Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Tobira Therapeutics, Inc. | d492832dex11.htm |

| EX-23.1 - EX-23.1 - Tobira Therapeutics, Inc. | d492832dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 29, 2013

Registration No. 333-188209

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

Form S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

REGADO BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 03-0422069 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

120 Mountain View Boulevard

Basking Ridge, New Jersey 07920

(908) 580-2100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David J. Mazzo, Ph.D.

President and Chief Executive Officer

Regado Biosciences, Inc.

120 Mountain View Boulevard

Basking Ridge, New Jersey 07920

(908) 580-2100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael J. Lerner John D. Hogoboom Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 |

Michael D. Maline Edward A. King Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, New York 10018 (212) 813-8800 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

|

Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

The registrant is an “emerging growth company” as defined in Section 2(a) of the Securities Act. This registration statement complies with the requirements that apply to an issuer that is an emerging growth company.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PROSPECTUS (Subject to Completion) |

Dated May 29, 2013 |

5,000,000 Shares

Common Stock

This is the initial public offering of shares of our common stock. We are offering 5,000,000 shares of our common stock. Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on The NASDAQ Global Market under the symbol “RGDO.” We expect that the public offering price will be between $14.00 and $16.00 per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary – Implications of Being an Emerging Growth Company.”

Our business and an investment in our common stock involve significant risks. These risks are described under the caption “Risk Factors” beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount(1) |

$ | $ | ||

| Proceeds, before expenses, to us |

$ | $ |

| (1) | We refer you to “Underwriting” beginning on page 134 of this prospectus for additional information regarding total underwriter compensation. |

The underwriters may also purchase up to an additional 750,000 shares from us at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any.

Certain of our existing stockholders, including stockholders affiliated with certain of our directors, have indicated an interest in purchasing up to an aggregate of approximately $29.5 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

| Cowen and Company | BMO Capital Markets |

Canaccord Genuity Needham & Company Wedbush PacGrow Life Sciences

, 2013

Table of Contents

For investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. You should carefully read this prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our common stock, including the information discussed under “Risk Factors” beginning on page 10 and our financial statements and notes thereto that appear elsewhere in this prospectus. As used in this prospectus, the terms “we,” “our,” “us,” or “the Company” refer to Regado Biosciences, Inc.

Our Company

We are a biopharmaceutical company focused on the discovery and development of novel, first-in-class, actively controllable antithrombotic drug systems for acute and sub-acute cardiovascular indications. We are pioneering the discovery and development of two-component drug systems consisting of a therapeutic aptamer and its specific active control agent. Our actively controllable product candidates have the potential to improve outcomes, enhance the patient experience and reduce overall treatment costs.

Our Lead Product Candidate

REG1 is an actively controllable anticoagulant targeting coagulation Factor IXa for use in patients with a wide variety of acute coronary syndromes, or ACS, undergoing a percutaneous coronary intervention, or PCI, a hospital-based procedure used to mechanically open or widen obstructed coronary arteries. REG1 consists of pegnivacogin, an anticoagulant aptamer, and its specific active control agent, anivamersen. Pegnivacogin achieves its maximal anticoagulant effect within five minutes of injection. Anivamersen is an oligonucleotide, a biological polymer consisting of a relatively small number of nucleotides chemically bound in a linear sequence that forms a chain-like structure, or strand, and has no pharmacologic activity other than to bind to pegnivacogin. Anivamersen rapidly and precisely reduces or eliminates the anticoagulant activity of pegnivacogin. Both pegnivacogin and anivamersen are administered by intravenous bolus injection using weight-based dosing. By adjusting the dose of anivamersen relative to pegnivacogin, the anticoagulant effect of pegnivacogin can be precisely and rapidly controlled or eliminated. The unprecedented level of control that REG1 provides permits physicians to achieve levels of anticoagulation in patients that would be unsafe to use with existing anticoagulants.

PCI procedures involve a significant risk of ischemic events, including death, stroke, myocardial infarction and the need for revascularization of the artery. Because of this risk, powerful anticoagulant drugs are administered prior to and throughout the PCI procedure. However, anticoagulants create a significant risk of major bleeding events. As a result, interventional cardiologists are forced to make a compromising medical decision because they lack the means to simultaneously reduce the risks of ischemic and major bleeding events.

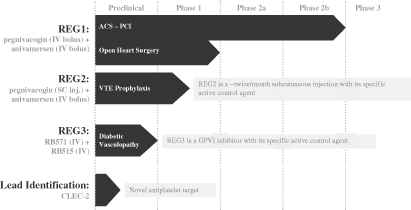

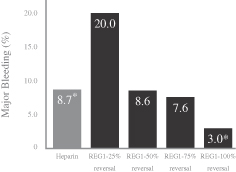

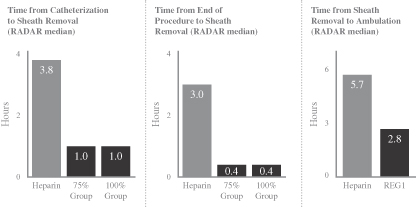

REG1 is the first and only anticoagulant to demonstrate a reduction in both ischemic and major bleeding events in a clinical trial for PCI. In our randomized, partially blinded, dose-ranging Phase 2b trial involving 640 subjects, or the RADAR trial, when compared to standard of care heparin, REG1 demonstrated both a rapid and predictable anticoagulant effect and the ability to precisely modulate or eliminate that effect in real time. REG1 also demonstrated the following important clinical and pharmacoeconomic benefits:

| • | an approximate 66.0% reduction in ischemic events; |

| • | a reduction of up to 60.0% in major bleeding events; |

| • | a substantial reduction in time from catheterization to catheter sheath removal from a median of 3.8 hours to a median of one hour; |

| • | a substantial reduction in time from completion of the PCI procedure to catheter sheath removal from a median of three hours to a median of 24 minutes; and |

| • | a substantial reduction in the time subjects were required to remain still following catheter sheath removal from a median of 5.7 hours to a median of 2.8 hours. |

1

Table of Contents

Based on these clinical results and after discussion with the U.S. Food and Drug Administration, or FDA, and the European Medicines Agency, we intend to initiate a single, open-label, 13,200 subject Phase 3 trial of REG1, or the REGULATE-PCI trial, in the second half of 2013. REGULATE-PCI, if successful, will serve as the basis for product registration applications worldwide.

