Attached files

| file | filename |

|---|---|

| EX-4.6 - EXHIBIT 4.6 - Vuzix Corp | v347380_ex4-6.htm |

| EX-23.1 - EXHIBIT 23.1 - Vuzix Corp | v347380_ex23-1.htm |

| EX-10.66 - EXHIBIT 10.66 - Vuzix Corp | v347380_ex10-66.htm |

| EX-10.63 - EXHIBIT 10.63 - Vuzix Corp | v347380_ex10-63.htm |

| EX-10.65 - EXHIBIT 10.65 - Vuzix Corp | v347380_ex10-65.htm |

| EX-10.64 - EXHIBIT 10.64 - Vuzix Corp | v347380_ex10-64.htm |

| EX-10.62 - EXHIBIT 10.62 - Vuzix Corp | v347380_ex10-62.htm |

| EX-10.67 - EXHIBIT 10.67 - Vuzix Corp | v347380_ex10-67.htm |

| EX-1.1 - EXHIBIT 1.1 - Vuzix Corp | v347380_ex1-1.htm |

As filed with the Securities and Exchange Commission on June 10, 2013

Registration No. 333-185661

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VUZIX CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3577 (Primary Standard Industrial Classification Code Number) |

04-3392453 (I.R.S. Employer Identification Number) |

2166 Brighton Henrietta Townline Road

Rochester, NY 14623

585-359-5900

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Paul J. Travers

Chief Executive Officer

2166

Brighton Henrietta Townline Road

Rochester, NY 14623

585-359-5900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Gregory Sichenzia, Esq. Jeff Cahlon, Esq. |

Yvan-Claude Pierre, Esq. William Haddad, Esq. Reed Smith LLP 599 Lexington Avenue New York, New York 10022 Telephone: (212) 549-5400 Facsimile: (212) 521-5450 |

Approximate date of commencement of proposed sale to the public : As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer £ | Accelerated filer £ | |

| Non-accelerated filer £ (Do not check if a smaller reporting company) | Smaller reporting company S |

CALCULATION OF REGISTRATION FEE

| Title of Each Class

of Securities to be Registered |

Proposed

Maximum Aggregate Offering Price (1) |

Amount

of Registration Fee (2) |

||||||

| Common Stock, $0.001 par value per share (2)(3) | $ | 5,750,000 | $ | 784.30 | ||||

| Common Stock Purchase Warrants | 4,520 | 0.62 |

(4) | |||||

| Shares of Common Stock underlying Common Stock Purchase Warrants (2) (7) | 3,593,750 | 490.19 | ||||||

| Representative’s Common Stock Purchase Warrant | (5 | ) | ||||||

| Shares of Common Stock underlying Representative’s Common Stock Purchase Warrants (2) (6) | 312,500 | 42.63 | ||||||

| Total Registration Fee | 9,660,770 |

1,317.74 | * | |||||

(1) Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(o) under the Securities Act.

(2) Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

(3) Includes shares the underwriters have the option to purchase to cover over-allotments, if any.

(4) Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(i) under the Securities Act.

(5) No fee pursuant to Rule 457(g) under the Securities Act.

(6) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, based on an estimated proposed maximum aggregate offering price of $312,500, or 125% of $250,000 (5% of $5,000,000).

(7) There will be issued warrants to purchase shares of common stock. The warrants are exercisable at a per share price equal to [125%] of the public offering price.

* $3,952.95 was previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 10, 2013 |

Shares of Common Stock

Warrants to Purchase Shares of Common Stock

Vuzix Corporation is offering shares of our common stock and warrants to purchase up to an aggregate shares of our common stock. The warrants will have a per share exercise price of $__ [125% of public offering price of the common stock and warrants]. The warrants are exercisable immediately and will expire five years from the date of issuance.

Our common stock is quoted on the OTCQB under the symbol “VUZI”, on the TSX Venture Exchange, or TSX-V, under the symbol “VZX”, and on the Frankfurt Stock Exchange under the symbol “V7XN”. The underwriters have filed applications with FINRA to have our warrants quoted on the OTCQB. We expect to have the warrants quoted under the symbol “VUZIW”. We have applied to list the shares of common stock offered under this prospectus on the TSX-V and will apply to list any additional shares of common stock issued upon the exercise of the related warrants on the TSX-V. Listing of our common stock offered hereunder on the TSX-V will be subject to fulfilling all of the requirements of the TSX-V. No assurance can be given that our applications will be approved. On June 8, 2013, the last reported sale price for our common stock on the OTCQB was $6.45 per share.

Our business and an investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Per Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discount (1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

(1) The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 73 of this prospectus for a description of the compensation payable to the underwriters.

The underwriters may also purchase up to an additional shares of common stock and/or warrants from us at the public offering price, less the underwriting discount, within 45 days from the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the shares and warrants against payment therefor on or about , 2013.

Aegis Capital Corp

, 2013

TABLE OF CONTENTS

| Page | ||

| Prospectus Summary | 1 | |

| Risk Factors | 10 | |

| Cautionary Note Regarding Forward-Looking Statements and Industry Data | 25 | |

| Use of Proceeds | 26 | |

| Price Range of Common Stock | 27 | |

| Dividend Policy | 28 | |

| Dilution | 29 | |

| Capitalization | 30 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 31 | |

| Business | 42 | |

| Management | 57 | |

| Security Ownership of Certain Beneficial Owners and Management | 67 | |

| Certain Relationships and Related Party Transactions | 68 | |

| Description of Securities | 70 | |

| Underwriting | 73 | |

| Legal Matters | 82 | |

| Experts | 82 | |

| Where You Can Find More Information | 82 | |

| Index to Condensed Consolidated Financial Statements (unaudited) | F-1 | |

| Index to Consolidated Financial Statements | F-14 |

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

| I |

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless otherwise stated or the context requires otherwise, references in this prospectus to “Vuzix”, the “Company”, “we”, “us”, or “our” refer to Vuzix Corporation.

VUZIX CORPORATION

Business Overview

We are engaged in the design, manufacture, marketing and sale of wearable display products for use as an alternative private display solution in markets where portability and high resolution are key. Our products, known commercially as Video Eyewear (also referred to as head mounted displays, wearable displays, video glasses, personal viewers, and near-eye displays) are worn like eyeglasses and contain micro video displays that offer users a portable high-quality viewing experience.

Our Video Eyewear products provide virtual large high-resolution screens, fit in a user’s pocket or purse and can be viewed practically anywhere, anytime. They enable the user to view video and digital content, such as movies, computer data, the Internet or video games. They can also be used for virtual reality and augmented reality applications where the wearer is either immersed in a computer generated world or has their real world view augmented with computer generated information or graphics. We produce both monocular and binocular Video Eyewear devices. Video Eyewear are designed to work with mobile electronic devices, such as smartphones, laptop computers, portable media players and gaming systems as well as remote displays for medical devices like digital endoscopes and ultrasound equipment. Historically, we focused on two markets: the consumer markets for gaming, education, entertainment and mobile video and the market for rugged mobile displays for defense, medical, commercial and industrial markets. In June 2012, we sold the assets (including equipment, tooling, certain patents and trademarks and sales of our proprietary Tac-Eye displays and night vision display electronics) that comprised our Tactical Defense Group, which sold and licensed products and provided services, directly and indirectly, to military organizations and defense and security organizations. We refer to these assets as the “TDG Assets”. Accordingly, we now focus primarily on the consumer, commercial and entertainment market.

