Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v346619_8k.htm |

IMMEDIATE RELEASE

American Realty Capital Properties Accelerates 2013 Forecasted Acquisitions with Agreement to Acquire $807 Million GE Capital Portfolio, Creating Pro Forma Enterprise Value of Approximately $6.9 Billion.

Acquisition Will Further Diversify ARCP’s Net Lease Portfolio by Adding 471 Net Lease Properties

Announced 2013 Acquisitions Will Create a Portfolio of 1,264 Net Lease Properties

New York, New York, May 31, 2013 – American Realty Capital Properties, Inc. (“ARCP” or the “Company”) (NASDAQ: “ARCP”) announced today that it has entered into an agreement to purchase from GE Capital a $807 million portfolio of 471 net lease properties comprised primarily of nationally recognized restaurants. The 471 property portfolio includes assets net leased to tenants who operate restaurants including: IHOP; Jack in the Box; Golden Corral; Burger King; Arby’s; Taco Bell; Applebee’s; Wendy’s; Logan’s Roadhouse; and Denny’s. These ten national brands constitute approximately 64% of the net operating income of the portfolio to be acquired.

Nicholas S. Schorsch, Chief Executive Officer and Chairman of ARCP commented, “This transaction allows us to deliver on our promise to acquire $1.1 billion of properties, consistent with our investment strategy, and do so earlier than expected in 2013 at a cap rate in excess of 7%. This acquisition solidifies the Company’s position as the fastest growing single tenant net lease REIT. We are pleased to have forged this agreement to purchase a portion of the formerly publicly traded Trustreet Properties Inc. portfolio from GE Capital which bolsters and further diversifies significantly our net lease portfolio.”

Mike Weil, President of ARCP added, “This portfolio acquisition underscores our ability to identify and purchase a diversified pool of assets anchored by brand name tenants paying rents which are accretive to our earnings.” Mr. Weil continued, “Following this transaction, our portfolio will be among the strongest net lease REIT programs available to the investor, diversified across industry, geographical location and tenant.”

“With approximately $355 million in acquisitions closed year-to-date, as a result of this announced acquisition, once closed, ARCP will exceed its previously announced $1.1 billion of 2013 forecasted purchases by the end of the second quarter of 2013, five months earlier than expected. Our pipeline of additional acquisitions for 2013 remains strong. Following the close of all of our announced target acquisitions, we expect to own a portfolio comprised of 1,264 properties which is 69% investment grade. We will use low-cost financing and equity as necessary,” stated Brian S. Block, Chief Financial Officer of the Company.

Strategic and Financial Benefits of Expected 2013 ARCP Portfolio Transactions

Strategic Portfolio Construction. This portfolio acquisition significantly advances ARCP’s investment objectives by growing its net lease portfolio consistent with its investment strategy and further reduces its credit concentration by adding 137 new tenants. ARCP’s expected 2013 portfolio will include more than 225 distinct tenants.

High Portfolio Occupancy and Balance of Lease Duration. The Company reasonably expects its portfolio to remain approximately 100% occupied. The average remaining lease duration on the entire portfolio would be 9.0 years, reflecting the Company’s strong balance of mid-term and long-term lease durations. Only modest lease rollover would occur until 2018.

Increased Size and Scale. Once ARCP completes its expected 2013 acquisitions, its portfolio of 1,264 net lease properties, containing over 30.0 million rentable square feet, will be one of the largest net lease portfolios among public REITs.

Available Financing. ARCP expects to use currently available debt to consummate the GE Capital transaction, supporting ARCP’s strategy of finding accretive transactions to prudently expands its portfolio.

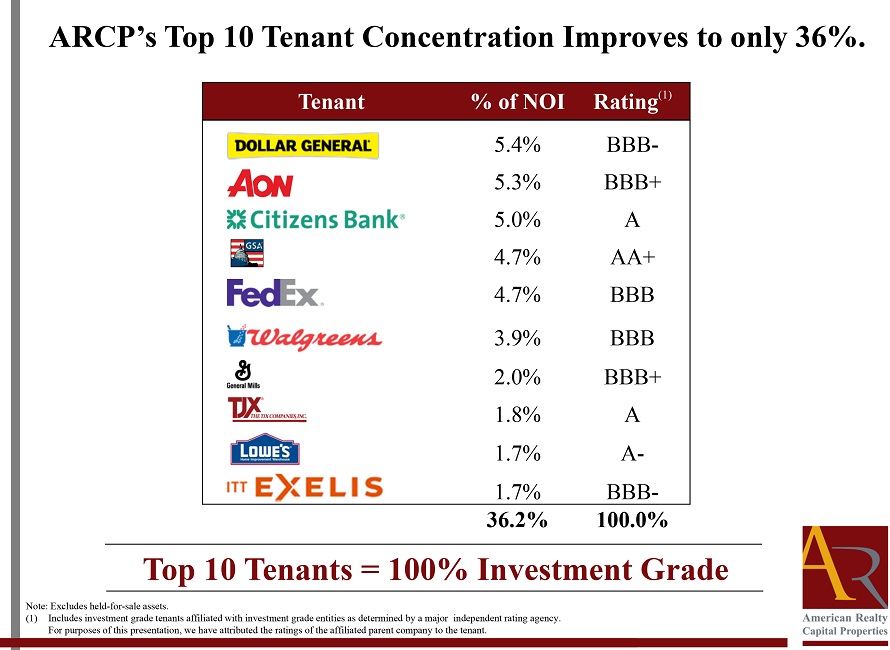

Increased Diversification/Reduced Concentration. 2013 pro forma rental revenue generated by ARCP’s largest 10 tenants will decline from 60% to 36%. The Company’s portfolio would include tenants located in 48 states plus Puerto Rico spanning 27 industries.

The table attached as Annex A hereto shows ARCP’s improved top ten tenant concentration following the close of its announced 2013 acquisitions. ARCP’s top tenants will remain 100% investment grade.

Important Notice

ARCP is a publicly traded Maryland corporation listed on The NASDAQ Global Select Market that qualified as a real estate investment trust for U.S. federal income tax purposes for the taxable year ended December 31, 2011, focused on acquiring and owning single tenant freestanding commercial properties subject to net leases with high credit quality tenants. Additional information about ARCP can be found on its website at www.arcpreit.com. The Company may disseminate important information regarding the company and its operations, including financial information, through social media platforms such as Twitter, Facebook and LinkedIn.

The statements in this press release that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. In addition, words such as “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words.

For more information about this announcement, please contact Tony DeFazio at 484-342-3600 or tdefazio@ddcworks.com.

|

Contacts |

|

| From: Anthony J. DeFazio | For: Brian S. Block, EVP & CFO |

| Diccicco Battista Communications | American Realty Capital Properties, Inc. |

| tdefazio@ddcworks.com | bblock@arlcap.com |

| Ph: 484-342-3600 | Ph: 212-415-6500 |

ANNEX A