Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - AZZ INC | aquilex8ka.htm |

| EX-23.1 - EXHIBIT 23.1 CONSENT - AZZ INC | ex231consentaquilex.htm |

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Consolidated Financial Statements

As of December 31, 2012 (Successor) and 2011 (Predecessor) and for the periods February 3, 2012 to December 31, 2012 (Successor), January 1, 2012 to February 2, 2012 (Predecessor), and the year ended December 31, 2011 (Predecessor)

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Index to Consolidated Financial Statements

Page(s) | ||||

Reports of Independent Auditors | 1-3 | |||

Consolidated Financial Statements | ||||

Consolidated Balance Sheets as of December 31, 2012 (Successor) and 2011 (Predecessor) | 4 | |||

Consolidated Statements of Operations and Other Comprehensive Loss for the periods February 3, 2012 to December 31, 2012 (Successor), January 1, 2012 to February 2, 2012 (Predecessor), and the year ended December 31, 2011 (Predecessor) | 5 | |||

Consolidated Statements of Changes in Member's Equity/(Deficit) for the periods February 3, 2012 to December 31, 2012 (Successor), January 1, 2012 to February 2, 2012 (Predecessor), and the year ended December 31, 2011 (Predecessor) | 6 | |||

Consolidated Statements of Cash Flows for the periods February 3, 2012 to December 31, 2012 (Successor), January 1, 2012 to February 2, 2012 (Predecessor), and the year ended December 31, 2011 (Predecessor) | 7 | |||

Notes to Consolidated Financial Statements | 8-32 | |||

Independent Auditor's Report

To Board of Directors and Members of Aquilex Specialty Repair & Overhaul LLC:

We have audited the accompanying consolidated financial statements of Aquilex Specialty Repair & Overhaul LLC and its subsidiaries (“Successor”) which comprise the consolidated balance sheet as of December 31, 2012 and the related statements of operations and other comprehensive income, of changes in member's equity, and of cash flows for the period from February 3, 2012 to December 31, 2012.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on the consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Successor's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Successor's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Aquilex Specialty Repair & Overhaul LLC and its subsidiaries at December 31, 2012 and the results of their operations and their cash flows for the period from February 3, 2012 to December 31, 2012 in accordance with accounting principles generally accepted in the United States of America.

PricewaterhouseCoopers LLP, 1075 Peachtree Street, Suite 2600, Atlanta, GA 30309

T: +1 (678) 419 1000, F:+1 (678) 419 1239, www.pwc.com/us

Emphasis of Matter

As discussed in Note 1 and 2, the Parent Company of the Successor completed a consensual financial restructuring on February 3, 2012, which impacted the Successor's debt and equity structure and liquidity position.

/s/ PricewaterhouseCoopers LLP

Atlanta, Georgia

March 28, 2013

1

PricewaterhouseCoopers LLP, 1075 Peachtree Street, Suite 2600, Atlanta, GA 30309

T: +1 (678) 419 1000, F:+1 (678) 419 1239, www.pwc.com/us

Independent Auditor's Report

To Board of Directors and Members of Aquilex Specialty Repair & Overhaul LLC:

In our opinion, the accompanying consolidated balance sheet and the related consolidated statements of operations and other comprehensive loss, of changes in member's deficit, and of cash flows present fairly, in all material respects, the financial position of Aquilex Specialty Repair & Overhaul LLC and its subsidiaries (“Predecessor”, and formerly known as Aquilex Specialty Repair & Overhaul Inc.) at December 31, 2011 and the results of their operations and their cash flows for the period from January 1, 2012 to February 2, 2012, and the year ended December 31, 2011 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Predecessor's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Atlanta, Georgia

March 28, 2013

1

PricewaterhouseCoopers LLP, 1075 Peachtree Street, Suite 2600, Atlanta, GA 30309

T: +1 (678) 419 1000, F:+1 (678) 419 1239, www.pwc.com/us

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Consolidated Balance Sheets

(Amounts in thousands of dollars)

See accompanying notes to these consolidated financial statements

4

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Consolidated Statements of Operations and Other Comprehensive Loss

(Amounts in thousands of dollars)

See accompanying notes to these consolidated financial statements

5

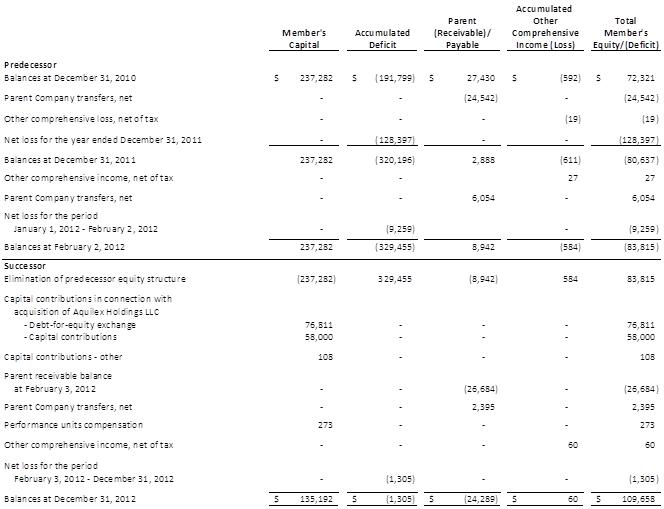

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Consolidated Statements of Changes in Member’s Equity / (Deficit)

(Amounts in thousands of dollars, except unit amounts)

See accompanying notes to these consolidated financial statements

6

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Consolidated Statements of Cash Flows

(Amounts in thousands of dollars)

See accompanying notes to these consolidated financial statements

7

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

1. | Description of Business and Basis of Presentation |

Description of Business

Aquilex Specialty Repair & Overhaul LLC (formerly known as Aquilex Specialty Repair & Overhaul , Inc.) and Subsidiaries (the “Company” or “Aquilex SRO”) is a wholly-owned subsidiary of Aquilex LLC (formerly known as Aquilex Corporation), which is a wholly-owned subsidiary of Aquilex Intermediate Holdings LLC, which is a wholly-owned subsidiary of Aquilex Holdings LLC (the ultimate “Parent Company”). On February 3, 2012, Aquilex Corporation and Aquilex SRO were converted to a limited liability company “LLC”. The Company is a leading global provider of critical maintenance, repair and construction solutions, including component repair, servicing a diverse base of customers in energy end-markets including nuclear and fossil power generation, refining, chemical processing, pulp and waste-to-energy facilities. The Company provides services through proprietary automation technology, and the Company's services are essential in maintaining and enhancing the efficiency, operability and profitability of customer plants by minimizing downtime and extending service life at a lower cost than replacement alternatives. Specifically, the Company provides specialized welding overlay and repair services for industrial applications of erosion and corrosion protection services, repair technology services, and shop services.

