Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHWEST PIPE CO | d546696d8k.htm |

2013 Annual Shareholder Meeting

May 31, 2013

Exhibit 99.1 |

2

Forward Looking Statements

This

presentation

includes

certain

estimates

and

other

forward-looking

statements

within

the

meaning

of

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

including

statements

with

respect

to

anticipated

operating

and

financial

performance,

growth

opportunities,

growth

rates,

potential

acquisition

opportunities,

and

other

statements

of

expectation.

Words

such

as

“forecasts”,

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“assumes,”

“seeks,”

“estimates,”

“should,”

and

variations

of

these

words

and

similar

expressions,

are

intended

to

identify

these

forward-looking

statements.

While

we

believe

these

statements

are

accurate,

forward-looking

statements

are

inherently

uncertain

and

we

cannot

assure

you

that

these

expectations

will

occur

and

our

actual

results

may

be

significantly

different.

These

statements

by

the

Company

and

its

management

are

based

on

estimates,

projections,

beliefs

and

assumptions

of

management

and

are

not

guarantees

of

future

performance.

Important

factors

that

could

cause

actual

results

to

differ

from

those

in

the

forward-looking

statements

include

the

factors

described

in

the

“Risk

Factors”

section

of

our

most

recent

10-Q

filing

with

the

SEC.

The

Company

disclaims

any

obligation

to

update

or

revise

any

forward-looking

statement

based

on

the

occurrence

of

future

events,

the

receipt

of

new

information,

or

otherwise.

This

presentation

includes

certain

non-GAAP

financial

measures,

that

are

different

from

financial

measures

calculated

in

accordance

with

GAAP

and

may

be

different

from

similar

measures

used

by

other

companies. |

3

Who Are We?

•

Diversified manufacturer of welded steel pipe for

the water infrastructure and energy markets

–

Specializing in large diameter, high pressure, engineered steel

water pipe systems for transporting raw water to treatment plants

and for treatment plant infrastructure

–

Also focused on API tubular products for oil and gas

transmission, as well as for oil and gas drilling, including wells

that are for hydraulically fracking |

Northwest Pipe Company Locations |

5

Record Sales in 2012 |

6

Income

Statement

Summary

($ in millions)

2011

2012

Q1-2013

Net Sales

Water Transmission

$ 271.9

$ 269.2

$ 78.6

Tubular Products

239.8

255.3

62.0

Net Sales

511.7

524.5

140.6

Gross Profit

Water Transmission

43.2

45.1

19.9

Tubular Products

15.9

11.1

1.3

Gross Profit

59.1

56.2

21.2

SG&A

26.3

28.6

6.4

Operating Income/(Loss)

32.8

27.6

14.8

Other (Income)/Expense

1.3

0.3

0.1

Interest Income

(0.1)

(0.2)

(0.2)

Interest Expense

9.3

5.6

1.0

Income/(Loss) Before Taxes

22.3

21.7

13.9

Provision/(Benefit) for Income Taxes

9.6

5.5

4.4

Net Income/(Loss)

12.7

16.2

9.5

Diluted Earnings per Share

$ 1.35

$ 1.72

$ 1.00 |

7

Balance

Sheet

Summary

($ in millions)

