Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Crestwood Midstream Partners LP | d558727d8k.htm |

| EX-99.1 - EX-99.1 - Crestwood Midstream Partners LP | d558727dex991.htm |

Exhibit 10.1

EXECUTION COPY

PURCHASE AND SALE AGREEMENT

by and between

RKI EXPLORATION & PRODUCTION, LLC

- and -

CRESTWOOD NIOBRARA LLC

- and -

CRESTWOOD MIDSTREAM PARTNERS LP

(solely for purposes of its obligations under Section 2.04)

June 21, 2013

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 DEFINITIONS |

1 | |||||

| 1.01 |

Definitions |

1 | ||||

| ARTICLE 2 PURCHASE AND SALE |

9 | |||||

| 2.01 |

Purchase and Sale |

9 | ||||

| 2.02 |

Purchase Price at Closing |

9 | ||||

| 2.03 |

Post-Closing Adjustments |

9 | ||||

| ARTICLE 3 PURCHASE AND SALE AND CLOSING |

10 | |||||

| 3.01 |

Time and Place of Closing |

10 | ||||

| 3.02 |

Closing Deliveries |

11 | ||||

| 3.03 |

Valuation Schedule |

12 | ||||

| ARTICLE 4 REPRESENTATIONS AND WARRANTIES REGARDING SELLER |

13 | |||||

| 4.01 |

Organization |

13 | ||||

| 4.02 |

Authority |

13 | ||||

| 4.03 |

No Conflicts; Consents and Approvals |

13 | ||||

| 4.04 |

Title to Company Interests |

13 | ||||

| 4.05 |

Legal Proceedings |

14 | ||||

| 4.06 |

Brokers |

14 | ||||

| 4.07 |

No Tax Partnership |

14 | ||||

| ARTICLE 5 REPRESENTATIONS AND WARRANTIES REGARDING COMPANY |

14 | |||||

| 5.01 |

Organization and Qualification |

14 | ||||

| 5.02 |

Consents and Approvals; No Violation |

14 | ||||

| 5.03 |

Ownership |

15 | ||||

| 5.04 |

Material Contracts |

15 | ||||

| 5.05 |

Real Property |

15 | ||||

| 5.06 |

Title and Condition |

16 | ||||

| 5.07 |

Permits |

17 | ||||

| 5.08 |

Compliance with Laws |

17 | ||||

| 5.09 |

Legal Proceedings |

17 | ||||

| 5.10 |

Environmental Matters |

17 | ||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 5.11 |

Taxes |

17 | ||||

| 5.12 |

Employees and Employee Benefits |

18 | ||||

| 5.13 |

Brokers |

18 | ||||

| 5.14 |

Financial Statements |

18 | ||||

| 5.15 |

Absence of Undisclosed Liabilities |

18 | ||||

| 5.16 |

Absence of Changes |

19 | ||||

| 5.17 |

Insurance |

19 | ||||

| 5.18 |

Future Delivery of Hydrocarbons |

19 | ||||

| 5.19 |

Regulation |

19 | ||||

| ARTICLE 6 REPRESENTATIONS AND WARRANTIES OF BUYER |

19 | |||||

| 6.01 |

Organization and Qualification |

19 | ||||

| 6.02 |

Approval and Enforceability |

19 | ||||

| 6.03 |

No Violation or Consent |

20 | ||||

| 6.04 |

Brokers |

20 | ||||

| 6.05 |

Legal Proceedings |

20 | ||||

| ARTICLE 7 ADDITIONAL AGREEMENTS OF THE PARTIES |

20 | |||||

| 7.01 |

HSR Act |

20 | ||||

| 7.02 |

Access |

21 | ||||

| 7.03 |

Required Consents |

22 | ||||

| 7.04 |

Operation of Business |

22 | ||||

| 7.05 |

Cooperation and Preservation of Books and Records |

22 | ||||

| 7.06 |

Casualty Loss |

22 | ||||

| 7.07 |

Rights of First Offer |

23 | ||||

| 7.08 |

Taxes |

23 | ||||

| ARTICLE 8 CONDITIONS TO CLOSING AND TERMINATION |

23 | |||||

| 8.01 |

Conditions to Obligation of Buyer |

23 | ||||

| 8.02 |

Conditions to Obligation of Seller |

24 | ||||

| 8.03 |

Termination |

24 | ||||

ii

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 8.04 |

Specific Performance for Pre-Closing Breach |

25 | ||||

| 8.05 |

Effect of Termination |

25 | ||||

| ARTICLE 9 SURVIVAL |

25 | |||||

| 9.01 |

Survival |

25 | ||||

| ARTICLE 10 INDEMNIFICATION |

26 | |||||

| 10.01 |

Indemnification |

26 | ||||

| 10.02 |

Exclusive Remedy Post-Closing |

29 | ||||

| 10.03 |

Limitation of Liability |

29 | ||||

| ARTICLE 11 MISCELLANEOUS |

29 | |||||

| 11.01 |

Governing Law; Waiver of Jury Trial |

29 | ||||

| 11.02 |

Entire Agreement |

30 | ||||

| 11.03 |

Waiver |

30 | ||||

| 11.04 |

Captions |

30 | ||||

| 11.05 |

Assignment |

30 | ||||

| 11.06 |

Notices |

30 | ||||

| 11.07 |

Expenses |

31 | ||||

| 11.08 |

Severability |

31 | ||||

| 11.09 |

Amendment |

31 | ||||

| 11.10 |

Further Assurances |

31 | ||||

| 11.11 |

Third-Party Beneficiaries |

31 | ||||

| 11.12 |

Counterparts; Exhibits |

31 | ||||

| 11.13 |

Publicity |

32 | ||||

| 11.14 |

Construction |

32 | ||||

| 11.15 |

Schedules |

32 | ||||

iii

EXHIBITS AND SCHEDULES

| Exhibits | ||

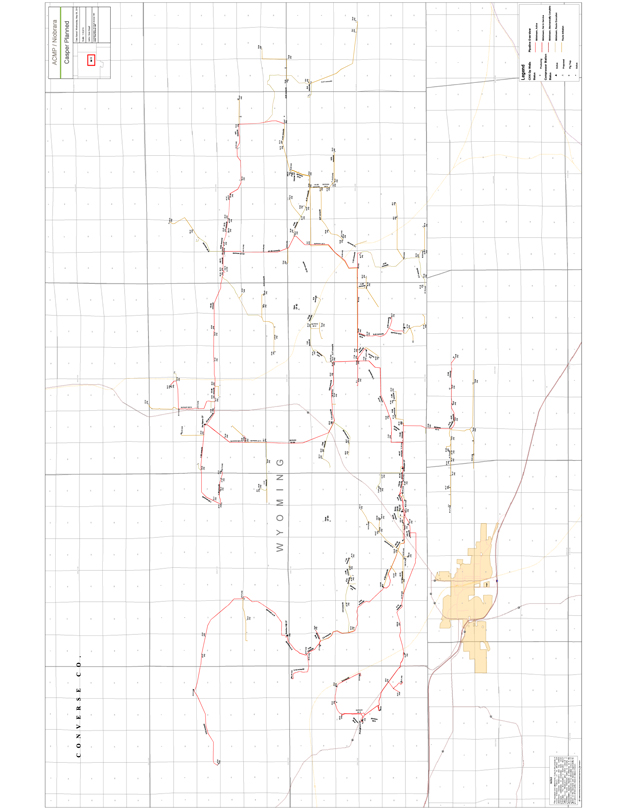

| Exhibit A | Jackalope System Maps | |

| Exhibit B | Company Agreement | |

| Exhibit C | Form of Company Interests Assignment Agreement | |

| Schedules | ||

| Schedule 5.04(a) | Material Contracts | |

| Schedule 5.05(d) | Real Property Owned | |

| Schedule 5.05(e) | Real Property Leases | |

| Schedule 5.05(f) | Easements | |

| Schedule 5.07 | Permits | |

| Schedule 5.14 | Financial Statements | |

| Schedule 5.15 | Absence of Undisclosed Liabilities | |

| Schedule 5.17 | Insurance | |

| Schedule 8.01(e) | Required Consents | |

iv

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (“Agreement”) is made and entered into on this 21st day of June, 2013 by and between RKI Exploration & Production, LLC, a Delaware limited liability company (“Seller”), and Crestwood Niobrara LLC, a Delaware limited liability company (“Buyer”), and Crestwood Midstream Partners LP, a Delaware limited partnership (“Parent”), solely for purposes of its obligations under Section 2.04. Seller and Buyer are sometimes herein referred to individually as a “Party” and collectively as the “Parties.”

