Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT51 - Emerald Isle Explorations Ltd. | exhibit51.htm |

| EX-3.2 - EXHIBIT32 - Emerald Isle Explorations Ltd. | exhibit32.htm |

| EX-3.1 - EXHIBIT31 - Emerald Isle Explorations Ltd. | exhibit31.htm |

| EX-23.3 - EXHIBIT233 - Emerald Isle Explorations Ltd. | exhibit233.htm |

| EX-23.2 - EXHIBIT232 - Emerald Isle Explorations Ltd. | exhibit232.htm |

| EX-10.1 - EXHIBIT101 - Emerald Isle Explorations Ltd. | exhibit101.htm |

As filed with the Securities and Exchange Commission on June 24, 2013

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

EMERALD ISLE EXPLORATION LTD.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

|

1000

(Primary Standard Industrial Classification Number)

|

90-0961033

(IRS Employer Identification Number)

|

1218 Purtov Street

Kodiak, Alaska 99615

(907) 539-2222

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nevada Agency and Transfer Company

50 W. Liberty Street, Suite 880

Reno, Nevada 89501

(775) 322-0626

(Address, including zip code, and telephone number, including area code,

of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

|

Proposed Maximum

|

Proposed Maximum

|

||||||||||||||

|

of Securities

|

Amount to Be

|

Offering Price

|

Aggregate

|

Amount of

|

||||||||||||

|

to be Registered

|

Registered (1)

|

per Share

|

Offering Price

|

Registration Fee

|

||||||||||||

|

Common Stock, par value $0.00001 per share

|

1,000,000

|

$

|

0.035

|

(2)

|

$

|

35,000

|

$

|

4.77

|

||||||||

|

TOTAL

|

1,000,000

|

$

|

-

|

$

|

35,000

|

4.77

|

||||||||||

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) and (o) of the Securities Act.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be amended. The Registrant may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JUNE 24, 2013

EMERALD ISLE EXPLORATION LTD.

1,000,000 SHARES OF COMMON STOCK

This Prospectus relates to the offer and sale of a maximum of 1,000,000 shares (the “Maximum Offering”) of common stock, $0.001 par value, by Emerald Isle Explorations Ltd., a Nevada company (“we”, “us”, “our”, “Emerald Isle Explorations”, “Company” or similar terms). There is no minimum for this Offering. The Offering will commence promptly on the date upon which this prospectus is declared effective by the SEC and will continue for 16 months. We will pay all expenses incurred in this Offering. We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

The offering of the 1,000,000 shares is a “best efforts” offering, which means that our sole director and officer will use his best efforts to sell the common stock and there is no commitment by any person to purchase any shares. The shares will be offered at a fixed price of $0.035 per share for the duration of the offering. There is no minimum number of shares required to be sold to close the offering. Proceeds from the sale of the shares will be used to fund the initial stages of our business development. We have not made any arrangements to place funds received from share subscriptions in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. As such, it is possible that a creditor could attach your subscription which could preclude or delay the return of money to you. If that happens, you will lose your investment and your funds will be used to pay creditors.

This is a direct participation offering, since we are offering the stock directly to the public without the participation of an underwriter. Our sole officer and director will be solely responsible for selling shares under this Offering and no commission will be paid on any sales.

Prior to this Offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $0.035 per share in relation to this Offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this Prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS, PARTICULARLY, THE RISK FACTORS SECTION BEGINNING ON PAGE 5.

Neither the United States Securities and Exchange Commission (“SEC”), nor any state securities commission, has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

|

Page

|

|

|

2

|

|

|

4

|

|

|

4

|

|

|

6

|

|

|

9

|

|

|

9

|

|

| Dilution | 10 |

| 11 | |

|

12

|

|

|

14

|

|

|

24

|

|

|

24

|

|

|

24

|

|

|

25

|

|

|

31

|

|

|

33

|

|

|

34

|

|

|

35

|

|

|

35

|

|

|

35

|

|

| 35 | |

|

35

|

|

|

F-1

|

Until ____________, 2013 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Emerald Isle Exploration Ltd.” refer to Emerald Isle Exploration Ltd. unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

OUR COMPANY

Emerald Isle Exploration Ltd. was incorporated on November 7, 2012, under the laws of the State of Nevada, for the purpose of conducting mineral exploration activities.

We are an exploration stage company formed for the purposes of acquiring, exploring, and if warranted and feasible, developing natural resource property. Proceeds from this placement will be used for working capital. As of April 30, 2013, Samuell Eads, our sole officer and director, has loaned us a total of $16,000. The loans have no term, are interest-free and non-secured.

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “RISK FACTORS--RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK - WE ARE AN `EMERGING GROWTH COMPANY’ AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS” on page 4 of this prospectus.