Products

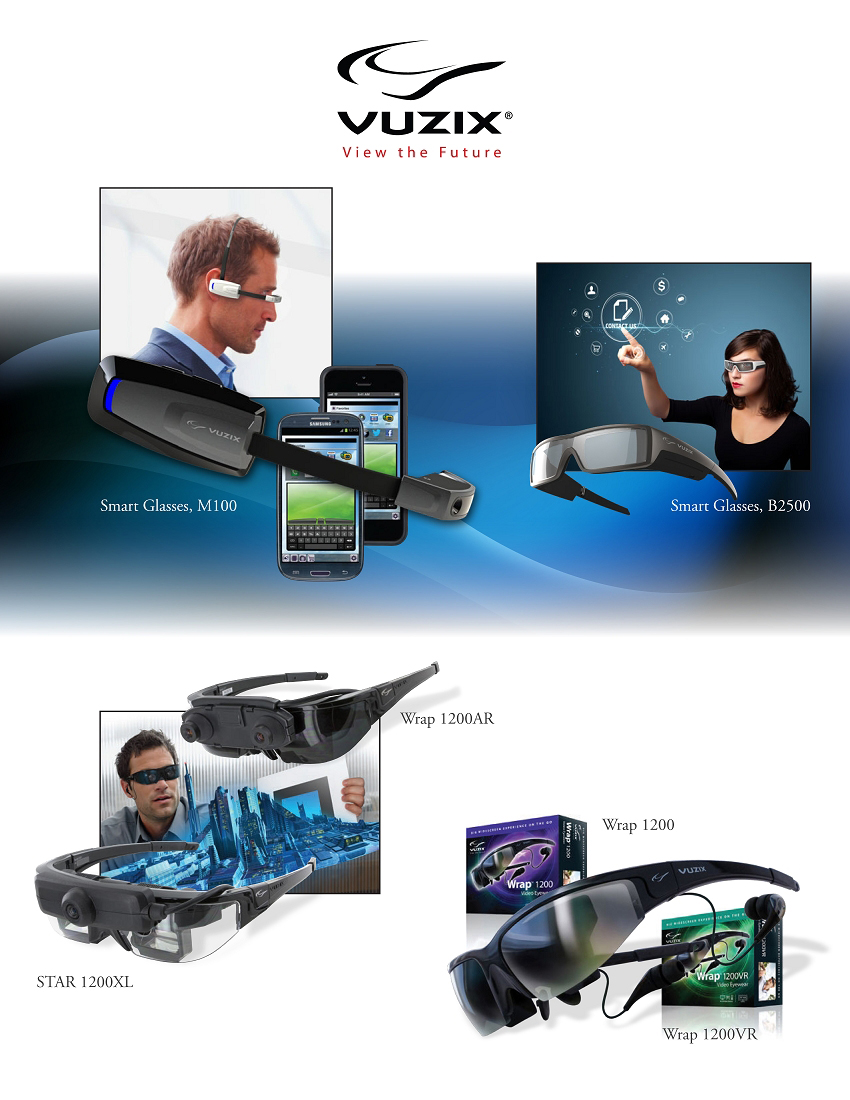

We produce and sell three main types of products: Video Eyewear (for on-the-go users as remote displays for mobile and hands-free use); Virtual Reality, or VR Video Eyewear (for stepping into virtual worlds, simulations & gaming); Augmented Reality, or AR Video Eyewear, (for overlaying virtual information from the cloud/internet onto the real world). Our products are available with varying features and include either monocular or binocular display systems. Starting in the third quarter of 2013, we intend to introduce “Smart Glasses” versions of all three types of our Video Eyewear that have many of the capabilities of a smartphone to allow applications to be run directly in the Video Eyewear enabling cloud-connected applications through a wireless link directly with the glasses. We believe we provide the broadest range of consumer Video Eyewear product offerings available in the market and that our products contain some of the most advanced electronics and optics for their target markets and uses. Our products include:

| 1 |

Binocular Video Eyewear Products

We currently produce a line of binocular Video Eyewear products called Wrap Video Eyewear. Introduced in the fall of 2009, they are the fourth generation of consumer focused Video Eyewear products that we have produced since 2005. Each Wrap model has a different apparent virtual display size and native resolution, all of which support 3D applications. Our binocular Video Eyewear products contain two microdisplays (a separate display for each eye), typically mounted in a frame attached to eyeglass-style temples. These products enable mobile and hands-free private viewing of video content on screens that simulate home theater-sized screens. Headphones are built into the temples so that users can listen to accompanying audio in full stereo. They can be employed as mobile high-resolution displays with products such as smartphones with video output capability, laptop computers, tablets, portable DVD players, game systems, and personal digital media/video players (video iPods).

We are developing, and intend to introduce in 2013, a line of advanced Smart Glasses Video Eyewear that have resolutions up to full high definition with wireless connectivity, ideal as a smartphone mobile display accessory, for cloud computing and for gaming. This advanced line of products will utilize our extremely thin and light weight see-through optics employed in fashion wear eyeglass frames.

Monocular Video Eyewear Products

We have offered monocular Video Eyewear products since 2003, when we introduced the M920. The monocular Video Eyewear products we have offered were designed to interface with various devices, including personal computers and Personal Digital Assistants (or PDAs). In or around June 2013, we intend to release our first waveguide based monocular head mounted displays (or HMD) that are fully enabled for AR use. The M2000AR will have gyros, accelerometers and magnetic field sensors, hi-resolution camera, HDMI interface, and see through optics that can be mounted to hardhats or goggles. Applications will include training, academic research, manufacturing, maintenance and other hands-free operations.

In the third quarter of 2013, we also intend to launch a new line of monocular Video Eyewear smart glasses designed for use with smartphones. We won a 2013 Consumer Electronics Show (or CES) Best of Innovations Design and Engineering award as the best new techonology in the wireless handset accessories category for our first Smart Glasses, the M100, which was demonstrated publicly at the January 2013 CES show. The M100 is a “hands-free display” much like today’s hands-free audio systems commonly used with cellphones for voice calls, but with many advanced features. The M100 has an added display, camera, GPS, motion sensors and wireless radios. Users control the M100 through use of the wirelessly connected smartphone or gesturing and speech recognition voice control. It runs the Android operating system, which allows for software applications with advanced functions ranging from browsing the Internet to augmented reality.

Engineering Solutions

We provide engineering services to third party customers ranging from near-eye display engines to full head mounted displays. When performing such work we typically obtain a first right of refusal to be the volume manufacturer of our proprietary display subassemblies in our contracts for the custom design of products. Historically most of this work has been for the U.S. Government; however, we do perform engineering services for commercial and industrial users. The agreement for the sale of the TDG Assets limits our ability to sell research and development services for the military, defense and security markets, such that we can sell such services only to the U.S. government and only for waveguide and waveguide display engine development.

