Attached files

| file | filename |

|---|---|

| EX-23.2 - EX 23.2 - Acer Therapeutics Inc. | d551477dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 17, 2013

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

OPEXA THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Texas | 2834 | 76-0333165 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2635 Technology Forest Blvd.

The Woodlands, Texas 77381

(281) 272-9331

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Neil K. Warma

President and Chief Executive Officer

OPEXA THERAPEUTICS, INC.

2635 Technology Forest Blvd.

The Woodlands, Texas 77381

(281) 272-9331

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Mike Hird, Esq. Patty M. DeGaetano, Esq. Pillsbury Winthrop Shaw Pittman LLP 12255 El Camino Real, Suite 300 San Diego, CA 92130 (619) 234-5000 |

Christopher S. Auguste, Esq. Kramer Levin Naftalis & Frankel LLP 1177 Avenue of the Americas New York, NY 10036 (212) 715-9100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Common Stock, $0.01 par value(3) |

$17,250,000 | $2,352.90 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Pursuant to Rule 416(a) under the Securities Act of 1933, the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| (3) | Includes shares of common stock which may be issued upon exercise of an option granted to the underwriters to cover over-allotments, if any. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 17, 2013 |

Shares

Common Stock

We are offering shares of our common stock. Our common stock is listed on the NASDAQ Capital Market under the symbol “OPXA.” On June 14, 2013, the last reported sales price for our common stock was $1.70 per share.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 14 in this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” for a description of compensation payable to the underwriters. |

We have granted a 30-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares of common to purchasers in this offering on or about , 2013.

Aegis Capital Corp

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 10 | ||||

| 14 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| Market Price of our Common Stock and Related Stockholder Matters |

43 | |||

| 43 | ||||

| 44 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | |||

| 51 | ||||

| 67 | ||||

| 69 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

74 | |||

| 78 | ||||

| 80 | ||||

| 81 | ||||

| 89 | ||||

| 89 | ||||

| 89 | ||||

| 89 | ||||

| F-1 | ||||

ABOUT THIS PROSPECTUS

The registration statement we filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find More Information,” before making your investment decision.

You should rely only on the information provided in this prospectus or in a prospectus supplement or amendment thereto. We have not authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any state where the offer or sale is not permitted. You should assume that the information in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless the context otherwise requires, references in this prospectus to “Opexa,” “the Company,” “we,” “us” and “our” refer to Opexa Therapeutics, Inc. TcelnaTM and ImmPathTM are trademarks of Opexa. All other product and company names are trademarks of their respective owners.

i

Table of Contents

This summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before you decide to invest in our common stock, you should read this entire prospectus carefully, including the section entitled “Risk Factors,” and our consolidated financial statements and the related notes.

Our Business

Opexa is a biopharmaceutical company developing a personalized immunotherapy with the potential to treat major illnesses, including multiple sclerosis (MS). This therapy is based on our proprietary T-cell technology. Our mission is to lead the field of Precision ImmunotherapyTM by aligning the interests of patients, employees and shareholders. Information related to our product candidate, Tcelna™, is preliminary and investigative. Tcelna has not been approved by the U.S. Food and Drug Administration (FDA) or other global regulatory agencies for marketing.

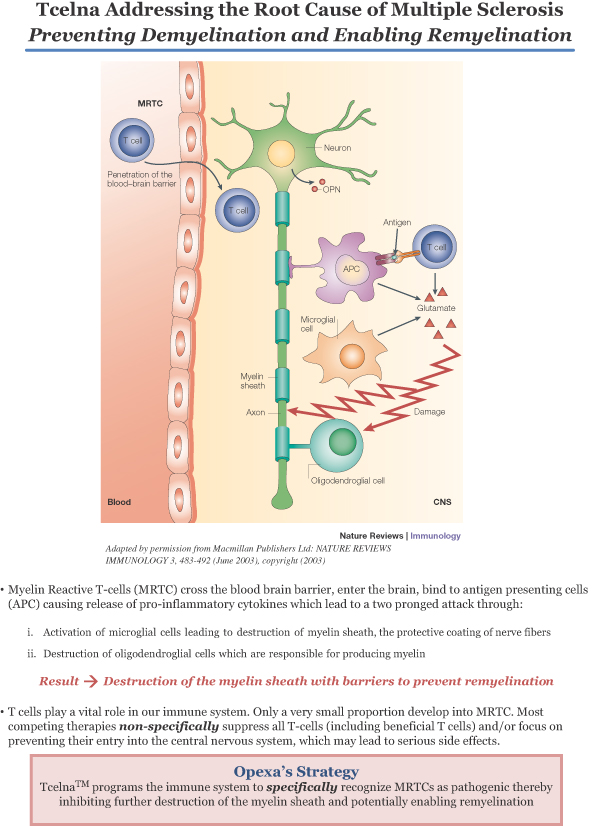

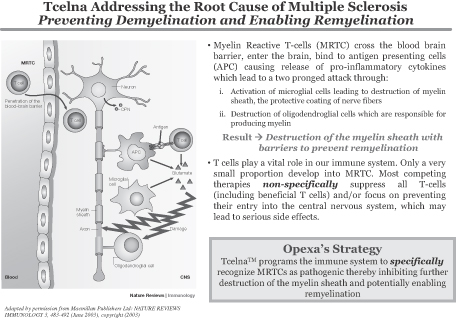

MS is a chronic, often disabling disease that affects the central nervous system (CNS), which is made up of the brain, spinal cord and optic nerves. MS attacks the covering surrounding nerve cells, or myelin sheaths, leading to loss of myelin (demyelination) and nerve damage. Symptoms may be mild, such as numbness in the limbs, or severe, such as paralysis or loss of vision. The progress, severity and specific symptoms of MS are unpredictable and vary from one person to another. We believe that our product candidate, Tcelna, has the potential to fundamentally address the root cause of MS by stopping the demyelination process and in supporting the generation of new myelin sheaths where demyelination has occurred (remyelination).

Tcelna is an autologous T-cell immunotherapy that is currently being developed for the treatment of Secondary Progressive MS (SPMS) and is specifically tailored to each patient’s immune response profile to myelin. Tcelna is designed to reduce the number and/or functional activity of specific subsets of myelin-reactive T-cells (MRTCs) known to attack myelin. This technology was originally licensed from Baylor College of Medicine in 2001.

Tcelna is manufactured using our proprietary method for the production of an autologous T-cell product, which comprises the collection of blood from the MS patient and the expansion of MRTCs from the blood. Upon completion of the manufacturing process, an annual course of therapy consisting of five doses is cryopreserved. At each dosing time point, a single dose of Tcelna is formulated and attenuated by irradiation before returning the final product to the clinical site for subcutaneous administration to the patient.

Tcelna has received Fast Track designation from the FDA in SPMS, and we believe it is positioned as a potential first-to-market personalized T-cell therapy for MS patients. The FDA’s Fast Track program is designed to facilitate the development and expedite the review of drug candidates intended to treat serious or life-threatening conditions and that demonstrate the potential to address unmet medical needs.

Opexa was incorporated in Texas in March 1991. Our principal executive offices are located at 2635 Technology Forest Blvd., The Woodlands, Texas 77381, and our telephone number is (281) 775-0600.

