Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(MARK ONE)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2012

Commission file number

000-54648

LAS VEGAS RAILWAY EXPRESS, INC.

(Exact name of Registrant as Specified in its Charter)

|

Delaware

|

56-2646797

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification Number)

|

6650 Via Austi Parkway, Suite 170

Las Vegas, NV 89119

(Address of principal executive offices)

702-583-6715

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $0.0001 PAR VALUE

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes [ ] No [ X ]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

Aggregate market value of Common Stock held by non-affiliates based on the closing price of the registrant's Common Stock on the OTCBB on September 30, 2011 was $3,321,267.

Number of outstanding shares of common stock as of June 22, 2012 was 83,362,303.

Documents Incorporated by Reference: None.

2

LAS VEGAS RAILWAY EXPRESS, INC.

TABLE OF CONTENTS

|

PART I

|

PAGE

|

|

|

Item 1.

|

Business

|

4

|

| Item 1A | Risk Factors | 10 |

| Item 1B | Unresolved Staff Comments | 14 |

|

Item 2

|

Properties

|

14

|

|

Item 3.

|

Legal Proceedings

|

14

|

|

Item 4.

|

Mine Safety Disclosures

|

14

|

|

PART II

|

14

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

14

|

|

Item 6.

|

Selected Financial Data

|

15

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

16

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

19

|

|

Item 8.

|

Financial Statements and Supplemental Data

|

20

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A.

|

Controls and Procedures

|

36

|

|

Item 9B.

|

Other Information

|

37

|

|

PART III

|

37

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

37

|

|

Item 11.

|

Executive Compensation

|

41

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

43

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence.

|

44

|

|

Item 14.

|

Principal Accounting Fees and Services

|

44

|

|

PART IV

|

44

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

45

|

|

SIGNATURES

|

46

|

|

3

LAS VEGAS RAILWAY EXPRESS, INC.

EXPLANATORY NOTE

Las Vegas Railway Express, Inc. (the “Company”, “we”, “us”, or “our”) is filing this Amendment No. 1 to its Annual Report on Form 10-K/A (the "Amended 10-K") to amend its Annual Report on Form 10-K for the year ended March 31, 2012, filed with the Securities and Exchange Commission (the "SEC") on July 10, 2012 (the "Original 10-K"). This Amended 10-K restates, for reasons described below, the balance sheets as of March 31, 2012 and 2011 and its related statements of operations, stockholders’ deficit and cash flows for the years ended March 31, 2012.

The accompanying balance sheets as of March 31, 2012 and 2011 and related statements of operations, stockholders’ deficit and cash flows for the year ended March 31, 2012 have been restated for the following errors:

|

(1)

|

Reflect a correction in the presentation of common stock subscribed related to the purchase of the train business, from a liability to stockholders’ equity. The nature of this account is such that it will not be settled with cash or other assets, but rather it will be settled by issuance of a fixed number of Company’s common stock. Accordingly it should be classified in stockholders’ equity.

|

|

(2)

|

Certain of the warrants outstanding had elements that qualified them as derivative liabilities instead of equity. And two of the notes payable also had embedded elements that required bifurcation and statement as derivative liabilities. Accordingly, we obtained a third party valuation of the warrants and embedded derivatives and reclassified them as derivative liabilities.

|

|

(3)

|

The Company made corrections to the way it accounts for stock based compensation.

|

|

(4)

|

Finally, the Company has determined that since goodwill is amortized for income taxes, but not for books, there exists a temporary difference in the carrying amount of this asset between book and tax. Furthermore, as it cannot be concluded that this difference can be absorbed by the Company’s net operating loss carryforward, it is necessary to record a deferred income tax liability.

|

Amendments to the Original 10-K

For the convenience of the reader, this Amended 10-K sets forth the Original 10-K, as modified and superseded where necessary to

reflect the restatement. The following items have been amended principally as a result of, and to reflect, the restatement:

• Part II — Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

• Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations;• Part II — Item 8. Financial Statements and Supplementary Data;

• Part II — Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure;

• Part II — Item 9A. Controls and Procedures;

• Part III — Item 14. Principal Accountant Fees and Services; and

• Part IV — Item 15. Exhibits and Financial Statement Schedules.

In accordance with applicable SEC rules, this Amended 10-K includes certifications from our Chief Executive Officer and Chief Financial Officer dated as of the date of this filing. Except for the items noted above, no other information included in the Original 10-K is being amended by this Amended 10-K. The Amended 10-K continues to speak as of the date of the Original 10-K, and we have not updated the filing to reflect events occurring subsequently to the Original 10-K date, other than those associated with the restatement of the Company's financial statements. Accordingly, this Amended 10-K should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original 10-K.

PART I

Item 1. Business

History

Las Vegas Railway Express, Inc. (the “Company”, “we”, “us”, or “our”) was formed as a Delaware corporation in March 9, 2007 as Corporate Outfitters, Inc., a development stage company whose business plan involved establishing itself as a specialized brand promotional merchandising company. On November 3, 2008, pursuant to a common stock purchase agreement, the Company acquired all of the outstanding capital stock of Liberty Capital Asset Management. In connection with the acquisition, the Company changed its name to Liberty Capital Asset Management, Inc. and changed its business plan to one of acquiring pools of non-performing loans and restructuring the financial parameters such that the defaulted borrower can return to making payments in a timely manner. On January 21, 2010, the Company acquired all of the assets of Las Vegas Railway Express, a Nevada corporation. In connection with the acquisition, the Company changed its name to Las Vegas Railway Express, Inc. and changed its business plan to one of developing passenger rail transportation and ancillary ticketing and reservation services between the Los Angeles area and Las Vegas, Nevada.

