Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AUXILIUM PHARMACEUTICALS INC | a13-12497_38k.htm |

Exhibit 99.1

|

|

Deutsche Bank Conference “Corporate Overview and Strategy” May 29, 2013 |

|

|

Safe Harbor Statement We will make various remarks during this presentation that constitute “forward-looking statements” for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995, including statements regarding: our continued profitability for the year; the Company’s expected financial performance, including the degree to which we will achieve our financial guidance, strategic priorities, and development and operational goals for 2013; the Company’s expected tax benefit and the amount of such benefit as a result of our acquisition of Actient, that the acquisition will be immediately accretive on a non-GAAP basis to our 2013 adjusted net income; whether the Company will receive a step-up in basis resulting in tax deductible amortization of goodwill as a result of the acquisition of Actient; whether the acquisition of Actient will enable the Company to drive its future earnings growth, achieve greater leverage in the commercial infrastructure and potentially higher operating margins; whether the Company will realize run-rate cost synergies and the value of such synergies from its acquisition of Actient and in what time frame; whether there are cross-selling opportunities that create revenue synergies from the Company’s acquisition of Actient; whether the acquisition of Actient will expand the Company’s portfolio; the degree to which the Company will remain committed to urology and the TRT market; whether the Actient acquisition will enhance the Company’s growth trajectory and create value for shareholders; whether Auxilium and the Company will benefit from a broader spectrum of specialty pharmaceutical products, complementary commercial capabilities or an expanded sales force; the ability of Auxilium to better serve TRT physician customers; whether the Actient acquisition will increase the Company’s commercial efforts, calling points, reach or expertise; whether the Company will achieve other expected benefits from its acquisition of Actient; whether the TRT market will remain an opportunity for growth across multiple testosterone delivery options; the degree to which the Company’s cash from operations will be available or used for amortizing outstanding indebtedness; and the speed with which debt may be amortized; whether the Company will achieve anticipated top-line growth over the next several years; whether the Actient acquisition will provide the Company with a return on invested capital; whether the Actient acquisition will create sustainable base of cash flow, which when combined with the Company’s expanded operating margins, will enable the combined Company to generate operating cash flow; whether the consolidation of the corporate headquarters, the development of a shared culture or the achievement of core strategic objectives will result in low levels of capital expenditures or generate shareholder value; the degree to which the Company’s execution on its strategic goals will lead to increased shareholder value; the degree to which XIAFLEX® becomes the standard of care for the treatment of Dupuytren's contracture; our ability to obtain and the timing of the potential approval of XIAFLEX for the treatment of Peyronie’s disease in the U.S. as well as the timing of related regulatory milestones; the timing of our U.S. launch, if any, of XIAFLEX for the treatment of Peyronie’s disease; our strategies for marketing XIAFLEX for the treatment of Peyronie’s disease if approval is received; the time to market, size of market, growth potential and therapeutic benefits of the Company’s products and product candidates; the size and development of, and the Company’s strategies for further developing, the markets and potential market share for our XIAFLEX products and XIAFLEX sales in the U.S., the EU and the rest of the world; the potential for XIAFLEX to be used in multiple indications; the size of the user base and number of target sites we believe exist in the U.S. for XIAFLEX and our ability to narrow the gap between prescribing sites and sites that have enrolled but not yet used XIAFLEX; the potential benefits and efficacy of XIAFLEX for the treatment of Peyronie’s disease, if approved; the size and growth potential of the testosterone replacement therapy market and the influence of our competitors on market growth; future Testim® market share, prescriptions and sales growth and factors that may drive such growth; the Company’s ability to address what it believes to be the causes of previously weak Testim sales and the effect of the new sales strategies, resources and tactics that will be deployed to defend Testim’s market position; competitive developments affecting the Company’s products and product candidates, including generic competition in the testosterone replacement therapy market; the timing of reporting top-line results of our phase IIIb studies for XIAFLEX for the potential treatment of multiple Dupuytren’s contractures and our phase IIa study for Collagenase Clostridium Histolyticum for the treatment of Frozen Shoulder Syndrome; the commencement of additional clinical studies; the potential benefits of our partnership with GlaxoSmithKline and the potential effects of the promotional reach and call frequency of its sales force on our ability to grow Testim sales and market share; our ability to regain access to managed care plans with which we experienced disruption in the Fourth Quarter of 2012; the strength and duration of our intellectual property protections; business development efforts and opportunities to build out the Company’s pipeline; and the opportunities and strategies to build shareholder value. All remarks other than statements of historical facts made during this presentation, including but not limited to, statements regarding future expectations, plans and prospects for the Company, statements regarding forward-looking financial information and other statements containing words such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, as they relate to the Company, constitute forward-looking statements. Actual results may differ materially from those reflected in these forward-looking statements due to various factors, including general financial, economic, regulatory and political conditions affecting the biotechnology, medical device and pharmaceutical industries and those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 filed on February 26, 2013, as updated in Item 8.01 of the Current Report on Form 8-K that we filed with the SEC on April 29, 2013, and as updated from time to time in its periodic reports, in each case, under the heading “Risk Factors,” which is on file with the Securities and Exchange Commission (the “SEC”) and may be accessed electronically by means of the SEC’s home page on the Internet at http://www.sec.gov or by means of the Company’s home page on the Internet at http://www.auxilium.com under the heading “For Investors - SEC Filings.” There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial which could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, any or all of these forward-looking statements may prove to be incorrect. Therefore, you should not rely on any such factors or forward-looking statements. In addition, forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this presentation. 1 |

