Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Approach Resources Inc | d554765d8k.htm |

Approach Resources Inc.

JUNE 2013

Exhibit 99.1

INVESTOR PRESENTATION |

Forward-Looking Statements

2

Cautionary Statements Regarding Oil & Gas Quantities

This presentation contains forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements

of historical facts, included in this presentation that address activities, events or developments that

the Company expects, believes or anticipates will or may occur in the future are forward-looking statements.

Without limiting the generality of the foregoing, forward-looking statements contained in this

presentation specifically include the expectations of management regarding plans, strategies, objectives, anticipated

financial and operating results of the Company, including as to the Company’s Wolfcamp shale

resource play, estimated resource potential and recoverability of the oil and gas, estimated reserves and drilling

locations, capital expenditures, typical well results and well profiles, type curve, and production and

operating expenses guidance included in the presentation. These statements are based on certain assumptions

made by the Company based on management's experience and technical analyses, current conditions,

anticipated future developments and other factors believed to be appropriate and believed to be reasonable by

management. When used in this presentation, the words “will,” “potential,”

“believe,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,” “target,”

“profile,” “model” or their negatives, other similar expressions or the

statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such

statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond

the control of the Company, which may cause actual results to differ materially from those implied or expressed

by the forward-looking statements. In particular, careful consideration should be given to the

cautionary statements and risk factors described in the Company's most recent Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Any forward-looking statement speaks only as of the date

on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking

statement, whether as a result of new information, future events or otherwise, except as required by

applicable law. The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their

filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such

terms, and price and cost sensitivities for such reserves, and prohibits disclosure of resources that

do not constitute such reserves. The Company uses the terms “estimated ultimate recovery” or “EUR,” reserve

or resource “potential,” and other descriptions of volumes of reserves potentially

recoverable through additional drilling or recovery techniques that the SEC’s rules may prohibit the Company from including in

filings with the SEC. These estimates are by their nature more speculative than estimates of proved,

probable and possible reserves and accordingly are subject to substantially greater risk of being actually

realized by the Company.

EUR estimates, identified drilling locations and resource potential estimates have not been risked by

the Company. Actual locations drilled and quantities that may be ultimately recovered from the Company’s

interest may differ substantially from the Company’s estimates. There is no commitment by

the Company to drill all of the drilling locations that have been attributed these quantities. Factors affecting ultimate

recovery include the scope of the Company’s ongoing drilling program, which will be directly

affected by the availability of capital, drilling and production costs, availability of drilling and completion services and

equipment, drilling results, lease expirations, regulatory approval and actual drilling results, as

well as geological and mechanical factors Estimates of unproved reserves, type/decline curves, per well EUR and

resource potential may change significantly as development of the Company’s oil and gas assets

provides additional data. Type/decline curves, estimated EURs, resource potential, recovery factors and well costs represent

Company estimates based on evaluation of petrophysical analysis, core data and well logs, well performance

from limited drilling and recompletion results and seismic data, and have not been reviewed by

independent engineers. These are presented as hypothetical recoveries if assumptions and estimates regarding

recoverable hydrocarbons, recovery factors and costs prove correct. The Company has very limited

production experience with these projects, and accordingly, such estimates may change significantly as results

from more wells are evaluated. Estimates of resource potential and EURs do not constitute

reserves, but constitute estimates of contingent resources which the SEC has determined are too speculative to

include in SEC filings. Unless otherwise noted, IRR estimates are before taxes and assume NYMEX

forward-curve oil and gas pricing and Company-generated EUR and decline curve estimates based

on Company drilling and completion cost estimates that do not include land, seismic or G&A costs.