T-Cell Therapy and Tcelna

Tcelna is a novel T-cell immunotherapy in Phase IIb clinical development for the treatment of patients with SPMS. It is also positioned to enter Phase III clinical development for the treatment of patients with relapsing remitting MS (RRMS), subject to the availability of sufficient resources. Tcelna is a personalized therapy that is specifically tailored to each patient’s disease profile. Tcelna is manufactured using ImmPathTM, our proprietary

1

Table of Contents

method for the production of a patient-specific T-cell immunotherapy which encompasses the collection of blood from the MS patient, isolation of peripheral blood mononuclear cells, generation of an autologous pool of MRTCs raised against selected peptides from myelin basic protein (MBP), myelin oligodendrocyte glycoprotein (MOG) and proteolipid protein (PLP), and the return of these expanded, irradiated T-cells back to the patient. These attenuated T-cells are reintroduced into the patient via subcutaneous injection to trigger a therapeutic immune system response.

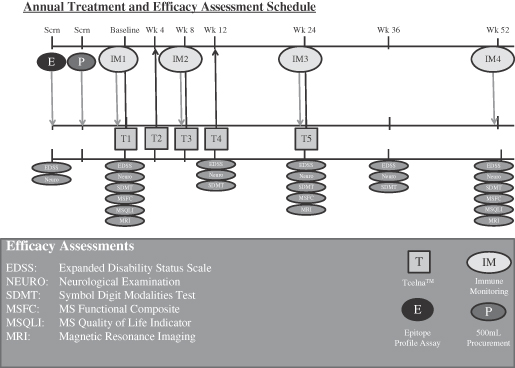

Abili-T Trial: Phase IIb Clinical Study in Patients with SPMS

In September 2012, we announced the initiation of a Phase IIb clinical trial of Tcelna in patients with SPMS. The trial is entitled: A Phase II Double-Blind, Placebo Controlled Multi-Center Study to Evaluate the Efficacy and Safety of Tcelna in Subjects with Secondary Progressive Multiple Sclerosis and has been named the “Abili-T” trial. The Abili-T trial is a double-blind, 1:1 randomized, placebo-controlled study in SPMS patients who demonstrate evidence of disease progression with or without associated relapses. The trial is expected to enroll 180 patients who have Expanded Disability Status Scale (EDSS) scores between 3.0 and 6.0 at approximately 30 leading clinical sites in the U.S. and Canada. According to the study protocol, patients will receive two annual courses of Tcelna treatment consisting of five subcutaneous injections per year at weeks 0, 4, 8, 12 and 24.

The primary efficacy endpoint of the trial is the percentage of brain volume change (whole brain atrophy) at 24 months. Study investigators will also measure several important secondary outcomes commonly associated with MS including sustained disease progression as measured by EDSS, changes in EDSS, time to sustained progression, annualized relapse rate (ARR), change in Multiple Sclerosis Functional Composite (MSFC) assessment of disability and change in Symbol Digit Modality Test. Data on certain exploratory endpoints such as quality of life metrics as measured by the Multiple Sclerosis Quality of Life Inventory (MSQLI), magnetic resonance imaging (MRI) measures and immune monitoring metrics are also being collected.

2

Table of Contents

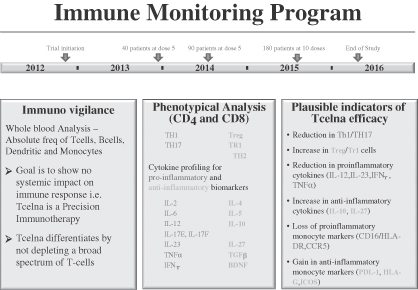

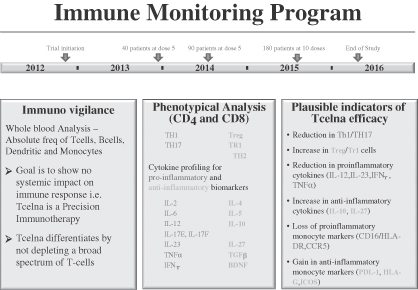

As part of the Abili-T trial, we are undertaking a comprehensive immune monitoring program for all patients enrolled in the study. The goals of this program are to further understand the biology behind the mechanism of action for Tcelna and to possibly identify novel biomarkers that are dominant in the pathophysiology of SPMS patients. The program encompasses an analysis of various pro-inflammatory and anti-inflammatory biomarkers. We believe that the blinded data, which will be analyzed during the course of the trial, may potentially signal responders and non-responders. Directional movement of certain biomarkers, when corroborated with final clinical trial data, may be indicative of responders and disease stabilization or progression. A summary of pro-inflammatory and anti-inflammatory biomarkers to be studied, with their potential outcomes, is set forth in the graphic below.

As of June 14, 2013, the Abili-T clinical trial has randomized 53 patients. A scheduled Data Safety Monitoring Board meeting took place during the week of May 20, 2013, and a recommendation was made to continue the study. The Abili-T clinical study in North America of Tcelna is expected to complete enrollment of 180 patients by late 2013 or early 2014, with the resulting top-line data expected to be available in the first half of 2016.

During the first quarter of 2013, the pace of on-boarding clinical sites for the Abili-T clinical study was tempered pending the completion of our negotiations with Ares Trading SA (“Merck”), a wholly owned subsidiary of Merck Serono S.A., for the Option (see “—Option and License Agreement with Merck Serono”) as well as financial considerations. Upon receipt of the upfront payment of $5 million for granting the Option, we were able to refocus on execution of the Abili-T clinical trial, including enrollment. The future costs of the study, which have been impacted by a slowed rate of enrollment prior to receipt of the upfront payment of $5 million for granting the Option, as well as the ongoing expenses of our operations through the expected completion date of the study and release of top-line data, are estimated as of May 31, 2013 to be between $30-$32 million. Our existing resources are not adequate to permit us to complete such study or the majority of it. We anticipate that $ million of the proceeds from the offering will be applied to funding the continuation of the clinical study as well as the ongoing expenses of our operations during such development. We will need to secure significant additional resources to complete the trial and support our operations during the pendency of the trial. There can be no assurance that any such financings or potential opportunities and alternatives can be consummated on acceptable terms, if at all. We believe we have sufficient liquidity to support our clinical trial activities into the fourth quarter of 2013. Given our need for substantial amounts of capital to continue the Abili-T clinical study in

3

Table of Contents

North America of Tcelna in SPMS, we intend to continue to explore potential opportunities and alternatives to obtain the significant additional resources, including one or more additional financings, that will be necessary to complete the Abili-T study and to support our operations during the pendency of such study.

Option and License Agreement with Merck Serono

On February 4, 2013, we entered into an Option and License Agreement with Merck. Pursuant to the agreement, Merck has an option (the “Option”) to acquire an exclusive, worldwide (excluding Japan) license of our Tcelna program for the treatment of MS. The Option may be exercised by Merck prior to or upon completion of our ongoing Abili-T trial of Tcelna in patients with SPMS.

Under the terms of the agreement, we received an upfront payment of $5 million for granting the Option. If the Option is exercised, Merck would pay us an upfront license fee of $25 million unless Merck is unable to advance directly into a Phase III clinical trial of Tcelna for SPMS without a further Phase II clinical trial (as determined by Merck), in which event the upfront license fee would be $15 million. After exercising the Option, Merck would be solely responsible for funding development, regulatory and commercialization activities for Tcelna in MS, although we would retain an option to co-fund certain development in exchange for increased royalty rates. We would also retain rights to Tcelna in Japan, certain rights with respect to the manufacture of Tcelna, and rights to use for other indications outside of MS.