4

Company Overview

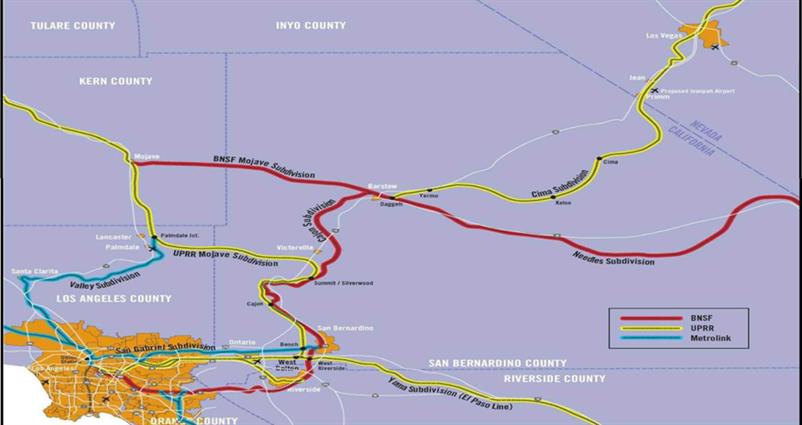

The Company’s plan is to establish a rail passenger train service between Las Vegas and Los Angeles using existing railroad lines currently utilized by two Class I railroads, Burlington Northern and Union Pacific. The development concept is to provide a Las Vegas style experience on the train (which we plan to call the “X” Train), which would traverse the planned route in approximately 5 hours. We plan to operate a single travel route marketed primarily to a leisure traveler from the Southern California basin enabling us to sell rail travel as a stand-alone operation with hotel rooms and other travel related services. Our unique travel option will offer a diversified product that will set us apart from travel related options of automobile and air.

The Company is in discussions with both the Union Pacific Railroad and the BNSF Railway seeking to secure rail trackage rights agreements. The Company has reached a preliminary agreement with Union Pacific Railroad awaiting finalization of the BNSF agreement and certain capital planning issues. An updated capacity planning and feasibility analysis has substantially been completed for Union Pacific and is in final discussion with BNSF. A series of passenger railcars has been negotiated to be acquired under an agreement with Transportation Management Services. The Company has executed a Memorandum of Understanding (or MOU) with the Plaza Hotel as a Las Vegas station site and has a similar pending agreement with the City of Fullerton for use of that station for the Los Angeles terminus of the service. The Company has executed an MOU with AMTRAK outlining duties and responsibilities of each party.

The Company estimates that it will need to obtain $35MM in additional capital to begin operations of our train service. The Company intends to seek to raise these funds through the public or private sale of equity and/or debt securities. There is no assurance such funding will be available on terms acceptable to the Company, or at all. If the Company succeeds in raising such funds, it intends to use them for railcar purchase, design, refurbishment and outfitting, Las Vegas depot design and construction, lease payments, UP and BNSF mileage fees, salaries and other professional fees and also information technology and corporate infrastructure development. Subject to obtaining needed funding, the Company estimates that the train service will start in 3rd quarter of 2013.

The Company’s common stock is currently quoted on the OTCBB under the symbol XTRN. The company website is www.vegasxtrain.com. The contents of this site are not incorporated in this Memorandum.

The Company maintains offices at 6650 Via Austi Parkway, Suite 170, Las Vegas, Nevada 89119.

Marketplace

There has been no regular passenger rail service between these two demographic areas for 13 years. The only major highway between Los Angeles and Las Vegas is Interstate 15 (I-15). Over 12 million people travel this corridor from LA to Las Vegas every year and as the LA population grows, so will the traffic on this highway. The forecast for traffic on I-15 is expected to be 17 million by 2030. It is congested and becoming increasingly so, with motor vehicle travelers experiencing substantial delays during peak travel times (e.g., Friday and Sunday afternoons to 6 hours or more). With increasing fuel costs, increasingly restrictive highway capacity, and reduced air travel from LA to Las Vegas, a rail transportation product with a Vegas motif, is a viable alternative.

The Southern California traveler represents a third of all visitors to Las Vegas and 95% of these travelers use their automobile to travel to Las Vegas. If we capture 237,000 of these drivers (2.0% of the total marketplace) in Year 1, it will fill our product to its initial capacity and achieve profitability with additional capacity being added through Year 5.

5

Travel from Southern California to Las Vegas constitutes a major portion of visitor activity and is a financial foundation for the economy of the Las Vegas region. About a third of all Vegas visitors are Californians, according to a survey by the Las Vegas Convention and Visitors Authority in 2010. Statistics collected by the Center for Business and Economic Research at UNLV show that of 44.5 million annual visitors that drove into the Las Vegas Valley in 2010, 27% arrived from Southern California.

Products and Services

Class 1 Railroad Access

The Burlington Northern Santa Fe Railroad and the Union Pacific Railroad are the two largest Class 1 railroads in the United States and own the railroad right of way between Los Angeles, California and Las Vegas, Nevada, where we plan to have the “X” Train operate its service. The first step in allowing any passenger train service along their infrastructure is the completion of capacity planning and logistics studies in order for the Class I railroads to align the introduction of passenger service with their existing freight business. Final scheduling of the “X” Train time slot will be finalized by the third quarter of 2012.

AMTRAK

We entered into an arrangement with AMTRAK in September 2009 in connection with our goal of reinstating passenger rail service on the Las Vegas/Los Angeles rail corridor. AMTRAK had planned, but abandoned the service when their Federal funding did not materialize in 2006. We then began negotiations with AMTRAK to take over their position to run service on the route. Now, almost 3 years later, we have executed with AMTRAK the first of several agreements on this route and they have agreed to provide locomotive engineers, conductors, train servicing, maintenance, ticketing services, and a host of other services associated with the operations of The “X” Train.

Train Operations

The proposed route of The “X” Train is approximately 300 miles with the end points being Fullerton, California and then direct to Las Vegas, Nevada, The railroad Rights-of-Way (ROW) over which passenger train service could operate between Las Vegas and Los Angeles, California include privately and publicly owned segments. The privately-held portions are owned either by BNSF Railway (BNSF) or by Union Pacific Railroad (UPRR).

6

Las Vegas Railway Express, Inc. has negotiated a trackage rights agreement with Union Pacific Railroad allowing our “X” Train access to their portion of our route. This agreement from Union Pacific Railroad is pending execution subject to the concurrence of the Burlington Northern Santa Fe Railroad by 3rd quarter of 2012.

Our agreements with the owners of the track where our route will travel and our willingness to pay the owners a competitive market rate gives our “X” Train the status needed to meet our scheduled travel times. In railroad terms, the owners of the track will allow our “X” Train to pass slower and longer freight trains by moving to the numerous sidings along the route. Further, such track owners will ensure immediate maintenance of any and all track maintenance and other services that we would rely on for prompt and safe service.

In addition, the Class 1 railroads have completed their capacity planning analysis. These projects are performed by the railroad companies and include a specific time and destination study of the exact consist we will be running on the proposed existing rail infrastructure in our route..