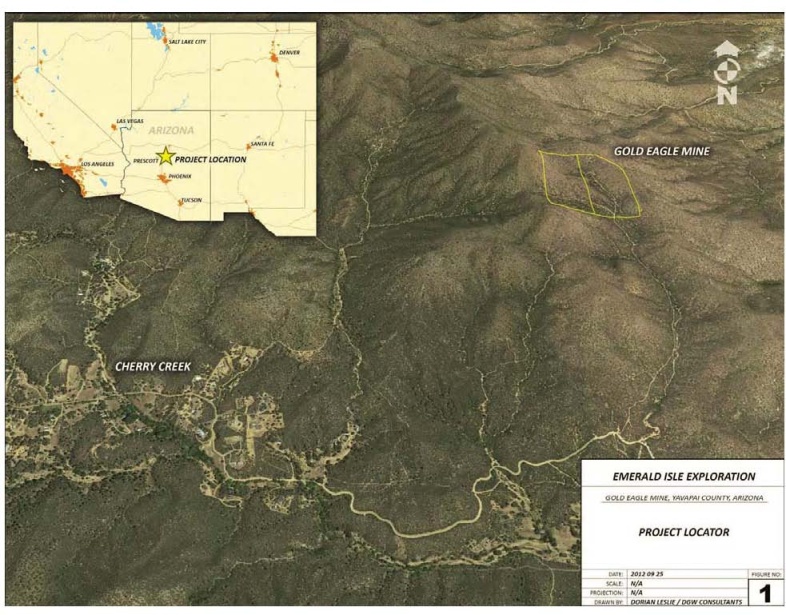

On December 1, 2012, we entered into an Agreement (the “Purchase Agreement”) with Beowulf Properties Corp. (“Beowulf”), whereby, for a purchase price of $1,000, we purchased two mining claims, Gold Eagle #1 and Gold Eagle #2 (collectively, the “Gold Eagle Mine Property”), located in central Arizona approximately 25 miles east of Prescott, Arizona and two (2) miles northeast from the town of Cherry, Arizona. We had a qualified consulting geologist prepare a geological evaluation report on the claim. We intend to conduct exploratory activities on the claims and if feasible, develop the Gold Eagle Mine Property.

We anticipate that our current cash of $7,931 will be sufficient to operate our company for a period of 6 months from the date of this prospectus but is not enough to commence our first phase of our planned exploration program on the Gold Eagle Mine Property. None of our officers and directors, or our consulting geologist, has ever visited the Gold Eagle Mine Property. Phase I of our exploration program, estimated at a cost of $9,200, will require approximately one week to complete and will consisting of grid emplacement, geological mapping in the vicinity of the known underground mine workings as well as rock sampling. An additional 3 weeks will be required to complete analysis of samples, data compilation and interpretation, drafting and report writing. Phase II of our exploration program is contingent on the success of the Phase I program. A small campaign of diamond drilling is recommended to intersect the projected down dip extensions of the known mineralization below the deepest level previously mined. Upon the completion of, and based on positive results from, the Phase 1 program additional detailed geological mapping, rock sampling and analysis will be carried out. The objective of this work will be to locate the most perspective geological targets for drill testing in the Phase 3 program. The estimated cost of Phase II is $40,000. Upon the completion of Phase II, and based on positive results, Phase III would be denoted by a second larger diamond drill program which would be initiated to provide additional information. This would consist of approximately 1,600 feet of diamond drilling. The estimated cost of the Phase 3 program is $200,000. We will require additional funding to proceed with all phases work on the claim. We must sell at least 75% of the shares in this offering to have sufficient funds to commence with Phase I of our exploration program. We have no current plans on how to raise the additional funding for Phases II or III.

In order to execute against our plan of operations for the next 12 months, we will need to raise approximately $61,705. Until such funds are obtained by the Company via debt, equity or other form of financing, we will be unable to take concrete steps towards the implementation of our plan of operations.

The Company’s principal offices are located at 1218 Purtov Street, Kodiak, Alaska 99615, and our telephone number is (907) 539-2222.

THE OFFERING

|

Securities offered:

|

The Company is hereby offering up to 1,000,000 shares of common stock.

|

|

|

Offering price:

|

$0.035 per share of common stock.

|

|

|

Shares outstanding prior to offering:

|

4,000,000 shares of common stock.

|

|

|

Shares outstanding after offering:

|

5,000,000 shares of common stock.

|

|

|

Net proceeds to the Company:

|

$35,000 less estimated offering registration costs of $12,504.77, assuming the maximum number of shares are sold. For further information on the Use of Proceeds, please see Page 9.

|

|

|

Market for the common shares:

|

There is no public market for our shares. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to eligible for trading on the Over The Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

|

Use of proceeds:

|

See “Use of Proceeds” on page 9.

