Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Capital Bank Financial Corp. | d551215d8k.htm |

Transforming the Franchise

June 2013

Exhibit 99.1 |

Safe Harbor Statement

2

Forward-Looking Statements

Information in this presentation contains forward-looking statements. Any

statements about our expectations, beliefs, plans, predictions,

forecasts,

objectives,

assumptions

or

future

events

or

performance

are

not

historical

facts

and

may

be

forward-looking.

These statements are often, but not always, made through the use

of words or phrases such as “anticipate,”

“believes,”

“can,”

“could,”

“may,”

“predicts,”

“potential,”

“should,”

“will,”

“estimate,”

“plans,”

“projects,”

“continuing,”

“ongoing,”

“expects,”

“intends”

and

similar

words

or

phrases.

Accordingly,

these

statements

are

only

predictions

and

involve

estimates,

known

and

unknown

risks,

assumptions

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

expressed

in

them.

Our

actual

results

could differ materially from those anticipated in such forward-looking

statements as a result of several factors more fully described under the

caption “Risk Factors” in the annual report on Form 10-K and

other periodic reports filed by us with the Securities and Exchange

Commission. Any or all of our forward-looking statements in this presentation may turn out to be inaccurate. The

inclusion of this forward-looking information should not be regarded as a

representation by us or any other person that the future plans, estimates or

expectations contemplated by us will be achieved. We have based these forward-looking statements largely on

our

current

expectations

and

projections

about

future

events

and

financial

trends

that

we

believe

may

affect

our

financial

condition,

results of operations, business strategy and financial needs. There are important

factors that could cause our actual results, level of activity, performance

or achievements to differ materially from the results, level of activity, performance or achievements expressed

or implied by the forward looking statements including, but not limited to: (1)

changes in general economic and financial market conditions;

(2)

changes

in

the

regulatory

environment;

(3)

economic

conditions

generally

and

in

the

financial

services

industry;

(4)

changes in the economy affecting real estate values; (5) our ability to achieve

loan and deposit growth; (6) the completion of future acquisitions or

business combinations and our ability to integrate the acquired business into our business model; (7) projected

population and income growth in our targeted market areas; and (8) volatility and

direction of market interest rates and a weakening of the economy which

could materially impact credit quality trends and the ability to generate loans. All forward-looking statements

are necessarily only estimates of future results and actual results may differ

materially from expectations. You are, therefore, cautioned not to place

undue reliance on such statements which should be read in conjunction with the other cautionary statements

that are included elsewhere in this presentation. Further, any forward-looking

statement speaks only as of the date on which it is made and we undertake no

obligation to update or revise any forward-looking statement to reflect events or circumstances after the

date

on

which

the

statement

is

made

or

to

reflect

the

occurrence

of

unanticipated

events. |

The

Capital Bank Story 3

From ‘blind pool’

to $7.1 billion bank in less than three years |

4

Significant Improvement in Returns

See reconciliation of non-GAAP measures in appendix.

