Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - PASSPORT POTASH INC | Financial_Report.xls |

| EX-23.1 - EXHIBIT 23.1 - PASSPORT POTASH INC | exhibit23-1.htm |

As filed with the Securities and Exchange Commission on June 19, 2013.

SEC File No. 333- 187879

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1 /A

(Amendment No.1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PASSPORT POTASH INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 1400 | Not Applicable |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer Identification |

| incorporation or organization) | Classification Code Number) | Number) |

608 – 1199 West Pender Street

Vancouver, BC,

Canada V6E2R1

Telephone: (604) 687-0300

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

608,1199 West Pender Street

Vancouver, B.C.

Canada V6E2R1

Telephone: (604)687-0300

(Name,

address, including zip code, and telephone number,

including area

code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Harvey J. Kesner, Esq.

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Fax: (212) 930-9725

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED |

AMOUNT TO BE REGISTERED (1) |

PROPOSED MAXIMUM OFFERING PRICE PER SHARE |

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE |

AMOUNT OF REGISTRATION FEE |

| Primary Offering | ||||

| Common Stock, without par value | [_____] | $[_____] | $40,000,000 | $5,456 |

| Common Stock Purchase Rights (4) | ||||

| Secondary Offering | ||||

| Common Stock, without par value | 53,041,727 | $0.21 (2) | $11,138,762.67 | $1,519.33 |

| Common Stock underlying warrants | 21,333,204 | $0.21 (2) | $4,479,972.84 | $611.07 |

| Common Stock Purchase Rights (4) | ||||

| Total | [_____] | $55,618,735.51 | $7,586.40 (3) |

| (1) |

Pursuant to Rule 416 under the Securities Act, the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (2) |

Estimated at $0.21 per share, the average of the high and low prices as reported on the OTCQX on April 11, 2013, for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. |

| (3) |

Previously paid. |

| (4) |

The common stock currently includes certain common stock purchase rights (collectively, the “Rights”) issued pursuant to a shareholder rights plan agreement, dated August 25, 2011 (filed on Exhibit 4.2 to the Registration Statement on Form 10 filed on June 29, 2012, File No. 000-54751, as amended), by and between Computer Share Trust Company of Canada and us (the “Rights Plan”). Until the occurrence of certain events specified in the Rights Plan, none of which have occurred, the Rights are not exercisable, are evidenced by the certificate for the common stock and will be transferred along with and only with, and are not severable from, the common stock. The value attributable to the Rights, if any, is reflected in the market price of the common stock. No separate consideration will be payable for the Rights. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED ___, 2013

PRELIMINARY PROSPECTUS

OFFERING UP TO [_______] SHARES

PASSPORT POTASH INC.

Common Stock

_________________

This prospectus relates to a public offering of [______] shares of our common stock, without par value (including the associated Rights). We will use our best efforts to sell all of the shares of common stock being offered. The public offering price will be $[ ] per share. Because there is no minimum offering amount required as a condition to the closing of this offering, the placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth below.

We will bear the costs relating to the registration of the shares offered by the Company.

We intend to engage one or more placement agents in connection with this offering. The placement agents will not purchase or sell any of our securities, nor will they be required to arrange for the purchase and sale of any specific number or dollar amount of securities, other than to use their “best efforts” to arrange for the sale of securities by us. We have not arranged to place the funds in an escrow, trust or similar account.

| Proceeds, | |||||||||

| Before | |||||||||

| Price to | Placement | Expenses, to | |||||||

| Public | Agent Fees | Us | |||||||

| Per Share | $ | [___] | $ | [___] | $ | [___] | |||

| Total | $ | [___] | $ | [___] | $ | [___] |

This registration statement of which this prospectus forms a part also registers on behalf of the selling stockholders of up to 74,374,931 shares of our common stock (including the associated Rights) which includes 21,333,204 shares of common stock issuable upon the exercise of outstanding warrants. The shares of our common stock offered by the selling stockholders are not part of or conditioned on the closing of our public offering.

Our common stock is quoted on the OTCQX under the symbol “PPRTF” and on the TSX Venture Exchange under the symbol “PPI.” On June 18, 2013, the last reported sale price of our common stock as reported on the OTCQX was $0.18 per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled “Risk Factors” beginning on page 2 of this prospectus before making a decision to purchase our stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| The date of this prospectus is , 2013 |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Prospectus Summary

Our principal executive offices are located at 608 – 1199 West Pender Street, Vancouver, British Columbia, Canada V6E2R1 and our telephone number is (604) 687-0300. Our website is http://www.passportpotash.com/. Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

As used in this prospectus, unless otherwise specified, references to the “Company,” “we,” “our” and “us” refer to Passport Potash Inc. and, unless otherwise specified, its subsidiary.

The Offering

| Common stock offered by us |

[______________] |

|

| |

| Offering Price |

[ ] |

|

| |

| Common stock outstanding before and after this offering: |

183,593,073 (1) and [______________] (2) |

|

| |

| Use of proceeds: |

We intend to use the proceeds from the sale of the securities by the Company as described in “Use of Proceeds”. |

|

| |

| OTCQX |

PPRTF |

| symbol: |

|

|

| |

| TSXV symbol: |

PPI |

|

| |

| Risk factors: |

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 1 of this prospectus before deciding whether or not to invest in shares of our common stock. |

___________________

(1) The number of outstanding shares

before the offering is based upon 183,593,073 shares outstanding as of June 18, 2013 and excludes:

- 30,476,526 shares of common stock issuable upon conversion of outstanding convertible debentures;

- 18,279,892 shares of common stock issuable upon the exercise of outstanding options; and

- 50,968,146 shares of common stock issuable upon the exercise of outstanding warrants.

(2) The number of outstanding shares after the offering excludes:

- 30,476,526 shares of common stock issuable upon conversion of outstanding convertible debentures;

- 18,279,892 shares of common stock issuable upon the exercise of outstanding options; and

- 50,968,146 shares of common stock issuable upon the exercise of outstanding warrants.

1

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment.