RECITALS

Seller owns fifty percent (50%) of the outstanding equity interests (the “Company Interests”) of Jackalope Gas Gathering Services, L.L.C., an Oklahoma limited liability company (the “Company”). The Company owns a gathering system and gas liquids pipeline located in Converse County, Wyoming, maps of which are included in Exhibit A attached hereto, and certain gathering and processing rights as set forth in the Area of Mutual Interest as defined in the GGPA (collectively, the “Jackalope System”). Buyer desires to purchase from Seller, and Seller desires to sell to Buyer, all of Seller’s interest in the Company Interests on the terms and conditions set forth in this Agreement.

AGREEMENTS

NOW, THEREFORE, for and in consideration of the premises, the mutual covenants and agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties, the Parties hereby agree as follows:

ARTICLE 1

DEFINITIONS

1.01 Definitions. Each capitalized term used herein shall have the meaning given such term as set forth below.

“Access” means Access MLP Operating, L.L.C.

“Actual Capex” shall have the meaning given such term in Section 2.03(a).

“Actual Capex Amount” shall have the meaning given such term in Section 2.03(a).

“Actual Proceeds” shall have the meaning given such term in Section 2.03(a).

“Affiliate” shall mean, with respect to a specified Person, any other Person controlling, controlled by or under common control with that first Person. As used in this definition, the term “control” shall mean (a) with respect to any Person having voting shares or the equivalent and elected directors, managers or Persons performing similar functions, the ownership of or power

1

to vote, directly or indirectly, shares or the equivalent representing more than fifty percent (50%) of the power to vote in the election of directors, managers or Persons performing similar functions, and (b) ownership of more than fifty percent (50%) of the equity or equivalent interest in any Person.

“Agreement” shall have the meaning given such term in the introductory paragraph hereof.

“Assets” shall mean all of Company’s right, title and interest in and to the property and assets of the Jackalope System.

“Balance Sheet Date” shall have the meaning given such term in Section 5.14.

“Business Day” shall mean any day except a Saturday, Sunday or any other day on which commercial banks in Houston, Texas are required or authorized by any Legal Requirement to be closed.

“Buyer” shall have the meaning given such term in the introductory paragraph hereof.

“Buyer Indemnified Parties” shall have the meaning given such term in Section 10.01(a).

“Buyer UPE” shall have the meaning given such term in Section 7.01.

“C&O Agreement” shall mean that certain Construction and Operating Agreement between the Company and Access dated as of the date hereof.

“Cap” shall have the meaning given such term in Section 10.01(a).

“Casualty Loss” shall have the meaning given such term in Section 7.06.

“Charter Documents” shall mean, with respect to any Person, the article or certificate of incorporation, formation or organization and by-laws, limited partnership agreement, partnership agreement or limited liability company agreement, or such other organizational documents of such Person.

“Claim Notice” shall have the meaning given such term in Section 10.01(c).

“Claims” shall mean any and all claims, actions, suits, demands or other Proceedings, whether in the nature of judicial or prejudicial Proceedings, arbitration or mediation Proceedings, made or brought against a Person for recovery of Damages.

“Closing” shall have the meaning given such term in Section 3.01.

“Closing Date” shall have the meaning given such term in Section 3.01.

“Code” shall mean the Internal Revenue Code of 1986, as amended.

“Company” shall have the meaning given such term in the recitals hereof.

2

“Company Agreement” shall mean that certain First Amended and Restated Limited Liability Company Agreement between Seller and Access dated as of June 20, 2013 and attached hereto as Exhibit B.

“Company Interests” shall have the meaning given such term in the recitals hereof.

“Company Interests Assignment Agreement” shall have the meaning given such term in Section 3.02(a).

“Confidentiality Agreement” shall mean that certain Confidentiality and Non-Disclosure Agreement by and between Parent and Seller, dated July 18, 2012.

“Creditors’ Rights” shall have the meaning given such term in Section 4.02.

“Damages” shall mean any and all damages, judgments, losses, costs, penalties, fines, court costs, expenses (including reasonable attorneys’ fees) and Liabilities of any kind or character.

“Deductible” shall have the meaning given such term in Section 10.01(a).

“Easements” shall mean easements, rights-of-way, surface use agreements, surface lease agreements, line rights and real property licenses.

“Effective Time” shall mean 7:00 a.m. Central Time on July 1, 2012.

“Employee Benefit Plan” means any (i) employee pension benefit plan (as described in Section 3(2) of ERISA), (ii) employee welfare benefit plan (as described in Section 3(1) of ERISA), or (iii) incentive, deferred compensation, severance, stock option, bonus, vacation or other employee benefit plan, arrangement, agreement, and practice that relates to employee benefits, or any employment agreement, bonus program and any other arrangement subject to the requirements of Section 409A of the Code, whether or not subject to ERISA.

“Encumbrances” shall mean any lien, mortgage, deed of trust, security interest, pledge, hypothecation, option, charge, security interest, preferential purchase right, right of first refusal or other encumbrance.

“Environmental Legal Requirements” shall mean any and all Legal Requirements which relate in any manner or impose liability with respect to health, the environment, natural resources, pollution, a community’s right to know, worker protection, or the emission, discharge, release, treatment, storage, disposal, management, remediation, or other form of response to, Hazardous Materials, specifically including, without limitation, but by way of example, the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended, the Superfund Amendments and Reauthorization Act of 1986, as amended, the Resource Conservation and Recovery Act of 1976, as amended, the Clean Air Act, as amended, the Federal Water Pollution Control Act, as amended, The Oil Pollution Act of 1990, as amended, the Safe Drinking Water Act, as amended, the Hazardous Materials Transportation Act, as amended, the Toxic Substances Control Act, as amended, the Occupational Safety and Health Act of 1970, as amended, and other environmental conservation or protection Legal Requirements.

3

“Environmental Permits” shall mean all permits, licenses, certificates, registrations, exemptions, identification numbers, applications, consents, approvals, variances, notice of intent, and other authorizations necessary to comply with Environmental Legal Requirements.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means any entity that is considered a single employer with Seller or its Affiliate under ERISA Section 4001(b) or part of the same “controlled group” as Seller or its Affiliate for purposes of Sections 414(b) or (c) of the Code.

“Estimated Capex Amount” shall have the meaning given such term in Section 2.02(a).

“Fee Property” shall mean all real property owned by Company.

“Financial Statements” shall have the meaning given such term in Section 5.14.

“Fundamental Reps” shall have the meaning given such term in Section 9.01.

“GAAP” means generally accepted accounting principles of the United States, consistently applied.

“Gap” means any part of the Jackalope System not located on or under (i) the Fee Property or (ii) real property the subject of an Easement.

“GGPA” shall mean that certain Gas Gathering and Processing Agreement between the Company and Seller dated as of the date hereof.

“Governmental Entity” shall mean any court, governmental department, commission, council, board, bureau, agency or other judicial, administrative, regulatory, legislative or other instrumentality of the United States of America, tribal, state, county, municipality or local governmental body or political subdivision.

“Hazardous Materials” shall mean (a) any substances, materials, or wastes that are or become classified or regulated under any Environmental Legal Requirement; and/or (b) those substances, materials, or wastes included within statutory and/or regulatory definitions or listings of “hazardous substance,” “special waste” “hazardous waste,” “extremely hazardous substance,” “solid waste,” “regulated substance,” “hazardous materials,” “toxic substances,” “pollutant” or “contaminant” under any Environmental Legal Requirement.

“HSR Act” shall mean the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“HSR Approval Deadline” shall mean 5:00 p.m., Central Time, on the 75th day following the date of this Agreement.

4

“Improvements” shall mean all structures, fixtures and facilities located on the Fee Property and Easements, and all appurtenances attached to the Fee Property and Easements, including, without limitation, all buildings, gathering lines, pipelines, valves, fittings, storage tanks and pumping facilities.