On February 3, 2012, the Parent Company became majority owned by affiliates of Centerbridge Partners L.P. when it completed a consensual out-of-court financial restructuring with lenders under its First Lien Credit Agreement and Second Lien Credit Agreement and holders of the $225,000 11 1/8% Senior Notes due 2016 (“Senior Notes”). This restructuring resulted in a debt-for-equity exchange where holders of approximately 98.4% of the Senior Notes agreed to exchange their Senior Notes for new Common Units and 100% of lenders under its Second Lien Credit Agreement agreed to exchange their Second Lien Loans for new Preferred Units. All membership interest of Aquilex Holdings LLC outstanding prior to February 3, 2012 were cancelled.. In conjunction with the debt-for-equity exchange, holders of Senior Notes invested $80,000 of new equity in the Parent Company in exchange for new Preferred Units. Proceeds from the cash equity investment were used to pay down debt on the First Lien Credit Agreement and to pay expenses associated with the transaction. The Parent Company's debt was reduced from approximately $441,324 to $136,509 as a result of the transaction. The Company, as a wholly owned subsidiary of the Parent Company, is now majority owned by affiliates of Centerbridge Partners L.P. The restructuring agreements entered into during 2011 leading to the ultimate consensual out-of-court financial restructuring in 2012 are in Note 2, "Parent Company Restructuring."

Aquilex SRO, as it existed prior to the acquisition of the Parent Company by affiliates of Centerbridge Partners, L.P. and other minority investors on February 3, 2012, is referred to as Predecessor. Aquilex SRO, for the period from and after February 3, 2012 is referred to as the Successor.

On March 9, 2012, the Parent Company initiated a restructuring plan wherein certain upper management positions in the corporate office were eliminated. This restructuring resulted in a more decentralized management setup for purposes of operating the business units separately given the differences in services provided.

The subsidiaries of Aquilex SRO are wholly owned and include Aquilex WSI LLC (formerly, Aquilex WSI, Inc,), Aquilex SMS LLC (formerly, Aquilex SMS, Inc.), Aquilex Welding Services B.V., Aquilex Welding Services Poland Sp. z.o.o, SMS Global, Inc., and Aquilex WSI Canada ULC. On February 3, 2012, Aquilex WSI, Inc. and Aquilex SMS, Inc. were converted to a limited liability company “LLC”.

2. | Parent Company Restructuring |

Restructuring Support Agreement and Term Sheet

On December 23, 2011, the Parent Company entered into a restructuring support agreement (the “Restructuring Support Agreement”) with, among others, (i) holders representing approximately 92% of the aggregate outstanding principal amount of the Senior Notes (the “Consenting Noteholders”) , (ii) holders representing 100% of the aggregate outstanding principal amount of the First Lien Loans (the “Consenting First Lien Lenders” and together with the Consenting Noteholders, the “Consenting Lenders”), (iii) the Consenting Noteholders, as beneficial holders of 100% of the aggregate outstanding amount of the Second Lien Loans, (iv) Aquilex Holdco L.P. and (v) the Ontario Teachers' Pension Plan in its capacity as holder of 98.5% of the equity interests in Aquilex Holdco L.P, the principal owner of the Parent Company.

8

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

The parties to the Restructuring Support Agreement agreed to the principal terms of a financial restructuring (the “Restructuring”) of the debt of the Parent Company, through the simultaneous commencement of (i) an out-of-court offer (the “Exchange Offer”) to exchange the Senior Notes for Class A Units (“Common Units”) or for a cash amount described below and (ii) the solicitation of votes for a prepackaged plan of reorganization (the “Prepackaged Plan”) under the Bankruptcy Code Title 11 of the United States Code (the “Bankruptcy Code”). In connection with the Restructuring, the Parent Company commenced a rights offering (the “Rights Offering”) with an aggregate offering amount of $80,000, pursuant to which certain holders of the Senior Notes were entitled to subscribe for their pro rata share of Class B Units (“Preferred Units”).

Pursuant to the terms of the Restructuring Support Agreement, each Consenting Lender agreed, among other things, subject to certain conditions, to vote to accept the Prepackaged Plan. In addition, each Consenting Noteholder agreed, among other things, to (a) tender and not withdraw its Senior Notes in the Exchange Offer, (b) consent to certain proposed amendments to the Indenture (the “Proposed Amendments”), and (c) provide the Backstop Commitment (as defined below).

As required, upon the close of the Restructuring on February 3, 2012:

▪ | each Consenting Noteholder, as a lender under the Second Lien Credit Agreement, received its pro rata share of Preferred Units; |

▪ | each holder of the Senior Notes (“Noteholder”) that complied with the Exchange Offer procedures and elected to exchange its Senior Notes in the Exchange Offer received, at its option, either, (1) if such Noteholder was an accredited investor (an “Eligible Noteholder”), its pro rata share of Common Units and the right to participate in the Rights Offering and purchase its pro rata share of the Preferred Units offered in the Rights Offering or (2) cash in an amount equal to (a) a range of 24.8% - 27.7% of the principal amount of such Noteholders' Senior Notes, depending on the degree of holder participation in the Exchange Offer or, (b) if such Noteholder was not an accredited investor (a “Non-Eligible Noteholder”) and owned its Senior Notes on December 23, 2011, 37.5% of the principal amount of such Non-Eligible Noteholders' Senior Notes; |

▪ | each Non-Eligible Noteholder who tendered into the Exchange Offer and purchased its Senior Notes after December 23, 2011, received cash in an amount equal to a range of 24.8% - 27.7% of the principal amount of such Noteholders' Senior Notes, depending on the degree of holder participation in the Exchange Offer; |

▪ | each Noteholder who tendered into the Exchange Offer (other than the Consenting Noteholders) also received a 3% consent fee (based on the principal amount of the Senior Notes tendered by such Noteholder); |

▪ | each non-tendering Eligible Noteholder retained its Senior Notes upon the Restructuring consummated through the Exchange Offer; |

▪ | each non-tendering Non-Eligible Noteholder retained its Senior Notes upon the Restructuring consummated through the Exchange Offer; |

▪ | The Restructuring Support Agreement provided for the terms of a Term Loan Facility to be perfected by a second-priority security interest in substantially all of the assets of the Parent Company; |

▪ | All equity interests of the Parent Company outstanding immediately prior to the closing of the Restructuring were required to be canceled. |

9

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Backstop Purchase Agreement

On December 23, 2011, the Parent Company entered into a Backstop Purchase Agreement (the “Backstop Agreement”) with the Consenting Noteholders, pursuant to which each Consenting Noteholder agreed, among other things, to purchase in the aggregate, at the Rights Offering purchase price, all of the Parent Company's Preferred Units that were not subscribed for prior to the closing of the Rights Offering (the “Backstop Commitment”) and to purchase additional Preferred Units at the Rights Offering purchase price in order to fund the sum of the cash amount that the Parent Company was required to pay to Noteholders that elected to exchange their Senior Notes in the Exchange Offer for cash and the cash amount that the Parent Company was required to pay to the Noteholders who tendered into the Exchange Offer (other than the Consenting Noteholders) as a consent fee. In exchange for providing the Backstop Commitment, the Consenting Noteholders received a backstop commitment fee, which was deemed earned upon receipt of a Debtor in Possession Commitment on December 23, 2011 from Royal Bank of Canada, in an amount equal to $3,632 (the “Backstop Fee”), which was paid in the form of a dollar for dollar increase in the principal amount of the Parent Company's Second Lien Loan which, in turn, converted into Preferred Units at the Rights Offering price. At December 31, 2011, the Backstop Fee is a deferred asset and is included in prepaid assets. Upon the close of the restructuring on February 3, 2012, the deferred asset was charged against the gross proceeds of the Rights Offering.