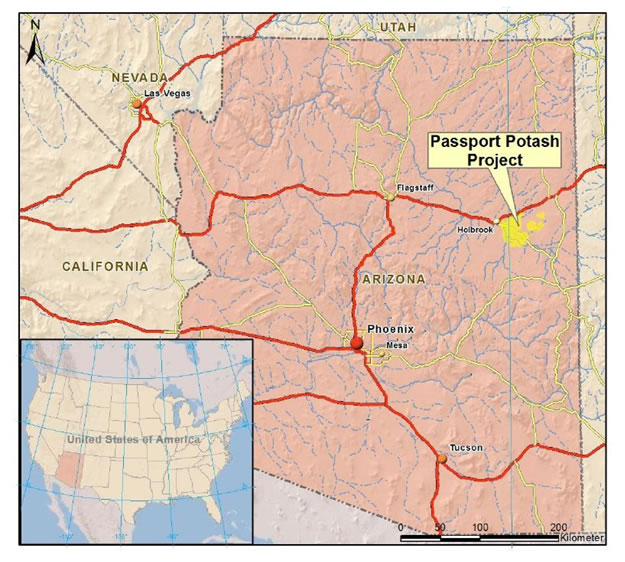

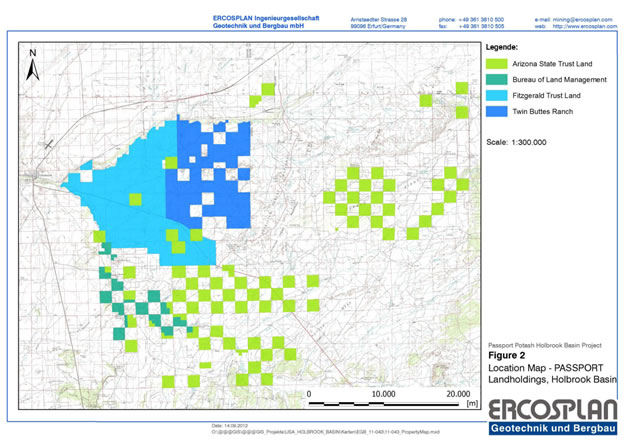

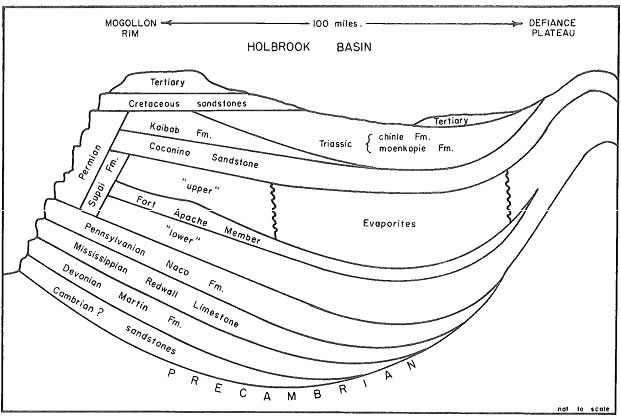

Risks Associated with the Holbrook Basin Project

The Holbrook Project may be subject to unknown land title defects.

Although we believe we have exercised reasonable due diligence with respect to determining title to our properties, there is no guarantee that title to our properties and other tenure will not be challenged or impugned. No assurances can be given that there are no title defects affecting our properties. Our properties may be subject to prior unregistered liens, agreements, transfers or claims and title may be affected by, among other things, undetected defects. There may be valid challenges to the title of our properties which, if successful, could prevent us from operating our properties as planned or permitted or prevent us from enforcing our rights with respect to our properties.

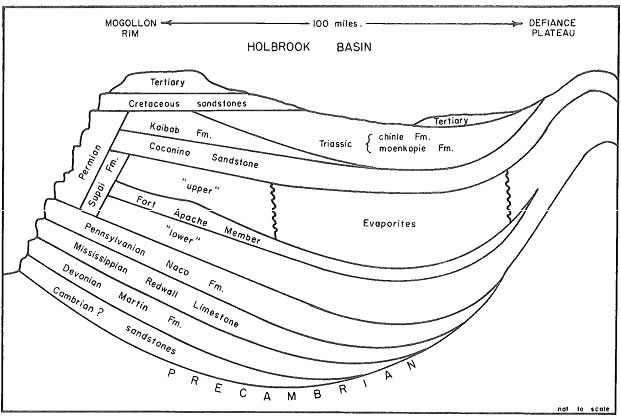

We may not locate any commercially viable mineral deposits on any of our current properties within the Holbrook Basin Project, which would have an adverse effect on the value of our common stock.

Our exploration for commercially viable mineral deposits is highly speculative in nature and involves the substantial risk that no viable mineral deposits will be located on any of our properties within the Holbrook Basin Project. There is a considerable risk that any exploration program we conduct on our properties may not result in the discovery of any significant mineralization or commercially viable mineral deposits. We may encounter numerous geological features that limit our ability to locate mineralization or that interfere with our planned exploration programs, each of which could result in our exploration efforts proving unsuccessful. In such a case, we may incur the costs associated with an exploration program without realizing any benefit. This would likely result in a decrease in the value of our common stock and investors may lose their entire investment.

There is no guarantee that we will be able to finance the Holbrook Basin Project for production if we are successful at locating a commercially viable mineral deposit.

If we are successful at locating a commercially viable mineral deposit on any of our current properties within the Holbrook Basin Project, then any decision to proceed with production on the Holbrook Basin Project will require significant production financing. If we are unable to source production financing on commercially viable terms, we may not be able to proceed with the project and may have to write-off our investment in the project.

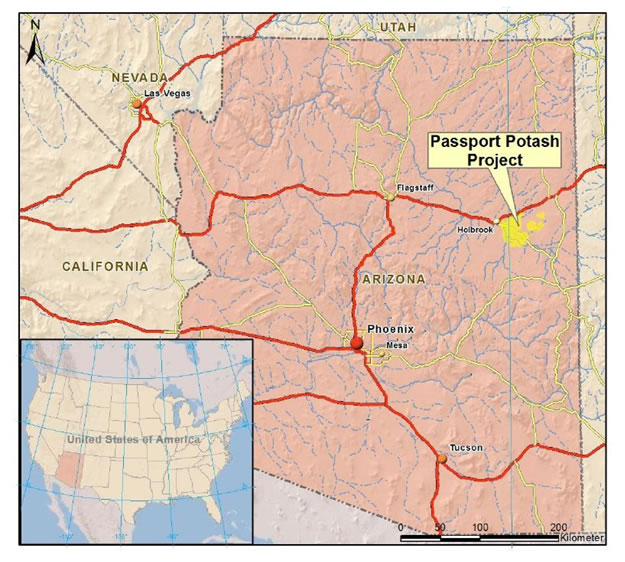

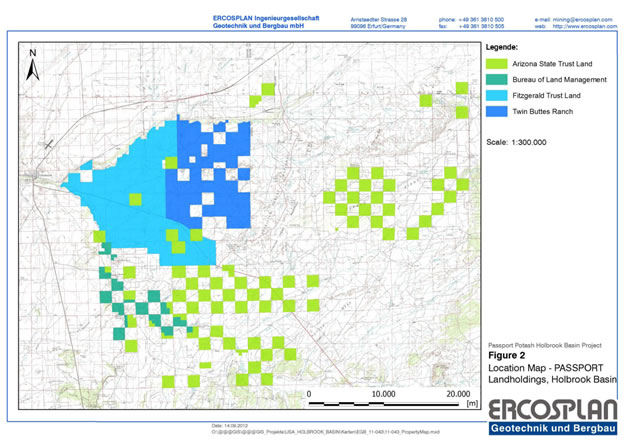

A portion of our properties is within the expanded boundaries of the Petrified Forest National Park, which may expose us to increased environmental and regulatory scrutiny.