Based upon the achievement of development milestones by Merck for Tcelna in SPMS, we would be eligible to receive one-time milestone payments totaling up to $70 million as follows: (i) milestone payments aggregating $35 million if Tcelna is submitted for regulatory approval and commercialized in the United States; (ii) milestone payments aggregating $30 million if Tcelna is submitted for regulatory approval in Europe and commercialized in at least three major countries in Europe; and (iii) a milestone payment of $5 million if Tcelna is commercialized in certain markets outside of the United States and Europe. If Merck elects to develop and commercialize Tcelna in RRMS, we would be eligible to receive milestone payments aggregating up to $40 million based upon the achievement by Merck of various development, regulatory and first commercial sale milestones.

If Tcelna receives regulatory approval and is commercialized by Merck, we would be eligible to receive royalties pursuant to a tiered structure at rates ranging from 8% to 15% of annual net sales, with step-ups over such range occurring when annual net sales exceed $500 million, $1 billion and $2 billion. Any royalties would be subject to offset or reduction in various situations, including if third party rights are required or if patent protection is not available in an applicable jurisdiction. We would also be responsible for royalty obligations to certain third parties, such as Baylor College of Medicine from which we originally licensed related technology. If we were to exercise an option to co-fund certain of Merck’s development, the royalty rates payable by Merck would be increased to rates ranging from 10% to 18%. In addition to royalty payments, we would be eligible to receive one-time commercial milestones totaling up to $85 million, with $55 million of such milestones achievable at annual net sales targets in excess of $1 billion.

SPMS Overview and Tcelna Mechanism of Action

SPMS is characterized by a steady accrual of irreversible disability, despite, in some cases, relapses followed by remissions or clinical plateaus. Older age at onset of MS diagnosis is the strongest predictor of conversion to SPMS. Males have a shorter time to conversion to SPMS compared with females. Available immunomodulating and immunosuppressive therapies used for RRMS have not been effective in SPMS. In clinical trials, these therapies have demonstrated anti-inflammatory properties as measured by the reduction in number and volume of contrast-enhancing or acutely inflammatory CNS lesions most commonly seen in patients with RRMS. The typical SPMS patient, however, has little or no radiographic evidence of acute inflammation. It is commonly observed that contrast-enhancing CNS lesions are uncommon among these patients, despite a clearly deteriorating neurologic course.

4

Table of Contents

The lack of effect of conventional MS therapeutics in SPMS suggests that the cerebral deterioration characterizing progressive disease may be driven by factors other than acute inflammation. For instance, the immunopathology of SPMS is more consistent with a transition to a chronic T-cell dependent inflammatory type, which may encompass the innate immune response and persistent activation of microglia cells.

Radiographic features that stand out among patients with SPMS include significantly more atrophy of gray matter compared with RRMS patients. Of note, long-term disability in MS in general appears more closely correlated to gray matter atrophy than to white matter inflammation. Such atrophy may be suggestive of progressive clinical disability. Both clinically and radiographically, SPMS represents a disease process with certain features distinct from those of RRMS, and one with extremely limited treatment options.

Tcelna immunotherapy in SPMS may reduce the drivers of this chronic disease by down-regulating anti-myelin immunity through priming regulatory responses that may act in the periphery as well as within the CNS. We believe that our clinical results show therapeutic subcutaneous dosing of 30-45 million cells of Tcelna stimulates host reactivity to the over-represented MRTCs and, as a consequence, a dominant negative regulatory T-cell response is induced leading to down-regulation of similar endogenous disease-causing MRTCs.

We believe that Tcelna has the potential to induce an up-regulation of regulatory cells, such as Foxp3+ Treg cells and IL-10 secreting Tr1 cells, which may effect a reduction in inflammation and provide neuroprotection should they gain entry to the CNS. Data from our TERMS study showed statistically significant changes from baseline (p=0.02) in Foxp3+ Treg cells for the subset of Tcelna patients who had ARR >1. The placebo arm for this subset was not statistically different from its baseline levels. Three SPMS patients from prior clinical studies, whose blood samples were analyzed to measure Tr1 cells prior to treatment and post treatment, showed an increase in the levels of Tr1 cells from non-detectable levels to the range of healthy donor samples. These three patients who had relapses in the preceding 12-24 month period remained relapse free during the 52-week assessment period and also showed a 57% to 67% reduction in MRTCs.

Current Treatment Options for SPMS

Only one product, mitoxantrone, is currently approved for the indication of SPMS. However, as of 2005, this drug carries a black box warning, due to significant risks of decreased systolic function, heart failure, and leukemia. The American Academy of Neurology has issued a report indicating that these risks are even higher than suggested in the original report leading to the black box warning. Hence, a safe and effective treatment for SPMS remains a significant unmet medical need.

Tcelna Clinical Overview in SPMS

In multiple previously conducted clinical trials for the treatment of patients with MS (which have been weighted significantly toward patients with RRMS), Tcelna has demonstrated one of the safest side effect profiles for any marketed or development-stage MS therapy, as well as encouraging efficacy signals. A total of 144 MS patients have received Tcelna in previously conducted Opexa trials for RRMS and SPMS. The therapy has been well-tolerated in all subjects and has demonstrated an excellent overall safety profile. The most common side effect is mild to moderate irritation at the site of injection, which is typically resolved in 24 hours. Tcelna has been administered to a total of 36 subjects with SPMS across three previous clinical studies.

In a pooled assessment of data from 36 SPMS patients treated in Phase I open label studies at the Baylor College of Medicine completed in 1998 and in Opexa sponsored studies completed in 2006 and 2007, approximately 80% of the 35 SPMS patients who completed two years of treatment showed disease stabilization as measured by EDSS following two years of treatment with Tcelna, with the other 20% showing signs of progression. This compares to historical control data which showed a progression rate of 40% in SPMS patients (as reported in ESIMS Study published in Hommes Lancet 2004). The 10 SPMS patients in Opexa sponsored

5

Table of Contents

studies showed a substantial reduction in ARR at two years from 0.5 to an ARR less than 0.1. Only 1 out of the 10 patients experienced one episode of relapse during the two years of assessment. This same cohort showed no worsening of physical or psychological condition (key quality of life indicators as measured by the MS Impact Scale) after two years of treatment with Tcelna. Additionally, there were no reported serious adverse events (SAEs) in any of the patients. Based on preliminary data suggesting stabilized or improved disability among SPMS subjects receiving Tcelna, we believe that further development of this product candidate in SPMS is warranted.

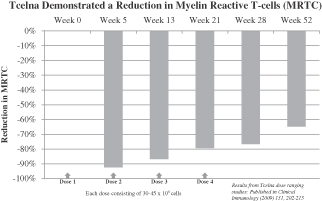

Summary of Phase I Dose Escalation Study in MS

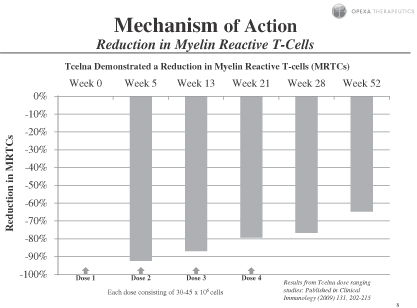

A Phase 1 dose escalation study completed in 2006 was conducted in patients with both RRMS and SPMS who were intolerant or unresponsive to current approved therapies for MS. The open-label, dose escalation study evaluated safety and clinical benefit by administering a primary series of four treatments at one of three dose levels administered at baseline and weeks four, eight, and twelve. Results of the efficacy analyses provide some evidence of the effectiveness of Tcelna in the treatment of MS. The follow-on TERMS Phase IIb clinical study provided further encouraging signs of efficacy in ARR and Multiple Sclerosis Impact Scale (MSIS-29). Data from the Phase I study evaluating the EDSS showed improvements in some subjects in comparison to baseline for weeks 20 and 28.