“Indebtedness” of any Person means any obligations of such Person (a) for borrowed money, (b) evidenced by notes, bonds, indentures or similar instruments, (c) for the deferred purchase price of goods and services (other than trade payables incurred in the ordinary course of business), (d) under capital leases or (e) in the nature of guarantees of the obligations described in clauses (a) through (d) above of any other Person.

“Indemnified Party” shall have the meaning given such term in Section 10.01(c).

“Indemnifying Party” shall have the meaning given such term in Section 10.01(c).

“Jackalope System” shall have the meaning given such term in the recitals hereof.

“Knowledge”, wherever used in the phrase “to the knowledge of” Seller or to Seller’s “knowledge” or wherever it is said that Seller has or does not have “knowledge,” shall mean the actual knowledge of Jeffrey A. Bonney and Jacob S. Fowler, with no obligation of investigation or inquiry.

“Legal Requirement(s)” shall mean any applicable laws, statutes, codes, rules, regulations, ordinances, judgments, orders, memorandums of agreement, writs, decrees or guidance documents of any Governmental Entity having competent jurisdiction, in each case as in effect on and as interpreted on the date of this Agreement or on and as of the Closing Date, as applicable.

“Liability” shall mean any liability (including, without limitation, STRICT LIABILITY arising under Environmental Legal Requirements or otherwise), obligation, Indebtedness, expense, claim, loss, damage, or guaranty or endorsement of or by any Person, absolute or contingent, accrued or unaccrued, due or to become due, liquidated or unliquidated, regardless of whether such liability would be required to be disclosed on a balance sheet prepared in accordance with GAAP.

“Marketing Agreement” shall mean that certain Marketing Agreement between the Company and Buyer dated as of the date hereof.

“Material Adverse Effect” means any material adverse effect on the condition (financial or otherwise), operations, properties, assets or Liabilities of Company taken as a whole (whether or not covered by insurance).

“Material Contracts” shall mean any of the following types of contracts in effect on the date of this Agreement binding upon, affecting or relating to Company or the Assets:

(i) any contract, agreement or arrangement, that requires aggregate expenditures or payments of more than $50,000;

5

(ii) any contract, agreement or arrangement that can reasonably be expected to result in aggregate revenues of more than $50,000 during the current or any subsequent fiscal year or $100,000 in the aggregate over the primary term of such contract;

(iii) any contract, agreement or arrangement that may not be cancelled on ninety (90) days or fewer notice without liability or penalty or resulting in a breach thereunder;

(iv) any contract, agreement or arrangement containing provisions that restrict the right to engage in any type of business or compete in any geographic area and which provisions would be binding on Buyer or Company following the Closing;

(v) any partnership or joint venture agreement covering the Assets;

(vi) any security agreement, mortgage or other agreement creating an Encumbrance (other than Permitted Encumbrances);

(vii) any pipeline interconnect agreement, gas purchase agreement, gas gathering and compression services agreement, operator (including joint operator) agreements, compressor lease agreement, amine treating agreement, gas gathering and processing agreement, condensate sales agreement or NGL sales agreement;

(viii) any contract that is an indenture, mortgage, loan, credit or sale-leaseback, guaranty of any obligation, security agreement, assignment, pledge, bonds, letters of credit or similar financial contract or Indebtedness;

(ix) any contract that constitutes a lease under which Seller is the lessor or the lessee of real, immovable, personal or movable property which lease (A) cannot be terminated by Seller without penalty upon sixty (60) days or less notice and (B) involves an annual base rental of more than $50,000;

(x) any contract among or between Seller, on the one hand, and any Affiliate of the Seller, on the other hand;

(xi) any contract where the primary purpose thereof was to indemnify a third party;

(xii) any executory contract that constitutes a pending purchase and sale agreement or other contract providing for the purchase, sale or earning of any material asset;

(xiii) any contract that constitutes a swap, sale or other exchange of commodities or other hedging agreement;

(xiv) any contract the termination of which would result in a Material Adverse Effect; or

(xv) any contract that is otherwise material to the business or the ownership and operation of Company.

6

“NGL” shall mean natural gas liquids.

“Notice Period” shall have the meaning given such term in Section 10.01(c).

“Objection Report” shall have the meaning given such term in Section 2.03(a).

“Outside Date” shall mean 5:00 p.m., Central Time, on the 90th day following the date of this Agreement.

“Party(ies)” shall have the meaning given such term in the introductory paragraph hereof.

“Permits” shall mean all permits, Environmental Permits, licenses, certificates, authorizations, registrations, orders, waivers, variances and approvals granted by any Governmental Entity affecting or pertaining to the Assets, or for which Seller has filed or applied, for the ownership and/or operation of the Real Property and/or the Tangible Personal Property, to the extent the same are assignable.

“Permitted Encumbrances” shall mean the following matters:

(i) Any lien for Taxes that are not yet due and payable or, if delinquent, that are being contested in good faith;

(ii) Materialmen’s, mechanic’s, repairmen’s, employees’, contractors’, tax and other similar liens or charges arising in the ordinary course of business for obligations that are not delinquent or that will be paid and discharged in the ordinary course of business or, if delinquent, that are being contested in good faith;

(iii) Preferential rights to purchase and required third-party consents to or approvals of or waivers respecting assignments and similar agreements with respect to which waivers or consents, approvals or waivers are obtained from the appropriate parties prior to Closing;

(iv) All rights reserved to or vested in any Governmental Entity to control or regulate any of the real property interests constituting a part of the Assets;

(v) All easements, restrictions, reservations, contracts, rights-of-way, agreements, terms, conditions and covenants now of record to the extent (but no further) that each such matter described or referred to in this clause is valid and subsisting as of the date hereof and affects the Real Property;

(vi) Any matters that are waived without reservation in writing by Buyer or otherwise released or satisfied by Seller on or prior to the Closing Date; and

(vii) Consents and approvals that are customarily obtained after sale and conveyance.

7

“Person” shall mean an individual, a corporation, a partnership, a limited liability company, an association, a trust or any other legal entity or organization, including any Governmental Entity.

“Proceeding” means any action, suit, litigation, arbitration, lawsuit, claim, proceeding (including any civil, criminal, administrative, investigative or appellate proceeding), prosecution, contest, hearing, inquiry, inquest, audit, examination, investigation, challenge, controversy or dispute commenced, brought, conducted or heard by or before, or otherwise involving, any Governmental Entity or any arbitrator.

“Purchase Price” shall have the meaning given such term in Section 2.02(a).

“Real Property” shall mean the Fee Property, Easements and Improvements, collectively.

“Real Property Lease” and “Real Property Leases” shall have the meaning given such term in Section 5.05(e).

“Required Consents” shall mean those waivers, approvals, consents, filings and notices which are required to be made by or given to Seller to transfer the Company Interests as contemplated herein, as further set forth on Schedule 8.01(e).

“Seller” shall have the meaning given such term in the introductory paragraph hereof.

“Seller Indemnified Parties” shall have the meaning given such term in Section 10.01(b).

“Settlement Statement” shall have the meaning given such term in Section 2.03(a).

“Side Letter” shall mean that certain Letter Agreement between Parent, Seller and Buyer dated as of the date hereof.

“Tangible Personal Property” shall mean, to the extent the same do not constitute Improvements, all fittings, tools, spare parts, racks, rectifiers, cathodic protection devices, storage tanks, machinery, equipment, pumps, engines, pipes, valves, connections, gates, pig launchers and receivers, lines, wires, computer hardware, motor vehicles, trailers and other tangible personal property located on the Real Property.

“Tax Return” shall mean any return, report, election, document, estimated tax filing, declaration, claim for refund, information return or other similar filing provided to any Governmental Entity with respect to any Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Taxes” shall mean all applicable federal, state and local income, margins, capital gains, capital stock, gross receipts, sales, use, ad valorem, transfer, franchise, profits, withholding, service, occupation, payroll, real property, windfall profits, employment, social security,

8

unemployment, disability, environmental, alternative minimum, add-on, value-added, excise, severance, stamp, property, or other taxes imposed by a Governmental Entity having jurisdiction, together with any estimated taxes, deficiency assessments, additions to tax, interest and penalties, whether disputed or otherwise, with respect thereto.