Our Holbrook Basin Project is in close proximity to the Petrified Forest National Park (“PFNP”), a national park in northeastern Arizona protected by the United States National Parks Services. In December 2004, the United States government enacted legislation which expanded the authorized boundaries of the PFNP by approximately 125,000 acres to include adjacent lands. Portions of our Twin Butte Ranch property fall within the expanded boundaries of the PFNP. Although the enabling legislation for the expansion of the PFNP provides that the Secretary of the Interior may only acquire land in private ownership from willing sellers, the proximity of our properties to the PFNP may expose us to increased environmental and regulatory scrutiny.

The proximity of our properties to the PFNP could lead to the denials of approvals and permits necessary to develop portions or our Holbrook Project. Furthermore, the proposed expansion of the PFNP boundaries could limit our ability to acquire additional mineral rights, and additional acquisitions of lands or interests in land by the National Park Service would lead to further overlap with our current holdings.

2

Continued government and public emphasis on environmental issues can be expected to result in increased future investments in environmental controls at ongoing operations, which may lead to increased expenses. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

Risks Related to Our Business

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation, shareholder approval of any golden parachute payments not previously approved and presenting the relationship between executive compensation actually paid and our financial performance. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We will remain an “emerging growth company” for up to five years after our first sale of common stock pursuant to a Securities Act registration statement, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any August 31.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it. Because of the exemptions from various reporting requirements provided to us as an “emerging growth company”, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

We are an exploration stage company with no current revenue source and a history of operating losses and there is an expectation that we will generate operating losses for the foreseeable future; we may not achieve profitability for some time, if at all.

We have a history of operating losses and there can be no assurance that we will ever be profitable. We presently have no ability to generate earnings as our properties are in the exploration stage. Significant operating losses are anticipated for at least the next several years before we will be able to generate any revenues. If the Holbrook Basin Project is successfully developed and operated, we anticipate that we will retain future earnings and other cash resources for the future operation and development of our business.

We will require additional financing in order to continue our exploration activities and our assessment of the commercial viability of our mineral properties, and if we raise additional financing existing security holders may experience dilution.

We will need to raise additional financing to complete further exploration of our mineral properties. Furthermore, if the costs of our planned exploration programs are greater than anticipated, we may have to seek additional funds through public or private share offerings or arrangements with corporate partners. There can be no assurance that we will be successful in our efforts to raise these required funds, or on terms satisfactory to us. The continued exploration of our mineral properties and the development of our business will depend upon our ability to establish the commercial viability of our mineral properties and to ultimately develop cash flow from operations and reach profitable operations. We currently are in the exploration stage and we have no revenue from operations and we are experiencing significant negative cash flow from operations. Accordingly, the only other sources of funds presently available to us are through the sale of equity. We presently believe that debt financing will not be an alternative to us as all of our properties are in the exploration stage. Alternatively, we may finance our business by offering an interest in our mineral properties to be earned by another party or parties carrying out further exploration thereof or to obtain project or operating financing from financial institutions, neither of which is presently intended. If we are able to raise funds from the sale of our securities, existing security holders may experience significant dilution of their ownership interests and possibly to the value of their existing securities. If we are unable to obtain this additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of our mineral properties.

3

As our mineral properties do not contain any reserves or any known body of economic mineralization, we may not discover commercially exploitable quantities of potash on our mineral properties that would enable us to enter into commercial production, achieve revenues and recover the money we spend on exploration.

Our properties do not contain reserves in accordance with the definitions adopted by the SEC and there is no assurance that any exploration programs that we carry out will establish reserves. All of our mineral properties are in the exploration stage as opposed to the development stage and have no known body of economic mineralization. The known potash mineralization at these projects has not yet been determined to be economic, and may never be determined to be economic. We plan to conduct further exploration activities on our mineral properties, which future exploration may include the completion of feasibility studies necessary to evaluate whether a commercial mineable mineral body exists on any of our mineral properties. There is a substantial risk that these exploration activities will not result in discoveries of commercially recoverable quantities of potash. Any determination that our properties contain commercially recoverable quantities of potash may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that a potential mine is likely to be economic. There is a substantial risk that any preliminary or final feasibility studies carried out by us will not result in a positive determination that our mineral properties can be commercially developed.

Our exploration activities on our mineral properties may not be successful, which could lead us to abandon our plans to develop such properties and our investments in exploration.

We are an exploration stage company and have not as yet established any reserves on our properties. Our long-term success depends on our ability to establish commercially recoverable quantities of potash on our mineral properties that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of mineral exploration is determined in part by the following factors:

- identification of potential mineral mineralization based on superficial analysis;

- availability of government-granted exploration permits;

- the quality of management and geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop processes to extract potash, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be established or determined to be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; potash prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of potash on our mineral properties.

4

We have a history of operating losses and there can be no assurances we will be profitable in the future.

We have a history of operating losses, expect to continue to incur losses, are considered to be in the exploration stage, and may never be profitable. Further, we have been dependent on sales of our equity securities to meet our cash requirements. We incurred net loss of $9,474,700 for the year ended February 28, 2013. We incurred net profit of $8,505,659 in the year ended February 29, 2012, however, this net profit was a result of substantial non-cash decrease in derivative liability. Further, we do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that: (i) the costs to acquire additional mineral exploration claims are more than we currently anticipate; (ii) exploration costs for additional claims increase beyond our expectations; or (iii) we encounter greater costs associated with general and administrative expenses or offering costs.

Our participation in mineral exploration prospects has required and will continue to require substantial capital expenditures. The uncertainty and factors described throughout this section may impede our ability to economically discover mineral prospects. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

Our operations are subject to losses due to exchange rate fluctuation.

We maintain accounts in Canadian currency. Our equity financings have to-date been priced in Canadian dollars, however our material project is located in the United States and requires regular currency conversions to U.S. dollars. Our operations are accordingly subject to currency fluctuations and such fluctuations may materially affect our financial position and results. We do not engage in currency hedging activities.

Declining economic conditions could negatively impact our business.

