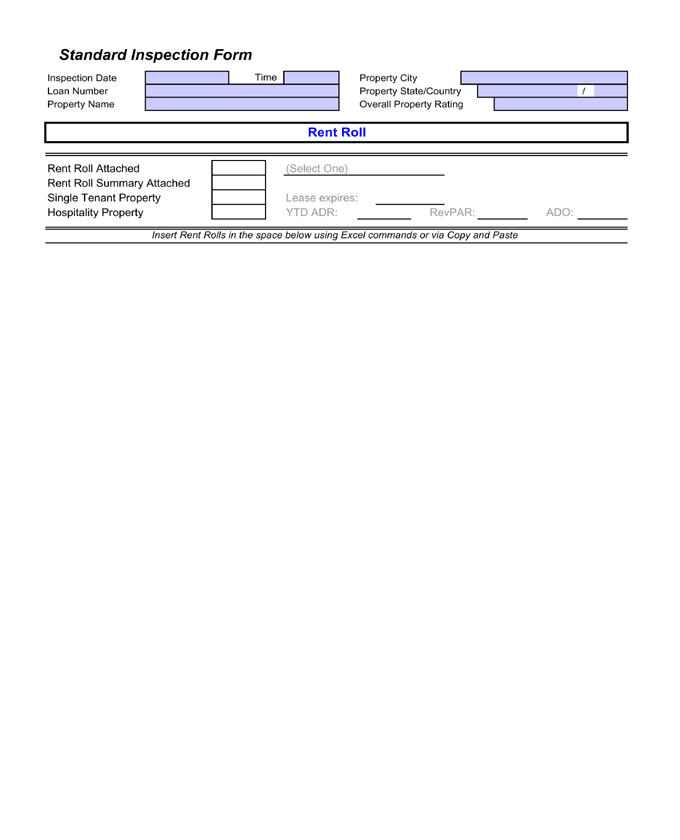

“Remittance Report”: A written report regarding any remittance made pursuant to the terms and provisions of this Agreement, which report shall be delivered electronically pursuant to this Agreement substantially in the form attached hereto as Exhibit B (or in such other form as may be reasonably acceptable to KRECM and the Subservicer).

“Reportable Event”: The occurrence of an event requiring disclosure under Form 8-K.

“Responsible Officer”: Any officer or employee of the Subservicer or KRECM, as the case may be, involved in or responsible for the administration, supervision or management of this Agreement and whose name and specimen signature appear on a list prepared by each party and delivered to the other party, as such list may be amended from time to time by either party.

“Restricted Servicing Action”: As defined in Section 2.02(a).

“Sarbanes-Oxley Certification”: To the extent such is required pursuant to the applicable PSA as defined in the applicable PSA.

“Securitization Servicing Agreements”: With respect to each Mortgage Loan, the related PSA, primary servicing agreement, sub-servicing agreement or other similar agreement pursuant to which such Mortgage Loan is serviced by KRECM.

“Security Breach”: Any intrusion, security breach, or unauthorized access to or use of any personally identifiable information, including, but not limited to, Customer Information in the possession of Subservicer or that of its service providers.

“Servicing Advance”: Any “servicing advance,” “property advance” or other similar term as defined in the applicable PSA, excluding any T&I Advances.

“Servicing Accounts”: The account or accounts maintained by the Subservicer, other than the Subservicer Collection Account, pursuant to the applicable PSA, which may include any escrow accounts, reserve accounts, lock-box accounts and/or cash collateral accounts.

4

“Servicing Criteria”: The criteria set forth in paragraph (d) of Item 1122 of Regulation AB, as such may be amended from time to time.

“Servicing Fee”: Any amounts payable on the Mortgage Loans pursuant to the related PSA as the monthly fee payable to KRECM.

“Servicing Officer”: Any officer and/or employee of the Subservicer involved in, or responsible for, the administration and servicing of the Mortgage Loans, whose name and specimen signature appear on a list of servicing officers furnished by the Subservicer to KRECM on the Effective Date, as such list may be amended from time to time thereafter.

“SSAE 16”: The Statements on Standards for Attest Engagements written by the American Institute of Certified Public Accountants, Service Organization Control (SOC) level 1 report.

“Subservicer Event of Default”: As defined in Section 6.01.

“Subservicer”: As defined in the first paragraph of this Agreement.

“Subservicer Collection Account”: As defined in Section 3.01(a)(v).

“Subservicer Remittance Date”: The Business Day immediately preceding the applicable master servicer’s remittance date under the applicable PSA.

“Subservicing File”: With respect to each Mortgage Loan, all documents, information and records relating to such Mortgage Loan that are necessary or appropriate to enable the Subservicer to perform its obligations under this Agreement and any additional documents or information related thereto maintained or created in any form by the Subservicer, including all analysis, working papers, inspections reports, written communications with any Borrower or other Person, and all other information collected from or concerning any Borrower or the related Mortgaged Property in the Subservicer’s possession.

“T&I Advances”: Any advances representing real estate taxes or insurance premiums (to the extent required in the PSA, including renewal payments).

“Task List”: The list of Subservicer responsibilities set forth on Exhibit G.

“Tax, Insurance, UCC and Letter of Credit Certification”: A written report certifying for the applicable quarterly period that all property taxes and hazard insurance premiums that are due have been paid in full, that all UCC liens, assignments or continuations are current and that all letters of credit are current, which report shall be delivered electronically pursuant to this Agreement substantially in the form attached hereto as Exhibit D (or in such other form as may be reasonably acceptable to KRECM and the Subservicer).

“Transfer Instructions”: The instructions and process for transferring certain of the servicing responsibilities to the Subservicer, as set forth on Exhibit H.

“Trust”: The trust created by each PSA.

5

Section 1.02. Interpretative Matters.

For purposes of this Agreement, and except as otherwise expressly provided in this Agreement, all references in this Agreement to “KRECM” and all references to any compensation, fees, or other amounts payable to or by KRECM, any rights, duties or obligations of KRECM, or otherwise, shall be references to KRECM solely in its capacity as master servicer under the related PSA. Notwithstanding anything to the contrary in this agreement, the Subservicer shall not be entitled to receive any portion of any compensation, fee or other amount that is payable to the Special Servicer under any Securitization Servicing Agreement or otherwise. Subservicer’s servicing duties and obligations with respect to a specific Mortgage Loan shall be performed in accordance with the related PSA unless otherwise set forth in this Agreement.

ARTICLE II.

RETENTION AND AUTHORITY OF SUBSERVICER

Section 2.01. Servicing Standard; Commencement of Servicing Responsibilities.