“Transfer Taxes” shall mean any sales, use, transfer, excise, stock, stamp, document, filing, recording, authorization and/or similar taxes, fees and charges levied by a Governmental Entity.

“Valuation Objection Report” shall have the meaning set forth in Section 3.03(a).

“Valuation Schedule” shall have the meaning set forth in Section 3.03(a).

ARTICLE 2

PURCHASE AND SALE

2.01 Purchase and Sale. On the Closing Date, Seller shall sell, assign, transfer and convey to Buyer (or its designated subsidiary), and Buyer (or its designated subsidiary) shall purchase the Company Interests, on the terms and subject to the conditions set forth in this Agreement.

2.02 Purchase Price at Closing.

(a) The purchase price for the Company Interests shall be the sum (such sum, the “Purchase Price”) of (i) Seventy Five Million and 00/100 Dollars ($75,000,000.00), plus (ii) the amount (the “Estimated Capex Amount”) estimated in good faith by the Parties equal to (A) the amount of capital expenditures (but excluding any interest or similar payments with respect thereto) made by Seller with respect to the Jackalope System for the period beginning on the Effective Time and ending on the Closing Date, less (B) an amount equal to 50% of the revenue of Company, net of 50% of the operating expenses of Company, in each case for the period beginning on the Effective Time and ending on the Closing Date. The Purchase Price shall be adjusted after Closing in accordance with Section 2.03.

(b) Payment of the Purchase Price shall be made at Closing by wire transfer of immediately available funds to the bank account designated in writing by Seller to Buyer two (2) Business Days prior to Closing.

2.03 Post-Closing Adjustments.

(a) As soon as commercially practicable, but not later than one hundred fifty (150) days after the Closing Date, Buyer shall prepare and deliver to Seller a statement (the “Settlement Statement”) setting forth (i) the actual amount of capital expenditures made by Seller with respect to the Jackalope System for the period beginning on the Effective Time and ending on the Closing Date (the “Actual Capex”), (ii) an amount equal to 50% of the actual amount of revenue of Company, net of 50% of the operating expenses of Company, in each case for the period beginning on the Effective Time and ending on the Closing Date (the “Actual Proceeds”),

9

and (iii) the amount by which the Actual Capex exceeds the Actual Proceeds (the “Actual Capex Amount”). As may be requested by either Party, Buyer or Seller, as applicable, shall promptly furnish to the requesting Party all information that it or its Affiliates may have that is useful to Buyer or Seller, as applicable, in the calculation or verification of the Settlement Statement. Should Seller dispute any amount shown as payable by Seller or payable by Buyer under the Settlement Statement, Seller shall deliver to Buyer a written report (the “Objection Report”) containing any changes that Seller proposes to be made to the Settlement Statement no later than thirty (30) days after Seller’s receipt of the Settlement Statement. If Seller provides a notice of agreement or does not deliver an Objection Report to Buyer within such 30-day period, then Seller shall be deemed to have accepted the calculations and amounts set forth in the Settlement Statement delivered by Buyer, which shall then be final, binding and conclusive for all purposes hereunder.

(b) In the event Seller does deliver an Objection Report to Buyer within such 30-day period, Buyer and Seller shall undertake to agree upon a final resolution of the amounts owing under the Settlement Statement not later than two hundred ten (210) days after the Closing Date should Seller dispute any amount thereunder. If Seller timely proposes changes to the Settlement Statement and thereafter Seller and Buyer are unable to agree upon the final resolution Settlement Statement within two hundred ten (210) days after the Closing Date, a mutually acceptable, nationally recognized, accounting firm not performing services for either Buyer or Seller shall be designated to act as an arbitrator (failing such mutual agreement, the American Arbitration Association shall nominate an accountant or accounting firm in accordance with its established procedures), and such arbitrator shall decide all points of disagreement with respect to the Settlement Statement. Such decision shall be binding upon both Parties. The costs and expenses of the arbitrator shall be shared equally by Seller and Buyer pursuant to the arbitrator’s standard engagement letter. Upon the acceptance or deemed acceptance of the Settlement Statement by the Parties or the resolution of all disputes thereof, then within five (5) Business Days thereafter, Seller shall pay, in immediately available funds to an account designated by Buyer, the amount by which the Estimated Capex Amount exceeds the Actual Capex Amount, or Buyer shall pay, in immediately available funds to an account designated by Seller, the amount by which the Actual Capex Amount exceeds the Estimated Capex Amount.

2.04 Parent Liability. Parent hereby irrevocably and unconditionally agrees to be jointly and severally liable for the full, complete and timely performance by Buyer of all of Buyer’s obligations under this Agreement.

ARTICLE 3

PURCHASE AND SALE AND CLOSING

3.01 Time and Place of Closing. Subject to the terms and conditions stated in this Agreement, the consummation of the transactions contemplated hereby (the “Closing”) shall occur (a) five (5) Business Days after the satisfaction or waiver of each Party’s closing conditions as set forth in Section 8.01 and Section 8.02, or (b) on such other date as the Parties may mutually agree in writing; provided, however, that in no event shall the Closing occur before June 26, 2013. The Closing shall be held at the offices of Locke Lord LLP, located at 600 Travis St., Suite 2800, Houston, Texas. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date.”

10

3.02 Closing Deliveries.

(a) At the Closing, Seller shall execute and deliver (or cause to be executed and delivered, as appropriate) to Buyer the following:

(i) an executed counterpart by Seller of an assignment of the Company Interests (the “Company Interests Assignment Agreement”) in substantially the form attached hereto as Exhibit C evidencing the assignment and transfer to Buyer or a subsidiary of Buyer of the Company Interests held by Seller;

(ii) releases of any Encumbrances filed against the Company Interests or the Assets and releases of any guarantees made by the Company or otherwise affecting the Company Interests or the Assets;

(iii) the appropriate Foreign Investment in Real Property Tax Act affidavits in a form acceptable to both Parties;

(iv) a certificate of good standing or existence of Seller from its state of formation dated not more than ten (10) days prior to the Closing Date;

(v) a certificate from an officer of Seller as required by Section 8.01(a) of this Agreement; and

(vi) such other instruments as may be reasonably requested by Buyer in order to effectively transfer the Company Interests to Buyer.

(b) At the Closing, Buyer shall execute and deliver (or cause to be executed and delivered, as appropriate) to Seller the following:

(i) Buyer shall pay the Purchase Price to Seller as described in Section 2.02(a) and (b);

(ii) an executed counterpart by Buyer of the Company Interests Assignment Agreement;

(iii) a certificate of good standing or existence of Buyer from its state of formation dated not more than ten (10) days prior to the Closing Date;

(iv) a certificate from an officer of Buyer as required by Section 8.02(a) of this Agreement; and

(v) such other instruments as may be reasonably requested by Seller in order to effectively transfer the Company Interests to Buyer.

11

3.03 Valuation Schedule.

(a) As soon as commercially practicable, but not later than ninety (90) days after the Closing Date, Buyer shall prepare and deliver to Seller a schedule (the “Valuation Schedule”) setting forth the respective gross fair market values and character of each category of the Assets of Company to be used for purposes of Code Sections 743, 751 and 754 and the Treasury Regulations promulgated thereunder. As may be requested by either Party, Buyer or Seller, as applicable, shall promptly furnish to the requesting Party all information that it or its Affiliates may have that is useful to Buyer or Seller, as applicable, in the calculation or verification of the Valuation Schedule, subject to the right of each Party to refrain from disclosing or making available any proprietary information, any written or oral communications that are subject to the attorney-client privilege and any documents that are covered by the work product doctrine. Should Seller dispute any amount shown on the Valuation Schedule, Seller shall deliver to Buyer a written report (the “Valuation Objection Report”) containing any changes that Seller proposes to be made to the Valuation Schedule no later than thirty (30) days after Seller’s receipt of the Valuation Objection Report. If Seller provides a notice of agreement or does not deliver a Valuation Objection Report to Buyer within such 30-day period, then Seller shall be deemed to have accepted the allocations and amounts set forth in the Valuation Schedule delivered by Buyer, which shall then be final, binding and conclusive for all purposes hereunder.

