Attached files

| file | filename |

|---|---|

| EX-10.6 - EX-10.6 - Green Field Energy Services, Inc. | d484319dex106.htm |

| EX-23.1 - EX-23.1 - Green Field Energy Services, Inc. | d484319dex231.htm |

| EX-23.4 - EX-23.4 - Green Field Energy Services, Inc. | d484319dex234.htm |

| EX-10.8 - EX-10.8 - Green Field Energy Services, Inc. | d484319dex108.htm |

| EX-10.7 - EX-10.7 - Green Field Energy Services, Inc. | d484319dex107.htm |

| EX-10.9 - EX-10.9 - Green Field Energy Services, Inc. | d484319dex109.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 14, 2013

Registration No. 333-182107

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Green Field Energy Services, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 1389 | 11-3682539 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4023 Ambassador Caffery Parkway, Suite 200

Lafayette, Louisiana 70503

(337) 706-1700

(address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Earl J. Blackwell

Chief Financial Officer

4023 Ambassador Caffery Parkway, Suite 200

Lafayette, Louisiana 70503

(337) 706-1700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

J. Michael Chambers

Ryan J. Maierson

Latham & Watkins LLP

811 Main Street, Suite 3700

Houston, Texas 77002

(713) 546-5400

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1) |

Amount of Registration Fee | ||

| Common stock, par value $0.01 per share, underlying warrants |

$ 2,470 | $0.29 | ||

|

| ||||

|

| ||||

| (1) | Estimated in accordance with Rule 457(g), calculated on the basis of the warrant exercise price, $0.01 per share. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting any offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 14, 2013

PRELIMINARY PROSPECTUS

Green Field Energy Services, Inc.

247,058 Shares of Common Stock

This prospectus relates to the resale of 247,058 shares of common stock, $0.01 par value per share (“common stock”), to be offered by the shareholders identified under the “Selling Shareholders” section of this prospectus upon the exercise of outstanding warrants. We initially issued (the “November 2011 Private Placement”) the warrants as part of 250,000 units (the “Units”), each consisting of $1,000 principal amount of our 13% senior secured notes due 2016 (the “Notes”) and a warrant to purchase 0.988235 shares of common stock (the “Warrants”).

We will not receive any proceeds from the sale of common stock by the selling shareholders. The selling shareholders and any brokers, dealers or agents, upon affecting the sale of any of the common stock offered by this prospectus, may be deemed “underwriters” as that term is defined under the Securities Act of 1933 or the Securities Exchange Act of 1934, or the rules and regulations thereunder.

Our common stock is not listed for trading on any national securities exchange and we have no plans to list our stock on any exchange. The securities being registered in this offering may not be liquid since they are not listed on any exchange or quoted in the OTC Bulletin Board. Because there is currently no active trading market, selling stockholders will sell at a stated fixed price until our common stock in quoted on the OTC Bulletin Board. The selling shareholders may sell shares of common stock from time to time in privately negotiated transactions or, if a public market for our stock develops, on the principal market on which our common stock may be traded in the future. We can provide no assurance to you that a public market for our stock will develop and if so, what the market price of our stock may be.

Investing in our common stock involves risks. You should carefully consider the “Risk Factors” beginning on page 6 of this prospectus.

We are an emerging growth company under applicable Securities and Exchange Commission rules and are eligible for, and are relying on, certain reduced public company reporting requirements. See “Summary—Emerging Growth Company Status” on page 3 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

YOU SHOULD READ THIS ENTIRE DOCUMENT AND THE ACCOMPANYING LETTER OF TRANSMITTAL AND RELATED DOCUMENTS AND ANY AMENDMENTS OR SUPPLEMENTS CAREFULLY BEFORE MAKING A DECISION WHETHER TO PURCHASE OUR COMMON STOCK.

The date of this prospectus is , 2013

Table of Contents

| ii | ||||

| iii | ||||

| 1 | ||||

| 6 | ||||

| 19 | ||||

| 20 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | |||

| 43 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 74 | ||||

| 76 | ||||

| 77 | ||||

| 81 | ||||

| 81 | ||||

| 81 | ||||

| F-1 |

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates and the information is accurate and complete, we have not independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

Trade Names and Trademarks

This prospectus may also include trade names and trademarks of other companies. Our use or display of other parties’ trade names, trademarks or products is not intended to, and does not imply a relationship with, or endorsement or sponsorship of us by, the respective owners of such trade names, trademarks or products.

i

Table of Contents

We have filed with the Securities and Exchange Commission (the “SEC”) a registration statement (“Registration Statement”) on Form S-1 under the Securities Act of 1933, as amended (the “Securities Act”), with respect to the common stock. This prospectus, which is a part of the Registration Statement, omits certain information included in the Registration Statement and in its exhibits. For further information relating to us and our common stock, we refer you to the Registration Statement and its exhibits, from which this prospectus incorporates important business and financial information about the Company that is not included in or delivered herewith. You may read and copy the Registration Statement, including its exhibits, at the SEC’s Public Reading Room located at 100 F. Street, N.E., Room 1580, Washington D.C. 20549. You may obtain information on the operation of the Public Reading Room by calling the SEC at 1-800-SEC-0300. The SEC also maintains a Web site (www.sec.gov) that contains reports, proxy and information statements and other information regarding registrants like us who file electronically with the SEC.

We are not currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Following effectiveness of the registration statement of which this prospectus is a part, we will file annual, quarterly and current reports and other information with the SEC in accordance with the Exchange Act. You may read and copy any document we file with the SEC at the SEC’s address set forth above.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything not contained in this prospectus, and, if given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer to sell our common stock in any jurisdiction where an offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus. We will disclose any material changes in our affairs in an amendment to this prospectus or a prospectus supplement.

We are not making an offer to sell these securities or soliciting an offer to buy these securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone whom it is unlawful to make an offer or solicitation.

ii

Table of Contents

Cautionary Statement Regarding Forward-Looking Statements

This prospectus contains “forward-looking statements” that involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, projections of revenue, statements relating to our future financial performance, the growth of the market for our services, expansion plans and opportunities and statements regarding our plans, strategies and objectives for future operations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology.