Haulage Agreements

Our agreement with AMTRAK would provide us with trained T&E crews, consulting and inspection services during design, development and construction and daily inspections services to ensure safe and reliable operations. In addition to the stated services, our agreement and operating partnership would bring the following strengths:

|

●

|

Experience in operating passenger rail service

|

|

●

|

Existing contracts with Class I railroads

|

|

●

|

Liability insurance caps

|

|

●

|

Experienced crew and maintenance teams

|

|

●

|

Established ticketing infrastructure on- line for cross marketing opportunities

|

|

●

|

Established relationships with host railroads

|

AMTRAK will not be involved in any customer service operations related to our stated customer service standards.

7

Fullerton Station

As the Los Angeles departure and arrival points of our service, Fullerton was chosen for a number of reasons.

|

●

|

Within 26 miles from LA |

|

●

|

Located in the sixth largest population county in the United States

|

|

●

|

Links to Los Angeles County via public roads, bus and rail routes

|

|

●

|

Very affluent

|

|

●

|

Tourism-centric

|

|

●

|

Connection to MetroLink services where there are over 15,000 daily boarding’s with easy connection to Union Station passengers

|

|

●

|

Strategic marketing and ridership partnership opportunities with MetroLink

|

| ● | Proximity to Disneyland for Las Vegas marketing efforts |

Las Vegas Station

Our Las Vegas arrival statement will be located within the Downtown Las Vegas gaming and resort district boarding and connected to the recently remodeled Plaza Hotel and Casino. Adjacent to Union Pacific’s main line and Symphony Plaza, our re-modeled station (formally AMTRAK’s Las Vegas station for its Dessert Wind) was chosen for:

|

●

|

Its parking and local transportation ease of ingress and egress

|

| ● | Location along the Union Pacific Railroad mainline |

|

●

|

10 minutes from over 150,000 hotel rooms

|

|

●

|

Impact of ridership views along the famous Las Vegas “Strip”

|

|

●

|

Strategic alliances with Fremont Street Experience, Downtown Redevelopment Agency and Las Vegas Convention and Visitors Agency

|

|

●

|

Low cost proximity to traveling staff accommodations

|

These are examples of specifications and drawing disclosures of the train and station concept that will help you understand what constitutes a complete design of the train, which are provided as examples only. Actual designs will vary from these illustrations.

8

Our Business Strategy

Capture And Divert Current Automobile Travelers. 95% of the 12,000,000 annual visitors from the Southern California/Los Angeles market drive to Las Vegas. In order to fill the initial “X” Train, we need only to divert/convert 237,000 from their car to the train or just 2.0% of the total annual drivers. The two demographic areas have significantly grown their population bases without the needed automobile infrastructure growing with it. 95% of all Las Vegas travelers from the Southern California basin drive to Las Vegas using the I-15 corridor.

Operating Partnerships with Host Railroads to Deliver on Time Performance. Our agreements and our ability to pay a “market rate” with the two host railroad companies will be designed to ensure we and they will have no issues with their freight business and that they will ensure a high on-time result.

Operating Partnerships with Los Angeles based commuter Rail services. Metrolink. The “X” Train is leveraging various relationships in the Los Angeles Metro area and one of them is the co- marketing plan with Metrolink. Metrolink operates commuter passenger rail service in the greater Los Angeles metro area and services over 12 million riders annually. Metrolink has 55 local train stations which share the same right of way and/or connect to X Train planned station at Fullerton, California. By joint venturing a marketing plan with Metrolink, “X” Train gains access to its ridership for travel to Las Vegas.

Metrolink is looking to expand its weekend ridership and the “X” Train is a viable candidate. Discussions have already begun with Metrolink towards forging a joint marketing and operations plan for “X” Train to have access to the 55 stations in the Metrolink network.

Capacity Management. We plan to start out with two (2) roundtrips a week. We anticipate that our capacity will be nearly 1,200 passengers a day. If demand fluctuates, we anticipate that we will have the ability to add or subtract cars to meet the demands of each day. In year 2 of our Business Plan we plan to add two additional trains to our schedule and by year 5 we anticipate having 10 trains running on this route.

Low Operating Costs. Most transportation travel companies have very high fixed and variable costs associated with operating their businesses and can comprise up to 70% of all of their operating costs. Our model projects a stabilized cost associated with hauling our train comprised of negotiated rates with the host railroads. Corporate overhead is minimal.

Competition

Las Vegas Railway Express’ “X” Train will have no conventional passenger rail service competing against our product. The 2012 Nevada State Rail Plan (www.nvrailplan.com) reviewed all the proposals for rail services for the year and Las Vegas Railway Express, Inc. was among the recommended projects.

There are two proposed high speed rail alternatives:

DesertXpress - Private Las Vegas Company

|

●

|

High-speed rail

|

|

●

|

Las Vegas to Victorville, CA (85 miles from Los Angeles)

|

|

●

|

Requires right-of-way acquisition

|

|

●

|

$6 billion to construct new rail system

|

|

●

|

7-10 years to complete if funded

|

Mag-Lev - American Mag-Lev Sponsor

|

●

|

High-speed magnetic levitation technology

|

|

●

|

Las Vegas to Anaheim, CA (25 miles from Los Angeles)

|

|

●

|

Requires right-of-way acquisition

|

|

●

|

$15 billion to construct

|

|

●

|

15 years to complete if funded

|

9

Intellectual Property

None.

Employees

As of March 31, 2012, we had 5 full-time employees, of whom 1 was in an administrative position and 4 were in management.

Item 1A. Risk Factors

Risk Factors

Investing in our Common Stock involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this prospectus before making an investment decision. If any of the possible adverse events described below actually occurs, our business, results of operations or financial condition would likely suffer. In such an event, the market price of our Common Stock could decline and you could lose all or part of your investment.

We have a history of losses and a large accumulated deficit and we may not be able to achieve profitability in the future.

We have net losses of $2,006,033 and $1,791,983 for the years ended March 31, 2012 and 2011, respectively. As of March 31, 2012, we have an accumulated deficit of $11,809,532. There can be no assurance that we will be profitable in the future. If we are not profitable and cannot obtain sufficient capital we may have to cease our operations.

Changes in government policy could negatively impact demand for the Company’s services, impair its ability to price its services or increase its costs or liability exposure.

Changes in United States government policies could change the macroeconomic environment and affect demand for the Company’s services. Developments and changes in laws and regulations as well as increased economic regulation of the rail industry through legislative action and revised rules and standards applied by the U.S. Surface Transportation Board in various areas, including rates, services and access to facilities could adversely impact the Company’s ability to determine prices for rail services and significantly affect the revenues, costs and profitability of the Company’s business. Additionally, because of the significant costs to maintain its rail network, an increase in expenditures related to the maintenance of the rails owned by the Class I railroads could hinder the Company’s ability to maintain, improve or expand the rail network, facilities and equipment in order to accept or handle our Company’s increased demand. Federal or state spending on infrastructure improvements or incentives that favor other modes of transportation could also adversely affect the Company’s revenues.