|

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from November 7, 2012 (Inception) to March 31, 2013. Our working capital defict as at June 19, 2013 was $(8,069).

|

April 30, 2013 ($)

|

||||

|

Financial Summary

|

||||

|

Cash and Deposits

|

7,931

|

|||

|

Total Assets

|

7,931

|

|||

|

Total Liabilities

|

16,000

|

|||

|

Total Stockholder’s Equity

|

7,931

|

|||

|

November 7, 2012

|

||||

|

(Inception) to

April 30, 2013 ($)

|

||||

|

Statement of Operations

|

||||

|

Total Expenses

|

(8,069

|

) | ||

|

Net Loss for the Period

|

(8,069

|

) | ||

|

Net Loss per Share

|

0.00

|

|||

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements for the period ended April 30, 2013 were prepared assuming that we will continue our operations as a going concern. We were incorporated on November 7, 2012 and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We will require additional funds which we plan to raise through the sale of our common stock, which requires favorable market conditions and interest in our activities by investors. If we are not be able to sell our common stock, funding will not be available for continued operations, and our business will fail.

Our current cash of $7,931 will not be sufficient to complete the first phase of any initial exploration program of any mining claim. Subsequent exploration activities will require additional funding. We will need $9,200 to complete phase 1 and a total of $75,037 to complete the first two phases of our plan of operation detailed on page 24. Our only present means of funding is through the sale of our common stock. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock, neither of which may exist if and when additional funding is required by us. If we are unable to raise additional funds in the future, our business will fail.

We have a very limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful mineral exploration activities. We may not be successful in carrying out our business objectives.

We were incorporated on November 7, 2012 and to date, have been involved primarily in organizational activities and obtaining financing. Accordingly we have no track record of successful exploration activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a junior resource exploration company. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

Due to the speculative nature of mineral property exploration, there is substantial risk that no commercially viable mineral deposits will be found on our Gold Eagle Mine Property or other mineral properties that we acquire.

In order for us to even commence mining operations we face a number of challenges which include finding mining claims, qualified professionals to conduct exploration programs, obtaining adequate financing to continue exploration programs, locating viable mineral bodies, partnering with senior mining companies, obtaining mining permits, and ultimately selling minerals in order to generate revenue. Moreover, exploration for commercially viable mineral deposits is highly speculative in nature and involves substantial risk that no viable mineral deposits will be located on any future mineral properties. There is a substantial risk that any exploration program that we conduct on future claims may not result in the discovery of any significant mineralization, and therefore no commercial viable mineral deposit. There are numerous geological features that we may encounter that would limit our ability to locate mineralization or that could interfere with our exploration programs as planned, resulting in unsuccessful exploration efforts. In such a case, we may incur significant costs associated with an exploration program, without any benefit. This would likely result in a decrease in the value of our common stock.

We have not independently verified the mineral reserves on the Gold Eagle Mine Property, nor have we personally visited the property, and we have relied solely on the representations and advice of our expert advisors.

No members of management of the Company have personally visited the Gold Eagle Mine Property. We have relied on the expert advice of the Craig Parkinson, a qualified geologist in the State of Arizona, advising us has not conducted a site visit to the Gold Eagle Mine Property. Because we have not independently verified that there are mineral reserves, there may be no commercially viable mineral reserves located on the Gold Eagle Mine Property. Assuming there are mineralized materials or mineral reserves that can be proved or proven at some time in the future, there can be no assurance that the Gold Eagle Mine Property does not contain physical or geological defects that could pose obstacles to our exploration plans that a site visit would have revealed.

Due to the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or may elect not to insure. We currently have no such insurance nor do we expect to obtain such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets and cease operations, resulting in the loss of your entire investment.

The market price for precious metals is based on numerous factors outside of our control. There is a risk that the market price for precious metals will significantly decrease, which will make it difficult for us to fund further mineral exploration activities, and would decrease the probability that any significant mineralization that we locate can be economically extracted.

Numerous factors beyond our control may affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in this offering by existing investors.

Our sole officer and director’s lack of experience in and/or with mining and, in particular, mineral exploration activity, means that it is difficult to assess, or make judgments about, our potential success.

Our sole officer and director has not had any prior experience with or ever been employed in the mining industry. Additionally, he does not have a college or university degree, or other educational background, in mining or geology or in a field related to mining. More specifically, he lacks technical training and experience with exploring for, starting, and/or operating a mine. With no direct training or experience in these areas, he may not be fully aware of many of the specific requirements related to mineral exploration, let alone the overall mining industry as a whole. For example, each of our sole officer and director’s decisions and choices may fail to take into account standard engineering and other managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to his future possible mistakes, lack of sophistication, judgment or experience in this particular industry. As a result, if we do obtain the funding or other means to implement a bona fide mineral exploration program, such program will likely have to be implemented and carried out by joint venturers, partners or independent contractors who would have the requisite mineral exploration experience and know-how that we currently lack.