Recent Developments

On June 15, 2012, we entered into an Asset Purchase Agreement with TDG Acquisition Company, LLC pursuant to which we sold the TDG Assets. The TDG Assets included equipment, tooling, certain patents and trademarks and our proprietary Tac-Eye displays and night vision display electronics, which comprised our tactical defense group, which engaged in the business of selling and licensing products and providing services, directly and indirectly, to military organizations and defense organizations. We received a worldwide, royalty free, assignable grant-back license to all the patents and other intellectual property sold, for use in the manufacture and sale of products for the consumer markets. We retained the right to sell goods and services to the TDG purchaser and into all markets other than the military, defense and security markets. Under our agreement with the purchaser, it is allowed to sell its goods and services in all markets other than the consumer market or to end users.

| 2 |

The purchase price paid to us consists of 2 components: $8,500,000 less $154,207 in adjustments, or $8,345,793, which was paid at closing, and up to an additional $2.5 million, which will be paid to us only if the purchaser achieves certain quarterly and annual revenue targets within the first 12 months from sales of goods and services to military organizations and defense and security organizations. The purchase price was determined by arm’s length negotiations between the parties.

In connection with the Asset Purchase Agreement, we entered into a letter agreement, dated as of June 15, 2012, with LC Capital Master Fund Ltd., the senior lender under our convertible loan and security agreement, dated December 23, 2010, and promissory note and security agreement, dated May 19, 2012, pursuant to which it consented to the sale of the TDG Assets (as required by the terms of our existing loan agreements), and paid it $4,450,000 in reduction of our obligations. Following such payment, we executed a new note for $619,122, which represents the remaining obligation under this loan. The new note carries interest at a rate of 13.5% (18.5% if in default) and repayment is due in 12 equal payments commencing on October 15, 2012. We also agreed to use 40% of any of the earn-out received under the Asset Purchase Agreement in reduction of this note. We are in default under the loan agreement with the senior lender for failure to make required principal payments totaling $154,781. We are currently in negotiations with the senior lender to have the senior lender grant a waiver or enter into a forbearance agreement, under which it would forebear from enforcing its remedies against us. There is no assurance the senior lender will agree to grant a waiver or enter into a forbearance agreement. Our senior lender is currently able to exercise its remedies under the loan agreement, including acceleration of the amounts due and foreclosure and sale of the collateral held by it.

On February 6, 2013, we effected a one-for-seventy five reverse stock split of our outstanding common stock. Unless otherwise indicated, all historical and pro forma common stock and per share data in this prospectus have been retroactively restated to account for the reverse stock split.

On March 21, 2013 we entered into a Securities Purchase Agreement with Hillair Capital Management L.P. (Hillair), pursuant to which, on March 27, 2013, we issued to Hillair a secured convertible debenture in the amount of $800,000. The debenture bears interest at a rate of 16% per year, payable quarterly in cash or shares of common stock at our option. Commencing on February 1, 2014, we will be required to redeem a certain amount under the debenture on a periodic basis in an amount equal to $200,000 on each of February 1, 2014, May 1, 2014 and August 1, 2014 and $50,000 on each of August 1, 2015, August 1, 2016, August 1, 2017 and March 21, 2018, the debenture’s maturity date, which we may make in cash or common stock at our option subject to certain conditions. The debenture is convertible into shares of our common stock at a conversion price of $4.29 per share. In connection with the debenture issuance, we also issued to Hillair five-year warrants to purchase 186,480 shares of our common stock at an exercise price of $4.72 per share. Upon closing of this transaction, we retained Gentry Capital Advisors LLC (Gentry) as a financial advisor and agreed to pay Gentry a fee of $50,000 over a period of 4 months commencing upon the closing of the debenture issuance. We also issued to Gentry five-year warrants to purchase 20,000 shares of common stock at an exercise price of $4.72 per share. The warrants issued to each of Hillair and Gentry (and shares issuable upon exercise thereof) are not being registered on the registration statement of which this prospectus forms a part.

On March 27, 2013, we entered into a debt conversion agreement, and on March 31, 2013 and June 10, 2013, we entered into amendments thereto (as amended, the VTI Agreement) with Vast Technologies, Inc. (VTI). Pursuant to the VTI Agreement, VTI agreed to convert its outstanding secured promissory note, in the principal amount of $838,096 (as of December 31, 2012), together with accrued interest thereon (equal to $119,051 as of December 31, 2012) into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, subject to the closing of this offering by June 30, 2013, at a conversion price equal to the public offering price, subject to approval of the TSX Venture Exchange. We agreed to prepare and file with the Securities and Exchange Commission (SEC), within 30 days of such conversion, a registration statement for the resale of the shares of common stock issuable upon such conversion and upon exercise of such warrants, and to cause such registration statement to be declared effective by the SEC within 90 days of such conversion.

On March 27, 2013, we entered into a debt conversion agreement, and on April 1, 2013 and June 10, 2013, we entered into amendments thereto (as amended, the Kopin Agreement) with Kopin Corporation (Kopin). Pursuant to the Kopin Agreement, Kopin agreed to convert its outstanding secured promissory note, in the principal amount of $482,547 (as of December 31, 2012), together with accrued interest thereon (equal to $60,996 as of December 31, 2012) into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, subject to the closing of this offering by June 30, 2013, at a conversion price equal to the public offering price, subject to approval of the TSX Venture Exchange. We agreed to prepare and file with the SEC, within 30 days of such conversion, a registration statement for the resale of the shares of common stock issuable upon such conversion and upon exercise of such warrants, and to cause such registration statement to be declared effective by the SEC within 90 days of such conversion.

On March 27, 2013, we entered into a debt conversion agreement, and on March 31, 2013 and June 10, 2013, we entered into amendments thereto (as amended, the Travers Debt Conversion Agreement) with Paul Travers, our chief executive officer. Pursuant to the Travers Debt Conversion Agreement, Mr. Travers agreed to convert his outstanding secured promissory notes, in the aggregate principal amount of $434,927, together with accrued interest thereon (equal to $231,525 as of December 31, 2012), into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, subject to the closing of this offering by June 30, 2013, at a conversion price equal to the public offering price, subject to approval of the TSX Venture Exchange. We agreed to prepare and file with the SEC, within 30 days of such conversion, a registration statement for the resale of the shares of common stock issuable upon such conversion and upon exercise of such warrants, and to cause such registration statement to be declared effective by the SEC within 90 days of such conversion.

On March 27, 2013, we entered into a deferred compensation deferral and conversion option agreement, and on June 10, 2013 we entered into an amendment thereto (as amended, the Travers Deferred Compensation Agreement) with Paul Travers, which agreement is subject to the closing of this offering by June 30, 2013, and which agreement is effective upon such closing. Pursuant to the Travers Deferred Compensation Agreement, Mr. Travers and we agreed that, unpaid salary owed to Mr. Travers, in the amount of $815,168 (including $268,536 in accrued interest, as of December 31, 2012), will be converted into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, at a conversion price equal to the offering price of this offering, subject to approval of the TSX Venture Exchange. We granted to Mr. Travers piggyback and demand registration rights with respect to the shares of common stock issuable upon such conversion and upon exercise of such warrants.

