Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InvenTrust Properties Corp. | a13-15153_18k.htm |

| EX-99.1 - EX-99.1 - InvenTrust Properties Corp. | a13-15153_1ex99d1.htm |

Exhibit 99.2

|

|

Investor Services Group 800-826-8228 Foward-Looking Statements This presentation may contain forward-looking statements. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, and are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “will,” the Securities Exchange Act of 1934. These forward-looking statements involve numerous risks and uncertainties that could cause actual results to be materially different from those set forth in the forward-looking statements. These risks are outlined more particularly in our annual report on Form 10-K for the year ended December 31, 2012 and any subsequent Quarterly Reports on Form 10-Q or current reports on Form 8-K to include but are not limited to: Financial market disruptions current and future economic conditions could adversely affect our ability to refinance or secure additional debt financing at attractive terms as well as the values of our investments Our ongoing strategy involves the disposition of properties; however, we may be unable to sell a properly at acceptable terms and conditions, it at all. Our strategy also depends on future acquisitions, and we may not be successful in identifying and consummating these transactions. There is no assurance that we will be able to continue paying cash distributions or that distributions will increase over time An ongoing investigation by the SEC and the receipt of two related derivative demands by stockholders to conduct investigations and a lawsuit related to the derivative demands. The SEC’s investigation, the derivative demands, or both could have a material adverse impact on our business Funding distributions from sources other than cash flow from operating activities may negatively impact our ability to sustain or pay distributions and will result in us having less cash available for other uses These is no established public market for our shares, and stockholders may not be able to sell their shares, including through our share repurchase program Increasing vacancy rates for certain classes of real estate assets and possible disruption in the financial markets could adversely affect the value of our assets We may suffer adverse consequences due to the financial difficulties, bankruptcy or insolvency of our tenants Our investments in equity and debt securities have materially impacted, and may in future, materially impact our results Our borrowings may reduce the funds available for distribution and increase the risk of loss since defaults may cause us to lose the properties securing the loans Two tenants generated a significant portion of our revenue, and rental payment defaults by these significant tenants could adversely affect our results of operations We are subject to conflicts of interest with affiliates of our sponsor, which may affect our acquisition of properties and financial performance The estimated value of our common stock is based on a number of assumptions and estimates that may not be accurate or complete and is also subject to a number of limitations We rely on our business manager and property managers to manage our business and assets, and pay significant fees to these parties If we fail to qualify as a REIT, our operations and distributions to stockholders will be adversely affected This material is neither an offer to sell nor the solicitation of an offer to buy any security, which can be made only by the prospectus which has been filed or registered with appropriate state and federal regulatory agencies. No regulatory agency has passed on or endorsed the merits of this offering. Any representation to the contrary is unlawful. The companies depicted in the photographs herein may have proprietary interests in their trade names and trademarks and nothing herein shall be considered to be on endorsement, authorization or approval of Inland American by the companies. Furthermore, none of these companies are affiliated with Inland American in any manner. The Inland name and logo are registered trademarks being used under license. |

|

|

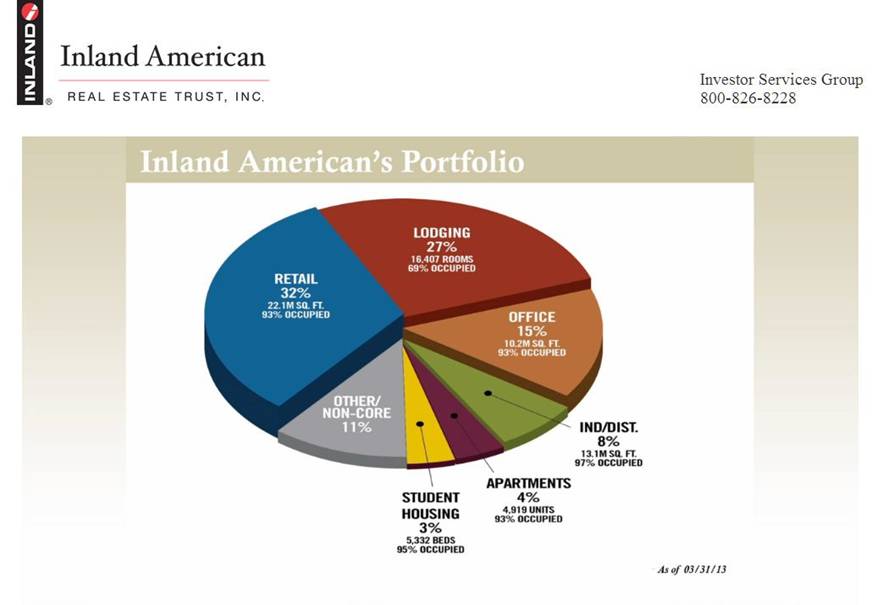

Inland American REAL ESTATE TRUST, INC. Investor Services Group 800-826-8228 Inland American's Portfolio RETAIL 32% 22.1M.SQ.FT. 93% OCCUPIED LODGING 27% 16.407 ROOMS 69% OCCUPIED OFFICE 15% 10.2M SQ.FT. 93% OCCUPIED STUDENT HOUSING 3% 5,332 BEDS 95% OCCUPIED APARTMENTS 4% 4,919 UNITS 93% OCCUPIED As of 03/31/13 IND/DIST. 8% 13.1M SQ.FT. 97% OCCUPIED OTHER/NON-CORE 11% |

|

|

Investor Services Group 800-826-8228 In Millions Three months ended 3/31/2013 3/31/2012 Net income (loss) attributable to Company 4,483 (30,283) Add: Depreciation and amortization related to investment properties and investment in unconsolidated entities 112,822 124,971 Provision for asset impairment reflected in continuing and discontinued operations 13,932 10,429 Impairment, loss and (gain) of investment in unconsolidated entities, net (131) 4,200 Impairment / (gain) of investment property reflected in equity in earnings of unconsolidated entities, net - - Gain on sale of property reflected in net income attributed to noncontrolling interest - - Less: Gains from property sales and transfer of assets 23,893 - Funds from Operations 107,213 109,317 Weighted Average Shares Outstanding 892,097,144 872,885,566 |