We believe that REG1 has the potential to become the standard of care for anticoagulation therapy in PCI and other cardiovascular procedures because it gives physicians precise, on-demand control over anticoagulation levels. We believe the key advantages of REG1 over existing therapies are the following:

| • | Reduced ischemic events. REG1 allows a higher level of anticoagulation to be used safely during PCI, which will reduce the occurrence of ischemic events. |

| • | Reduced major bleeding events. REG1’s anticoagulant effect can be modulated or eliminated at the end of PCI which will reduce the risk of major bleeding events. |

| • | Precise and predictable dosing. Because REG1’s effect is independent of an individual patient’s metabolism or health, dosing is precise and predictable, thereby eliminating the need for time-consuming and costly patient monitoring during and after PCI. |

| • | Broad applicability. REG1’s use in PCI is unrestricted for high risk patients such as those with kidney or liver impairment. |

| • | Pharmacoeconomic benefits. REG1 will reduce overall treatment costs by reducing ischemic and major bleeding events, shortening procedure and recovery times, reducing the need for procedure-related follow-up interventions and re-hospitalizations, increasing staff and facility efficiency and improving the patient experience. |

We believe that REG1 has potential for use in other PCI and interventional cardiovascular procedures, such as open heart surgery, PCI as a treatment for ST segment elevation myocardial infarction as well as transcatheter aortic valve replacement or implantation.

PCI Overview

PCIs are hospital-based procedures used to mechanically open or widen obstructed coronary arteries. According to the American Heart Association, approximately 950,000 PCIs were performed in the United States in 2010. We estimate that in 2010 approximately 1.1 million PCIs were performed in Europe and at least 1.0 million PCIs were performed in the rest of the world. Based upon the estimated cost per procedure of branded anticoagulants, we believe that this represents a greater than $3.0 billion annual market opportunity for anticoagulants used in PCI procedures. We believe that an antithrombotic treatment that can address the shortcomings of existing anticoagulants would establish a new standard of care.

Our Proprietary Technology Platform

Our aptamers are single strands of nucleic acids, or oligonucleotides, that are chemically synthesized. Unlike other oligonucleotides, which are designed to control gene expression, an aptamer has a unique geometric shape that binds specifically and tightly to a target protein molecule, leading to inhibition of the target’s activity. Aptamers have been discovered that interact with essentially every class of therapeutic protein target. An aptamer’s pharmacologic activity can be controlled by interaction with a complementary oligonucleotide, which we term a specific active control agent. When the specific active control agent binds to the aptamer, it changes the aptamer’s shape thereby eliminating its therapeutic activity. We believe that the following factors give us a competitive advantage:

| • | a proven discovery team including the co-inventor of active aptamer control agent technology; |

2

Table of Contents

| • | an exclusive license to the patents covering active aptamer control agent technology, which include broad claims for methods to design and administer agents to control aptamer activity in the body; |

| • | a commercial license to a combinatorial chemistry technology platform for aptamer discovery and development; |

| • | the know-how to identify, isolate and optimize therapeutic aptamers and their active control agents, which has led to the discovery of multiple product candidates; |

| • | a proven pharmaceutical development team with experience in the development of efficient and economical manufacturing processes for aptamers and active control agents; and |

| • | an extensive clinical database of systemic aptamer use, which gives us unparalleled expertise in the discovery of new two-component aptamer-based product candidates. |

Aptamer technology has evolved significantly since first generation aptamers were described in 1990. Our product candidates consist of third and fourth generation aptamers which have significantly improved pharmaceutic and pharmacokinetic stability and have not shown immunological activity present in earlier generation aptamers.

Additional Pipeline Opportunities

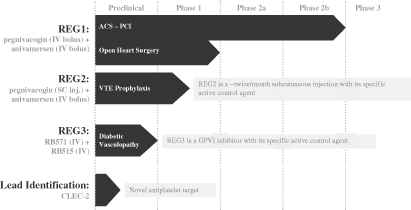

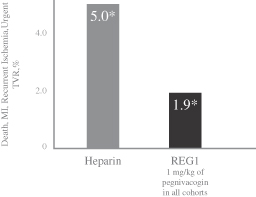

Using our proprietary technology platform, we are developing a portfolio of additional clinical candidates in acute and sub-acute cardiovascular and other indications. REG3 is a preclinical stage antiplatelet therapy, consisting of a glycoprotein VI, or GPVI, inhibitor being evaluated in diabetic vasculopathy and other inflammatory diseases. The specific active control agent component of REG3 is designed to permit modulation or reversal of the GPVI inhibition, if necessary, to optimize dosing and minimize unwanted side effects that might result from GPVI inhibition. We plan to initiate a Phase 1 study of REG3 in 2014. REG2 is an early clinical stage program evaluating an extended release formulation of pegnivacogin intended to provide a controllable level of anticoagulation for up to two weeks for venous antithrombotic applications such as venous thromboembolism, or VTE, prophylaxis. In REG2, anivamersen would be used as an active control agent, if needed. We have completed a single escalating dose Phase 1 clinical trial of REG2 and plan to conduct additional clinical testing in the future. Additionally, we are evaluating potential product candidates against the receptor CLEC-2, an antiplatelet target.

The following table lists our current product candidates and discovery programs and their respective stages of development:

3

Table of Contents

Our product candidates and proprietary technology platform are protected by a patent estate of 30 issued or allowed patents, including 14 in the United States, covering the composition of matter and methods of use for our product candidates as well as our fundamental controllable aptamer technology. We maintain worldwide commercialization rights to all of our product candidates except in Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan.