Since the majority of our shares of common stock are owned by our sole officer and director, our other stockholders may not be able to influence control of the company or decision making by management of the company, and as such, our officers and directors may have a conflict of interest with the minority shareholders at some time in the future.

Our sole officer and director beneficially owns 100% of our outstanding common stock. The interests of our sole officer and director may not be, at all times, the same as that of our other shareholders. Our sole officer and director is not simply a passive investor but is also executive officer of the Company, his interest as executive may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our director exercising, in a manner fair to all of our shareholders, his fiduciary duties as officer or as member of the Company’s board of directors. Also, our sole officer and director will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our articles of incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

Since our sole officer and director has the ability to be employed by or consult for other companies, his other activities could slow down our operations.

Our sole officer and director is not required to work exclusively for us and does not devote all of his time to our operations. Therefore, it is possible that a conflict of interest with regard to her time may arise based on his employment by other companies. His other activities may prevent him from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that our officer and director will devote between 5 and 10 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our director.

We have no employment or compensation agreements with our sole officer and director and as such he may have little incentive to devote time and energy to the operation of the company.

Our sole officer and director is not subject to any employment or compensation agreement with the Company. Therefore, it is possible that he may decide to focus his effort on other projects or companies which have a higher economic benefit to him. Currently, he is not obligated to spend any time at all on Company business and could opt to leave the Company for other opportunities or focus on other business which could negatively impact the Company’s ability to succeed. We do not have any expectation that he will enter into an employment or compensation agreement with the Company in the foreseeable future and her loss would be highly detrimental to our ability to conduct ongoing operations.

There is no liquidity and no established public market for our common stock and we may not be successful at obtaining a quotation on a recognized quotation service. In such event it may be difficult to sell your shares.

There is presently no public market in our shares. There can be no assurance that we will be successful at developing a public market or in having our common stock quoted on a quotation facility such as the OTC Bulletin Board. There are risks associated with obtaining a quotation, including that broker dealers will not be willing to make a market in our shares, or to request that our shares be quoted on a quotation service. In addition, even if a quotation is obtained, the OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our common stock on acceptable terms. If trades in our common stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

Our common stock is subject to the “penny stock” rules of the sec and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock. As of the date of this prospectus, the Company had 4,000,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 71,000,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to have an application filed for admission to quotation of our securities on the OTC Bulletin Board after this prospectus is declared effective by the SEC. If for any reason our common stock is not quoted on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs will negatively affect our ability to earn a profit.

Following the effective date of the registration statement in which this prospectus is included, we will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations thereunder. In order to comply with such requirements, our independent registered auditors will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. Although we believe that the approximately $10,000 we have estimated for these costs should be sufficient for the 12 month period following the completion of our offering, the costs charged by these professionals for such services may vary significantly. Factors such as the number and type of transactions that we engage in and the complexity of our reports cannot accurately be determined at this time and may have a major negative affect on the cost and amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit.

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.” We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that you become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Because we are a shell company, you will not be able to resell your shares in certain circumstances, which could hinder the resale of your shares.

We are a “shell company” within the meaning of Rule 405, promulgated pursuant to Securities Act of 1933, as amended (the “Securities Act”), because we have nominal assets and nominal operations. Accordingly, the securities sold in this offering can only be resold through registration under Section 5 the Securities Act, Section 4(1), if available, for non-affiliates, or by meeting the conditions of Rule 144(i). Another implication of us being a shell company is that we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, a short form of registration to register securities issued to employees and consultants under an employee benefit plan. Additionally, though exemptions, such as Section 4(1) of the Securities Act may be available for non-affiliate holders our shares to resell their shares, because we are a shell company, a holder of our securities may not rely on the safe harbor from being deemed statutory underwriter under Section 2(11) of the Securities Act, as provided by Rule 144, to resell his or her securities. Only after we (i) are not a shell company, and (ii) have filed all reports and other materials required to be filed by section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months (or for such shorter period that we may be required to file such reports and materials, other than Form 8-K reports); and have filed current “Form 10 information” with the SEC reflecting our status as an entity that is no longer a shell company for a period of not less than 12 months, can our securities be resold pursuant to Rule 144. “Form 10 information” is, generally speaking, the same type of information as we are required to disclose in this prospectus, but without an offering of securities. These circumstances regarding how Rule 144 applies to shell companies may hinder your resale of your shares of the Company.

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of our company.

