Attached files

| file | filename |

|---|---|

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - SERVICE CORP INTERNATIONAL | ss176990_ex0201.htm |

| EX-10.1 - VOTING AND SUPPORT AGREEMENT - SERVICE CORP INTERNATIONAL | ss176990_ex1001.htm |

| 8-K - CURRENT REPORT - SERVICE CORP INTERNATIONAL | ss176990_8k.htm |

Investor Presentation Regarding SCI’s Acquisition of Stewart Enterprises, Inc. May 29, 2013 NYSE: SCI North America’s largest provider of funeral, cemetery & cremation services |

|

Forward-Looking Statements Information set forth in this release contains forward-looking statements, which involve a number of risks and uncertainties. Readers are cautioned that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving SCI and Stewart Enterprises, including future financial and operating results, the combined company's plans, objectives, synergies, expectations and intentions and other statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Stewart Enterprises’ shareholders to approve the transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers. Additional factors that may affect future results are contained in SCI's filings with the SEC, which are available at www.sci-corp.com. SCI disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise. |

|

Transaction overview On May 29, 2013, SCI announced a definitive agreement to acquire all of the outstanding shares of Class A and Class B common stock of Stewart Enterprises for $13.25 in cash Acquisition valued at $1.2 billion, or approximately $1.4 billion inclusive of cash and debt acquired Transaction subject to customary closing conditions, which include the approval of Stewart’s shareholders and the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Act Frank Stewart and certain of his affiliates have entered into a voting agreement to support the transaction Acquisition not anticipated to close until end of year 2013 or early 2014 No expected impact to normalized financial outlook for 2013; any costs incurred as a result of the transaction will be considered one-time and removed from normalized earnings per share and adjusted cash flow from operations |

|

Strategic rationale Complementary geographic fit in a highly fragmented industry and established platform in attractive metropolitan markets Further promotes our operational and preneed sales initiatives at a time where we believe the Baby Boomer impact is beginning to take effect Stewart has leadership positions in many of their markets; strong local scale with significant volume through each location further leverages back-office costs Compelling and opportunistic use of capital to accelerate long-term strategies and enhance shareholder value Immediately accretive to adjusted cash flow from operations and normalized earnings per share, excluding one-time implementation and closing costs Compelling return on investment that meaningfully exceeds our weighted average cost of capital Attractive and tangible synergies Favorable financing opportunities |

|

Significant synergies We expect to realize approximately $60 million in annual cost savings from the combined company within 24 months after close Synergy opportunities are significant Reduced back-office systems and infrastructure costs Elimination of duplicative public company and management structure costs Improved purchasing power through greater scale $60 million synergies represent 11.4% of Stewart’s revenues To achieve these synergies, we expect to incur one-time cash costs of approximately $30 million spread over a 2 year period We have a proven track record of successfully integrating large acquisitions and delivering on or exceeding our expected synergies |

|

A look at the combined company SCI LTM 3/31/13 Stewart LTM 1/31/13 Pro forma Combined Company Estimated Synergies Post Synergy Pro forma Combined Company Revenues (in millions) $2,460.4 $526.9 $2,987.3 Operating Income (in millions) $428.4 $87.4 $515.8 Operating Margin 17.4% 16.6% 17.3% Adjusted EBITDA (in millions) $644.5 $115.5 $760.0 $60 $820 Preneed Backlog (in billions) $7.5 $1.8 $9.3 Number of Funeral Homes 1,437 216 1,653 Number of Cemeteries 374 141 515 Total Operating locations 1,811 515 2,168 Total Combination Operations (included in above) 213 69 282 Employees (at fiscal year end 2012) 20,567 4,800 25,367 Note – Pro forma Combined Company subject to reduction due to divestitures required by regulatory agencies. Adjusted EBITDA and Operating Margin are non-GAAP financial measures. Please see slides 11-12 for a reconciliation of Adjusted EBITDA to the appropriate GAAP measure and for other disclosures. The pro forma combined information does not include the impact of any divestitures which may be required in order to consummate the transaction. |