KRECM hereby engages the Subservicer to perform, and the Subservicer hereby agrees to perform, the servicing duties and obligations of the master servicer under each PSA with respect to the Mortgage Loans, beginning on the Effective Date and continuing throughout the term of, subject to the Relevant Servicing Criteria, and otherwise upon and subject to the terms, covenants and provisions of, this Agreement. The Subservicer shall service and administer each Mortgage Loan in accordance with the applicable “Servicing Standard” or “Accepted Servicing Practices” as set forth in each applicable PSA. The above-described servicing standards are collectively referred to in this Agreement as “Accepted Subservicing Practices.”

Section 2.02. Subcontractors and Vendors.

The Subservicer shall have full power and authority to enter into one or more agreements with Affiliates, subcontractors, vendors or other third parties for the performance of inspections, monitoring insurance and/or taxes, financial statement collection calls, UCC Financing Statements, appraisals, flood certifications, imaging, defeasance, satisfactions and legal; provided that the Subservicer may engage third parties for the underwriting of assumptions and modifications on a case-by-case basis, upon approval of KRECM. Subservicer shall remain obligated and liable to KRECM for performing all such delegated duties in accordance with this Agreement without diminution of such obligation or liability by virtue of such delegation. The Subservicer shall be obligated to pay all fees and expenses of any Affiliates, subcontractors, vendors or other third parties out of its subservicing fee amounts.

Section 2.03. Authority of Subservicer.

(a) Except as otherwise provided in this Agreement and subject to the terms of this Agreement and KRECM’s limitations of authority as master servicer under the applicable PSA, in performing its obligations under this Agreement, the Subservicer shall have full power and authority to take any and all actions in connection with such obligations that it deems necessary or appropriate; provided, however, that the Subservicer shall not take any of the following actions (each, a “Restricted Servicing Action”) with respect to any Mortgage Loan without receiving the prior written consent of KRECM:

(i) granting or withholding consent to, or the performance of, any defeasance of a Mortgage Loan in accordance with the applicable PSA;

6

(ii) any consent, modification, waiver, amendment of, or with respect to, any Mortgage Loan, whether or not material, including but not limited to any forgiveness of principal, any change in the amount or timing of any payment of principal or interest, maturity, extension rights or prepayment provisions or the substitution, full or partial release or addition of any collateral for any Mortgage Loan or the waiver of any late fees to the extent permitted in the applicable PSA, provided, however, that Subservicer may waive late fees without the prior written consent of KRECM if (A) the related Borrower has had a clean payment history since KRECM has been the master servicer of the Mortgage Loan, no additional consents are required and there are no outstanding compliance matters or funds due or (B) the related Borrower has previously received only one late fee waiver with an otherwise clean payment history and the Borrower signs up for auto-debit;

(iii) granting or withholding consent to any transfer of ownership of a Mortgaged Property or any transfer of any interest in any Borrower or any owner of a Mortgaged Property (including entering into any assumption agreement in connection therewith);

(iv) granting or withholding consent to any request for approval to encumber a Borrower or Mortgaged Property with subordinate or other financing or to encumber any interest in any Borrower or any owner of a Mortgaged Property with mezzanine financing;

(v) any action to initiate, prosecute and manage foreclosure proceedings or other legal proceedings related thereto in connection with any Mortgage Loan;

(vi) with respect to any Mortgage Loan that is an ARD Mortgage Loan, after its Anticipated Repayment Date, taking any enforcement action (other than requests for collection) for the payment of, or the waiver of all or any portion of, the accrued Excess Interest;

(vii) any termination or replacement, or consent to the termination or replacement, of a property manager with respect to any Mortgaged Property, or any termination or change, or consent to the termination or change, of the franchise affiliation with respect to any hospitality property that in whole or in part constitutes any Mortgaged Property;

(viii) approving or granting any consent to leasing activity (including any subordination, non-disturbance and attornment agreement) with respect to any Mortgaged Property (but not including confirmations that a lease does not require consent), provided, however, if the consent of any third party other than the Master Servicer, KRECM, is not required under the PSA, then Subservicer may approve or consent, without KRECM’s prior written consent, to a borrower’s requested leasing activity (including but not limited to approving the execution, termination or renewal of the applicable lease, subordination, non-disturbance and attornment agreement and/or other related documents);

(ix) granting any consent to any request by a Borrower for approval to modify its organizational documents, excluding any amendments by the Borrower to modify its organizational documents in connection with any permitted transfers not requiring Lender’s consent, as determined in consultation with counsel; or

(x) any determination with respect to a Mortgage Loan as to whether a default has occurred under the related Mortgage Loan documents by reason of any failure on the part of the related Borrower to maintain insurance policies in accordance with the loan documents or Subservicer’s standard requirements.

7

With respect to any Restricted Servicing Action which under the applicable PSA is to be performed exclusively by the Special Servicer, the Subservicer shall deliver to KRECM the related Borrower’s request therefor and any other documents or information related thereto in its possession or otherwise reasonably requested by KRECM and the Subservicer shall not have any obligation to process such request or to obtain any consent or approval from the Special Servicer. With respect to any Restricted Servicing Action which under the applicable PSA is to be performed by KRECM, the Subservicer shall not perform such action without obtaining the prior written consent of KRECM (which consent (x) may be in the form of an asset business plan approved in writing by KRECM and (y) shall be subject to the prior approval of the Special Servicer, any required Certificateholder, the Rating Agencies and any other Person if so required under the applicable PSA, which approvals shall be requested by KRECM).

(b) Regardless of whether the consent or approval of KRECM is required pursuant to this Agreement, the Subservicer shall take or refrain from taking any action that KRECM directs in writing and relates to the Subservicer’s obligations under this Agreement; provided, however, that the Subservicer shall not be obligated to take or refrain from taking any such action to the extent that the Subservicer determines in its reasonable discretion that taking or refraining from taking such action may cause (i) a violation of applicable laws, court orders or restrictive covenants with respect to any Mortgage Loan or Mortgaged Property or (ii) a violation of any term or provision of the related Mortgage Loan documents.

ARTICLE III.

SERVICES TO BE PERFORMED

Section 3.01. Services as Subservicer.

