UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

AMENDMENT NO.2

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 15, 2013

| SILVERSTAR MINING CORP. | ||||

| (Exact name of registrant as specified in its charter) | ||||

| Nevada | 333-140299 | 98-0425627 | ||

| (State or

other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) | ||

| 1489 West Warm Springs Road, Ste. 110, Henderson, NV | 89014 | |||

| (Address of principal executive offices) | (Zip Code) | |||

| Registrant’s telephone number, including area code (201) 633-4716 | ||||

| 2500 Plaza 5, 25th Floor, Harborside Financial Center, Jersey City, NJ 07311 | ||||

| (Former name or former address, if changed since last report.) | ||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note: This Amendment No. 2 to our Current Report on Form 8-K originally filed on February 19, 2013 (as first amended on May 21, 2013) is filed to withdraw the audited financial statements of Arriba Resources Inc. for the years ended December 31, 2011 and September 30, 2012, and the AICPA audit report of Grant Thornton LLP dated November 30, 2012. We are removing the audit report at the request of Grant Thornton LLP pending completion of incremental audit procedures required to bring the audit report into conformance with PCAOB standards, and certain amendments to our original Current Report on Form 8-K.

| ITEM 2.01 | COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS | |

| ITEM 3.02 | UNREGISTERED SALES OF EQUITY SECURITIES | |

| ITEM 5.01 | CHANGES IN CONTROL OF REGISTRANT |

ACQUISITION OF ARRIBA RESOURCES INC.

On December 27, 2012 we entered into a share exchange agreement (the “Share Exchange Agreement”) with Arriba Resources Inc., a Canadian incorporated company (“Arriba”) and the shareholders of Arriba, pursuant to which we agreed to acquire all 20,899,262 issued and outstanding shares of Arriba in exchange for the issuance of 4,179,852 shares of our common stock as well as warrants to acquire 2,078,477 shares of our common stock at $1.75 per share for a period of 360 days from the closing. On February 15, 2013, we closed on this agreement. These securities were issued without a prospectus

Arriba is engaged in the exploration and development of mineral properties. It currently holds 70% of a drilling company as well as 50% of the “La Palma” gold and silver property in Mexico and an option to acquire a further 30%.

Upon the acquisition of Arriba as our wholly owned subsidiary, we have changed our business focus to that of operating Arriba’s majority owned drilling company and completing an exploration program on the La Palma property.

We will file audited financial statements of Arriba within 75 days of the completion of the acquisition by including them in an amendment to this Current Report on Form 8-K.

The closing of the share exchange agreement also resulted in the creation of a new control shareholder in our company. Mexican Resources Ltd., now holds 1,319,852 shares of our common stock as well as warrants to acquire a further 1,319,852 shares of our common stock at $1.75 per share until February 15, 2014. The shares and warrants, in the aggregate, result in Mexican Resources Ltd., holding a total of 46.4% of our issued and outstanding voting securities.

La Palma Property

On June 17, 2011, our wholly owed subsidiary, Arriba, entered into an option agreement with Minas de Alta Ley La Palma, S.A. de C.V. a company incorporated under the laws of Mexico for the right to acquire up to 80% of the La Palma Property. This agreement was subsequently amended twice.

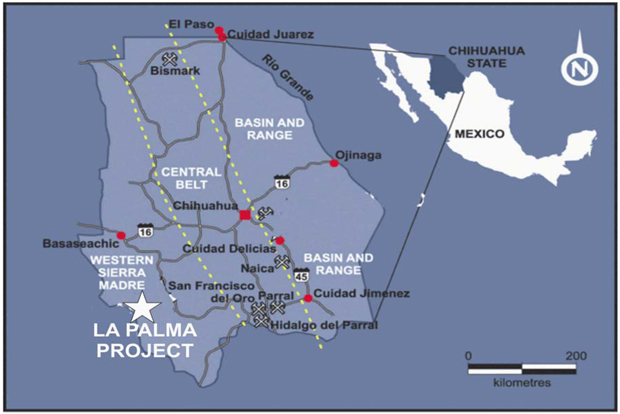

Location and Access

The La Palma property is located in the south-western portion of the Mexican state of Chihuahua. The La Palma property comprises a package of two active exploration Claims (T-226922 and T-227492) that totals 2,600 hectares. The two exploration claims comprising the La Palma Property are located in the south-western part of the Chihuahua state, Mexico, approximately 275 km. southwest of Chihuahua City and 33 km southwest of the municipality of Batopilas. Access to the property area from Chihuahua is via paved Highway 127 driving south to the town of Creel. From Creel, a paved mountain road leads south to Cusare. From this point a state-maintained gravel road leads southerly to the village of Batopilas. Access to the property from Batopilas is by gravel road (approximately a 2-hour drive). Driving time from Chihuahua to Batopilas is approximately seven hours in dry weather. By helicopter, the flying time from Chihuahua to the property is approximately 1 hour forty minutes. International flights by commercial airlines to some US cities and to most national major cities are available from Chihuahua City. Only some parts of the property are accessible by foot due to the steep to moderately undulating topography. There are few dirt roads that can be driven by 4-wheel-drive vehicles. Topographic relief at the property has creeks and canyons up to 300 meters deep which expose bedrock suitable for the geological evaluation.