Forward-looking statements reflect our current views about future events, are based on assumptions, and are subject to known and unknown risks and uncertainties. Many important factors could cause actual results or achievements to differ materially from any future results or achievements expressed in or implied by our forward-looking statements, including the factors listed below. Many of the factors that will determine future events or achievements are beyond our ability to control or predict. Certain of these are important factors that could cause actual results or achievements to differ materially from the results or achievements reflected in our forward-looking statements, including, but not limited to:

| • | general economic conditions and conditions affecting the industries we serve; |

| • | the level of oil and natural gas exploration, development and production in the U.S.; |

| • | our future financial and operating performance and results; |

| • | our business strategy and budgets; |

| • | changes in technology; |

| • | our financial strategy; |

| • | amount, nature and timing of our capital expenditures; |

| • | changes in competition and government regulations; |

| • | our operating costs and other expenses; |

| • | our cash flow and anticipated liquidity; and |

| • | our plans, forecasts, objectives, expectations and intentions. |

These forward-looking statements reflect our views and assumptions only as of the date such forward-looking statements are made. You should not place undue reliance on forward-looking statements. Except as required by law, we assume no responsibility for updating any forward-looking statements nor do we intend to do so. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. The risks included in this section are not exhaustive. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements are set forth under the section titled “Risk Factors.”

iii

Table of Contents

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. You should read carefully the rest of this prospectus and should consider, among other things, the matters set forth under the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our combined financial statements and related notes to those statements and other financial data included elsewhere in this prospectus. Some of the statements in the following summary are forward-looking statements. See the section titled “Cautionary Statement Regarding Forward-Looking Statements.” Unless the context requires otherwise, references in this prospectus to the “Company,” “we,” “us,” “our” or “ours” refer to Green Field Energy Services, Inc., together with its subsidiaries and predecessor entities.

Company Overview

Formed in 1969, we are an independent oilfield services company that provides a wide range of pressure pumping related services to oil and natural gas drilling and production companies to help develop and enhance the production of hydrocarbons. Our traditional oilfield pumping services included cementing, coiled tubing, pressure pumping, acidizing, and other pumping services. We also produce our own TFPs (as defined below). In December 2010, we began providing hydraulic fracturing pumping services as a part of our portfolio of services provided to our customers using our own internally produced turbine-powered hydraulic fracturing units. To support our hydraulic fracturing operations, we have also entered into two long-term leases during 2011 for sand mines in Louisiana and Mississippi. These mines are expected to supply a portion of our fracturing sand needs and provide us with the opportunity to sell fracturing sand to third parties. Our hydraulic fracturing operations utilize turbine-powered hydraulic fracturing pumping equipment that we believe provides several advantages over the diesel-powered pumping equipment generally utilized in the industry. These advantages include lower emissions, a smaller operating footprint, lower operating costs and greater fuel flexibility, including the ability to operate on natural gas. “HP” as used in this prospectus means the maximum horsepower rating on the applicable pump(s).

Each of our turbine-powered hydraulic fracturing units consists primarily of a high pressure hydraulic pump, a turbine engine, a gear box, electrical and hydraulic assemblies, and skids (collectively, a “TFP”) and various hoses, valves, tanks and other supporting equipment that are typically mounted to a flat-bed trailer. The group of hydraulic fracturing units, other equipment and vehicles necessary to perform a typical fracturing job is referred to as a hydraulic fracturing “spread” and we refer to all of our spreads together as our hydraulic fracturing “fleet.”

As of May 20, 2013, we had approximately 159,750 HP of high pressure pumping capacity in our fleet, of which 150,750 HP was turbine powered. During December 2012, we placed into service the first of six planned new coiled tubing units. A second new coiled tubing unit and two new cementing units were also placed into service in April and May of 2013, respectively. We do not anticipate adding more horsepower without additional firm customer commitments in the future and we may also consider reconfiguring or selling some portion of the earlier assembled units in the fleet based on customer commitments and our evaluation of the market over the near term.

1

Table of Contents

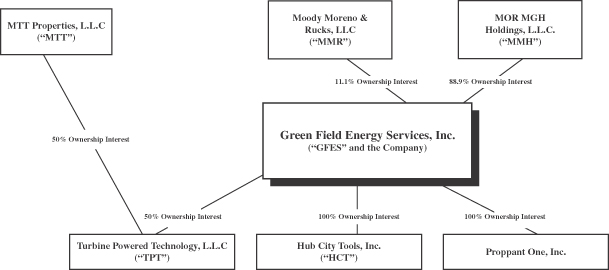

Organizational Structure

The following diagram depicts our organizational structure and ownership as of March 31, 2013.

General Corporate Information

Green Field Energy Services, Inc. is incorporated under Delaware law. Our principal executive offices are located at 4023 Ambassador Caffery Parkway, Suite 200, Lafayette, LA 70503, and our telephone number at that address is (337) 706-1700. Our website address is http://gfes.com; however, information contained on our website is not incorporated by reference into this prospectus, and you should not consider the information contained on our website to be part of this prospectus.

Emerging Growth Company Status

We qualify as an emerging growth company as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. For instance, emerging growth companies are not required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | comply with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | provide certain disclosures regarding executive compensation required of larger public companies; or |

| • | hold shareholder advisory votes on executive compensation. |

We may take advantage of these reduced reporting burdens which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

2

Table of Contents

We will cease to be an emerging growth company upon the earliest of:

| • | when we have $1.0 billion or more in annual revenues; |

| • | when we have at least $700 million in market value of our common stock held by non-affiliates; |

| • | when we issue more than $1.0 billion of non-convertible debt over a rolling three-year period; or |

| • | the last day of the fiscal year following the fifth anniversary of our initial public offering. |

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933 for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

3

Table of Contents

Summary of the Offering

| Issuer |

Green Field Energy Services, Inc. |

| Common Stock Being Offered by the Selling Shareholders |

247,058 shares of common stock issuable upon exercise of the Warrants. |

| Shares of Common Stock Outstanding Prior to this Offering |

1,524,446 |

| Shares of Common Stock Outstanding After this Offering |

1,771,504 |

| Use of Proceeds |

All of the common stock offered hereby will be sold by the selling shareholders. We will not receive any proceeds from the sale of these shares. See “Use of Proceeds.” |

| Offering Price |

All or some of the shares offered hereby may be sold from time to time in amounts and or terms to be determined by the selling stockholders at the time of sale. |

| Voting Rights |

Holders of common stock are entitled to one vote for each share of common stock held. |

| Dividend Policy |

Holders of common stock have the right to receive dividends when and as dividends are declared by our Board of Directors. We have not paid dividends on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. In addition, the terms of our Shell Credit Facility and the indenture governing our Notes restrict our ability to pay dividends on our common stock. |

| Liquidation Rights |

Upon any liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary, any assets remaining after satisfaction of the rights of creditors and the rights of any holders of preferred stock will be distributed to the holders of common stock. |

| Trading Market |

There is currently no established public market for trading of the shares of our common stock being offered hereby. |

| Risk Factors |

You should carefully consider the information set forth in this prospects and, in particular, the specific factors set forth in the “Risk Factors” section before deciding whether to purchase shares of our common stock. |

4

Table of Contents

November 2011 Private Placement

In November 2011, we issued an aggregate of 250,000 units (the “Units”) to certain qualified institutional buyers (the “Purchasers”) for aggregate cash proceeds of $247,500,000, at a price per Unit of $990.00 (the “November 2011 Private Placement”).