With respect to each Mortgage Loan, the Subservicer shall, in accordance with Accepted Subservicing Practices and subject to supervision by KRECM as set forth in this Agreement, perform the following servicing activities on behalf of KRECM as primary servicer, as follows:

(a) The Subservicer shall, subject to the limitations and restrictions on its authority otherwise set forth in this Agreement and the PSAs, perform the duties and obligations with respect to the Mortgage Loans that KRECM is required to perform under the PSAs as modified, clarified or more specifically stated as follows:

(i) the Subservicer shall file a Uniform Commercial Code Financing Statement amendment continuing the effectiveness of each UCC Financing Statement filed with respect to each Mortgage Loan within six (6) months before (and not later than three (3) months before) the expiration of the five year period of effectiveness of such UCC Financing Statement, and shall deliver monthly reports of such UCC Financing Statement amendments to KRECM;

(ii) the Subservicer shall provide KRECM with notice of any communication by the Borrower with respect to any related letter of credit provided by such Borrower;

8

(iii) the Subservicer shall have no obligation to make principal and interest advances or Servicing Advances; provided that to the extent that KRECM retained the responsibility to make T&I Advances under the respective PSA, KRECM hereby delegates this responsibility to Subservicer. In the event that Subservicer determines that such T&I Advance is necessary, the Subservicer shall make the T&I Advance as and when required. For each T&I Advance made by Subservicer, Subservicer shall have the right to reimburse itself from funds collected from the applicable borrower, as permitted under the applicable PSA and the Subservicer shall be entitled to interest on any T&I Advance made with respect to a Mortgage Loan. Such interest (“Advance Interest”) shall accrue at the “prime rate” published in the “Money Rates” section of The Wall Street Journal, as such “prime rate” may change from time to time, commencing from the date on which such T&I Advance was made to the Business Day on which the Subservicer is reimbursed for such T&I Advance pursuant to this Agreement. In the event that Subservicer is unable to reimburse itself for a T&I Advance with Advance Interest by the fifth (5th) business day of the following month, Subservicer will send an invoice for advances and Advance Interest to KRECM for reimbursement. Within two (2) business days after KRECM’s receipt of a written request from Subservicer, KRECM will remit advance funds and Advance Interest to Subservicer. As Subservicer receives funds from the borrower to repay the advance, Subservicer will, upon monthly investor reporting remittance, remit collected advance funds to KRECM. All T&I Advance reimbursement notices delivered by Subservicer to KRECM or delivered by KRECM to Subservicer shall state the applicable loan servicing number, applicable escrow bucket and T&I Advance amounts due and owing;

(iv) with respect to each Mortgage Loan, the Subservicer shall, consistent with Accepted Subservicing Practices and the Task List, monitor the related Borrower’s insurance obligations in accordance with PSA and the related Mortgage Loan documents, and in the event a Borrower fails to maintain such insurance, the Subservicer shall promptly (A) notify KRECM in writing of such Borrower’s failure to maintain such insurance and whether or not such insurance is required by the terms of the related Mortgage Loan documents, and (B) deliver to KRECM all documents and other information in Subservicer’s possession, and any additional information reasonably requested by KRECM, to assist KRECM in determining, among other things, whether or not such insurance is available at commercially reasonable rates; provided that the Subservicer shall not be required to maintain insurance coverage on any Mortgaged Property and KRECM shall notify the Subservicer of such determination within ten (10) Business Days after KRECM’s receipt of such request, notice or other requested information or KRECM shall be deemed to have approved force placed insurance coverage unless such action requires third party approval, in which case, the consent of KRECM and the third party is required; and (C) with the consent (or deemed consent) of KRECM and consistent with the Task List administer for forced place insurance as required by the applicable PSA;

(v) the Subservicer shall establish a collection account (the “Subservicer Collection Account”) meeting all of the requirements of the collection account or certificate account (or such other similar term) maintained by KRECM under the applicable PSA for each Trust and shall deposit into the related Subservicer Collection Account, payments received from a Borrower or any other source as required pursuant to the applicable PSA; provided that any withdrawals from the Subservicer Collection Account shall be made only as specifically authorized under this Agreement;

(vi) the creation of any Account shall be evidenced by a certification substantially in the form attached hereto as Exhibit E, and a copy of any such certification shall be delivered to KRECM on or prior to the Effective Date and thereafter upon any transfer of such Account; provided that Subservicer shall establish all Accounts related to Non-Moody’s CMBS Transactions at KeyBank National Association, so long as KeyBank National Association is an eligible depository institution under the related PSA;

(vii) the Subservicer may invest the funds in each Subservicer Collection Account and the Servicing Accounts related to Moody’s CMBS Transactions in one or more Permitted Investments on the same terms as KRECM may invest funds in the collection account or certificate account and the related servicing accounts under the applicable PSA, and subject to the same restrictions and obligations regarding maturity dates, gains, losses, possession of Permitted Investments and Permitted Investments payable on demand;

9

(viii) Section 3.03 of this Agreement shall control with respect to the Subservicer’s obligation to maintain a fidelity bond and errors and omissions insurance policy that satisfies the requirements of PSA;

(ix) Section 4.01 of this Agreement shall control with respect to the servicing fees and additional servicing compensation the Subservicer may retain;

(x) The Subservicer shall, within forty (40) days after the Effective Date, deliver to KRECM written evidence of each notification to any related ground lessor that such Mortgage Loan has been transferred into the Trust. KRECM and the Subservicer, as applicable, shall deliver to the other party within two (2) Business Days after receipt any notices of default under any ground lease that KRECM or the Subservicer, as applicable, receives; and

(xi) except as otherwise set forth in this Agreement, all notices, information, reports, certifications, consents, and other documentation that are required under any PSA to be provided by KRECM to, or obtained by KRECM from, the Trustee, custodian, the Depositor, the certificate administrator, any mortgage loan seller, the initial purchasers, the guarantor, the 17g-5 Information Provider if applicable, any Rating Agency, the applicable Certificateholders, the Special Servicer, any other party to the applicable PSA or any other Person shall be provided by the Subservicer to KRECM only (or as otherwise directed by KRECM) within the time set forth in this Agreement (or if no such time is set forth, within one (1) Business Day prior to the date on which KRECM is required to deliver such item to the applicable Person); provided, however, to the extent the Subservicer is required to provide any of the foregoing directly to any such third party, including the document custodian, pursuant to this Agreement, the Subservicer shall forward original documents/closing binders to the document custodian and electronic copies to any other third party. Additionally, Subservicer shall provide KRECM with electronic copies through the web services feed. KRECM and Subservicer hereby agree that Subservicer may directly request, and receive, from the document custodian electronic copies of any pertinent loan or transaction level documents.

(b) The Subservicer shall promptly notify KRECM in writing of all material collection and customer service issues and furnish KRECM with copies of all written communications regarding such issues between the Subservicer and any Borrower or any third party in connection with the Subservicer’s obligations under this Agreement.

