Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BIOGEN INC. | tecfideraform8-kbody.htm |

TITLE OF PRESENTATION BIOGEN IDEC 38TH ANNUAL dbACCESS HEALTH CARE CONFERENCE BOSTON, MA MAY 30, 2013

Forward-Looking Statements This presentation contains forward-looking statements, including statements about our growth prospects, regulatory filings and agency actions, product launch plans and the anticipated timing thereof, our intellectual property, data and other proprietary rights, the anticipated development of and data readouts from programs in our clinical pipeline, and the development, commercialization and therapeutic effect of new and potential treatments. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. You should not place undue reliance on these statements. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements, including our dependence on our three principal products, AVONEX, TYSABRI and RITUXAN, the importance of TYSABRI’s sales growth, uncertainty of success in executing our commercial launch of TECFIDERA, uncertainty of success in commercializing and developing other products, product competition, the occurrence of adverse safety events with our products, changes in the availability of reimbursement for our products, adverse market and economic conditions, our dependence on collaborations and other third parties over which we may not always have full control, problems with our manufacturing processes and our reliance on third parties, failure to comply with government regulation, our ability to protect our intellectual property, data and other proprietary rights and have sufficient rights to market our products together with the cost of doing so, the risks of doing business internationally, failure to manage our growth and execute our growth initiatives, charges and other costs relating to our properties, fluctuations in our effective tax rate, our ability to attract and retain qualified personnel, product liability claims, fluctuations in our operating results, the market, interest and credit risks associated with our portfolio of marketable securities, environmental risks, change of control provisions in our collaborations and the other risks and uncertainties that are described in the Risk Factors section of our most recent annual or quarterly report and in other reports we have filed with the SEC. These statements are based on our current beliefs and expectations and speak only as of the date of this presentation. We do not undertake any obligation to publicly update any forward-looking statements. 2 2

Consistently Strong Financial Performance Non-GAAP Diluted EPS ($) 2.74 3.66 4.12 5.15 5.90 6.53 2007 2008 2009 2010 2011 2012 Free Cash Flow ($M) 735 1,286 909 1,452 1,520 1,625 2007 2008 2009 2010 2011 2012 +17% CAGR +19% CAGR 3.2 4.1 4.4 4.7 5.0 5.5 2007 2008 2009 2010 2011 2012 Revenues ($B) +11% CAGR Note: a reconciliation of our GAAP to non-GAAP EPS and free cash flow appears at the end of this presentation. 3

Pillars of Near and Long-term Growth Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science New Potential Product Launches • PLEGRIDYTM • ELOCTATETM • ALPROLIXTM Core Business • AVONEX ® • TYSABRI ® • TECFIDERATM • FAMPYRA® • RITUXAN ® 4

Pillars of Near and Long-term Growth Core Business • AVONEX • TYSABRI • TECFIDERA • FAMPYRA • RITUXAN 5 New Potential Product Launches • PLEGRIDY • ELOCTATE • ALPROLIX Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science

Core Products: Provide Sustainable Revenue Stream Powerful multiple sclerosis therapy A leading worldwide therapy for multiple sclerosis First treatment indicated to improve walking in multiple sclerosis Standard of care for NHL and CLL -- Ex US -- 6 Includes Industry-leading MS Franchise Effective & convenient oral therapy for multiple sclerosis

7 AVONEX: Maintaining a leading position in first-line MS use One of the most prescribed treatments for relapsing forms of MS worldwide A treatment you can start and stay on Maintaining leading position within the interferon class Convenience is key differentiator within injectable segment AVONEX Revenues ($B) 2007 2008 2009 2010 2011 2012 1.1 1.3 1.4 1.5 1.6 1.8 0.8 0.9 0.9 1.0 1.1 1.1 1.9 2.2 2.3 2.5 2.7 2.9 US ROW GAINING SHARE WITHIN THE INJECTABLE CLASS AVONEX PEN® AVOSTARTGRIPTM