Dec. 31,

2011

Dec. 31,

2012

Mar. 31,

2013

Assets

Cash and Cash Equivalents

$ 0.2

$ 0.0

$ 0.0

Trade and Other Receivables, Net

69.9

41.5

65.4

Costs and Estimated Earnings in Excess

of Billings on Uncompleted Contracts

38.0

73.3

70.0

Inventories

107.2

113.5

109.6

Other Current Assets

11.6

7.8

8.5

Total Current Assets

226.9

236.1

253.5

Property and Equipment, Net

152.8

152.5

158.8

Other Assets

33.7

33.8

33.6

Total Assets

$ 413.4

$ 422.4

$ 445.9

Liabilities

Current Maturities of Long-Term Debt

$ 9.1

$ 9.0

$ 9.0

Accounts Payable

20.2

21.0

33.6

Accrued Liabilities

19.2

32.2

30.2

Billings in Excess of Cost and Estimated Earnings

on Uncompleted Contracts

7.8

6.5

2.8

Total Current Liabilities

56.3

68.7

75.6

Long-Term Note Payable to Financial Institution

62.0

47.5

56.2

Other Long-Term Debt, Less Current Maturities

24.4

15.5

11.9

Other Liabilities

30.4

31.3

33.4

Total Liabilities

173.1

163.0

177.1

Stockholders' Equity

240.3

259.4

268.8

Total Liabilities and Stockholders' Equity

$ 413.4

$ 422.4

$ 445.9 |

Tubular Products |

9

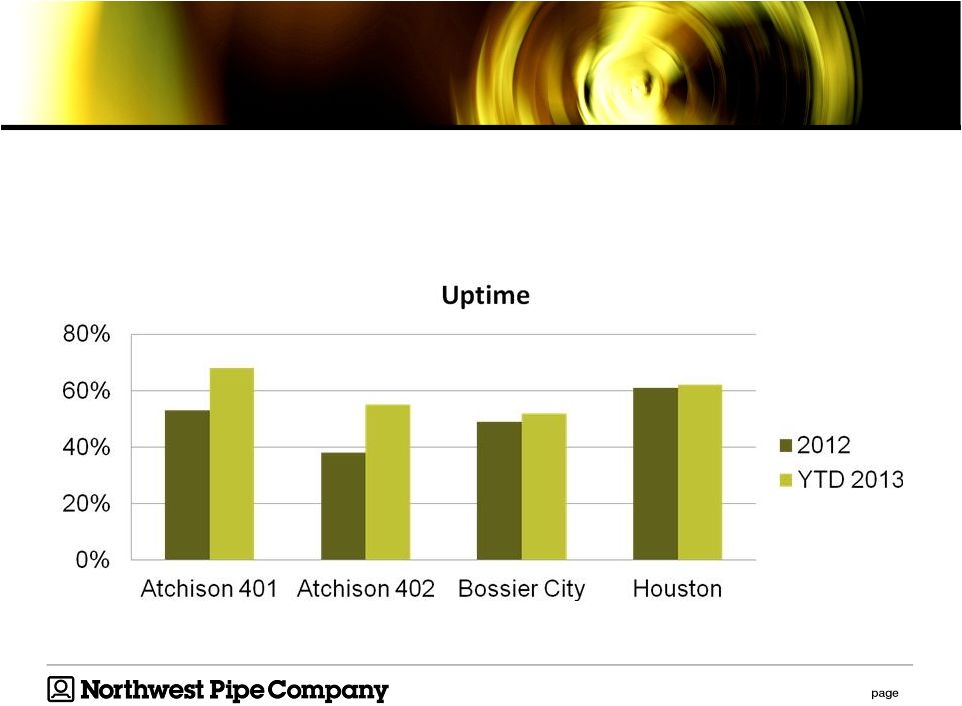

Emerging Presence in Energy Tubular

Business

•

Expanding customer base

•

Growing downstream processing capabilities

•

Improving operational efficiency

•

Recognizing areas of strength |

10

Tubular Net Sales $$ by Product Group |

11

Tubular Net Sales $$

by Value Added Energy Product |

12

Operational Improvements |

13

U.S. Rig Counts

Source: Pipe Exchange May 2013 |

14

Impact of Imports

•

Import levels continue to have a major impact on

the API market

•

Import levels in OCTG market at 48%

•

Import levels in Line Pipe market at 64%

•

Downward pressure on price in OCTG and Line

Pipe |

15

Outlook

•

Near term outlook

•

Long term outlook |

Water Transmission |

17

Well Positioned Industry Leader

•

Largest, most flexible capacity in the market

•

Strong relationships with public water agencies,

contractors and engineering firms

–

Assist in development process of projects prior to bidding

•

Competitive position

–

Experienced workforce

–

Low freight costs

–

Excellent reputation for quality and service

–

Strong cost focus on lean manufacturing |

18

Current Conditions and a Look Ahead

•

In 2013, water infrastructure projects compete with

other infrastructure needs and municipal funding

decreases

•

The bidding activity is down in 2013, compared to

2012 and 2011

•

Emergency drought-related work and expected

infrastructure projects in Texas should increase in

2014 and beyond |

19

Water Transmission Backlog |

20

Tarrant Regional Water District

Integrated Pipeline Project (IPL)

Source: Tarrant Regional Water District

http://www.iplproject.com/about-the-ipl/map/

•

The

pipeline

will

run

from

Lake

Palestine

to

Lake

Benbrook,

with

connections

to

Cedar

Creek

and

Richland-Chambers

Reservoirs

•

It

will

integrate

TRWD's

existing

pipelines

to

the

Dallas

system

to

provide

up

to

an

additional

350

million

gallons

per

day

(MGD)

of

raw

water

to

North

Central

Texas |

21

Timeline / Project Components

•

IPL Components:

–

150 miles of buried pipeline

•

72”

–

108”

diameter welded steel pipe

•

3 lake intake pump stations

•

2 booster pump stations

–

Water delivery could begin by 2021

–

Communities served:

•

DFW metroplex

•

Ellis County

–

Cost estimated to be over $1.6 B |

22

Northwest Pipe Strategic Plans

•

Optimize recent capital investments

•

Lean manufacturing focus

•

Continue modernization of Atchison facility

•

Focus growth plans around areas of strength

•

Double EBITDA from 2011 to 2015 |

2013 Annual Shareholder Meeting

May 31, 2013 |