Our operations are affected by local, national and worldwide economic conditions. Markets in the US, Canada and elsewhere have been experiencing extreme volatility and disruption for more than 12 months, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding energy prices and the capital and commodity markets. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

The mining industry is very competitive and our ability to attract and retain qualified contractors and staff is critical to our success. The departure of key personnel or loss of key contractors could adversely affect our ability to run our business and achieve our business objectives.

We will compete in the hiring of appropriate geological, engineering, permitting, environmental and other operational experts to assist with the location, exploration and development of our mineral property interests and implementation of our business plan. We believe we will have to offer or pay appropriate cash compensation and options to induce persons to be associated with an exploration stage company.

In addition, we depend to a great extent on principal members of our management. If we lose the services of any key personnel, in particular, Mr. Joshua Bleak, our President and CEO, who has been instrumental in the growth and expansion of our business, it could significantly impede our growth plans and corporate strategies, identifying business opportunities, recruiting new staff, and retaining existing capable staff. The recruiting and retaining of qualified scientific, technical and managerial personnel is critical to our success. We do not currently have any key man life insurance policies. We may not be able to retain existing personnel or attract and retain qualified staff in the future.

5

If we are unable to hire qualified contractors and staff and retain personnel in key positions because of our limited resources, we may be unable to proceed with the implementation of our business plan of exploring and possibly developing our mineral property interests. In that event, investors will have their investment impaired or it may be entirely lost.

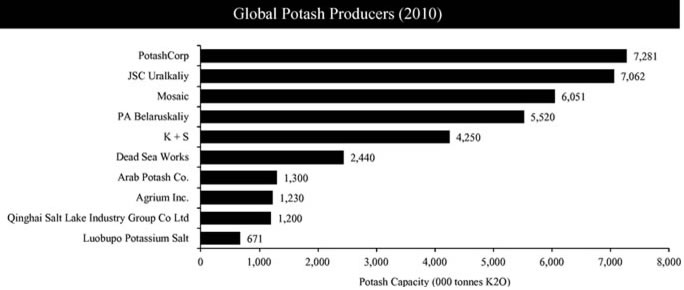

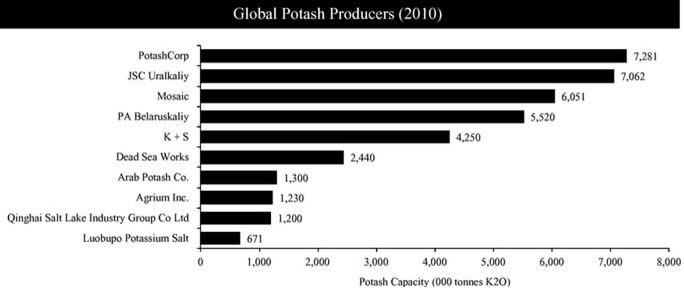

We face competition from larger companies having access to substantially more resources than we possess.

Our competitors include other mineral exploration and mining companies and fertilizer producers in the United States and globally, including state-owned and government-subsidized entities. Many of these competitors are large, well-established companies and have substantially larger operating staffs and greater capital resources than we do. We may not be able to successfully conduct our operations, evaluate and select suitable properties and consummate transactions in this highly competitive environment. Specifically, these larger competitors may be able to pay more for exploratory prospects and productive mineral properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, such companies may be able to expend greater resources on the existing and changing technologies that we believe are and will be increasingly important to attaining success in the industry. If our competition is such that we cannot compete and generate a sufficient return on our investment and operations, we may be forced to curtail our operations, resulting in a loss to investors.

There is substantial doubt as to whether we can continue as a going concern.

Our auditors have included an explanatory paragraph in their opinion that accompanies our audited financial statements as of and for the year ended February 28, 2013, indicating that we have incurred losses since inception of the exploration stage of $34,928,564 which raises substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Our officers and directors may be subject to conflicts of interest.

Some of our officers and directors serve only part time and may be subject to conflicts of interest. Each may devote part of his working time to other business endeavors, including consulting relationships with other corporate entities, and may have responsibilities to these other entities. Such conflicts may include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, some of our officers and directors may be subject to conflicts of interest.

Joshua Bleak, our President, CEO and a director, Michael Schlumpberger, our Chief Operating Officer, as well as John Eckersley, our Vice President and a director, serve full time (40 hours per week). All of the other directors and officers only provide services to us on a part time basis as follows:

Laara Shaffer (CFO and a director) – 15

hours per week;

Ali Rahimtula (director) – 10 hours per week;

David

Salisbury (director) – 10 hours per week;

Dennis Ickes (director) – 10 hours

per week; and

Jerry Aiken (director) – 10 hours per week.

We are required to indemnify our directors and executive officers against liability to us and our stockholders, and such indemnification could increase our operating costs.

Our Articles require us to indemnify our directors and officers against claims associated with carrying out the duties of their offices. Our Articles also require us to reimburse them for expenses actually and reasonably incurred by such director and/or officer in respect of legal proceedings relating to carrying out the duties of their offices.

6

Since our directors and executive officer are aware that they may be indemnified for carrying out the duties of their offices, they may be less motivated to meet the standards required by law to properly carry out such duties, which could increase our operating costs. Further, if our directors or executive officer file a claim against us for indemnification, the associated expenses could also increase our operating costs.

Loss of Foreign Private Issuer Status under U.S. Securities Laws has led to significantly higher costs and expenses.

Based on our analysis of the number of our shares held by persons residing in the U.S., as well as the majority of our assets being in the U.S., we no longer meet the definition of a “foreign private issuer” under U.S. securities laws. As a result, we are subject to U.S. securities laws as applicable to a U.S. domestic company. The loss of our foreign private issuer status has led to significantly higher regulatory and compliance costs to us under U.S. securities laws. We are required to file periodic reports and registration statements on U.S. domestic issuer forms with the U.S. Securities and Exchange Commission, which are more detailed and extensive than the forms available to a foreign private issuer. We also have to mandatorily comply with U.S. federal proxy requirements, and our officers, directors and principal shareholders have become subject to the short-swing profit disclosure and recovery provisions of Section 16 of the Exchange Act. We are also required to modify certain of our policies to comply with good governance practices associated with U.S. domestic issuers. Such conversion and modifications have involved additional costs. In addition, we have lost our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers.

General Risks Associated with Our Exploration Activities

Mining operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on our business operations.

If economic quantities of minerals are found on any of our mineral property interests by us in sufficient quantities to warrant mining operations, such mining operations will be subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Mining operations are also subject to federal, state, and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus resulting in an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend material amounts on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Mineral exploration and development and mining activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

Mineral exploration and development and future potential mining operations are or will be subject to stringent federal, state and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested of many years ago.

7

Future potential mining operations and current exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Mining is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities.