(b) In the event Seller does deliver a Valuation Objection Report to Buyer within such 30-day period, Buyer and Seller shall undertake to agree upon a final resolution of the Valuation Schedule not later than one hundred sixty (160) days after the Closing Date should Seller dispute any amount thereunder. If Seller timely proposes changes to the Valuation Schedule and thereafter Seller and Buyer are unable to agree upon the final resolution Valuation Schedule within one hundred sixty (160) days after the Closing Date, a mutually acceptable, nationally recognized, accounting firm not performing services for either Buyer or Seller shall be designated to act as an arbitrator (failing such mutual agreement, the American Arbitration Association shall nominate an accountant or accounting firm in accordance with its established procedures), and to decide all points of disagreement with respect to the Valuation Schedule, such decision to be final, binding and conclusive upon both Parties. The costs and expenses of the arbitrator shall be shared equally by Seller and Buyer pursuant to the arbitrator’s standard engagement letter.

(c) Each Party shall report the transactions contemplated hereby on all Tax Returns in a manner consistent with the final Valuation Schedule. If, contrary to the intention of the Parties as expressed in this Section 3.03, any Governmental Entity makes or proposes an allocation different from the final Valuation Schedule, the Parties shall cooperate with each other in good faith to contest such Governmental Entity’s allocation (or proposed allocation), provided, however, that, after consultation with the Party (or Parties) adversely affected by such allocation (or proposed allocation), the other Party (or Parties) may file such protective claims or Tax Returns as may be reasonably required to protect its (or their) interests.

12

ARTICLE 4

REPRESENTATIONS AND WARRANTIES REGARDING SELLER

Seller represents and warrants to Buyer the following:

4.01 Organization. Seller is a limited liability company duly formed, validly existing and in good standing under the Legal Requirements of its jurisdiction of formation.

4.02 Authority. Seller has all requisite limited liability company power and authority to execute and deliver this Agreement, and Seller has all requisite limited liability company power and authority to perform its obligations hereunder and to consummate the transactions contemplated by this Agreement. The execution and delivery by Seller of this Agreement, and the performance by Seller of its obligations hereunder, have been duly and validly authorized by all necessary limited liability company action. This Agreement has been duly and validly executed and delivered by Seller and constitutes the legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium or other similar Legal Requirements relating to or affecting the rights of creditors generally, or by general equitable principles (collectively, “Creditors’ Rights”).

4.03 No Conflicts; Consents and Approvals. The execution and delivery by such Seller of this Agreement do not, and the performance by Seller of its obligations under this Agreement and the consummation by Seller of the transactions contemplated by this Agreement does not:

(a) violate or result in a breach of the Charter Documents of Seller;

(b) assuming all of the Required Consents have been obtained or made, violate or result in a breach of or default under any Material Contract to which Seller is a party; and

(c) assuming all Required Consents on Schedule 8.01(e) and other notifications provided in the ordinary course of business have been made, obtained or given, (i) violate or result in a breach of any Law or Order applicable to Seller or (ii) require any consent or approval of, or notice to, or filing or registration with, any Governmental Authority under any Law or Order applicable to Seller.

except, in the case of clauses (a) and (b), for such violations or defaults, or such failures to make or obtain consents, approvals, notices, filings or registrations which would not reasonably be expected to result in a material adverse effect on Seller’s ability to perform its obligations hereunder.

4.04 Title to Company Interests. Seller owns, holds of record and is the beneficial owner of the Company Interests free and clear of all Encumbrances and restrictions on transfer other than those arising pursuant to (i) this Agreement, (ii) the Charter Documents of Company, or (iii) applicable securities Legal Requirements.

13

4.05 Legal Proceedings. There is no Proceeding pending or, to Seller’s Knowledge, threatened against Seller by or before any Governmental Entity, which seeks an order restraining, enjoining or otherwise prohibiting or making illegal any of the transactions contemplated by this Agreement.

4.06 Brokers. Seller has no liability or obligation to pay fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement for which Buyer, or after the Closing, Company, could become liable or obligated.

4.07 No Tax Partnership. Prior to the date of this Agreement, RKI did not treat any part of the Jackalope System (including its interest therein) as being subject to the provisions of subchapter K, chapter 1 of the Code.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES REGARDING COMPANY

Seller represents and warrants to Buyer the following:

5.01 Organization and Qualification. Company is a limited liability company duly organized, validly existing and in good standing under the Legal Requirements of the State of Oklahoma. Company has all requisite limited liability company power and authority to carry on its business as now being conducted and to own, lease and operate its properties and assets as now owned, leased or operated, and to perform all its obligations under the agreements and instruments to which it is a party or by which it is bound.

5.02 Consents and Approvals; No Violation. The execution and delivery of this Agreement by Seller and the consummation by Seller of the transactions contemplated hereby will not:

(a) entitle any Person to exercise any preferential purchase right, option to purchase or similar right with respect to any of the Company Interests;

(b) conflict with or violate any provision of the Charter Documents of Company;

(c) result in a material violation or material breach of, or constitute (with or without due notice or lapse of time or both) a material default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, contract, agreement, commitment, bond, mortgage, indenture, license, lease, pledge agreement or other instrument or obligation to which Company is a party or by which Company or any of its Assets may be bound;

(d) violate or conflict with any provision of any Legal Requirement binding upon Company;

(e) result in, or require, the creation or imposition of, any Encumbrance upon or with respect to any of the Assets; or

14

(f) require Company to obtain or make any material waiver, consent, action, approval, clearance or authorization of, or registration, declaration or filing with, any Governmental Entity, other than the Required Consents and such approval as may be required to be obtained under the HSR Act.

5.03 Ownership. Company has no subsidiaries nor does the Company own any equity interests in any Person. Company is not a party to any Contract for the purchase, subscription, allotment or issue of any unissued equity interests or other equity securities of Company other than those arising pursuant to the Charter Documents of Company. Except for the Charter Documents of Company, none of the Company Interests are subject to any voting trust, member or partnership agreement or voting agreement. The Company Interests are duly authorized, validly issued, fully paid and nonassessable.

5.04 Material Contracts.

(a) Schedule 5.04(a) lists all Material Contracts. Seller or Company has furnished or made available to Buyer true, complete and correct copies of all written Material Contracts, together with amendments thereto. All of the Material Contracts are legal, valid and binding obligations of the parties thereto, enforceable in accordance with their terms, and are in full force and effect, subject to Creditors’ Rights. To Seller’s Knowledge, there are no current renegotiations of any amounts paid or payable to Company under current Material Contracts with any Person having the contractual or statutory right to demand or require such renegotiation, and no such Person has made written demand for such renegotiation.

(b) Neither the Company, nor any counterparty thereto, is in default under any Material Contract, and no termination, condition or other event has occurred which (whether with or without notice, lapse of time or the happening or occurrence of any other event) could reasonably be expected to constitute a material breach or default thereunder. Neither Seller nor, to Seller’s Knowledge, Company has received any written communication from, or given any written communication to, any other party indicating that Company or such other party, as the case may be, is in default under any Material Contract.

5.05 Real Property.

(a) Neither Seller nor, to Seller’s Knowledge, Company has received written notice or otherwise been formally advised that any Real Property, or any present use or operation of the Real Property by Company, does not comply with all applicable Legal Requirements (other than Environmental Legal Requirements which are covered by Section 5.10) and all valid covenants, conditions, restrictions, easements and similar matters affecting the Real Property.

(b) All Taxes (and applicable penalties and interest, if any) that are due and payable with respect to Company’s interest in the Real Property have been paid at or prior to the Closing Date.

15

(c) There are no outstanding options, rights of first offer, rights of first refusal, or other similar contracts or rights to purchase the Real Property or any portion thereof or interest therein.

(d) Schedule 5.05(d) sets forth and described a true, correct and complete list of all real property held in fee by the Company.

(e) With respect to each parcel of real property and interest in real property leased or subleased to Company, each of which is listed on Schedule 5.05(e) (individually, a “Real Property Lease” and collectively the “Real Property Leases”):

(i) each Real Property Lease will continue to be enforceable on identical terms following the consummation of the transactions contemplated by this Agreement;

(ii) neither Company nor any counterparty thereto is in default under any Real Property Lease, and no termination, condition or other event by Company or any counterparty thereto has occurred which (whether with or without notice, lapse of time or the happening or occurrence of any other event) would constitute a breach or default thereunder;

(iii) neither Company nor any counterparty thereto has repudiated any provision of any Real Property Lease; and

(iv) there are no Proceedings in effect as to any Real Property Lease.