On March 27, 2013, we entered into a deferred compensation deferral and conversion option agreement, and on June 10, 2013 we entered into an amendment thereto (as amended, the Russell Deferred Compensation Agreement) with Grant Russell, our chief financial officer, which agreement is subject to the closing of this offering by June 30, 2013, and which agreement is effective upon such closing. Pursuant to the Russell Deferred Compensation Agreement, Mr. Russell and we agreed that, unpaid salary owed to Mr. Russell, in the amount of $637,567 (including $174,102 in accrued interest, as of December 31, 2012), will be converted into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, , at a conversion price equal to the offering price of this offering, subject to approval of the TSX Venture Exchange. We granted to Mr. Russell piggyback and demand registration rights with respect to the shares of common stock issuable upon such conversion and upon exercise of such warrants.

On March 29, 2013, we entered into a conversion/exchange agreement, and on June 10, 2013 we entered into an amendment thereto (as amended, the LC Capital Agreement) with LC Capital Master Fund Ltd. (LC Capital). Pursuant to the LC Capital Agreement, LC Capital agreed, subject to the closing of this offering for gross proceeds of at least $5,000,000, to convert its outstanding convertible note, in the principal amount of $619,122, together with accrued interest thereon (equal to $22,907 as of March 29, 2013), into shares of our common stock and warrants to purchase shares of our common stock with the same terms as the warrants offered in this offering, at a conversion price equal to, in LC Capital’s option, the public offering price of this offering, or pursuant to the terms of the convertible note. LC Capital also agreed subject to the closing of this offering, to exchange outstanding warrants to purchase 533,333 shares of our common stock into the greater of (a) 200,000 shares of our common stock, or (B) the Black Scholes value of the warrants (calculated using the Bloomberg OV function) as of the date of the pricing of this offering based upon the per share offering price. We agreed to prepare and file with the SEC, within 45 days of such conversion and exchange, a registration statement for the resale of the shares of common stock issuable upon such conversion and exchange, and upon exercise of such warrants, and to cause such registration statement to be declared effective by the SEC within 90 days of such conversion and exchange. LC Capital may terminate the LC Capital Agreement if the closing of such conversion and exchange does not occur by June 30, 2013.

| 3 |

Our Business Strategy

Our strategy is to establish and maintain a leadership position as a worldwide supplier of Video Eyewear and other virtual display technology solutions. We intend to offer our technologies across major markets, platforms and applications. We will strive to be an innovator in designing near-eye virtual display devices that enable new mobile video viewing, information access as well as general entertainment, VR and AR applications.

To maintain and enhance our position as a leading provider of near-eye virtual display solutions, we intend to:

| • | develop products for large consumer markets; |

| • | improve our brand name recognition; |

| • | maintain and exploit any cost advantage our technology can provide us; |

| • | extend our proprietary technology leadership; |

| • | broaden and develop strategic relationships and partnerships including offering to sell our products or license our technologies to third parties; |

| • | expand market awareness for Video Eyewear including Smart Glasses for AR; and |

| • | establish multiple revenue sources from markets, products and related software applications. |

Risks Associated With Our Business

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| · | Because our financial statements for 2012 include an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, we may not be able to obtain any necessary financing. |

| · | We have incurred net losses since our inception and if we continue to incur net losses in the foreseeable future the market price of our common stock may decline. |

| · | We are in default under our loan agreement with our senior lender. As a result, the senior lender could foreclose on our assets, which ultimately could require us to curtail or cease operations. |

| · | We have depended on defense related engineering contracts and the sales of specialized products to defense customers, each of whom is a supplier to the U.S. government and as a result of the sale of the TDG Assets in June 2012, our sales and our revenues have materially declined and may not return to their prior levels or increase unless we develop new markets and products. |

| · | Our lack of long-term purchase orders and commitments from our customers may lead to a rapid decline in our sales and profitability. |

| · | If any of our major customers on whom we depend fails to pay us amounts owed in a timely manner, we could suffer a significant decline in cash flow and liquidity which, in turn, could cause us to fail to pay our liabilities and render us unable to purchase adequate inventory to sustain or expand our sales volume. |

| · | Our future growth and profitability may be adversely affected if our marketing initiatives are not effective in generating sufficient levels of brand awareness. |

| · | If we fail to accurately forecast seasonal demand for our consumer Video Eyewear products, our results of operations for the entire fiscal year may be materially adversely affected. |

| · | Our products require ongoing research and development and we may experience technical problems or delays and we may not have the funds necessary to continue their development, which could lead our business to fail. |

| · | Increased competition may result in decreased demand or lower prices for our products. |

| · | We depend on advances in technology by other companies and if those advances do not materialize, some of our anticipated new products could be delayed or cancelled. |

| · | We depend on third parties to provide integrated circuit chip sets and other critical components for use in our products. |

| 4 |

| · | In preparing our consolidated financial statements, our management determined that our disclosure controls and procedures and internal controls were ineffective as of December 31, 2012 which could result in material misstatements in our financial statements. |

| · | If we fail to keep pace with changing technologies, our business and results of operations may be materially adversely affected. |

| · | If microdisplay-based personal displays do not gain some reasonable level of acceptance in the market for mobile displays, our business strategy may fail. |

| · | There are a number of competing providers of microdisplay-based personal display technology and we may fail to capture a substantial portion of the personal display market. |

| · | Our business and products are subject to government regulation and we may incur additional compliance costs or, if we fail to comply with applicable regulations, may incur fines or be forced to suspend or cease operations. |

| · | Our products will likely experience rapidly declining unit prices and we may not be able to offset that decline with production cost decreases or higher unit sales. |

| · | If we cannot obtain and maintain appropriate patent and other intellectual property rights protection for our technology, our business will suffer. |

| · | Our products could infringe on the intellectual property rights of others. |

| · | If we lose our rights under our third-party technology licenses, our operations could be adversely affected. |

| · | Our business may expose us to product liability claims for damages resulting from the design or manufacture of our products. Product liability claims, whether or not we are ultimately held liable for them, could have a material adverse effect on our business and results of operations. |

| · | Our products may be subject to future health and safety regulations that could increase our development and production costs. |

| · | Our dependence on sales to distributors increases the risks of managing our supply chain and may result in excess inventory or inventory shortages. |

| · | Our operating results may be adversely impacted by worldwide political and economic uncertainties and specific conditions in the markets we address. |

| · | Our results of operations may suffer if we are not able to successfully manage our increasing exposure to foreign exchange rate risks. |

| · | Due to our significant level of international operations, including the use of foreign contract manufactures, we are subject to international operational, financial, legal and political risks which could harm our operating results. |

| · | We may lose the services of key management personnel and may not be able to attract and retain other necessary personnel. |

| · | Our failure to effectively manage growth could harm our business. |

| · | Our facilities and information systems and those of our key suppliers could be damaged as a result of disasters or unpredictable events, which could have an adverse effect on our business operations. |

| 5 |

| · | A failure of our information technology systems could materially adversely affect our business. |

| · | A breach of our cyber security systems could materially adversely affect our business. |

| · | Terrorism and the uncertainty of future terrorist attacks or war could reduce consumer confidence which could adversely affect our operating results. |

| · | We do not manufacture our own microdisplays, one of the key components of our Video Eyewear products, and we may not be able to obtain the microdisplays we need. |