Our Risks

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | we have a limited operating history and have incurred operating losses of approximately $115.2 million from inception through March 31, 2013; |

| • | we will need to obtain additional financing to complete REGULATE-PCI; |

| • | clinical trials for our product candidates, including REGULATE-PCI, may not be successful; |

| • | we are heavily dependent on the success of our lead product candidate, REG1; |

| • | we have not completed clinical development of any of our product candidates and do not have any products approved for sale by the FDA or any other regulatory bodies; |

| • | we rely on third parties to manufacture our product candidates and to conduct our clinical trials; |

| • | we currently do not have the infrastructure to commercialize any of our product candidates if such products receive regulatory approval; and |

| • | we depend on our ability to attract and retain scientists, clinicians and sales personnel with extensive experience in drug development and commercialization. |

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. We are choosing to “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, and intend to take advantage of the other exemptions.

4

Table of Contents

Corporate Information

We were incorporated in Delaware under the name Quartet Biosciences, Inc. in December 2001 and changed our name to Regado Biosciences, Inc. in March 2003. Our principal executive offices are located at 120 Mountain View Boulevard, Basking Ridge, New Jersey 07920, and our telephone number is (908) 580-2100. Our website address is www.regadobio.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our common stock.

5

Table of Contents

The Offering

| Common stock offered by us |

5,000,000 shares |

| Common stock to be outstanding after this offering |

14,618,039 shares |

| Overallotment option |

750,000 shares |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $68.3 million from the sale of the shares of common stock offered in this offering, or approximately $78.7 million if the underwriters exercise their overallotment option in full, based on an assumed initial public offering price of $15.00 per share (the midpoint of the price range set forth on the cover page of this prospectus) and after deducting the estimated underwriting discount and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to fund further clinical development of REG1 and for working capital and other general corporate purposes. See the section entitled “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Risk factors |

See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

RGDO |

Certain of our existing stockholders, including stockholders affiliated with certain of our directors, have indicated an interest in purchasing up to an aggregate of approximately $29.5 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these potential investors and any of these potential investors could determine to purchase more, less or no shares in this offering. Any shares purchased by our existing stockholders will be subject to lock-up restrictions described in “Shares Eligible for Future Sale.”

The number of shares of our common stock to be outstanding after this offering is 14,618,039, based on 9,618,039 shares of our common stock outstanding as of March 31, 2013 (including convertible preferred stock on an as-converted basis), and excludes the following:

| • | 1,441,252 shares of our common stock issuable upon the exercise of stock options outstanding at a weighted-average exercise price of $7.18 per share; |

| • | 901,023 shares of our common stock (assuming the sale of 5,000,000 shares of our common stock in this offering) issuable upon the exercise of options granted under our 2013 Equity Compensation Plan, or the 2013 Plan, which will become effective upon the consummation of this offering and will have an exercise price equal to the initial public offering price set forth on the cover page of this prospectus; |

| • | up to 781,089 shares of our common stock reserved for future awards under the 2013 Plan (assuming the sale of 5,000,000 shares of our common stock in this offering); |

6

Table of Contents

| • | 96,360 shares of our common stock reserved for future issuance under our Employee Stock Purchase Plan which will become effective upon the consummation of this offering; and |

| • | 38,122 shares of our common stock issuable upon the exercise of common stock warrants and convertible preferred stock warrants outstanding at a weighted-average exercise price of $5.66 per share. |

Except as otherwise indicated herein, all information in this prospectus assumes or gives effect to:

| • | the conversion of our outstanding shares of preferred stock into an aggregate of 9,396,767 shares of our common stock immediately prior to the closing of this offering; |

| • | a one-for-16.7 reverse split of our common stock and an increase in the number of shares of common stock we are authorized to issue to 500,000,000, each of which became effective on May 21, 2013; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the closing of this offering; and |

| • | no exercise of the underwriters’ overallotment option. |

7

Table of Contents

SUMMARY FINANCIAL DATA

The following tables summarize our financial data. We derived the following summary of our statement of operations data for the years ended December 31, 2012, and 2011 from our audited financial statements and related notes included elsewhere in this prospectus. We derived the following summary of our statement of operations data for the three months ended March 31, 2013 and 2012 and the balance sheet data as of March 31, 2013 from our unaudited financial statements and related notes included elsewhere in this prospectus. Our interim unaudited financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America on the same basis as the annual audited financial statements and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to a fair statement of our financial position as of March 31, 2013 and our results of our operations for the three months ended March 31, 2013 and 2012. The results for the three months ended March 31, 2013 are not necessarily indicative of results to be expected for the year ending December 31, 2013, any other interim periods or any future period or year. You should read this information together with the sections entitled “Capitalization,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus.

| Years ended December 31, |

Three months ended March 31, |

|||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except for per share data) | ||||||||||||||||

| Statement of operations data: |

||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

(5,306 | ) | (11,862 | ) | (1,343 | ) | (1,609 | ) | ||||||||

| General and administrative |

(6,857 | ) | (7,042 | ) | (1,833 | ) | (2,313 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

(12,163 | ) | (18,904 | ) | (3,176 | ) | (3,922 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(12,163 | ) | (18,904 | ) | (3,176 | ) | (3,922 | ) | ||||||||

| Other income (expense), net |

(899 | ) | (294 | ) | (114 | ) | (150 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (13,062 | ) | $ | (19,198 | ) | $ | (3,290 | ) | $ | (4,072 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted(1) |

(59.03 | ) | (86.86 | ) | (14.87 | ) | (18.40 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute basic and diluted net loss per share(1) |

221 | 221 | 221 | 221 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share, basic and diluted (unaudited)(2) |

$ | (1.88 | ) | $ | (3.07 | ) | $ | (0.36 | ) | $ | (0.59 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute pro forma net loss per share, basic and diluted (unaudited)(2) |

6,945 | 6,248 | 9,189 | 6,878 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | See Note 8 of our Notes to Financial Statements appearing elsewhere in this prospectus for an explanation of the method used to calculate the basic and diluted net loss per common share. |

| (2) | The calculations for the unaudited pro forma net loss per common share, basic and diluted, assume the conversion of all our outstanding shares of convertible preferred stock into shares of our common stock, as if the conversion had occurred at the beginning of the period presented. |