3. | Significant Accounting Policies |

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Parent Company Allocations

The accompanying financial statements include an allocation of the Parent Company's costs for shared services, support functions and certain entity wide benefits expenses that have been allocated to Aquilex SRO using methodologies primarily based on Aquilex SRO's revenues as a percentage of the total Parent Company's consolidated revenue, which is considered to be most meaningful in the circumstances. These allocated costs to Aquilex SRO are primarily related to the Parent Company's general and administrative expenses, reorganization costs, corporate employee costs, as well as costs for certain health and welfare benefits, incentive compensation plans, and other costs maintained at the Parent Company level for each of its subsidiaries. In addition, Aquilex SRO is allocated a portion of the Parent Company's costs for shared services for the following functional groups: information technology, legal services, accounting and finance services, human resources, marketing and product support, product development, treasury, travel group, and payroll services. Subsequent to the February 3, 2012 restructuring, the Parent Company continued allocation of such costs though the amounts declined from the prior periods. These allocated costs are recorded in selling, general and administrative (“SG&A”) expenses in the Aquilex SRO Consolidated Statements of Operations and Other Comprehensive Loss. For the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended December 31, 2011, the Parent Company allocated SG&A costs to Aquilex SRO totaling $4,923, $4,276, and $19,086, respectively.

The accompanying financial statements also include related party debt, interest, and deferred financing costs allocated from the Parent Company as described in Note 5, “Related Parties.” The debt amounts allocated include gross proceeds from debt net of original issue discount ("OID") and principal repayments.

Management believes that the estimates, assumptions, and methodology underlying the allocation of these shared services, support functions, certain entity wide benefits expenses, related party debt, interest and deferred financing costs as reflected in the financial statements are reasonable, however, actual expenses and financing may have differed materially from these allocations had the Company operated independently of the Parent Company for the periods presented. The Company's financial statements do not purport to reflect what the results of operations, financial position or cash flows would have been had the Company operated as an independent company during the periods presented nor do they purport to indicate what the Company's results of operations, cash flows or financial position will be as of any future date or for any future period.

10

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Central Treasury Operations

For each of the Parent Company's businesses, which were historically managed as a separate business, the Parent Company used a centralized approach to cash management and financing of its operations. Central treasury activities include the sweeping of cash balances daily from subsidiary accounts to a Parent Company master account, the investment of surplus cash, the issuance and repayment of short-term and long-term debt and interest rate management. All Parent Company funding to and from Aquilex SRO has been accounted for as a related party payable or receivable from the Parent Company. These Parent Company transfers to and from Aquilex SRO are presented as a Parent (Receivable) Payable within the Consolidated Statement of Changes in Member's Equity (Deficit). With the exception of the Aquilex Welding Services B.V. operations, the cash balance of Aquilex SRO is normally nominal.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material. On an ongoing basis, estimates are reviewed based on information that is currently available.

Cash and Cash Equivalents

Cash and cash equivalents consist of all highly liquid investments with initial maturities of three months or less. The Company's cash equivalents consist primarily of overnight commercial bank and money market deposits. The carrying amounts reported in the balance sheet approximate fair value.

Accounts Receivable

Accounts receivable represent amounts currently due from customers, but not yet collected. The allowance for doubtful accounts is the Company's best estimate of the amount of probable credit losses in the Company's existing accounts receivable. The allowance consists of specifically reserved against receivables with an additional reserve, based on historical write-off experience and current economic conditions. The Company reviews its allowance for doubtful accounts monthly. Account balances are charged off against the allowance after all means of collection have been exhausted and are deemed by management probable of being uncollectible.

Inventories

Inventories are valued at the lower of cost or market using the average cost method. Costs included in inventories primarily consist of welding wire and related materials used in production or delivery of services.

Contract Related Assets and Liabilities

Costs and estimated earnings in excess of billings on uncompleted contracts in the accompanying Consolidated Balance Sheets represent unbilled amounts earned and reimbursable under contracts in progress. Such costs include all direct costs and overhead allocation. These amounts become billable according to the contract terms, which usually consider the passage of time, achievement of milestones or completion of the project.

Billings in excess of costs and estimated earnings on uncompleted contracts in the accompanying Consolidated Balance Sheets represent advanced billings to clients on contracts in advance of work performed.

11

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Property and Equipment

Property and equipment are stated at cost, and depreciation is computed using the straight-line method, net of estimated salvage values, over the estimated useful lives of the assets. Leasehold improvements are capitalized and amortized over the lesser of the life of the lease or the estimated useful life of the asset. Estimated useful lives are as follows:

Expenditures for repairs and maintenance are charged to expense when incurred. Expenditures for major renewals and betterments that extend the useful lives of existing equipment are capitalized and depreciated. Upon retirement or disposition of property and equipment, the cost and related accumulated depreciation are removed from the Company's accounts and any resulting gain or loss is recognized in the consolidated statement of operations.

Fair Value of Financial Instruments

Fair value is defined under Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures” ("ASC 820"), as the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a three-level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

Level 1-inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

Level 2-inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model-derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

Level 3-inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

As of December 31, 2012, the Company had carrying values of $27,567 for accounts receivable, net, $4,233 for accounts payable, and $90,202 for related party debt. For these respective items, the carrying value approximated fair value at December 31, 2012.

During 2011, in accordance with ASC 350 “Goodwill and Other Intangible Assets” ("ASC 350"), and ASC 360 “Accounting for the Impairment or Disposal of Long-Lived Assets” ("ASC 360"), goodwill and intangible assets were written down to $68,334 and $89,930, respectively, at December 31, 2011. The write down of the assets resulted in a goodwill impairment charge of $71,622 and an intangible assets impairment charge of $35,502 in 2011. These are measured at fair value on a non-recurring basis. The Company utilized Level 3 inputs, as defined in the fair value hierarchy, for the fair value measurement of these assets. These items are presented on the balance sheet as “Goodwill” and “Other intangible assets, net.” Changes in these respective items appear as “Impairment charges” on the Consolidated Statements of Operations and Other Comprehensive Loss. There were no impairment charges in for the periods February 3, 2012 to December 31, 2012 or January 1, 2012 to February 2, 2012. See Note 7, "Goodwill and Other Intangible Assets."

12

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

For the year ended December 31, 2012, there have been no transfers between hierarchy levels.

Deferred Financing Costs

Deferred financing costs are amortized over the life of the related debt using the effective interest method.

Goodwill and Nonamortizable Intangible Assets

ASC 350 provides that goodwill and other intangible assets that have indefinite useful lives are not amortized but must be tested at least annually for impairment. ASC 350 also provides specific guidance for testing goodwill and other indefinite-lived intangible assets for impairment. The first step in testing for goodwill impairment compares the fair value of a reporting unit to its carrying amount, including goodwill. If the carrying amount of a reporting unit exceeds its fair value, the second step is then performed. The second step compares the carrying amount of the reporting unit's goodwill to the fair value of the goodwill. An impairment charge is recognized for any amount by which the carrying value of a reporting unit's goodwill exceeds its implied fair value.

The Predecessor's annual goodwill impairment testing date was November 30 and the Successor's annual impairment testing date is December 31. A test for impairment will be performed between annual test dates if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. Examples of such events or circumstances may include a significant change in business climate, loss of a significant customer or loss of key personnel. ASC 350 requires that we make certain estimates and assumptions in order to allocate goodwill to reporting units and to determine the fair value of reporting unit net assets and liabilities, including, among other things, an assessment of market conditions, projected cash flows, cost of capital and growth rates, which could significantly impact the reported value of goodwill and other intangible assets.

