UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): June 3, 2013

COLONIAL PROPERTIES TRUST

(Exact name of registrant as specified in its charter)

| Alabama | 1-12358 | 59-7007599 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

COLONIAL REALTY LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

| Delaware | 0-20707 | 63-1098468 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

2101 Sixth Avenue North, Suite 750, Birmingham, Alabama 35203

(Address of principal executive offices) (Zip Code)

(205) 250-8700

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

Colonial Properties Trust (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Mid-America Apartment Communities, Inc. (“MAA”), dated June 3, 2013. The Company and MAA issued a joint press release on June 3, 2013 announcing the execution of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In addition, the Company and MAA will host a conference call on Monday, June 3, 2013, at 7:30 a.m. Central regarding the proposed transaction during which they will discuss a presentation to analysts and investors. The slides to be used in connection with this analyst and investor presentation are attached hereto as Exhibit 99.2 and are incorporated herein by reference.

The information required by Item 1.01, including a copy of the Merger Agreement, will be filed in a separate Current Report on Form 8-K.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which Colonial Properties Trust and MAA operate and beliefs of and assumptions made by Colonial Properties Trust management and MAA management, involve uncertainties that could significantly affect the financial results of Colonial Properties Trust or MAA or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the anticipated benefits of the business combination transaction involving Colonial Properties Trust and MAA, including future financial and operating results, and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to expected synergies, improved liquidity and balance sheet strength — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, regional and local economic climates, (ii) changes in financial markets and interest rates, or to the business or financial condition of either company or business (iii) increased or unanticipated competition for our properties, (iv) risks associated with acquisitions, including the integration of the combined companies’ businesses, (v) maintenance of real estate investment trust (“REIT”) status, (vi) availability of financing and capital, (vii) risks associated with achieving expected revenue synergies or cost savings, (viii) risks associated with the companies’ ability to consummate the merger and the timing of the closing of the merger, and (ix) those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by Colonial Properties Trust and MAA from time to time, including those discussed under the heading “Risk Factors” in their respective most recently filed reports on Forms 10-K and 10-Q. Neither Colonial Properties Trust nor MAA undertakes any duty to update any forward-looking statements appearing in this document.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, MAA expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of MAA and Colonial Properties Trust that also constitutes a prospectus of MAA. MAA and Colonial Properties Trust also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by MAA and Colonial Properties Trust with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by MAA with the SEC will be available free of charge on MAA’s website at www.maac.com or by contacting MAA Investor Relations at 901-682-6600. Copies of the documents filed by Colonial Properties Trust with the SEC will be available free of charge on Colonial Properties Trust’s website at www.colonialprop.com or by contacting Colonial Properties Investor Relations at 205-250-8700.

MAA and Colonial Properties and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about MAA’s executive officers and directors in MAA’s definitive proxy statement filed with the SEC on March 22, 2013. You can find information about Colonial Properties Trust’s executive officers and directors in Colonial Properties Trust’s definitive proxy statement filed with the SEC on March 13, 2013. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from MAA or Colonial Properties Trust using the sources indicated above.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description | |

| 99.1 | Joint Press Release issued by Colonial Properties Trust and Mid-America Apartment Communities, Inc. on June 3, 2013 | |

| 99.2 | Joint Investor Presentation Material | |

* * *

This Current Report on Form 8-K is being filed or furnished, as applicable, on behalf of Colonial Properties Trust (“CLP”) and Colonial Realty Limited Partnership (“CRLP”) to the extent applicable to either or both registrants. Certain of the events disclosed in the items covered by this Current Report on Form 8-K may apply to CLP only, CRLP only or both CLP and CRLP, as applicable.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COLONIAL PROPERTIES TRUST | ||||

| June 3, 2013 | By: | /s/ John P. Rigrish | ||

| John P. Rigrish Chief Administrative Officer and Secretary | ||||

| COLONIAL REALTY LIMITED PARTNERSHIP | ||||

| By: Colonial Properties Trust, its general partner | ||||

| June 3, 2013 | By: | /s/ John P. Rigrish | ||

| John P. Rigrish Chief Administrative Officer and Secretary | ||||

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Joint Press Release issued by Colonial Properties Trust and Mid-America Apartment Communities, Inc. on June 3, 2013 | |

| 99.2 | Joint Investor Presentation Material | |

Exhibit 99.1

PRESS RELEASE

June 3, 2013

MAA and Colonial Properties Trust to merge in $8.6 billion transaction

Creates the pre-eminent Sunbelt-focused multifamily REIT

Combined total market cap of $8.6 billion and equity valuation of $5.1 billion

Merged company will own 85,000 apartment units representing the 2nd largest publicly traded REIT portfolio of owned apartments

MEMPHIS, TN, and BIRMINGHAM, AL, June 3, 2013 /PRNEWSWIRE/ MAA (NYSE: MAA) and Colonial Properties Trust (NYSE: CLP) today announced that they have entered into a definitive merger agreement under which MAA and Colonial Properties Trust will merge, creating a Sunbelt-focused, publicly traded, multifamily REIT with enhanced capabilities to deliver superior value for residents, shareholders and employees. The combined company is expected to have a pro forma equity market capitalization of approximately $5.1 billion and a total market capitalization of $8.6 billion.