Each Unit consisted of $1,000 principal amount of our 13% senior secured notes due 2016 (the “Notes”) and one one warrant (together with all other warrants issued in connection with the Units, the “Warrants”) to purchase 0.988235 shares of our common stock (together with all other shares of our common stock issuable upon exercise of the Warrants, the “Warrant Shares”). Each Warrant entitles the holder, subject to certain conditions, to purchase 0.988235 Warrant Shares at an exercise price of $0.01 per share, subject to adjustment. The Warrants are exercisable at any time and will expire on November 15, 2021.

In connection with the November 2011 Private Placement, we granted each Purchaser registration rights. We are obligated to use our best efforts to cause a registration statement registering for resale the common stock underlying the Warrant Shares. The shares underlying the Warrant Shares are registered pursuant to this prospectus.

For more information about the common stock, see “Description of Common Stock.”

Risk Factors

You should carefully consider all of the information set forth in this prospectus and, in particular, you should refer to the section captioned “Risk Factors” for an explanation of certain risks related to investing in the common stock.

5

Table of Contents

You should carefully consider the risks described below, as well as the other information contained in this prospectus and our other filings with the SEC, before making an investment decision in our common stock. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. The actual occurrence of any of these risks could materially adversely affect our business, financial condition and results of operations. In that case, the value of the Securities could decline substantially, and you may lose part or all of your investment.

Risks Related to Investing in our Common Stock

There may be no public market for the common stock being offered, which could significantly impair the liquidity of the common stock.

There has been no public market for any of the common stock. As of the date of this prospectus, all of our common stock is privately held. Our common stock is not listed on any exchange and we do not intend to apply for any listing. We cannot assure you as to:

| • | whether any public market will develop for the common stock; |

| • | the liquidity of any such market that may develop; |

| • | your ability to sell your common stock; or |

| • | the price at which you would be able to sell your common stock. |

The initial purchaser of the Warrants from which these shares of common stock are issuable upon exercise has advised us that it intends to make a market in the common stock. The initial purchaser is not obligated, however, to make a market in the common stock, and they may discontinue any such market-making at any time at their sole discretion. Accordingly, we cannot assure you as to the development or liquidity of any market for our common stock.

There may be dilution of the value of our common stock when the Warrants become exercised.

On November 15, 2011, we issued warrants to purchase common stock representing 17.6% of our outstanding common stock on a fully diluted basis as of such date (assuming exercise of all such warrants) as part of an issuance of investment units consisting of (a) $1,000 principal amount of our Notes and (b) one Warrant. Because common stock is issuable upon exercise of the Warrants, and in particular because the Warrants are initially exercisable for $0.01 per share of common stock, there may be a dilutive effect on the value of our common stock when the Warrants are exercised.

We do not intend to pay dividends on the common stock in the foreseeable future.

We have not paid dividends on our common stock and do not anticipate paying any cash dividends on the common stock in the foreseeable future. In addition, the terms of our Shell Credit Facility (as later defined) and the indenture governing the Notes restrict our ability to pay dividends on the common stock.

As a result of our exchange offering, we will become subject to financial reporting and other requirements for which our accounting and other management systems and resources may not be adequately prepared.

Our concurrent exchange offering will subject us to reporting and other obligations under the Securities Exchange Act of 1934, as amended, including the requirements of Section 404 of the Sarbanes-Oxley Act. Section 404 will require us to conduct an annual management assessment of the effectiveness of our internal controls over financial reporting and to obtain a report by our independent auditors addressing these assessments. These reporting and other obligations will place significant demands on our management, administrative,

6

Table of Contents

operational and accounting resources. We also expect these regulations to increase our legal and financial compliance costs, make it more difficult to attract and retain qualified officers and members of our board of directors and make some activities more difficult, time consuming and costly. We are presently upgrading our systems, implementing financial and management controls and reporting systems and procedures; we also have hired additional accounting and finance staff. If we are unable to accomplish these objectives in a timely and effective fashion, our ability to comply with our financial reporting requirements and other rules that apply to reporting companies could be impaired. Any failure to maintain effective internal controls could have a material adverse effect on our business, operating results and stock price. Moreover, effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed.

Risks Relating to Our Business

Our independent registered public accounting firm’s report on our financial statements included an explanatory paragraph regarding our ability to continue as a going concern.

As discussed in Note 2 to our 2012 consolidated financial statements, such financial statements were prepared assuming that we would continue as a going concern. We have recurring operating losses and a net working capital deficiency that raise substantial doubt about our ability to continue as a going concern. Our independent registered public accounting firm included an explanatory paragraph in its report on our 2012 consolidated financial statements regarding the substantial doubt about our ability to continue as a going concern. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including by the sale of our securities or obtaining loans from financial institutions or our controlling stockholders, where possible. If we obtain additional financing, such funds may not be available on favorable terms. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience significant dilution. Any debt financing, if available, may involve restrictive covenants that restrict our ability to conduct our business. Our continued net operating losses increase the difficulty of our meeting such goals and our efforts to continue as a going concern may not prove successful.

Our business depends on the oil and natural gas industry and particularly on the level of exploration, development and production of oil and natural gas in the United States. Our markets may be adversely affected by industry conditions that are beyond our control.