Subjects showed statistically significant improvement in overall reduction of MRTC counts over baseline at all visits through week 52 for subjects receiving 30-45 million cells per dose, as assessed by total MRTC count percentage changes. These data indicate that Tcelna treatment causes a depletion or immunomodulation of these cells, most obvious at time points closer to the injections. These findings, which demonstrate that administration of Tcelna induces a reduction in MRTCs, were published in Clinical Immunology (2009) 131,202-215.

Overall, results of the safety analyses indicate that treatment with Tcelna is well-tolerated. Reported adverse events were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. In conclusion, data from this study suggest that Tcelna is safe for the treatment of MS.

Summary of Phase I/IIA Clinical Trial Data in MS

The second clinical study performed by Opexa was an open-label extension study completed in 2007 to treat patients who were previously treated with T-cell immunotherapy but who saw a rebound in MRTC activity. The purpose of this extension study was to continue evaluating the efficacy, safety and tolerability of Tcelna in patients with RRMS and SPMS with repeated administration of Tcelna. Results of the study provide evidence of the effectiveness of Tcelna in the treatment of MS with repeated dosing. Improvements from baseline at both week 28 and week 52 of the extension study were observed for the frequency of MS exacerbations

6

Table of Contents

(ARR). Evaluation of MSIS-29 component scores suggests a trend for Tcelna therapy in the improvement of physical and psychological parameters assessed by the MSIS-29. The EDSS score analysis revealed an upward trend for the percentage of subjects that reported improvement and sustained improvement over baseline as a result of Tcelna treatment.

Subjects showed statistically significant improvement over baseline in the MRTC counts for each time point through month nine of the extension study. These results indicate that Tcelna treatment results in a statistically significant impact on these cells.

Overall, results of the safety analyses indicate that repeated treatment with Tcelna is well-tolerated. Reported adverse events (AEs) were mostly mild or moderate in intensity. Mild injection site reactions were observed but all resolved rapidly without treatment. Furthermore, results from this study suggest that repeated dosing of Tcelna has a substantive effect in reduction of ARR in subjects with MS and was well-tolerated.

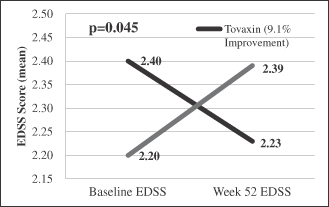

Summary of TERMS Phase IIb Clinical Trial Data in RRMS

Tovaxin for Early Relapsing Multiple Sclerosis (TERMS) was a Phase IIb clinical study of Tcelna in RRMS patients completed in 2008. Although the study did not show statistical significance in its primary endpoint (the cumulative number of gadolinium-enhanced brain lesions using MRI scans summed at various points in the study), the study showed compelling evidence of efficacy in various clinical and other MRI endpoints.

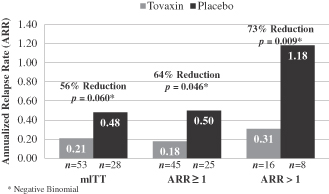

The TERMS study was a multi-center, randomized, double blind, placebo-controlled trial in 150 patients with RRMS or high risk Clinically Isolated Syndrome. Patients received a total of five subcutaneous injections at weeks 0, 4, 8, 12 and 24. Key results from the TERMS trial included:

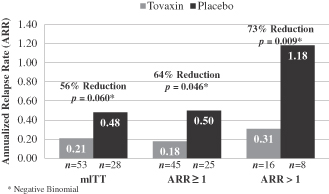

| • | In the modified intent to treat patient population consisting of all patients who received at least one dose of study product and had at least one MRI scan at week 28 or later (n=142), the ARR for Tcelna-treated patients was 0.214 as compared to 0.339 for placebo-treated patients, which represented a 37% decrease in ARR for Tcelna as compared to placebo in the general population; |

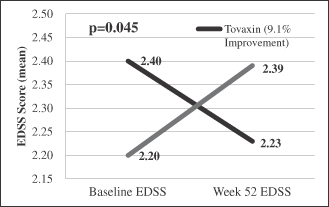

| • | In a prospective group of patients with more active disease (ARR>1, n=50), Tcelna demonstrated a 55% reduction in ARR as compared to placebo, 88% reduction in whole brain atrophy and a statistically significant improvement in disability (EDSS) compared to placebo (p<0.045) during the 24-week period following the administration of the full course of treatment; and |

7

Table of Contents

| • | In a retrospective analysis in patients naïve to previous disease modifying treatment, the results showed that patients, when treated with Tcelna, had a 56% to 73% reduction in ARR versus placebo for the various subsets and p values ranged from 0.009 to 0.06. |

We remain committed to further advancing Tcelna in RRMS at a later date assuming the availability of sufficient resources. For Opexa, however, SPMS is an area which we believe represents a higher unmet medical need. Depending upon the outcome of further feasibility analyses, the T-cell platform may have applications in development treatments for other autoimmune disorders such as rheumatoid arthritis, Type 1 diabetes, and orphan indications such as myasthenia gravis. The primary focus of Opexa remains the development of Tcelna in SPMS.

Other Opportunities

Our proprietary T-cell technology has enabled us to develop intellectual property and a comprehensive sample database that may enable discovery of novel biomarkers associated with MS.

We have developed (and, in part, licensed from the University of Chicago) a proprietary adult stem cell technology to produce monocyte-derived stem cells (MDSC) from blood. These MDSC can be derived from a patient’s monocytes, expanded ex vivo, and then administered to the same patient. Our initial focus for this technology is the further development of this monocyte-derived stem cell technology as a platform for the in vitro generation of highly specialized cells for potential application in autologous cell therapy for patients with diabetes mellitus. The diabetes program is in an early (pre-clinical) development stage.

Risks Associated with our Business

We are a development stage company and have generated minimal revenues to date. Since our inception, we have incurred substantial losses. Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus, and among these important risks are the following:

| • | We will be required to raise significant additional capital in the near-term, and our ability to obtain funding is uncertain. If sufficient capital is not available, we may not be able to continue our operations as proposed (including any Phase IIb clinical trial initiated or ongoing for Tcelna), which may require us to modify our business plan, curtail various aspects of our operations, cease operations or seek relief under applicable bankruptcy laws. |

| • | We have a history of operating losses and do not expect to be profitable in the foreseeable future. |

8

Table of Contents

| • | Our business is at an early stage of development. We are largely dependent on the success of our product candidate, Tcelna, and we cannot be certain that Tcelna will receive regulatory approval or be successfully commercialized. |

| • | We might be unable to service our debt due to a lack of cash flow or otherwise fail to comply with terms of the convertible secured promissory notes or related agreements and might be subject to default. The convertible secured promissory notes are secured by a pledge of all of our assets. The issuance of securities upon the conversion of such notes and/or the exercise of warrants issued in tandem with such notes will result in significant dilution for our shareholders. |

| • | We have provided Merck with the Option, which provides Merck with the opportunity, if exercised, to control the development and commercialization of Tcelna in MS. |

| • | We will need regulatory approvals for any product candidate, including Tcelna, prior to introduction to the market, which will require successful testing in clinical trials. Clinical trials are subject to extensive regulatory requirements, and are very expensive, time-consuming and difficult to design and implement. Any product candidate, such as Tcelna, may fail to achieve necessary safety and efficacy endpoints during clinical trials in which case we will be unable to generate revenue from the commercialization and sale of our products. |

| • | We will rely on third parties to conduct our clinical trials and perform data collection and analysis, which may result in costs and delays that may hamper our ability to successfully develop and commercialize any product candidate, including Tcelna. |

| • | We are dependent upon our management team and a small number of employees. |

Corporate Information

We were incorporated in Texas in March 1991. Our principal executive offices are located at 2653 Technology Forest Blvd., The Woodlands, Texas 77381, and our telephone number is (281) 775-0600. Our website address is www.opexatherapeutics.com. The information contained on, or that can be accessed through, our website is not part of this prospectus.