TYSABRI: Solid growth trajectory driven by powerful efficacy 8 A compelling treatment option that may be considered early at the first sign of progression Proven to reduce flare-ups and slow physical disability progression Reduces ARR by 68% and EDSS by 42- 54% JCV assay is changing the treatment paradigm Earlier adoption seen in JCV ab (-) patient population Majority of the patients who are starting TYSABRI treatment are JCV ab (-) Retention rates are generally higher in the JCV ab (-) patient population 2007 2008 2009 2010 2011 2012 218 422 509 593 747 886 125 391 551 637 764 745 343 813 1,059 1,230 1,511 1,631 US ROW TYSABRI In Market Sales ($M) HIGH EFFICACY SEGMENT LEADER

TYSABRI in SPMS: High Unmet Medical Need ASCEND Trial Overview SPMS is a large portion of the MS market No effective therapies for SPMS Trends towards improved ambulation in patients with SPMS seen in two prior TYSABRI trials An investigation of whether TYSABRI treatment slows the accumulation of disability not related to relapses in patients with SPMS Primary endpoint: the proportion of subjects experiencing confirmed progression of disability as measured by a composite endpoint FDA special protocol assessment (SPA) obtained with accepted regulatory endpoint Data readout expected 2015 9

TECFIDERA (dimethyl fumarate): Providing a strong oral option for MS treatment 10 10 Strong efficacy Favorable safety profile Convenience of oral administration High physician awareness Anticipate broad appeal to a large segment of prescribing neurologists and MS patients *Under Active Review with EMA Improved IP offers protection until 2028

11 TECFIDERA US Launch Underway Pleased with the speed and quality of the execution by the US Commercial organization Encouraged by the early signs with both high patient and physician interest New starts coming from both naïve to therapy and patient switches Expect to be the leading oral MS therapy over time US Launch off to a Great Start

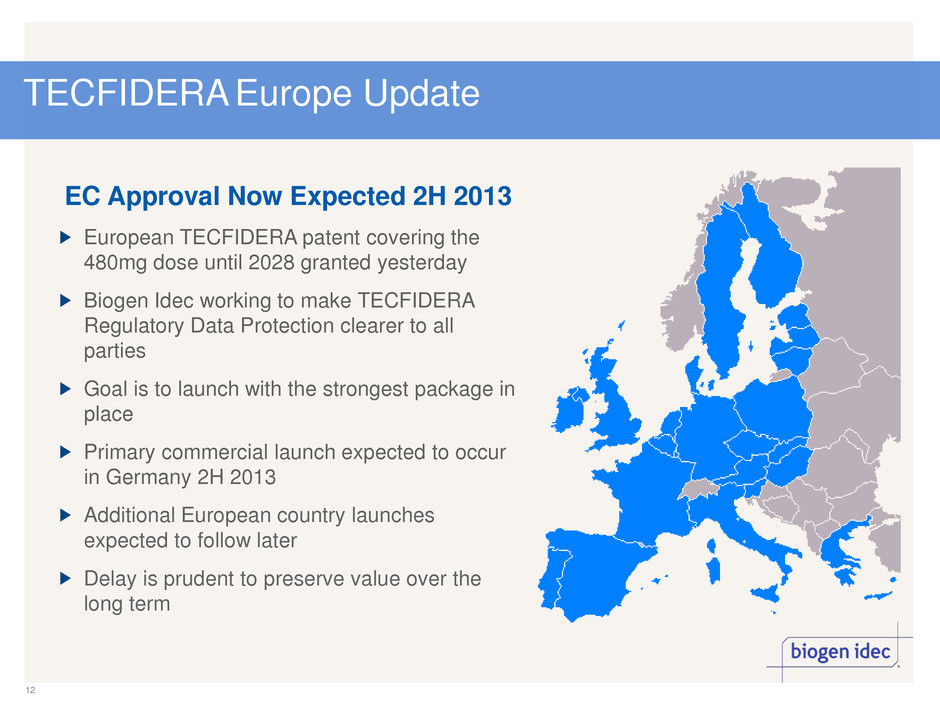

12 TECFIDERA Europe Update EC Approval Now Expected 2H 2013 European TECFIDERA patent covering the 480mg dose until 2028 granted yesterday Biogen Idec working to make TECFIDERA Regulatory Data Protection clearer to all parties Goal is to launch with the strongest package in place Primary commercial launch expected to occur in Germany 2H 2013 Additional European country launches expected to follow later Delay is prudent to preserve value over the long term