The Company's profitability may suffer from downturns in customer demand and other factors. If material adverse conditions occur, our future estimates of fair value may not support the carrying amount of Aquilex SRO and goodwill would need to be written down to an amount considered recoverable.

The Company is required to test indefinite-lived intangible assets for impairment annually or whenever events and circumstances change that would indicate the asset might be impaired. The Predecessor's annual indefinite-lived intangible assets impairment testing date is November 30 and the Successor's annual impairment testing date is December 31. The Company performs the impairment test for indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. An impairment charge is recognized if the asset's estimated fair value is less than its carrying value. The fair value of the Company's indefinite lived intangible assets is based on projected DCFs. The use of different estimates or assumptions within the Company's DCF model when determining the fair value, or using a methodology other than a DCF model, could result in different values and could result in an impairment charge. The most significant assumptions within the Company's discounted cash flow model are the discount and growth rates. The Company believes its estimates are consistent with assumptions that marketplace participants would use in their estimates of fair value.

Management considers the trade names to have indefinite useful lives and, accordingly, are not subject to amortization. The Company reached this conclusion principally due to the longevity of the Aquilex SRO name and the associated subsidiary names, and because the Company considered renewal upon the legal limit of the trade names as perfunctory. The Company expects to maintain usage of the Aquilex SRO and the associated subsidiary trade names on existing services and introduce new products in the future that will also display the trade names. Consequently, the trade names qualify as an indefinite-lived asset in accordance with ASC 350.

13

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Long-Lived Assets and Amortizable Intangible Assets

We review our long-lived assets, including our intangible assets with finite useful lives, for impairment if events or changes in circumstances indicate that the carrying value of such assets may not be recoverable, as required by ASC 360. If an evaluation is required, the estimated future undiscounted cash flows associated with the asset or asset group are compared to the asset or asset groups' carrying amount to determine if an impairment of such asset is necessary. This requires us to make long-term forecasts of the future revenues and costs related to the assets or asset groups subject to review. Forecasts require assumptions about demand for our services and future conditions in the end markets we serve. Since estimating future cash flows requires significant judgment, our projections may vary from cash flows eventually realized. Future events and unanticipated changes to assumptions could require a provision for impairment in a future period. The effect of any impairment would be to expense the difference between fair value of such asset or asset group and its carrying value. Such expense would be reflected in operating expenses.

We estimate the useful life and fair value of purchased intangible assets at the time of acquisition and periodically review these estimates to determine whether these lives are appropriate. Our intangible assets subject to amortization consist primarily of customer relationships and technology. Customer relationships, which include the fair value of acquired customer contracts, are evaluated using a DCF methodology.

If the estimate of an intangible asset's remaining useful life is changed, the remaining carrying amount of the intangible asset is amortized prospectively over the revised remaining useful life. Intangible assets with estimable useful lives are reviewed for impairment whenever events or circumstances indicate that the carrying value of such assets may not be recoverable.

Revenue Recognition

The Company evaluates the circumstances of each contract to determine the appropriate application of revenue recognition methods.

The Company's component construction services contracts that are short-term in nature are primarily accounted for by the completed contract method and these contracts set forth the scope of services and provide a detailed work plan and timetable. Revenue is recognized at the completion of the job, when accepted by the customer, title and risk of loss have transferred to the customer and collectibility is reasonably assured.

Certain other Company contracts are accounted for by the percentage of completion method. This method is used where there are reliable estimates of revenue and cost, the contract specifies terms and conditions, and both the purchaser and the Company have the ability and expectation to perform all the contractual duties. In this regard, the Company uses two methods for determining the percent complete.

The output method involves the use of contract milestones which are specifically outlined in the contracts and reflect a reasonable estimate of progress on the project. Once the specific milestone is met, a percentage of revenue is recognized based on the cost incurred of the milestone and the estimated margin of the project. These milestones have clearly defined, recognized, and separable value and cost that reasonably reflect the progress of a long-cycle contract across multiple accounting periods. In some contracts, both specific billing and completion milestones are present. Sometimes, these are the same. However, the Company does have contracts where the billing milestone is set to have cash in advance of the revenue. In such circumstance, billing in excess of cost is recognized as a liability. In the event the project does not have definitive milestones, the input method of cost-to-total estimated costs is used to measure results directly and to measure progress toward completion. In these arrangements, a percentage of revenue is recognized based on the ratio of costs incurred to total estimated costs after giving effect to estimates of costs to complete based on most recent

14

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

information. We recognize revisions in profit estimates to income in the period in which the revision is determined. Estimated contract losses are recognized in full when determined.

The input method is used to determine the percent complete on time and materials contracts. Under the time and materials contracts, revenue is recognized based upon hours and cost to date at the estimated margin of the job. Due to the nature of these jobs, actual invoicing is completed after the revenue event occurs and therefore a cost in excess of billing is recorded at month end.

For the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and the year ended December 31, 2011, the Company did not have any contracts for which a significant loss was anticipated.

These methods for determining the percent complete are applied consistently among all of the Company contracts having similar characteristics.

Insurance Reserves

The Company, through the Parent Company's group insurance policy, has a $500 per occurrence high deductible insurance program for most losses related to general liability, product liability, automobile liability, workers' compensation, and certain legal claims. For the policy period June 7, 2012 through June 6, 2013, the automobile deductible was $250 for Aquilex SRO. For the policy period June 7, 2011 through June 6, 2012, the automobile liability deductible was $500 for Aquilex SRO. The Company's self-insurance reserves for claims filed and claims incurred but not reported at the balance sheet date are based upon management's assumptions and estimates regarding the probable outcome of the claims, historical payment trends, estimates of the aggregate liability for uninsured claims using loss development factors, and actuarial assumptions followed in the insurance industry. From time to time the Company obtains an actuarial estimate of its workers' compensation liability. Should the outcome differ from management's assumptions and estimates or should the insurance carriers become insolvent and unable to cover claims in excess of the Company's deductible, revisions to the estimated reserves for property and casualty and workers' compensation insurance would be required.

The expected ultimate cost for claims incurred as of the balance sheet date is not discounted and is recognized as a liability. For the policy period ended June 30, 2012, the Parent Company's group policy has a stop loss amount for our worker's compensation, general liability, and auto insurance programs that limits our exposure to an aggregate deductible payout in a policy year. For the policy period ending June 6, 2013, the Company does not have a stop loss provision. The limit for the policy period June 7, 2011 to June 6, 2012 was $7,280.

The Company has a $300 per covered person high deductible insurance policy for medical and dental coverage.

Losses up to the deductible amount for our different insurance policies are accrued based upon the Company's estimates of the ultimate liability for claims incurred. The accruals are based on all available information at the time the financial statements are prepared.

Foreign Currency Translation and Transaction Gains/ (Losses)

Assets and liabilities of our non-U.S. subsidiaries, whose functional currency is the local currency, are translated at period-end exchange rates. Income and expense items are translated at the average rates of exchange prevailing during the period. The adjustments resulting from translating the financial statements of our foreign subsidiaries are included in Accumulated Other Comprehensive Income (Loss), a component of Member's Equity (Deficit). Foreign currency transaction gains and losses are reported in results of operations. Translation adjustments included in Other Comprehensive Loss for the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and the year ended December 31, 2011 were $60, $27, and ($19), respectively. Net gains and losses from foreign currency transactions included in earnings for the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and the year ended December 31, 2011 were $157, $4 and $61, respectively and are included in Other income (expense), net in the Consolidated Statements of Operations and Other Comprehensive Loss.