Under the terms of the agreement, each Colonial Properties Trust common share will be converted into 0.36 newly issued MAA common share, and the combined company will be an UPREIT. On a pro forma basis, following the merger, former MAA equity holders will hold approximately 56 percent of the combined company’s equity, and former Colonial Properties Trust equity holders will hold approximately 44 percent. The all-stock merger is intended to be a tax-free transaction. The merger is subject to customary closing conditions, including receipt of the approval of a majority of both the MAA and Colonial Properties Trust shareholders. The parties currently expect the transaction to close during the third quarter of 2013.

The merger brings together two highly complementary multifamily portfolios with a combined asset base consisting of approximately 85,000 multifamily units in 285 properties. The combined company will maintain strategic diversity across large and secondary markets within the high growth Sunbelt region of the U.S. The combined company’s ten largest markets will be Dallas/Ft. Worth, Atlanta, Austin, Raleigh, Charlotte, Nashville, Jacksonville, Tampa, Orlando and Houston.

“The combination of MAA and Colonial Properties Trust will provide an enhanced competitive advantage across the Sunbelt region,” said H. Eric Bolton, Jr., MAA CEO. “The scale of the combined company will support accelerated growth and deployment of capital across our high-growth Sunbelt markets driving superior value creation opportunity for our shareholders. In addition, through capitalizing on the strengths gained from the combination of the two platforms, we will enhance our ability to serve residents across the region, drive higher margins as a result of synergies and advantages generated by the merger, and enhance career opportunities for our associates.”

“This is a combination that makes a lot of sense for the constituents of both Colonial Properties Trust and MAA,” added Thomas H. Lowder, Colonial Properties Trust CEO. “Our two companies have a shared vision for success that will only be enhanced by coming together through this merger transaction. We are excited for the future of our combined company.”

Leadership and Organization

Both the Board of Directors of MAA and Board of Trustees of Colonial Properties Trust have unanimously approved the merger. The number of directors on MAA’s Board of Directors will be increased to 12, of which 5 directors will be nominated by Colonial Properties Trust’s Board of Trustees. Thomas H. Lowder will join the Board of Directors along with four others from Colonial Properties Trust. Alan B. Graf, Jr. and Ralph Horn, Co-Lead Independent Directors for MAA, will serve as Co-Lead Independent Directors for the combined company.

H. Eric Bolton, Jr., MAA’s CEO and Chairman of the Board of Directors, will serve as CEO and Chairman of the Board of Directors of the combined company. Albert M. Campbell, III, MAA’s CFO, will serve as CFO of the combined company, and Thomas L. Grimes, Jr., MAA’s COO, will serve as the COO of the combined company.

Upon completion of the merger, the company will retain the MAA name and will trade under the ticker symbol MAA (NYSE). Following the close of the transaction, the combined company’s corporate headquarters will be located in Memphis, TN.

Anticipated Synergies

Annual gross G&A savings are estimated to be approximately $25 million. The combined company is expected to benefit from the elimination of duplicative costs associated with supporting a public company platform and the leveraging of state of the art technology and systems. These savings are expected to be realized upon full integration, which is expected to occur over the 18-month period following the closing.

Pro Forma Operations and Balance Sheet

Both companies have high quality properties diversified across the Sunbelt region. On a consolidated basis the company will have a strong presence in both large and secondary markets. With a significant regional overlap, meaningful opportunity for synergy and margin improvement is expected. The combined company is committed to a strategy aimed at driving superior long-term shareholder performance with a full-cycle performance profile and objective.

The combined company is expected to have significant liquidity, a strong investment-grade balance sheet and a well-staggered debt maturity profile provided by long-standing lending partners.

“Our goal is to create one of the strongest balance sheets in the sector, providing us the financial flexibility in the capital markets to manage our cost of capital, allowing us to capitalize on business opportunities, ultimately supporting the growth of the combined company and the security of our dividend to our shareholders,” said Albert M. Campbell, III, CFO of MAA.

Dividend Policy and Declaration

The timing of the pre-closing dividends of MAA and Colonial Properties Trust will be coordinated such that, if one set of shareholders receives their dividend for a particular quarter prior to the closing of the merger, the other set of shareholders will also receive their dividend for such quarter prior to the closing of the merger.

On May 21, 2013, MAA announced that its Board of Directors has declared its third quarter dividend of $0.695 per common share, payable on July 31, 2013, to stockholders of record on July 15, 2013.

Advisors

J.P. Morgan is acting as financial advisor, and Goodwin Procter LLP and Baker, Donelson, Bearman, Caldwell & Berkowitz, PC acted as legal advisors to MAA. BofA Merrill Lynch is acting as financial advisor, and Hogan Lovells and Burr & Forman LLP acted as legal advisors to Colonial Properties Trust.

Conference Call and Webcast

The companies will host a conference call on Monday, June 3, 2013 at 7:30am CDT to discuss the business combination. Participants will include MAA’s CEO and Colonial Properties Trust’s CEO. The conference call-in number is 866-847-7859 or interested parties can join the live webcast of the conference call by accessing the investor relations section of each company’s website at http://ir.maac.com or at www.colonialprop.com.

A transcript of the call and the conference call replay will be posted when available on the respective companies’ websites under the Investor Relations sections.