Though not now, in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of Emerald Isle Exploration Ltd. from doing so if it cannot obtain the approval of our board of directors.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

Our public offering of 1,000,000 shares is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.035. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $35,000 as anticipated.

|

If 25% of

Shares

Sold

|

If 50% of

Shares

Sold

|

If 75% of

Shares

Sold

|

If 100% of

Shares

Sold

|

|||||||||||||

|

GROSS PROCEEDS FROM THIS OFFERING(1)

|

$

|

8,750

|

$

|

17,500

|

$

|

26,250

|

$

|

35,000

|

||||||||

|

Legal and Accounting fees

|

$

|

5,000

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

||||||||

|

Costs associated with being a “reporting issuer”

|

$

|

3,750

|

$

|

7,500

|

$

|

10,000

|

$

|

10,000

|

||||||||

|

Phase 1 of exploration

|

$

|

$

|

$

|

5,800

|

$

|

9,200

|

||||||||||

|

General and administrative

|

$

|

$

|

$

|

450

|

$

|

5,800

|

||||||||||

|

Total

|

$

|

8,750

|

$

|

17,500

|

$

|

26,250

|

$

|

35,000

|

||||||||

|

(1)

|

Expenditures for the 12 months following the completion of this offering. The expenditures are categorized by significant area of activity.

|

The above figures represent only estimated costs. All proceeds will be deposited into our corporate bank account. Any funds that we raise from our offering of 1,000,000 shares will be immediately available for our use and will not be returned to investors. We do not have any arrangements to place the funds received from our offering of 1,000,000 shares in an escrow, trust or similar account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. If that happens, you will lose your investment and your funds will be used to pay creditors.

Please see a detailed description of the use of proceeds in the “Plan of Operation” section of this prospectus.

The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

The price of our offering our offering of 1,000,000 shares is fixed at $0.035 per share. This price is significantly higher than the consideration paid by Samuell Eads, our sole officer and director, for the 4,000,000 shares of common stock we issued him for agreeing to be an officer and a director of the Company on November 7, 2012.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

As of April 30, 2013, the net tangible book value of our shares of common stock was $(2,864) or $(0.0007) per share based upon 4,000,000 shares outstanding.

Existing Stockholders if all of the Shares are Sold

|

Price per share

|

$

|

0.035

|

||

|

Net tangible book value per share before offering

|

$

|

(0.002)

|

||

|

Potential gain to existing shareholders

|

$

|

35,000

|

||

|

Net tangible book value per share after offering

|

$

|

0.005

|

||

|

Increase to present stockholders in net tangible book value per share after offering

|

$

|

0.007

|

||

|

Capital contributions

|

$

|

40

|

||

|

Number of shares outstanding before the offering

|

5,000,000

|

|||

|

Number of shares after offering held by existing stockholders

|

4,000,000

|

|||

|

Percentage of ownership after offering

|

80.0

|

%

|

Purchasers of Shares in this Offering if all Shares Sold

|

Price per share

|

$

|

0.035

|

||

|

Dilution per share

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

35,000

|

||

|

Percentage of capital contributions

|

99.8

|

%

|

||

|

Number of shares after offering held by public investors

|

1,000,000

|

|||

|

Percentage of ownership after offering

|

20.0

|

%

|

Purchasers of Shares in this Offering if 75% of Shares Sold

|

Price per share

|

$

|

0.035

|

||

|

Dilution per share

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

26,250

|

||

|

Percentage of capital contributions

|

99.8

|

%

|

||

|

Number of shares after offering held by public investors

|

750,000

|

|||

|

Percentage of ownership after offering

|

15.7

|

%

|

Purchasers of Shares in this Offering if 50% of Shares Sold

|

Price per share

|

$

|

0.035

|

||

|

Dilution per share

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

17,500

|

||

|

Percentage of capital contributions

|

99.5

|

%

|

||

|

Number of shares after offering held by public investors

|

500,000

|

|||

|

Percentage of ownership after offering

|

11.1

|

%

|

Purchasers of Shares in this Offering if 25% of Shares Sold

|

Price per share

|

$

|

0.035

|

||

|

Dilution per share

|

$

|

0.03

|

||

|

Capital contributions

|

$

|

8,750

|

||

|

Percentage of capital contributions

|

99.5

|

%

|

||

|

Number of shares after offering held by public investors

|

250,000

|

|||

|

Percentage of ownership after offering

|

5.8

|

%

|

GENERAL

There is no established public trading market for our common stock. Our authorized capital stock consists of 75,000,000 shares of common stock, with $0.00001 par value per share. As of the date of this prospectus, there were 4,000,000 shares of our common stock issued and outstanding that were held by 1 stockholder of record, and no shares of preferred stock issued and outstanding.

COMMON STOCK

The following is a summary of the material rights and restrictions associated with our common stock. This description does not purport to be a complete description of all of the rights of our stockholders and is subject to, and qualified in its entirety by, the provisions of our most current Articles of Incorporation and Bylaws, which are included as exhibits to this Registration Statement.

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote.