|

|

Overview of 1Q13 and Recent Events Financial / Commercial Total net revenues of $66.2 MM (-10% vs. 1Q12 ) Global Testim® revenue of $45.5 MM (-22% vs. 1Q12) Global XIAFLEX® revenue of $20.7 MM; U.S. XIAFLEX revenue of $12.0MM (-5% vs. 1Q12) Non-GAAP net loss of $2.3 MM vs. non-GAAP net income of $1.9 MM 1Q12 (1) Ended 1Q13 with cash balance of $467.8 MM (2) Research and Development Reported positive Phase II data for XIAFLEX (CCH) for the potential treatment of Frozen Shoulder IMPRESS trials of XIAFLEX in Peyronie's disease published online in The Journal of Urology Expanded exclusive license for CCH to include the potential treatment of Cellulite Corporate Development and Licensing Issuance of $350.0 Million of 1.50% Convertible Senior Notes due 2018 Closed acquisition of Actient Issuance of $225 Million Term Loan to finance Actient acquisition 1 See Appendix for reconciliation of the pro forma non-GAAP financial measures to the closest GAAP financial measures 2 Pre Actient transaction, which closed on April 26, 2013 2 |

|

|

Testim – 1Q13 Commercial Performance TRT Gel Market Dynamics 1Q13 Prescriptions: +11% vs. 1Q12 4Q12 Prescriptions: +27% vs. 4Q11 Continued heavy investments in DTC advertising within the market Testim Performance 1Q13 U.S. net revenue of $45.3MM; -22% vs. 1Q12 ~$3-4 MM destocking of Testim inventories may have occurred Testim Commercial Dynamics Testim market share loss slowing Increased competitive pressures with managed care plans contracting Testim Average Monthly TRx Share Change Source: IMS NPA Data – March 2013; Market Share calculated based on Gel Market 3 |

|

|

XIAFLEX – 1Q13 Commercial Performance XIAFLEX Performance 1Q13 XIAFLEX U.S. net revenues were $12.0MM; -5% vs. 1Q12 1Q13 XIAFLEX ex-U.S. net revenues were $8.8 MM XIAFLEX Commercial Dynamics Increase of 6.5% in vials shipped to physicians in 1Q13 vs. 1Q12 Market share appears to be trending lower in first quarter Number of total DC procedures increased 5.1% rolling 12 months vs. prior 12 months through Jan. 2013 121 new sites utilized XIAFLEX in 1Q13 Since launch, 2,136 sites have utilized XIAFLEX through March 2013 XIAFLEX Purchases & Sites Ordering by Quarter (1) 1 Minor historical adjustments may affect historical demand figures over time 4 |