|

Transforming the Loan Portfolio

5

$ in millions

Legacy Impaired = accounted for as Purchase Credit Impaired

|

Topgrading the Commercial Salesforce

6

Number of salespersons |

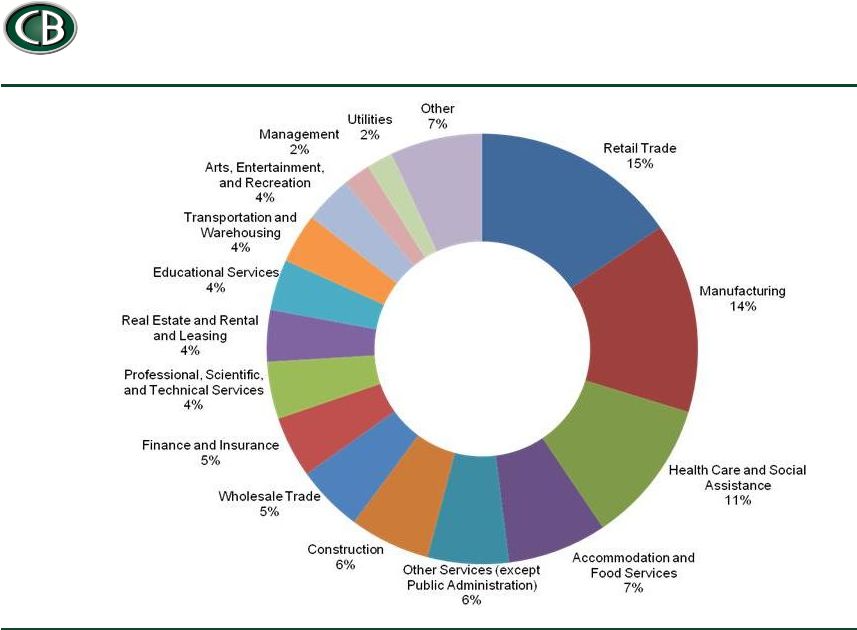

Commercial Book Starts with Customer Selection

7

Originated commercial

loan portfolio as of

3/31/2013, by borrower

industry

Excludes all acquired loans. |

Transforming the Deposit Franchise

8

Growing Core Deposits

And Lowering Deposit Costs |

Checking Accounts Now Growing after Integrations

9

Sequential change in total checking accounts

Excludes addition of checking accounts from Southern Community in October

2012 |

Transforming the Team with Promotions/New Hires

10

General Counsel

BSA/AML Executive

Enterprise Risk Executive

Head of Loan Operations

Head of Small Business Lending

Wealth Management Executive |

First Quarter Highlights

11

See reconciliation of non-GAAP measures in appendix.

Reported GAAP net income of $5.6 million, or $0.10 per diluted share

Reported core net income of $9.4 million, or $0.17 per diluted share

TBV per share of $17.89

Originations steady at $251 million

Deposit costs down 3 bps on core deposit repricing

Legacy credit costs improved from $12 mm to $8 mm

Strongly capitalized with 13.5% tier 1 leverage

Loan portfolio shrank 2% on Special Assets resolution activity

|

Illustrative Path to Target Returns

12

Core ROAA

0.19%

0.19%

0.18%

0.15%

0.29%

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

1Q13

Loan growth,

net

Legacy credit

expense

normalization

Fee income

initiatives, net

Other initiatives

Normalization

of NIM

Target

ROAA = Return on average assets.

See reconciliation of non-GAAP measures in appendix.