Our Bylaws provide that at all meetings of the stockholders for the election of directors, a plurality of the votes cast shall be sufficient to elect. On all other matters, except as otherwise required by Nevada law or the Articles of Incorporation, a majority of the votes cast at a meeting of the stockholders shall be necessary to authorize any corporate action to be taken by vote of the stockholders. A “plurality” means the excess of the votes cast for one candidate over any other. When there are more than two competitors for the same office, the person who receives the greatest number of votes has a plurality.

We do not have any preferred stock authorized in our Articles of Incorporation, and we have no warrants, options or other convertible securities issued or outstanding.

NEVADA ANTI-TAKEOVER LAWS

The Nevada Business Corporation Law contains a provision governing “Acquisition of Controlling Interest.” This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges: (1) 20 to 33 1/3%, (2) 33 1/3 to 50%, or (3) more than 50%. A “control share acquisition” is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the Articles of Incorporation or Bylaws of the corporation. Our Articles of Incorporation and Bylaws do not exempt our common stock from the control share acquisition act. The control share acquisition act is applicable only to shares of “Issuing Corporations” as defined by the act. An Issuing Corporation is a Nevada corporation, which; (1) has 200 or more stockholders, with at least 100 of such stockholders being both stockholders of record and residents of Nevada; and (2) does business in Nevada directly or through an affiliated corporation.

At this time, we do not have 100 stockholders of record resident of Nevada. Therefore, the provisions of the control share acquisition act do not apply to acquisitions of our shares and will not until such time as these requirements have been met. At such time as they may apply to us, the provisions of the control share acquisition act may discourage companies or persons interested in acquiring a significant interest in or control of the Company, regardless of whether such acquisition may be in the interest of our stockholders.

The Nevada “Combination with Interested Stockholders Statute” may also have an effect of delaying or making it more difficult to effect a change in control of the Company. This statute prevents an “interested stockholder” and a resident domestic Nevada corporation from entering into a “combination,” unless certain conditions are met. The statute defines “combination” to include any merger or consolidation with an “interested stockholder,” or any sale, lease, exchange, mortgage, pledge, transfer or other disposition, in one transaction or a series of transactions with an “interested stockholder” having; (1) an aggregate market value equal to 5 percent or more of the aggregate market value of the assets of the corporation; (2) an aggregate market value equal to 5 percent or more of the aggregate market value of all outstanding shares of the corporation; or (3) representing 10 percent or more of the earning power or net income of the corporation. An “interested stockholder” means the beneficial owner of 10 percent or more of the voting shares of a resident domestic corporation, or an affiliate or associate thereof. A corporation affected by the statute may not engage in a “combination” within three years after the interested stockholder acquires its shares unless the combination or purchase is approved by the board of directors before the interested stockholder acquired such shares. If approval is not obtained, then after the expiration of the three-year period, the business combination may be consummated with the approval of the board of directors or a majority of the voting power held by disinterested stockholders, or if the consideration to be paid by the interested stockholder is at least equal to the highest of: (1) the highest price per share paid by the interested stockholder within the three years immediately preceding the date of the announcement of the combination or in the transaction in which he became an interested stockholder, whichever is higher; (2) the market value per common share on the date of announcement of the combination or the date the interested stockholder acquired the shares, whichever is higher; or (3) if higher for the holders of preferred stock, the highest liquidation value of the preferred stock. The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of the Company from doing so if they cannot obtain the approval of our board of directors.

RULE 144

All 4,000,000 shares of our issued and outstanding shares of our common stock are “restricted securities” under Rule 144, promulgated pursuant to the Securities Act of 1933, as amended, but none of those 4,000,000 shares can be resold under Rule 144.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

This is a self-underwritten offering, and Samuell Eads, our sole officer and director, will sell the shares directly to family, friends, business associates and acquaintances, with no commission or other remuneration payable to him for any shares he may sell. There are no plans or arrangements to enter into any contracts or agreements to sell the shares with a broker or dealer. In offering the securities on our behalf, Mr. Eads will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934. Our sole officer and director will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions, as noted herein, under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer:

1. Our sole officer and director is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his participation; and,

2. Our sole officer and director will not be compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

3. Our sole officer and director is not, nor will he be at the time of his participation in the offering, an associated person of a broker-dealer; and

4. Our sole officer and director meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily perform, or intend primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and (B) each of them is not a broker or dealer, or been an associated person of a broker or dealer, within the preceding twelve months; and (C) has not participated in selling and offering securities for any issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). Under Paragraph 3a4-1(a)(4)(iii), our sole and director must restrict his participation to any one or more of the following activities:

(A) Preparing any written communication or delivering such communication through the mails or other means that does not involve oral solicitation by either of our two officers and sole director of a potential purchaser; provided, however, that the content of such communication is approved by either of our two officers and sole director;

(B) Responding to inquiries of a potential purchaser in a communication initiated by the potential purchaser; provided, however, that the content of such responses are limited to information contained in a registration statement filed under the Securities Act of 1933 or other offering document; or

(C) Performing ministerial and clerical work involved in effecting any transaction.