Costs associated with environmental liabilities and compliance are expected to increase with the increasing scale and scope of operations and we expect these costs may increase in the future.

We believe that our operations comply, in all material respects, with all applicable environmental regulations. However, we are not fully insured at the current date against possible environmental risks.

Our operations are dependent on receiving the required permits and approvals from governmental authorities. Denial or delay by a government agency in issuing any of our permits and approvals or imposition of restrictive conditions on us with respect to these permits and approvals may impair our business and operations.

We must obtain numerous environmental and exploration permits and approvals authorizing our future operations. A decision by a government agency to deny a permit or approval could have a material adverse effect on our ability to continue operations at the affected location and may have a material adverse effect on our business operations.

In addition, if we are successful at identifying a commercially viable potash deposit on our Holbrook Basin Project, the future potential development of such deposit into a mine is also predicated upon securing all necessary permits and approvals. A denial of or delay in obtaining any of these permits or approvals or the issuance of any of these permits with cost-prohibitive conditions could interfere with any potential development of this property and have a material adverse effect on our business, financial condition or results of operations.

Our business involves many operating risks, which may result in substantial losses, and insurance may be unavailable or inadequate to protect us against these risks.

Our operations are subject to hazards and risks associated with the exploration of natural resources and related fertilizer materials and products, such as: fires; explosions; inclement weather and natural disasters; mechanical failures; unscheduled downtime; and availability of needed equipment at acceptable prices. Any of these risks can cause substantial losses resulting from: damage to and destruction of property, natural resources and equipment; regulatory investigations and penalties; revocation or denial of our permits; suspension of our operations; and repair and remediation costs.

Our liability for environmental hazards may extend to those created either by the previous owners of properties that we purchase or lease or by acquired companies prior to the date we acquire them. We do not currently maintain insurance against all of the risks described above. In the future we may not be able to obtain insurance at premium levels that justify its purchase. We may also experience losses in amounts in excess of the insurance coverage carried. Either of these occurrences could harm our financial condition and results of operations.

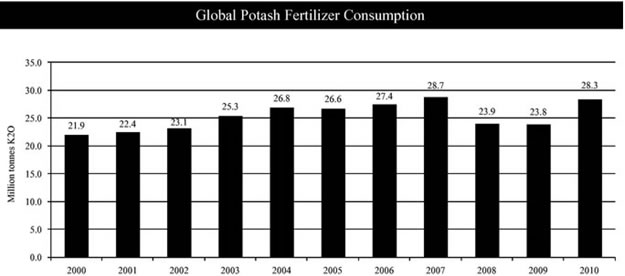

Potash is a commodity with a selling price that is highly dependent on the business and economic conditions and governmental policies affecting the agricultural industry. These factors are outside of our control and may significantly affect our profitability.

If we are able to achieve commercial production on any of our properties, our future revenues, operating results, profitability and rate of growth will depend primarily upon business and economic conditions and governmental policies affecting the agricultural industry, which we cannot control. The agricultural products business can be affected by a number of factors. The most important of these factors, for U.S. markets, are: weather patterns and field conditions (particularly during periods of traditionally high crop nutrients consumption); quantities of crop nutrients imported to and exported from North America; current and projected grain inventories and prices, both of which are heavily influenced by U.S. exports and world-wide grain markets; and U.S. governmental policies, including farm and biofuel policies and subsidies, which may directly or indirectly influence the number of acres planted, the level of grain inventories, the mix of crops planted or crop prices.

8

International market conditions, which are also outside of our control, may also significantly influence our future operating results. The international market for crop nutrients is influenced by such factors as the relative value of the U.S. dollar and its impact upon the cost of importing crop nutrients, foreign agricultural policies, the existence of, or changes in, import barriers, or foreign currency fluctuations in certain foreign markets, changes in the hard currency demands of certain countries and other regulatory policies of foreign governments, as well as the laws and policies of the United States affecting foreign trade and investment.

Government regulation may adversely affect our business and results of operations.

Projects related to mineral exploration, mining and natural resources are subject to various and numerous federal, state and local government regulations, which may be changed from time to time. There are federal, state and local laws and regulations primarily relating to protection of human health and the environment applicable to the exploration, mining, development, production, handling, storage, transportation and disposal of natural resources, including potash, or its by-products and other substances and materials produced or used in connection with mining operations. Activities subject to regulation include the use, handling, processing, storage, transportation and disposal of hazardous materials, and we could incur substantial additional costs to comply with environmental, health and safety law requirements related to these activities. We also could incur substantial costs for liabilities arising from past unknown releases of, or exposure to, hazardous substances.

Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, we could be held jointly and severally responsible for the removal or remediation of any hazardous substance contamination at future facilities, at neighboring properties to which such contamination may have migrated and at third-party waste disposal sites to which we have sent waste. We could also be held liable for natural resource damages. Liabilities under these and other environmental health and safety laws involve inherent uncertainties. Violations of environmental, health and safety laws are subject to civil, and, in some cases, criminal sanctions. As a result of liabilities under and violations of environmental, health and safety laws and related uncertainties, we may incur unexpected interruptions to operations, fines, penalties or other reductions in income, third-party claims for property damage or personal injury or remedial or other costs that would negatively impact our financial condition and operating results. Finally, we may discover currently unknown environmental problems or conditions. The discovery of currently unknown environmental problems may subject us to material capital expenditures or liabilities in the future.

Continued government and public emphasis on environmental issues can be expected to result in increased future investments for environmental controls at ongoing operations, which may lead to increased expenses. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

Risks Related to Our Securities

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. To the extent that we require additional funding currently not provided for in our financing plans, our funding sources may prohibit the payment of any dividends. Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

9

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000, not including any equity in that person’s or person’s spouse’s primary residence, or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder's ability to buy and sell our stock.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Any future sales of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of revenues and the doubtful prospect that we will earn significant revenues in the next several years, we will likely have to issue additional equity securities to obtain funds for our planned exploration operations and acquisition activities. Our efforts to fund our planned exploration and acquisition activities will therefore result in dilution to our existing stockholders. In short, our continued need to sell equity will result in reduced percentage ownership interests for all of our investors, which may decrease the market price for our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

10

You should review carefully the section entitled “Risk Factors” beginning on page 1 of this prospectus for a discussion of these and other risks that relate to our business and investing in shares of our common stock.

USE OF PROCEEDS

We estimate that the net proceeds to us from the sale of common stock in this offering, assuming gross proceeds of $40,000,000 (which is the amount of gross proceeds received if the offering is fully subscribed), will be approximately $36,000,000, after deducting the placement agent fees and estimated expenses of this offering which, for purposes herein, we have assumed to be $4,000,000. We may not be successful in selling any or all of the securities offered hereby. Because there is no minimum offering amount required as a condition to closing in this offering, we may sell less than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us.