|

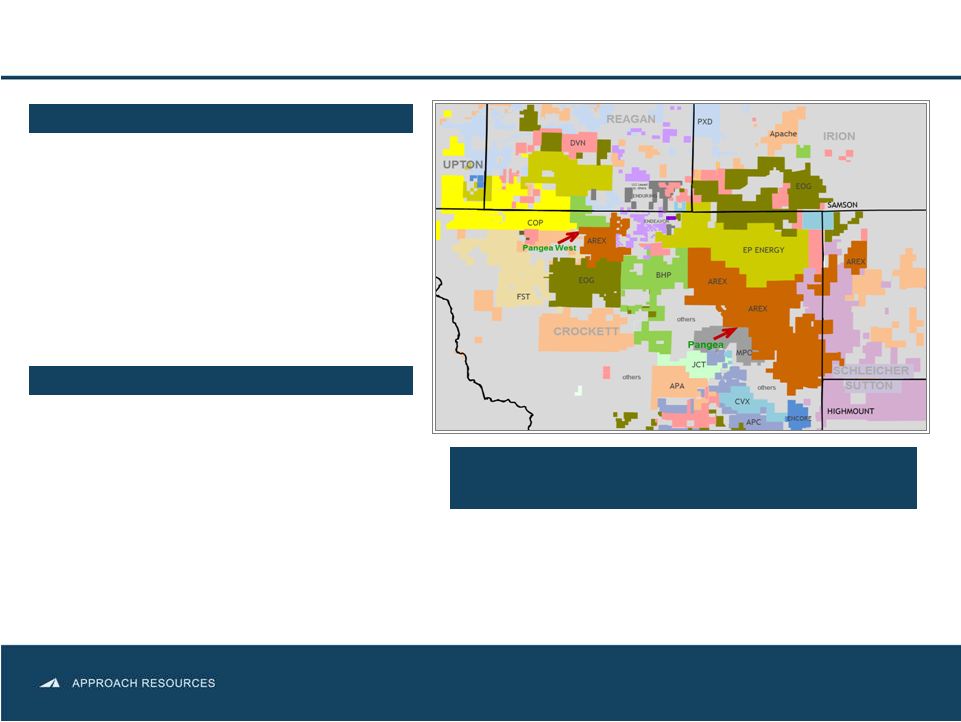

Company Overview

•

Enterprise value $1.2 BN

•

High quality reserve base

95.5 MMBoe proved reserves

99% Permian Basin

•

Permian core operating area

167,000 gross (148,000 net) acres

1+ BnBoe gross, unrisked resource

potential

2,000+ Identified HZ drilling locations

targeting the Wolfcamp A/B/C

•

2013 capital program of $260 MM

Running 3 HZ rigs in the Wolfcamp shale

play

Targeting 30%+ production growth

3

Notes: Proved reserves and acreage as of 12/31/2012 and 3/31/2013, respectively.

All Boe and Mcfe calculations are based on a 6 to 1 conversion ratio.

Enterprise value is equal to market capitalization using the closing share price of

$25.39 per share on 6/7/2013, plus net debt as of 3/31/2013, pro forma for

$250 MM senior notes offering. ASSET OVERVIEW

AREX OVERVIEW |

Key Investment Highlights

•

Low-Risk, Oil-Rich Asset Base

•

Oil and liquids-weighted asset base in Midland Basin

167,000 gross (148,000 net) primarily contiguous acres

Proved reserves are 69% liquids; 1Q13 production is 69% liquids (41% oil)

•

High Degree of Operational Control

•

Operate 100% reserve base with ~100% working interest

•

Track Record of Growth at Competitive Cost

•

Reserve and production CAGR since 2004 of 32% and 35% respectively

•

Low-cost operator with competitive F&D and low lifting costs

3-year average drill-bit F&D cost of $7.95/Boe vs. peer median of

$13.69/Boe¹ 1Q13 lease operating expense of $7.14/Boe vs. peer median

of $9.42/Boe¹ •

Prudent Financial Management

•

Substantial pro forma liquidity of $406 MM as of 3/31/13²

•

Capital

budget

will

be

fully

funded

through

2014

and

beyond

with

operating

cash

flow,

credit

facility

borrowings

and

proceeds

from

$250 MM senior notes offering

•

Active hedging program

•

Experienced Management

•

Over 150 years of combined industry experience for senior management team

•

Strong operational track record in Permian Basin

•

Significant technical expertise

4

Note:

Estimated

proved

reserves

and

acreage

as

of

12/31/2012

and

3/31/2013,

respectively.

¹

Peers

include

CXO,

FANG,

KOG,

LPI,

OAS,

PXD,

ROSE

and

SM;

F&D

cost

is

a

non-GAAP

financial

measure.

See

“F&D

Costs”

slide

in

appendix

for

our calculation of F&D cost and reconciliation to the information required by

paragraphs 11 and 21 of ASC 932-235. ²

Pro

forma

for

$250

MM

senior

notes

offering

and

5/1/2013

borrowing

base

increase.

See

“Liquidity”

slide

in

appendix. |

Extensive Inventory of Future Wolfcamp/Wolffork Drilling Locations

703

690

703

2,096

887

2,983

HZ Wolfcamp A

HZ Wolfcamp B

HZ Wolfcamp C

Subtotal HZ

Wolfcamp

Vertical Wolffork

Total

Gross Resource

Potential (MMBoe):

316

311

316

943

126

1,068

IDENTIFIED DRILLING LOCATIONS

5

Notes: Identified locations based on 120-acre spacing for HZ Wolfcamp,

20-acre spacing for Vertical Wolffork, 20 to 40-acre spacing for Vertical Wolffork

Recompletions and 40-acre spacing for Vertical Canyon Wolffork. No Wolfcamp or

Wolffork locations assigned to south Project Pangea. |

Track Record of Reserve Growth…

6

•

YE’12 reserves up 24% YoY

•

Replaced 1,346% of reserves at a drill-bit F&D

cost of $7.45/Boe

•

60.1 MMBoe proved reserves booked to

Wolfcamp/Wolffork oil shale play

•

Strong organic reserve growth driven by oil

from HZ Wolfcamp shale

•

Oil reserves up 7x

since YE’09

•

Oil reserves up 106%

YoY

PD Oil reserves up 60%

YoY

Launched

Wolfcamp Study

Announced

Vertical Wolfcamp

Pilot Results

Began HZ

Wolfcamp Pilot

Program

Strong HZ Wolfcamp Results;