We depend on our customers’ willingness to make operating and capital expenditures to explore for, develop and produce oil and natural gas in the United States. If these expenditures decline, our business may suffer. Our customers’ willingness to explore, develop and produce depends largely upon prevailing industry conditions that are influenced by numerous factors over which our management has no control, such as:

| • | the supply of and demand for oil and natural gas, including current natural gas storage capacity and usage; |

| • | the prices, and expectations about future prices, of oil and natural gas; |

| • | the supply of and demand for hydraulic fracturing and other well service equipment in the United States; |

| • | public pressure on, and legislative and regulatory interest within, federal, state and local governments to stop, significantly limit or regulate hydraulic fracturing activities; |

| • | the expected rates of decline of current oil and natural gas production; |

| • | lead times associated with acquiring equipment and products and availability of personnel; |

| • | regulation of drilling activity; |

| • | the discovery rates of new oil and natural gas reserves; |

7

Table of Contents

| • | available pipeline and other transportation capacity; |

| • | weather conditions, including hurricanes that can affect oil and natural gas operations over a wide area; |

| • | political instability in oil and natural gas producing countries; |

| • | domestic and worldwide economic conditions; |

| • | technical advances affecting energy consumption; |

| • | the price and availability of alternative fuels; and |

| • | merger and divestiture activity among oil and natural gas producers. |

The level of activity in the oil and natural gas exploration and production (“E&P”) industry in the United States is volatile. In 2009, our industry experienced an unprecedented decline in drilling activity in the United States as rig counts dropped by approximately 57% from 2008 highs. Unexpected material declines in oil and natural gas prices, or drilling or completion activity in the southern United States oil and natural gas shale regions, could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, a decrease in the development rate of oil and natural gas reserves in our market areas may also have an adverse impact on our business, even in an environment of stronger oil and natural gas prices.

We have operated at a loss in the past and there is no assurance of our profitability in the future.

Historically, we have experienced periods of low demand for our services and have incurred operating losses. In the future, we may incur further operating losses and experience negative operating cash flow. We may not be able to reduce our costs, increase revenues, or reduce our debt service obligations sufficient to achieve or maintain profitability and generate positive operating income in the future.

We may be unable to implement price increases or maintain existing prices on our core services.

We periodically seek to increase the prices of our services to offset rising costs and to generate higher returns for our stockholders. However, we operate in a very competitive industry and as a result, we are not always successful in raising, or maintaining our existing prices. Additionally, during periods of increased market demand, a significant amount of new service capacity may enter the market, which also puts pressure on the pricing of our services and limits our ability to increase or maintain prices. Furthermore, during periods of declining pricing for our services, we may not be able to reduce our costs accordingly, which could further adversely affect our profitability.

Even when we are able to increase our prices, we may not be able to do so at a rate that is sufficient to offset such rising costs. In periods of high demand for oilfield services, a tighter labor market may result in higher labor costs. During such periods, our labor costs could increase at a greater rate than our ability to raise prices for our services. Also, we may not be able to successfully increase prices without adversely affecting our activity levels. The inability to maintain our prices or to increase our prices as costs increase could have a material adverse effect on our business, financial position and results of operations.

8

Table of Contents

Our inability to acquire or delays in the delivery of our new fracturing spreads or future orders of specialized equipment from suppliers could harm our business, results of operations and financial condition.

As of May 20, 2013, we had approximately 159,750 HP of high pressure pumping capacity in our fleet, of which 150,750 HP was turbine powered. During December 2012, we placed into service the first of six planned new coiled tubing units. A second new coiled tubing unit and two new cementing units were also placed into service in April and May of 2013, respectively.

The delivery of the pumps or any other fracturing equipment we have ordered or may order in the future could be materially delayed or not delivered at all. Three equipment suppliers are constructing our hydraulic fracturing pumps to be utilized for our hydraulic fracturing units. These pumps will then be delivered to Dynamic Industries, Inc. (“Dynamic”) for mounting onto the pump skids, and then to Turbine Powered Technology L.L.C. (“TPT”), for the addition of the turbines and completion of the TFPs. Please see the section titled “Certain Relationships and Related Person Transactions—Joint Venture” for additional information. The overall number of hydraulic fracturing equipment suppliers in the industry is limited, and there is high demand for such equipment, which may increase the risk of delay or failure to deliver and limit our ability to find alternative suppliers. Any material delay or failure to deliver new equipment could defer or substantially reduce our revenue from the deployment of this equipment for our fracturing units.

If we cause disruptions to our customers’ businesses or provide inadequate service, particularly by failing to meet our delivery deadlines with Shell, our customers may have claims for damages against us, which could cause us to lose customers, have a negative effect on our reputation and adversely affect our results of operations.

If we fail to provide services under our contracts with our customers, like our contract with Shell Western E&P, (“Shell”), we may disrupt such customers’ business, which could result in a reduction in our revenues or a claim for substantial damages against us. In addition, a failure or inability to meet a contractual requirement could seriously damage our reputation and affect our ability to attract new business. Any significant failure of our equipment, or any major disruption in our acquisition of equipment from TPT or our other vendors, could impede our ability to provide services to our customers, have a negative impact on our reputation, cause us to lose customers and adversely affect our results of operations. For example, under our contract with Shell, if we fail to meet the required number of frac stages per month, Shell may terminate the agreement for cause, and we would be required to pay Shell $10 million in liquidated damages within 90 days of the date such termination is effective. The successful assertion of one or more large claims against us in amounts greater than those covered by our current insurance policies could materially adversely affect our business, financial condition and results of operations. Even if such assertions against us are unsuccessful, we may incur reputational harm and substantial legal fees.

If Shell terminates our agreement under certain circumstances that constitute a change of control, we must pay $100 million to Shell in liquidated damages.

Shell may terminate the Shell agreement upon a change of control. A change of control occurs upon our consolidation or merger, a sale, lease, exchange or other transfer of substantially all our assets, or a combination in which our shareholders immediately before such combination do not hold, directly or indirectly, more than 50% of the voting securities of the combined company, except that no change of control shall have occurred if Michel B. Moreno remains Chairman of the Company and certain other conditions are met. Following a change of control termination, we must pay Shell $100 million in liquidated damages, which would have a significant negative impact on our liquidity.

9

Table of Contents

Delays in deliveries of key raw materials or increases in the cost of key raw materials could harm our business, results of operations and financial condition.

We have established relationships with a limited number of suppliers of our raw materials. Should any of our current suppliers be unable to provide the necessary raw materials (such as proppant or chemicals) or otherwise fail to deliver such raw materials in a timely manner and in the quantities required, any resulting delays in the provision of services could have a material adverse effect on our business, financial condition, results of operations and cash flows. Our industry has faced sporadic proppant shortages associated with pressure pumping operations requiring work stoppages, which adversely impacted the operating results of several competitors. We may not be able to mitigate any future shortages of raw materials, including proppants. In connection with the newly leased sand mines, we have entered into a contract with Alliance Consulting Group, LLC (“Alliance”), an affiliate, to build and operate a wet and dry facility to process and transport sand from our mines. This agreement with is in the process of being assumed by Shale Support Services, LLC (“SSS”). However, there can be no assurance that such equipment will be delivered as anticipated and any such delays or unavailability may adversely impact our ability to produce the estimated quantity of sand at each mine. Failure to achieve our production estimates in a timely manner could have a material adverse effect on any or all of our future cash flows, profitability, results of operations and financial condition.