About MAA

MAA is a self-managed real estate investment trust (REIT) that acquires, owns and operates apartment communities across 13 states in the Sunbelt region of the United States. As of March 31, 2013, MAA owned or had ownership interest in 49,591 apartment units at completed communities, focused on delivering full-cycle and superior investment performance for shareholders. For further details, please visit the MAA website at www.maac.com.

| CONTACT: | MAA Investor Relations |

investor.relations@maac.com

Leslie B.C. Wolfgang, Senior Vice President, Director of Investor Relations and

Corporate Secretary, 1-901-248-4126

About Colonial Properties Trust

Colonial Properties Trust is a real estate investment trust (REIT) that creates value for its shareholders through the acquisition, management, and development of a multifamily portfolio in the Sunbelt region of the United States. As of March 31, 2013, the company owned, had partial ownership in or managed 35,181 apartment units. Headquartered in Birmingham, Alabama, Colonial Properties is listed on the New York Stock Exchange under the symbol CLP and is included in the S&P SmallCap 600 Index. For more information, please visit the company’s website at www.colonialprop.com.

| CONTACT: | Colonial Properties Trust |

Jerry A. Brewer, Executive Vice President, Finance, 1-800-645-3917

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which MAA and Colonial Properties Trust operate and beliefs of and assumptions made by MAA management and Colonial Properties Trust management, involve uncertainties that could significantly affect the financial results of MAA or Colonial Properties Trust or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking

statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the anticipated benefits of the business combination transaction involving MAA and Colonial Properties Trust, including future financial and operating results, and the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to expected synergies, improved liquidity and balance sheet strength — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, regional and local economic climates, (ii) changes in financial markets and interest rates, or to the business or financial condition of either company or business (iii) increased or unanticipated competition for our properties, (iv) risks associated with acquisitions, including the integration of the combined companies’ businesses, (v) maintenance of real estate investment trust (“REIT”) status, (vi) availability of financing and capital, (vii) risks associated with achieving expected revenue synergies or cost savings, (viii) risks associated with the companies’ ability to consummate the merger and the timing of the closing of the merger, and (ix) those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by MAA and Colonial Properties Trust from time to time, including those discussed under the heading “Risk Factors” in their respective most recently filed reports on Forms 10-K and 10-Q. Neither MAA nor Colonial Properties Trust undertakes any duty to update any forward-looking statements appearing in this document.

Additional Information about the Proposed Transaction and Where to Find It

This communication relates to the proposed merger transaction pursuant to the terms of the Agreement and Plan of Merger, dated as of June 3, 2013, among Mid-America Apartment Communities, Inc., Mid-America Apartments, L.P., Colonial Properties Trust, Colonial Realty Limited Partnership and Martha Merger Sub, LP.

In connection with the proposed transaction, MAA expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of MAA and Colonial Properties Trust that also constitutes a prospectus of MAA, which joint proxy statement will be mailed or otherwise disseminated to MAA and Colonial Properties Trust shareholders when it becomes available. MAA and Colonial Properties Trust also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by MAA and Colonial Properties Trust with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by MAA with the SEC will be available free of charge on MAA’s website at www.maac.com or by emailing MAA Investor Relations at investor.relations@maac.com or contacting Leslie B.C. Wolfgang, Senior Vice President, Director of Investor Relations and Corporate Secretary at 901-248-4126. Copies of the documents filed by Colonial Properties Trust with the SEC will be available free of charge on Colonial Properties Trust’s website at www.colonialprop.com or by contacting Jerry A. Brewer, Executive Vice President, Finance at 800-645-3917.

Certain Information Regarding Participants

MAA and Colonial Properties Trust and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about MAA’s executive officers and directors in MAA’s definitive proxy statement filed with the SEC on March 22, 2013 in connection with its 2013 annual meeting of shareholders. You can find

information about Colonial Properties Trust’s executive officers and directors in Colonial Properties Trust’s definitive proxy statement filed with the SEC on March 13, 2013 in connection with its 2013 annual meeting of shareholders. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from MAA or Colonial Properties Trust using the sources indicated above.

No Offer or Solicitation

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

SOURCE MAA; Colonial Properties Trust

A

transformative combination creating the pre-eminent Sunbelt Multifamily REIT

June 2013

Exhibit 99.2 |

Two

highly complementary multifamily REIT platforms coming together to establish

the pre-eminent Sunbelt multifamily REIT 100% all stock combination of

Mid-America Apartment Communities (NYSE: MAA) with Colonial Properties

Trust (NYSE: CLP) Fixed exchange ratio of 0.36x MAA shares for each CLP

share Pro forma ownership of approximately 56.2% MAA / 43.8% CLP

Transaction

consideration

Expected

close

Q3 2013

Corporate

name and

headquarters

MAA to retain its corporate name and ticker symbol (NYSE: MAA)