Even if we sell all of the securities subject to this offering on favorable terms, of which there can be no assurance, we may still need to obtain additional financing in the future in order to fully fund our growth plan. We may seek such additional financing through public or private equity or debt offerings or other sources, including collaborative or other arrangements with strategic partners.

We anticipate that the net proceeds obtained from this offering will be used to fund the following uses, assuming 25% of the maximum proceeds are obtained:

| Application of | Percentage of | |||||

| Net Proceeds | Net Proceeds | |||||

| Exploration Costs | $ | 6,250,000 | 69.4% | |||

| Investor Relations Costs | $ | 187,500 | 2.1% | |||

| Working capital and general corporate purposes (1) | $ | 2,360,000 | 26.2% | |||

| Officers’ salaries and related expenses | $ | 202,500 | 2.3% | |||

| Total | $ | 9,000,000 | 100% |

(1) Working capital and general corporate purposes include cash payments needed to maintain option agreements on Twin Buttes Ranch and Fitzgerald Trust Ranch, amounts required to pay professional fees, ongoing public reporting costs, office-related expenses and other corporate expenses. Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree.

We anticipate that the net proceeds obtained from this offering will be used to fund the following uses, assuming 50% of the maximum proceeds are obtained:

| Application of | Percentage of | |||||

| Net Proceeds | Net Proceeds | |||||

| Exploration Costs | $ | 12,500,000 | 69.4% | |||

| Investor Relations Costs | $ | 375,000 | 2.1% | |||

| Working capital and general corporate purposes (1) | $ | 4,720,000 | 26.2% | |||

| Officers’ salaries and related expenses | 405,000 | 2.3% | ||||

| Total | $ | 18,000,000 | 100% |

11

(1) Working capital and general corporate purposes include cash payments needed to maintain option agreements on Twin Buttes Ranch and Fitzgerald Trust Ranch, amounts required to pay professional fees, ongoing public reporting costs, office-related expenses and other corporate expenses. Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree.

We anticipate that the net proceeds obtained from this offering will be used to fund the following uses, assuming 75% of the maximum proceeds are obtained:

| Application of | Percentage of | |||||

| Net Proceeds | Net Proceeds | |||||

| Exploration Costs | $ | 18,750,000 | 69.4% | |||

| Investor Relations Costs | $ | 562,500 | 2.1% | |||

| Working capital and general corporate purposes (1) | $ | 7,080,000 | 26.2% | |||

| Officers’ salaries and related expenses | $ | 607,500 | 2.3% | |||

| Total | $ | 27,000,000 | 100% |

(1) Working capital and general corporate purposes include cash payments needed to maintain option agreements on Twin Buttes Ranch and Fitzgerald Trust Ranch, amounts required to pay professional fees, ongoing public reporting costs, office-related expenses and other corporate expenses. Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree.

We anticipate that the net proceeds obtained from this offering will be used to fund the following uses, assuming 100% of the maximum proceeds are obtained:

| Application of | Percentage of | |||||

| Net Proceeds | Net Proceeds | |||||

| Exploration Costs | $ | 25,000,000 | 69.4% | |||

| Investor Relations Costs | $ | 750,000 | 2.1% | |||

| Working capital and general corporate purposes (1) | $ | 9,440,000 | 26.2% | |||

| Officers’ salaries and related expenses | $ | 810,000 | 2.3% | |||

| Total | $ | 36,000,000 | 100% |

(1) Working capital and general corporate purposes include cash payments needed to maintain option agreements on Twin Buttes Ranch and Fitzgerald Trust Ranch, amounts required to pay professional fees, ongoing public reporting costs, office-related expenses and other corporate expenses. Our management team will have immediate and broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree.

The allocation of the net proceeds of this offering set forth above represents our best estimates based upon our current plans and assumptions regarding industry and general economic conditions and our future revenues and expenditures. If any of these factors change, it may be necessary or advisable for us to reallocate some of the proceeds within the above-described categories or to use portions for other purposes. Investors will be relying on the judgment of our management regarding application of the net proceeds of this offering.

DILUTION

Our pro forma net tangible book value as of February 28, 2013 was $304,167 or $0.01 per share of common stock, based upon 183,551,407 shares outstanding as of that date. Net tangible book value per share is determined by dividing such number of outstanding shares of common stock, into our net tangible book value, which is our total tangible assets less total liabilities. After giving effect to the sale of common stock in this offering at the assumed public offering price of $0.30 per share, at February 28, 2013, after deducting the placement agent fees and other estimated expenses of this offering, our pro forma as adjusted net tangible book value at February 28, 2013 would have been approximately $36,304,167 or $0.11 per share assuming sales of all the shares offered in this offering. This represents an immediate increase in net tangible book value of approximately $0.10 per share to our existing stockholders, and an immediate dilution of $0.19 per share to investors purchasing common stock in the offering.

12

The following table illustrates the per share dilution assuming sales of 25%, 50%, 75% and 100% of shares offered respectively:

| |

Assuming sales of 25% of shares offered |

Assuming sales of 50% of shares offered |

Assuming sales of 75% of shares offered |

Assuming sales of 100% of shares offered |

| Assumed public offering price per share | $0.30 | $0.30 | $0.30 | $0.30 |

| Net tangible book value per share before this offering | $0.01 | $0.01 | $0.01 | $0.01 |

| Pro forma increase attributable to new investors | $0.03 | $0.06 | $0.09 | $0.10 |

| Pro forma net tangible book value per share after this offering | $0.04 | $0.07 | $0.10 | $0.11 |

| Pro forma dilution per share to new investors in this offering | $0.26 | $0.23 | $0.20 | $0.19 |

The foregoing illustration does not reflect potential dilution as of June 18, 2013 from the exercise of outstanding options to purchase an aggregate of 18,279,892 shares of our common stock or 50,968,146 shares of common stock issuable upon the exercise of outstanding warrants or 30,476,526 shares of common stock issuable upon the conversion of outstanding convertible debentures. Of the approximately 183,593,073 shares of our common stock outstanding as of June 18, 2013, approximately 125,282,118 shares are freely tradable without restriction as of that date.

