Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABERCROMBIE & FITCH CO /DE/ | jeffriesconferencejune2013.htm |

| EX-99.1 - EXHIBIT 99.1 - ABERCROMBIE & FITCH CO /DE/ | anftranscript20130618.htm |

JEFFERIES 2013 GLOBAL CONSUMER CONFERENCE JUNE 18, 2013

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this presentation or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the Company’s control. Words such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements. The factors included in the disclosure under the heading “FORWARD-LOOKING STATEMENTS AND RISK FACTORS” in “ITEM 1A. RISK FACTORS” of A&F’s Annual Report on Form 10-K for the fiscal year ended February 2, 2013, in some cases have affected and in the future could affect the Company’s financial performance and could cause actual results for the 2013 fiscal year and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this presentation or otherwise made by management. OTHER INFORMATION All dollar and share amounts are in 000’s unless otherwise stated. Sub-totals and totals may not foot due to rounding. Due to the fifty-third week in fiscal 2012, first quarter fiscal 2013 comparable sales are compared to the thirteen week period ended May 5, 2012. The Company changed its method of accounting for inventory from the retail method to the cost method effective February 2, 2013. Prior year figures have been restated to reflect the cost method of accounting for inventory.

STRATEGIC OBJECTIVE LEVERAGE THE INTERNATIONAL APPEAL OF OUR ICONIC BRANDS TO BUILD A HIGHLY PROFITABLE, SUSTAINABLE, GLOBAL BUSINESS

Q1 P&L SUMMARY %20122013 (RESTATED) NET SALES GROSS PROFIT GROSS PROFIT RATE OPERATING EXPENSE OPERATING LOSS OPERATING MARGIN NET LOSS NET LOSS PER BASIC & DILUTED SHARE BASIC & DILUTED WEIGHTED- AVERAGE SHARES OUTSTANDING $838,769 $921,218 541,092 570,037 (28,945) $ (21,305) 553,166 65.9% 58.7% 567,087 (13,921) -1.7% -3.1% $ (7,203) $ (0.09) $ (0.25) 78,324 84,593 -9.0% 2.2% -0.5% -7.4%

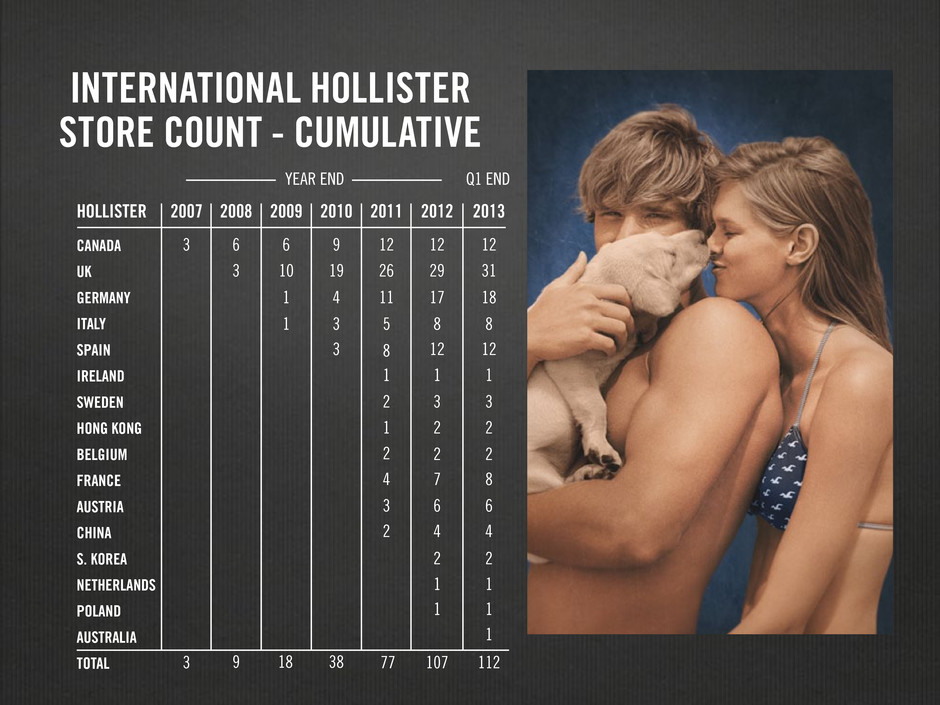

INTERNATIONAL HOLLISTER STORE COUNT - CUMULATIVE 2007 3 3 6 9 6 9 12 12 12 26 29 31 77 107 112 11 17 18 5 8 8 8 12 12 1 1 1 2 3 3 1 2 2 2 2 2 4 7 8 3 6 6 2 4 4 2 2 1 1 1 1 1 19 38 4 3 3 3 10 18 1 1 2008 2009 2010 2012 20132011HOLLISTER CANADA UK GERMANY ITALY SPAIN IRELAND SWEDEN HONG KONG BELGIUM FRANCE AUSTRIA CHINA S. KOREA NETHERLANDS POLAND AUSTRALIA TOTAL YEAR END Q1 END

CAPITAL ALLOCATION HISTORY 700,000 800,000 600,000 500,000 400,000 300,000 200,000 100,000 0 2007 2008 2009 2010 20122011 CAPEXDIVIDENDS SHARE REPURCHASES

STRATEGIC CROSS FUNCTIONAL INITIATIVES PROCESS EFFICIENCY & ROI 1. GENERAL NON-MERCHANDISE 2. MARKETING 3. SUPPLY CHAIN 4. MERCHANDISE PLANNING & ALLOCATION 5. HOME OFFICE 6. STORE OPERATIONS 7. REAL ESTATE / CONSTRUCTION AUR LONG-RANGE PLAN

STRATEGIC OBJECTIVE LEVERAGE THE INTERNATIONAL APPEAL OF OUR ICONIC BRANDS TO BUILD A HIGHLY PROFITABLE, SUSTAINABLE, GLOBAL BUSINESS