Prepare for Large-Scale

Development

RESERVE GROWTH

OIL RESERVE GROWTH

100

120

80

60

40

20

0

2004

2005

2006

2007

2008

2009

2010

2011

2012

Natural Gas (MMBoe)

Oil & NGLs (MMbbls)

Oil (MMBbls)

40

35

30

25

20

15

10

5

0

2009

2010

2011

2012 |

…and Production Growth…

7

•

2012 production increased 24% YoY

•

Targeting 30%+ production growth in 2013

•

Strong organic production growth driven by

oil from HZ Wolfcamp shale

•

Oil production up 4x

since 2009

•

Oil production up 101%

over 2011

PRODUCTION GROWTH

OIL PRODUCTION GROWTH

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

2004

2005

2006

2007

2008

2009

2010

2011

2012

1200

1000

800

600

400

200

0

2009

2010

2011

2012

Natural Gas (MBoe/d)

Oil & NGLs (Mbbls/d)

Oil (MBbls) |

…at Low-Cost

Notes:

Peer

companies

include

CXO,

FANG,

KOG,

LPI,

PXD,

ROSE

and

SM.

3-YR

average

F&D

costs

data

based

on

SEC

filings

for

twelve

months

ended

December

31,

2012.

F&D

cost

is

a

non-GAAP

financial

measure.

See

“F&D

Costs”

slide

in

appendix

for

our

calculation

of

F&D

cost

and

reconciliation

to

the

information required by paragraphs 11 and 21 of ASC 932-235.

Lease operating expense data based on SEC filings for three months ended March 31,

2013. 1Q13 LOE ($/Boe)

3-YR AVERAGE F&D COSTS ($/Boe)

LEASE OPERATING EXPENSE ($/Boe)

8

2010-2012 Drill-Bit F&D

Cost ($/Boe)

$20.00

$18.00

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

Peer 1

AREX

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 1

AREX

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

$7.11

$7.95

$9.59

$12.89

$13.44

$13.72

$14.80

$18.18

$19.76

$5.67

$7.14

$7.18

$7.74

$8.41

$9.35

$9.86

$12.61

$14.52 |

AREX Wolfcamp Oil Shale Resource Play

9

Plan to drill ~ 35 to 40 HZ wells with 3 rigs

Testing “stacked-wellbore”