| · | The consumer electronics industry is subject to significant fluctuations in the availability of components. If we do not properly anticipate the need for critical components, we may be unable to meet the demands of our customers and end-users. |

| · | Unanticipated disruptions in our operations or slowdowns by our suppliers, distributors and shipping companies could adversely affect our ability to deliver our products and service our customers. |

| · | The price of our common stock has been highly volatile and an investment in our common stock could suffer a decline in value. |

| · | Because our common stock is listed on the TSX Venture Exchange and not on any U.S. national exchange, investors in the United States may find it difficult to buy and sell our shares. |

| · | The rights of holders of common stock may be impaired by the possible future issuance of preferred stock. |

| · | The warrants are speculative in nature. |

| · | Our management will have broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree. |

| · | Additional stock offerings in the future may dilute your percentage ownership of our company. |

| · | We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on your investment will likely be limited to the value of our common stock. |

| · | If our common stock becomes subject to the SEC's penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected. |

| · | If management continues to own a significant percentage of our outstanding common stock, management may prevent other stockholders from influencing significant corporate decisions. |

| · | You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future. |

Company Information

We were incorporated in Delaware in 1997 as VR Acquisition Corp. In 1997, we changed our name to Kaotech Corporation. In 1998, we changed our name to Interactive Imaging Systems, Inc. In 2004, we changed our name to Vicuity Corporation and then to Icuiti Corporation. In September 2007, we changed our name to Vuzix Corporation.

Our principal executive offices are located at 2166 Brighton Henrietta Townline Road, Rochester, New York 14623. Our telephone number is (585) 359-5900. We maintain an Internet website at www.vuzix.com . The information contained on, connected to or that can be accessed via our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference only and not as an active hyperlink.

| 6 |

Summary of the Offering

| Securities offered by us | shares of common stock and warrants to purchase shares of common stock ( shares and warrants if the underwriters exercise their over-allotment option in full) | |

| Common Stock to be outstanding after this offering | shares ( if the warrants are exercised in full). If the underwriters’ over-allotment option is exercised in full, the total number of shares of common stock outstanding immediately after this offering would be ( if the warrants are exercised in full). | |

| Description of Warrants | The warrants will have a per share exercise price equal to $ [125% of public offering price of the common stock and warrants]. The warrants are exercisable immediately and expire five years from the date of issuance | |

| Use of proceeds | We expect to use the net proceeds received from this offering to complete commercialization of our smart glasses and waveguide optic technologies, repayment of debt in the amount of approximately $502,000 and for working capital and general corporate purposes. See “Use of Proceeds” on page 26. | |

| Risk factors | See “Risk Factors” beginning on page 10 and the other information included in this prospectus for a discussion of factors you should carefully consider before investing in our securities. | |

| OTCQB, TSX Venture Exchange and Frankfurt Stock Exchange trading symbols of common stock | VUZI, VZX, and V7XN, respectively. | |

| Proposed symbol and listing of common stock and warrants |

We have applied to list the shares of common stock offered under this prospectus on the TSX-V and will apply to list any additional shares of common stock issued upon the exercise of the related warrants on the TSX-V. Listing of the common stock offered hereunder on the TSX-V will be subject to fulfilling all the requirements of the TSX-V. There can be no assurance that we will fulfill all such requirements. |

Unless we indicate otherwise, all information in this prospectus:

| · | is based on 3,536,865 shares of common stock issued and outstanding as of June 7, 2013; |

| · | includes all historical and pro forma common stock and per share data in this prospectus that have been retroactively restated to account for the reverse split of our outstanding common stock, effected on February 6, 2013; |

| · | assumes no exercise by the underwriters of their option to purchase up to an additional shares of common stock and/or warrants to cover over-allotments, if any; |

| · | excludes 192,729 shares of our common stock issuable upon exercise of outstanding stock options under our stock incentive plans at a weighted average exercise price of $10.68 per share as of June 7, 2013; |

| · | excludes 45,000 shares of our common stock issuable upon exercise of options which we intend to grant under our stock incentive plan to our three non-employee directors at the closing of this offering at an exercise price equal to the offering price; | |

| · | excludes 329,788 shares of our common stock issuable upon exercise of outstanding warrants (not including warrants to purchase 533,333 shares of common stock which will be exchanged for common stock following the closing of this offering) at a weighted average exercise price of $5.82 per share as of June 7, 2013; |

| · | excludes 186,480 shares of our common stock issuable upon conversion of outstanding convertible debt at a conversion price of $4.29 per share as of June 7, 2013; |

| · | excludes shares of our common stock which we will issue in exchange for the cancellation of 533,333 warrants to purchase shares of our common stock following completion of this offering, in an amount which will be equal to the greater of (i) 200,000, or (ii) the Black Scholes value of the warrants (calculated using the Bloomberg OV function) as of the date of the pricing of this offering based upon the per share offering price); |

| · | excludes shares of common stock and shares of common stock underlying warrants with the same terms as the warrants offered in this offering issuable upon conversion of $2,870,642 in outstanding secured debt and accrued interest thereon, which the holders have agreed to convert to common stock and warrants at a conversion price equal to the offering price upon the closing of this offering. | |

| · | excludes shares of common stock and shares of common stock underlying warrants with the same terms as the warrants offered in this offering issuable upon the conversion of $1,532,051 in outstanding long-term accrued compensation and accrued interest which our officers have agreed to convert into common stock and warrants at a conversion price equal to the offering price upon the closing of this offering; and |

| · | excludes shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering. |

| 7 |

Summary Consolidated Financial Data

The following tables set forth our (i) summary statement of operations data for the years ended December 31, 2012 and 2011 and the three months ended March 31, 2013 and 2012 (unaudited) and (ii) summary balance sheet data as of December 31, 2012 and 2011 and March 31, 2013 (unaudited) derived from our audited and unaudited consolidated financial statements and accompanying notes appearing elsewhere in this prospectus. The unaudited summary financial data as of March 31, 2013 and for the three months ended March 31, 2013 and 2012 include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our financial position and results of operations for these periods. The operating results of our former TDG Assets business, sold on June 15, 2012, have been classified and presented as discontinued operations in the accompanying unaudited and audited consolidated financial statements. Prior period operating results have been adjusted to conform to this presentation. No other adjustments have been made to the unaudited consolidated financial statements or notes thereto. The results set forth below are not necessarily indicative of our future performance.