15

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Employee Benefit Plans

Pension Benefits

The Company is subject to collective bargaining agreements with various unions and makes contributions to various multi-employer defined benefit pension plans administered by said unions under Title IV of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). The plans are accounted for under the provisions of ASC 715 “Compensation and Retirement.” The Company's participation in the plans is accounted for as a participant in a multiemployer pension plan, and as such, the Company records pension expense as it is incurred.

401(k) Plan

The Parent Company maintains a 401(k) plan which eligible Company employees may elect to contribute from 0% to 75% of their pre-tax compensation subject to an annual maximum dollar amount as set by the Internal Revenue Service. The Company may make discretionary matching cash contributions.

Stock Based Compensation

Parent Company Management and Director Equity Incentive Plan, Successor

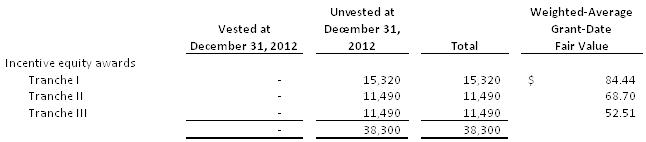

As an incentive to perform services for the Company, a management equity incentive plan was created by the Parent Company subsequent to the Parent Company restructuring that occurred on February 3, 2012. Certain members of management were granted incentive equity units in the Parent Company, which upon vesting can be converted into Class A units (common shares). The incentive equity units are separated into three tranches described as follows:

• | Tranche I - Forty percent of the incentive equity units vest ratably over five years with continued employment. These units vest immediately if Centerbridge Partners L.P. and its affiliates cease to hold at least 20% of the greatest number of each class of units held by Centerbridge Partners L.P. and its affiliates at any time and if Centerbridge Partners L.P. and its affiliates have achieved at least a 10% internal rate of return on invested capital. Compensation expense on Tranche I is recorded over the five year vesting period. |

• | Tranche II - Thirty percent of the incentive equity units vest ratably over five years with continued employment and upon the accomplishment of a performance hurdle which states Centerbridge Partners L.P. and its affiliates receive a 200% cash return and a 15% internal rate of return on invested capital. These units become fully vested at any time when the respective performance hurdles are met and Centerbridge Partners L.P. and its affiliates cease to hold at least 50% of the greatest number of each class of units held by Centerbridge Partners L.P. and its affiliates at any time. The Company did not recognize any compensation expense on the Tranche II incentive equity units until performance hurdles are met. The Company does not deem a performance hurdle probable until it occurs. |

• | Tranche III - Thirty percent of the incentive equity units vest ratably over five years with continued employment and upon the accomplishment of a performance hurdle which states Centerbridge Partners L.P. and its affiliates receive a 300% cash return and a 25% internal rate of return on invested capital. These units become fully vested at any time when the respective performance hurdles are met and Centerbridge Partners L.P. and its affiliates cease to hold at least 50% of the greatest number of each class of units held by Centerbridge Partners L.P. and its affiliates at any time. The Company did not recognize any compensation expense on the Tranche III incentive equity units until performance hurdles are met. The Company does not deem a performance hurdle probable until it occurs. |

Income Taxes

For the period February 3, 2012 through December 31, 2012, the Company was a Single Member Limited Liability Company treated as an entity that is disregarded from its owner for Federal and State income tax purposes. As a result, the Company's income is allocated to the investors in its Parent Company and taxed at that level. As required by the Successor Limited Liability Company Agreement, the Company is required to make capital distributions to the investors equal to their tax liability attributable to the Company's earnings. If required, these distributions are reflected as capital distributions in the Consolidated Statements of Changes in Member's Equity (Deficit). No tax distribution is required by the company for the year ended December 31, 2012. Entities owned by the Company pay income tax in certain state and foreign jurisdictions, and a U.S. subsidiary of the company is still liable for Federal and state income tax.

16

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

For the Predecessor, for the periods ended December 31, 2011 and February 2, 2012, the Company consisted of a group of U.S. corporations filing as members of a U.S. consolidated group, certain foreign entities, and one U.S. Corporation that filed a separate Federal and state income tax return.

The Company follows the asset and liability method of accounting for income taxes in accordance with ASC 740, “Income Taxes” (“ASC 740”). Under this method, the deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that includes the enactment date. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless it is more likely than not that such asset will be realized.

The Company regularly evaluates valuation allowances established for deferred tax assets for which future realization is uncertain. The estimation of required valuation allowances includes an estimate of future taxable income, reversals of deferred tax liabilities, carry back periods, and tax planning strategies.

For the Successor, deferred taxes are applicable to the foreign corporate entities and the one U.S. corporate entity.

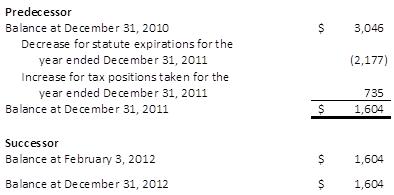

In accordance with ASC 740-10, the Company records reserves and interest for the uncertain outcome of certain tax positions and elected to include any future penalties and interest related to uncertain tax positions in income tax expense.

For the period ended December 31, 2012 the unrecognized tax benefits did not change. For the year ended December 31, 2011 the unrecognized tax benefits decreased by $2,177 for statue expirations and increased by $735 for certain tax positions taken.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist of accounts receivable and cash deposits. Through the central treasury operations, the Parent Company maintains cash balances at financial institutions which may at times be in excess of federally insured levels. The Company has not incurred to date nor does it expect to incur any losses related to the cash deposits.

The Company grants credit, generally without collateral, to its customers, which include electric power, oil and gas, and petrochemical companies located primarily in the United States, Europe, Canada, South America, and India. Consequently, the Company is subject to potential credit risk related to changes in business and economic factors throughout such countries. However, the Company generally is entitled to payment for work performed and has certain lien rights on that work.

Management believes the Company's credit risk in its portfolio of accounts receivable is adequately reserved. Receivables with any one particular customer could be material at a point in time and if a bankruptcy occurred with one of these customers, the loss could be material. Management believes timely collection of trade receivables minimizes associated credit risk. On a periodic basis, management evaluates the creditworthiness of the Company's customers and monitors accounts receivable, but typically does not require collateral. For the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and the year ended December 31, 2011, the largest customer represented 7.9%, 24.6% and 6.3% of revenue, respectively.

17

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

New Accounting Pronouncements

ASU 2012-02, Intangibles - Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment

In July 2012, the FASB issued ASU 2012-02, "Intangibles - Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment." This revised standard provides entities with the option to first use an assessment of qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the fair value of an indefinite-lived intangible asset is less than its carrying amount. If a conclusion is reached that the indefinite-lived intangible asset fair value is not more likely than not below carrying value, no further impairment testing is necessary. The Company will adopt this standard for its consolidated financial statements for 2013.