Pillars of Near and Long-term Growth Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science New Potential Product Launches • PLEGRIDY • ELOCTATE • ALPROLIX Core Business • AVONEX • TYSABRI • TECFIDERA • FAMPYRA • RITUXAN 13

Pillars of Near and Long-term Growth New Potential Product Launches • PLEGRIDY • ELOCTATE • ALPROLIX Core Business • AVONEX • TYSABRI • TECFIDERA • FAMPYRA • RITUXAN 14 Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science

PLEGRIDY: Interferon Candidate with a strong potential 15 MS therapies Administration Injections per year PLEGRIDY sub-Q No more than 26 AVONEX IM 52 Rebif® sub-Q 156 Betaseron® sub-Q 182 Extavia® sub-Q 182 Copaxone® sub-Q 365 Positive Phase III (ADVANCE) trial results showed potential for every two and four week dosing to significantly reduce relapses and disability progression with a favorable safety and tolerability profile Potential to grow market share within the injectable segment Potential to reduce current treatment burden POTENTIAL TO PROVIDE STRONG EFFICACY & COMPELLING CONVENIENCE Note: sub-Q = subcutaneous injection, IM = Intramuscular injection. PLEGRIDY is still under investigation and not commercially available

ELOCTATE (rFVIIIFc): Potential first long-lasting treatment for Hemophilia A The extended half-life of ELOCTATE may allow for once to twice weekly prophylactic treatment Potential for prophylactic patients to reduce their injections by 50 to 100 per year Potential for episodic patients to dose once weekly prophylactically and significantly reduce their bleeding episodes with the same number of injections per year Zero inhibitors seen in clinical trial Announced in May 2013 our BLA submission was accepted by FDA; standard review ELOCTATE has 1.5-fold fold longer half-life Episodic Treatment Once Weekly Prophylaxis With rFVIII ~40 bleeds a year / ~56 injections With ELOCTATE ~4 bleeds a year / ~56 Injections Hypothetical for illustrative purposes only based on data seen in Valentino et al, The Journal of Thrombosis and Haemostasis (JTH), March 2012 and the weekly prophylaxis arm in the A-Long study. No head-to-head studies have been conducted. 16 19 hours 12 hours ELOCTATE Advate®* ELOCTATE is still under investigation and not commercially available *Registered trademark of Baxter International

ALPROLIX (rFIXFc): Potential first long-lasting treatment for Hemophilia B ALPROLIX showed a 2.4-fold longer half-life compared to BeneFIX® in the B-LONG study Prophylactic dosing every 1-2 weeks resulted in low bleeding rates Potential to have major impact on adoption of prophylaxis Zero inhibitors seen in clinical studies Announced in March 2013 our BLA submission was accepted by FDA; standard review 17 ALPROLIX is still under investigation and not commercially available

Pillars of Near and Long-term Growth Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science New Potential Product Launches • PLEGRIDY • ELOCTATE • ALPROLIX Core Business • AVONEX • TYSABRI • TECFIDERA • FAMPYRA • RITUXAN 18

Pillars of Near and Long-term Growth New Potential Product Launches • PLEGRIDY • ELOCTATE • ALPROLIX Core Business • AVONEX • TYSABRI • TECFIDERA • FAMPYRA • RITUXAN 19 Revitalized Pipeline & R&D • Maturing Pipeline • Advanced target discovery • Novel academic consortia • Innovative science

Multiple Sclerosis (Ph. 1) Optic Neuritis (Ph. 2) Lupus Nephritis Idiopathic Pulmonary Fibrosis General Lupus Spinal Muscular Atrophy Neuropathic Pain Alzheimer's Disease Pipeline PHASE I PHASE II PHASE III FILED 20 Multiple Sclerosis Daclizumab Multiple Sclerosis TECFIDERA Hemophilia A ALPROLIX ELOCTATE Hemophilia B PLEGRIDY Multiple Sclerosis Chronic Lymphocytic Leukemia & Non-Hodgkin’s Lymphoma Obinutuzumab (GA101) Secondary Progressive Multiple Sclerosis TYSABRI Neublastin Anti-TWEAK Anti-LINGO Anti-CD40 Ligand STX-100 ISIS-SMNRx BIIB037 *Under Active Review with EMA FDA APPROVED* FDA FILED FDA FILED FDA FILED