(f) The Parties acknowledge that the Jackalope System is not a complete system, that parts of the Jackalope System remain to be built out, and that Company does not (and on the Closing Date will not) own all Easements that may be required for operation of the Jackalope System pursuant to such build-out. Schedule 5.05(f) sets forth a true, correct and complete list (including, to the extent such information is readily available to Seller, location by state, county, date, grantor, grantee, recording volume number and recording volume page number or document number, as applicable) of all Easements owned by Company on the date hereof. There are no Gaps (including any Gap arising as a result of any breach by Company of the terms of any Easement) in the Easements other than (i) in respect of parts of the Jackalope System that remain under construction or (ii) Gaps that have not and could not reasonably be expected to, individually or in the aggregate, materially impair the business of Company in the gathering of natural gas from wells connected to the Gathering System on the date hereof.

5.06 Title and Condition. Subject to Permitted Encumbrances, Company: (a) has good and marketable title to the Fee Property and Easements; and (b) has good and marketable title to, or a valid leasehold or other contractual interest in, all of the Improvements and Tangible Personal Property. There are no outstanding agreements or options which grant to any Person the right to purchase or otherwise acquire any of the Assets, other than those which will be waived pursuant to the Required Consents. The Assets constitute all of the material tangible assets that are necessary to operate the business of Company as currently conducted, except for such assets as may be required for operation of the Jackalope System pursuant to any further build-out of the Jackalope System.

16

5.07 Permits. Schedule 5.07 lists all material Permits. (a) Company is the lawful licensee or permittee under all Permits; (b) each such Permit is in full force and effect; and (c) Company is in compliance with all material obligations with respect thereto. All fees and other payments due and owing under the Permits prior to the date hereof and prior to the Closing Date, as applicable, and in each case attributable to the Company Interests, have been paid in full. Company has all Permits required for the continued conduct of the business of Company, except for such Permits as may be required for construction and operation of the Jackalope System pursuant to any further build-out of the Jackalope System. There is no formal Proceeding pending by, nor has Seller or Company received a notice of any pending investigation or Proceeding by any Governmental Entity modifying, suspending, revoking, withdrawing, or terminating any such Permit.

5.08 Compliance with Laws. Company is in compliance in all material respects with all Legal Requirements applicable to the ownership, use or operation of the Assets.

5.09 Legal Proceedings. There are no civil, criminal, administrative, arbitration or other Proceedings pending or, to Seller’s Knowledge, threatened against Company, and there are no governmental investigations pending or, to Seller’s Knowledge, threatened against Company.

5.10 Environmental Matters. The ownership, use, maintenance and operations of the Assets, and the conduct of Company’s business, are, to Seller’s Knowledge, in compliance in all material respects with all Environmental Legal Requirements. Seller has not received any written notice alleging that Company or the Assets or any operations thereon are not in compliance with all applicable Environmental Legal Requirements, which notice has not been fully and finally resolved. The ownership, operation, or condition of any of the Assets is not subject to any consent order, compliance order or administrative order relating to or issued under any Environmental Legal Requirement directed specifically to or specifically concerning the Assets. No Hazardous Materials have been disposed of or released at, on, under, about or from any of the Assets by Company or its Affiliates or, to Seller’s Knowledge, any other Person, except in compliance with, or as would not give rise to Liability under, Environmental Legal Requirements.

5.11 Taxes. For the periods ending on or before the Closing Date, Company has not been required to file any Tax Return, and (a) there is no claim or adjustment pending by any Governmental Entity in connection with any Tax relating to Company; (b) no Tax Returns are under audit or examination by any Governmental Entity; (c) there are no agreements or waivers currently in effect that provide for an extension of time with respect to the filing of any Tax Return relating or the assessment or collection of any Tax relating to Company or the Assets; and (d) Company is not a party to any Tax allocation or sharing arrangement. Prior to the Closing, Seller shall use its reasonable endeavors as a non-operator of the Assets and a non-managing member of the Company to request Company not to (y) take any action to amend any Tax Return or settle or compromise any federal, state, local or foreign Tax liability or enter into any agreement or preliminary settlement with any Governmental Entity concerning Taxes or (z) file

17

with, or provide to, any Governmental Entity any waiver extending the statutory period for assessment or reassessment of Taxes or any other waiver of restrictions on assessment or collection of any Taxes.

5.12 Employees and Employee Benefits.

(a) Neither Company nor any of its ERISA Affiliates sponsors, maintains, or contributes to, or have any obligation or liability under any Employee Benefit Plan. None of the Employee Benefit Plans provides medical or death benefits with respect to current or former employees beyond their termination of employment, other than coverage mandated by Sections 601-608 of ERISA, Section 4980B of the Code or applicable state law.

(b) Neither Company nor any of its ERISA Affiliates have within the last six (6) years had an obligation to contribute to, or had any liability, including any contingent liability, with respect to, a “defined benefit plan,” as defined in Section 3(35) of ERISA, a pension plan subject to the minimum funding standards of Section 302 of ERISA or Section 412 of the Code, or a “multiemployer plan,” as defined in Section 3(37) of ERISA.

(c) Company is in material compliance with all Legal Requirements respecting employment and employment practices (including all immigration and I-9 obligations), terms and conditions of employment, wages, hours of work and occupational safety and health, and is not engaged in any unfair labor practices as defined in the National Labor Relations Act or other applicable Legal Requirements.

5.13 Brokers. Neither Company nor any of its Affiliates has entered (directly or indirectly) into any agreement with any Person that provides for the payment of any commission, brokerage or “finders’ fee” arising out of the transactions contemplated by this Agreement for which Buyer or Company will have any Liability or obligation.

5.14 Financial Statements. Attached hereto as Schedule 5.14 are: (a) the unaudited balance sheet of Company as of September 30, 2012 for the three months then ended; (b) the unaudited balance sheet of Company as of December 31, 2012 for the three months then ended; (c) the unaudited balance sheet of Company as of March 31, 2013 (the “Balance Sheet Date”) for the three months then ended, and (d) in each case, the related unaudited statements of income and cash flow (collectively, the “Financial Statements”). The Financial Statements fairly present the financial condition and results of operations of Company as of the respective dates thereof and for the periods therein referred. The Financial Statements referred to in this Section reflect the consistent application of accounting principles used therein throughout the periods involved.

5.15 Absence of Undisclosed Liabilities. From and after the Balance Sheet Date, Company has not incurred any Liabilities (whether absolute, accrued, contingent or otherwise) of any nature, except Liabilities (a) which would not be required to be accrued or disclosed on Company’s balance sheet, related statements of income, members equity and cash flows under GAAP; (b) which were incurred in the ordinary course of business consistent with past practice; or (c) which are disclosed in Schedule 5.15 hereto.

18

5.16 Absence of Changes. Since December 31, 2012, there has not been: (a) any damage, destruction or loss, whether covered by insurance or not, materially and adversely affecting the Assets; (b) any sale, assignment, lease, transfer, license, abandonment or other disposition by Company of any interest in the Assets; or (c) any agreement to do any of the foregoing. Since December 31, 2012, the Assets have been operated and maintained in the ordinary course of business consistent with past practices as a gathering system that remains under construction.

5.17 Insurance. Schedule 5.17 sets forth a true, correct and complete list of all insurance policies owned by Company or by which Company or the Assets are covered against Liabilities, all of which are now in full force and effect. Except as set forth in Schedule 5.17, all policies to which Company is a party are in full force and effect, all premiums with respect thereto covering all periods up to and including the Closing Date have been paid, and, to Seller’s Knowledge, no pending notice of default, cancellation or termination has been received by Company.

5.18 Future Delivery of Hydrocarbons. Company is not obligated by virtue of any prepayment arrangement under any contract for the sale of hydrocarbons or forward sale of production obligation to deliver hydrocarbons at some future time without receiving full payment therefor at or after the time of delivery.