|

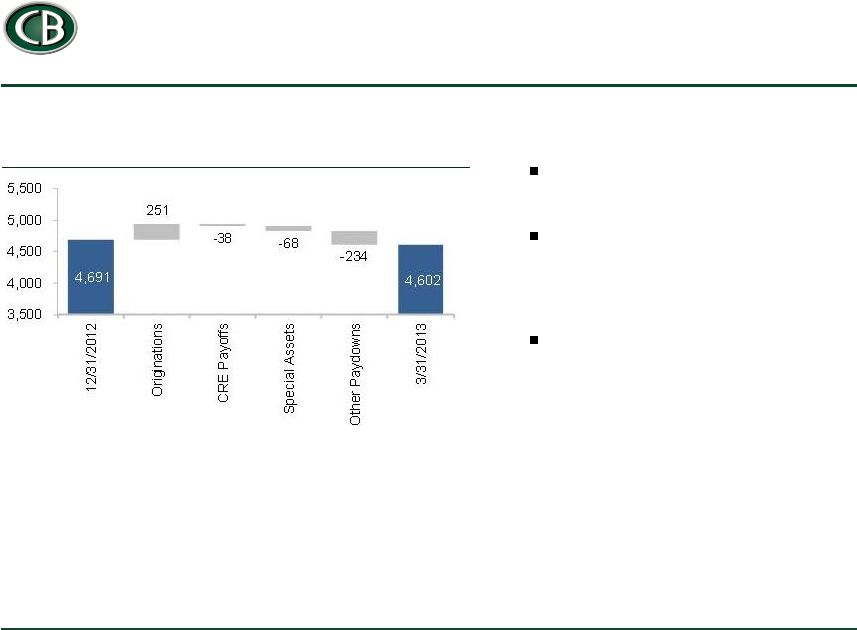

1Q13 Portfolio Growth Impacted by Resolutions

13

Loan Portfolio

Loan portfolio growth was -2% in 1Q13,

an improvement from -3% in 4Q

As expected, paydowns of commercial

real estate slowed significantly from $138

mm in 4Q to $38 mm in 1Q as we have

significantly reduced CRE concentrations

Resolution activity picked up from $43

mm in 4Q to $68 mm in 1Q, reflecting

progress in resolving criticized / classified

loans |

Legacy Credit Expenses Improved in 1Q13

14

Favorable performance on legacy

covered loans in Florida and South

Carolina drove the negative provision

and the corresponding writedown on the

FDIC asset

REO write-downs improved slightly from

4Q and remain largely concentrated in

non-urban land & lots

Legacy Credit Expense

$ in millions

1Q12

4Q12

1Q13

Provision on legacy loans

4.0

1.4

(3.1)

FDIC indemnification asset income

(0.3)

(0.3)

2.2

Foreclosed asset related expenses

4.2

9.2

6.8

Loan workout expense

1.6

1.8

2.1

Total legacy credit expense

9.5

12.1

8.0

|

Liquidity and Capital Ratios Remain Strong

15

We continue to run a conservative

liquidity strategy as part of our asset

sensitive position

Effective duration of investments was 3.1

years at March 31, 2013

Our capital ratios remain strong with tier

1 leverage of 12.2% at the bank and

13.5% on a consolidated basis at

3/31/2013

We have substantially completed the $50

million stock repurchase authorized in

February 2013

Liquidity

$ in millions, at 3/31/2013

Cash /

Equivalents,

$510 , 31%

Agency MBS,

$768 , 47%

Agency

CMO, $200 ,

12%

ABS / Other,

$82 , 5%

CMBS, $66 ,

4%

Muni, $16 ,

1% |

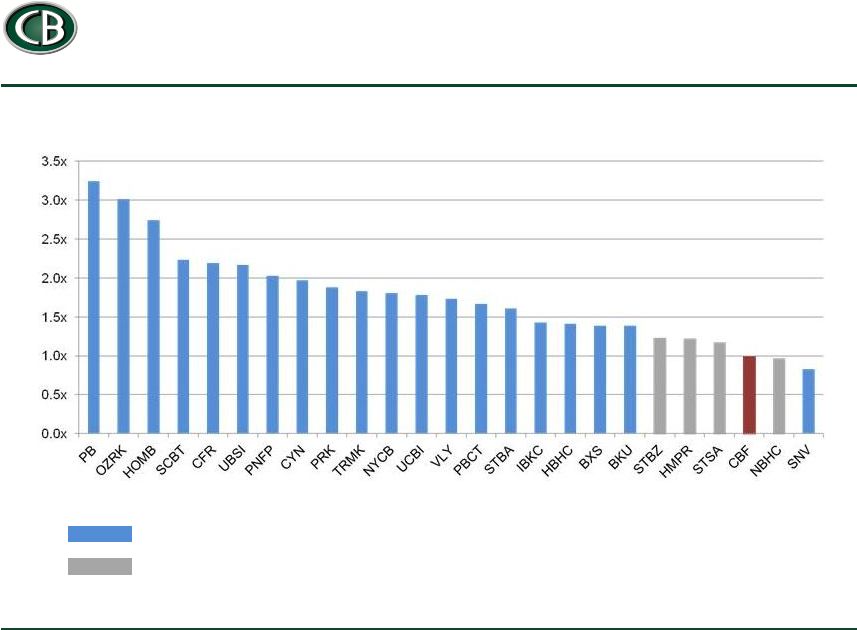

CBF and Peers: Price to Fully-marked TBV

16

Note: Fully Marked TBV as of 3/31/2013, stock prices as of 6/3/2013.