Memphis, TN

Management

& Board

Eric Bolton, Chairman & CEO

Al Campbell, EVP & CFO

Tom Grimes, EVP & COO

Ongoing support from CLP management in integration efforts

New MAA board will be composed of 12 directors, including 7 directors from MAA

board and 5 directors from CLP board

Gross G&A

synergies

Expected $25 million annual run rate

Dividend

MAA will maintain its quarterly dividend at an annual rate of $2.78 per

share Positioned to drive superior long-term investment returns to

capital 1 |

Strategic rationale and transaction benefits

Higher efficiency in on-site product and service procurement in addition to

back-office and system platforms

Ability to further scale local and regional management operations

Cost elimination from duplicative public company costs and platform

Enhanced

margins and

synergy

opportunities

Leading Sunbelt footprint to drive superior deal flow and opportunistic new growth

opportunities

Superior cost of capital benefits over full cycle to enhance accretive capital

deployment opportunities

Platform

scale

drives

operating

cost

advantages

and

enhances

the

ability

to

attract

top

talent

Strengthened platform through integration of best practices of both

companies Enhanced

competitive

advantage

Enhanced

portfolio

strength

Second largest multifamily REIT by number of units

Improved diversification across high-growth region and markets

Enhanced ability to increase pro-active and opportunistic capital

re-cycling “Full cycle”

capital deployment and performance strategy strengthened

Improved investment grade metrics and limited near-term debt maturities

Larger scale enhances capital market opportunities

Long-term cost of capital benefits

Enhanced

balance sheet

Shared vision for success; enhanced platform to execute

2 |

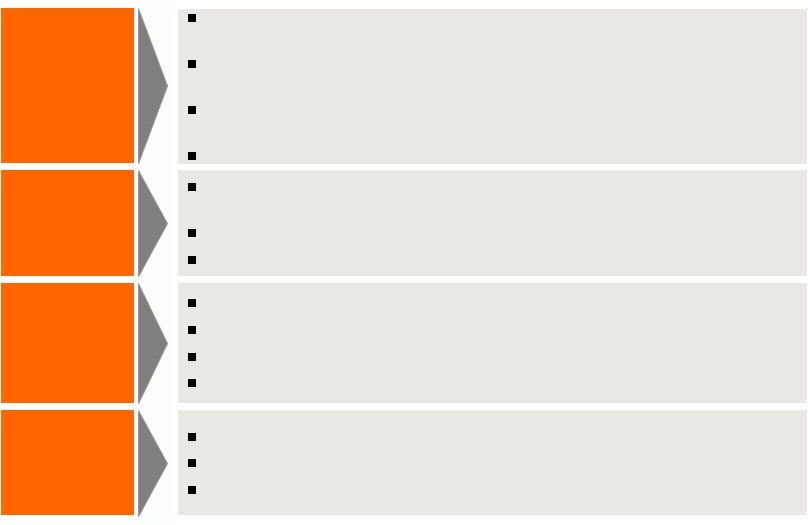

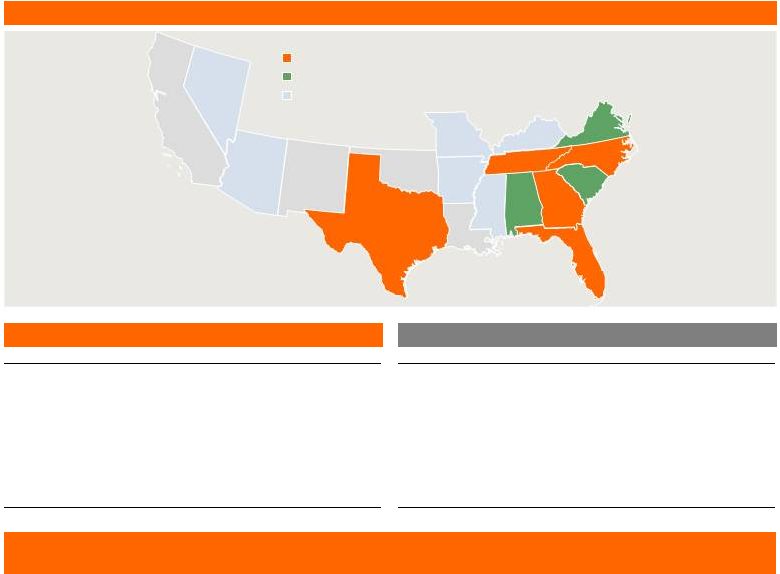

Combination of complementary portfolios to create market-leading platform

1

As of 5/31/13

2

Includes all multifamily properties, including operating, lease up, joint venture

communities 3

Multifamily assets weighted by 3/31/13 NOI

4

Represents multifamily portfolio occupancy as of 3/31/13

Formation date

Mid-America Apartments

Colonial Properties

New MAA

Equity market cap

($bn)

Age

3

Occupancy

January 1994

September 1993

Q3 2013

$3.0

$2.1

$5.1

168

117

285

15.4 yrs

14.5 yrs

15.0 yrs

96%

96%

96%

Total market cap

($bn)

1

$4.7

$3.9

$8.6

Units

49,591

35,181

84,772

Revenue / unit

$994

$966

$982

Communities

3

1

2

2

4 |

Second largest multifamily REIT by units with a market cap of over $8.6bn

Units

1

Total market capitalization ($bn)