5.19 Regulation. Company is not subject to regulation under any applicable U.S. state Legal Requirements or regulations (a) as a “public utility,” “public service company” or similar designation(s), or as a “holding company” or similar designation of such regulated entity, or (b) respecting the rates charged by, or the financial or organizational regulation of, public utilities, common carriers or their affiliates. Neither the Assets nor the business of Company as currently owned and operated is subject to regulation under the Natural Gas Act or the Natural Gas Policy Act of 1978, as amended.

ARTICLE 6

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller the following:

6.01 Organization and Qualification. Buyer is a limited partnership duly organized, validly existing and is in good standing under the Legal Requirements of the State of Delaware. Buyer has all requisite limited partnership power and authority to carry on its business as now being conducted and to own, lease and operate its properties and assets as now owned, leased or operated, and to perform all its obligations under the agreements and instruments to which it is a party or by which it is bound.

6.02 Approval and Enforceability. The execution and delivery of this Agreement by Buyer and the performance of the transactions contemplated hereby have been duly and validly approved by all requisite company or partnership action, as applicable, necessary on behalf of Buyer. This Agreement constitutes the legal, valid and binding obligation of Buyer, enforceable

19

against Buyer in accordance with its terms, subject to Creditors’ Rights. At the Closing, all documents required hereunder to be executed and delivered by Buyer will have been duly authorized, executed and delivered by Buyer and will constitute legal, valid and binding obligations of Buyer, enforceable against Buyer in accordance with its terms, subject to Creditors’ Rights.

6.03 No Violation or Consent. The execution and delivery of this Agreement by Buyer and the consummation by Buyer of the transactions contemplated hereby will not:

(a) result in a material violation or material breach of, or constitute (with or without due notice or lapse of time or both) a material default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, contract, agreement, commitment, bond, mortgage, indenture, license, lease, pledge agreement or other instrument or obligation to which Buyer is a party or by which Buyer or any of its properties or assets may be bound; or

(b) require Buyer to obtain or make any material waiver, consent, action, approval, clearance or authorization of, or registration, declaration or filing with, any Governmental Entity, other than such approval as may be required to be obtained under the HSR Act.

6.04 Brokers. Neither Buyer nor any of its Affiliates has entered (directly or indirectly) into any agreement with any Person that provides for the payment of any commission, brokerage or “finders’ fee” arising out of the transactions contemplated by this Agreement for which Seller might have any Liability or obligation.

6.05 Legal Proceedings. There are no civil, criminal, administrative, arbitration or other Proceedings pending or, to Buyer’s knowledge, threatened against Buyer or any of its Affiliates, and there are no governmental investigations pending or, to Buyer’s knowledge, threatened against Buyer, that seek to restrain or enjoin the transactions contemplated by this Agreement.

ARTICLE 7

ADDITIONAL AGREEMENTS OF THE PARTIES

7.01 HSR Act. In the event approval under the HSR Act is required for the consummation of the transactions contemplated by this Agreement, from the date of this Agreement until the Closing, (a) Seller shall, and shall cause its respective Affiliates to, and (b) Buyer shall request that the Buyer UPE (as defined below) shall: (i) use reasonable efforts to make or cause to be made the filings required of such Party or any of its Affiliates under the HSR Act with respect to the transactions contemplated by this Agreement, and take any action necessitated by such filings, in each case as promptly as is reasonably practicable; (ii) cooperate with the other Party and furnish all information in such Party’s possession that is necessary in connection with such other Party’s filings; (iii) use reasonable efforts to cause the expiration of the notice or waiting periods under the HSR Act with respect to the transactions contemplated hereby as promptly as reasonably possible; (iv) promptly inform the other Party of any

20

communication from or to, and any proposed understanding or agreement with, any Governmental Entity in respect of such filings; (v) consult and cooperate with the other Party in connection with any analyses, appearances, presentations, memoranda, briefs, arguments and opinions made or submitted by or on behalf of any Party in connection with all meetings, actions and Proceedings with any Governmental Entity relating to such filings; (vi) comply, as promptly as is reasonably practicable, with any requests received by such Party or any of its Affiliates under the HSR Act or any related Legal Requirements for additional information, documents or other materials; (vii) use reasonable efforts to resolve any objections as may be asserted by any Governmental Entity with respect to the transactions contemplated by this Agreement; and (viii) use reasonable efforts to contest and resist any action or Proceeding instituted (or threatened in writing to be instituted) by any Governmental Entity challenging the transactions contemplated by this Agreement as violative of the HSR Act or any other Legal Requirement. The Parties acknowledge that the Person anticipated to be the ultimate parent entity of Buyer upon the closing of the transactions contemplated by this Agreement (the “Buyer UPE”) is not an Affiliate of Buyer as of the date hereof. In the event such Buyer UPE is unable to obtain approval under the HSR Act or such Buyer UPE will not be the ultimate parent entity of Buyer upon the closing of the transactions contemplated by this Agreement, then Buyer shall, and shall cause its Affiliates to, comply with the provisions set forth in clauses (i) – (viii) above. If a Party intends to participate in any meeting with any Governmental Entity with respect to such filings, it shall give the other Party reasonable prior notice of, and an opportunity to participate in, such meeting. Notwithstanding the foregoing, nothing contained in this Agreement requires Buyer or any its Affiliates to take any action with respect to any of the assets or businesses of Buyer or any of its Affiliates, or the Jackalope System or any of the Company Interests, or any combination thereof, if such action would require any assets or businesses to be divested or held separately by Buyer. Seller and Buyer shall each bear and pay one-half of the initial filing fees required to be paid by Seller or Buyer, and any other applicable fees required to be paid by Seller or Buyer under the HSR Act shall be paid by such required party.

7.02 Access. The Parties acknowledge that Seller is not the operator of the Jackalope System or the managing member of the Company, and does not have general authority or control in respect of the actions of the Company or the operation of the Jackalope System. Until the earlier of the Closing Date or termination of this Agreement, Seller shall use its reasonable endeavors as a non-managing member of the Company to request that Buyer shall have reasonable access to the business, properties and employees of Company and information concerning its financial and legal condition, provided that such access shall not interfere with normal operations of Company. Seller agrees to request, at Buyer’s request, that the Company permit Buyer and its authorized representatives to have, after the date hereof and until the earlier of the Closing Date or termination of this Agreement, reasonable access to the accounting, real property and operational records and documents which relate to Company during normal business hours. The officers of Seller will furnish Buyer with such existing financial and operating data and other information in Seller’s possession with respect to Seller’s investment in the Jackalope System as Buyer shall from time to time reasonably request. Buyer shall coordinate all of its requests for such access through Seller, and shall provide reasonable advance notice of each such request. No investigation by Buyer heretofore or hereafter made, or knowledge by Buyer, its Affiliates or its or their respective employees of any of breach of Seller’s representations, warranties or covenants, shall affect the representations, warranties and covenants of Seller or Buyer’s right to indemnification as provided in this Agreement, and each such representation, warranty and covenant shall survive any such investigation.

21

7.03 Required Consents. Seller shall use its reasonable efforts to obtain the Required Consents, and Buyer shall provide Seller with any information and assistance reasonably requested by Seller in relation thereto.

7.04 Operation of Business. From the date of this Agreement until Closing, Seller shall use its reasonable endeavors as a non-operator of the Assets and a non-managing member of the Company to request that Company shall operate its business in the ordinary course and substantially in accordance with its past operating and maintenance practices, and Seller shall cause Company not to, without the prior written consent of Buyer (which shall not be unreasonably withheld or delayed): (a) sell, assign, transfer, lease, or otherwise dispose of any of the material Assets; (b) approve or consent to any Unanimous Voting Item (as defined in the Company Agreement); (c) liquidate, dissolve, recapitalize or otherwise wind up its business; (d) merge or consolidate with, or purchase any equity interests in, or make an investment in any Person; or (e) agree, whether in writing or otherwise, to do any of the foregoing.