The Company’s success depends on its ability to continue to comply with the significant federal, state and local governmental regulations to which it is subject.

The Company is subject to a significant amount of governmental laws and regulation with respect to its and practices, taxes, railroad operations and a variety of health, safety, labor, environmental and other matters. Failure to comply with applicable laws and regulations could have a material adverse effect on the Company. Governments may change the legislative and/or regulatory framework within which the Company operates without providing the Company with any recourse for any adverse effects that the change may have on its business. Federal legislation enacted in 2008 mandates the implementation of positive train control technology by December 31, 2015, on certain mainline track where intercity and commuter passenger railroads operate and where toxic-by-inhalation hazardous materials are transported. This type of technology is new and deploying it across our host railroads’ infrastructure may pose significant operating and implementation risks and could require significant capital expenditures.

As part of the Class I railroad operations, the Company will traverse rails that frequently transports chemicals and other hazardous materials, which could expose it to the risk of significant claims, losses and penalties.

The “host” or Class I railroads are required to transport these commodities to the extent of its common carrier obligation. An accidental release of these commodities could result in a significant loss of life and extensive property damage as well as environmental remediation obligations. The associated costs could have an adverse effect on the Company’s operating results, financial condition or liquidity. In addition, insurance premiums charged for some or all of the coverage currently maintained by the Company could increase dramatically or certain coverage may not be available to the Company in the future if there is a catastrophic event related to rail transportation of these commodities.

10

Downturns in the economy could adversely affect demand for the Company’s services.

Significant, extended negative changes in domestic and global economic conditions that impact the customers transported by the Company and may have an adverse effect on the Company’s operating results, financial condition or liquidity. Declines in economic growth and the United States travel industry all could result in reduced revenues in one or more business units.

Negative changes in general economic conditions could lead to disruptions in the credit markets, increase credit risks and could adversely affect the Company’s financial condition or liquidity.

Challenging economic conditions may not only affect revenues due to reduced demand for many goods and services, but could result in payment delays and increased credit risk. Railroads are capital-intensive and may need to finance a portion of the building and maintenance of infrastructure as well as locomotives and other rail equipment. Economic slowdowns and related credit market disruptions may adversely affect the Company’s cost structure, its timely access to capital to meet financing needs and costs of its financings. Declines in the securities and credit markets could also affect the Company’s pension fund and railroad retirement tax rates, which in turn could increase funding requirements.

The Company is subject to stringent environmental laws and regulations, which may impose significant costs on its business operations.

The Company’s operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures to comply with these regulations with respect to the Company’s diesel locomotives, equipment, vehicles and machinery and its maintenance yards. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, local concerns on emissions and other forms of pollution could inhibit the Company’s ability to build facilities in strategic locations to facilitate growth and efficient operations. In addition, many land holdings are and have been used for industrial or transportation-related purposes or leased to commercial or industrial companies whose activities may have resulted in discharges onto the property. The Company’s subsidiaries have been and may continue to be subject to allegations or findings to the effect that they have violated, or are strictly liable under, these laws or regulations. The Company’s operating results, financial condition or liquidity could be adversely affected as a result of any of the foregoing, and it may be required to incur significant expenses to investigate and remediate environmental contamination.

Fuel supply availability and fuel prices may adversely affect the Company’s results of operations, financial condition or liquidity.

Fuel supply availability could be impacted as a result of limitations in refining capacity, disruptions to the supply chain, rising global demand and international political and economic factors. A significant reduction in fuel availability could impact the Company’s ability to provide transportation services at current levels, increase fuel costs and impact the economy. Each of these factors could have an adverse effect on the Company’s operating results, financial condition or liquidity. If the price of fuel increases substantially, the Company may be able to offset a significant portion of these higher fuel costs through a fuel surcharge program or increase in ticket prices, which may result in loss of customers.

Severe weather and natural disasters could disrupt normal business operations, which would result in increased costs and liabilities and decreases in revenues.

The Company’s success will be dependent on its ability to operate its railroad system efficiently. Severe weather and natural disasters, such as tornados, flooding and earthquakes, could cause significant business interruptions and result in increased costs and liabilities and decreased revenues. In addition, damages to or loss of use of significant aspects of the Company’s infrastructure due to natural or man-made disruptions could have an adverse effect on the Company’s operating results, financial condition or liquidity for an extended period of time until repairs or replacements could be made. Additionally, during natural disasters, the Company’s workforce may be unavailable, which could result in further delays. Extreme swings in weather could also negatively affect the performance of locomotives and rolling stock.

11

The Company’s operational dependencies may adversely affect results of operations, financial condition or liquidity.

Due to the integrated nature of the United States’ freight transportation infrastructure, the Company’s operations may be negatively affected by service disruptions of other entities such as ports and other railroads which interchange with the Company and its Class I railroad partners. A significant prolonged service disruption of one or more of these entities could have an adverse effect on the Company’s results of operations, financial condition or liquidity.

Acts of terrorism or war, as well as the threat of war, may cause significant disruptions in the Company’s business operations.

Terrorist attacks and any government response to those types of attacks and war or risk of war may adversely affect the Company’s results of operations, financial condition or liquidity. The Company’s use of the Class I railroad rail lines and facilities could be direct targets or indirect casualties of an act or acts of terror, which could cause significant business interruption and result in increased costs and liabilities and decreased revenues, which could have an adverse effect on operating results and financial condition. Such effects could be magnified if releases of hazardous materials are involved. Any act of terror, retaliatory strike, sustained military campaign or war or risk of war may have an adverse impact on the Company’s operating results and financial condition by causing unpredictable operating or financial conditions, including disruptions of our host railroads or connecting rail lines, loss of critical customers or partners, volatility or sustained increase of fuel prices, fuel shortages, general economic decline and instability or weakness of financial markets. In addition, insurance premiums charged for some or all of the coverage currently maintained by the Company could increase dramatically, the coverage available may not adequately compensate it for certain types of incidents and certain coverage’s may not be available to the Company in the future.

The Company depends on the stability and availability of its information technology systems.