(c) The Subservicer shall perform principal prepayments in accordance with the Task List. The Subservicer shall, (i) not later than five (5) Business Days after its receipt of any such request or notice, deliver to KRECM a payoff statement calculated by the Subservicer with respect to such principal prepayment setting forth the amount of the principal prepayment, the aggregate interest accrued thereon, the rates used, the date of such rates, and the other fees or expenses to be paid by the Borrower; and (ii) deliver to KRECM and a copy to AMS Real Estate Services for any loan with a calculated yield maintenance charge, all documents and other information in Subservicer’s possession, and any other information reasonably requested by KRECM, or AMS Real Estate Services, to verify the Subservicer’s calculations. KRECM shall respond within five (5) Business Days after receipt of such requests, notices or other requested information or KRECM shall be deemed to have approved the Subservicer’s calculations unless such action requires third party approval, in which case, the consent of KRECM and the third party is required. If the Subservicer accepts any principal prepayment, then it shall (pursuant to wiring instructions from KRECM) remit such principal prepayment to KRECM on the Subservicer Remittance Date.

10

(d) If the Subservicer causes any voluntary prepayment interest shortfall with respect to any principal prepayment resulting in an obligation by KRECM to make a payment in respect of any prepayment interest shortfall under the applicable PSA, then the Subservicer shall, on the Subservicer Remittance Date following such breach, remit to the Trust the amount of such prepayment interest shortfall required to be paid by KRECM under the applicable PSA. Any payment by the Subservicer of such prepayment interest shortfall shall not be construed to constitute a waiver or cure of a Subservicer Event of Default.

(e) The Subservicer shall promptly notify KRECM in writing upon obtaining actual knowledge or receipt of notice from a Borrower of the occurrence of any event that the Subservicer has determined may cause a Mortgage Loan to become a specially serviced Mortgage Loan pursuant to the requirements in the applicable PSA. The final determination as to whether a Mortgage Loan has become a specially serviced loan shall be made by KRECM and KRECM shall promptly notify the Subservicer of its determination.

(f) With respect to all servicing responsibilities of KRECM under the applicable PSA that are not being performed by the Subservicer under this Agreement, the Subservicer shall promptly notify KRECM in writing of (and in any event, within one (1) Business Day after) its receipt of notice thereof or a request therefor and shall reasonably cooperate with KRECM to facilitate the timely performance of such servicing responsibilities, including the REMIC provisions of the applicable PSA.

(g) No later than the last day of each calendar month, the Subservicer shall deliver to KRECM a statement prepared by the Subservicer setting forth the status of the Subservicer Collection Account as of the close of business on the Determination Date in such month (together with a copy of the most recent monthly bank reconciliation statement received by the Subservicer with respect to the Subservicer Collection Account) and showing the aggregate amount of deposits into and withdrawals from the Subservicer Collection Account since the preceding Determination Date for each category of deposit specified in the applicable PSA Section and each category of withdrawal specified in the applicable PSA.

(h) Not later than 2:00 p.m. (New York City time) one (1) Business Day after each Determination Date, beginning in the month following the Effective Date, the Subservicer shall prepare and deliver or cause to be delivered to KRECM, in an electronic form, (i) the CREFC Loan Periodic Update File, the CREFC Property File, the CREFC Financial File, the CREFC Delinquent Loan Status Report, the CREFC Historical Loan Modification and Corrected Mortgage Loan Report, the CREFC Loan Level Reserve/LOC Report, the CREFC Comparative Financial Status Report, the CREFC Servicer Watch List and, (ii) to the extent required to be delivered by KRECM under the PSA, any other file or report that may from time to time be recommended by the CREFC for commercial mortgage-backed securities transactions generally (substantially in the form of, and containing the information called for in, the downloadable form of such file or report then-available on the CREFC Website) and requested in writing by KRECM, in each case providing the most recent information with respect to the Mortgage Loans as of the close of business on the related Determination Date (and which, in each case, if applicable, will identify each Mortgage Loan by loan number and property name). Delivery of any of the foregoing shall be deemed satisfied at the time such file or report is posted to Subservicer’s website InvestorView, or such other website as the Subservicer may notify KRECM in writing; provided that the Subservicer shall notify KRECM in writing or electronically immediately upon the posting of any such file or report to the Subservicer’s website.

11

(i) Commencing with the calendar quarter following the Effective Date, the Subservicer shall use its reasonable efforts to obtain quarterly and annual operating statements, budgets and rent rolls with respect to each of the Mortgage Loans, and quarterly and annual financial statements of each related Borrower, which efforts shall include sending a letter to such Borrower each quarter (followed up with telephone calls) requesting such quarterly and annual operating statements, budgets, rent rolls and financial statements by no later than the timeframe set forth in the applicable PSA for KRECM to deliver such information, whether or not delivery of such items is required pursuant to the terms of the related Mortgage Loan documents, but to the extent such action is consistent with applicable law, the terms of such Mortgage Loans and Accepted Subservicing Practices. Upon KRECM’s written request, the Subservicer shall deliver copies of all of the foregoing items so collected in an imaged PDF format, Excel format, or such other format reasonably acceptable to KRECM and the Subservicer within twenty-five (25) days after the Subservicer’s receipt of such items together with the CREFC Operating Statement Analysis Report and CREFC NOI Adjustment Worksheet.

(j) After the Effective Date, the Subservicer shall maintain a CREFC Operating Statement Analysis Report and CREFC NOI Adjustment Worksheet with respect to each Mortgaged Property. The Subservicer shall deliver electronically to the requisite parties designated to receive the information from KRECM under the applicable PSA and KRECM the CREFC Operating Statement Analysis Report and CREFC NOI Adjustment Worksheet, as required by and in the timeframes set forth in the PSA.

(k) The Subservicer shall determine and analyze financial ratios and perform other financial analysis required under the CREFC reporting guidelines (including the preparation of related comments under such guidelines) and deliver to KRECM all reports summarizing such analysis based upon the property operating statements with respect to the related Mortgaged Property and the financial statements of the related Borrower and each related guarantor collected by the Subservicer pursuant to PSA, which reports shall be in the forms required under this Agreement.

(l) Each month by 2:00 p.m. (New York City time) on the Subservicer Remittance Date, the Subservicer shall remit to KRECM, pursuant to wiring instructions from KRECM, all amounts received for such collection or due period by the Subservicer with respect to the Mortgage Loans on or before the close of business on the Business Day immediately preceding such Subservicer Remittance Date. In addition, the Subservicer shall remit to KRECM within one (1) Business Day after receipt any delinquent payments on the Mortgage Loans received by the Subservicer and any related Penalty Charges. Each of the foregoing remittances of funds shall be accompanied by a Remittance Report.

(m) On the Subservicer Remittance Date, the Subservicer shall remit to KRECM (pursuant to wiring instructions from KRECM) any whole or partial balloon payments, principal prepayments, prepayment premiums, yield maintenance charges, liquidation proceeds, insurance proceeds and condemnation proceeds, and any interest thereon, together with a Remittance Report, provided however, that upon request from KRECM, if Subservicer receives liquidation proceeds for a specially serviced Mortgage Loan or any whole or partial balloon payments, principal prepayments, prepayment premiums, yield maintenance charges and any interest thereon received in the prior Due Period and remitted to the Trust by KRECM in that Due Period, Subservicer shall remit the liquidation proceeds or such other funds previously remitted within one (1) Business Day after funds are posted to the borrower record.