development and

optimizing well spacing and completion

design

Decrease well costs and increase efficiencies

when field infrastructure projects are

completed

PERMIAN CORE OPERATING AREA

2013 OPERATIONS

Large, primarily contiguous acreage

position with oil-rich, multiple pay zones

Large, primarily contiguous acreage position

Oil-rich, multiple pay zones

167,000 gross (148,000 net) acres

Low acreage cost ~$500 per acre

2,096 Identified HZ Wolfcamp locations targeting

the Wolfcamp

A, B & C

940+ MMBoe gross, unrisked HZ Wolfcamp

resource potential |

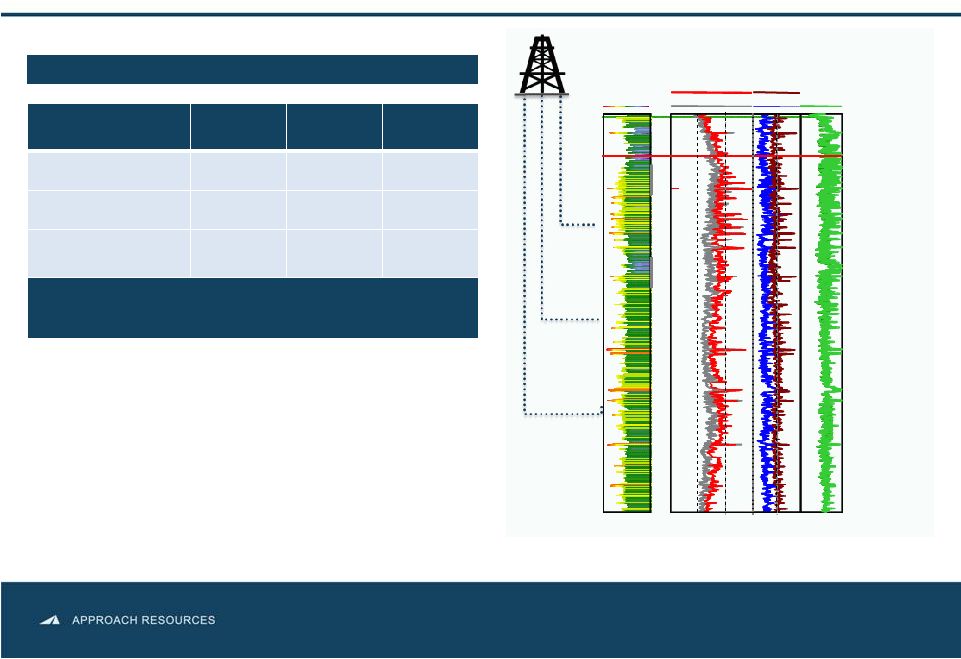

Wolfcamp Oil Shale Play

10

WOLFCAMP

SHALE

–

WIDESPREAD,

THICK,

CONSISTENT

&

REPEATABLE |

HZ Wolfcamp –

79% of IP is Oil

11

Source: Publicly available regulatory filings, company presentations.

|

Wolfcamp Stacked Pay Zones

HZ WOLFCAMP

TARGET

Wolfcamp

A

Wolfcamp

B

Wolfcamp

C

Identified locations

703

690

703

EUR (MBoe)

450

450

450

Gross Resource

Potential (MMBoe)

316

310

316

940+ MMBoe Total Gross

Resource Potential

HZ TARGETS & RESOURCE POTENTIAL

Notes: Identified locations based on multi-bench development and 120-acre

spacing. No locations assigned to south Project Pangea. 12

AREX Baker A 112

Wolfcamp A

Wolfcamp B

Wolfcamp C

Wolfcamp

Top

GR API

LLD OHMM

200

0.2

2,000

MSFL OHMM

0.2

2,000

0.3

-0.1

0.3

-0.1

DPHI

0.2

Free Hydrocarbon

0.2

0

BVW

20

200

20

200

NPHI

0

0

5500

5600

5700

5900

6000

6100

6200

6300

6400

6500

5800 |

13

X-Section View

(heel to toe)

Allows maximum volumes of

shale reservoir to be fraced

Multiple Lateral Stacking –

Effective Frac Volumes

A Bench

B Bench

C Bench

660’

481’

481’

CHEVRON STACKING DEVELOPMENT PATTERN |

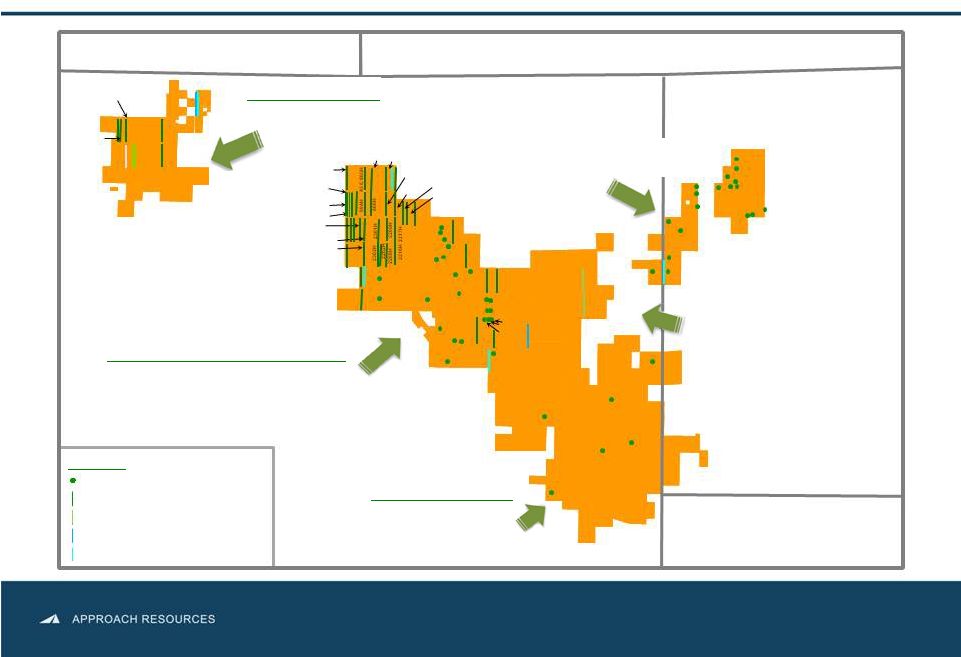

AREX HZ Wolfcamp Activity

14

Note: Acreage as of 3/31/2013.