The area is semi-arid with a pronounced rainy season from June through late September. The annual temperature at la Palma varies from 12° to 26° C, with an average of about 18° C. Daytime temperatures during the summer can reach 35° C with cooler evenings. Snow is unusual during the winter dry season although temperatures occasionally dip below freezing. Climate is generally dry with sporadic, often violent rainstorms during the summer months. Rainfall in the northern parts of Chihuahua averages 42 centimeters (16.9 inches) per year mainly between May and October. Field work can be carried out during most of the year, except from minor interruptions during intermittent rains that make the tracks difficult to drive.

| 2 |

| 3 |

*Photo looking southwest from UTM 214,800 2´965,580, showing the topography and typical vegetation on the La Palma property.

Ownership Interest

On June 17, 2011 our wholly owned subsidiary, Minera Arriba S.A. de C.V, entered into an option agreement with Minas de Alta Ley La Palma, S.A. de C.V., for an option to acquire up to 80% of the La Palma property. This agreement was subsequently amended twice.

In order to acquire 50% of the La Palma property, Arriba paid a total of $350,000 and issued 1,500,000 shares of its common stock to Minas de Alta Ley La Palma, S.A. de C.V. The 1,500,000 shares held by Minas de Alta Ley La Palma, S.A. de C.V., are part of the share exchange described in this Current Report and result in Minas de Alta Ley La Palma, S.A. de C.V., owning 300,000 shares of our company.

We can earn a further 30% of the La Palma property as follows:

| ● | upon: (i) incurring cumulative exploration expenditures equal to or greater than $1,500,000 on or prior to June 30, 2013, and (ii) making cash payment installments to the Minas de Alta Ley La Palma, S.A. de C.V., of $25,000 by October 31, 2012 (paid) and an additional $275,000 by June 30, 2013, a further ten percent (10%) right, title and interest in the property (for a total of 60%) will automatically vest to us free and clear of all encumbrances; |

| ● | upon: (i) incurring cumulative exploration expenditures equal to or greater than $2,500,000 on or prior to January 31, 2014, and (ii) making a cash payment of $300,000 to the Minas de Alta Ley La Palma, S.A. de C.V., a further ten percent (10%) right, title and interest in the property (for a total of 70%) will automatically vest to us free and clear of all encumbrances; and |

| ● | upon: (i) incurring cumulative exploration expenditures equal to or greater than $4,000,000 on or prior to January 31, 2015, and (ii) making a cash payment of $300,000 to Minas de Alta Ley La Palma, S.A. de C.V., a further ten percent (10%) right, title and interest in the property (for a total of 80%) will automatically vest to us free and clear of all encumbrances. |

| 4 |

History of Operations and Present Condition

Though there appears to have been historical activity on the property, nothing is known about the historic pits, trenches and old shallow mines which are present.

Upon the execution of the option agreement between our subsidiary and Minas de Alta Ley La Palma, S.A. de C.V, Geomaps S.A. de C.V. was engaged to do initial exploration work which included (i) geological mapping and prospecting, (ii) reconnaissance geochemistry through channel sampling and (iii) rehabilitating the access road from San Ignacio to La Palma property (16 km) and construction of new roads (8 km) for the drilling exploration program. The three components of this initial phase were completed by December 2011 at a total cost of US$107,254.

This initial reconnaissance exploration program was completed under the direction of geologist Hipolito Monje. The program began on September 3rd 2011 and was finished on October 30th 2011. It involved a geological mapping and prospecting to locate areas with significant quartz veining. Old workings and pits were examined and sampled, including those at the Tejon and La Soledad mines.

Geologist Jose Yael Ocampo collected a total of 269 chip channel samples to test the possibility that high-grade, silver-gold mineralization may be present. Channel samples up to 1 m long were taken; these included the various types of quartz vein material as well as the hydrothermally altered wall-rock adjacent to individual veins. The assay results revealed a number of localities underlain by andesitic rocks with significant amounts of silver mineralization.