Our two officers and sole director do not intend to purchase any shares in this offering.

Terms of the Offering

We are offering a total of 1,000,000 shares of our common stock in a self-underwritten public offering, with no minimum purchase requirement. We do not have an arrangement to place the proceeds from this offering in an escrow, trust, or similar account. Any funds raised from the offering will be immediately available to us for our immediate use. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. As such, it is possible that a creditor could attach your subscription which could preclude or delay the return of money to you. If that happens, you will lose your investment and your funds will be used to pay creditors.

The shares will be sold at the fixed price of $0.035 per share until the completion of this offering. There is no minimum amount of subscription required per investor, and subscriptions, once received, are irrevocable. This offering will commence on the date of this prospectus and continue for a period of 16 months. At the discretion of our board of directors, we may discontinue the offering before expiration of the 16-month period.

Penny Stock Rules

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to the penny stock rules.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and is in such form as the Commission shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

ORGANIZATION WITHIN THE LAST FIVE YEARS

On November 7, 2012, the Company was incorporated under the laws of the State of Nevada. We are engaged in the business of acquisition, exploration and development of natural resource properties.

Samuell Eads has served as our President and Chief Executive Officer, Secretary and Treasurer, from November 7, 2012, until the current date. Our board of directors is comprised of one person: Samuell Eads. We are authorized to issue 75,000,000 shares of common stock, par value $.00001 per share. On November 7, 2012, we offered and sold 4,000,000 shares of common stock to our sole officer and director, Samuell Eads, at a purchase price of $0.00001 per share, for total proceeds of $40. As of April 30, 2013, Samuell Eads, our sole officer and director, has loaned us a total of $16,000. The loans have no term, are interest-free and non-secured.

On December 1, 2012, we entered into an Agreement (the “Purchase Agreement”) with Beowulf Properties Corp. (“Beowulf”), whereby, for a purchase price of $1,000, we purchased two mining claims, Gold Eagle #1 and Gold Eagle #2 (collectively, the “Gold Eagle Mine Property”), located in central Arizona approximately 25 miles east of Prescott, Arizona and two (2) miles northeast from the town of Cherry, Arizona. We intend to conduct exploratory activities on the claims and if feasible, develop the Gold Eagle Mine Property.

We intend to conduct exploratory activities on the Gold Eagle Mine Property and if feasible, develop the prospects.

IN GENERAL

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We own one property, Gold Eagle Mine Property. We are currently conducting mineral exploration activities on the Gold Eagle Mine Property in order to assess whether it contains any commercially exploitable mineral reserves. Currently there are no known mineral reserves on the Gold Eagle Mine Property.

Since our inception, we have not earned any revenues to date and our net losses are $8,069 at April 30, 2013. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The source of information contained in this discussion is from a report prepared by Beowulf Properties Corp., which is the entity which sold us the Gold Eagle Mine Property.

While we intend to test for commercially viable reserves of gold, there is the likelihood of our mineral claim containing little or no economic mineralization or reserves of gold and other minerals. We are presently in the exploration stage of our business and we can provide no assurance that any commercially viable mineral deposits exist on our mineral claims, that we will discover commercially exploitable levels of mineral resources on our property, or, if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final determination can be made as to whether our mineral claims possess commercially exploitable mineral deposits. If our claim does not contain any reserves all funds that we spend on exploration will be lost.

We have no current plans, proposals or arrangements, written or otherwise, to seek a business combination with another entity in the near future.

ACQUISITION OF THE GOLDEN EAGLE MINE PROPERTY

On December 1, 2012, we entered into an Agreement (the “Purchase Agreement”) with Beowulf Properties Corp. (“Beowulf”), whereby, for a purchase price of $1,000, we purchased two mining claims, Gold Eagle #1 and Gold Eagle #2 (collectively, the “Gold Eagle Mine Property”), located in central Arizona approximately 25 miles east of Prescott, Arizona and two (2) miles northeast from the town of Cherry, Arizona. We intend to conduct exploratory activities on the claims and if feasible, develop the Gold Eagle Mine Property.

We intend to conduct exploratory activities on the Gold Eagle Mine Property and if feasible, develop the prospects.

We engaged Craig Parkinson, a qualified geologist to prepare a geological evaluation report on the Gold Eagle Mine Property. Mr. Parkinson graduated from the University of Nevada, School of Mines (MS Hydrogeology) in 1993, the University of Idaho, College of Mines (MS Mining Geology) in 1984, and Cornell College, Iowa (BS Geology) in 1980. Mr. Parkinson is a professional geologist registered in the State of Arizona (PG #30843).