Fully-marked TBV equals net assets, adjusted for fair value of financial instruments, less

goodwill and intangibles net of tax effect. See appendix for additional

discussion of estimated fair value adjustments. Source: Company

filings, SNL Financial Peer

Blind Pools / Recap |

Capital Bank: Transforming the Franchise

17

Building high-quality loan portfolio

Building low-cost deposit franchise

Consistent progress in resolving legacy assets

Deploying capital to drive investor returns

Positioned in attractive growth markets

Committed to organic growth and higher returns |

Appendix

18 |

CBF and Peers: Price to Tangible Book Value

19

Note: TBV as of most recent quarter available, stock prices as of

6/3/2013. Peer

Blind Pools / Recap |

Tangible and Fully-marked Tangible Book Value

20

Fair Value = Carrying Value adjusted for the fair value of financial

instruments. See explanatory note on following page. $ in millions

December 31, 2012

March 31, 2013

Total common shareholders' equity

$1,156

$1,161

Intangibles, net of taxes

(165)

(165)

Tangible book

value $991

$997

Common shares outstanding

55.8

55.7

Tangible

book value per share $17.74

$17.89

$ in millions

Fair Value

Carrying

Value

Difference

Fair Value

Carrying

Value

Difference

Assets

6,758

6,475

283

6,533

6,276

257

Liabilities

6,105

6,097

8

5,887

5,877

10

Net assets

653

378

275

646

399

247

Net assets, net of tax effect

168

151

Plus tangible book value

991

997

Fully-marked tangible book value

1,159

1,147

Shares outstanding

55.8

55.7

Fully marked TBV / share

$20.75

$20.60

December 31, 2012

March 31, 2013 |

Tangible and Fully-marked Tangible Book Value

21

The methods and assumptions used to estimate fair value of financial instruments

are described as follows: Carrying amount is the estimated fair value for

cash and cash equivalents, receivable from FDIC, derivatives, noncontractual demand deposits and certain

short-term borrowings. As it is not practicable to determine the fair value of

Federal Reserve, Federal Home Loan Bank stock, indemnification asset and other

bankers’

bank stock due to restrictions placed on transferability, the estimated fair value

is equal to their carrying amount. Security fair values are based on market

prices or dealer quotes, and if no such information is available, on the rate and term of the security and information about the issuer including

estimates of discounted cash flows when necessary. For fixed rate loans or

contractual deposits and for variable rate loans or deposits with infrequent

repricing or repricing limits, fair value is based on discounted

cash flows using current market rates applied to the estimated life, adjusted for

expected credit risk. Fair values for impaired loans are estimated using

discounted cash flow analysis or underlying collateral values. Fair value of long-term debt is based on

current rates for similar financing.

The fair value of off-balance sheet items that includes commitments to extend

credit to fund commercial, consumer, real estate construction and real estate-

mortgage loans and to fund standby letters of credit is considered nominal.

The most significant difference between carrying value and estimated fair value of

financial instruments is the differential between the carrying value and

estimated fair value of our loan portfolio. As described in Note

14 to the Company’s Consolidated Financial Statements, the estimated fair

value of loans

exceeded their carrying value by approximately $256.8 million. This difference

arises as acquired loans were initially recorded at acquisition date fair values

which incorporated management’s expectation of lifetime credit losses. As our

loan cash flow expectations and experience has generally improved from our

original expectations and the market interest rates for similar instruments have

generally declined, our estimates of fair value have increased. These

estimates utilize discounted cash flows as a primary valuation approach

incorporating collateral value, prepayment and credit risk (including consumer credit

scores where applicable) along with the LIBOR/Swap curve for market interest rates.

For loans with higher credit risk ratings, incremental spreads were added

for credit and liquidity factors. Estimated fair values for commercial loans were determined using syndicated loan prices and spreads, survey data from

the Federal Reserve e2 release, and rated corporate bonds. The Company’s

internal risk ratings were mapped to the Federal Reserve e2 and Moody’s rating

categories. Estimated fair values for commercial real estate loans also

incorporated commercial mortgage backed security securitization prices and spreads.