Schleicher

Irion

Reagan

Sutton

54-9 1

54-2 1

54-9 2

54-12 1

54-15 1

54-15 2

54-16 3

55-21 2

54-19 3

54-8 1

54-13 1

56-6 1

56-15 1

PW 6601H

PW 6602H

CT L 1801

54-13 2

54-20 2

54-20

1

55-21 3

56-14 1

PW 6507H

Childress 603

Childress G 1008

Davidson 3406

CT B 1601

CT M 901H

Baker B 203

CT B 1303

45 C 803H ST

42-11 2R

45 E 1101H

Baker C 1201

45 A 701H

45 B 2401H

45 F 2303H

CT B 1308

42-23 9

Baker A 114

West 2308

42-14 10

42 A 2101H

45 D 902H

CT A 807

45 A 703H

45 B 2402H

CT J 1001

CT G 1001

CT H 1001

West A 2210

42-11 3

CT J 1003H

42 C 101H

CT H 1002

CT G 701H

45 B 2403H

45 D 905H

45 A 704H

CT K 1901

CT K 1902

45 D 904H

45 E 1102H

Baker B 207H

Baker B 206H

CT H 1004H

PW 6533H

PW 6535H

45 F 2304H

45 A 706H

45A 708H

45A 710H

45A 712H

Elliott 2002HB

U 50 A 603HA

CT M 902

Baker B 201

PW 6504H

PW 6502H

Elliott 2001HB

42-23 11

42-15 2

42 B 1001H

Crockett

CT M 934HB

Pangea West

North & Central Pangea

South Pangea

•

18,000

gross

acres

•

Pad

drilling

with

A/B

and

A/C

“stacked”

wellbores

•

3-D

seismic

interpretation

completed

•

HZ

pilot

wells

WOC

•

59,000 gross acres

•

Continuing completion

design improvement

•

89,000

gross

acres

•

Pad

drilling

with

A/B

&

A/C

“stacked”

laterals

•

Infrastructure

2Q’13

in

North

Pangea

Õ

D&C

target

cost

$5.5

MM

•

3-D

seismic

acquisition

completed.

Data

processing

in

progress

•

Targeting

HZ

pilot

well

in

3Q’13

Chandler 4403

Lauffer 1306

Bailey 315

Legend

Vertical Producer

HZ Producer

HZ –

Waiting on Completion

HZ –

Drilling

HZ –

Permit |

HZ

Wolfcamp Well Performance 15

Time (Days)

0

100

200

300

400

500

600

700

800

900

1,000

1,100

1,200

0

60

120

180

240

300

360

420

480

Daily Production Data from

AREX Recent HZ Wells

450 MBoe Type Curve

Daily Production Data from

AREX HZ A Bench Wells

B Bench well data (24 wells)

Legend

A Bench well data (3 wells)

450 MBoe Type Curve

Recent B bench well data (7 wells)

CONTINUED STRONG WELLS RESULTS –

TRACKING ABOVE THE TYPE CURVE |

AREX HZ Wolfcamp Economics

16

Notes: Identified locations based on multi-bench development and 120-acre

spacing for HZ Wolfcamp. No locations assigned to south Project Pangea.

Play Type

Horizontal

Wolfcamp

Avg. EUR (gross)

Targeted Well Cost

Potential Locations

Gross Resource

Potential

BTAX IRR SENSITIVITIES

•

Horizontal drilling improves recoveries and

returns

•

Multiple, stacked horizontal targets

•

7,000’+ lateral length

•

~80% of EUR made up of oil and NGLs

•

3 HZ rigs running in Project Pangea / Pangea

West

80

70

60

50

40

30

20

10

0

$100 / bbl

$90 / bbl

$80 / bbl

$70 / bbl

350

400

450

500

550

Well EUR (MBoe)

940+ MMBoe

2,096

$5.5 MM

450 MBoe |

AREX Drilling Locations, Targets & Resource Potential

17

Notes: Potential locations based on 120-acre spacing for HZ Wolfcamp,

20-acre spacing for Vertical Wolffork, 20 to 40-acre spacing for Vertical Wolffork

Recompletions and 40-acre spacing for Vertical Canyon Wolffork. No Wolfcamp or

Wolffork locations assigned to south Project Pangea. TARGET

DRLLING

DEPTH (FT.)

EUR

(MBoe)

IDENTIFIED

LOCATIONS

GROSS

RESOURCE

POTENTIAL

Horizontal

Wolfcamp

Wolfcamp A

7,000+

(lateral length)

450

703

316,350

Wolfcamp B

7,000+

(lateral length)

450

690

310,500

Wolfcamp C

7,000+

(lateral length)