The Company relies on information technology in all aspects of its business. A significant disruption or failure of its information technology systems could result in service interruptions, revenue collections, safety failures, security violations, regulatory compliance failures and the inability to protect corporate information assets against intruders or other operational difficulties. Although the Company has taken steps to mitigate these risks, a significant disruption could adversely affect the Company’s results of operations, financial condition or liquidity. Additionally, if the Company is unable to acquire or implement new technology, it may suffer a competitive disadvantage, which could also have an adverse effect on the Company’s results of operations, financial condition or liquidity.

The Company is subject to various claims and lawsuits, and increases in the amount or severity of these claims and lawsuits could adversely affect the Company’s operating results, financial condition and liquidity.

As part of its railroad operations, the Company’s Class I railroad partners are exposed to various claims and litigation related to commercial disputes, personal injury, property damage, environmental liability and other matters. Personal injury claims by our employees and those of the host railroads are subject to the Federal Employees’ Liability Act (FELA), rather than state workers’ compensation laws. The Company believes that the FELA system, which includes unscheduled awards and a reliance on the jury system, can contribute to increased expenses. Other proceedings include claims by third parties for punitive as well as compensatory damages, and a few proceedings purport to be class actions. Developments in legislative and judicial standards, material changes to litigation trends, or a catastrophic rail accident or series of accidents involving any or all of property damage, personal injury, and environmental liability could have a material adverse effect on the Company’s operating results, financial condition and liquidity.

Most of the Company’s host railroad employees are represented by unions, and failure to negotiate reasonable collective bargaining agreements may result in strikes, work stoppages or substantially higher ongoing labor costs.

A significant majority of the Class I railroads employees are union-represented. These union employees work under collective bargaining agreements with various labor organizations. Wages, health and welfare benefits, work rules and other issues have traditionally been addressed through industry-wide negotiations. These negotiations have generally taken place over an extended period of time and have previously not resulted in any extended work stoppages. The existing agreements have remained in effect and will continue to remain in effect until new agreements are reached or the Railway Labor Act’s procedures (which include mediation, cooling-off periods and the possibility of presidential intervention) are exhausted. While the negotiations have not yet resulted in any extended work stoppages, if the Company or our Class I railroad partners are unable to negotiate acceptable new agreements, it could result in strikes by the affected workers, loss of business and increased operating costs as a result of higher wages or benefits paid to union members, any of which could have an adverse effect on the Company’s operating results, financial condition or liquidity.

12

The unavailability of qualified personnel could adversely affect the Company’s operations.

Changes in demographics, training requirements and the unavailability of qualified personnel, particularly engineers and trainmen, could negatively impact the Company’s ability to meet demand for rail service. Recruiting and retaining qualified personnel, particularly those with expertise in the railroad industry, are vital to operations. Although the Company has adequate personnel for the current business environment, unpredictable increases in demand for rail services may exacerbate the risk of not having sufficient numbers of trained personnel, which could have a negative impact on operational efficiency and otherwise have a material adverse effect on the Company’s operating results, financial condition or liquidity.

Our independent registered public accounting firm, in their report on the audited financial statements for the year ended March 31, 2012, states that there is a substantial doubt that we will be able to continue as a going concern.

Our auditors' report on our audited March 31, 2012 financial statements, and Note 2 to such financial statements, reflect the fact that without raising additional financing through loans or stock sales, it would be unlikely for us to continue as a going concern. The business plan requires extensive infrastructure and capital expenditures prior to commencement of revenue generating operations. There can be no assurance that we will be able to raise additional capital and if we are unable to do so we may have to cease operations.

The Company has identified material weaknesses in internal control over financial reporting.

The Company has concluded that its internal control over financial reporting as of March 31, 2012 is ineffective because of material weakness identified related to inadequate technical accounting review of transactions which resulted in a restatement of the 2012 and 2011 financial statements. A failure to implement improved internal controls, or difficulties encountered in their implementation or execution, could cause the Company future delays in its reporting obligations and could have a negative effect on the Company and the trading price of the Company’s common stock. See “Item 9A. Controls and Procedures,” for more information on the status of the Company’s internal control over financial reporting.

RISKS RELATING TO OUR COMMON STOCK

We have not paid dividends on common stock in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock would depend on earnings, financial condition and other business and economic factors affecting it at such time as the Board of Directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

There is a limited market for our common stock which may make it more difficult to dispose of your stock.

Our common stock is currently quoted on the Over the Counter Bulletin Board under the symbol "XTRN". There is a limited trading market for our common stock. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock, or the prices at which holders may be able to sell our common stock.

A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, the market price of our common stock could fall. These sales also may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our common stock is subject to the "Penny Stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 3a51-1 which establishes the definition of a "penny stock", for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires:

|

●

|

that a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

●

|

that the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

●

|

obtain financial information and investment experience objectives of the person; and

|

|

●

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

13

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

|

●

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

●

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

As an issuer of “penny stock”, the protection provided by the federal securities laws relating to forward looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

As of March 31, 2012, we lease approximately 2,600 square feet of general office space in premises located at 6650 Via Austi Parkway, Suite 170, Las Vegas, Nevada. Our lease for this space expires in February 2013 and provides for monthly payments of $5,800.

Item 3. Legal Proceedings.

In the ordinary course of business, the Company may be or has been involved in legal proceedings from time to time. As of the date of this annual report on Form 10-K, there have been no material changes to any legal proceedings relating to the Company which previously were not reported.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is currently quoted on the Over-The-Counter Bulletin Board under the symbol “XTRN”. On June 6, 2012, the last trade of our stock was at the price of $0.065 per share. The following table sets forth the high and low prices per share of our common stock for each period indicated. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

Common Shares

|

||||||||

|

Year Ended March 31, 2012:

|

High

|

Low

|

||||||

|

Quarter Ended June 30, 2011

|

$ | 0.27 | $ | 0.15 | ||||

|

Quarter Ended September 30, 2011

|

$ | 0.19 | $ | 0.095 | ||||

|

Quarter Ended December 31, 2011

|

$ | 0.13 | $ | 0.07 | ||||

|

Quarter Ended March 31, 2012

|

$ | 0.11 | $ | 0.06 | ||||

|

Year Ended March 31, 2011:

|

High

|

Low

|

||||||

|

Quarter Ended June 30, 2010

|

$ | 0.25 | $ | 0.13 | ||||

|

Quarter Ended September 30, 2010

|

$ | 0.35 | $ | 0.18 | ||||

|

Quarter Ended December 31, 2010

|

$ | 0.33 | $ | 0.08 | ||||

|

Quarter Ended March 31, 2011

|

$ | 0.29 | $ | 0.11 | ||||

14

Number of Stockholders

As of March 31, 2012, there were 188 stockholders of record of our common stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends to stockholders in the foreseeable future. In addition, any future determination to pay cash dividends will be at the discretion of the Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as the Board of Directors deem relevant.