You should read this information together with the section entitled “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and accompanying notes appearing elsewhere in this prospectus.

| Statement of | Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||

| Operations Data | 2012 | 2011 | 2013 | 2012 | ||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Sales | $ | 3,228,228 | $ | 4,825,663 | $ | 739,184 | $ | 1,110,041 | ||||||||

| Cost of Sales | 2,341,026 | 3,614,821 | 337,387 | 750,958 | ||||||||||||

| Gross Margin | 887,202 | 1,210,842 | 401,797 | 359,083 | ||||||||||||

| Operating Expenses | ||||||||||||||||

| Research and development | 1,153,403 | 1,340,973 | 317,695 | 247,338 | ||||||||||||

| Selling and marketing | 1,225,154 | 1,647,105 | 274,743 | 354,706 | ||||||||||||

| General and administrative | 2,181,310 | 2,590,636 | 416,686 | 562,591 | ||||||||||||

| Depreciation, Amortization and Patent Impairment | 533,520 | 504,088 | 98,348 | 145,095 | ||||||||||||

| Total operating expenses | 5,093,387 | 6,082,802 | 1,107,472 | 1,309,730 | ||||||||||||

| (Loss) from Continuing Operations | (4,206,185 | ) | (4,871,960 | ) | (705,675 | ) | (950,647 | ) | ||||||||

| Taxes and Other Income (Expense) | ||||||||||||||||

| Interest and other income (expense) | 232 | 1,182 | — | 48 | ||||||||||||

| Foreign exchange (loss) gain | (11,111 | ) | (35,770 | ) | (13,070 | ) | (4,942 | ) | ||||||||

| Loss on Derivative Valuation | (14,287 | ) | — | |||||||||||||

| Amortization of Senior Debt Discount | (9,728 | ) | — | |||||||||||||

| Interest expense | (509,925 | ) | (398,629 | ) | (179,842 | ) | (95,049 | ) | ||||||||

| Tax (expense) benefit | (20,398 | ) | (27,689 | ) | (13,696 | ) | (17,002 | ) | ||||||||

| Total tax and other income (expense) | (541,202 | ) | (460,906 | ) | (216,927 | ) | (99,943 | ) | ||||||||

| Net (Loss) from Continuing Operations | (4,747,387 | ) | (5,332,866 | ) | (936,298 | ) | (1,067,592 | ) | ||||||||

| Income (Loss) from Discontinued Operations | (747,580 | ) | 1,453,285 | — | 223,109 | |||||||||||

| Gain (Loss) on Disposal of Discontinued Operations, net of tax | 5,817,807 | — | — | — | ||||||||||||

| Net Income(Loss) | $ | 322,840 | $ | (3,879,581 | ) | $ | (936,298 | ) | $ | (844,483 | ) | |||||

| Earnings (Loss) per Share from Continued Operations | ||||||||||||||||

| Basic | $ | (1.34 | ) | $ | (1.52 | ) | $ | (0.26 | ) | $ | (0.30 | ) | ||||

| Diluted* | (1.34 | ) | $ | (1.52 | ) | (0.26 | ) | (0.30 | ) | |||||||

| Earnings (Loss) per Share | ||||||||||||||||

| Basic | $ | 0.09 | $ | (1.10 | ) | $ | (0.26 | ) | $ | (0.24 | ) | |||||

| Diluted | 0.09 | $ | (1.10 | ) | (0.26 | ) | (0.24 | ) | ||||||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic | 3,536,865 | 3,518,333 | 3,536,865 | 3,536,865 | ||||||||||||

| Diluted | 3,651,100 | 4,193,282 | 3,536,865 | 3,536,865 | ||||||||||||

| 8 |

· All outstanding warrants, options, and convertible debt are anti-dilutive, therefore basic and diluted earnings per share are the same for all periods. All outstanding share amounts reflect our 1-for-75 reverse stock split, which was effective February 6, 2013.

| As of December 31, | As of March 31, | |||||||||||||||

| Balance Sheet Data | 2012 | 2011 | 2013 | 2013

Pro Forma, as adjusted |

||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Cash and cash equivalents | $ | 66,554 | $ | 417,976 | $ | 532,426 | $ | 3,930,426 | ||||||||

| Working Capital (deficiency) | (3,940,974 | ) | (6,052,282 | ) | (4,882,459 | ) | 197,870 | |||||||||

| Total Assets | 2,425,948 | 5,818,697 | 3,084,035 | 6,239,395 |

||||||||||||

| Long-Term Liabilities | 3,484,865 | 2,454,757 | 3,548,350 | 223,146 | ||||||||||||

| Accumulated (deficit) | (26,146,304 | ) | (26,469,144 | ) | (27,082,603 | ) | (27,082,603 | ) | ||||||||

| Total Stockholders’ equity (deficit) | (6,209,565 | ) | (6,824,748 | ) | (7,059,913 | ) | 1,242,779 | |||||||||

(1) Pro forma, as adjusted amounts give effect to (i) the conversion of $2,870,642 in aggregate principal amount of promissory notes then outstanding, together with all interest accrued and unpaid thereon through the date of conversion, upon completion of this offering; (ii) the conversion of $1,532,051 in aggregate principal of accrued compensation then outstanding, together with all interest accrued and unpaid thereon through the date of conversion, into common stock and warrants to purchase common stock, at the assumed public offering price of $6.36 per share, which is based on the closing price of our common stock on June 6, 2013, upon completion of this offering; (iii) the sale of the common stock and warrants in this offering at the assumed public offering price of $6.36 per share, which is based on the closing price of our common stock on June 6, 2013, and $0.01 per warrant, and (iv) the repayment of approximately $502,000 in other notes payable, accrued interest and bank loans from the net proceeds received in this offering, and after deducting underwriting discounts and commissions and other estimated offering expenses payable by us.

| 9 |

RISK FACTORS

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business

Because our financial statements for 2012 include an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, we may not be able to obtain any necessary financing .

The independent registered public accounting report for our consolidated financial statements for the year ended December 31, 2012 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. This "going concern" paragraph may have an adverse effect on our ability to obtain financing for operations and to further develop and market products. If we are not able to obtain adequate financing when and in the amounts needed in the near future, and on terms that are acceptable, our operations, financial condition and prospects could be materially and adversely affected, and our ability to continue as a going concern is in substantial doubt.

Our plans with respect to addressing these matters are discussed in greater detail under “Management’s Discussion and Analysis of Financial Conditional and Results of Operations—Liquidity and Capital Resources” and in Note 3 to our consolidated financial statements. Our future viability is dependent on our ability to execute these plans successfully and the successful closing of this offering. If we fail to do so for any reason, we would not have adequate liquidity to fund our operations, would not be able to continue as a going concern and could be forced to seek relief through a filing under U.S. Bankruptcy Code.

We have incurred net losses since our inception and if we continue to incur net losses in the foreseeable future the market price of our common stock may decline.

We reported a net loss of $936,298 for the quarter ending March 31, 2013, and we reported net income of $322,840 for the year ended December 31, 2012 and a net loss of $3,879,581 for the year ended December 31, 2011. The net income for 2012 included a gain on the sale of the TDG Assets of $5,817,807. We have an accumulated deficit of $27,082,603 as of March 31, 2013.

We may not achieve or maintain profitability in the future. In particular, we expect that our expenses relating to sales and marketing and product development and support, as well as our general and administrative costs, may increase, requiring us to increase sales in order to achieve and maintain profitability. If we do not achieve and maintain profitability, our financial condition will be materially and adversely affected. We would eventually be unable to continue our operations unless we were able to raise additional capital. We may not be able to raise any necessary capital on commercially reasonable terms or at all. If we fail to achieve or maintain profitability on a quarterly or annual basis within the timeframe expected by investors, the market price of our common stock may decline.

We are in default under our loan agreement with our senior lender. As a result, the senior lender could foreclose on our assets, which ultimately could require us to curtail or cease operations.