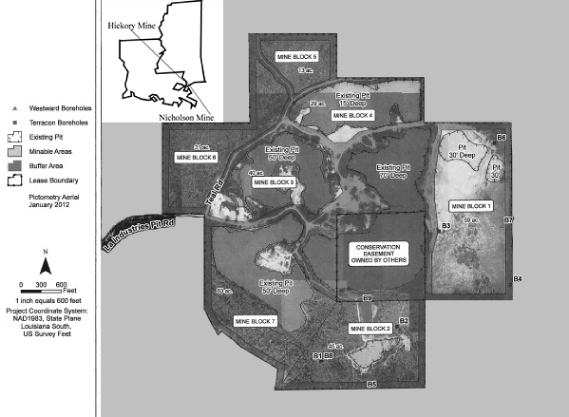

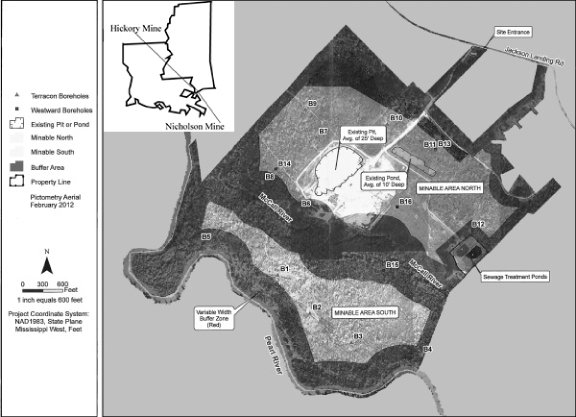

Inaccuracies in our estimates of sand reserves could result in lower than expected revenues and higher than expected costs.

We base our sand reserves estimates on engineering, economic and geological data assembled and analyzed by our staff and on the data and conclusions in the subsurface sand report prepared by Westward Environmental, Inc. These estimates are also based on the expected cost of production and projected sale prices. There are numerous factors and assumptions inherent in estimating quantities and qualities of sand reserves and costs to mine recoverable reserves, including many factors beyond our control. Estimates of economically recoverable sand reserves necessarily depend upon a number of variable factors and assumptions, all of which may vary considerably from actual results.

For these reasons, estimates of the quantities and qualities of the economically recoverable sand attributable to our sand mines, classifications of sand reserves based on risk of recovery, estimated cost of production and estimates of net cash flows expected from particular reserves as prepared by different engineers or by the same engineers at different times may vary materially due to changes in the above factors and assumptions. Actual production from identified sand deposit areas or properties and revenues and expenditures associated with our mining operations may vary materially from estimates. Accordingly, these estimates may not reflect our actual sand reserves. Any inaccuracy in our estimates related to sand reserves could result in lower than expected revenues and higher than expected costs, which could have a material adverse effect on our financial results.

Our agreement with a sand supplier includes significant take-or-pay obligations and other risks.

In order to secure a sufficient source of sand to perform under our agreement with Shell and other future hydraulic fracturing service arrangements, we have entered into a four-year agreement with a sand supplier that contains provisions under which we are required to take delivery of a certain annual volume of sand or pay the seller for the volume difference between the required quantity and the volume actually purchased. The agreement fixes a price per ton of sand for the four-year period, subject to an annual increase or decrease of not more than 5% if such adjustment is agreed upon by the parties. Please see the section titled “Business—Sand Purchase Agreement” for additional information. If we are unable to generate sufficient cash from operations or obtain alternative financing, our cash position may not be sufficient to pay for the take-or-pay volumes.

Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays.

Hydraulic fracturing is an important common practice, utilized by many of our customers, that is used to stimulate production of hydrocarbons, particularly natural gas, from tight formations, including shales. The

10

Table of Contents

process involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. Federal, state, regional and local legislative and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays as well as adversely affect our support services. See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Hydraulic Fracturing Legislation and Regulation.”

The federal Safe Drinking Water Act (the “SDWA”) regulates the underground injection of substances through the Underground Injection Control (the “UIC”) program. Due to a 2005 amendment to the SDWA, hydraulic fracturing generally has been exempt from regulation under the UIC program except for the underground injection of hydraulic fracturing fluids or propping agents that contain diesel fuels. As a result, hydraulic fracturing is typically regulated by state environmental regulators or oil and gas commissions and not pursuant to the SDWA. However, the EPA believes that hydraulic fracturing with fluids containing diesel fuel are subject to regulation under the UIC program, specifically as “Class II” UIC wells and can be regulated through the use of Emergency Orders under the SDWA. In addition, the EPA has commenced a study, at the order of the U.S. Congress, of the potential environmental and health impacts of hydraulic fracturing activities, and a committee of the U.S. House of Representatives is also conducting an investigation of hydraulic fracturing practices. As part of these studies, both the EPA and the House committee have requested that certain companies provide them with information concerning the chemicals used in the hydraulic fracturing process. These studies, depending on their results, could spur initiatives for federal regulation of hydraulic fracturing under the SDWA or otherwise. Legislation, which has not passed, has been introduced before.

Congress in the last few sessions to remove the exemption of hydraulic fracturing under the SDWA and to require disclosure to a regulatory agency of chemicals used in the fracturing process. In addition, on October 21, 2011, the EPA announced its intention to propose regulations by 2014 under the federal Clean Water Act to regulate wastewater discharges from hydraulic fracturing and other natural gas production. The adoption of new federal laws or regulations imposing reporting obligations on, or otherwise limiting or regulating, the hydraulic fracturing process could make it more difficult to complete oil and natural gas wells in shale formations, increase our and our customers’ costs of compliance, and adversely affect the hydraulic fracturing services that we render for our E&P customers.

On August 16, 2012, the EPA published final regulations under the federal Clean Air Act, as amended, (the “CAA”) that establish new air emission controls for oil and natural gas production and natural gas processing operations. Specifically, the EPA’s rule package includes New Source Performance Standards to address emissions of sulfur dioxide and volatile organic compounds (“VOCs”) and a separate set of emission standards to address hazardous air pollutants frequently associated with oil and natural gas production and processing activities. The final rule includes a 95% reduction in VOCs emitted by requiring the use of reduced emission completions or “green completions” on all hydraulically-fractured wells constructed or refractured after January 1, 2015. The rules also establish specific new requirements regarding emissions from compressors, controllers, dehydrators, storage tanks and other production equipment. EPA received numerous requests for reconsideration of these rules from both industry and the environmental community, and court challenges to the rules were also filed. EPA intends to issue revised rules in 2013 that are likely responsive to some of these requests. For example, on April 12, 2013 EPA published a proposed amendment extending compliance dates for certain storage vessels. The final revised rules could require modifications to our operations or increase our capital and operating costs without being offset by increased product capture. At this point, we cannot predict the final regulatory requirements or the cost to comply with such requirements with any certainty. In addition, the U.S. Department of the Interior published a revised proposed rule on May 24, 2013 that would updated existing regulation of hydraulic fracturing activities on federal lands, including requirements for disclosure, well bore integrity and handling of flowback water.