Equity Compensation Plan Information as of March 31, 2012

|

Equity Compensation Plan Information

|

||||||||||||

|

Plan category

|

Number of

securities to

be issued

upon

exercise of outstanding

options,

warrants

and rights

(a)

|

Weighted-

average

exercise

price of

outstanding

options,

warrants

and rights

(b)

|

Number of

securities

remaining

available for

future

issuance

under equity compensation

plans

(excluding

securities

reflected in

column (a))

(c)

|

|||||||||

|

Equity compensation plans approved by security holders

|

-

|

$

|

-

|

20,000,000

|

||||||||

|

Equity compensation plans not approved by security holders

|

2,000,000

|

$ |

0.14

|

-

|

||||||||

|

Total

|

2,000,000 |

$

|

-

|

20,000,000

|

||||||||

Recent Sales of Unregistered Securities.

On May 3, 2012, Las Vegas Railway Express, Inc. (the “Company”) entered into an a subscription agreement with an accredited investor, pursuant to which the Company sold 3,000,000 shares of common stock for an aggregate purchase price of $150,000. On May 23, 2012 the Company sold 1,500,000 shares of common stock for an aggregate purchase price of $75,000 and on May 31, 2012 the Company sold 8,300,000 shares of common stock for an aggregate purchase price of $415,000. In connection with the foregoing, the Company relied on the exemption from registration provided by Section 4(2) of the Securities Act of 1933, as amended, for transactions not involving a public offering.

Purchases of Equity Securities by the Issuer and Affiliated Purchaser

None.

Item 6. Selected Financial Data

Not applicable.

Forward-Looking Statements

Statements contained in this Form 10-K that are not historical facts are forward-looking statements. In addition, words such as “believes,” “anticipates,” “expects,” “intends” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements or events, or timing of events, to differ materially from any future results, performance or achievements or events, or timing of events, expressed or implied by such forward-looking statements. We cannot assure that we will be able to anticipate or respond timely to the changes that could adversely affect our operating results in one or more fiscal quarters. Results of operations in any past period should not be considered indicative of results to be expected in future periods. Fluctuations in operating results may result in fluctuations in the price of our securities.

15

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our financial statements and notes thereto included elsewhere herein.

Overview

Las Vegas Railway Express, Inc. (the "Company”, “Las Vegas Railway”, “we”, “our” or “us”), a Delaware corporation, is a company whose plan is to re-establish a conventional rail passenger train service between Las Vegas and Los Angeles using existing freight railroad lines. The development concept is to provide a Las Vegas style experience on the train, which would traverse the planned route in approximately 5:00 hours. We plan to operate a single travel route marketed primarily to a leisure traveler from the Southern California basin enabling us to sell rail travel as a stand-alone operation bundled with hotel rooms and other travel related services. Our unique travel option will offer a diversified product that will set us apart from travel related options of automobile and air.

Critical Accounting Policies

The preparation of our financial statements and notes thereto requires management to make estimates and assumptions that affect the amounts and disclosures reported within those financial statements. On an ongoing basis, management evaluates its estimates, including those related to revenue recognition, workers' compensation costs, collectibles of accounts receivable, and impairment of goodwill and intangible assets, contingencies, litigation and income taxes. Management bases its estimates and judgments on historical experiences and on various other factors believed to be reasonable under the circumstances. Actual results under circumstances and conditions different than those assumed could result in differences from the estimated amounts in the financial statements. There have been no material changes to these policies during the fiscal year.

Intangible Assets:

Goodwill represents the excess of purchase price over tangible and intangible assets acquired, less liabilities assumed arising from the acquisition of the train business on November 23, 2009. Goodwill is not amortized, but is reviewed for potential impairment on an annual basis at the reporting unit level. On March 31, 2012, as required by the Intangible topic of Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”), the Company conducted an analysis of the goodwill on its single reporting unit using the Company’s market capitalization (based on Level 1 inputs). For the fiscal years ending March 31, 2012 and 2011, our assessment for impairment found that due to the continued progress toward the measurement goals of the business plan that there is no impairment of goodwill. The Company has no accumulated impairment losses on goodwill.

Income Taxes:

The Company accounts for income taxes under FASB ASC 740 "Income Taxes." Under the asset and liability method of FASB ASC 740, deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The deferred tax assets of the Company relate primarily to operating loss carryforwards for federal income tax purposes. A full valuation allowance for deferred tax assets has been provided because the Company believes it is not more likely than not that the deferred tax asset will be realized. Realization of deferred tax assets is dependent on the Company generating sufficient taxable income in future periods.

The Company’s goodwill is deductible for tax but not for book. This difference creates a deferred tax liability, which cannot be matched with the Company’s deferred tax asset. As a result, the Company cannot net it with its net operating loss carryforward and therefore records a deferred tax liability to reflect the future non-deductibility of its goodwill asset. The deferred tax liability at March 31, 2012 and 2011 was $42,343 and $0, respectively.

The Company periodically evaluates its tax positions to determine whether it is more likely than not that such positions would be sustained upon examination by a tax authority for all open tax years, as defined by the statute of limitations, based on their technical merits. As of March 31, 2012 and 2011, the Company has not established a liability for uncertain tax positions.

Stock-Based Compensation:

The Company issues stock, options and warrants as share-based compensation to employees and non-employees.

The Company accounts for its stock-based compensation to employees in accordance FASB ASC 718. Stock-based compensation cost is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense over the requisite service period.

16

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of FASB ASC 505-50 “Equity - Based Payments to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The final fair value of the share-based payment transaction is determined at the performance completion date. For interim periods, the fair value is estimated and the percentage of completion is applied to that estimate to determine the cumulative expense recorded.

The Company values compensatory stock based on the market price on the measurement date. As described above, for employees this is the date of grant, and for non-employees, this is the date of service completion.

The Company values stock options and warrants that do not qualify as derivative instruments using the Black-Scholes option pricing model. There were no warrants or options granted during the years ended March 31, 2012 or 2011 for which the Company used the Black-Scholes model.

Certain compensatory warrants qualify as derivative instruments and are valued using the binomial lattice method. See Note 7 to the financial statements below regarding accounting for derivative liabilities.