We are in default under our loan agreement with our senior lender for failure to make required principal and interest payments totaling $333,424 as of March 31, 2013 and a breach of the covenant that requires us to maintain minimum levels of cash balances. As of March 31, 2013 the outstanding loan balance with accrued interest totaled $642,984. We have had periodic negotiations with the senior lender to have it grant a waiver or enter into a forbearance agreement, under which it would forebear from enforcing its remedies against us. There is no assurance the senior lender will agree to grant a waiver or enter into a forbearance agreement. This senior lender is currently able to exercise its remedies under the loan agreement, including acceleration of the amounts due and foreclosure and sale of the collateral held by it. Even if we receive a waiver or enter into a forbearance agreement, it is uncertain whether we will be able to meet the conditions contained in any such waiver or forbearance agreement. If we remain in default under the loan agreement, the senior lender could foreclose on its collateral and commence legal action against us to recover the amounts due which ultimately could require the disposition of some or all of our assets. Any such action could require us to curtail or cease operations.

| 10 |

We have depended on defense related engineering contracts and the sales of specialized products to defense customers, each of whom is a supplier to the U.S. government and as a result of the sale of the TDG Assets in June 2012, our sales and our revenues have materially declined and may not return to their prior levels or increase unless we develop new markets and products.

Since inception, a substantial portion of our sales have been derived from the sale of night vision display drive electronics to two suppliers to the U.S. government. Sales of night vision display drive electronics to these customers amounted to 10% and 20% of our sales in 2012 and 2011, respectively and are reported in revenues from discontinued operations. As a result of our sale of the TDG Assets, we no longer sell night vision display drive electronics, which has materially reduced our revenue and cash flow and could materially adversely affect our ability to achieve or maintain profitability in the future.

The next largest source of our revenues has been sales directly to the U.S. Department of Defense, primarily for research and development engineering programs. Such sales amounted to 11% and 21% of our sales in 2012 and 2011, respectively and portions of this revenue have been reported in revenues from discontinued operations. As a result of the sale of the TDG Assets, we will no longer be performing general engineering services for the U.S. Government and/or its defense contractors, but rather only waveguide related services, unless so requested by the buyer of the TDG Assets. Under our Asset Purchase Agreement with the purchaser of the TDG Assets, all future U.S. government sales of waveguide development and related engineering services by us must be approved by the buyer. We have no long-term contracts with the U.S. government for engineering services on our waveguide technologies. We expect to submit proposals for additional development contract funding in cooperation with the buyer. However, development contract funding is subject to legislative authorization and, even if funds are appropriated, such funds may be withdrawn based on changes in government priorities.

Together, these two groups of defense related customers accounted for 21% and 41% of our total revenues in 2012 and 2011, respectively with the majority of this revenue reported as revenues from discontinued operations. We will not be receiving further night vision display electronics orders, due to the sale of those product lines and our agreement not to compete with the buyer of the TDG Assets. We may not be successful in obtaining new government waveguide research, development and engineering services programs or future waveguide based new product sales. Our inability to obtain sales from general non-waveguide related government engineering services contracts could have a material adverse effect on our results of operations and would likely cause us to delay or slow our growth plans, resulting in lower net sales than projected and adversely affecting our liquidity and profitability.

Our lack of long-term purchase orders and commitments from our customers may lead to a rapid decline in our sales and profitability.

All of our significant customers issue purchase orders solely in their own discretion, often shortly before the requested date of shipment. Our customers are generally able to cancel orders (without penalty) or delay the delivery of products on relatively short notice. In addition, our current customers may decide not to purchase products from us for any reason. If those customers do not continue to purchase our products, our sales volume and profitability could decline rapidly with little or no warning.

| 11 |

We cannot rely on long-term purchase orders or commitments to protect us from the negative financial effects of a decline in demand for our products. We typically plan our production and inventory levels based on internal forecasts of customer demand, which are highly unpredictable and can fluctuate substantially. The uncertainty of product orders makes it difficult for us to forecast our sales and allocate our resources in a manner consistent with our actual sales. Moreover, our expense levels and the amounts we invest in capital equipment and new product development costs are based in part on our expectations of future sales and, if our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls. Furthermore, because we have depended on a small number of customers for the majority of our sales, the ramifications of these risks is greater than if we had a greater number of customers. As a result of our lack of long-term purchase orders and purchase commitments, we may experience a rapid decline in our sales and profitability.

As a result of these and other factors, investors should not rely on our revenues and our operating results for any one quarter or year as an indication of our future revenues or operating results. If our quarterly revenues or results of operations fall below expectations of investors or public market analysts, the price of our common stock could fall substantially.

If any of our major customers on whom we depend fails to pay us amounts owed in a timely manner, we could suffer a significant decline in cash flow and liquidity which, in turn, could cause us to fail to pay our liabilities and render us unable to purchase adequate inventory to sustain or expand our sales volume.

Our accounts receivable represented approximately 13%, 14% and 26% of our total current assets as of March 31, 2013, December 31, 2012 and 2011, respectively. As of March 31, 2013 one customer owed us just under 54% of our total accounts receivable. As of December 31, 2012, one customer owed us just under 47% of our total accounts receivable. At certain times there can be substantial amounts and concentrations of our accounts receivable, and if any of our major customers fails to pay us amounts owed in a timely manner, we could suffer a significant decline in cash flow and liquidity which could adversely affect our ability to pay our liabilities and to purchase inventory to sustain or expand our current sales volume and adversely affect our ability to continue our business.

In addition, the portions of our business sold through distributors and retail stores is characterized by long periods for collection from our customers and short periods for payment to our suppliers, the combination of which may cause us to have liquidity problems. We experience an average accounts settlement period ranging from one month to as high as two and half months from the time we deliver our products to the time we receive payment from our customers. In contrast, we typically need to place certain deposits and advances with our suppliers on a portion of the purchase price. Because our payment cycle is considerably shorter than our receivable collection cycle, we may experience working capital shortages. Working capital management, including prompt and diligent billing and collection, is an important factor in our results of operations and liquidity. System problems, industry trends, our customers’ liquidity problems or payment practices or other issues may extend our collection period, which would adversely impact our liquidity, our ability to pay our liabilities and to purchase inventory to sustain or expand our current sales volume, and adversely affect our ability to continue our business.

Our future growth and profitability may be adversely affected if our marketing initiatives are not effective in generating sufficient levels of brand awareness.

A significant portion of our sales have been derived from the sale of night vision display electronics and from research and development contracts with suppliers to, or directly with the U.S. government and other customers. As a result of the sale in June 2012 of the TDG Assets, our revenues from these sources will decline significantly or be eliminated, and our business plan contemplates a transition primarily to the consumer, commercial and industrial markets. Our future growth and profitability from our consumer, commercial and industrial products will depend in large part upon the effectiveness and efficiency of our marketing efforts, including our ability to:

| · | create awareness of our brand and products, including general awareness of this new Video Eyewear product category; |

| · | identify the most effective and efficient levels of spending for marketing expenditures in our new target market; |

| 12 |

| · | effectively manage marketing costs (including creative and media) in order to maintain acceptable operating margins and return on marketing investment; |

| · | successfully offer to sell our products or license our technology to third party companies for sale under their own brand name as OEM partners; |

| · | select the right markets in which to market our products; and |

| · | convert consumer awareness into actual product purchases. |

Our planned marketing expenditures may not result in increased total sales or generate sufficient levels of product and brand name awareness. We may not be able to manage our marketing expenditures on a cost-effective basis.