2

Source: Company 1Q’13 Financial Supplements

1

As of 3/31/2013

2

As of 5/31/13

4

$33.8

New MAA

AIMCO

UDR

Essex

Property

Trust

Post

Properties

Home

Properties

AvalonBay

Communities

Essex

Property

Trust

New MAA

Home

Properties

Post

Properties

Camden

Property

Trust |

Portfolio

distribution

by

total

units

Note: Other large markets includes 3 additional MSAs; Other secondary markets

includes 29 additional MSAs 1

Breakdown based on number of total multifamily 1Q’13 NOI, including operating,

lease-up and joint venture communities (at share) Continued commitment to a

portfolio strategy focused on high-growth markets across the Sunbelt region, allocated

across both large and secondary markets, to capture superior risk-adjusted

performance over full market cycles Distribution

by

secondary

markets

(38%

of

total)

Distribution by large markets (62% of total)

Alabama

Arizona

Arkansas

California

Florida

Georgia

Kentucky

Louisiana

Nevada

New Mexico

North Carolina

Oklahoma

South

Carolina

Tennessee

Texas

Virginia

Mississippi

2,000–5,000 units

Greater than 5,000 units

Less than 2,000 units

Missouri

Note: Includes all multifamily properties, including operating, lease up, joint

venture communities Enhanced diversification across high-growth Sunbelt

region Large markets

% of total Q1'13 NOI

1

Dallas / Fort Worth

11.7%

2

Atlanta

6.9%

3

Austin

6.4%

4

Raleigh

6.3%

5

Charlotte

5.8%

6

Nashville

4.9%

7

Jacksonville

4.6%

8

Tampa

4.0%

9

Orlando

3.9%

10

Houston

3.4%

Secondary markets

% of total Q1'13 NOI

1

Memphis

3.2%

2

Charleston

3.0%

3

Savannah

2.9%

4

Birmingham

2.4%

5

Richmond

2.2%

6

Jackson

2.0%

7

Greenville

1.6%

8

Columbus

1.6%

9

San Antonio

1.6%

10

Little Rock

1.5%

5

1

1

1 |

Significant presence in large, high growth markets

Source: Moody’s

Note: Highlighted markets represent 58.7% of New MAA’s multifamily portfolio

(weighted by units) U.S. average: 2.2%

Large markets with meaningful presence

MAA’s combined new, large markets are on a weighted average basis projected to

show 3.0% job growth over the next 5 years vs. U.S. average of 2.2%

Major non-MAA markets

6

5-year projected employment growth CAGR (%) |

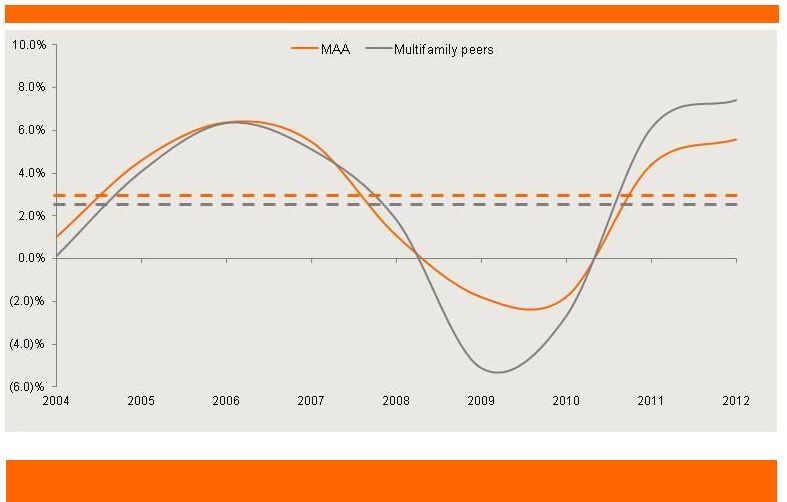

MAA’s two-tier market strategy has delivered stable, long-term

outperformance over the “full cycle”

MAA has generated higher average growth combined with lower volatility than

peers MAA

average: 2.8%

Peer

average: 2.6%

Source: Third party research

Note: Multifamily peers include BRE, CLP, CPT, ESS, HME, PPS, UDR

2009

trough: (5.1%)

2009

trough: (1.8%)