Estimated fair values for consumer loans were determined using product-specific

survey rate data from a leading provider of financial information. Estimated

fair values for residential mortgage loans were determined using

mortgage backed security option-adjusted spreads, with incremental spreads

added credit and liquidity. Credit spreads were sourced from third party

survey data of mortgage banking activities from a leading provider of financial information. |

First Quarter Core Earnings Summary

22

($ millions except per share data)

1Q13

4Q12

1Q12

Q/Q

Y/Y

Net interest income

67.8

66.0

63.9

3%

6%

Provision

6.9

4.4

5.4

-57%

-28%

Core non-interest income

10.9

15.4

12.1

-29%

-10%

Core non-interest expense

56.4

61.9

54.0

9%

-4%

Pretax income

15.4

15.1

16.6

2%

-7%

Core net income

9.4

9.3

10.1

1%

-7%

Per share

$0.17

$0.17

$0.22

0%

-24%

Non-core adjustments

(3.9)

(4.0)

(4.0)

Non-controlling interest

-

-

(0.9)

Net income

5.6

5.3

5.2

Per share

$0.10

$0.10

$0.12

Net interest margin

4.41%

4.11%

4.50%

Core fee ratio

13.9%

18.8%

15.9%

Core efficiency ratio

72%

76%

71%

Core ROAA

0.52%

0.51%

0.62%

Core ROAE

3.2%

3.2%

4.0%

See reconciliation of non-GAAP measures on p. 24-25.

|

Disciplined and Thoughtful Acquiror

23

Announce

Premium

Price /

Price /

Target

Date

to Market

TBV

Adj. TBV

06/10

(77%)

0.25x

1.25x

11/10

59%

0.45x

1.25x

05/11

(20%)

0.41x

1.17x

03/12

59%

0.95x

1.42x

Capital Bank Average

5%

0.51x

1.27x

Comparables Average

59%

1.28x

1.85x

07/10

NA

NA

0.93x

(1)

(2)

Extensive local market

knowledge, including board-level

relationships with many targets

Healthy acquiror with clean

balance sheet and compelling

growth story

Creative structuring skills

Track record of timely regulatory

approval and rapid integration

No social issues

(3)

Source:

Company filings, SNL Financial, FactSet, and management.

(1)

Premium / (discount) paid per share to 1-day unaffected share price.

(2)

Price / adjusted TBV = Announced deal value / (TBV –

net loan mark + incremental DTA).

(3)

Comparable unassisted M&A transactions include those $25mm–$500mm in deal

value between two public banks since July 2010 with public credit mark disclosures (25 such transactions).

Conservative Deal Pricing

Acquisitions have been negotiated at discounts to prevailing deal pricing

|

Reconciliation of Core Net Income

24

$ in millions

Core non Interest Income

1Q12

2Q12

3Q12

4Q12

1Q13

Net interest income

$63.9

$63.3

$60.3

$66.0

$67.8

Reported non interest income

14.8

12.2

20.3

15.4

10.9

(-)Securities / Purchase Gains

2.7

0.9

4.9

0.0

–

(-)Insurance settlement gain

–

–

1.8

–

–

Core non interest income

$12.1

$11.3

$13.6

$15.4

$10.9

Reported non interest expense

$63.2

$58.6

$69.4

$68.4

$61.0

(-) Conversion expenses

1.6

1.6

4.2

2.4

0.0

(-) Stock compensation

6.5

4.2

4.2

3.8

1.6

(-) Extinguishment debt

0.3

–

2.9

–

0.3

(-) CVR Valuation

–

–

(0.1)

–

2.6

(-) Insurance settlement expense

–

–

1.8

–

–

(-) Intangible impairment

–

–

–

0.2

–

(-) Legal fees

0.9

0.4

0.5

0.1

0.1

Core non interest expense

$54.0

$52.5

$55.9

$61.9

$56.4

*Core fee ratio

15.87%

15.13%

18.59%

18.80%

13.86%

**Core efficiency ratio

70.95%

70.36%

75.41%

76.14%

71.68%

*Core fee ratio: core noninterest income / (net interest income + core noninterest income)