8

Table of Contents

| As of March 31, 2013 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma as Adjusted(2)(3) |

||||||||||

| (unaudited, in thousands) |

||||||||||||

| Balance sheet data: | ||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 10,835 | $ | 10,835 | 79,085 | |||||||

| Cash held in escrow |

5,155 | 5,155 | 5,155 | |||||||||

| Working capital |

19,987 | 19,987 | 88,237 | |||||||||

| Total assets |

24,071 | 24,071 | 92,321 | |||||||||

| Current liabilities |

1,909 | 1,909 | 1,909 | |||||||||

| Long-term debt, including current portion |

3,871 | 3,871 | 3,871 | |||||||||

| Other liabilities |

— | — | — | |||||||||

| Common stock |

4 | 140 | 140 | |||||||||

| Convertible preferred stock |

127,155 | — | — | |||||||||

| Additional paid-in-capital |

4,962 | 137,136 | 205,386 | |||||||||

| Accumulated deficit |

(113,830 | ) | (113,830 | ) | (113,830 | ) | ||||||

| (1) | Pro forma balance sheet data have been calculated assuming the conversion of our outstanding shares of preferred stock into an aggregate of 9,396,776 shares of our common stock. |

| (2) | The pro forma as adjusted column reflects the pro forma adjustments described in footnote (1) above and the sale by us of 5,000,000 shares of common stock in this offering at an assumed initial public offering price of $15.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discount and estimated offering expenses payable by us. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $15.00 per share would increase (decrease) each of cash, cash equivalents and short-term investments, working capital and total assets by approximately $4.7 million and increase (decrease) additional paid-in capital by approximately $4.7 million, assuming the number of shares we are offering, as set forth on the cover page of this prospectus, remains the same, after deducting the estimated underwriting discount and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase (decrease) of 1,000,000 shares in the number of shares we are offering would increase (decrease) each of cash, cash equivalents and short-term investments, working capital and total assets by approximately $14.0 million, increase (decrease) common stock by $1,000 and increase (decrease) additional paid-in capital by approximately $14.0 million, assuming an initial public offering price per share of $15.00, which is the midpoint of the price range set forth on the cover page of this prospectus. The pro forma as adjusted information is illustrative only, and we will adjust this information based on the actual initial public offering price, number of shares offered and other terms of this offering determined at pricing. |

9

Table of Contents

An investment in shares of our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Financial Position and Need for Additional Capital

We have never been profitable. Currently, we have no products approved for commercial sale, and to date we have not generated any revenue from product sales. As a result, our ability to curtail our losses and reach profitability is unproven, and we may never achieve or sustain profitability.

We have never been profitable and do not expect to be profitable in the foreseeable future. We have incurred net losses in each year since our inception, including net losses of approximately $13.1 million and $19.2 million for 2012 and 2011, respectively. For the three months ended March 31, 2013, we incurred a net loss of $3.3 million, and as of March 31, 2013, we had an accumulated deficit of approximately $113.8 million. We have devoted most of our financial resources to research and development, including our preclinical development activities and clinical trials. We have not completed development of any product candidate and we have therefore not generated any revenues from product sales. Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve or maintain profitability. We expect to incur increased expenses as we commence our single, open-label 13,200 subject Phase 3 trial of REG1, or the REGULATE-PCI trial, in the second half of 2013, advance our other product candidates and expand our research and development programs. We also expect an increase in our expenses associated with creating additional infrastructure to support operations as a public company. As a result, we expect to continue to incur net losses and negative cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect on our stockholders’ equity and working capital.

To date, we have financed our operations through the sale of our equity and debt securities, bank borrowings and government grants. The amount of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. In addition, we may not be able to enter into any collaborations that will generate significant cash. If we are unable to develop and commercialize one or more of our product candidates either alone or with collaborators, or if revenues from any product candidate that receives marketing approval are insufficient, we will not achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability.

We will need additional capital to complete the REGULATE-PCI trial and commercialize REG1. If we are unable to raise sufficient capital, we would be forced to delay, reduce or eliminate our product development programs.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect our research and development expenses to increase in connection with our ongoing activities, particularly as we commence our REGULATE-PCI trial, undertake additional clinical trials of our other product candidates and continue to work on our other research programs. We believe that the net proceeds of this offering will be sufficient for us to fund the REGULATE-PCI trial through the interim analysis at 50% enrollment, which we expect will occur by the end of 2014. Because the expected net proceeds of this offering will not be sufficient for us to complete the REGULATE-PCI trial, we will need to raise substantial additional capital to complete the development and commercialization of REG1. If the U.S. Food and Drug Administration, or the FDA, or other regulators require that we perform additional studies beyond those we currently expect, or if there are any delays in completing our clinical trials or the development of any of our product candidates, our expenses could increase beyond what we currently anticipate and the timing of any potential product approval may be delayed. Except for potential additional sales of our Series E Preferred Stock as described in “Certain

10

Table of Contents

Relationships and Related Party Transactions—Series E Financing,” we have no commitments or arrangements for any additional financing to fund our research and development programs. We also will need to raise substantial additional capital in the future to complete the development and commercialization of REG1 for additional indications and for our other product candidates. Because successful development of our product candidates is uncertain, we are unable to estimate the actual funds required to complete research and development and commercialize our products under development.

Until we can generate a sufficient amount of revenue from our product candidates, if ever, we expect to finance future cash needs through public or private equity offerings, debt financings or corporate collaborations and licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or development programs. To the extent that we raise additional funds by issuing equity securities, our stockholders will experience additional dilution, and debt financing, if available, may involve restrictive covenants. To the extent that we raise additional funds through collaborations and licensing arrangements, it may be necessary to relinquish some rights to our technologies or our product candidates or grant licenses on terms that may not be favorable to us. We may seek to access the public or private capital markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time.

Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to:

| • | the initiation, progress, timing, costs and results of preclinical studies and clinical trials for our product candidates and potential product candidates, including our REGULATE–PCI trial and the continued development of our other product candidates; |

| • | the number and characteristics of product candidates that we pursue; |

| • | the terms and timing of any future collaboration, licensing or other arrangements that we may establish; |

| • | the outcome, timing and cost of regulatory approvals; |

| • | the cost of obtaining, maintaining, defending and enforcing intellectual property rights, including patent rights; |

| • | the effect of competing technological and market developments; |

| • | the cost and timing of completing commercial-scale outsourced manufacturing activities; |

| • | market acceptance of any product candidates for which we may receive regulatory approval; |

| • | the cost of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval; and |

| • | the extent to which we acquire, license or invest in businesses, products or technologies. |

We have a limited operating history and we expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

We are a development stage biopharmaceutical company with a limited operating history. Our operations to date have been primarily limited to developing our technology and undertaking preclinical studies and clinical trials of REG1 and any of our other product candidates. We have not yet obtained regulatory approvals for REG1 or any of our other product candidates. Consequently, any predictions made about our future success or viability may not be as accurate as they could be if we had a longer operating history or commercialized products. Our financial condition and operating results have varied significantly in the past and will continue to fluctuate from quarter-to-quarter or year-to-year due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include other factors described elsewhere in this prospectus and also include:

| • | our ability to obtain additional funding to develop our product candidates; |

11

Table of Contents

| • | delays in the commencement, enrollment and timing of clinical trials; |

| • | the success of our clinical trials through all phases of clinical development, including our REGULATE-PCI trial; |

| • | any delays in regulatory review and approval of product candidates in clinical development; |

| • | our ability to obtain and maintain regulatory approval for REG1 or any of our other product candidates in the United States and foreign jurisdictions; |

| • | potential side effects of our product candidates that could delay or prevent commercialization, limit the indications for any approved drug, require the establishment of risk evaluation and mitigation strategies, or REMS, or cause an approved drug to be taken off the market; |

| • | our dependence on third-party manufacturers, or CMOs, to supply or manufacture our products; |

| • | our dependence on clinical research organizations, or CROs, to conduct our clinical trials; |

| • | our ability to establish or maintain collaborations, licensing or other arrangements; |

| • | market acceptance of our product candidates; |

| • | our ability to establish and maintain an effective sales and marketing infrastructure, either through the creation of a commercial infrastructure or through strategic collaborations; |

| • | competition from existing products or new products that may emerge; |

| • | the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for our products; |

| • | our ability to leverage our proprietary technology platform to discover and develop additional product candidates; |

| • | our ability and our licensors’ abilities to successfully obtain, maintain, defend and enforce intellectual property rights important to our business; |

| • | our ability to attract and retain key personnel to manage our business effectively; |

| • | our ability to build our finance infrastructure and improve our accounting systems and controls; |

| • | potential product liability claims; |

| • | potential liabilities associated with hazardous materials; and |

| • | our ability to obtain and maintain adequate insurance policies. |

Accordingly, the results of any quarterly or annual periods should not be relied upon as indications of future operating performance.

The audit opinion on our financial statements contains a going concern modification.

Based on our cash balances, recurring losses, net capital deficiency and debt outstanding as of December 31, 2012 and our projected spending in 2013, which raise substantial doubt about our ability to continue as a going concern, the audit opinion on our audited financial statements as of and for the year ended December 31, 2012 contains a going concern modification. We believe that the net proceeds from this offering, the proceeds from our sale of additional shares of Series E Preferred Stock and existing cash and cash equivalents and interest thereon, will be sufficient to fund our projected operating requirements through the end of 2014. However, if we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. Amounts due under our loan with Comerica Bank, or Comerica, may become immediately due and payable upon the occurrence of a material adverse change, as defined under the loan agreement. Under the terms of the Comerica loan agreement, we are subject to operational covenants, including limitations on our ability to

12

Table of Contents

incur liens or additional debt, pay dividends, redeem stock, make specified investments and engage in merger, consolidation or asset sale transactions, among other restrictions. In addition, the inclusion of a going concern statement by our auditors, our lack of cash resources and our potential inability to continue as a going concern may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

Risks Relating to the Development and Regulatory Approval of Our Product Candidates

Clinical failure can occur at any stage of clinical development. Because the results of earlier clinical trials are not necessarily predictive of future results, any product candidate we advance through clinical trials may not have favorable results in later clinical trials or receive regulatory approval.

Clinical failure can occur at any stage of clinical development. Clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical or preclinical trials. In addition, data obtained from trials are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay, limit or prevent regulatory approval. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will generate the same results or otherwise provide adequate data to demonstrate the efficacy and safety of a product candidate. Frequently, product candidates that have shown promising results in early clinical trials have subsequently suffered significant setbacks in later clinical trials. In addition, the design of a clinical trial can determine whether its results will support approval of a product and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced. While members of our management team have experience in designing clinical trials, our company has limited experience in designing clinical trials and we may be unable to design and execute a clinical trial to support regulatory approval. Further, clinical trials of potential products often reveal that it is not practical or feasible to continue development efforts. For example, if the results of our REGULATE-PCI trial do not achieve the primary efficacy endpoints or demonstrate expected safety, the prospects for approval of REG1 would be materially and adversely affected. If REG1 or our other product candidates are found to be unsafe or lack efficacy, we will not be able to obtain regulatory approval for them and our business would be harmed.

REGULATE-PCI includes three interim analyses of REG1 by the Data Safety Monitoring Board, or the DSMB. The first interim analysis will be a general safety analysis after enrollment of 1,000 subjects, which is expected to occur by the end of the second quarter of 2014. The second interim analysis will be another general safety analysis after 25% of the subjects are enrolled, which is expected to occur by the end of the third quarter of 2014. The final interim analysis will be an analysis of the general safety and efficacy of REG1 after 50% of the subjects are enrolled, which is expected to occur by the end of 2014. If, as a result of any of those interim analyses, we or the DSMB determine that REG1 is not safe or that it is futile to continue the trial because of a lack of efficacy, the trial will be terminated. If the results of any one of these analyses is unfavorable, our business would be harmed.

We cannot be certain that REG1 or any of our other product candidates will receive regulatory approval, and without regulatory approval we will not be able to market our product candidates. Any delay in the regulatory review or approval of REG1 or any of our other product candidates will materially or adversely harm our business.