450

703

316,350

Total HZ

2,096

943,200

Vertical

Wolffork

Recompletions,

Wolffork &

Canyon Wolffork

< 7,500 to

< 8,500

93 to 193

887

124,594

1.1 BnBoe Total Gross Resource Potential

Multiple Decades of HZ Drilling Inventory |

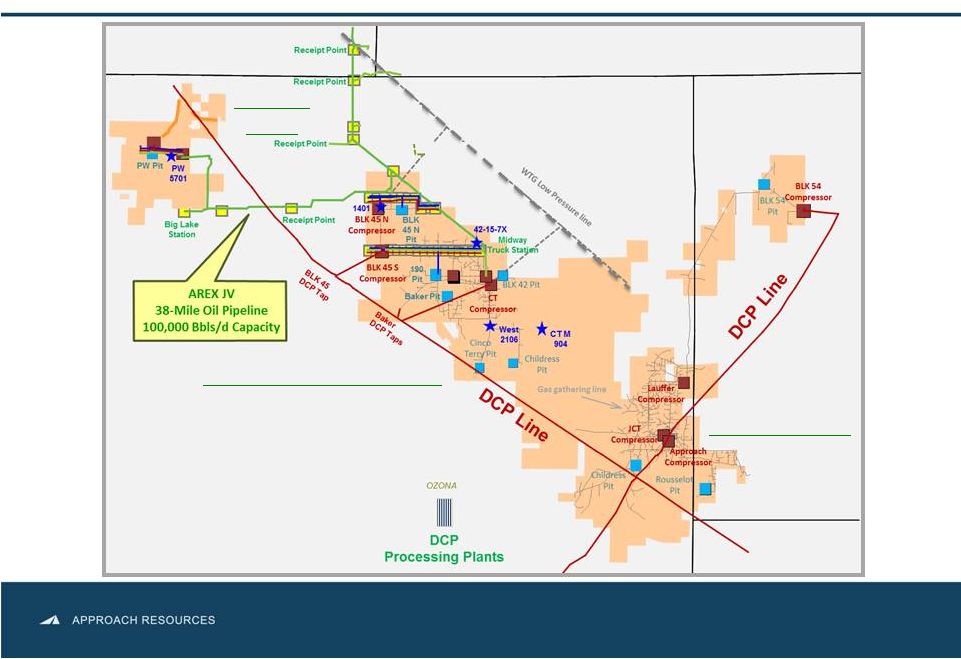

Infrastructure for Large-Scale Development

18

•

Reducing D&C Cost to $5.5 MM or lower

•

Reducing LOE

•

Minimizing truck traffic and surface disturbance

•

Increasing project profit margin

Pangea

West

North & Central Pangea

South Pangea

Schleicher

Crockett

Irion

Reagan

Sutton |

Infrastructure & Equipment Projects

19

•

Safely and securely transport water across Project Pangea and Pangea West

•

Reduce time and money spent on water hauling and disposal and truck traffic

•

Expected savings from water transfer equipment ~$0.1 MM/HZ well

•

Expected savings from SWD system ~$0.45 MM/HZ well

•

Expected company-wide LOE savings ±$0.4 MM per month

•

Replace rental equipment and contractors with Company-owned and operated

equipment and personnel; reduce money spent on flowback operations

•

Expected savings from flowback equipment ~$0.1 MM/HZ well

•

Expected LOE savings from gas lift system $6,300/HZ per month

•

Facilitate large-scale field development

•

Reduce fresh water use and water costs

•

Expected savings from non-potable water source ~$0.45 MM/HZ well

•

Efficiently transport crude oil to market and reduce inventory

•

Reduce

oil

transportation

differential

to

an

estimated

$2.50/Bbl

–

$4.00/Bbl

Purchasing and installing water

transfer equipment

Drilling and/or converting SWD

wells

Purchasing and installing flowback

equipment

Securing water supply

Testing non-potable water and

recycling flowback water

Installing crude takeaway lines

Purchased oil hauling trucks

BENEFITS

Infrastructure and equipment projects are key to large-scale field development

and to reducing D&C costs as well as LOE cost

PROJECTS |

Financial

Information

NON-GAAP RECONCILIATIONS |

2013 Capital Budget

•

2013 Capital budget $260 MM, approx. 90% for HZ Wolfcamp

•

3 HZ rigs in the Wolfcamp shale

•

Targeting 30%+ production growth

Key takeaways:

21

•

2013

Production

guidance

3.6

MMBoe

–

3.9

MMBoe

•

2013E Production mix 70% liquids

2013 capital program provides flexibility to develop Wolfcamp oil shale and

monitor commodity prices and service costs

Increase in oil production drives expected increase in cash flow

Borrowing base increase to $315 MM and $250 MM senior notes offering strengthen

liquidity •

Targeting Wolfcamp A, B and C

•

Testing

“stacked-wellbore”

development

•

Optimizing well spacing and completion design |

Strong, Simple Balance Sheet

22

FINANCIAL RESULTS ($MM)

3/31/13

Summary Balance Sheet

Cash

$0.6

$91.5

Revolver

152.3

–

Senior Notes

–

250.0

Total Debt

$152.3

$250.0

Shareholders’

Equity

635.2

635.2

Total Book Capitalization

$787.5

$885.2

Liquidity

Borrowing Base

$280.0

$315.0²

Cash and Cash Equivalents

0.6

91.5

Outstandings and letters of credit

(152.6)

(0.3)

Liquidity

$128.0

$406.2

Key Metrics

LTM EBITDAX

$86.5

$86.5

Total Reserves (MMBoe)

95.5

95.5

Proved Developed Reserves (MMBoe)

32.8

32.8

% Proved Developed

34%

34%

% Liquids

69%

69%

Credit Statistics

4

Net Debt / Book Cap

20%

Net Debt / 1Q13 Annualized EBITDAX

1.6x

Net Debt / Proved Reserves ($/Boe)

$1.66

Net Debt / Proved Developed Reserves ($/Boe)

$4.83

Net Debt / Production ($/Boepd)

$18,838

Notes:

Estimated

proved

reserves

as

of

12/31/2012.