**Core efficiency ratio: core noninterest expense / (net interest income + core noninterest

income) |

Reconciliation of Core Net Income and Core ROAA

25

$ in millions

Pre-Tax

After-Tax

Pre-tax

After-Tax

Pre-tax

After-Tax

For the Quarter

For the Quarter

For the Quarter

For the Quarter

For the Quarter

For the Quarter

Ended

Ended

Ended

Ended

Ended

Ended

1Q13

1Q13

4Q12

4Q12

1Q12

1Q12

$5.6

$5.6

$5.3

$5.3

$6.2

$6.2

Non-Interest Income

Security gains

-

-

-

-

(2.8)

(1.7)

Insurance settlement gain

-

-

-

-

-

-

Non-Interest Expense

1.6

0.9

3.8

2.3

6.5

3.9

-

-

2.4

1.5

1.6

1.0

2.6

2.6

-

-

-

-

0.1

0.1

0.1

0.1

0.9

0.5

0.3

0.2

-

-

0.3

0.2

-

-

0.2

0.1

-

-

Taxes

Tax benefit

-

-

-

-

-

-

Tax Effect

(0.8)

N/A

(2.5)

N/A

(2.6)

N/A

$9.4

$9.4

$9.3

$9.3

$10.1

$10.1

Average Assets

$7,182

$7,352

$6,553

Average Equity

$1,166

$1,153

$1,003

*Core ROAA

0.52%

0.51%

0.62%

**Core ROAE

3.2%

3.2%

4.0%

*Core ROAA: Annualized core net income / average assets

**Core ROAE: Annualized core net income / average equity

Net income

Adjustments

Core Net Income

Non-cash equity compensation

Conversion and severance expense

(conversion and salary / employee benefits)

Loss on extinguishment of debt

CVR (other expense)

Legal and merger (professional fees)

Impairment of intangible |

26

Core ROAA

$ in millions

Pre -Tax

After -Tax

Pre -Tax

After -Tax

Pre -Tax

After -Tax

Pre -Tax

After -Tax

YTD 2010

YTD 2010

YTD 2011

YTD 2011

YTD 2012

YTD 2012

1Q13

1Q13

Net income

$12.1

$12.1

$7.5

$7.5

$55.7

$55.7

$5.6

$5.6

Adjustments:

Non-Interest Income

Security gains

–

–

($4.7)

($2.9)

($8.6)

($5.2)

–

–

Insurance settlement gain

–

–

–

–

($1.7)

($1.1)

–

–

Non-Interest Expense

Non-cash equity compensation

–

–

9.8

6.0

18.7

11.4

1.6

0.9

Conversion and severance expense

(conversion and salary/employee benefits)

2.0

1.2

7.6

4.6

9.2

5.6

0.0

0.0

CVR (other expense)

–

–

–

–

–

–

2.6

2.6

Legal and merger (professional fees)

2.5

2.0

1.5

1.5

2.5

2.2

0.1

0.1

Loss on extinguishment of debt

–

–

(0.4)

(0.3)

3.3

2.0

0.3

0.2

Impairment of intangible

–

–

2.9

1.8

0.2

0.1

–

–

Insurance settlement expense

–

–

–

–

1.7

1.1

–

–

Bargain purchase gain

(15.2)

(15.2)

–

–

–

–

–

–

Tax benefit

–

–

–

–

(34.0)

(34.0)

–

–

Tax effect

(1.3)

N/A

(6.0)

N/A

(9.2)

N/A

(0.8)

N/A

Core net income

$0.1

$0.1

$18.2

$18.2

$37.8

$37.8

$9.4

$9.4

Average assets

$1,581

$5,344

$6,615

$7,182

Core ROAA

0.01%

0.34%

0.57%

0.52% |

27

Accretable Yield Rollforward

Contractual yield on loan portfolio 1Q 2013: 5.1%

$ in thousands |