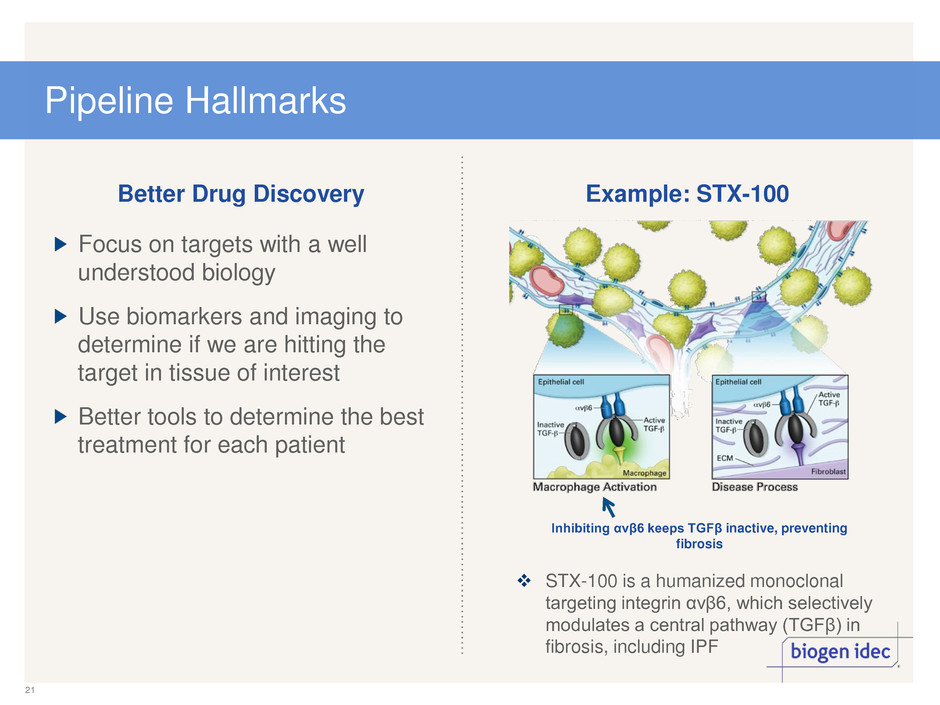

Pipeline Hallmarks 21 Inhibiting αvβ6 keeps TGFβ inactive, preventing fibrosis Example: STX-100 Better Drug Discovery Focus on targets with a well understood biology Use biomarkers and imaging to determine if we are hitting the target in tissue of interest Better tools to determine the best treatment for each patient STX-100 is a humanized monoclonal targeting integrin αvβ6, which selectively modulates a central pathway (TGFβ) in fibrosis, including IPF

A Passion for Innovative Science 22 ALS Genotyping Consortium ALS Consortium Academic Collaborations Hemophilia Genotyping Project Interactome Approaches to understand the biology of devastating diseases Collaboration with top tier academic centers Novel ALS consortium of eminent neuroscientists focused on understanding the biology of ALS including: Harvard Interactome Project established to understand human protein-protein interactions and define novel pathways for drug target identification R&D Vision: Create the Best Science Driven R&D Pipeline DROSOPHILA INTERACTOME COURTESY OF SPYROS ARTAVANIS-TSAKONAS, Ph.D. Pietro De Camilli, M.D. J. Wade Harper, Ph.D. Christopher E. Henderson, Ph.D. Arthur L. Horwich, M.D. Lee L. Rubin, Ph.D. Marc Tessier-Lavigne, Ph.D.

Biogen Idec: A Bright Future 23 Strong near-term growth prospects driven by our core business Entering into an era of significant long-term growth driven by multiple potential new product launches Building an innovative pipeline to sustain longer-term value creation