We have invested a significant portion of our efforts and financial resources in the development of REG1, our most advanced product candidate. Our ability to generate revenue related to product sales, which we do not expect will occur for at least the next several years, if ever, will depend on the successful development and regulatory approval of our product candidates. We plan to commence our REGULATE-PCI trial in the second half of 2013. We may conduct our REGULATE-PCI trial only to learn that REG1 is not a safe or effective treatment, in which case the REGULATE-PCI trial may not lead to regulatory approval for REG1. Similarly, our clinical development programs for our other product candidates may not lead to regulatory approval from the FDA and similar foreign regulatory agencies. This failure to obtain regulatory approvals would prevent our product candidates from being marketed and would have a material and adverse effect on our business.

13

Table of Contents

All of our product candidates require regulatory review and approval prior to commercialization. Any delays in the regulatory review or approval of our product candidates would delay market launch, increase our cash requirements and result in additional operating losses.

The process of obtaining FDA and other required regulatory approvals, including foreign approvals, often takes many years and can vary substantially based upon the type, complexity and novelty of the products involved. Furthermore, this approval process is extremely complex, expensive and uncertain. We may be unable to submit any new drug application, or an NDA, in the United States or any marketing approval application in foreign jurisdictions for any of our products. If we submit an NDA including any amended NDA or supplemental NDA, to the FDA seeking marketing approval for any of our product candidates, the FDA must decide whether to accept or reject the submission for filing. We cannot be certain that any of these submissions will be accepted for filing and reviewed by the FDA, or that the marketing approval application submissions to any other regulatory authorities will be accepted for filing and review by those authorities. We cannot be certain that we will be able to respond to any regulatory requests during the review period in a timely manner, or at all, without delaying potential regulatory action. We also cannot be certain that any of our product candidates will receive favorable recommendations from any FDA advisory committee or foreign regulatory bodies or be approved for marketing by the FDA or foreign regulatory authorities. In addition, delays in approvals or rejections of marketing applications may be based upon many factors, including regulatory requests for additional analyses, reports, data and studies, regulatory questions regarding data and results, changes in regulatory policy during the period of product development and the emergence of new information regarding REG1 or our other product candidates.

Data obtained from preclinical studies and clinical trials are subject to different interpretations, which could delay, limit or prevent regulatory review or approval of any of our product candidates. Furthermore, regulatory attitudes towards the data and results required to demonstrate safety and efficacy can change over time and can be affected by many factors, such as the emergence of new information, including on other products, policy changes and agency funding, staffing and leadership. We do not know whether future changes to the regulatory environment will be favorable or unfavorable to our business prospects.

In addition, the environment in which our regulatory submissions may be reviewed changes over time. For example, average review times at the FDA for NDAs have fluctuated over the last ten years, and we cannot predict the review time for any of our submissions with any regulatory authorities. Review times can be affected by a variety of factors, including budget and funding levels and statutory, regulatory and policy changes. Moreover, in light of widely publicized events concerning the safety risk of certain drug products, regulatory authorities, members of the U.S. Government Accountability Office, medical professionals and the general public have raised concerns about potential drug safety issues. These events have resulted in the withdrawal of drug products, revisions to drug labeling that further limit use of the drug products and establishment of REMS measures that may, for instance, restrict distribution of drug products. The increased attention to drug safety issues may result in a more cautious approach by the FDA to clinical trials. Data from clinical trials may receive greater scrutiny with respect to safety, which may make the FDA or other regulatory authorities more likely to terminate clinical trials before completion, or require longer or additional clinical trials that may result in substantial additional expense and a delay or failure in obtaining approval or may result in approval for a more limited indication than originally sought.

Delays in the commencement, enrollment and completion of our clinical trials could result in increased costs to us and delay or limit our ability to obtain regulatory approval for REG1 and our other product candidates.

Delays in the commencement, enrollment and completion of clinical trials could increase our product development costs or limit the regulatory approval of our product candidates. We plan to commence our REGULATE-PCI trial in the second half of 2013; however, this clinical trial may not be initiated or completed on schedule, if at all. In addition, we do not know whether planned clinical trials of REG1 in additional indications and of our other product candidates will begin on time or will be completed on schedule or at all. The

14

Table of Contents

commencement, enrollment and completion of our REGULATE-PCI trial or other clinical trials can be delayed for a variety of reasons, including:

| • | inability to reach agreements on acceptable terms with prospective CROs and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | regulatory objections to commencing a clinical trial; |

| • | inability to identify and maintain a sufficient number of trial sites, many of which may already be engaged in other clinical trial programs, including some that may be for the same indication as our product candidates; |

| • | withdrawal of clinical trial sites from our clinical trials as a result of changing standards of care or the ineligibility of a site to participate in our clinical trials; |

| • | inability to obtain institutional review board approval to conduct a clinical trial; |

| • | difficulty recruiting and enrolling subjects to participate in clinical trials for a variety of reasons, including meeting the enrollment criteria for our study and competition from other clinical trial programs for the same indication as our product candidates; |

| • | inability to retain subjects in clinical trials due to the treatment protocol, personal issues, side effects from the therapy or lack of efficacy; and |

| • | difficulty in importing and exporting clinical trial materials and study samples. |

In addition, our REGULATE-PCI trial or any of our other clinical trials may be suspended or terminated by us, the FDA or other regulatory authorities due to a number of factors, including:

| • | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| • | failure to pass inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| • | failure of any CMOs that we use to comply with current Good Manufacturing Practices, or cGMP; |

| • | unforeseen safety issues or any determination that a clinical trial presents unacceptable health risks; |

| • | changes in the regulatory requirement and guidance; or |

| • | lack of adequate funding to continue the clinical trial due to unforeseen costs resulting from enrollment delays, requirements to conduct additional trials and studies, increased expenses associated with the services of our CROs and other third parties or other reasons. |

If we are required to conduct additional clinical trials or other testing of REG1 or our other product candidates beyond those currently contemplated, we may be delayed in obtaining, or may not be able to obtain, marketing approval for these product candidates.

We have never conducted a Phase 3 clinical trial or submitted an NDA before, and may be unable to do so for REG1 and other product candidates we are developing.