Plan of Exploration

We plan to conduct exploration activities on the La Palma in two separate phases as follows:

Phase 1

| Trenching and road construction. | $ | 82,365 | ||

| Diamond drilling (10,000 m @ $125/m) | $ | 1,250,000 | ||

| Project geologist (150 days @ $370/day | $ | 55,500 | ||

| Camp, meals, transportation & logistics | $ | 61,770 | ||

| Assays (2,000 samples @ $36/sample) | $ | 72,000 | ||

| Miscellaneous and contingencies 20% | $ | 304,330 | ||

| Total phase 1 estimated cost | $ | 1,825,965 |

Contingent on the successful completion of Phase I, it is recommended a Phase II exploration program consisting primarily on 8,000 m of diamond drill targets areas defined in Phase I. The Phase II, program as proposed includes: follow up geology, geochemistry and sampling in addition to the drilling and is estimated to cost $1,211,660.

Phase 2

| Trenching and road construction. | $ | 51,475 | ||

| Diamond drilling (8,000 m @ $125/m) | $ | 1,000,000 | ||

| Project geologist (120 days @ $370/day) | $ | 44,400 | ||

| Camp, meals, transportation | $ | 61,785 | ||

| Assays (1,500 samples @ $36/sample) | $ | 54,000 | ||

| Total phase 2 estimated cost | $ | 1,211,660 |

| 5 |

Geology

The La Palma property is underlain by a series of equi-granular, porphyritic andesitic flows and breccias of the Lower volcanic complex. The andesitic rocks are unconformably overlain by rhyolite flows and ignimbrites of the Upper volcanic complex which occur at higher elevations and often form prominent cliffs in the area. The rocks of the Lower volcanic complex are predominately andesitic and dacitic rocks, whose exposures are most abundant within arroyos and along walking trails. Beside, little outcrop is exposed within the area under exploration. The most abundant rocks in the property area are andesitic ash tuffs and lapilli tuffs. There are medium grayish-green to light grey to brownish-green, generally crystalline rocks. The andesitic tuffs are usually medium grained, but grain size ranges from aphanitic to coarse grained, lapilli clast range in size from 4 mm to greater than 35 cm across, and generally form 10 to 40% of the rock volume.

Coarse grained agglomerates are most abundant within the central and northern portions of the area, immediately underlying Upper Volcanic Series rhyolites at west of La Palma claim. These agglomerates are generally maroon in color and contain abundant hematite within both the coarse clasts and the matrix. The coarse-grained andesitic fragmental units locally contain well-rounded pebbles and cobbles of andesitic and feldspar porphyry within and andesitic tuff matrix.

Undifferentiated, fine grained, crystalline andesites occur throughout the property. Coarse to medium grained, porphyritic andesite flows occur locally. Subhedral to euhedral plagioclase phenocrysts in these flows are of variable size up to 4 mm in length. Maroon andesite porphyry locally contains blocky euhedral feldspar phenocrysts 5 by 12 mm across. The andesite within the mapped area is generally non-magnetic.

Dacitic ash and lapilli tuffs are commonly interlayered on a meter scale within the andesitic tuffs. The dacitic rocks are light brownish grey to pale grey, are more felsic and commonly appear to be more “bleached” than adjacent andesites. This “bleaching” may simply be due to more abundant feldspars within the dacites which weather may form clay minerals.

The Lower Volcanic Series rocks are generally maroon and contain abundant disseminated hematite and occur at higher elevations within the mapped area. This hematite typically occurs in the rocks immediately underlying the Upper Volcanic Series rhyolites throughout the region; it is likely a product of weathering of the Lower Volcanic Complex rocks prior to deposition of the Upper Volcanic Series. All these Lower Volcanic Complex rocks have a weak chlorite alteration and are silicified in many places. Patchy epidote alteration occurs, mainly as irregular veinlets up to a few cm in width, or as alteration envelopes along fractures. Bleaching and argillic alteration are common, and are especially intense along major fault structures.

The rocks of the Lower Volcanic Series have locally been intruded by andesite to basalt dykes that are usually emplaced along north trending structural breaks or faults. The dykes are generally 1 to 5 meters wide and are relatively fresh and unaltered; they have a brown weathered surface. The dykes are generally porphyritic with plagioclase and hornblende phenocrysts and are locally moderately magnetic.

Rhyolite tuff and agglomerate of the Upper Volcanic Series discordantly overlie the Lower Volcanic Series rocks, and were deposited after the main structural and mineralizing events within the area. The rhyolite tuff and agglomerate are present at higher elevations in the area. These rock units are relatively flat-lying, with dips ranging up to 15 degrees. Rhyolite tuff is fine grained, granular, silica-indurated. It locally contains small amounts of hematite. The matrix of the rhyolite agglomerate at the northwest area is generally cemented by silica and hematite.