|

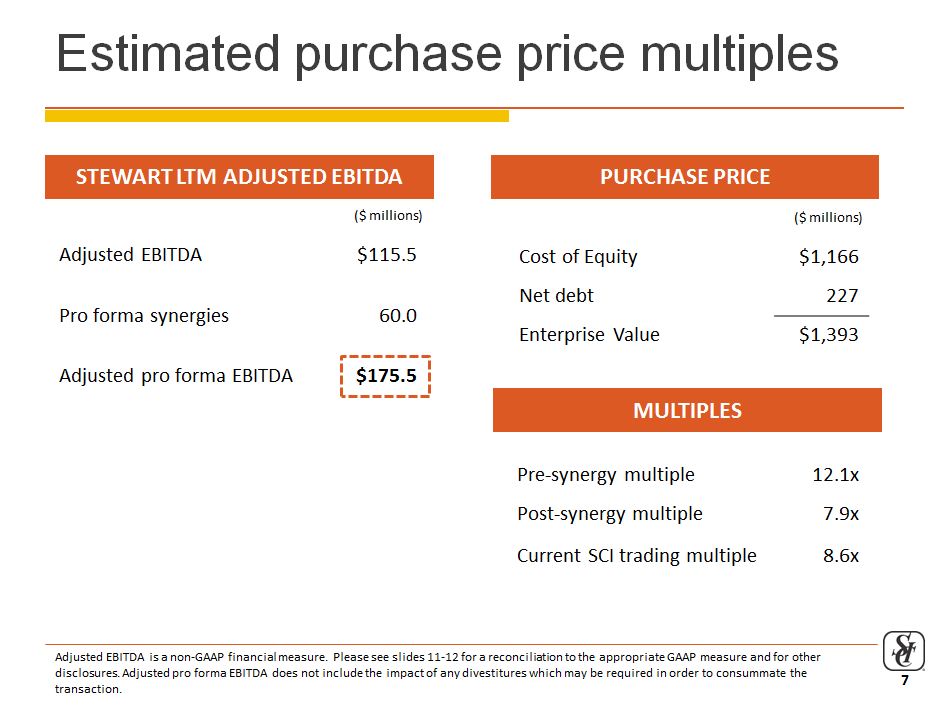

STEWART LTM ADJUSTED EBITDA PURCHASE PRICE ($ millions) ($ millions) |

|

Funding for the transaction Commitment currently in place from JPMorgan Chase Bank, N.A. to finance the acquisition We expect to use cash on hand from both companies at closing Optimal structure of permanent financing to be determined prior to the close of the transaction, but will likely involve a mix of long-term permanent debt and shorter term pre-payable debt We believe the strong cash flow and balance sheet of the combined company will support continued investment in growth initiatives as well as facilitate deleveraging post-close We expect to maintain a balanced approach of investing in our business and returning capital to shareholders while also supporting a prudent capital structure We anticipate the continuation of our regular quarterly cash dividends |

|

Transaction summary Expands unparalleled presence in the highly fragmented North America funeral and cemetery industry Complementary businesses with leadership positions Enhanced opportunities for operational and preneed sales initiatives in metropolitan markets at a time where we believe Baby Boomer impact is beginning to take effect Proven track record of successfully integrating large acquisitions and delivering on synergy commitments Immediately accretive to adjusted operating cash flow and normalized earnings per share Compelling return on investment that meaningfully exceeds weighted average cost of capital Attractive and tangible synergies |

|

Additional information Additional Information About This Transaction In connection with the proposed transaction, Stewart Enterprises will file a proxy statement with the SEC. INVESTORS ARE URGED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain the proxy statement, as well as other filings containing information about Stewart Enterprises and SCI, free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the proxy statement and other filings made by Stewart Enterprises with the SEC can be obtained, free of charge, by directing a request to Stewart Enterprises, Inc., 1333 South Clearview |

|

EBITDA & Adjusted EBITDA We use EBITDA as an underlying operational performance measure of the continuing operations of the business and to have a basis to compare underlying operating results to prior and future periods To calculate EBITDA, we make adjustments to net income (a GAAP measure) to remove provision for income taxes, interest expense and depreciation and amortization expense Adjusted EBITDA is a financial measure calculated in accordance with our credit agreement, and represents EBITDA further adjusted to reflect the impact of Gains or losses on the early extinguishment of debt Gains or losses on divestitures and impairment charges, net Non-cash stock compensation expenses Other operating income, net Acquisitions and dispositions Other non-recurring expenses We believe that EBITDA and Adjusted EBITDA provide investors and our lenders with additional information to measure our financial performance and evaluate our ability to service our debt Our calculations of EBITDA and Adjusted EBITDA are non-GAAP measures and are not necessarily comparable to other similarly titled measures of other companies. In addition, EBITDA and Adjusted EBITDA do not include interest expense and the replacement costs of assets, both of which can impact our ability to generate profits and cash flows |

|

EBITDA & Adjusted EBITDA reconciliation (in millions) SCI LTM at March 31, 2013 STEWART LTM |

|