7

Same store NOI growth |

New

MAA will have an enhanced large market focus across the Sunbelt region Top 10

markets by NOI 1Q’13 unit count by market

% of 1Q’13 same store NOI by market

1

2

3

4

5

6

7

8

9

10

MAA

DFW

Jacksonville

Nashville

Houston

Atlanta

Memphis

Austin

Tampa

Raleigh

Columbus

CLP

DFW

Charlotte

Raleigh

Austin

Atlanta

Orlando

Charleston

Savannah

Birmingham

Tampa

New MAA

DFW

Atlanta

Austin

Raleigh

Charlotte

Nashville

Jacksonville

Tampa

Orlando

Houston

49,591

35,181

84,772

Source: REIS

Markets with 5-year projected employment growth above national average

8

25,846

24,646

50,492

23,745

10,535

34,280 |

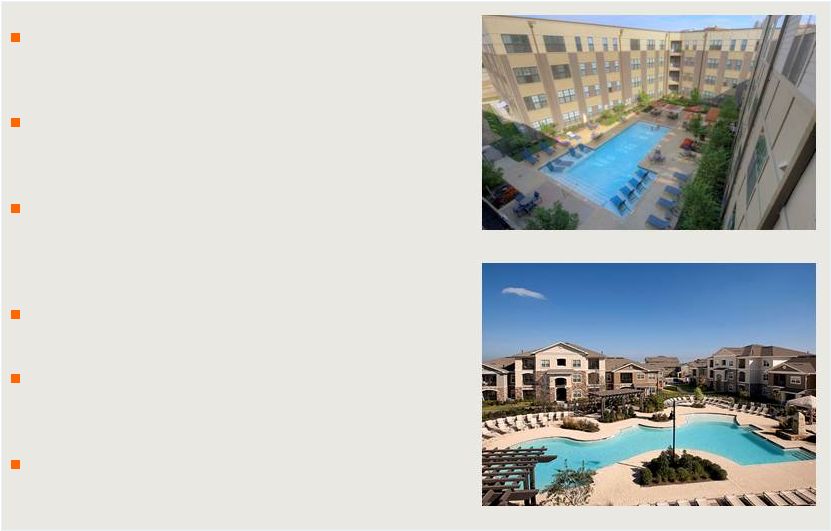

Synergy and value creation potential through integration

Significant overlap in asset footprint creates potential for

margin improvement

Significant overlap in technology to drive and track

performance, leading to minimal business disruption

Opportunity to improve cost structure by leveraging a

combined business platform across a significantly larger

asset portfolio

Estimated total run-rate annual synergies of $25mm

Potential for additional synergies include improved debt

costs and opportunities for scale efficiencies

Strengthened platform through integration of best

practices of both companies

Market

Station

-

Kansas

City,

MO

Colonial

Grand

at

Double

Creek

-

Austin,

TX

9 |

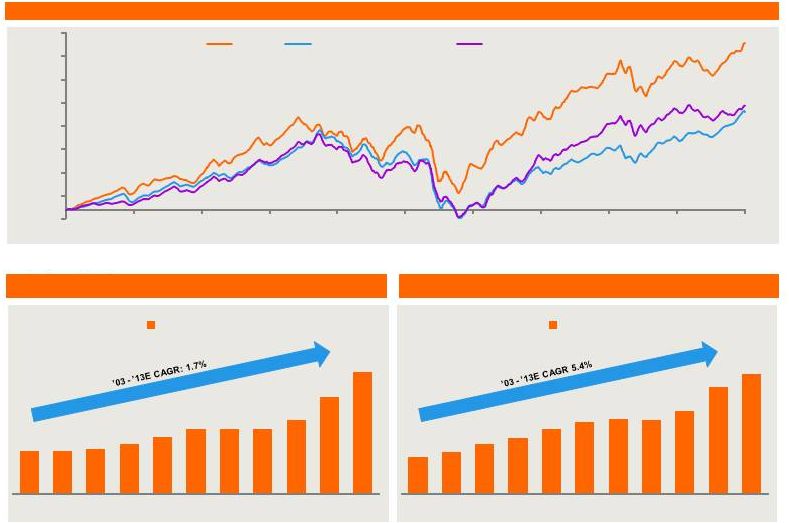

2

Q1 2013 dividend / share annualized

3

Excludes the write-off of original issuance costs for preferred shares

redeemed 4

Mid point of 2013E FFO / share guidance

MAA management’s proven record of disciplined capital deployment and

performance 359%

224%

211%

Note: Multifamily peers include AIV, AVB, BRE, CLP, CPT, EQR, ESS, HME, PPS,

UDR 1

20 day simple moving average

4

2

3

3

10

(20.0)%

30.0%

80.0%

130.0%

180.0%

230.0%

280.0%

330.0%

380.0%

05/30/03

05/29/04

05/29/05

05/30/06

05/30/07

05/30/08

05/30/09

05/30/10

05/31/11

05/30/12

05/31/13

MAA

MSCIUS REIT Index

Multifamily peers

Total

return

performance

10

years

1

$2.34 $2.34

$2.35

$2.38

$2.42

$2.46 $2.46 $2.46

$2.51

$2.64

$2.78

2003

2005

2007

2009

2011

2013E

Dividend / share

$2.87

$3.00

$3.20

$3.33

$3.55

$3.73

$3.79

$3.77

$3.98

$4.57

$4.87

2003

2005

2007

2009

2011

2013E

FFO / share

MAA dividend growth 10 years

MAA FFO growth 10 years

2004

2006

2008

2010

2012

2004

2006

2008

2010

2012

–

–

– |

New

MAA will maintain a disciplined approach to development Expected stabilized

NOI yields between 6% and 8% Cost to

Cost to

Expected cost

Expected

MSA

Total units

date

complete

Total

Per unit ($000)

stabilization

MAA

River's Walk

Charleston

270

21.9

11.5

33.4

124

4Q14

1225 South Church Phase II

Charlotte

210

$26.3

$1.2

$27.5

$131

1Q14

Subtotal: MAA

774

$56.3

$45.0

$101.3

$131

CLP

CR at South End

Charlotte

353

31.7

27.6

59.3

168

4Q14

CG at Ayrsley (Phase II)

Charlotte

81

$5.4

$3.7

$9.1

$113

4Q13

CG at Randal Lakes

Orlando

462

24.2

32.8

57.0

123

1Q15

CG at Lake Mary (Phase III)

