Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MEDIFAST INC | v346585_8k.htm |

Exhibit 99.1

Investor Presentation Mike MacDonald, Chairman & Chief Executive Officer Meg Sheetz, President & Chief Operating Officer Tim Robinson, Chief Financial Officer May, 2013

Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement 2

Medifast Products and Programs Have Been Recommended by over 20,000 Doctors Since 1980 and Used by Over a Million Customers Since 1980 FAST SAFE SIMPLE LONG TERM PORTABLE 3

Vision To create health, hope, and happiness through clinically proven weight - management products, programs, and support Mission To combat the obesity epidemic and improve health in two ways: • Through clinically proven weight - management products & programs • Through multiple, innovative support channels, each of which meets different personal weight management, health, and wellness needs 4

• Rapidly growing addressable market and significant market penetration opportunities • Vertically integrated model producing industry leading gross margins • Strong historical track record of growth in sales, profits and cash flows • Consistent profitability and return on invested capital Over 70 Unique Food Items 5

6 Medifast 5&1 Plan, Transition, & Maintenance

MacDonald Center for Obesity Prevention & Education Scientific Advisory Board 7 Clinically Proven and Scientifically Based

8

• Company - owned state - of - the - art manufacturing and distribution facilities • Help support industry leading gross margins • Capacity in place to drive aggressive growth Owings Mills, MD Ridgely, MD MANUFACTURING AND DISTRIBUTION Dallas, TX 9

Strong, Consistent Financial Performance Revenue 10

Strong, Consistent Financial Performance EPS 11 * 2012 EPS excluding two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter

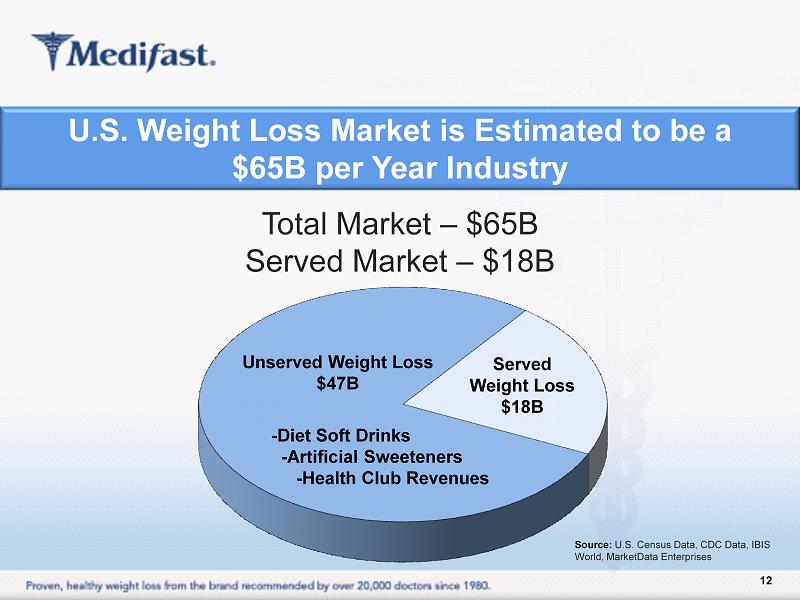

Source: U.S. Census Data, CDC Data, IBIS World, MarketData Enterprises Unserved Weight Loss $47B - Diet Soft Drinks - Artificial Sweeteners - Health Club Revenues Served Weight Loss $18B Total Market – $65B Served Market – $18B U.S. Weight Loss Market is Estimated to be a $65B per Year Industry 12