If we fail to accurately forecast seasonal demand for our consumer Video Eyewear products, our results of operations for the entire fiscal year may be materially adversely affected.

Historically, a high percentage of our consumer Video Eyewear product annual sales have been attributable to the winter holiday selling season. Like many manufacturers of consumer electronics products, we must make merchandising and inventory decisions for the winter holiday selling season well in advance of actual sales. Further compounding the difficulty of this forecasting are other fluctuations in demand for the consumer electronics products that work with our Video Eyewear products, often due to the same seasonal influences, as well as technological advances and new models which are often introduced later in the calendar year. Inaccurate projections of demand or deviations in the demand for our products may cause large fluctuations in our fourth quarter results and could have a material adverse effect on our results of operations for the entire fiscal year.

Our products require ongoing research and development and we may experience technical problems or delays and we may not have the funds necessary to continue their development, which could lead our business to fail.

Our research and development efforts remain subject to all of the risks associated with the development of new products based on emerging and innovative technologies, including, for example, unexpected technical problems or the possible insufficiency of funds for completing development of these products. If we experience technical problems or delays, further improvements in our products and the introduction of future products could be delayed, and we could incur significant additional expenses and our business may fail.

We anticipate that we will require additional funds to maintain our current levels of expenditure for research and development of new products and technologies, and to obtain and maintain patents and other intellectual property rights in these technologies, the timing and amount of which are difficult to forecast. Any funds we need may not be available on commercially reasonable terms or at all. If we cannot obtain the necessary additional capital when needed, we might be forced to reduce our research and development efforts which would materially and adversely affect our business. If we attempt to raise capital in an offering of shares of our common stock, preferred stock, convertible securities or warrants, our then-existing stockholders’ interests will be diluted.

Increased competition may result in decreased demand or lower prices for our products.

Competition in the consumer electronics display markets for our products is intense and we may not be able to compete successfully. We compete with several companies, most of whom are much larger than us, including entities that supply some of the key components used in our products. Our competitors could develop new technologies or products that may be superior to ours, including products that target markets in which our products are sold. Many of our existing and potential competitors have strong market positions, considerable internal manufacturing capacity, established intellectual property rights and substantial in-house technological capabilities. Furthermore, they also have greater financial, technical, manufacturing, and marketing resources than we do, and we may not be able to compete successfully with them.

| 13 |

We expect competition to increase. This could mean lower prices or reduced demand for our products. Any of these developments would have an adverse effect on our operating results.

We depend on advances in technology by other companies and if those advances do not materialize, some of our anticipated new products could be delayed or cancelled.

We rely on and will continue to rely on technologies (including microdisplays) that are developed and produced by other companies. The commercial success of certain of our planned future products will depend in part on advances in these and other technologies by other companies. We may, from time to time, contract with and support companies developing key technologies in order to accelerate the development of them for our specific uses. Such activities might not result in useful technologies or components for us. We are attempting to mitigate this risk by developing our own microdisplay technologies, but there can be no assurance that we will be successful in doing so.

We depend on third parties to provide integrated circuit chip sets and other critical components for use in our products.

We do not manufacture the integrated circuit chip sets, optics, backlights, printed circuit boards or other electronic components which are used in our products. Instead, we purchase them from third party suppliers or rely on third party independent contractors for these integrated circuit chip sets and other critical components, some of which are customized or specially made for us. We also may use third parties to assemble all or portions of our products. Some of these third party contractors and suppliers are small companies with limited financial resources. If any of these third party contractors or suppliers were unable or unwilling to supply these integrated circuit chip sets or other critical components to us, we would be unable to manufacture and sell our products until a replacement supplier could be found. We cannot assure investors that a replacement third party contractor or supplier could be found on reasonable terms or in a timely manner. Any interruption in our ability to manufacture and distribute our products could cause our display business to be unsuccessful and the value of investors’ investment in us may decline.

In preparing our consolidated financial statements, our management determined that our disclosure controls and procedures and internal controls were ineffective as of December 31, 2012 which could result in material misstatements in our financial statements.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934, as amended, or the Exchange Act. As of December 31, 2012, our management has determined that our disclosure controls and procedures and internal controls were ineffective because of material weaknesses including a financial reporting and close process that does not ensure accurate financial reporting on a timely basis, limited segregation of duties, lack of adequate monitoring of subsidiaries, and weaknesses in our inventory control.

We intend to implement remedial measures designed to address the ineffectiveness of our disclosure controls and procedures and internal controls, including the hiring of additional staff and the development, assessment, implementation and testing of the changes in controls and procedures that we believe are necessary to conclude that the material weakness has been remediated. If these remedial measures are insufficient to address the ineffectiveness of our disclosure controls and procedures and internal controls, or if material weaknesses or significant deficiencies in our internal control are discovered or occur in the future and the ineffectiveness of our disclosure controls and procedures and internal controls continues, we may fail to meet our future reporting obligations on a timely basis, our consolidated financial statements may contain material misstatements, we could be required to restate our prior period financial results, our operating results may be harmed, and we may be subject to class action litigation. Any failure to address the ineffectiveness of our disclosure controls and procedures could also adversely affect the results of the periodic management evaluations regarding the effectiveness of our internal control over financial reporting and our disclosure controls and procedures that are required to be included in our annual report on Form 10-K. Internal control deficiencies and ineffective disclosure controls and procedures could also cause investors to lose confidence in our reported financial information. We can give no assurance that the measures we plan to take in the future will remediate the ineffectiveness of our disclosure controls and procedures or that any material weaknesses or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or adequate disclosure controls and procedures or circumvention of these controls. In addition, even if we are successful in strengthening our controls and procedures, in the future those controls and procedures may not be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our consolidated financial statements.

| 14 |

If we fail to keep pace with changing technologies, our business and results of operations may be materially adversely affected.

Rapidly changing customer requirements, evolving technologies and industry standards characterize the consumer electronics, wireless phone, and display industries. To achieve our goals, we need to enhance our existing products and develop and market new products that keep pace with continuing changes in industry standards, requirements and customer preferences. If we cannot keep pace with these changes, our business could suffer. For example, the market segment for our new Smart Glass Video Eyewear, a hands-free cloud computing product that we are developing, may not develop or may take longer to develop than we anticipate which may impact our ability to grow revenues.

If microdisplay-based personal displays do not gain some reasonable level of acceptance in the market for mobile displays, our business strategy may fail.

The mobile display market is dominated by displays larger than one-inch, based on direct view liquid crystal display, or LCD and organic light emitting display, or OLED technology. A number of companies have made and continue to make substantial investments in, and are conducting research to improve characteristics of, small direct view LCDs. Many of the leading manufacturers of these larger direct view LCDs, including LG Electronics, Royal Philips Electronics, Samsung Electronics Co., Ltd., Sony Corporation and Sharp Corporation, are large, established companies with global marketing capabilities, widespread brand recognition and extensive financial resources. Advances in direct view LCD and OLED technology or other technologies may overcome their current limitations and permit them to remain or become more attractive technologies for personal viewing applications, which could limit the potential market for our Video Eyewear technology and cause our business strategy to fail.