(n) After the Effective Date, the Subservicer shall prepare or have prepared, and deliver electronically to the requisite parties designated to receive the information from KRECM under the applicable PSA and KRECM a Property Inspection Report for each inspection performed by it or on its behalf by a third party, in each case as required by and in the timeframes set forth in the applicable PSA.

(o) The Subservicer shall provide KRECM with such reports and other information (in the Subservicer’s possession or to the extent readily obtainable and as reasonably requested by KRECM and in an electronic format reasonably acceptable to KRECM) with respect to the servicing of the Mortgage Loans by the Subservicer under this Agreement in order for KRECM to perform its duties under the PSA.

12

(p) Within fifteen (15) days following the end of each calendar quarter, the Subservicer shall prepare and deliver to KRECM the Tax, Insurance, UCC and Letter of Credit Certification in the form attached hereto as Exhibit D.

(q) KRECM shall provide a copy of any loan purchase agreements to the Subservicer. The Subservicer shall notify KRECM in writing within five (5) Business Days after the Subservicer discovers or receives notice alleging a Defect. The Subservicer shall promptly provide to KRECM a copy of any written repurchase request received by the Subservicer and such other information in the possession of the Subservicer reasonably requested by KRECM to fulfill its obligations under the applicable PSA.

(r) Following receipt of any Borrower Paid Fees, the Subservicer shall promptly (and in any case, no later than one (1) Business Day after receipt of available funds) remit to KRECM any such Borrower Paid Fees.

(s) The Subservicer shall promptly notify KRECM if the Subservicer becomes an Affiliate of the related Trustee.

(t) Without limiting, and where applicable in addition to, the duties and obligations with respect to the Mortgage Loans otherwise described in this Agreement, the Subservicer shall perform the servicing actions described on the Task List.

(u) If a Mortgage Loan becomes a specially serviced Mortgage Loan pursuant to the related PSA and the related PSA does not require that servicing under this Agreement be terminated with respect to such Mortgage Loan upon such Mortgage Loan becoming a specially serviced Mortgage Loan, the Subservicer shall continue to receive payments (and apply such funds as directed by KRECM or the related special servicer), update payment records, file UCC Financing Statements, monitor tax amounts due, and monitor insurance coverage with respect to each such specially serviced Mortgage Loan and shall provide KRECM or the special servicer with any information reasonably required by KRECM or the special servicer to perform its duties under the related PSA, but the Subservicer shall take no other actions with respect to such specially serviced Mortgage Loan unless expressly directed in writing by KRECM or the special servicer. Subservicer will be responsible for all communications with any special servicer under the related PSA. If an inquiry on a specially serviced Mortgage Loan requires the review or consent of KRECM, Subservicer shall forward such request to KRECM for review/consent/denial/modification and will coordinate the delivery of such consent/denial/modification to the special servicer, if applicable. If permitted or not prohibited by the related PSA, upon a specially serviced Mortgage Loan becoming a “corrected” or “performing” Mortgage Loan, KRECM shall promptly notify the Subservicer of such change and the Subservicer shall resume its servicing obligations and duties required pursuant to this Agreement. If any amounts payable to the Subservicer are not paid because there are not sufficient amounts received with respect to such Mortgage Loan at any time, all such amounts shall accrue and remain payable to the Subservicer from any amounts, if any, that are subsequently received with respect to such Mortgage Loan.

Section 3.02. Portfolio Manager.

(a) The Subservicer shall designate a portfolio manager and other appropriate personnel to receive documents and communications from KRECM and to provide assistance to KRECM consistent with KRECM’s supervisory authority over the Subservicer under this Agreement.

(b) KRECM shall designate a portfolio manager and other appropriate personnel to receive documents and communications from the Subservicer and to provide to the Subservicer information, materials and correspondence relating to the Mortgage Loans and the related Borrowers which may be necessary or appropriate to enable the Subservicer to perform its obligations under this Agreement.

13

Section 3.03. Maintenance of Errors and Omissions and Fidelity Coverage.

The Subservicer shall obtain and maintain with Qualified Insurers, at its own expense, and keep in full force and effect throughout the term of this Agreement, a blanket fidelity bond and an errors and omissions insurance policy covering all of the Subservicer’s officers, employees and agents acting on behalf of the Subservicer in connection with its activities under this Agreement and that satisfies the fidelity bond and errors and omissions insurance policy requirements under the PSAs. The Subservicer shall deliver or cause to be delivered to KRECM a certificate of insurance or other evidence of such fidelity bond and insurance within thirty (30) days of the Effective Date and thereafter (i) within ten (10) Business Days after each renewal thereof, (ii) if not delivered in any calendar year pursuant to clause (i), then upon each anniversary of the Effective Date, and (iii) from time to time upon KRECM’s reasonable request. Such fidelity bond and errors and omissions policy shall provide that it may not be canceled without twenty (20) days’ prior written notice to the KRECM. The Subservicer shall (i) furnish to KRECM copies of all binders and policies or certificates evidencing that such fidelity bond and errors and omissions insurance policy are each in full force and effect, and (ii) promptly report or cause its insurer(s) to report in writing to KRECM any termination of or any material changes to the Subservicer’s fidelity bond or errors and omissions insurance policy.

Section 3.04. Delivery and Possession of Servicing Files.

The parties acknowledge that KRECM did previously have possession of or control over, the Subservicing Files. KRECM shall on the Effective Date, transfer to the Subservicer electronically each of the servicing files relating to the Mortgage Loans in accordance with the Transfer Instructions. Upon receipt, the Subservicer shall acknowledge possession of the Subservicing Files. The contents of each Subservicing File are and shall be held in trust by the Subservicer for the benefit of the Trust as the owner thereof; the Subservicer’s possession of the contents of each Subservicing File is for the sole purpose of servicing the related Mortgage Loan; and such possession by the Subservicer shall be in a custodial capacity only. The Subservicer shall release its custody of the contents of any Subservicing File only in accordance with written instructions from KRECM, and upon request of KRECM, the Subservicer shall deliver to KRECM the requested Subservicing File or an electronic copy (in a format reasonably acceptable to KRECM) of any document contained therein. In addition, KRECM shall also complete the Subservicer’s standard electronic data transfer template for each Mortgage Loan and provide such electronic data transfer template to Subservicer on the Effective Date to enable the Subservicer to board the Mortgage Loans to its servicing system.