ASU 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income

In February 2013, the FASB issued ASU 2013-02, “Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income.” Under this standard, an entity is required to provide information about the amounts reclassified out of Accumulated OCI by component. In addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts reclassified out of Accumulated OCI by the respective line items of net income, but only if the amount reclassified is required to be reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts. This standard does not change the current requirements for reporting net income or other comprehensive income in the financial statements and is effective for interim and annual periods beginning on or after December 15, 2012. The adoption of this standard is not expected to have a material impact on the Company's consolidated financial statements.

ASU 2011-09, Compensation - Retirement Benefits, Multiemployer (Topic 715), Disclosures about an Employer's Participation in a Multiemployer Plan

In September 2011, the FASB issued ASU 2011-09, which amends ASC 715-802 by increasing the quantitative and qualitative disclosures an employer is required to provide about its participation in significant multiemployer plans that offer pension and other postretirement benefits. The ASU's objective is to enhance the transparency of disclosures

about (1) the significant multiemployer plans in which an employer participates, (2) the level of the employer's participation in those plans, (3) the financial health of the plans, and (4) the nature of the employer's commitments to the plans. The disclosure requirements do not apply to an employer's participation in multiple-employer plans

(i.e., single-employer plans aggregated to pool plan assets for investment purposes or to reduce the costs of plan administration). For nonpublic entities, the new disclosure requirements are effective for fiscal years ending after December 15, 2012. The amendments in the ASU should be applied retrospectively for all periods presented. The standard will require increased disclosures for the Company. The Company adopted this standard for its consolidated financial statements for 2012.

ASU 2011-08, Intangibles - Goodwill and Other (Topic 350), Testing Goodwill for Impairment

In September 2011, the FASB issued amendments allowing the option to first assess qualitative factors to determine whether it is more likely than not (a likelihood of more than 50%) that the fair value of a reporting unit is less than its carrying amount. If, after considering the totality of events and circumstances, an entity determines it is not more likely than not that the fair value of a reporting unit is less than its carrying amount, performing the two-step impairment test is unnecessary. The amendment is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. Early adoption is permitted. The Company will adopt this standard for its consolidated financial statements for 2013

18

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

4. | Acquisition of Parent Company - Aquilex Holdings LLC |

On February 3, 2012, the Parent Company became majority owned by affiliates of Centerbridge Partners, L.P. The total adjusted acquisition price as of the closing date was $187,238. The acquisition was financed through a debt for equity conversion with a fair value of $107,238 and approximately $80,000 in equity contributions. The accompanying financial statements include $134,811 of the consideration received by the Parent Company, which was allocated to Aquilex SRO based on its relative fair value compared to the total Parent Company.

The acquisition was accounted for as a business combination using the acquisition method of accounting under the provisions of ASC 805, “Business Combinations,” (“ASC 805”). Accordingly, the Company allocated the purchase price based upon the fair values of the net assets acquired and liabilities assumed.

The following table summarizes the final allocation of the fair value consideration to the assets acquired and liabilities assumed:

The Company separately identified customer relationships, trade names, and technology as the acquired identifiable intangible assets. Trade names have been assigned an indefinite life and, therefore, will not be amortized, but tested at least annually for impairment. Customer relationships have a weighted average amortization period of 20 years and Technology has a weighted average amortization period of 10 years. As of the date of acquisition, these assets were valued as follows:

19

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

In conjunction with the acquisition, the Parent Company paid down the Parent Company term loan and revolving credit facility by $40,000 and $36,000, respectively and Aquilex LLC entered into the Second Lien Term Loan and First Lien Revolving Loan (See Note 9, “Parent Company Debt”).

In connection with the Second Lien Term Loan and the First Lien Revolving Loan, the Successor capitalized financing costs of $6,371.

5. | Related Parties |

Parent Company Allocations

For the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended December 31, 2011, the Parent Company allocated SG&A and restructuring costs to Aquilex SRO totaling $4,923, $4,276, and $19,086, respectively.

Parent Company Professional Advisor and Related Restructuring Fees

The Parent Company incurred professional advisor, legal, investment banking and related restructuring fees in connection with the restructuring. Additionally, Aquilex SRO incurred related restructuring fees. For the periods February 3, 2012 to December, 31 2012, January 1, 2012 to February 2, 2012, and for the year ended December 31, 2011, Aquilex SRO recognized total restructuring fees of $3,836, $3,723, and $12,514 of such fees, respectively, in selling, general and administrative expense in the Consolidated Statements of Operations and Other Comprehensive Loss.

Parent Company Debt and Interest Expenses Allocation

The Parent Company debt (“Parent Company Debt”) consists of debt and interest expense allocations as of December 31, 2011 and for the periods January 1, 2012 to February 2, 2012 and the year ended December 31, 2011 to Aquilex SRO from Aquilex Holdings LLC (“Predecessor Debt”), and consists of the debt and interest expense allocations as of December 31, 2012 and for the period February 3, 2012 to December 31, 2012 to Aquilex SRO from Aquilex LLC (“Successor Debt”). Aquilex LLC, Aquilex SRO, as well as substantially all other U.S. based subsidiaries of the Parent Company (jointly “Aquilex Parties”), are borrowers under the Parent Company Debt.

All Parent Company Debt and related interest expense is allocated to the Parent Company's US based subsidiaries on a relative fair value basis. At December 31, 2012 and 2011, this debt was categorized on the Consolidated Balance Sheets as related party debt payable of $90,202 and $286,707, respectively. Aquilex SRO is also allocated interest expense on a quarterly basis. At December 31, 2012 and 2011, the Company had a related party interest payable of $29 and $30,579, respectively, which is included in Parent (Receivable) Payable, in the Consolidated Balance Sheets. Parent Company debt is described further in Note 9, “Parent Company Debt”.

The intercompany debt agreement maintains that repayment of the allocated Aquilex SRO long-term Parent Company Debt and accrued related party interest is at the discretion of the Parent Company and no specified terms are provided. The terms in Note 9, “Parent Company Debt”, refer to the actual terms of the Parent Company Debt with the respective lenders. Substantially all of the assets of Aquilex Holdings LLC, Aquilex Intermediate Holdings LLC, Aquilex LLC, and its U.S. based subsidiaries, including Aquilex SRO; serve as collateral for the Parent Company Debt.

20

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Member's Capital

Upon the close of the Restructuring on February 3, 2012, the Predecessor's equity structure, including the Member's Capital, was eliminated when the debt-for-equity exchange occurred. The Member's Capital in the Successor period represents the Parent Company's interest in the recorded net assets of the Company. At December 31, 2012 and 2011, 100 member units were outstanding.

Parent Company Employee Retention Plan

On October 13, 2011, the Parent Company adopted an employee retention plan (the “Employee Retention Plan”) in contemplation of the restructuring that was completed on February 3, 2012. The plan covers certain of the Parent Company's managers and executives (the “Covered Employees”). Under the Employee Retention Plan, each Covered Employee received a bonus payment, one-half of which was paid upon the Covered Employee's entry into an agreement confirming acceptance of the terms of the Employee Retention Plan. The remaining one-half of the bonus payment was paid to the Covered Employee approximately ninety days following the consummation of the change of control of the Parent Company on February 3, 2012. The Employee Retention Plan was no longer in effect at December 31, 2012.