See

“Liquidity”

slide

in

appendix.

¹

Pro forma for $250 MM senior notes offering and 05/1/2013 borrowing base

increase. ²

$315mm borrowing base under $500 MM facility.

3

EBITDAX

is

a

non-GAAP

financial

measure.

See

“EBITDAX”

slide

in

appendix

for

reconciliation

to

net

income

(loss).

4

Net debt is debt balance less available cash and letters of credit.

1

3/31/13 As Adj. |

2013 Operating and Financial Guidance

23

2013

GUIDANCE

2013 Guidance

Production

Total (MBoe)

3,600 –

3,900

Percent Oil & NGLs

70%

Operating costs and expenses ($/per Boe)

Lease operating

$

7.00 –

8.00

Production and ad valorem taxes

$

3.00 –

4.50

Exploration

$

2.00 –

3.00

General and administrative

$

7.00 –

8.50

Depletion, depreciation and amortization

$

20.00 –

24.00

Capital expenditures ($MM)

Approximately $260

•

2Q13

Production

guidance

8.7

MBoe/d

–

9.1

MBoe/d |

Hedge Position

24

Commodity and Time Period

Type

Volume

Price

Crude Oil

2013

Collar

650 Bbls/d

$90.00/Bbl -

$105.80/Bbl

2013

Collar

450 Bbls/d

$90.00/Bbl -

$101.45/Bbl

2013 (1)

Collar

1,200 Bbls/d

$90.35/Bbl -

$100.35/Bbl

2014

Collar

550 Bbls/d

$90.00/Bbl -

$105.50/Bbl

2014

Collar

650 Bbls/d

$85.05/Bbl -

$95.05/Bbl

Crude Oil Basis Differential (Midland/Cushing)

2013 (2)

Swap

2,300 Bbls/d

$1.10/Bbl

Natural Gas

2013

Swap

200,000 MMBtu/month

$3.54/MMBtu

2013

Swap

190,000 MMBtu/month

$3.80/MMBtu

2013 (3)

Collar

100,000 MMBtu/month

$4.00/MMBtu -

$4.36/MMBtu

2014

Swap

360,000 MMBtu/month

$4.18/MMBtu

(1)

February 2013 –

December 2013

(2)

March 2013 –

December 2013

(3)

May 2013 –

December 2013

•

Prudent hedging program protects cash flow and returns as well as capital budget

activities 53% of FY’13 oil hedged at $90.17/Bbl x $102.19/Bbl

81% of FY’13 gas hedged at weighted average floor of $3.72/MMBtu

|

Liquidity

25

Liquidity

(unaudited)

is

calculated

by

adding

the

net

funds

available

under

our

revolving

credit

facility

and

cash

and

cash

equivalents.

We

use

liquidity

as

an

indicator of

the Company’s ability to fund development and exploration activities.

Liquidity has limitations, and can vary from year to year for the Company and can

vary among companies based on what is or is not included in the measurement on a

company’s financial statements. Liquidity is provided in addition to, and not as an

alternative for, and should be read in conjunction with, the information contained

in our financial statements prepared in accordance with GAAP (including the notes),

included in our SEC filings and posted on our website. The table below

summarizes our liquidity at March 31, 2013, and our liquidity at March 31, 2013, on a pro

forma basis to give effect to our $250 MM senior notes offering and May 1, 2013,

borrowing base increase. Long-term

debt-to-capital

ratio

(unaudited)

is

calculated

by

dividing

long-term debt

(GAAP)

by

the

sum

of

total

stockholders’

equity

(GAAP)

and

long-term

debt

(GAAP). We

use

the

long-term

debt-to-capital

ratio

as

a

measurement

of

our

overall

financial

leverage.

However,

this

ratio

has

limitations.

This

ratio

can

vary

from

year-to-year for the Company and can vary among companies based on what is

or is not included in the ratio on a company’s financial statements. This ratio is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

our

website.

The

table

below summarizes

our

long-term

debt-to-capital

ratio

at

December

31,

2012

and

March

31,

2013,

and

at

March

31,

2013,

on

a

pro

forma

basis

to

give

effect

to

our

$250

MM

senior

notes

offering

in

June

2013.