Section 3.05. Financial Statements of the Subservicer.

The Subservicer shall deliver to KRECM quarterly and annual financial statements of the Subservicer and its subsidiaries for its last complete fiscal quarter or year, as applicable. All such financial statements shall be prepared in accordance with Generally Accepted Accounting Principles consistently applied, and shall fairly present the pertinent results of (i) operations for such quarter or year, as applicable, (ii) the financial position at the end of such quarter or year, as applicable, and (iii) changes in financial position with respect to the Subservicer’s last complete fiscal quarter or year, as applicable. KRECM shall enter into a confidentiality agreement with the Subservicer to keep any nonpublic information that is provided by the Subservicer to KRECM pursuant to this Section 3.05 confidential.

14

Section 3.06. Exchange Act Reporting and Regulation AB Compliance.

(a) Intent of the Parties. The parties hereto acknowledge and agree that the purpose of this Section 3.06 is, among other things, to facilitate compliance with the provisions of Regulation AB and related rules and regulations of the Commission and the applicable PSA requirements related thereto. The Subservicer acknowledges that interpretations of the requirements of Regulation AB may change over time, whether due to interpretive guidance provided by the Commission or its staff, consensus among participants in the asset-backed securities markets, advice of counsel, or otherwise, and agrees to comply with requests made by KRECM for delivery of information under these provisions on the basis of evolving interpretations of Regulation AB. In connection with the Trust, the Subservicer shall cooperate fully with KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator) to deliver or make available to them (and any of their respective assignees or designees) any and all statements, reports, certifications, records and any other information in its possession and (as determined by KRECM, the Depositor or the party designated in the applicable PSA to file the Commission’s reports, as applicable) necessary to permit KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports to comply with the provisions of Regulation AB and the applicable PSA, together with such disclosures relating to the Subservicer or the servicing of the Mortgage Loans reasonably believed by KRECM or the Depositor, as applicable, to be necessary in order to effect such compliance. On or after the Effective date, but no longer than thirty (30) days after the Effective Date, KRECM shall provide all notices and documentation required under the related PSA to inform the PSA parties that the Subservicer has been appointed and shall provide Regulation AB reports, as provided herein. KRECM shall inform the Subservicer as to whether the Trust has filed the requisite documentation to suspend its reporting obligations under the Exchange Act.

15

(b) Information to be Provided by the Subservicer.

(i) The Subservicer shall, for so long as the applicable Trust is subject to the reporting requirements of the Exchange Act, promptly following written notice to or discovery by the Subservicer, (A) notify KRECM in writing of (I) any material litigation or governmental proceedings pending against the Subservicer that, in each such case, would be material to the Certificateholders and (II) any affiliations or relationships that develop following the Effective Date between the Subservicer and any other Person with respect to the applicable Trust, and (B) provide to KRECM or the Depositor a description of such proceedings, affiliations or relationships.

(ii) For so long as the applicable Trust is subject to the reporting requirements of the Exchange Act, in connection with the succession to the Subservicer as subservicer under this Agreement by any Person, the Subservicer shall provide to KRECM, at least 30 days prior to the effective date of such succession, (x) written notice to KRECM of such succession and (y) in writing and in form and substance reasonably satisfactory to KRECM, all information reasonably requested by KRECM or the Depositor in order to comply with its reporting obligations under the applicable PSA (including any report under Item 6.02 of Form 8-K).

(iii) If, during any year the applicable Trust is subject to the reporting requirements of the Exchange Act, the Subservicer appoints a servicer that constitutes a “servicer” contemplated by Item 1108(a)(2) of Regulation AB, then the Subservicer shall cause such servicer, in connection with its acceptance of such appointment, to provide KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator) with such information regarding itself, its business and operations and its servicing experience and practices, as is required to be reported by the Depositor pursuant to Item 6.02 of Form 8-K.

(iv) The Subservicer acknowledges and agrees that the information to be provided by it (or by any Servicing Function Participant acting on its behalf hereunder) pursuant to or as contemplated by this Section 3.06 is intended to be used in connection with the preparation of any reports required by the Exchange Act with respect to the applicable Trust.

(c) Additional Obligations. Without limiting any other provision of this Section 3.06, the Subservicer shall (i) observe and perform any obligation applicable to a “Servicing Function Participant” set forth in the applicable PSA, (ii) reasonably cooperate with KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator) in connection with the such party’s efforts to satisfy the applicable Trust’s reporting requirements under the Exchange Act, and (iii) if the Subservicer is terminated or resigns pursuant to the terms of this Agreement, provide the reports (annual or otherwise) and other information required by this Section 3.06 with respect to the period of time that the Subservicer was subject to this Agreement.

16

(d) Additional Filing Disclosures.

(i) Additional Form 10-D Disclosures. For so long as the applicable Trust is subject to the reporting requirements of the Exchange Act, the Subservicer shall, within one (1) day after the related Distribution Date, provide to KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator), to the extent known by the Subservicer or a Servicing Officer thereof (other than information contemplated by Item 1117 or Item 1119 of Regulation AB, which shall be reported if known by any Servicing Officer, any lawyer in the in-house legal department or any senior manager of the Subservicer), in EDGAR-compatible form (or in such other format as otherwise agreed upon by the Subservicer and KRECM, the Depositor or the party designated in the applicable PSA to file the Commission’s reports), any additional Form 10-D disclosure required under the applicable PSA, as applicable to KRECM, together with an additional disclosure notification as required under the applicable PSA.

(ii) Additional Form 10-K Disclosures. For so long as the applicable Trust is subject to the reporting requirements of the Exchange Act, the Subservicer shall, no later than March 1 (with no grace period) of each year (commencing in 2013), provide to KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator), to the extent known by the Subservicer or a Servicing Officer thereof (other than information contemplated by Items 1117 and 1119 of Regulation AB, which shall be reported if known by any Servicing Officer, any lawyer in the in-house legal department or any senior manager of the Subservicer), in EDGAR-compatible format (or in such other format as otherwise agreed upon by the Subservicer and KRECM, the Depositor or the party designated in the applicable PSA to file the Commission’s reports), any additional Form 10-K disclosure required under the applicable PSA, as applicable to KRECM, together with an additional disclosure notification as required under the applicable PSA.