We intend to commence our REGULATE-PCI trial in the second half of 2013. The conduct of Phase 3 clinical trials and the submission of a successful NDA is a complicated process. Although members of our management team have extensive industry experience, including in the development, clinical testing and commercialization of drug candidates, our company has never conducted a Phase 3 clinical trial before, has limited experience in preparing, submitting and prosecuting regulatory filings, and has not submitted an NDA before. Consequently, we may be unable to successfully and efficiently execute and complete these planned clinical trials in a way that leads to NDA submission and approval of REG1 and other product candidates we are developing. We may require more time and incur greater costs than our competitors and may not succeed in

15

Table of Contents

obtaining regulatory approvals of product candidates that we develop. Failure to commence or complete, or delays in, our planned clinical trials would prevent or delay commercialization of REG1 and other product candidates we are developing.

We have never performed a clinical trial comparing the safety or efficacy of REG1 to bivalirudin. Because our clinical trials used heparin as a comparator, the risk that our REGULATE-PCI trial does not achieve one or more of its primary endpoints may be increased.

We have never performed a clinical trial directly comparing the safety or efficacy of REG1 to bivalirudin. Our randomized, partially blinded, dose-ranging Phase 2b trial involving 640 subjects, or the RADAR trial, used standard of care heparin as the comparator and, as a result, we have no clinical trial data directly comparing REG1 and bivalirudin. The primary efficacy endpoint of our REGULATE-PCI trial is a 20.0% reduction in the occurrence of ischemic events using REG1 compared to bivalirudin and the primary safety endpoint of the trial is non-inferiority of REG1 compared to bivalirudin with respect to major bleeding events. Because we have no clinical trial data directly comparing REG1 to bivalirudin, the prediction of Phase 3 success based on Phase 2 results is complicated and the risk that REGULATE-PCI does not achieve one or more of these endpoints may be increased.

Our product candidates may cause serious adverse events or undesirable side effects which may delay or prevent marketing approval, or, if approval is received, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales.

Serious adverse events or undesirable side effects from REG1 or any of our other product candidates could arise either during clinical development or, if approved, after the approved product has been marketed. For example, three severe allergic events occurred in our RADAR trial. In addition, in 2008 we terminated an exploratory Phase 2a trial of REG1 in subjects undergoing off-pump coronary arterial bypass grafting when the first enrolled subject experienced clotting in one of three bypass grafts. The results of future clinical trials, including REGULATE-PCI, may show that our product candidates cause serious adverse events or undesirable side effects, which could interrupt, delay or halt clinical trials, resulting in delay of, or failure to obtain, marketing approval from the FDA and other regulatory authorities.

If REG1 or any of our other product candidates cause serious adverse events or undesirable side effects:

| • | regulatory authorities may impose a clinical hold which could result in substantial delays and adversely impact our ability to continue development of the product; |

| • | regulatory authorities may require the addition of labeling statements, specific warnings, a contraindication or field alerts to physicians and pharmacies; |

| • | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| • | we may be required to implement a risk minimization action plan, which could result in substantial cost increases and have a negative impact on our ability to commercialize the product; |

| • | we may be required to limit the patients who can receive the product; |

| • | we may be subject to limitations on how we promote the product; |

| • | sales of the product may decrease significantly; |

| • | regulatory authorities may require us to take our approved product off the market; |

| • | we may be subject to litigation or product liability claims; and |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenues from the sale of our products.

16

Table of Contents

We have limited experience manufacturing the oligonucleotides comprising our product candidates at commercial scale and there are no established standards for their manufacture. As a result, delays in regulatory approval of our product candidates may occur. Also, manufacturing issues may arise that could cause delays or increase costs.

We have limited experience manufacturing the oligonucleotides comprising our product candidates at commercial scale. We, together with our CMOs, have developed manufacturing processes that have never been tested in commercial production. Our manufacturing process will be subject to approval by regulators before we can commence the manufacture and sale of an approved product. The standards of the International Conference on Harmonization of Technical Requirements for Registration of Pharmaceuticals for Human Use, which establishes basic guidelines and standards for drug development in the United States, the European Union, Japan and other countries, do not apply to oligonucleotides, including our product candidates. As a result, there is no established generally accepted manufacturing or quality standard for the production of our product candidates. Even though the FDA has agreed to the quality standards for the REG1 to be used in our REGULATE-PCI trial, the FDA has the ability to modify those standards at any time and foreign regulatory agencies may impose differing quality standards and quality control on the manufacture of our drug candidates. The lack of uniform manufacturing and quality standards among regulatory agencies may delay regulatory approval of our product candidates. Also, as we scale-up manufacturing of any approved product, our CMOs may encounter unexpected issues relating to the manufacturing process or the quality, purity and stability of the product and we may be required to refine or alter our manufacturing processes to address these issues. Resolving these issues could result in significant delays and may result in significantly increased costs. If we experience significant delays or other obstacles in producing any approved product for commercial scale, our ability to market and sell any approved products may be adversely affected and our business could suffer.

REG1 and our other product candidates employ novel mechanisms of action and may never be approved or accepted by their intended markets.

Our activities have focused on the discovery and development of therapeutic aptamers and their specific active control agents. Our future success depends on our ability to complete the REGULATE-PCI trial of REG1 successfully, obtain market approval for and successfully commercialize REG1, as well as our ability to develop and market other product candidates that use our proprietary technology platform. We believe only one therapeutic aptamer has been approved for commercial sale and no product candidate consisting of a therapeutic aptamer and its specific active control agent has ever received regulatory approval. The scientific discoveries that form the basis of our proprietary technology platform and our product candidates are relatively new. We are not aware of any other antithrombotic drugs that have the same mechanism of action as our product candidates and there can be no assurance that, even if approved, physicians will be willing to use them. If we do not successfully develop and commercialize product candidates based upon our technological approach, we may not become profitable and the value of our common stock may decline.

In addition, regulatory approval of novel product candidates such as REG1 and our other product candidates manufactured using novel manufacturing processes such as ours can be more expensive and take longer than for other, more well-known or extensively studied pharmaceutical or biopharmaceutical products, due to our and regulatory agencies’ lack of experience with them. We believe that the FDA has only approved one aptamer product to date. This lack of experience may lengthen the regulatory review process, require us to conduct additional studies or clinical trials, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of these product candidates or lead to significant post-approval limitations or restrictions.

The novel nature of REG1 and our other product candidates also means that fewer people are trained in or experienced with product candidates of this type, which may make it difficult to find, hire and retain capable personnel for research, development and manufacturing positions.

