Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SLM Corp | d545160dex991.htm |

| 8-K - FORM 8-K - SLM Corp | d545160d8k.htm |

Separating to Enhance Value and

Increase Growth Potential

MAY 29, 2013

Exhibit 99.2 |

2

Forward Looking Statements

This investor presentation contains “forward-looking statements” and information based

on management’s current expectations as of the date of this release, including the planned

separation of Sallie Mae’s portfolios holding federally guaranteed and private education loans, as well as most

related servicing and collections activities, from the private education loan origination and

servicing business, including Sallie Mae Bank and the private loans it currently holds, and the

expected financial results of the two companies after the separation. Statements that are not historical

facts, including statements about Sallie Mae’s beliefs or expectations and statements that assume

or are dependent upon future events, are forward-looking statements. Forward-looking

statements are subject to risks, uncertainties, assumptions and other factors that may cause actual

results to be materially different from those reflected in such forward-looking statements. These

factors include, among others, the risks and uncertainties set forth in Item 1A “Risk

Factors” and elsewhere in Sallie Mae’s Annual Report on Form 10-K for the year ended Dec. 31, 2012;

increases in financing costs; limits on liquidity; increases in costs associated with compliance with

laws and regulations; changes in accounting standards and the impact of related changes in

significant accounting estimates; any adverse outcomes in any significant litigation to which Sallie

Mae is a party; credit risk associated with Sallie Mae’s exposure to third parties, including

counterparties to Sallie Mae’s derivative transactions; and changes in the terms of

student loans and the educational credit marketplace (including changes resulting from new laws and the

implementation of existing laws). Sallie Mae could also be affected by, among other things: changes in

its funding costs and availability; reductions to its credit ratings or the credit ratings of

the United States of America; failures of its operating systems or infrastructure, including those of third-

party vendors; damage to its reputation; failures to successfully implement cost-cutting and

restructuring initiatives and adverse effects of such initiatives on its business; changes in

the demand for educational financing or in financing preferences of lenders, educational institutions,

students and their families; changes in law and regulations with respect to the student lending

business and financial institutions generally; increased competition from banks and other

consumer lenders; the creditworthiness of its customers; changes in the general interest rate

environment, including the rate relationships among relevant money-market instruments and those of

its earning assets vs. its funding arrangements; changes in general economic conditions; and

changes in the demand for debt management services. The preparation of Sallie Mae’s

consolidated financial statements also requires management to make certain estimates and assumptions including estimates and

assumptions about future events. These estimates or assumptions may prove to be incorrect. All

forward-looking statements contained in this investor presentation are qualified by these

cautionary statements and are made only as of the date of this presentation. Sallie Mae does not

undertake any obligation to update or revise these forward-looking statements to conform the

statement to actual results or changes in its expectations except as required by law. In

addition, the planned separation transaction and the terms, details, asset allocations, timing and

implementation are all subject to change as Sallie Mae continues to consider, analyze and work on the

implementation of the foregoing.

|

3

Sallie Mae’s Progress Post-2008

Built leading private education lending platform

Consistent access to low-cost funds through ABS issuance and consumer

deposits Significantly reduced unsecured debt outstanding

Proven ability to monetize FFELP residuals at attractive levels

Executed capital return strategy through dividends and share repurchases

Steady improvement in credit quality

Repositioned franchise in response to elimination of FFELP

Aggressively managed expenses

Major achievements across all facets of the

business: Liquidity,

Earnings, Capital Management, Credit Quality & Operations |

4

Separate Into Two Distinct Businesses

NewCo

Sallie Mae Bank

Strategic

Focus

Leading education loan management

company

Leading private education loan origination

franchise –

retains Sallie Mae brand

Key

Businesses

FFELP Loan Portfolio

Non-Bank Private Education Loan Portfolio

Existing Secured & Unsecured Debt

Largest Education Loan Servicer

Collection

Guarantor Servicing

Largest Private Education Loan Originator

Private Loan Servicing (incl. NewCo loans)

Other Consumer Assets (Future)