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock has been publicly traded in the United States since March 1, 2011 on the OTCQX. Our common stock is quoted under the symbol “PPRTF.” The following table sets forth for the periods indicated the range of high and low bid quotations per share as reported by the OTCQX. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

13

| OTCQX | ||||

| High | Low | |||

| Quarter Ended | ($) | ($) | ||

| May 31, 2013 | 0.25 | 0.16 | ||

| February 28, 2013 | 0.23 | 0.18 | ||

| November 30, 2012 | 0.24 | 0.16 | ||

| August 31, 2012 | 0.24 | 0.17 | ||

| May 31, 2012 | 0.35 | 0.18 | ||

| February 29, 2012 | 0.40 | 0.16 | ||

| November 30, 2011 | 0.64 | 0.22 | ||

| August 31, 2011 | 0.80 | 0.45 | ||

| May 31, 2011 | 1.30 | 0.57 | ||

On June 18, 2013, the high and low prices of our common stock as reported on the OTCQX were $0.18 and $0.17, respectively.

Our common shares are also traded on the TSX-V. Our common shares commenced trading on the TSX-V on October 3, 2001 under the symbol “PPI”. On June 18, 2013, the high and low trading prices of our common shares on the TSX-V were CAD$0.19 and CAD$0.185, respectively. The following table shows the high and low trading prices in Canadian dollars of our common shares on the TSX-V for the periods indicated.

| TSX Venture Exchange | ||||

| High | Low | |||

| Quarter Ended | (CAD$) | (CAD$) | ||

| May 31, 2013 | $0.26 | $0.17 | ||

| February 28, 2013 | $0.24 | $0.19 | ||

| November 30, 2012 | $0.23 | $0.16 | ||

| August 31, 2012 | $0.24 | $0.17 | ||

| May 31, 2012 | $0.29 | $0.18 | ||

| February 29, 2012 | $0.395 | $0.165 | ||

| November 30, 2011 | $0.63 | $0.225 | ||

| August 31, 2011 | $0.75 | $0.43 | ||

| May 31, 2011 | $0.95 | $0.53 | ||

| February 28, 2011 | $1.86 | $0.245 | ||

| November 30, 2010 | $0.385 | $0.055 | ||

Holders

On June 18, 2013, we had approximately 638 shareholders of record, which does not include shareholders whose shares are held in street or nominee names.

14

Options

As of June 18, 2013, we have 18,279,892 stock options outstanding which are exercisable into 18,279,892 shares of our common stock.

Warrants

As of June 18, 2013, we have 50,968,146 common share purchase warrants outstanding which are exercisable into 50,968,146 shares of common stock.

Convertible Debentures

As of June 18, 2013, we have convertible debentures in the amount of $5,790,540 which are convertible into 30,476,526 shares of common stock without giving effect to accrued interest.

Dividend Policy

We have not paid any cash dividends on our common shares since our inception and do not anticipate paying any cash dividends in the foreseeable future. We plan to retain our earnings, if any, to provide funds for the expansion of our business.

Securities Authorized for Issuance under Equity Compensation Plans

The following table shows our equity securities that are authorized for issuance pursuant to equity compensation plans for our most recently completed fiscal year ended February 28, 2013.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by security holders | 18,279,892 | CAD$0.31 | 75,248 |

| Equity compensation plans not approved by security holders | Nil | Nil | Nil |

| Total | 18,279,892 | CAD$0.31 | 75,248 |

2011 Rolling Share Option Plan

On July 20, 2011, our Board of Directors approved the adoption of a new share option plan (the “2011 Plan”) to comply with the current policies of the TSXV and the amendments to the Income Tax Act (Canada) which impose withholding obligations on taxable benefits arising at the time options are exercised. The 2011 Plan was subject to approval of the TSXV and our shareholders. On August 25, 2011, our shareholders approved the 2011 Plan. On November 24, 2011, the TSXV approved the 2011 Plan.

The purpose of the 2011 Plan is to provide incentives to qualified parties to increase their proprietary interest in us and thereby encourage their continuing association with us. The 2011 Plan is administered by the Board of Directors. The 2011 Plan provides that options will be issued to our directors, officers, employees or consultants or our subsidiary. The 2011 Plan also provides that the number of common shares issuable under the 2011 Plan, together with all of our other previously established or proposed share compensation arrangements, may not exceed 10% of the total number of issued and outstanding common shares (considered to be a “rolling” stock option plan). Pursuant to the 2011 Plan all options expire on a date not later than 10 years after the date of grant of an option. All options outstanding under any existing share plan were rolled into the 2011 Plan.

15

The TSXV policies also require shareholders to annually approve the continuation of the 2011 Plan at our subsequent annual general meetings by ordinary resolution. On November 29, 2012, our shareholders approved the continuation of the 2011 Plan at the Annual General and Special Meeting of Shareholders.

The 2011 Plan is subject to the following restrictions:

| (a) |

We must not grant an option to a director, employee, consultant, or consultant company (the “Service Provider”) in any 12 month period that exceeds 5% of the outstanding shares, unless we have obtained approval by a majority of the votes cast by our shareholders eligible to vote at a shareholders’ meeting, excluding votes attaching to shares beneficially owned by insiders and their associates (“Disinterested Shareholder Approval”); | |

| (b) |

The aggregate number of options granted to a Service Provider conducting investor relations activities in any 12 month period must not exceed 2% of the outstanding shares calculated at the date of the grant, without the prior consent of the TSXV; | |

| (d) |

We must not grant an option to a consultant in any 12 month period that exceeds 2% of the outstanding shares calculated at the date of the grant of the option; | |

| (e) |

The number of optioned shares issued to insiders in any 12 month period must not exceed 10% of the outstanding shares (in the event that the 2011 Plan is amended to reserve for issuance more than 10% of the outstanding shares) unless we have obtained Disinterested Shareholder Approval to do so; | |

| (f) |

The exercise price of an option previously granted to an insider must not be reduced, unless we have obtained Disinterested Shareholder Approval to do so. |

The following is a summary of the material terms of the 2011 Plan:

| (a) |

Persons who are Service Providers to us or our affiliates, or who are providing services to us or our affiliates, are eligible to receive grants of options under the 2011 Plan; | |

| (b) |

Options granted under the 2011 Plan are non-assignable and non-transferable and are issuable for a period of up to 10 years; | |

| (c) |

For options granted to Service Providers, we must ensure that the proposed optionee is a bona fide Service Provider of us or our affiliates; | |

| (d) |

An option granted to any Service Provider will expire within one year (or such other time, not to exceed one year, as shall be determined by the Board as at the date of grant or agreed to by the Board and the optionee at any time prior to expiry of the option), after the date the optionee ceases to be employed by or provide services to us, but only to the extent that such option was vested at the date the optionee ceased to be so employed by or to provide services to us; | |

| (e) |

If an optionee dies, any vested option held by him or her at the date of death will become exercisable by the optionee’s lawful personal representatives, heirs or executors until the earlier of one year after the date of death of such optionee and the date of expiration of the term otherwise applicable to such option; | |

| (f) |

In the case of an optionee being dismissed from employment or service for cause, such optionee’s options, whether or not vested at the date of dismissal, will immediately terminate without right to exercise same; |