Fair Value of Financial Instruments:

The Company's financial instruments as defined by FASB ASC 825-10-50 include cash, trade accounts receivable, accounts payable and accrued expenses. All instruments are accounted for on a historical cost basis, which, due to the short maturity of these financial instruments, approximates fair value at March 31, 2012. The amounts shown for notes payable approximate fair value because current interest rates and terms offered to the Company for similar debt are substantially the same.

FASB ASC 820 defines fair value, establishes a framework for measuring fair value, in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. FASB ASC 820 establishes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1. Observable inputs such as quoted prices in active markets;

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level 3. Unobservable inputs in which there is little or no market data, which requires the reporting entity to develop its own assumptions.

The process for determining fair value using unobservable inputs is generally more subjective and involves a high degree of management judgment and assumptions. These assumptions may have a significant effect on our estimates of fair value, and the use of different assumptions as well as changes in market conditions could have a material effect on our results of operations or financial condition.

17

Results of Operations

The following are the results of our continuing operations for the year ended March 31, 2012 compared to the year ended March 31, 2011.

|

Year Ended

|

||||||||||||||||

|

March 31,

|

March 31,

|

|||||||||||||||

|

2012

|

2011

|

$ Change

|

% Change

|

|||||||||||||

|

(Restated)

|

||||||||||||||||

|

Operating Expenses:

|

||||||||||||||||

|

Compensation and payroll taxes

|

$ | 1,222,013 | $ | 780,849 | $ | 441,164 | 56.5 | % | ||||||||

|

Selling, general and administrative

|

233,577 | 314,835 | (81,258 | ) | -25.8 | % | ||||||||||

|

Professional fees

|

268,731 | 752,052 | (483,321 | ) | -64.3 | % | ||||||||||

|

Depreciation expense

|

320 | - | 320 | 100.0 | % | |||||||||||

|

Total expenses

|

1,724,641 | 1,847,736 | (123,095 | ) | -6.7 | % | ||||||||||

|

Loss from continuing operations

|

(1,724,641 | ) | (1,847,736 | ) | 123,095 | -6.7 | % | |||||||||

|

Other (expense) income

|

||||||||||||||||

|

Interest income

|

- | 3,000 | (3,000 | ) | -100.0 | % | ||||||||||

|

Interest expense

|

(295,131 | ) | (198,813 | ) | (96,318 | ) | 48.4 | % | ||||||||

|

Change in derivative liability

|

37,086 | - | 37,086 | 100.0 | % | |||||||||||

|

Loss on disposition of assets

|

- | (2,965 | ) | 2,965 | -100.0 | % | ||||||||||

|

Gain on extinguishment of debt

|

- | 238,374 | (238,374 | ) | -100.0 | % | ||||||||||

|

Total other (expense) income

|

(258,045 | ) | 39,596 | (297,641 | ) | -751.7 | % | |||||||||

|

Net loss from continuing operations before tax provision

|

(1,982,686 | ) | (1,808,140 | ) | (174,546 | ) | 9.7 | % | ||||||||

|

Provision for income taxes

|

42,343 | - | 42,343 | 100.0 | % | |||||||||||

|

Net loss from continuing operations

|

(2,025,029 | ) | (1,808,140 | ) | (216,889 | ) | 12.0 | % | ||||||||

|

Discontinued operations:

|

||||||||||||||||

|

Income from discontinued operations

|

18,996 | 16,157 | 2,839 | 17.6 | % | |||||||||||

|

Net loss

|

$ | (2,006,033 | ) | $ | (1,791,983 | ) | $ | (214,050 | ) | 11.9 | % | |||||

Revenue

During the years ended March 31, 2012 and 2011, our railcar operations have yet to generate any revenue.

Operating Expenses

Compensation and payroll taxes increased by $441,164, or 56.5%, during the year ended March 31, 2012 as compared to 2011. The increase in compensation expense is related to the hiring of additional full-time employees to replace consultants that were previously used, including our Chief Executive Officer and Chief Operating Officer. Accordingly, we had a reduction of our professional fee expenses during the year ended March 31, 2012 of $483,321. Selling, general and administrative expenses decreased by $81,258, or 25.8% during 2012 primarily due to higher costs in 2011 associated with travel expenses related to raising capital, as well as higher expenses associated with officers auto allowances and rent expense.

Other (Expense) Income

Interest expense increased by $96,318, or 48%, during 2012 primarily due to the increase in debt outstanding during the period, as well as the issuance of warrants in connection with debt during 2012. Our change in derivative liability amounted to $37,086 during 2012 resulted in the decrease in the valuation of derivative transactions entered into during 2012. There was no corresponding amount during 2011, as we had no derivatives during that timeframe.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support asset growth, satisfy disbursement needs, maintain reserve requirements and otherwise operate on an ongoing basis. The Company has no operating revenues and is currently dependent on financing and sale of stock to fund operations.

We have experienced net losses and negative cash flows from operations since our inception. We have sustained losses from continuing operations of $2,006,033 and $1,791,983 for the years ended March 31, 2012 and 2011, respectively.

We continue to actively pursue various funding options, including equity offerings and debt financings, to obtain additional funds to continue the development of our products and bring them to commercial markets. There can be no assurance that we will be able to consummate any fund raising transactions on terms acceptable to us or at all.

18

We believe that the successful growth and operation of our business is dependent upon our ability to do any or all of the following:

|

●

|

obtain adequate sources of debt or equity financing to pay unfunded operating expenses and fund long-term business operations; and

|

|

●

|

manage or control working capital requirements by controlling operating expenses.

|

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. Although a substantial portion of the Company’s cumulative net loss is attributable to discontinued operations, management believes that it will need additional equity or debt financing to be able to implement the business plan. These matters raise substantial doubt about the Company’s ability to continue as a going concern. There can be no assurance that we will be successful in achieving our long-term plans as set forth above, or that such plans, if consummated, will enable us to obtain profitable operations or continue in the long-term.

The Company raised $ 383,254 during the year ended March 31, 2012 from private offerings of stock. The Company also received an additional $788,333 from the issuance of debt.

On April 27, 2012 the Company commenced a private offering of common stock to raise interim funds (up to $1.5MM) through a private offering memorandum. As of June 22, 2012, the Company has received gross proceeds of $1,120,000 from the sale of 22,400,000 shares of common stock. The Company anticipates this will provide the Company with sufficient operating cash for at least one year. The Company intends to seek such funding through private or public sales of equity and/or debt securities. There is no assurance such funding will be available on terms acceptable to the Company, or at all.