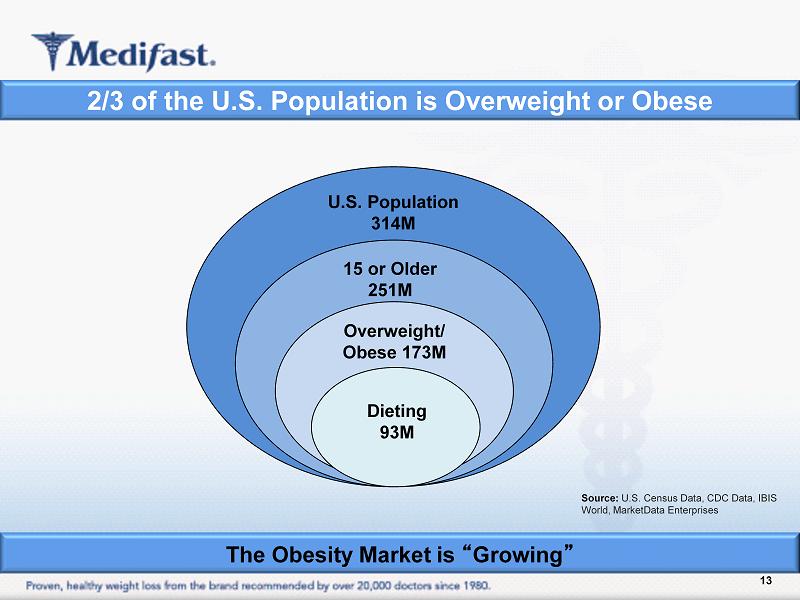

Source: U.S. Census Data, CDC Data, IBIS World, MarketData Enterprises U.S. Population 314M 15 or Older 251M Overweight/ Obese 173M Dieting 93M 2/3 of the U.S. Population is Overweight or Obese The Obesity Market is “ Growing ” 13

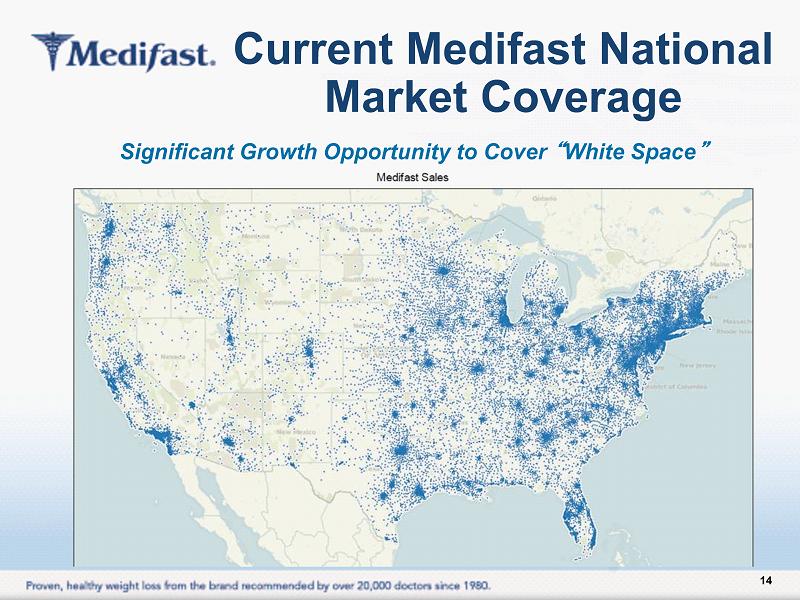

Current Medifast National Market Coverage 18 3 Significant Growth Opportunity to Cover “ White Space ” 14

International Coverage Opportunity Australia India Europe Asia Canada Latin America Through Medix Brazil Mexico (Medix) 1.6B Overweight Globally and Expected to Grow 40% in Next 10 Years 15

16

• US direct selling accounts for $30B – 24% or $7B comes from weight - loss products • 15.6M people engaged in direct sales in the US • U.S. is the #1 direct selling market in the world Direct Selling Overview 17

Free Personal Health Coach & Mentor to Guide Clients Through Their Weight Loss and Weight Management Journey • Health Coaches are required to take competency exam. • Health Coaches do not need to purchase product themselves to receive commission. • Health Coaches are not compensated for their own orders or for recruitment of clients/health coaches. • Health Coaches do not hold inventory. Health Coaches direct their clients to Take Shape for Life for product purchases. 18