9

Table of Contents

| Common stock offered by us |

shares of common stock |

| Common stock outstanding after this offering |

shares of common stock |

| Over-allotment option |

The underwriters have a 30-day option to purchase a maximum of additional shares of common stock. |

| Use of proceeds |

We estimate that the net proceeds from our sale of shares of our common stock in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, after deducting the estimated underwriting discount and estimated offering expenses payable by us. We currently expect to use the net proceeds from this offering as follows: |

| • | approximately $ million to fund further clinical development of Tcelna and the Phase IIb study in patients with SPMS as well as the ongoing expenses of our operations during such development; and |

| • | the balance, if any, for general corporate purposes, including potential repayment of certain outstanding indebtedness. |

| Our existing resources, together with the proceeds from this offering, will not be adequate to permit us to complete such study. We will need to secure significant additional resources to complete the trial and support our operations during the pendency of the trial. See “Use of Proceeds” on page 39 of this prospectus. |

| Risk factors |

See the “Risk Factors” section beginning on page 14 of this prospectus for factors to consider before deciding to purchase our securities. |

| NASDAQ Capital Market Symbol |

OPXA |

Unless we indicate otherwise, all information in this prospectus:

| • | is based on 7,991,559 shares of common stock outstanding as of May 31, 2013: |

| • | excludes 1,111,111 shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $4.51 per share; |

| • | excludes 3,069,113 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $4.12 per share; |

| • | excludes 1,020,007 shares of common stock issuable if all of the 12% convertible secured promissory notes outstanding are converted to Series A convertible preferred stock and such stock is then converted into shares of common stock; |

| • | excludes 27,109 shares of common stock available for future grants under our 2010 Stock Incentive Plan; |

10

Table of Contents

| • | excludes any additional shares of common stock that we may issue to Lincoln Park Capital Fund, LLC, or Lincoln Park, pursuant to a $1,500,000 purchase agreement and a $15,000,000 purchase agreement we entered into on November 5, 2012 and November 2, 2012, respectively, which provides that, upon the terms and subject to the conditions and limitation set forth therein, Lincoln Park is committed to purchase up to an aggregate of an additional $15.9 million of shares of our common stock over the term of the purchase agreements, should we elect to sell shares to Lincoln Park; and |

| • | assumes no exercise by the underwriters of the option to purchase up to additional shares of common stock from us to cover over-allotments, if any. |

11

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary consolidated statements of operations data for the years ended December 31, 2012 and 2011 have been derived from our audited consolidated financial statements that are included in this prospectus. The summary consolidated statements of operations data for the three-month periods ended March 31, 2013 and 2012 and the consolidated balance sheet data as of March 31, 2013 is derived from our unaudited consolidated financial statements that are included in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the three-month period ended March 31, 2013 are not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2013 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

| For the year ended December 31, | For the three months ended March 31, |

|||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Option revenue |

$ | — | $ | — | $ | 220,100 | $ | — | ||||||||

| Research and development |

6,318,476 | 3,340,038 | 1,621,366 | 1,490,097 | ||||||||||||

| General and administrative |

2,508,541 | 2,406,269 | 1,102,435 | 816,196 | ||||||||||||

| Depreciation and amortization |

303,677 | 210,252 | 78,311 | 67,355 | ||||||||||||

| Loss on disposal of fixed assets |

3,097 | 9,686 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(9,133,791 | ) | (5,966,245 | ) | (2,582,012 | ) | (2,373,648 | ) | ||||||||

| Interest income |

280 | 932 | 1,874 | 136 | ||||||||||||

| Gain on derivative instruments |

552,978 | — | — | — | ||||||||||||

| Other income and expense, net |

— | — | 37,910 | — | ||||||||||||

| Interest expense |

(350,300 | ) | (3,135 | ) | (1,635,254 | ) | (487 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (8,930,833 | ) | $ | (5,968,448 | ) | $ | (4,177,482 | ) | $ | (2,373,999 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted loss per share |

$ | (1.54 | ) | $ | (1.06 | ) | $ | (0.58 | ) | $ | (0.41 | ) | ||||

| Weighted average shares outstanding |

5,785,372 | 5,633,124 | 7,239,102 | 5,762,028 | ||||||||||||

The following table presents consolidated balance sheets data as of March 31, 2013 on:

| • | an actual basis; and |

| • | a pro forma as adjusted basis, giving effect to the sale by us of shares of common stock in this offering at an assumed public offering price of $ per share, after deducting the underwriting discount and estimated offering expenses. |

12

Table of Contents

The pro forma as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read this information in conjunction with our consolidated financial statements and notes thereto included in this prospectus.

| As of March 31, 2013 | ||||||||

| Actual | Pro Forma

As Adjusted(1) |

|||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 7,834,336 | $ | |||||

| Other current assets |

1,166,430 | |||||||

| Fixed assets, net |

1,189,328 | |||||||

| Restricted cash |

500,000 | |||||||

| Deferred financing costs, net |

158,540 | |||||||

| Other long-term assets |

104,027 | |||||||

| Total assets |

10,952,661 | |||||||

| Total current liabilities |

3,157,125 | |||||||

| Notes payable, net |

376,627 | |||||||

| Deferred revenue |

3,384,552 | |||||||

| Total stockholders’ equity |

4,034,357 | |||||||

| (1) | A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our cash and cash equivalents, total assets and total stockholders’ equity by approximately $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses payable by us. |

13

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider the following risk factors, as well as other information contained in this prospectus, before deciding to invest in our common stock. The following factors affect our business, our intellectual property, the industry in which we operate and our securities. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known or which we consider immaterial as of the date hereof may also have an adverse effect on our business. If any of the matters discussed in the following risk factors were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected, the market price of our common stock could decline and you could lose all or part of your investment in our securities.

Risks Related to Our Business

We will be required to raise significant additional capital in the near-term, and our ability to obtain funding is uncertain. If sufficient capital is not available, we may not be able to continue our operations as proposed (including any Phase IIb clinical trial initiated or ongoing for Tcelna), which may require us to modify our business plan, curtail various aspects of our operations, cease operations or seek relief under applicable bankruptcy laws.

As of March 31, 2013, we had cash and cash equivalents of $7,834,336. During 2012, we closed a private offering in July 2012 consisting of convertible secured notes and warrants to purchase common stock which generated approximately $4.1 million in gross proceeds (of which $500,000 is held in a controlled account, and $500,000 was released to us in January 2013). These convertible secured notes are due July 25, 2014, and to date, notes in the aggregate principal amount of $900,000 have been converted into shares of Series A convertible preferred stock, which in turn, have been converted into an aggregate of 288,229 shares of common stock. From November 2012 through January 2013, we sold an aggregate of 390,000 shares of our common stock to Lincoln Park for gross proceeds of $523,709 pursuant to our $1.5 million purchase agreement with Lincoln Park. We closed a private offering of unsecured convertible promissory notes and warrants to purchase common stock in January 2013 which generated $650,000 in gross proceeds. Upon receipt of the upfront payment from Merck in February 2013, we repaid $550,000 principal amount plus accrued interest of the January 2013 notes and converted the remaining $100,000 principal amount into shares of common stock pursuant to the investor’s election to convert into equity. In February 2013, we sold an aggregate of 167,618 shares of our common stock pursuant to a sales agreement executed on September 6, 2012 with Brinson Patrick Securities Corporation acting as sales agent under an “at-the-market” program, for gross proceeds of $536,417. On February 4, 2013, we entered into an Option and License Agreement with Merck pursuant to which we granted the Option to Merck to acquire an exclusive, worldwide (excluding Japan) license to our Tcelna program for the treatment of MS in consideration for an upfront payment of $5 million. On February 11, 2013, we closed on an offering of 1,083,334 shares of common stock and warrants to purchase 541,668 shares of common stock for gross proceeds of $3,250,002. As part of that offering, which offering Lincoln Park did not participate in, we agreed not to sell shares pursuant to our purchase agreements with Lincoln Park or under our “at-the-market” program for a period of 120 days following that offering (or June 11, 2013).