(iii) Form 8-K Disclosure Information. For so long as any Trust is subject to the reporting requirements of the Exchange Act, the Subservicer shall, no later than noon (New York City time) on the first (1st) Business Day after the occurrence of a Reportable Event requiring disclosure under Form 8-K, provide to KRECM, the Depositor and the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator), to the extent known by the Subservicer or a Servicing Officer thereof (other than information contemplated by Item 1117 of Regulation AB, which shall be reported if known by any officer of the Subservicer), in EDGAR-compatible format (or in such other format as otherwise agreed upon by the Subservicer and KRECM, the Depositor or the party designated in the applicable PSA to file the Commission’s reports), any Form 8-K disclosure information as required under the applicable PSA, as applicable to KRECM, together with an additional disclosure notification as required under the applicable PSA. Without limiting the foregoing, the Subservicer shall promptly notify KRECM, but in no event later than noon on the first (1st) Business Day after its occurrence, of any Reportable Event (or such similar term used under the applicable PSA) of which it has knowledge.

(iv) Upon the request of KRECM, the Depositor or the party designated in the applicable PSA to file the Commission’s reports (which may be the Trustee or the Certificate Administrator), the Subservicer shall promptly provide to the requesting party any information in its possession as is necessary or appropriate for such party to prepare fully and properly any report required under the Exchange Act with respect to the Trust in accordance with the Securities Act, the Exchange Act and the rules and regulations promulgated thereunder.

(v) The Subservicer shall promptly provide to KRECM a written description (in form and substance satisfactory to KRECM) of the role and function of each subcontractor that is a Servicing Function Participant (pursuant to Item 1108(a)(2) of Regulation AB) utilized by the Subservicer, specifying (A) the identity of such subcontractor, and (B) which elements of the Servicing Criteria will be addressed in assessments of compliance provided by each such subcontractor. The Subservicer shall cause any subcontractor determined to be a Servicing Function Participant to comply with the provisions of this Section 3.06 to the same extent as if such subcontractor were the Subservicer. The Subservicer shall obtain from each such subcontractor and deliver to KRECM any assessment of compliance report and related accountant’s attestation required to be delivered by such subcontractor under this Section 3.06, in each case, as and when required to be delivered.

17

(e) Sarbanes-Oxley Certification. The Subservicer shall deliver to KRECM, no later than March 5 (or if such day is not a Business Day, then the immediately succeeding Business Day, with no cure period) of each year (commencing in 2013) in which any Trust is subject to the reporting requirements of the Exchange Act for the preceding fiscal year (and otherwise within a reasonable period of time upon request), a certification in the form attached hereto as Exhibit F (a “Performance Certification”), on which KRECM and KRECM’s officers, directors, members, managers, employees, agents and Affiliates (collectively, the “Certification Parties”) can reasonably rely. The Subservicer shall, if it is terminated or resigns pursuant to the terms of this Agreement, provide a Performance Certification to KRECM with respect to the period of time it was subject to this Agreement. Pursuant to the provisions in the applicable PSA, each Performance Certification shall include (x) a reasonable reliance statement by the Subservicer enabling the Certification Parties to rely upon each (i) annual compliance statement, (ii) annual report on assessment of compliance with the Servicing Criteria and (iii) registered public accounting firm attestation report and (y) a certification that each such annual report on assessment of compliance discloses any material instances of noncompliance described to the Subservicer’s registered public accounting firm to enable such accountants to render the attestation.

(f) Annual Compliance Statements. The Subservicer shall deliver to KRECM no later than March 5 (or if such day is not a Business Day, then the immediately succeeding Business Day, with no cure period) of each year (commencing in 2013), an Officer’s Certificate (in Microsoft Word, Microsoft Excel or in such other reasonably requested format) stating, as to the signer thereof, that (i) a review of the Subservicer’s activities during the preceding annual year or portion thereof and of the Subservicer’s performance under this Agreement, has been made under such officer’s supervision and (ii) to the best of such officer’s knowledge, based on such review, the Subservicer has fulfilled all its obligations under this Agreement, in all material respects throughout such year or portion thereof, or, if there has been a failure to fulfill any such obligation in any material respect, specifying each such failure known to such officer and the nature and status thereof. KRECM and the Depositor shall have the right to review the Officer’s Certificate and consult with the Subservicer as to the nature of any failures by the Subservicer.

(g) Annual Reports on Assessment of Compliance with Servicing Criteria.

(i) The Subservicer shall deliver to KRECM no later than March 5 (or if such day is not a Business Day, then the immediately succeeding Business Day, with no cure period) of each year (commencing in 2013), a report (in Microsoft Word, Microsoft Excel or in such other reasonably requested format) on an assessment of compliance with the Relevant Servicing Criteria for the Trust’s preceding fiscal year that contains (A) a statement by the Subservicer of its responsibility for assessing compliance with the Relevant Servicing Criteria, (B) a statement that the Subservicer used the Servicing Criteria to assess its compliance with the Relevant Servicing Criteria, (C) the Subservicer’s assessment of compliance with the Relevant Servicing Criteria as of and for the period ending the end of the fiscal year of the Trust covered by the Form 10-K required to be filed pursuant to the applicable PSA (including, if there has been any material instance of noncompliance with the Relevant Servicing Criteria, a discussion of each such failure and the nature and status thereof), and (D) a statement that a registered public accounting firm has issued an attestation report on the Subservicer’s assessment of compliance with the Relevant Servicing Criteria as of and for such period. Each Regulation AB assessment of compliance and related attestation contemplated by Section 3.06(h) must be available for general use and may not contain restricted use language. KRECM and the Depositor shall have the right to review the report and consult with the Subservicer as to the nature of any material instance of noncompliance by the Subservicer with the relevant Servicing Criteria in the fulfillment of any of the Subservicer’s obligations under this Agreement.

18

(ii) Within three (3) Business Days prior to the end of each year for which any Trust is subject to the reporting requirements of the Exchange Act, commencing in December 2012, the Subservicer shall deliver to KRECM the name and address of each Servicing Function Participant and subservicer engaged by it and what Relevant Servicing Criteria will be addressed in the report on assessment of compliance prepared by such Servicing Function Participant or subservicer. The Subservicer shall, when it delivers its report on assessment under Section 3.06(g)(i), to the extent received, deliver each report on assessment (and the related accountants’ attestation) of each Servicing Function Participant and subservicer engaged by it.

(h) Annual Independent Public Accountants’ Attestation. The Subservicer shall cause a registered public accounting firm that is a member of the American Institute of Certified Public Accountant to, no later than March 5 (or if such day is not a Business Day, then the immediately succeeding Business Day, with no cure period) of each year (commencing in 2013), furnish a report to KRECM for the preceding fiscal year to the effect that (i) it has obtained a representation regarding certain matters from the management of the Subservicer that includes an assessment from the Subservicer of its compliance with the Relevant Servicing Criteria and (ii) on the basis of an examination conducted by such firm in accordance with standards for attestation engagements issued or adopted by the Public Company Accounting Oversight Board, it is expressing an opinion as to whether the Subservicer’s compliance with the Relevant Servicing Criteria was fairly stated in all material respects, or it cannot express an overall opinion regarding the Subservicer’s assessment of compliance with the Relevant Servicing Criteria. If an overall opinion cannot be expressed, such registered public accounting firm shall state in such report why it was unable to express such an opinion. Such Regulation AB report must (i) be available for general use and not contain restricted use language and (ii) if required to be filed with the Commission under applicable law, include the consent and authorization of such accounting firm for the filing of such report with the Commission. KRECM and the Depositor shall have the right to review the report and consult with the Subservicer as to the nature of any material instance of noncompliance by the Subservicer with the Relevant Servicing Criteria in the fulfillment of any of the Subservicer’s obligations under this Agreement.