In most states, our customers are required to obtain permits from one or more governmental agencies in order to perform drilling and completion activities, including hydraulic fracturing. Such permits are typically required by state and regional governmental agencies, but can also be required by federal and local governmental agencies.

11

Table of Contents

The requirements for such permits vary depending on the location where such drilling and completion activities will be conducted. As with all permitting processes, there is a degree of uncertainty as to whether a permit will be granted, the time it will take for a permit to be issued and the conditions that may be imposed in connection with the granting of the permit. In addition, there is an opportunity for public comment or challenge with respect to certain permit applications.

Various state, regional and local governments have implemented, or are considering, increased regulatory oversight of hydraulic fracturing through additional permit requirements, operational restrictions, disclosure requirements, and temporary or permanent bans on hydraulic fracturing in certain environmentally sensitive areas such as certain watersheds. For example, Colorado, Texas and Wyoming have passed laws and regulations requiring the disclosure of information regarding the substances used in the hydraulic fracturing process and other states are considering similar requirements. The availability of information regarding the constituents of hydraulic fracturing fluids could potentially make it easier for third parties opposing the hydraulic fracturing process to initiate legal proceedings based on allegations that specific chemicals used in the fracturing process could adversely affect groundwater.

In addition, a number of states have conducted, are currently conducting, or may in the future conduct, regulatory reviews that potentially could restrict or limit our customers’ access to shale formations located in their states. In some jurisdictions, including New York State and within the jurisdiction of the Delaware River Basin Commission, certain regulatory authorities have delayed or suspended the issuance of permits while the potential environmental impacts associated with issuing such permits can be studied and appropriate mitigation measures evaluated. Permitting delays, an inability to obtain new permits or revocation of our or our customers’ current permits could cause a loss of revenue and potentially have a materially adverse effect on our operations. See the section titled “Business—Environmental Matters.”

The adoption of new laws or regulations imposing reporting obligations on, or otherwise limiting, hydraulic fracturing could make it more difficult to complete natural gas wells in shale formations, increase costs of compliance, and adversely affect the hydraulic fracturing services that we render for our E&P customers. In addition, if hydraulic fracturing becomes regulated at the federal level as a result of federal legislation or regulatory initiatives by the EPA, hydraulic fracturing activities could become subject to additional permitting requirements, and also to attendant permitting delays and potential increases in cost, which could adversely affect our business and results of operations.

Our executive officers and certain key personnel are critical to our business and these officers and key personnel may not remain with us in the future.

Our future success depends upon the continued service of our executive officers and other key personnel, particularly Michel B. Moreno, our Chief Executive Officer, Enrique “Rick” Fontova, our President, and Earl Blackwell, our Chief Financial Officer. If we lose the services of Mr. Moreno, Mr. Fontova or Mr. Blackwell, our other officers or other key personnel, our business, operating results and financial condition could be harmed. Additionally, proceeds from the key person life insurance on any of Mr. Moreno, Mr. Fontova or Mr. Blackwell would not be sufficient to cover our losses in the event we were to lose any of their services.

Reliance upon a few large customers may adversely affect our revenues and operating results.

As of March 31, 2013, 94.8% of our revenues were from our top five customers. It is likely that we will continue to derive a significant portion of our revenue from a relatively small number of customers in the future. If a major customer fails to pay us or decides not to continue to use our services, revenue could decline and our operating results and financial condition could be harmed.

12

Table of Contents

If we are unable to fully protect our intellectual property rights, we may suffer a loss in our competitive advantage over other companies.

Certain technologies used in our business provide us with a competitive advantage over other companies that we believe will increase our market share. We attempt to protect these technologies and competitive advantages by protecting our intellectual property rights via trademark, copyright and trade secret laws, as well as licensing agreements and third-party non-disclosure and assignment agreements. While we do have an exclusive license under a third-party patent application claiming certain TFP technology, we do not have our own patents or patent applications relating to many of our key processes or technology. We attempt to protect these processes and technology as unpatented proprietary technology. Among such technology are trade secrets that we believe provide us with a competitive advantage, including proprietary designs we use in fabricating our hydraulic fracturing units. It is possible that others will independently develop the same or similar technology or otherwise obtain access to the unpatented technology that we license. To protect our trade secrets and other proprietary information, we often require employees, consultants, advisors and collaborators to enter into confidentiality agreements. We cannot assure you that these agreements will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Our failure to obtain or maintain adequate protection of our intellectual property rights for any reason or our inability to prevent competitors from replicating our technology could have a material adverse effect on our business, results of operations and financial condition.

We have secured exclusive rights, through our supply agreements with TPT, to certain TFP technology held by TPT relating to the Frac Stack PackTM configuration. Some of this TFP technology is the subject of a non-provisional patent application filed in the United States Patent and Trademark Office on August 25, 2011. Please see the section titled “Business—Intellectual Property Rights” and “Certain Relationships and Related Person Transactions—Joint Venture” for additional information. We cannot assure you that this patent application will be approved. We also cannot assure you that the patents issuing as a result of this or any future domestic or foreign patent applications will have the same scope of coverage as the application as filed. If issued, the patent could be challenged, invalidated or circumvented by others and may not be of sufficient scope or strength to provide us with any meaningful protection. Further, we cannot assure you that competitors will not infringe the patent, or that we will have adequate rights or resources to enforce the patent. Many patent applications in the United States are maintained in secrecy for a period of time after they are filed, and since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several months, we cannot be certain that our licensor was the first creator of the invention covered by the patent application made or that it was the first to file a patent application for the invention. Because some patent applications are maintained in secrecy for a period of time, there is also a risk that we could adopt a technology without knowledge of a pending patent application, which technology would infringe a third party patent once that patent is issued.

If third parties claim that we infringe upon their intellectual property rights, our operating profits could be adversely affected.