Our cash burn rate during the three months ended March 31, 2013, inclusive of the cost of our ongoing Abili-T clinical study, was approximately $775,000 per month. During this three-month period, the pace of on-boarding clinical sites for the Abili-T clinical study was tempered pending the completion of our negotiations with Merck for the Option as well as financial considerations. Upon receipt of the upfront payment of $5 million for granting the Option, we were able to refocus on execution of the Abili-T clinical trial, including enrollment. Significant activities in the conduct of the Abili-T clinical trial are expected to result in substantial increases in our monthly cash burn during the balance of 2013. Based on our projected burn rate increasing to an average of $1.2 million per month for the remainder of 2013, we believe we have sufficient liquidity to support our clinical trial activities into the fourth quarter of 2013. However, the Abili-T clinical study in North America of Tcelna is expected to complete enrollment of 180 patients by late 2013 or early 2014, with resulting top-line data expected to be available in the first half of 2016.

14

Table of Contents

The future costs of the study, which have been impacted by a slowed rate of enrollment prior to receipt of the upfront payment of $5 million for granting the Option, as well as the ongoing expenses of our operations through the expected completion date of the study and release of top-line data, are estimated as of May 31, 2013 to be between $30-$32 million. Our existing resources are not adequate to permit us to complete such study or the majority of it. We will need to secure significant additional resources to complete the trial and support our operations during the pendency of the trial.

Given our need for substantial amounts of capital to complete the Phase IIb clinical study for Tcelna in SPMS, we intend to continue to explore potential opportunities and alternatives to obtain the significant additional resources that will be necessary to complete the Phase IIb study and to support our operations during the pendency of such study. These opportunities and alternatives may include one or more additional financing transactions. There can be no assurance that any such financings can be consummated on acceptable terms, if at all. If we are unable to obtain additional funding for operations in the immediate future, we will be forced to suspend or terminate our ongoing clinical trial for Tcelna, which may require us to modify our business plan, curtail various aspects of our operations, cease operations or seek relief under applicable bankruptcy laws.

Assuming we are able to achieve financing which is sufficient to support the Phase IIb study of Tcelna in SPMS and to support our operations during the pendency of such study, we are also exploring a pivotal Phase III clinical study of Tcelna in RRMS. Any such study of Tcelna in RRMS would also depend upon the availability of sufficient resources.

Other than the $1.5 million purchase agreement and the $15 million purchase agreement we entered into with Lincoln Park on November 5, 2012 and November 2, 2012, respectively, each of which is subject to certain limitations and conditions, we have no sources of debt or equity capital committed for funding and we must rely upon best efforts third-party debt or equity funding. We can provide no assurance that we will be successful in any funding effort. The timing and degree of any future capital requirements will depend on many factors, including:

| • | our ability to establish, enforce and maintain strategic arrangements for research, development, clinical testing, manufacturing and marketing; |

| • | the accuracy of the assumptions underlying our estimates for capital needs in 2013 and beyond as well as for the clinical study of Tcelna; |

| • | scientific progress in our research and development programs; |

| • | the magnitude and scope of our research and development programs; |

| • | our progress with preclinical development and clinical trials; |

| • | the time and costs involved in obtaining regulatory approvals; |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims; and |

| • | the number and type of product candidates that we pursue. |

If we raise additional funds by issuing equity securities (including pursuant to the $1.5 million purchase agreement and the $15 million purchase agreement with Lincoln Park), shareholders may experience substantial dilution. Debt financing, if available, may involve restrictive covenants that may impede our ability to operate our business. Any debt financing or additional equity that we raise may contain terms that are not favorable to us or our shareholders. There is no assurance that our capital raising efforts will be able to attract the capital needed to execute on our business plan and sustain our operations.

If we are unable to obtain additional funding, we may not be able to continue or complete the Phase IIb clinical study of Tcelna in SPMS or otherwise continue our operations as proposed, which may require us to

15

Table of Contents

modify our business plan or curtail various aspects of our operations. If we are unable to maintain an adequate level of capital, it may be necessary to cease operations or seek relief under applicable bankruptcy laws. In such event, our shareholders may lose a portion or even all of their investment.

We may experience delays in our clinical trial enrollment, which could result in increased costs to us.

Once a clinical trial has begun, recruitment and enrollment of subjects may be slower than we anticipate. In addition, clinical trials may take longer than we anticipate if we are required, or believe it is necessary, to enroll additional subjects. Our ongoing Abili-T clinical study in North America of Tcelna is expected to complete enrollment of 180 patients by late 2013 or early 2014, with resulting top-line data expected to be available in the first half of 2016. The future costs of the study, which have been impacted by a slowed rate of enrollment prior to receipt of the upfront payment of $5 million for granting the Option, as well as the ongoing expenses of our operations through the expected completion date of the study and release of top-line data, are estimated as of May 31, 2013 to be between $30-$32 million. These estimated costs are partially a function of the pace of clinical trial enrollment, and should enrollment timelines get delayed beyond our current expectation, the estimated costs are likely to increase due to the additional operational expenses. Similarly, should additional patients be enrolled in the trial, the costs are likely to increase.

We may make changes to discretionary R&D investments that may have an impact on costs.

We are presently complementing the Abili-T clinical trial with an immune monitoring program. Expenses associated with the immune monitoring program are incurred at our discretion and are not required to satisfy any FDA-mandated criteria. Consequently, we may make changes to the parameters that are being analyzed, and these changes may result in either increased or decreased expenses for the study.

We may also incur discretionary expenses related to Phase III development, manufacturing scale-up/automation and technology transfer in the future. There is no assurance that any such future expenses would be recovered by us.

Funding from our purchase agreements with Lincoln Park may be limited or be insufficient to fund our operations or to implement our strategy.

Under our $1.5 million purchase agreement and our $15 million purchase agreement with Lincoln Park, we may direct Lincoln Park to purchase up to $16.5 million of shares of common stock, subject to certain limitations and conditions, over a 30-month period. However, in connection with our February 2013 common stock and warrant offering, we agreed not to sell shares under the purchase agreements with Lincoln Park for a period of 120 days after that offering (or June 11, 2013). From November 2012 through January 2013, we sold an aggregate of 390,000 shares to Lincoln Park pursuant to the $1.5 million purchase agreement, and we issued an aggregate of 56,507 initial commitment shares and 3,585 additional commitment shares in connection therewith. There can be no assurance that we will be able to receive any or all of the additional funds from Lincoln Park because the $1.5 million purchase agreement and the $15 million purchase agreement contain limitations, restrictions, requirements, events of default and other provisions that could limit our ability to cause Lincoln Park to buy common stock from us, including that the closing price of our stock is at least $1.00 and that Lincoln Park own no more than 4.99% of our common stock under the $1.5 million purchase agreement or no more than 9.99% of our common stock under the $15 million purchase agreement. In addition, under the applicable rules of the NASDAQ Capital Market, if we seek to issue shares which may be aggregated with shares sold to Lincoln Park under the $1.5 million purchase agreement and the $15 million purchase agreement in excess of 1,151,829 shares or 19.99% of the total common stock outstanding as of the date of the $15 million purchase agreement, we may be required to seek shareholder approval in order to be in compliance with the NASDAQ Capital Market rules.