7.05 Cooperation and Preservation of Books and Records. The Parties recognize that the Parties and their respective Affiliates may need access, from time to time, after the Closing Date, to certain accounting and Tax records and information held by the other Party; therefore, the Parties shall (a) use commercially reasonable efforts to properly retain and maintain such records until the thirtieth (30th) day following the last date on which the period to which such records relate is subject to audit by any Governmental Entity, and (b) subject to the right of each Party to refrain from disclosing or making available any proprietary information, any written or oral communications that are subject to the attorney-client privilege and any documents that are covered by the work product doctrine, allow the requesting Party and its respective agents and other representatives, at times and dates mutually acceptable to the Parties, to inspect, review, and make copies of such records as the requesting Party may deem necessary or appropriate from time to time for use in connection with the preparation of Tax Returns or in connection any Proceeding, Claim or Tax audit. Such inspection, review and copying of records shall be conducted during normal business hours and at the requesting Party’s expense.

7.06 Casualty Loss. If physical damage to, destruction of, or condemnation or taking under any right of eminent domain of any of the Assets occurs between the date of this Agreement and Closing (a “Casualty Loss”) and such Casualty Loss exceeds ten percent (10%) of the Purchase Price, either Party may, by notice to the other Party, terminate this Agreement. If either Party exercises its option to terminate this Agreement pursuant to this Section 7.06, this Agreement will be void and have no further effect, the provisions of Section 8.05 will apply, and each Party will have no further right or duty to or claim against the other Party, except as expressly provided otherwise in this Agreement. If neither Party exercises its option to terminate this Agreement pursuant to this Section 7.06, then: (a) neither Party’s rights or obligations shall be affected in any way; (b) there will not be deemed a breach of representation or warranty by Seller as a result of such Casualty Loss; (c) there will be no change to the Purchase Price in respect of the Casualty Loss; and (d) to the extent Seller is a named insured or additional insured under any insurance maintained by the operator of the Assets in respect of the Casualty Loss and the benefit of such position of the Seller is freely assignable to Buyer, Seller shall assign such benefit to Buyer.

22

7.07 Rights of First Offer. Each of the Parties have agreed to provide certain rights of first offer as more particularly described in the Side Letter.

7.08 Taxes. Buyer shall bear and pay all Transfer Taxes, if any, on the transfer of the Company Interests contemplated by this Agreement.

ARTICLE 8

CONDITIONS TO CLOSING AND TERMINATION

8.01 Conditions to Obligation of Buyer. The obligation of Buyer to perform its obligations hereunder at the Closing shall be subject to the satisfaction of the conditions set forth below (which conditions may be waived in whole or in part by Buyer in its sole discretion in writing on or before the Closing Date):

(a) The representations and warranties under Articles 4 and 5 shall be true and correct in all material respects as of the Closing Date (or in all respects in the case of Section 5.06 or in the case of any representation or warranty containing any materiality or similar qualification), and Seller shall have performed in all material respects all covenants and obligations required of Seller by this Agreement to be performed on or before the Closing Date; and Seller shall have delivered to Buyer a certificate to that effect.

(b) All documents, instruments, certificates or other items required to be delivered by Seller pursuant to Section 3.02(a) shall have been delivered or ready to be delivered.

(c) All waiting periods with respect to filings made under the HSR Act, if any, for approval of the transactions contemplated by this Agreement shall have expired or been terminated.

(d) No legal action or Proceeding shall have been instituted after the date hereof against Seller or Buyer, arising by reason of the acquisition of the Company Interests pursuant to this Agreement, which could reasonably be expected to restrain, prohibit or invalidate the consummation of the transactions contemplated by this Agreement.

(e) The Required Consents listed on Schedule 8.01(e) shall have been received or obtained by Seller.

(f) Each of the GGPA, C&O Agreement, and the Company Agreement shall be in full force and effect without any amendment, modification or supplementation except as otherwise approved in writing by Buyer. The Marketing Agreement shall have been fully executed and delivered and become in full force and effect at the Closing without any amendment, modification or supplementation except as otherwise approved in writing by Buyer.

23

8.02 Conditions to Obligation of Seller. The obligation of Seller to perform its respective obligations hereunder at the Closing shall be subject to the satisfaction of the conditions set forth below (which conditions may be waived in whole or in part by Seller in its sole discretion in writing on or before the Closing Date):

(a) The representations and warranties of Buyer hereunder shall be true and correct in all material respects as of the Closing Date, and Buyer shall have performed in all material respects all covenants and obligations required of Buyer by this Agreement to be performed on or before the Closing Date; and Buyer shall have delivered to Seller a certificate to that effect.

(b) All documents, instruments, certificates or other items required to be delivered by Buyer pursuant to Section 3.02(b) shall have been delivered or ready to be delivered, including, but not limited to, payment of the Purchase Price.

(c) All waiting periods with respect to filings made under the HSR Act, if any, for approval of the transactions contemplated by this Agreement shall have expired or been terminated.

(d) No legal action or Proceeding shall have been instituted after the date hereof against Seller, arising by reason of the acquisition of the Company Interests pursuant to this Agreement, which could reasonably be expected to restrain, prohibit or invalidate the consummation of the transactions contemplated by this Agreement.

(e) The Required Consents listed on Schedule 8.01(e) shall have been received or obtained by Seller.

8.03 Termination. Notwithstanding anything herein to the contrary, this Agreement may be terminated at any time prior to Closing:

(a) by Buyer, if the Closing has not taken place on or before the Outside Date other than as a result of a material breach by Buyer of any representation, warranty, covenant or obligation of Buyer contained in this Agreement which will or has prevented the satisfaction of any condition to the obligations of Seller at the Closing;

(b) by Seller, if the Closing has not taken place on or before Outside Date other than as a result of a material breach by Seller of any representation, warranty, covenant or obligation of Seller contained in this Agreement which will or has prevented the satisfaction of any condition to the obligations of Buyer at the Closing;

(c) by Buyer or Seller, if approval is required by the HSR Act for the transaction contemplated by this Agreement and such approval has not been obtained, nor deemed to have been obtained, prior to the HSR Approval Deadline other than as a result of any material breach by the terminating Party of any representation, warranty, covenant or obligation contained in this Agreement which will or has prevented the satisfaction of any condition to the obligations of the other Party at the Closing;

24

(d) by Seller, if there has been a material breach by Buyer of any representation, warranty, covenant or obligation contained in this Agreement which will or has prevented the satisfaction of any condition to the obligations of Seller at the Closing and, if such breach is of a character that it is capable of being cured, such breach has not been cured by Buyer within thirty (30) days after written notice thereof from Seller;

(e) by Buyer, if there has been a material breach by Seller of any representation, warranty, covenant or obligation contained in this Agreement which will or has prevented the satisfaction of any condition to the obligations of Buyer at the Closing and, if such breach is of a character that it is capable of being cured, such breach has not been cured by Seller within thirty (30) days after written notice thereof from Buyer;

(f) by either Buyer or Seller, if any Governmental Entity having competent jurisdiction has issued a final, non-appealable order, decree, ruling or injunction (other than a temporary restraining order) or taken any other action permanently restraining, enjoining or otherwise prohibiting the transactions contemplated by this Agreement; or

(g) by mutual agreement of the Parties in writing.

8.04 Specific Performance for Pre-Closing Breach. In the event of breach of this Agreement by Seller prior to Closing, Buyer shall be deemed to not have an adequate remedy at law and shall be entitled to seek specific performance with respect to performance of this Agreement, without the necessity of posting bond or furnishing other security. Such right shall be in addition to all other rights and remedies set forth in this Agreement or available at law or in equity.

8.05 Effect of Termination. If this Agreement is terminated pursuant to Section 8.03: this Agreement shall become void and of no further force or effect (except for the provisions of Section 10.03 and Article 11, which shall, except to the extent otherwise specifically provided, survive such termination and continue in full force and effect); provided, that nothing in this Section 8.05 shall release any Party from any Liability for any willful breach of any material representation, warranty, covenant or agreement in this Agreement that exists at the time of such termination.

ARTICLE 9

SURVIVAL

9.01 Survival. Except as otherwise expressly provided herein, the indemnification provisions in Article 10 in respect of the covenants and obligations of the Parties under this Agreement shall survive Closing for the applicable statute of limitations period. The indemnification provisions in Section 10.01(b) in respect of the representations and warranties of Buyer under this Agreement shall survive the Closing for a period of eighteen (18) months with the exception that the indemnities in respect of the representations and warranties in Sections 6.01, 6.02, 6.03 and 6.04 shall survive indefinitely. The indemnification provisions in Section 10.01(a) in respect of the representations and warranties of Seller under this Agreement shall

25