We face the risk of claims that we have infringed third parties’ intellectual property rights. For example, our equipment and manufacturing operations may unintentionally infringe upon the patents of a competitor or other company that uses patented components or processes in its manufacturing operations, and that company may have legal recourse against our use of its protected information. Our competitors, many of which have substantially greater resources and may have made substantial investments in competing technologies, may have applied for or obtained, or may in the future apply for and obtain, patents that will prevent, limit or otherwise interfere with our ability to make and sell our services. We have not conducted an independent review of patents issued to third parties. The large number of patents, the rapid rate of new patent issuances, the complexities of the technology involved and uncertainty of litigation increase the risk of business assets and management’s attention being diverted to patent litigation. In addition, because of the recent introduction to the market of TFP

13

Table of Contents

technology, claims that its use infringe on the patent rights of others are more likely to be asserted after more widespread use. We also face the risk of claims that we have misappropriated third parties’ trade secret information.

Any claims of patent or other intellectual property infringement, even those without merit, could:

| • | be expensive and time consuming to defend; |

| • | cause us to cease making, licensing or using services and products that incorporate the challenged intellectual property; |

| • | require us to redesign or reengineer our products, if feasible; |

| • | divert management’s attention and resources; or |

| • | require us to enter into royalty or licensing agreements in order to obtain the right to use a third party’s intellectual property. |

Any royalty or licensing agreements, if required, may not be available to us on acceptable terms or at all. A successful claim of infringement against us could result in our being required to pay significant damages, enter into costly license or royalty agreements, or stop the sale of certain services and products, any of which could have a negative impact on our operating profits and harm our future prospects.

New technology may cause us to become less competitive.

The oilfield service industry is subject to the introduction of new drilling and completion techniques and services using new technologies, some of which may be subject to patent protection. Although we believe our equipment and processes currently give us a competitive advantage, as competitors and others use or develop new or comparable technologies in the future, we may lose market share or be placed at a competitive disadvantage. Further, we may face competitive pressure to implement or acquire certain new technologies at a substantial cost. Some of our competitors have greater financial, technical and personnel resources that may allow them to enjoy technological advantages and implement new technologies before we can. We cannot be certain that we will be able to implement new technologies or services and products on a timely basis or at an acceptable cost. Thus, limits on our ability to effectively use and implement new and emerging technologies may have a material adverse effect on our business, financial condition or results of operations.

We are vulnerable to the potential difficulties associated with rapid growth and expansion.

We intend to grow rapidly over the next several years. We believe that our future success depends on our ability to manage the growth we expect to occur and the demands from increased responsibility on our management personnel. The following factors could present difficulties to us:

| • | lack of sufficient executive-level personnel; |

| • | increased administrative burden; |

| • | long lead times associated with acquiring additional equipment, including potential delays with respect to our on-order fracturing units; and |

| • | ability to maintain the level of focused service attention that we have historically been able to provide to our customers. |

In addition, we may in the future seek to grow our business through acquisitions that enhance our existing operations. The success of any completed acquisition will depend on our ability to integrate effectively the acquired business into our existing operations. The process of integrating acquired businesses may involve unforeseen difficulties and may require a disproportionate amount of our managerial and financial resources. Our operating results could be adversely affected if we do not successfully manage these potential difficulties.

14

Table of Contents

We may be unable to employ a sufficient number of skilled and qualified workers.

The delivery of our services and products requires personnel with specialized skills and experience who can perform physically demanding work. As a result of the volatility in the energy service industry and the demanding nature of the work, workers may choose to pursue employment in fields that offer a more desirable work environment. Our ability to be productive and profitable will depend upon our ability to employ and retain skilled workers. In addition, our ability to expand our operations depends in part on our ability to increase the size of our skilled labor force. The demand for skilled workers in our geographic areas of operations is high, and the supply is limited. A significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. If either of these events were to occur, our capacity and profitability could be diminished and our growth potential could be impaired.

Our operations are subject to hazards inherent in the energy services industry.

Risks inherent to our industry, such as equipment defects, vehicle accidents, explosions and uncontrollable flows of the chemicals we use in hydraulic fracturing as well as gas or well fluids, can cause personal injury, loss of life, suspension of operations, damage to formations, damage to facilities, business interruption and damage to, or destruction of property, equipment and the environment. These risks could expose us to substantial liability for personal injury, wrongful death, property damage, loss of oil and natural gas production, pollution and other environmental damages. The existence, frequency and severity of such incidents will affect operating costs, insurability and relationships with customers, employees and regulators. In particular, our customers may elect not to purchase our services if they view our safety record as unacceptable, which could cause us to lose customers and substantial revenues.

Our operational personnel have experienced accidents which have, in some instances, resulted in serious injuries. Our safety procedures may not always prevent such damages. Our insurance coverage may be inadequate to cover our liabilities. In addition, we may not be able to maintain adequate insurance in the future at rates we consider reasonable and commercially justifiable or on terms as favorable as our current arrangements. The occurrence of a significant uninsured claim, a claim in excess of the insurance coverage limits maintained by us or a claim at a time when we are not able to obtain liability insurance could have a material adverse effect on our ability to conduct normal business operations and on our financial condition, results of operations and cash flows.

We participate in a capital-intensive industry. We may not be able to finance future growth of our operations or future acquisitions.

Historically, we have funded the growth of our operations and equipment purchases from bank debt, capital contributions from our equity sponsors and cash generated by our business. If we do not generate sufficient cash from operations to expand our business, our growth could be limited unless we are able to obtain additional capital through equity or debt financings or bank borrowings. Our inability to grow our business may adversely impact our ability to sustain or improve our profits.

Our industry is highly competitive and we may not be able to provide services that meet the specific needs of oil and natural gas E&P companies at competitive prices.

Our industry is highly competitive. The principal competitive factors in our markets are generally technical expertise, fleet capability and experience. We compete with large national and multi-national companies that have longer operating histories, greater financial resources and greater name recognition than we do and who can operate at a loss in the regions in which we operate. Several of our competitors provide a broader array of services and have a stronger presence in more geographic markets. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. As a result of competition, we may lose market share or be unable to maintain or increase prices for our present services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial

15

Table of Contents

condition, results of operations and cash flows. In addition, competition among oilfield service and equipment providers is affected by each provider’s reputation for innovation, safety and quality. Our reputation for safety and quality may not be sufficient to enable us to maintain our competitive position.

MMH has significant influence over us, including influence over decisions that require stockholder approval, which could limit your ability to influence the outcome of key transactions, including a change of control.

MMH holds 88.9% of our outstanding common stock as of March 31, 2013 without giving effect to the exercise of the Warrants. As a result, MMH may exert controlling influence over our decisions to enter into any corporate transaction regardless of whether others believe that the transaction is in our best interests.