Orlando

132

2.4

13.7

16.1

122

3Q14

Subtotal: CLP

1,028

$63.7

$77.8

$141.5

$138

Total

1,802

$120.0

$122.8

$242.8

$135

220 Riverside

Jacksonville

294

8.1

32.3

40.4

137

4Q15

11

Active multifamily development pipeline ($mm, except per unit costs)

|

New

MAA will continue to recycle capital into high quality properties in growth markets

Allure at Brookwood

Colonial Grand at Windemere

Legends at Lowe’s Farm

Colonial Reserve at Las Colinas

MAA purchase: Sept. 2011

MSA: Dallas, TX

Acquisition price: $47mm

Total units: 456

Year built: 2008

Occupancy: 95%

MAA purchased: July 2012

MSA: Atlanta, GA

Acquisition price: $64mm

Total units: 349

Year built: 2008

Occupancy: 94%

CLP purchase: March 2013

MSA: Orlando, FL

Acquisition price: $43mm

Total units: 280

Year built: 2009

Occupancy: 95%

CLP purchase: Nov. 2012

MSA: Dallas, TX

Acquisition price: $43mm

Total units: 306

Year built: 2006

Occupancy: 91%

12 |

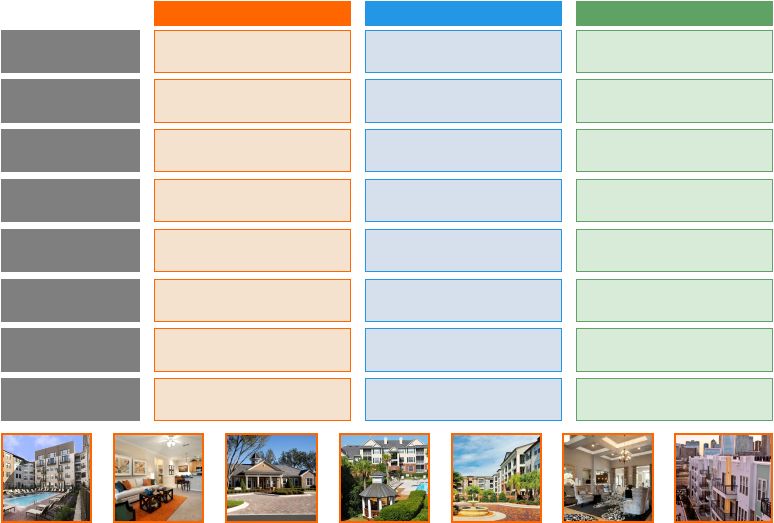

Total unencumbered assets to book value

Debt

/

LTM

EBITDA

Debt / gross assets

Debt / market capitalization

Secured debt / gross assets

LTM

fixed

charge

coverage

ratio

MAA

57.4%

6.5x

44.9%

36.2%

29.8%

4.3x

CLP

69.7%

7.7x

44.2%

45.6%

17.6%

2.5x

New MAA

63.7%

6.7x

44.5%

40.5%

23.6%

3.4x

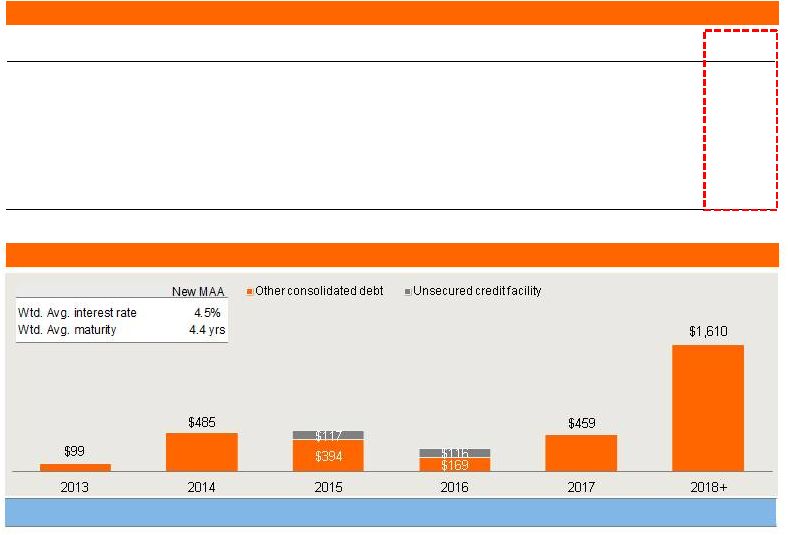

Debt maturity profile ($mm)