Deposits

Upromise

Insurance

Leadership

Jack Remondi

Joseph DePaulo

Currently Chief Executive Officer

Currently Executive Vice President,

Banking and Finance |

5

Rationale for Separation of Businesses

Provide greater visibility into the financial and operating performance of each

business

Allocate capital in a more efficient and customized manner for each business

Create strategic flexibility and increase management focus

Optimal structure for complex and increasingly different regulatory

environment Attract a more focused shareholder base to the specific operating

and return characteristics of each business |

6

Key Business Metrics & Financial Attributes

NewCo

Sallie Mae Bank

Key Financial

Metrics

Key Financial

Attributes

$ in billions, except per share amounts

Total Assets

$164.8

$118.1

Private Loans

$31.6

Other Assets

$15.1

Unsecured Debt

$17.9

Capital

$3.5

Total Assets

$9.9

Private Loans

$5.9

Other Assets

$4.0

Deposits

$7.8

Capital

$1.6

ROE

16 –

20%

Predictable cash flows

Consistent capital return

Strong debt service coverage

High ROE

High growth

Highly-capitalized

FFELP Loans

Note: Based on current plans and SLM’s 31-Mar-2013 financial information. |

7

NewCo Profile

Expand leading education loan portfolio

manager, servicer, and collection business

Maintain stable dividend and actively

manage capital structure

Diversify fee revenue through expansion

and growth of federal and other service

contracts

Efficiently manage expense base

Maintain access to capital markets

Leading market share and infrastructure

well-positioned for evolving market place

Substantial institutional knowledge and

expertise

Strong cash flow generation with ample

debt service coverage

Substantial

economies

of

scale

–

can

continue to deepen relationship and

servicing contract with the Department of

Education

Strategy

Strengths |

8

NewCo Profile

NewCo Net Assets

Projected Life of Loan Cash Flows

$ in billions

Net

Assets

Secured FFELP Net Assets

$6.4

Secured Private Net Assets

6.7

Net Tangible

Assets

7.9

Total

Net Assets

$21.0

Unsecured

Debt

$17.9

FFELP Cash Flows

Secured

Residual

$9.4

Floor

2.8

Servicing

4.9

Total

Secured

$17.0

Unencumbered

$0.9

Total

FFELP Cash Flows

$17.9

Private

Credit Cash Flows

Secured

Residual

$10.7

Servicing

1.3

Total

Secured

$12.0

Unencumbered

$7.2

Total

Private Cash Flows

$19.2

Combined Cash Flows

$37.1 |

9

Sallie Mae Bank Profile

Help families save and pay for college

through responsible loan, insurance, and

savings products

Continue to grow the market leading

Private Education Loan Origination

franchise

Leverage Sallie Mae Brand to develop

other consumer products

Diversify and grow funding-base

The most-recognized brands in the

education loan industry

Leading market share (~47%) in private

loan originations

Sustainable growth model with high current

and expected returns

Simple, low cost delivery system

Proven securitization program

Stable, deposit funded balance sheet

Strategy

Strengths |

10

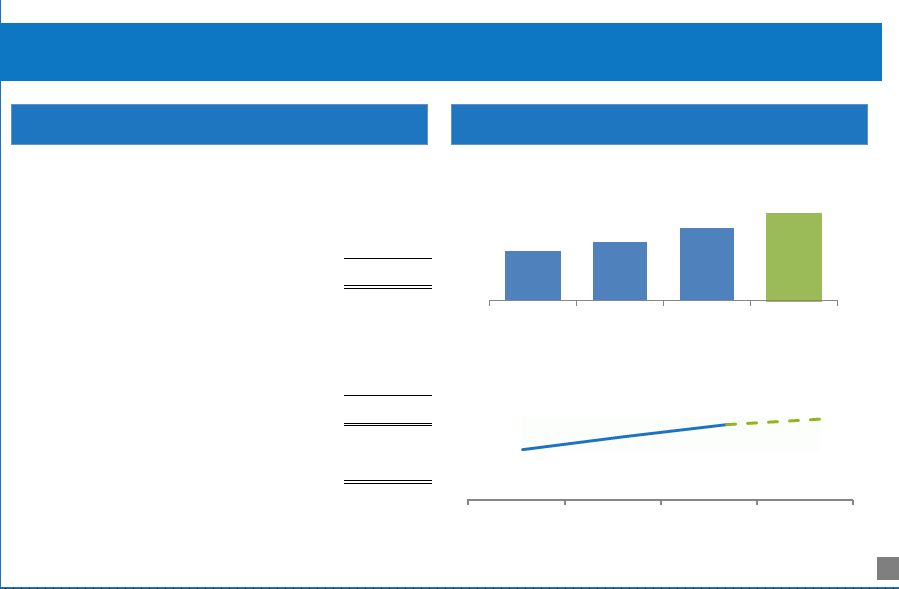

Sallie Mae Bank Profile

$2.3

$2.7

$3.3

$4.0

2010

2011

2012

2013E

Loan Origination

Balance Sheet Overview

Private Education Loan Growth

Assets

FFELP

Loans

$1.1

Private Education

Loans

5.9

Other

2.9

Total

Assets

$9.9

Liabilities

Bank Deposits

$7.8

Other Liabilities

0.5

Total Liabilities

$8.3

Total Capital

$1.6

Tier 1 RBC Ratio

13.8%

32.0%

40.0%

47.0%

51.0%

2010

2011

2012

2013E

Origination Market Share (%) |

11

Proposed Transaction Details

Proposed

Transaction

Structure

Financial

Details

Timing &

Approvals

The separation would be effected via a tax-free spin-off to Sallie Mae

shareholders Upon completion of the transaction, Sallie Mae’s then

current shareholders would own 100% of the common stock of both NewCo and

Sallie Mae Bank, each of which would be independent, publicly traded

companies Distribution ratio for the spin-off has not been

determined All existing secured and unsecured debt will remain at

NewCo NewCo expects to follow a capital return policy that is consistent

with current policy (dividend and share repurchase)

Sallie Mae Bank is not expected to pay a common dividend initially in order to

retain capital to support growth

Expect the separation of the business and spin-off distribution to be

completed within 12 months Subject to certain customary conditions including

Board of Director approval, receipt of a favorable IRS ruling and tax

opinion, SEC effectiveness of Form 10 The contemplated separation and

distribution will not require a shareholder vote |