GAAP to Non-GAAP Reconciliation 24 Condensed Consolidated Statements of Income – Operating Basis (unuadited, $ in millions, except per share amounts) FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 GAAP diluted EPS $ 1.99 $ 2.65 $ 3.35 $ 3.94 $5.04 $5.76 Adjustment to net income attributable to Biogen Idec Inc. (see below) $ 0.75 $ 1.01 $ 0.77 $ 1.21 $0.86 $0.77 Effect of the adoption of a new accounting standard which requires allocation of income to certain holders of equity and debt instruments - - - - Non-GAAP diluted EPS $ 2.74 $ 3.66 $ 4.12 $ 5.15 $5.90 $6.53 GAAP Net Income Attributable to Biogen Idec Inc. $ 638 $ 783 $ 970 $ 1,005 $1,234 $1,380 R&D – Severance and restructuring 1 1 3 1 - 9 R&D – Expenses paid by Cardiokine - 5 8 5 - - SG&A – Severance and restructuring 1 4 - 6 - - 2010 Restructuring initiatives - - - 75 19 2 Amortization of intangible assets 258 333 290 209 206 194 In-process R&D (IPR&D) related to the 2003 Biogen Idec merger; the 2006 acquisitions of Conforma and Fumapharm; the 2007 acquisition of Syntonix 84 25 - 245 - - and consolidation of Cardiokine and Neurimmune; the contingent consideration payments made in 2008 associated with the 2006 Conforma acquisition and in 2010 associated with the 2007 Syntonix acquisition, and the 2010 IPR&D charge related to the consolidation of Knopp (Gain)/loss on sale of long lived assets - (9) - - - Other income, net: Gain on sale of long lived assets (7) - - - - Income tax effect primarily related to reconciling items (66) (82) (97) (116) (62) (53) Stock option expense 36 26 29 33 12 8 Fair value adjustment of contingent consideration associated with 2010 Panima acquisition and 2011 purchase of Dompe’s noncontrolling interst 36 27 Net income attributable to non-controlling interests: consolidation of Knopp in 2010, Cardiokine and Neurimmune in 2007 and expenses paid by Cardiokine in 2008, 2009 and 2010. (65) (5) (8) (149) - - Non-GAAP Net Income Attributable to Biogen Idec Inc. $ 879 $ 1,081 $ 1,195 $ 1,315 $1,446 $1,567 Free Cash Flow Reconciliation (unaudited, $ in millions) FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 Net cash flows provided by operating activities $ 1,019 $ 1,562 $ 1,075 $ 1,625 $1,728 $ 1,880 Purchases of property, plant and equipment (Capital Expenditures) 284 276 166 173 208 255 Free Cash Flow $ 735 $ 1,286 $ 909 $ 1,452 $1,520 $ 1,625 Use of Non-GAAP Financial Measures We supplement our consolidated financial statements presented on a GAAP basis by providing additional measures which may be considered “non-GAAP” financial measures under applicable SEC rules. We believe that the disclosure of these non-GAAP financial measures provides additional insight into the ongoing economics of our business and reflects how we manage our business internally, set operational goals and forms the basis of our management incentive programs. These non-GAAP financial measures are not in accordance with generally accepted accounting principles in the United States and should not be viewed in isolation or as a substitute for reported, or GAAP, net income attributable to Biogen Idec Inc. and diluted earnings per share. Our “Non-GAAP net income attributable to Biogen Idec Inc.” and “Non-GAAP diluted EPS” financial measures exclude the following items from GAAP net income attributable to Biogen Idec Inc. and diluted earnings per share: 1. Purchase accounting and merger-related adjustments. We exclude certain charges related to the 2003 merger between Biogen Inc. and Idec Pharmaceuticals, Inc., certain acquisition-related items, and certain amounts in relation to the consolidation of variable interest entities for which we are the primary beneficiary. These adjustments include charges for in-process research and development, the amortization of certain acquired intangible assets and adjustments to the fair value of our contingent consideration obligations. The exclusion of these charges provides management and investors with a supplemental measure of performance which the Company believes better reflects the underlying economics of the business. 2. Stock option expense recorded in accordance with the accounting standard for share-based payments. We believe that excluding the impact of expensing stock options better reflects the recurring economic characteristics of our business. 3. Other items. We evaluate other items on an individual basis, and consider both the quantitative and qualitative aspects of the item, including (i) its size and nature, (ii) whether or not it relates to our ongoing business operations, and (iii) whether or not we expect it to occur as part of our normal business on a regular basis. We also include an adjustment to reflect the related tax effect of all reconciling items within our reconciliation of our GAAP to Non-GAAP net income attributable to Biogen Idec Inc.