19 Direct Sales Revenues (in $ millions)

Coverage Expansion • Expand coverage to new markets to cover “white space” • Leverage Success from Home magazine & Dr A ’ s book tour 20

Improve Field Effectiveness • Create development plan with simplified standards & processes • Enhance field communications & coach tools • Expand mobile “ on - the - go ” business 21

22 Self Guided Weight Loss & Weight Management with the Convenience of Online Ordering, Support, & Tools

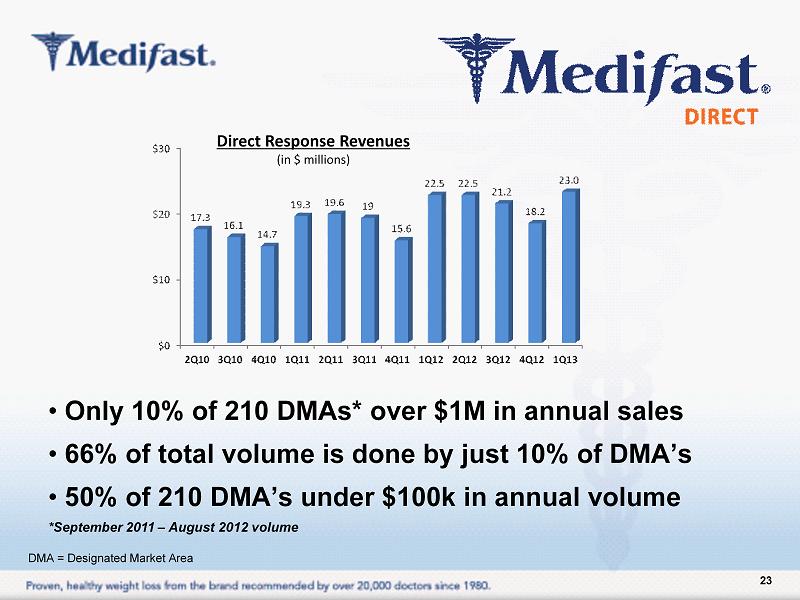

• Only 10% of 210 DMAs* over $1M in annual sales • 66% of total volume is done by just 10% of DMA ’ s • 50% of 210 DMA ’ s under $100k in annual volume *September 2011 – August 2012 volume DMA = Designated Market Area 23 Direct Response Revenues (in $ millions)

Optimize Marketing & Promotional Spends to Improve Profit • Drive multi - media customer acquisition strategy (website/call center) • Continue to evaluate discounts & promotional offers • Ensure effective execution of capital & high resource projects 24

Website Performance Critical Success Factors • Mobile friendly • Site load speed improved • Simplified design • Improved navigation • SEO benefits • Optimized content • Multiple versions for new & returning visitors 25

26

Weight Loss Management Partnership with a Team of Professionals Dedicated to Member Success • Brick - and - mortar centers offering supervised & structured programs • Currently operating 86 company - owned & 36 franchise - owned centers 27

28 Clinic Revenues (in $ millions)

Focus on Strengthening Overall Corporate Center Operational, Member Acquisition, and Member Counseling Practices • Q1 loss led to significant employee restructure in April, 2012 • Removed many program & food discounts • Heightened focus on operational efficiencies • Acquire & retain members by focusing on weight loss maintenance 29

Expand Franchise Footprint • Focus on current franchisee expansion • International presence through Medix strategic partnership • Medifast to provide focused resources and support 30

31

CUSTOMER Health Care Systems Ambulatory Care Centers Clinics & Medi Spas Individual Practices 32

• Execution of strategic planks and driving forces for change will drive aggressive growth • Infrastructure & process discipline lead to margin expansion opportunities • New talent and employee development = increased earnings and cash flow generation 33