Arroyos in the property area are generally the surface expression of faults. Faults mainly strike northeasterly to northerly and dip steeply to the west or are sub-vertical; however a few easterly striking faults were mapped. A subsidiary set of structures strikes northwesterly and dips steeply to the northeast. Fault zones are up to 5 m wide and are marked by moderate to intense clay alteration of crushed and broken rock. Silica alteration and/or quartz veining is less common along the faults.

The individual rock units are less than 100 meters thick. Bedding is absent or rare, especially within the coarse fragmental rocks units. The orientation of the rock units is therefore often difficult to determine. However, the rocks appear to strike northwesterly and dip steeply in the southeastern part of the property. Beds observed on the western side of the La Palma claim strike northerly and dip easterly at shallow angles.

| 6 |

A series of northerly striking, normal faults form a dominant structural trend in the La Palma property. The northerly striking shear systems are comprised of a series of sub-parallel, normal faults of regional extent. The more important faults within this structural set are the El Tejon and La Soledad to the east and Cueva Blanca to the west. El Tejon shear system can be traced for approximately 2.5 km, and La Soledad fault system 1.2 km from the central portion on the La Palma claim.

Index of Geologic Terms

| TERM | DEFINITION | |

| andesitic | a fine-grained grayish volcanic rock characterized by feldspar minerals | |

| agglomerate | rock produced by a volcanic eruption, consisting of fragments of different rock types, sizes, and shapes set in fine-grained solidified volcanic ash | |

| aphanitic | an igneous rock with mineral components that are too fine to be seen by the naked eye | |

| argillic | clay like | |

| arroyo | a steep-sided dry gulch in a desert area that is wet only after heavy rain | |

| basalt | a hard, black, often glassy, volcanic rock. It was produced by the partial melting of the Earth’s mantle | |

| dacitic | relating to an igneous, volcanic rock. It has an aphanitic to porphyritic texture and is intermediate in composition between andesite and rhyolite. | |

| epidote | a shiny green, yellow, or black hydrous aluminosilicate mineral containing calcium and iron. | |

| euhedral | crystals which are well-formed with sharp, easily recognised faces | |

| feldspar | an extremely common aluminosilicate mineral containing varying proportions of calcium, sodium, potassium, and other elements. Feldspar minerals are subdivided into two groups, orthoclase feldspars and plagioclase feldspars. | |

| hematite | a black, brown, or red mineral consisting of iron oxide, often in very large deposits. Use: source of iron. | |

| hornblende | a dark green to black mineral of the amphibole group, containing calcium, iron, magnesium, and sodium | |

| ignimbrite | a volcanic rock consisting of droplets of lava and glass that were welded together by intense heat | |

| lapilli | a small fragment of lava thrown from a volcano | |

| phenocryst | a large embedded crystal in a porphyritic rock | |

| plagioclase | a feldspar consisting of sodium and calcium aluminum silicates | |

| porphyry | a reddish purple rock containing large distinct feldspar crystals embedded in a fine-grained groundmass | |

| rhyolite | a fine-grained acid rock that is the volcanic form of granite | |

| silicification | to convert something into silica, or become converted into silica | |

| subhedral | a crystal where only part of the crystallographic shape is preserved | |

| tuff | a rock made up of very small volcanic fragments compacted together |

| 7 |

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(a) Financial Statements of Business Acquired

None.

(d) Exhibits

EXHIBIT INDEX

| Exhibit No. | Description | |

| 2.1 | Share Exchange Agreement with Arriba Resources Inc. (incorporated by reference from a Form 8-K/A Current Report filed on January 11, 2013) | |

| 10.1 | Option Agreement for La Palma Property (incorporated by reference from a Form 8-K Current Report filed on February 19, 2013) | |

| 10.2 | First Amendment to the Option Agreement for the La Palma Property (incorporated by reference from a Form 8-K Current Report filed on February 19, 2013) | |

| 10.3 | Second Amendment to the Option Agreement for the La Palma Property (incorporated by reference from a Form 8-K Current Report filed on February 19, 2013) | |

| 99.1 | 43-101 Report on La Palma (incorporated by reference from a Form 8-K Current Report filed on February 19, 2013) |

| * | The schedules to this document are not being filed herewith. Silverstar Mining Corp. agrees to furnish supplementally a copy of any such schedule to the Securities and Exchange Commission upon request. |

| 8 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SILVERSTAR MINING CORP. | ||

| Date: June 18, 2013 | By: | /s/ Neil Kleinman |

| Neil Kleinman | ||

| Chief Executive Officer | ||

| (Chief Principal Officer) | ||

| 9 |