As long as MMH continues to hold a large portion of our outstanding common stock, it will have the ability to influence the vote in any election of directors and over decisions that require stockholder approval. In addition, the concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our Company, could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our Company and might ultimately affect the value of our common stock.

MMH is also in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. MMH may also pursue acquisition opportunities that are complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

We engage in transactions and enter agreements with entities affiliated with or controlled by our stockholders, which could have a material adverse effect on our ability to raise capital or to do business.

We engage in transactions and enter agreements with entities affiliated with or controlled by our stockholders. We believe that the transactions and agreements we have entered into with these affiliated entities are on terms that are at least as favorable as could reasonably have been obtained at such time from third parties. However, these relationships could create, or appear to create, potential conflicts of interest when our board of directors is faced with decisions that could have different implications for us and these affiliated entities. The appearance of conflicts, even if such conflicts do not materialize, might adversely affect the public’s perception of us, as well as our relationship with other companies and our ability to enter into new relationships in the future, which could have a material adverse effect on our ability to raise capital or to do business.

Weather conditions could materially impair our business.

Our current and future operations, which may extend into Louisiana and parts of Texas, may be adversely affected by hurricanes and tropical storms, resulting in reduced demand for our services. Adverse weather can also directly impede our own operations. Repercussions of severe weather conditions may include:

| • | curtailment of services; |

| • | weather-related damage to facilities and equipment, resulting in suspension of operations; |

| • | inability to deliver equipment, personnel and products to job sites in accordance with contract schedules; |

| • | increase in the price of insurance; and |

| • | loss of productivity. |

These constraints could also delay our operations, reduce our revenues and materially increase our operating and capital costs.

16

Table of Contents

Climate change legislation or regulations restricting emissions of greenhouse gases could result in increased operating costs and reduced demand for our services.

On December 15, 2009, the EPA published its findings that emissions of carbon dioxide, methane and other greenhouse gases (“GHGs”) present an endangerment to public health and welfare because emissions of such gases are, according to the EPA, contributing to the warming of the earth’s atmosphere and other climate changes. Based on these findings, the EPA has begun to adopt and implement regulations that would restrict emissions of GHGs under existing provisions of the federal Clean Air Act (the “CAA”). The EPA recently adopted two sets of rules regulating GHG emissions under the CAA, one of which requires a reduction in emissions of GHGs from motor vehicles and the other of which will require that certain large stationary sources obtain permits for their emissions of GHGs. The EPA has also adopted rules requiring the reporting of GHG emissions from certain large GHG emission sources, on an annual basis, beginning in 2011 for emissions occurring after January 1, 2010. Further GHG regulation of our business could have an additional impact on our financial results.

In addition, both houses of Congress have actively considered legislation to reduce emissions of GHGs, and more than one-third of the states have already taken legal measures to reduce emissions of GHGs, primarily through the planned development of GHG emission inventories and/or regional GHG cap and trade programs. Most of these cap and trade programs work by requiring either major sources of GHG emissions or major producers of fuels to acquire and surrender emission allowances, with the number of allowances available for purchase reduced each year until the overall GHG emission reduction goal is achieved.

Any new federal, regional or state restrictions on emissions of carbon dioxide or other GHGs that may be imposed in areas in which we conduct business could result in increased compliance costs or additional operating restrictions on our customers. Such restrictions could potentially make our customers’ products more expensive and thus reduce demand for them, which could have a material adverse effect on the demand for our services and our business. Finally, some scientists have concluded that increasing concentrations of GHGs in the earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, and floods and other climatic events. If any such effects were to occur, they could have an adverse effect on our results of operations

We, and our customers, are subject to extensive and costly environmental, health and safety laws and regulations that may require us to take actions that will adversely affect our results of operations.

Our business, and our customers’ business, is significantly affected by stringent and complex federal, state and local laws and regulations governing the discharge of substances into the environment or otherwise relating to protection of the environment or human health and safety. As part of our business, we emit, handle, transport, and dispose of a variety of fluids and substances used by our customers in connection with their oil and natural gas E&P activities. We also generate and dispose of hazardous waste. The emission, generation, handling, transportation, and disposal of these fluids, substances, and wastes are regulated by a number of laws, including the CAA, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation, and Liability Act, the Clean Water Act, the SDWA, and analogous state laws and regulations. Failure to properly handle, transport, or dispose of these materials or otherwise conduct our operations in accordance with these and other environmental laws and regulations could expose us to liability for governmental penalties, third-party claims, cleanup costs associated with releases of such materials, damages to natural resources, and other damages, as well as potentially impair our ability to conduct our operations. We could be exposed to liability for cleanup costs, natural resource damages and other damages as a result of our conduct that was lawful at the time it occurred or the conduct of, or conditions caused by, prior operators or other third parties. We could also be subject to private party tort claims in connection with actual or alleged environmental impacts associated with our operations.

Environmental laws and regulations may, among other things, require the acquisition of permits to conduct our operations; restrict the amounts and types of substances that may be released into the environment or the way we

17

Table of Contents

use, handle or dispose of our wastes in connection with our operations; cause us to incur significant capital expenditures to install pollution control or safety-related equipment at our operating facilities; limit or prohibit construction or drilling activities in sensitive areas such as wetlands, wilderness areas or areas inhabited by endangered or threatened species; impose specific health and safety criteria addressing worker protection; require investigatory and remedial actions to mitigate pollution conditions caused by our operations or attributable to former operations; and impose substantial liabilities on us for pollution resulting from our operations. Environmental laws and regulations have changed in the past, and they are likely to change in the future. If existing regulatory requirements or enforcement policies change, we may be required to make significant unanticipated capital and operating expenditures.

Any failure by us to comply with applicable environmental, health and safety laws and regulations may result in governmental authorities taking actions against our business that could adversely impact our operations andfinancial condition, including the:

| • | issuance of material administrative, civil and criminal penalties; |

| • | modification, denial or revocation of permits or other authorizations; |

| • | imposition of limitations on our operations; and |

| • | performance of site investigatory, remedial or other corrective actions. |

The oil and gas industry presents environmental risks and hazards and environmental regulation has tended to become more stringent over time. Environmental laws and regulations may restrict the rate of oil and natural gas production below the rate that would otherwise be possible. The regulatory burden on the oil and natural gas industry increases the cost of doing business in the industry and consequently affects profitability. In addition, an increase in regulatory requirements on oil and gas exploration and completion activities could significantly delay or interrupt our customers’ operations.