The extent to which we rely on Lincoln Park as a source of funding will depend on a number of factors, including the amount of working capital needed, the prevailing market price of our common stock and the extent

16

Table of Contents

to which we are able to secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove unavailable or prohibitively dilutive, we would need to secure another source of funding. Even if we sell all $16.5 million of common stock under the purchase agreements with Lincoln Park, we will still need additional capital to fully implement our business, operating plans and development plans as of the date hereof, including to complete the Phase IIb clinical study of Tcelna in patients with SPMS and to conduct our operations through the expected completion date of such study.

We have a history of operating losses and do not expect to be profitable in the foreseeable future.

We have not generated any profits since our entry into the biotechnology business and we have incurred significant operating losses. We expect to incur additional operating losses for the foreseeable future. We have not received, and we do not expect to receive for at least the next several years, any revenues from the commercialization of any potential products. We do not have any sources of revenues as of the date hereof and may not have any in the foreseeable future.

There is substantial doubt as to our ability to continue as a going concern, which may make it more difficult for us to raise capital.

Our consolidated financial statements as of March 31, 2013 and for the three-month period then ended were prepared assuming that we will continue as a going concern, meaning that we will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations. We recognized $220,100 in revenue during the three-month period ended March 31, 2013 related to the $5 million upfront payment from Merck received in February 2013 in connection with the Option and License Agreement. We expect to continue recording revenue related to the $5 million upfront payment from Merck over the exclusive option period based on the expected completion term of the Abili-T clinical trial. However, we do not currently generate any additional revenues resulting in cash receipts, nor do we expect to generate revenues during the remainder of 2013 resulting in cash receipts. Our cash burn rate during the three months ended March 31, 2013, inclusive of the cost of our ongoing Abili-T clinical study, was approximately $775,000 per month. Significant activities in the conduct of the clinical trial are expected to result in substantial increases in our monthly cash burn during the balance of 2013. Based on our projected burn rate increasing to an average of $1.2 million per month for the remainder of 2013, we believe we have sufficient liquidity to support our clinical trial activities into the fourth quarter of 2013. In the absence of significant additional funding, there is substantial doubt about our ability to continue as a going concern. This may make it more difficult for us to raise funds. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures or to generate revenue. If we are unable to obtain additional financing for our operations, we may not be able to continue operations as proposed, requiring us to modify our business plan, curtail various aspects of our operations, cease operations or seek relief under applicable bankruptcy laws. In such event, investors may lose a portion or all of their investment. Our consolidated financial statements contain no adjustment for the outcome of this uncertainty.

Our business is at an early stage of development. We are largely dependent on the success of our product candidate, Tcelna, and we cannot be certain that Tcelna will receive regulatory approval or be successfully commercialized.

Our business is at an early stage of development. We do not have any product candidates that have completed late-stage clinical trials nor do we have any products on the market. We have only one product candidate, Tcelna, which has progressed to the stage of being studied in human clinical trials in the United States. In September 2012, we announced the initiation of a Phase IIb study of Tcelna in patients with SPMS. We are still in the very early stages of identifying and conducting research on any other potential products. Tcelna, and any other potential products, will require regulatory approval prior to marketing in the United States and other countries. Obtaining such approval requires significant research and development and preclinical and clinical testing. We may not be able to develop any products, to obtain regulatory approvals, to continue clinical

17

Table of Contents

development of Tcelna, to enter clinical trials (or any development activities) for any other product candidates or to commercialize any products. Tcelna, and any other potential products, may prove to have undesirable or unintended side effects or other characteristics adversely affecting their safety, efficacy or cost-effectiveness that could prevent or limit their use. Any product using any of our technology may fail to provide the intended therapeutic benefits or to achieve therapeutic benefits equal to or better than the standard of treatment at the time of testing or production.

We might be unable to service our debt due to a lack of cash flow or otherwise fail to comply with terms of the convertible secured promissory notes or related agreements and might be subject to default. The convertible secured promissory notes are secured by a pledge of all of our assets. The issuance of securities upon the conversion of such notes and/or the exercise of warrants issued in tandem with such notes will result in significant dilution for our shareholders.

On July 25, 2012, we closed a private offering consisting of 12% convertible secured notes and warrants to purchase shares of common stock which generated approximately $4.1 million in gross proceeds ($500,000 of which is held in a controlled account). The notes mature on July 25, 2014 and accrue interest at the rate of 12% per annum, compounded annually. Interest is payable semi-annually in either cash or registered shares of common stock at our election. The notes are secured by substantially all of our assets and are convertible into a new class of non-voting Series A convertible preferred stock. The notes can be converted into Series A convertible preferred stock at the option of the investors at a price of $100.00 per share, subject to certain limitations and adjustments. Additionally, we can elect to convert the notes into Series A convertible preferred stock if (i) our common stock closes at or above $10.00 per share for 20 consecutive trading days or (ii) we achieve certain additional funding milestones to continue our clinical trial program. These milestones include (x) executing a strategic agreement with a partner or potential partner by which we will receive a minimum of $5 million to partially fund, or an option to partner with us for, our Phase II clinical trial for Tcelna in patients with SPMS and (y) receiving a minimum of $25 million in additional capital (including the note offering proceeds) from any partner, potential partner or any other source. The Series A convertible preferred stock accrues dividends at the rate of 8% per annum, which are cumulative and payable semi-annually in either cash or registered shares of the common stock at our election. The Series A convertible preferred stock is convertible into shares of our common stock at the option of the holders at a price of $3.1225 per share, subject to certain limitations and adjustments. Additionally, we can elect to convert the Series A convertible preferred stock into common stock if our common stock closes at or above $16.00 per share for 20 consecutive trading days. To date, secured promissory notes in the aggregate principal amount of $900,000 have been converted into shares of Series A convertible preferred stock which, in turn, have been converted into an aggregate of 288,229 shares of common stock. No shares of Series A convertible preferred stock are outstanding as of the date hereof.

As a result of anti-dilution adjustments since the closing of the July 2012 secured promissory note financing, up to 1,020,007 shares of common stock are issuable if all of the 12% convertible secured promissory notes outstanding as of the date hereof are converted to Series A convertible preferred stock and such stock is then converted into shares of our common stock. The noteholders were granted certain registration rights for the shares of common stock underlying the notes and the warrants issued in July 2012.

The warrants have a five-year term and, as a result of anti-dilution adjustments since the closing of the July 2012 secured promissory note financing, (i) have an adjusted exercise price of $2.56 per share and (ii) are exercisable for an aggregate of 1,436,121 shares of common stock. We can redeem the warrants at $0.01 per share if our common stock closes at or above $10.00 per share for 20 consecutive trading days.

As part of the security interest in all of our assets granted to the noteholders, $500,000 of the proceeds is maintained as of the date hereof in a controlled account. This amount was previously $1 million; however, in January 2013 we issued the noteholders five-year warrants to acquire an aggregate of 187,500 shares of our common stock at an exercise price of $1.21 per share in exchange for the reduction of such amount.

