Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy Partners, L.P. | d556095d8k.htm |

Steel Success

Strategies XXVIII

Supporting Steel Industry

Competitiveness

June 19, 2013

Exhibit 99.1 |

TM

About SunCoke

Largest independent producer of

metallurgical coke in the Americas

2

•

More than 6 million tons of capacity

–

Facilities in U.S., Brazil and joint

venture in India

•

Reliable, long-term supplier to

leading steelmakers

–

ArcelorMittal, U.S. Steel, AK Steel

•

Industry-leading cokemaking

technology and know-how

–

50+ years of cokemaking experience

–

State-of-the-art heat recovery design

–

Meets U.S. EPA Maximum

Achievable Control Technology

(MACT) Standards |

TM

Steel Industry Dynamics

Challenging Steel

Industry Environment

Steelmakers’

and Raw

Material

Suppliers’

Strategic Choices

•

Lower raw material costs

•

Implement operating

efficiencies

•

Reduce ongoing capital

needs

•

Unlock value of captive

assets

•

Focus capital on

targeted growth

3

•

Allocate capital in highest

value add manner |

TM

The SunCoke Advantage

Implement best practices

Improve technology

•

Compiled comprehensive database of U.S. coals

•

Developed model to optimize coal blend for cost and targeted

quality

•

Enhanced oven controls and process automation

•

Improved coal/coke handling practices/equipment

•

Maximize power recovery

•

Maximize natural gas/injectant capability for customers

•

Blast furnaces using 100% our coke achieve some of best

fuel rates in industry

•

Simple operation; no by-product or waste water treatment plants

•

Less operating and maintenance manpower requirements

•

Gross operating cost ~ ½

that of typical by-product batteries

1

Master coal science

2

3

4

The SunCoke Way

Blend

optimization

Yield

improvement

Larger and

stronger coke

Lower operating

cost

•

Standardize operating and

maintenance practices to achieve

reliable, predictable operations

•

Use advanced prediction

models to optimize coal

blend and maximize yield

•

Increase production flexibility

•

Decrease equipment cost

and lengthen asset life |

TM

Capital Cost Reductions

5

SXC reengineering its next facility to reduce capital intensity of

cokemaking and meet increasingly stringent environmental requirements

|

TM

Capital Cost Reductions (cont’d)

•

Next plant up to 30% smaller in footprint

•

Modular design enables staged installation

•

Increased power and/or steam output

•

Capital costs per ton decrease with footprint

(~20% reduction in capital cost/ton, including next generation NAAQS requirements)

New plant

design

6 |

TM

Steel Value Chain

Raw materials

mining

Crude

steel

Finished

steel

End

customer

Raw material

processing/

transportation

Carbon

Ferrous

Transport

Processing

Handling

Disaggregation

Opportunity

•

Elements of steel value chain can

be disaggregated to create value

•

Maintain strategic control/use of

assets on long-term, competitive

and reliable basis

•

Free up and redeploy proceeds

•

Fund construction of new assets

7

Requires trusted counterparty to own/operate and

valuation/cost of capital advantage |

TM

SunCoke’s Strategic Role

SXCP

1

st

steel-facing MLP

Advantaged

cost of capital

Experienced constructor

and operator

Trusted, reliable long-

term supplier

SXC/SXCP can

create value for

steelmakers and

raw material

suppliers through

strategic

disaggregation

8 |

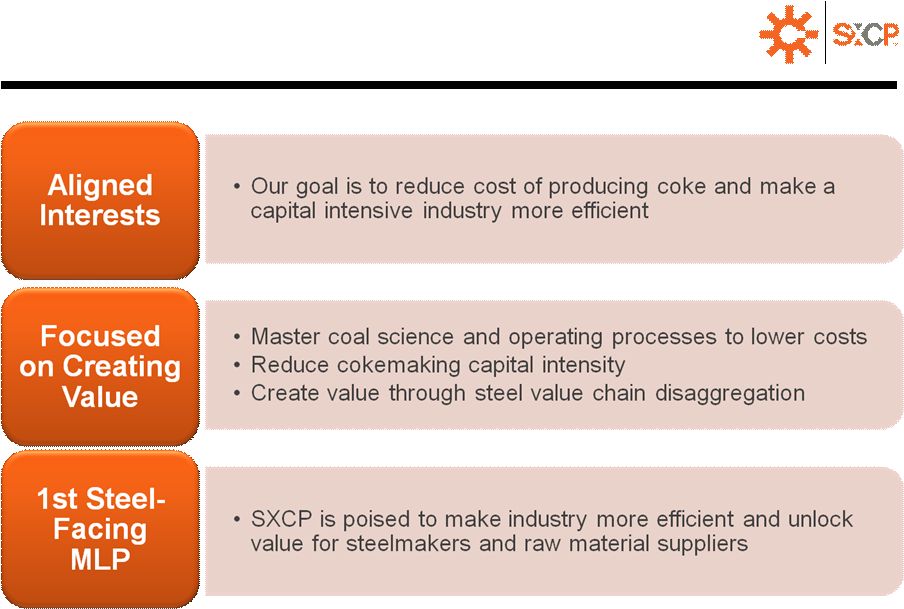

TM

Conclusion

9 |