Aquilex SRO recorded $383, $279, and $1,210 in SG&A costs in the periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended December 31, 2011 which represents an allocation of the total Employee Retention Plan costs of the Parent Company based on Aquilex SRO's revenue as a percentage of the total Parent Company consolidated revenue. The Company believes that such allocation methodology is reasonable. These retention plan costs are recorded as part of the total restructuring costs.The expense allocated to Aquilex SRO for the Employee Retention Plan are not necessarily indicative of the expense that would have been incurred if Aquilex SRO had been a separate, independent entity and had otherwise a specific Employee Retention Plan at the Aquilex SRO level.

6. | Property and Equipment |

Property and equipment consist of the following:

Depreciation expense for periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended December 31, 2011 was $10,335, $614, and $7,563, respectively.

During the third quarter 2011, the Predecessor experienced significant adverse changes in operating results, including changes to future forecasted results, cash flow, and covenant compliance. These factors were considered in the aggregate and deemed to be a triggering event for purposes of performing an impairment test in the third quarter of 2011 under ASC 350 and ASC 360. Accordingly, as of August 31, 2011, the Company performed an impairment review of long-lived assets which indicated a recoverable carrying value for property and equipment. Therefore, the Predecessor did not record

21

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

an impairment of property and equipment. However, the Predecessor did record impairments of the intangible assets as detailed in Note 7 “Goodwill and Other Intangible Assets” below.

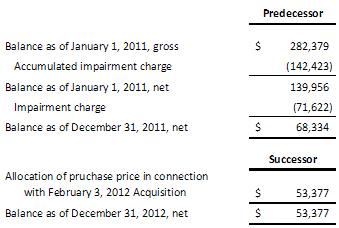

7. | Goodwill and Other Intangible Assets |

During the third quarter of 2011, the Company experienced significant adverse changes as described in Note 6 above. As of August 31, 2011, the Company performed an impairment review of goodwill and other intangible assets not subject to amortization. In conjunction with this evaluation, the Company updated its forecasted cash flows and underlying assumptions to reflect the current size and related demand requirements of the industries the Company serves after the impacts of the recent recession. As a result, the Company determined that its goodwill was impaired. As a result, the Company recorded a non-cash goodwill impairment charge of $71,622 in the third quarter of 2011. The remaining carrying value of goodwill at December 31, 2011 totaled $68,334.

Subsequently, as of November 30, 2011, the date of the annual impairment review, the Company determined that there were no further impairments for either goodwill or indefinite-lived intangible asset. Hypothetical increases or decreases in the long-term growth factors and discount rates for the November 30, 2011 annual impairment test date would be comparable to the August 31, 2011 hypothetical results.

Impairments of the indefinite-lived intangible assets are recognized when our estimate of discounted cash flows over the assets' remaining useful lives are less than the carrying value of the assets. The fair values of the Company's trade names are measured using the relief-from-royalty method. This method is used to estimate the cost savings that accrue to the owner of an intangible asset who would otherwise have to pay royalties or license fees on revenues earned through the use of the asset. The market-derived royalty rate is applied to estimate the royalty savings. The net after-tax royalty savings are discounted to determine the fair value. Any excess carrying value over the fair value represents the amount of impairment. In conjunction with the ASC 350 impairment test in the third quarter of 2011, the Company also recorded an impairment charge of $3,700 for the Company's trade names.

As a result of the triggering events described above in the Company's goodwill impairment analysis, the Company reviewed its definite-lived intangible assets in accordance with ASC 360 for recoverability. As a result of this analysis, the Company recognized a definite lived intangible asset impairment charge for customer relationships in the amount of $31,802 in the third quarter 2011. The inputs measured at fair value used in this valuation methodology were considered Level 3 in the three-tier value hierarchy per ASC 820.

The changes in the carrying amounts of goodwill for the period ended December 31, 2012 and the year ended December 31, 2011 are as follows:

22

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

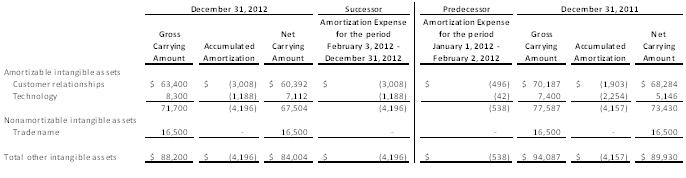

The changes in the carrying amounts of other intangible assets for the period ended December 31, 2012 and the year ended December 31, 2011 are as follows:

In conjunction with the Restructuring that was completed on February 3, 2012, an allocation of the purchase price to the assets acquired and liabilities assumed was performed. Under the provisions of ASC 805, the fair value of the intangible assets acquired was recorded on February 3, 2012 and amortized accordingly. For the period February 3, 2012 to December 31 2012, no intangible assets were impaired

The adjustment to the gross carrying amount for the customer relationships intangible assets in the year ended December 31, 2011 reflects both the impairment charge writedown of the gross carrying value and the write-off of the accumulated amortization as of August 31, 2011, the impairment test date resulting from changes in the forecasted results, cash flow and covenant compliance. For the year ended December 31, 2011, the accumulated amortization written off as part of the impairment charge was $6,211 for Aquilex SRO customer relationships.

Definite lived intangible assets are amortized over the period the economic use is consumed. Amortization expense for periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended 2011, was $4,196, $538 and $8,164, respectively.

As of December 31, 2012, future amortization is as follows:

23

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

8. | Accrued Liabilities |

Accrued liabilities consist of the following:

9. | Parent Company Debt |

Predecessor Debt

The Predecessor's First Lien Credit Agreement, interest payable quarterly for Prime-based borrowing or based on the LIBOR loan period for LIBOR-based borrowings; the Predecessor had the option to pay interest at either the base rate (rate is the greater of the federal funds rate plus 0.50%, the U.S. Prime rate, the one-month LIBOR plus 1.0%, or 2.5%) plus 4.5% or the Eurocurrency rate (rate is the greater of LIBOR or 1.5%) plus 5.5%. The term loan was scheduled to mature on April 1, 2016, and amortized in equal quarterly installments of annual amounts equal to 1% of the original principal amount during the first five and three-quarter years of the term loan, with the balance of the principal amount of the term loan due at maturity. At December 31, 2011, the interest rate was 7.0%. At December 31, 2012 and 2011, the total outstanding balance for the Parent Company totaled $0 and $161,763, respectively. The Predecessor First Lien Credit Agreement was restructured, into the Successor Second Lien Term Loan on February 3, 2012.

Predecessor Revolving $50,000 loan facility, interest payable quarterly for Prime-based borrowing or based on the LIBOR loan period for the LIBOR based borrowings; the Company had the option to pay interest at either the base rate (rate is the greater of the federal funds rate plus 0.50%, the U.S. Prime rate, the one-month LIBOR plus 1.0%, or 2.5%) plus 3.5% or the Eurocurrency rate (rate is the greater of LIBOR or 1.5%) plus 4.5%. The revolving loan facility was scheduled to mature on April 1, 2015 with the balance of the revolving loan facility due at maturity. At December 31, 2011 the interest rate was 7.75%. At December 31, 2012 and 2011, the total outstanding balance for the Parent Company totaled $0 and $36,000, respectively. The Predecessor Revolving loan facility was restructured into the Successor First Lien Revolving loan facility on February 3, 2012.