18

Table of Contents

If we do not make the required payments when due, either at maturity, or at applicable installment payment dates, or if we breach other terms of the convertible secured notes or related agreements, the noteholders could elect to declare all amounts outstanding, together with accrued and unpaid interest, to be immediately due and payable. Even if we were able to prepay the full amount in cash, any such repayment could leave us with little or no working capital for our business. If we are unable to repay those amounts, the noteholders will have a first claim on our assets pledged under the convertible secured notes. If the noteholders should attempt to foreclose on the collateral, it is unlikely that there would be any assets remaining after repayment in full of such secured indebtedness. Any default under the convertible secured notes and resulting foreclosure would have a material adverse effect on our financial condition and our ability to continue our operations.

We have provided Merck with the Option, which provides Merck with the opportunity, if exercised, to control the development and commercialization of Tcelna in MS.

In February 2013, we granted the Option to Merck. The Option permits Merck to acquire an exclusive, worldwide (excluding Japan) license of our Tcelna program for the treatment of MS. The Option may be exercised by Merck prior to or upon completion of our ongoing Phase IIb trial of Tcelna in patients with SPMS. If Merck exercises the Option, Merck would be solely responsible for funding development, regulatory and commercialization activities for Tcelna in MS, although we would retain an option to co-fund certain development in exchange for increased royalty rates. We would also retain rights to Tcelna in Japan, certain rights with respect to the manufacture of Tcelna, and rights outside of MS. In consideration for the Option, we received an upfront payment of $5 million and may be eligible to receive an option exercise fee as well as milestone and royalty payments based on achievement of development and commercialization milestones. The rights we have relinquished to our product candidate Tcelna, including development and commercialization rights, may harm our ability to generate revenues and achieve or sustain profitability.

If Merck exercises the Option, we would become reliant on Merck’s resources and efforts with respect to Tcelna in MS. In such an event, Merck may fail to develop or effectively commercialize Tcelna for a variety of reasons, including that Merck:

| • | does not have sufficient resources or decides not to devote the necessary resources due to internal constraints such as limited cash or human resources; |

| • | decides to pursue a competitive potential product; |

| • | cannot obtain the necessary regulatory approvals; |

| • | determines that the market opportunity is not attractive; or |

| • | cannot manufacture or obtain the necessary materials in sufficient quantities from multiple sources or at a reasonable cost. |

If Merck does not exercise the Option, we may be unable to enter into a collaboration with any other potential partner on acceptable terms, if at all. We face competition in our search for partners from other organizations worldwide, many of whom are larger and are able to offer more attractive deals in terms of financial commitments, contribution of human resources, or development, manufacturing, regulatory or commercial expertise and support.

If Merck does not exercise the Option, and we are not successful in attracting another partner and entering into collaboration on acceptable terms, we may not be able to complete development of or commercialize any product candidate, including Tcelna. In such event, our ability to generate revenues and achieve or sustain profitability would be significantly hindered and we may not be able to continue operations as proposed, requiring us to modify our business plan, curtail various aspects of our operations or cease operations.

19

Table of Contents

We will need regulatory approvals for any product candidate, including Tcelna, prior to introduction to the market, which will require successful testing in clinical trials. Clinical trials are subject to extensive regulatory requirements, and are very expensive, time-consuming and difficult to design and implement. Any product candidate, such as Tcelna, may fail to achieve necessary safety and efficacy endpoints during clinical trials in which case we will be unable to generate revenue from the commercialization and sale of our products.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous FDA requirements, and must otherwise comply with federal, state and local requirements and policies of the medical institutions where they are conducted. The clinical trial process is also time-consuming. We estimate that the Phase IIb clinical trial in North America of our lead product candidate, Tcelna, in SPMS will complete enrollment by late 2013 or early 2014, with the resulting top-line data expected to be available in the first half of 2016. In addition, we anticipate that a pivotal Phase III clinical trial would be necessary before an application could be submitted for approval of Tcelna for SPMS. Failure can occur at any stage of the trials, and problems could be encountered that would cause us or Merck (in the event the Option is exercised) to be unable to initiate a trial, or to abandon or repeat a clinical trial.

The commencement and completion of clinical trials, including the continuation and completion of the Phase IIb clinical trial of Tcelna in SPMS, may be delayed or prevented by several factors, including:

| • | FDA or IRB objection to proposed protocols; |

| • | discussions or disagreement with the FDA over the adequacy of trial design to potentially demonstrate effectiveness, and subsequent design modifications; |

| • | unforeseen safety issues; |

| • | determination of dosing issues and related adjustments; |

| • | lack of effectiveness during clinical trials; |

| • | slower than expected rates of patient recruitment; |

| • | product quality problems (e.g., sterility or purity); |

| • | challenges to patient monitoring and data collection during or after treatment (for example, patients’ failure to return for follow-up visits); and |

| • | failure of medical investigators to follow our clinical protocols. |

In addition, we, Merck (if the Option is exercised) or the FDA (based on its authority over clinical studies) may delay a proposed investigation or suspend clinical trials in progress at any time if it appears that the study may pose significant risks to the study participants or other serious deficiencies are identified. Prior to approval of any product candidate, the FDA must determine that the data demonstrate safety and effectiveness. The large majority of drug candidates that begin human clinical trials fail to demonstrate the desired safety and efficacy characteristics.

Furthermore, changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols, or otherwise modify our intended course of clinical development, to reflect these changes. This, too, may impact the costs, timing or successful completion of a clinical trial. In light of widely publicized events concerning the safety risk of certain drug products, regulatory authorities, members of Congress, the U.S. Government Accountability Office, medical professionals and the general public have raised concerns about potential drug safety issues. These events have resulted in the withdrawal of drug products, revisions to drug labeling that further limit use of the drug products, and establishment of risk management programs that may, for instance, restrict distribution of drug products. The increased attention to drug safety issues may result in a more cautious approach by the FDA to clinical trials. Data from clinical trials may receive greater scrutiny with respect to safety, which may make the FDA or other regulatory authorities more likely to terminate clinical trials before

20

Table of Contents

completion or require longer or additional clinical trials that may result in substantial additional expense and a delay or failure in obtaining approval or approval for a more limited indication than originally sought.

Even if regulatory approval is obtained for any product candidate, such as Tcelna, any such approval may be subject to limitations on the indicated uses for which it may be marketed. Our ability to generate revenues from the commercialization and sale of any potential products, whether directly or through any development arrangement (such as where Merck exercises the Option) will be limited by any failure to obtain or limitation on necessary regulatory approvals.

If Merck exercises the Option, Merck would be solely responsible for funding development, regulatory and commercialization activities for Tcelna in MS, although we would retain an option to co-fund certain development in exchange for increased royalty rates.

We will rely on third parties to conduct our clinical trials and perform data collection and analysis, which may result in costs and delays that may hamper our ability to successfully develop and commercialize any product candidate, including Tcelna.

Although we have participated in the design and management of our past clinical trials, we do not have the ability to conduct clinical trials directly for any product candidate, including Tcelna. We will need to rely on contract research organizations, medical institutions, clinical investigators and contract laboratories to conduct our clinical trials and to perform data collection and analysis, including the Phase IIb trial of Tcelna in patients with SPMS.

Our clinical trials may be delayed, suspended or terminated if:

| • | any third party upon whom we rely does not successfully carry out its contractual duties or regulatory obligations or meet expected deadlines; |

| • | licenses needed from third parties for manufacturing in order to conduct Phase III trials or to conduct commercial manufacturing, if applicable, are not obtained; |

| • | any such third party needs to be replaced; or |