To the extent the PSA expressly permits the master servicer to deliver a Uniform Single Attestation Program for Mortgage Bankers (“USAP”), the Subservicer may elect, in its sole discretion, to provide a USAP report in lieu of a Regulation AB attestation. The Subservicer shall cause, a registered public accounting firm and that is a member of the American Institute of Certified Public Accountants to, no later than March 5 (or if such day is not a Business Day, then the immediately succeeding Business Day, with no cure period) of each year (commencing in 2013), furnish a certificate to KRECM, to the effect that such firm has examined the servicing operations of the Subservicer for the previous calendar year and that, on the basis of such examination conducted substantially in compliance with the USAP, such firm confirms that the Subservicer complied with the minimum servicing standards identified in USAP, in all material respects, except for such exceptions or errors in records that, in the opinion of such firm, the USAP does not require it to report.

19

(i) Exchange Act Reporting Indemnification.

(i) The Subservicer shall indemnify and hold harmless each Certification Party, the Depositor and the party designated in the PSA to file the Commission’s reports (which may be the applicable Trustee or the Certificate Administrator) and their respective directors, officers, members, managers, employees, agents and Affiliates and each other Person that controls any such entity within the meaning of either Section 15 of the Securities Act or Section 20 of the Exchange Act (collectively, the “Indemnified Parties”) from and against any liabilities, losses, damages, penalties, fines, forfeitures, legal fees and expenses and related costs, judgments and other costs and expenses incurred by such Indemnified Party arising out of (i) any breach of its obligations under this Section 3.06 or (ii) negligence, bad faith or willful misconduct on its part in the performance of such obligations.

(ii) If the indemnification provided for in this Section 3.06(i) is unavailable or insufficient to hold harmless any Indemnified Party, then the Subservicer shall contribute to the amount paid or payable to such Indemnified Party in such proportion as is appropriate to reflect the relative fault of the Subservicer on the one hand and the Indemnified Party on the other in connection with a breach of the Subservicer’s obligations under this Section 3.06 or the Subservicer’s negligence, bad faith or willful misconduct in connection therewith.

(j) Amendments; Expenses; Subservicers. This Section 3.06 may be amended in writing, executed by the parties hereto for purposes of complying with or to conform to standards developed within the commercial mortgage-backed securities market, notwithstanding anything to the contrary contained in this Agreement. The Subservicer’s obligations under this Section 3.06 shall be performed by it in all cases at its own expense.

Section 3.07. Regulatory Oversight, Compliance and Privacy.

Any regulatory oversight or compliance request by KRECM shall not materially increase the obligations or materially impact the cost of servicing by the Subservicer beyond the duties and obligations of the Subservicer (without regard to the provisions in this Section 3.07) that are otherwise set forth in or required by this Agreement, the applicable PSAs, the Accepted Subservicing Practices, and laws and regulations applicable to the Subservicer; provided, however, that the Subservicer shall comply with all of its obligations in this Section 3.07, even if such compliance materially increases the Subservicer’s cost of servicing beyond the standard set forth in the preceding sentence, if KRECM agrees that it will reimburse the Subservicer for the Subservicer’s actual increased costs of servicing caused directly by having to so comply.

(a) The Subservicer understands and acknowledges that KRECM is subject to examination by certain regulatory agencies as may have regulatory authority over KRECM, including the OCC, Federal Deposit Insurance Corporation, the Federal Reserve, and the Securities and Exchange Commission. The Subservicer further understands and acknowledges that KRECM has informed Subservicer that pursuant to OCC Bulletin 2001-47 (November 1, 2001), KRECM is required to and will engage in ongoing oversight of its relationship with Subservicer, including reviewing Subservicer’s financial condition, compliance with privacy and laws and regulations, insurance coverage, and performance under this Agreement. Accordingly, the Subservicer agrees to permit, participate in, submit to, and reasonably cooperate with any examination or inquiry of the Subservicer or KRECM by KRECM or any such regulatory body or agency of KRECM and the Subservicer as KRECM’s subservicer under this Agreement. Subject to the introductory paragraph to this Section 3.07, in connection with any examination or audit performed pursuant to this Section 3.07(a), Subservicer shall reasonably cooperate with KRECM to fix, mitigate or otherwise address any problems, findings, or concerns raised in any such examination or audit.

20

(b) The Subservicer and KRECM agree to cooperate and share information, as permitted by Applicable Requirements, with regard to the subservicing as set forth in this Agreement in order to comply with the laws regarding money laundering and terrorist financing applicable to each. Subservicer acknowledges that KRECM may perform certain of its anti-money laundering and Bank Secrecy Act (“AML/BSA”) due diligence procedures during the term of this Agreement. The Subservicer agrees to provide data and information to KRECM, based on the services provided by Subservicer under this Agreement, on a periodic basis with reasonable advance notice to Subservicer, in writing, as stated by the KRECM to enable KRECM to perform its AML/BSA related activities.

(c) In the event that, in performing the subservicing under this Agreement, the Subservicer identifies unusual and suspicious activity, the Subservicer agrees to promptly deliver to KRECM all relevant information through the methods developed for reporting possible fraud. KRECM shall determine in its sole discretion whether further action is required by law and shall notify Subservicer in writing of such determination. KRECM shall, at its sole cost and expense, take any such further action.

(d) The Subservicer shall at all times have policies, procedures and internal controls that materially comply with the regulations administered by OFAC and shall provide KRECM with documentation of such policies, procedures and controls (“OFAC Program”). Upon KRECM’s written request, Subservicer agrees to provide KRECM with periodic updates regarding the functionality and effectiveness of the OFAC Program, including but not limited to the most current OFAC testing results, regarding Subservicer’s OFAC Program. Subservicer shall not knowingly perform any subservicing in material violation of the OFAC regulations. Subject to the introductory paragraph to this Section 3.07, in the event that the Subservicer’s OFAC Program are deemed by KRECM to be insufficient or not in compliance with the minimum standards established by KRECM’s AML Compliance Program, the Subservicer shall promptly adopt any changes, enhancements, or modifications to its OFAC Program that KRECM deems necessary.