Note: As of 3/31/13

2

Excludes pro rata share of unconsolidated joint venture debt

Strong investment grade balance sheet and manageable debt maturity profile

3%

14%

15%

8%

47%

%

maturing

13%

Credit metrics

Note: As of 3/31/13

1

Includes pro rata share of unconsolidated joint venture debt

2

New MAA EBITDA includes $25mm of synergies pro forma for the transaction

$511

$285

13

1

2

2

2 |

Strong investment grade balance sheet -

capital structure profile

New MAA capital structure

Debt / market capitalization: 40.5%

Note: As of 3/31/13. Includes pro rata share of unconsolidated joint venture

debt Floating vs. fixed rate debt

Unsecured vs. secured debt

% of unencumbered assets

14 |

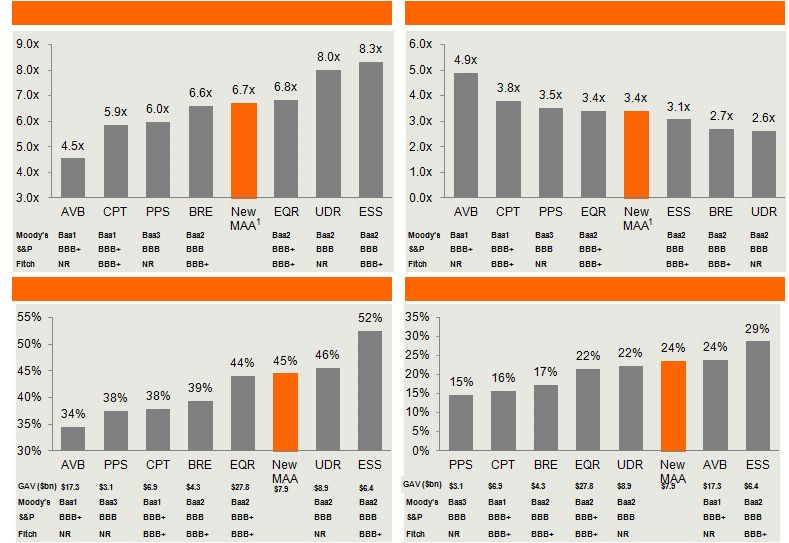

Source: Company filings, SNL Financial

1

EBITDA includes $25mm of synergies pro forma for the transaction

Investment grade balance sheet metrics

Debt / gross assets

Debt / LTM EBITDA

Secured debt / gross assets

LTM fixed charge coverage ratio

15 |

| Strategy and long-term outlook

Optimize cash flow growth through “full-cycle”

Support growing and secure dividend

Deliver superior long-term risk-adjusted returns

Focus on high-growth Sunbelt markets

Prudent capital deployment practices

Proactive capital recycling program

Build competitive advantages in local markets

Limited and disciplined approach to development

Develop New MAA brand value

16 |

Certain matters in this presentation may constitute forward-looking statements

within the meaning of Section 27-A of the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

and

Exchange

Act

of

1934.

Such

statements

include,

but are not limited to, statements made about anticipated economic and market

conditions, expectations for future demographics, the impact of competition,

general changes in the apartment industry, expectations for acquisition and

joint venture performance, ability to pay dividends and the ability to obtain financing at reasonable rates. Actual

results

and

the

timing

of

certain

events

could

differ

materially

from

those

projected

in

or

contemplated

by

the

forward-looking statements due to a number of factors, including a downturn in

general economic conditions or the capital markets, competitive factors

including overbuilding or other supply/demand imbalances in some or all of our

markets, changes in interest rates and other items that are difficult to control

such as the impact of legislation, as well as the other general risks

inherent in the apartment and real estate businesses. Reference is hereby made to

the filings of Mid-America Apartment Communities, Inc., with the Securities and

Exchange Commission, including quarterly reports on Form 10-Q, reports

on Form 8-K, and its annual report on Form 10-K, particularly including the

risk factors contained in the latter filing.

Eric Bolton, MAA

CEO

901-248-4127

eric.bolton@maac.com

Al Campbell, MAA

CFO

901-248-4169

al.campbell@maac.com

Leslie Wolfgang, MAA

Investor Relations

901-248-4126

leslie.wolfgang@maac.com

Jennifer Patrick, MAA

Investor Relations

901-435-5371

jennifer.patrick@maac.com

http://ir.maac.com

Tom Lowder, CLP

CEO

205-250-8700

tlowder@colonialprop.com

Jerry Brewer, CLP

Executive Vice President

800-645-3917

jbrewer@colonialprop.com

17 |

| Additional Information about the Proposed Transaction and Where to Find

It In connection with the proposed transaction, MAA expects to file with the SEC a registration

statement on Form S-4 that will include a joint proxy statement of MAA and Colonial

Properties Trust that also constitutes a prospectus of MAA. MAA and Colonial Properties

Trust also plan to file other relevant documents with the SEC regarding the proposed

transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy

statement/prospectus (if and when it becomes available) and other relevant documents filed by

MAA and Colonial Properties Trust with the SEC at the SEC’s website at www.sec.gov.

Copies of the documents filed by MAA with the SEC will be available free of charge on MAA’s website

at www.maac.com or by contacting MAA Investor Relations at 901-682-6600. Copies of the

documents filed by Colonial Properties Trust with the SEC will be available free of charge on

Colonial Properties Trust’s website at www.colonialprop.com or by contacting Colonial

Properties Trust Investor Relations at 205-250-8700.

MAA and Colonial Properties Trust and their respective directors and executive officers and other

members of management and employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. You can find information about MAA’s

executive officers and directors in MAA’s definitive proxy statement filed with the SEC on March 22,

2013. You can find information about Colonial Properties Trust’s executive officers and

directors in Colonial Properties Trust’s definitive proxy statement filed with the SEC on

March 13, 2013. Additional information regarding the interests of such potential

participants will be included in the joint proxy statement/prospectus and other relevant documents

filed with the SEC if and when they become available. You may obtain free copies of these

documents from MAA or Colonial Properties Trust using the sources indicated above. This document shall

not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offering

of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the U.S. Securities Act of 1933, as amended. |