Cash Flows

Net cash used in operating activities for the years ended March 31, 2012 and 2011 was $1,131,068 and $1,407,834, respectively. The primary sources of cash used in operating activities for the years ended March 31, 2012 and 2011 were from net losses of $2,006,033 and $1,791,983. The non-cash components of operating expenses during the years ended March 31, 2012 and 2011 primarily related to share based compensation expenses $685,881 and $625,993, respectively, as well as amortization of debt discounts of $257,653 and $166,930, respectively.

Net cash used for investing activities during the year ended March 31, 2012 was $3,200 and $0 for the purchase of a copier. We had no capital expenditures during 2011.

Net cash provided by financing activities for the years ended March 31, 2012 and 2011 were $1,171,587 and $1,418,276, respectively. In 2012, the Company sold stock for $383,254 and issued debt of $788,333. In 2011, the Company sold stock for $ 1,269,001 and issued debt of $175,000. During the years ended March 31, 2012 and 2011, $0 and $20,725, respectively, was paid on related party payables.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable

19

Item 8. Financial Statements and Supplementary Data.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Stockholders

Las Vegas Railway Express, Inc.

Las Vegas, Nevada

We have audited the accompanying balance sheet of Las Vegas Railway Express, Inc. (“Company”), as of March 31, 2012, and the related statement of operations, stockholders’ deficit and cash flows for the year ended March 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Las Vegas Railway Express, Inc. as of March 31, 2012, and the result of its operations and its cash flows for the year ended March 31, 2012, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Las Vegas Railway Express, Inc. will continue as a going concern. As described in Note 2 to the financial statements, the Company has suffered recurring losses from operations, has a net capital deficiency, has no revenues and has a negative working capital. These factors among others raise substantial doubt about its ability to continue as a going concern. Management's plans regarding these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

As described in Note 2 to the financial statements, the Company has restated its financial statements for 2012.

/s/ BDO USA, LLP

Los Angeles, California

June 10, 2013

20

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Las Vegas Railway Express, Inc.

Las Vegas, Nevada

We have audited the accompanying balance sheet of Las Vegas Railway Express, Inc., as of March 31, 2011, and the related statement of operations, stockholders’ equity (deficit) and cash flows for the year ended March 31, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Las Vegas Railway Express, Inc. as of March 31, 2011, and the result of its operations and its cash flows for the year ended March 31, 2011, in conformity with accounting principles generally accepted (GAAP) in the United States of America.

The accompanying financial statements have been prepared assuming that Las Vegas Railway Express, Inc. will continue as a going concern. As discussed in Note 2 to the financial statements, Las Vegas Railway Express, Inc. suffered recurring losses from operations which raises substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

As described in Note 2 to the financial statements, the Company has restated its financial statements for 2011.

Hamilton, PC

/s/ Hamilton, PC

Denver, Colorado

July 10, 2012, except as to Note 2 which is as of June 10, 2013

21

LAS VEGAS RAILWAY EXPRESS, INC.

BALANCE SHEETS

|

March 31,

|

March 31,

|

|||||||

|

2012

|

2011

|

|||||||

| (Restated) | (Restated) | |||||||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 53,632 | $ | 16,313 | ||||

|

Other current assets

|

47,028 | - | ||||||

|

Total current assets

|

100,660 | 16,313 | ||||||

|

Property and equipment, net of accumulated depreciation

|

2,880 | - | ||||||

|

Other assets

|

||||||||

|

Goodwill

|

843,697 | 843,697 | ||||||

|

Total other assets

|

843,697 | 843,697 | ||||||

|

Total assets

|

$ | 947,237 | $ | 860,010 | ||||

|

Liabilities and Stockholders' Equity (Deficit)

|

||||||||

|

|

||||||||

|

Current liabilities

|

||||||||

|

Short term notes payable

|

$ | 785,116 | $ | - | ||||

|

Accounts payable and accrued expenses

|

236,009 | 169,955 | ||||||

|

Derivative liability

|

170,499 | - | ||||||

|

Liabilities to be disposed of, current

|

905,950 | 999,122 | ||||||

|

Total current liabilities

|

2,097,574 | 1,169,077 | ||||||

|

Deferred tax liability

|

42,343 | - | ||||||

|

Total liabilities

|

2,139,917 | 1,169,077 | ||||||

|

Commitments

|

||||||||

|

Stockholders' deficiency

|

||||||||

|

Common stock subscribed

|

640,000 | 850,000 | ||||||

|

Common stock, $0.0001 par value, 200,000,000 shares authorized, 48,653,350 and 39,201,498 shares issued and outstanding as of March 31, 2012 and 2011, respectively

|

4,865 | 3,920 | ||||||

|

Additional paid-in capital

|

9,971,987 | 8,640,512 | ||||||

|

Accumulated deficit

|

(11,809,532 | ) | (9,803,499 | ) | ||||

|

Total stockholders' deficiency

|

(1,192,680 | ) | (309,067 | ) | ||||

|

Total liabilities and stockholders' deficiency

|

$ | 947,237 | $ | 860,010 | ||||

|

See accompanying notes to financial statements

|

||||||||

22

LAS VEGAS RAILWAY EXPRESS, INC.

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED MARCH 31, 2012 AND 2011

|

Year Ended

|

||||||||

|

March 31,

|

March 31,

|

|||||||

|

2012

|

2011

|

|||||||

| (Restated) | ||||||||

|

Operating Expenses:

|

||||||||

|

Compensation and payroll taxes

|

$ | 1,222,013 | $ | 780,849 | ||||

|

Selling, general and administrative

|

233,577 | 314,835 | ||||||

|

Professional fees

|

268,731 | 752,052 | ||||||

|

Depreciation expense

|

320 | - | ||||||

|

Total expenses

|

1,724,641 | 1,847,736 | ||||||

|

Loss from continuing operations

|

(1,724,641 | ) | (1,847,736 | ) | ||||

|

Other (expense) income

|

||||||||

|

Interest income

|

- | 3,000 | ||||||

|

Interest expense

|

(295,131 | ) | (198,813 | ) | ||||

|

Change in derivative liability

|

37,086 | - | ||||||

|

Loss on disposition of assets

|

- | (2,965 | ) | |||||

|

Gain on extinguishment of debt

|

- | 238,374 | ||||||

|

Total other (expense) income

|

(258,045 | ) | 39,596 | |||||

|