16

| (g) |

The exercise price of each option will be set by the Board on the effective date of the option and will not be less than the Discounted Market Price (as defined in the 2011 Plan); | |

| (h) |

Vesting of options shall be at the discretion of the Board, and will generally be subject to: (i) the Service Provider remaining employed by or continuing to provide services to us or our affiliates, as well as, at the discretion of the Board, achieving certain milestones which may be defined by the Board from time to time or receiving a satisfactory performance review by us or our affiliates during the vesting period; or (ii) the Service Provider remaining as a Director of us or our affiliates during the vesting period; and | |

| (i) |

The Board reserves the right in its absolute discretion to amend, suspend, terminate or discontinue the 2011 Plan with respect to all 2011 Plan shares in respect of options which have not yet been granted under the 2011 Plan. |

The Board has determined that, in order to reasonably protect the rights of participants, as a matter of administration, it is necessary to clarify when amendments to the 2011 Plan may be made by the Board without further shareholder approval. Accordingly, the Board may, without shareholder approval:

| (i) |

amend the 2011 Plan to correct typographical, grammatical or clerical errors; | |

| (ii) |

change the vesting provisions of an option granted under the 2011 Plan, subject to prior written approval of the TSXV, if applicable; | |

| (iii) |

change the termination provision of an option granted under the 2011 Plan if it does not entail an extension beyond the original expiry date of such option; | |

| (iv) |

make such amendments to the 2011 Plan as are necessary or desirable to reflect changes to securities laws applicable to us; | |

| (v) |

make such amendments as may otherwise be permitted by the TSXV Policies; | |

| (vi) |

if we become listed or quoted on a stock exchange or stock market senior to the TSXV, make such amendments as may be required by the policies of such senior stock exchange or stock market; and | |

| (vii) |

amend the 2011 Plan to reduce the benefits that may be granted to Service Providers. |

Potential Share Consolidation

Our management wishes to be in a position to effect a consolidation of our issued and outstanding shares of common stock on a basis of up to ten (10) pre-consolidated common shares without par value for one (1) post-consolidated common shares without par value, or such lesser whole number of pre-consolidated common shares as the directors may determine (the “Share Consolidation”). Our management believes that the ability to effect the Share Consolidation will provide us with increased flexibility to seek additional financing opportunities and strategic acquisitions.

We currently have no maximum number of authorized common shares and on effecting any consolidation there will continue to be no maximum number of authorized common shares.

As set out in Section 83 of the British Columbia Business Corporations Act, if any fractional shares are to be converted into whole common shares, each fractional common share remaining after conversion that is less than one-half of a common share must be cancelled and each fractional common share that is at least one-half of a common share must be changed to one whole common share.

17

Any registered shareholder who, on the date the Share Consolidation is effected, is the registered holder of a number of common shares not divisible by ten (10), then in such event, the number of post-consolidated shares shall be converted to whole common shares.

On August 25, 2011, our shareholders approved the Share Consolidation as proposed by our management, which among other things provided the board of directors in its absolute discretion to determine whether or not to proceed with the Share Consolidation without further approval, ratification or confirmation by the shareholders. The Board of Directors did not effect the Share Consolidation and the shareholder approval expired on August 25, 2012.

On November 29, 2012, we resubmitted the proposal of such Share Consolidation to our shareholders at the Annual General and Special Meeting of the Stockholders. The shareholders approved the Share Consolidation and the Board of Directors has by November 23, 2013 to implement the Share Consolidation. As of the date of this prospectus, we have not effected the Share Consolidation, which is also subject to regulatory approval, including the approval of the TSXV and Financial Industry Regulatory Authority (FINRA).

Shareholder Rights Plan

On July 20, 2011, our Board of Directors approved the adoption of a shareholder rights plan (the “Rights Plan”) between us and Computershare Trust Company of Canada (“Computershare Trust”), as Rights Agent. The Board’s objective in adopting the Rights Plan is to ensure the fair treatment of shareholders in connection with any take-over bid for our common shares. The Rights Plan was not adopted by the Board in response to any proposal to acquire control of us.

In accordance with TSXV policies, the Rights Plan must be ratified by a majority of the votes cast at a meeting of shareholders within six months of the adoption of the Rights Plan by the Board. At our annual and special general meeting held on August 25, 2011, our shareholders ratified and confirmed the Rights Plan.

The Rights Plan was subject to TSXV approval , which approval was received from the TSXV on September 6, 2012.

Purpose of Rights Plan

The primary objective of the Rights Plan is to ensure that all of our shareholders are treated fairly in connection with any take-over bid for us by (a) providing shareholders with adequate time to properly assess a take-over bid without undue pressure and (b) providing the Board with more time to fully consider an unsolicited take-over bid, and, if applicable, to explore other alternatives to maximize shareholder value.

Summary of Rights Plan

The following description of the Rights Plan is a summary only.

Issue of Rights

We will issue one right (a “Right”) in respect of each common share outstanding at the close of business on the adoption of the Rights Plan. We will also issue Rights on the same basis for each common share issued after the Record Time but prior to the earlier of the Separation Time and the Expiration Time (both defined below).

The Rights

Each Right will entitle the holder, subject to the terms and conditions of the Rights Plan, to purchase additional shares of our common stock after the Separation Time.

18

Rights Certificates and Transferability

Before the Separation Time, the Rights will be evidenced by certificates for the common shares, and are not transferable separately from the common shares. From and after the Separation Time, the Rights will be evidenced by separate Rights Certificates, which will be transferable separately from and independent of the common shares.

Exercise of Rights

The Rights are not exercisable before the Separation Time. After the Separation Time and before the Expiration Time, each Right entitles the holder to acquire one share for the exercise price of $50.00 (subject to certain anti-dilution adjustments). This exercise price is expected to be in excess of the estimated maximum value of the common shares during the term of the Rights Plan. Upon the occurrence of a Flip-In Event (defined below) prior to the Expiration Time, each Right (other than any Right held by an “Acquiring Person”, which will become null and void as a result of such Flip-In Event) may be exercised to purchase that number of common shares which have an aggregate market price equal to twice the exercise price of the Rights for a price equal to the exercise price (subject to adjustment). Effectively, this means our shareholder (other than the Acquiring Person) can acquire additional common shares from treasury at half their market price.

Definition of “Acquiring Person”

Subject to certain exceptions, an Acquiring Person is a person who becomes the Beneficial Owner (defined below) of 20% or more of our outstanding common shares.

Definition of “Beneficial Ownership”