Predecessor Second Lien Loans, interest payable at either the base rate (which is the highest of (i) the federal funds effective rate plus 0.5%, (ii) the rate announced in the Wall Street Journal as the prime lending rate in the United States and (iii) one-month LIBOR plus 1.00%, such base rate not to be less than 2.50% in any event) plus 8.50%, or one or two-month LIBOR (not to be less than 1.50%) plus 9.50%. Interest paid monthly by capitalizing and adding such accrued interest to the principal amount of the Second Lien Loans. The Second Lien Loans included a backstop fee of $3,632 as discussed in Note 2 regarding the Backstop Purchase Agreement. At December 31, 2011 the interest rate was 11.75%. At December 31, 2012 and 2011, the total outstanding balance for the Parent Company totaled $0 and $19,045, respectively. On February 3, 2012, the Predecessor Second Lien Loans were converted to equity in conjunction with the restructuring.

Senior Notes, interest at a fixed rate of 11 1/8% per annum, unsecured, payable semi-annually in cash in arrears, on June 15 and December 15 of each year, commencing on June 15, 2010. The notes mature on December 15, 2016. At December

24

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

31, 2011, the total outstanding balance for the Parent Company totaled $225,000, respectively. On February 3, 2012, $221,253 of the notes were converted to equity in conjunction with the restructuring.

Successor Debt

Successor Second Lien Term Loan, interest payable quarterly based on LIBOR plus 7.25% (LIBOR has a floor of 1.50%) until the time which the March 31, 2013 financial statements are delivered to the lender. Thereafter, the interest is determined based on a leverage grid. The term loan matures on April 1, 2016, and amortizes in equal quarterly installments of annual amounts equal to 1% of the original principal amount, with the balance of the principal amount of the term loan due at maturity. At December 31, 2012, the interest rate was 8.75%. At December 31, 2012 and 2011, the total outstanding balance for Aquilex LLC totaled $121,534 and $0, respectively.

Successor First Lien Revolving $50,000 loan facility, interest payable quarterly based on LIBOR plus 7.25% (LIBOR does not have a floor). The revolving loan facility matures on April 1, 2016 with the balance due at maturity. The Parent company had not drawn from the revolving loan facility at December 31, 2012.

Senior Notes, interest at a fixed rate of 11 1/8% per annum, unsecured, payable semi-annually in cash in arrears, on June 15 and December 15 of each year, commencing on June 15, 2010. The notes mature on December 15, 2016. On February 3, 2012, $221,253 of the notes were converted to equity in conjunction with the restructuring. At December 31, 2012, the total outstanding balance for the Parent Company totaled $3,747.

Future maturities of related party long-term debt as of December 31, 2012:

The Company's allocated and unamortized deferred financing costs were $4,951 and $696 at December 31, 2012 and 2011, respectively. Amortization of deferred financing costs recorded to interest expense for periods February 3, 2012 to December 31, 2012, January 1, 2012 to February 2, 2012 and for the year ended December 31, 2011 was $1,420, $610, and $8,607 respectively.

Debt Covenants

At December 31, 2012, the Parent Company's First Lien Revolving Loan Facility and Second Lien Term Loan Agreement contain certain financial maintenance covenants requiring the Parent Company to maintain certain minimum or maximum financial ratios, as follows: a minimum fixed charge coverage ratio (includes interest and capital expenditures) ranging from 0.80:1 to 1.20:1 over the term of the First Lien Revolving Loan Facility and Second Lien Term Loan Agreement and a maximum net leverage ratio ranging from 3.50:1 to 2.00:1 over the term of First Lien Revolving Loan Facility and Second Lien Term Loan Agreement. The Parent Company must also not spend less than 80% of the approved capital expenditures budget for each fiscal year over the term of the First Lien Revolving Loan Facility and Second Lien Term Loan Agreement and is required to maintain a minimum liquidity of $7.5 million at any time over the term of the First Lien Revolving Loan Facility and Second Lien Term Loan Agreement.

25

Aquilex Specialty Repair & Overhaul LLC and Subsidiaries

Notes to Consolidated Financial Statements

(Amounts in thousands of dollars, except unit amounts)

Subject to various exceptions and baskets set forth in the First Lien Revolving Loan Facility and Second Lien Term Loan Agreement, the Parent Company and its subsidiaries (other than any unrestricted subsidiaries) are restricted from taking certain actions, including: (i) incurring additional indebtedness; (ii) creating liens on assets; (iii) making investments, loans or advances in or to other persons; (iv) paying dividends or distributions on, or repurchasing stock or other equity interests; (v) repaying, redeeming or repurchasing certain indebtedness; (vi) changing the nature of the Parent Company's business; (vii) engaging in transactions with affiliates; (viii) undergoing fundamental changes (including mergers); and (ix) making dispositions of assets. The First Lien Revolving Loan Facility and Second Lien Term Loan Agreement also contains cross default covenants tied to all other indebtedness of the Parent Company. Substantially all of the assets of the Parent Company and its subsidiaries serve as collateral for First Lien Revolving Loan Facility and Second Lien Term Loan Agreement.

The Parent Company was in compliance with all financial maintenance covenants at December 31, 2012 associated with the First Lien Revolving Loan Facility and Second Lien Term Loan Agreement.

On February 28, 2011, the Parent Company entered into Amendment No. 1 (the “Amendment No. 1”) to its First Lien Credit Agreement, dated as of April 1, 2010 and modified on June 17, 2010, with the Royal Bank of Canada, as administrative agent and L/C (Letter of Credit) Issuer, and the required lenders there under.

The parent company was not in compliance with its financial maintenance covenants under the First Lien Credit Agreement at September 30, 2011 and December 31, 2011. In addition, Aquilex Holdings LLC did not make the scheduled interest payment due on December 15, 2011 of $12,516 on the Senior Notes. Forbearance Agreements were obtained for the financial covenant defaults. Also, a Notes Forbearance Agreement was obtained from the holders of a majority of the aggregate principal amount of the Senior Notes in conjunction with the failure to make the Senior Notes interest payment on December 15, 2011.

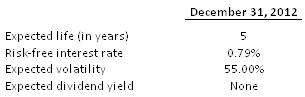

10. | Parent Company Management and Director Equity Incentive Plan, Successor |

During the period February 3, 2012 to December 31, 2012 there were 38,300 Parent Company incentive equity units awarded to SRO employees and 450 incentive equity units were forfeited. At December 31, 2012 there were 95,172 incentive equity units outstanding and 28,424 incentive equity units available for future awards. Aquilex SRO recorded $273 in SG&A costs related to the vesting of the Tranche I incentive equity units for the period February 3, 2012 to December 31, 2012 which represents the portion of the compensation expense recorded by the Parent Company related to SRO employees and an allocation of the compensation expense related to corporate employees and directors based on Aquilex SRO's revenue as a percentage of the total Parent Company consolidated revenue. The Company believes that such allocation methodology is reasonable. The expense allocated to Aquilex SRO for the Parent Company Management Equity Incentive Plan is not necessarily indicative of the expense that would have been incurred if Aquilex SRO had been a separate, independent entity and had otherwise a specific Parent Company Management Equity Incentive Plan at the Aquilex SRO level. No compensation expense has been recorded on Tranche II and Tranche III as no performance hurdles were met during 2012. Unrecognized compensation cost related to incentive equity units for the Parent Company of $2,948 is to be recognized over a weighted average period of 5 years. There was no cash impact for the incentive equity units in 2012.