(in thousands)

March 31, 2013

Pro Forma

March 31, 2013

Borrowing base

$

280,000

$

315,000

Cash and cash equivalents

594

91,513

Long-term debt

(152,250)

--

Undrawn letters of credit

(325)

(325)

Liquidity

$

128,019

$

406,188

(in thousands)

December 31, 2012

March 31, 2013

Pro Forma

March 31, 2013

Long-term debt

$

106,000

$

152,250

$

250,000

Total stockholders’

equity

633,468

635,211

635,211

$

739,468

$

787,461

$

885,211

Long-term debt-to-capital

14.3%

19.3%

28.2% |

EBITDAX (unaudited)

26

(in thousands, except per-share

amounts)

2Q12

3Q12

4Q12

1Q13

Net income (loss)

$

7,862

$

(2,355)

$

(837)

$

(347)

Exploration

(38)

1,170

2,131

260

Depletion, depreciation and

amortization

14,596

16,728

18,027

17,056

Share-based compensation

1,311

1,450

2,472

2,257

Unrealized (gain) loss on commodity

derivatives

(9,439)

4,185

(1,292)

4,100

Interest expense, net

1,380

1,544

926

1,229

Income tax provision (benefit)

4,390

(1,253)

(781)

(187)

EBITDAX

$

20,062

$

21,469

$

20,646

$

24,368

EBITDAX per diluted share

$

0.60

$

0.63

$

0.53

$

0.63

We define EBITDAX as net income, plus (1) exploration expense, (2) depletion,

depreciation and amortization expense, (3) share-based compensation expense, (4)

unrealized (gain) loss on commodity derivatives, (5) interest expense and (6) income taxes. EBITDAX is not a measure of net income or cash flow

as determined by GAAP. The amounts included in the calculation of EBITDAX were

computed in accordance with GAAP. EBITDAX is presented herein and reconciled to

the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator of a company's ability to

internally fund development and exploration activities. This measure is provided in

addition to, and not as an alternative for, and should be read in conjunction with,

the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our SEC filings and posted on

our website.

The following table provides a reconciliation of quarterly EBITDAX to net income (loss) for

the last twelve months. |

F&D Costs (unaudited)

27

We believe that providing measures of finding and development,

or F&D, cost is useful to assist an evaluation of how much it costs

the Company, on a per Boe basis, to add proved reserves.

However, these measures are provided in addition to, and not as

an alternative for, and should be read in conjunction with, the

information contained in our financial statements prepared in

accordance with GAAP (including the notes), included in our

SEC filings and posted on our website. Due to various factors,

including timing differences, F&D costs do not necessarily reflect

precisely the costs associated with particular reserves. For

example, exploration costs may be recorded in periods before the

periods in which related increases in reserves are recorded and

development costs may be recorded in periods after the periods

in which related increases in reserves are recorded. In addition,

changes in commodity prices can affect the magnitude of

recorded increases (or decreases) in reserves independent of the

related costs of such increases.

As a result of the above factors and various factors that could

materially affect the timing and amounts of future increases in

reserves and the timing and amounts of future costs, including

factors disclosed in our filings with the SEC, we cannot assure

you that the Company’s future F&D costs will not differ materially

from those set forth above. Further, the methods we use to

calculate F&D costs may differ significantly from methods used

by other companies to compute similar measures. As a result, our

F&D costs may not be comparable to similar measures provided

by other companies.

The following tables reflect the reconciliation of our estimated

finding and development costs to the information required by

paragraphs 11 and 21 of ASC 932-235.

2012 Reserve summary (MBoe)

Balance –

12/31/2011

76,975

Extensions & discoveries

38,861

Revisions

(17,469)

Production

(2,888)

Balance –

12/31/2012

95,479

Cost summary ($M)

Acquisition costs

$

7,742

Exploration costs

4,550

Development costs

285,039

Total

297,331

Finding & development costs ($/Boe)

All-in F&D costs

$

13.90

Drill-bit F&D cost

$

7.45

Reserve replacement ratio (%)

Extensions & discoveries (MBoe)

38,861

2012 Production (MBoe)

(2,888)

Reserve replacement

1,346%

3-Year Reserve summary (MBoe)

Balance –

12/31/2009

36,488

Extensions & discoveries

68,182

Purchases

12,456

Revisions

(14,866)

Production

(6,781)

Balance –

12/31/2012

95,479

Cost summary ($M)

Acquisition costs

$

131,189

Exploration costs

17,415

Development costs

524,476

Total

673,080

Finding & development costs ($/Boe)

3-YR All-in F&D costs

$

10.23

3-YR Drill-bit F&D cost

$

7.95

Reserve replacement ratio (%)

Extensions & discoveries (MBoe)

68,182

3-YR Production (MBoe)

(6,781)

Reserve replacement

1,005% |

Contact

Information

MEGAN P. HAYS

Manager, Investor Relations & Corporate Communications

817.989.9000 x2108

mhays@approachresources.com

www.approachresources.com |