Further, our focus solely on controllable aptamer technology for developing drugs as opposed to multiple, more proven technologies for drug development increases the risks associated with the ownership of our common

17

Table of Contents

stock. If we do not obtain regulatory approval for REG1 and our other product candidates and achieve market acceptance for our approved products, we may be required to change the scope and direction of our product development activities. In that case, we may not be able to identify and implement successfully an alternative product development strategy.

Risks Relating to the Commercialization of Our Product Candidates

If any of our product candidates for which we receive regulatory approval do not achieve broad market acceptance, the revenues that are generated from their sales will be limited.

The commercial success of REG1 and our other product candidates, if approved, will depend upon the acceptance of these products among physicians, healthcare payors and patients. The degree of market acceptance of our product candidates will depend on a number of factors, including:

| • | limitations or warnings contained in a product’s FDA-approved labeling; |

| • | changes in the standard of care or the availability of alternative therapies for the targeted indications for any of our product candidates; |

| • | limitations in the approved indications for our product candidates; |

| • | demonstrated clinical safety and efficacy compared to other products; |

| • | lack of significant adverse side effects; |

| • | education, sales, marketing and distribution support; |

| • | availability and degree of reimbursement from third-party payors; |

| • | timing of market introduction and perceived effectiveness of competitive products; |

| • | cost-effectiveness; |

| • | availability of alternative therapies at similar or lower cost, including generics, biosimilar and over-the-counter products; |

| • | adverse publicity about our product candidates or favorable publicity about competitive products; |

| • | convenience and ease of administration of our products; |

| • | potential product liability claims; and |

| • | government-imposed pricing restrictions. |

If our product candidates are approved, but do not achieve an adequate level of acceptance by physicians, healthcare payors and patients, sufficient revenue may not be generated from these products, and we may not become or remain profitable. In addition, efforts to educate the medical community and third-party payors on the benefits of our product candidates may require significant resources and may never be successful.

REG1 and each of our other product candidates consist of a therapeutic aptamer and its specific active control agent. These two components are administered at different times and in different strengths and the failure to administer the components correctly may expose a patient to significant risk. Physicians will need to be educated as to our products’ novel mechanisms of action and trained as to the proper use of our products. Physicians may be unwilling to devote the time necessary to learn how to use our product candidates properly and may continue using other competing products even if our products are safer and more effective. As a result, the commercialization of any approved product may be slower than we expect and any approved product may not achieve the level of acceptance we anticipate. If physicians are unwilling to use our products as a result of their novel mechanisms of action or the need to be trained on their use, our business may suffer.

18

Table of Contents

We do not have the capability to sell, distribute and market our product candidates. If we are unable to establish an effective sales force and marketing infrastructure, or enter into acceptable third-party sales and marketing or licensing arrangements, we may not be able to commercialize our product candidates successfully.

We do not have the capability to sell, distribute and market our product candidates. We will need to build a commercial organization or secure a strategic partner to commercialize REG1 or any other product candidates. If we are unable to build a commercial infrastructure or secure a strategic collaboration, our business and results of operations will be materially and adversely affected. Development of an internal commercial organization will require substantial resources and will be time consuming. These costs may be incurred in advance of any approval of our product candidates. In addition, we may not be able to hire a sales force in the United States that is sufficient in size or has adequate expertise in the medical markets that we intend to target. If we are unable to establish a sales and marketing capability, our operating results may be adversely affected. If we seek to enter into sales and marketing or licensing arrangements with third parties for the marketing and sale of any approved products, we may be unable to enter into any such arrangements on acceptable terms, or at all.

Even if our product candidates receive regulatory approval, we may still face future development and regulatory difficulties.

Even if regulatory approval is obtained for any of our product candidates, regulatory authorities may still impose significant restrictions on a product’s indicated uses or marketing or impose ongoing requirements for potentially costly post-approval studies. Given the number of high profile adverse safety events with certain drug products, regulatory authorities may require, as a condition of approval, costly REMS, which may include safety surveillance, restricted distribution and use, patient education, enhanced labeling, expedited reporting of certain adverse events, pre-approval of promotional materials and restrictions on direct-to-consumer advertising. For example, any labeling approved for any of our product candidates may include a restriction on the term of its use, or it may not include one or more of our intended indications. Furthermore, any new legislation addressing drug safety issues could result in delays or increased costs during the period of product development, clinical trials and regulatory review and approval, as well as increased costs to assure compliance with any new post-approval regulatory requirements.

Our product candidates will also be subject to ongoing regulatory requirements for the labeling, packaging, storage, advertising, promotion, record-keeping and submission of safety and other post-market information. In addition, sellers of approved products, manufacturers and manufacturers’ facilities are required to comply with extensive FDA requirements, including ensuring that quality control and manufacturing procedures conform to cGMP. As such, we and our CMOs are subject to continual review and periodic inspections to assess compliance with cGMP. Accordingly, we and others with whom we work must continue to expend time, money, and effort in all areas of regulatory compliance, including manufacturing, production, and quality control. We will also be required to report certain adverse reactions and production problems, if any, to the FDA, and to comply with certain requirements concerning advertising and promotion for our products. Promotional communications with respect to prescription drugs are subject to a variety of legal and regulatory restrictions and must be consistent with the information in the product’s approved label. As such, we may not promote our products for indications or uses for which they do not have approval.

If a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, or disagrees with the promotion, marketing, or labeling of a product, it may impose restrictions on that product or us, including requiring withdrawal of the product from the market. If our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

| • | issue warning or other letters; |

| • | mandate modifications to promotional materials or require us to provide corrective information to healthcare practitioners; |

19

Table of Contents

| • | require us to enter into a consent decree or permanent injunction, which can include imposition of various fines, reimbursements for inspection costs, required due dates for specific actions and penalties for noncompliance; |

| • | impose other civil or criminal penalties; |

| • | suspend or withdraw regulatory approval; |

| • | suspend any ongoing clinical trials; |

| • | refuse to approve pending applications or supplements to approved applications filed by us; |

| • | impose restrictions on operations, including costly new manufacturing requirements; or |

| • | seize or detain products or require a product recall. |