The work completed by Mr. Parkinson in preparing the geological report consisted of a review of geological data from previous exploration within the region. The acquisition of this data involved the research and investigation of historical files to locate and retrieve data information acquired by previous exploration companies in the area of the mineral claims.

We received the geological evaluation report on the Gold Eagle Mine Property, titled “Summary Report on the Gold Eagle Mine Property” prepared by Mr. Parkinson in June 2013. The geological report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claims and recommends a further geological exploration program on the mineral claims. The description of the Gold Eagle Mine Property provided below is based on Mr. Parkinson’s report.

DESCRIPTION OF PROPERTY

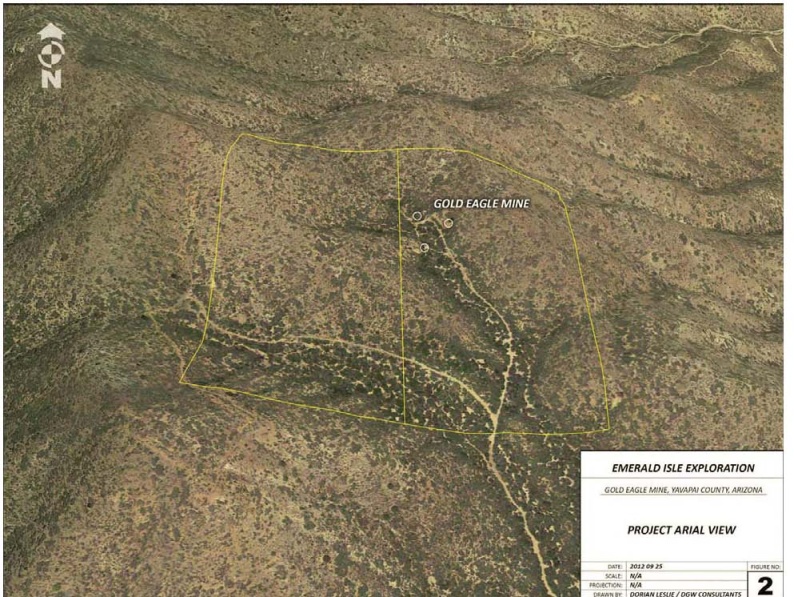

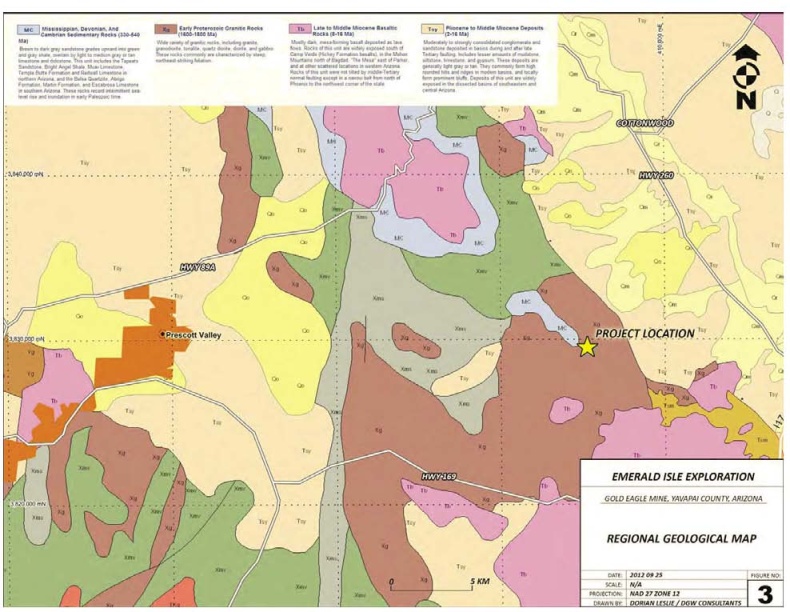

The Gold Eagle Mine is located in central Arizona approximately 25 miles east of Prescott, Arizona and two miles northeast from the town of Cherry. (Figure 1) within the Cherry Creek drainage. The property is located in the Cherry Creek (Black Hills) Mining District; Yavapai County Exploration in the area dates to the 1880’s when gold was discovered in the region. A subsequent `gold rush` occurred. At the height of exploration and mining activity in the area, approximately 50 properties were being developed and had some form of gold production.

The Gold Eagle Mine consists of two Federal unpatented lode-mining claims that have a total surface area of approximately 41.32 acres. The property is located in Township 14 North, Range 3 East, Section 15. The UTM coordinates for the approximate center of the property are Latitude 34.6000243 N by Longitude 112.023212 W on the USGS 1:24,000 scale (1” to 1 mile) map sheet “Cherry” (map MRC 34112E1). There is good road access to most parts of the property.