|

|

Actient Transaction – Aligned with Our Core Strategic Objectives $585MM in upfront cash and certain contingent consideration Contingency payments of up to $50MM dependent upon achieving certain sales milestones based on future Actient urology sales Warrants to purchase 1.25 MM shares of Auxilium common stock at an exercise price of $17.80/share Generates anticipated tax benefit with ~$60 MM net present value Financed with cash on hand and a $225MM Term Loan Key Transaction Terms 5 |

|

|

Actient Acquisition – A Compelling Strategic Rationale Creates a Leading Urology Franchise Diversifies and Balances Product Portfolio Enhances Existing Commercial Efforts Through Combined Sales Force Strong Growth Profile with Expanding Margins Financially Compelling + 6 |

|

|

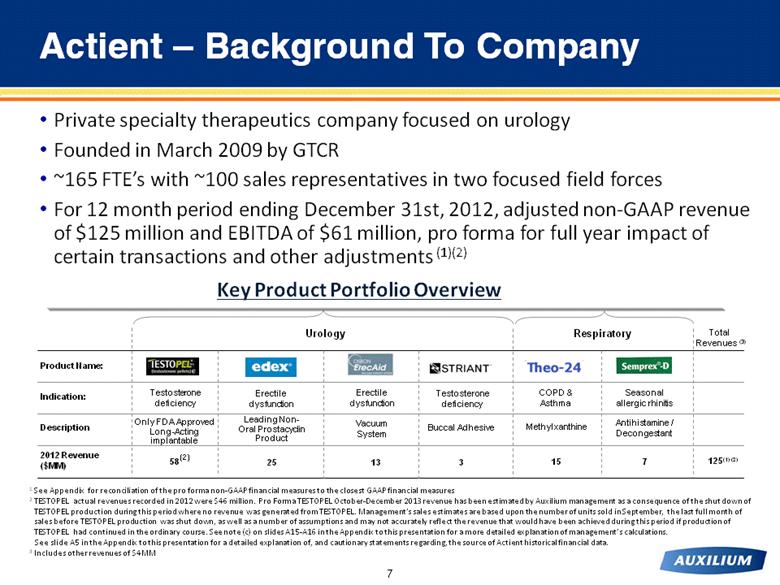

Urology Respiratory Product Name: Indication: COPD & Asthma Seasonal allergic rhinitis Description Methylxanthine Antihistamine / Decongestant 2012 Revenue ($MM) Erectile dysfunction Leading Non-Oral Prostacyclin Product 25 Erectile dysfunction Vacuum System 13 Testosterone deficiency Buccal Adhesive 3 15 7 Only FDA Approved Long-Acting implantable 58 Testosterone deficiency Private specialty therapeutics company focused on urology Founded in March 2009 by GTCR ~165 FTE’s with ~100 sales representatives in two focused field forces For 12 month period ending December 31st, 2012, adjusted non-GAAP revenue of $125 million and EBITDA of $61 million, pro forma for full year impact of certain transactions and other adjustments (1)(2) Actient – Background To Company Key Product Portfolio Overview Total Revenues (3) 125(1) (2) 1 See Appendix for reconciliation of the pro forma non-GAAP financial measures to the closest GAAP financial measures 2 TESTOPEL actual revenues recorded in 2012 were $46 million. Pro Forma TESTOPEL October-December 2013 revenue has been estimated by Auxilium management as a consequence of the shut down of TESTOPEL production during this period where no revenue was generated from TESTOPEL. Management’s sales estimates are based upon the number of units sold in September, the last full month of sales before TESTOPEL production was shut down, as well as a number of assumptions and may not accurately reflect the revenue that would have been achieved during this period if production of TESTOPEL had continued in the ordinary course. See note (c) on slides A15-A16 in the Appendix to this presentation for a more detailed explanation of management’s calculations. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of Actient historical financial data. 3 Includes other revenues of $4MM (2) 7 |

|

|

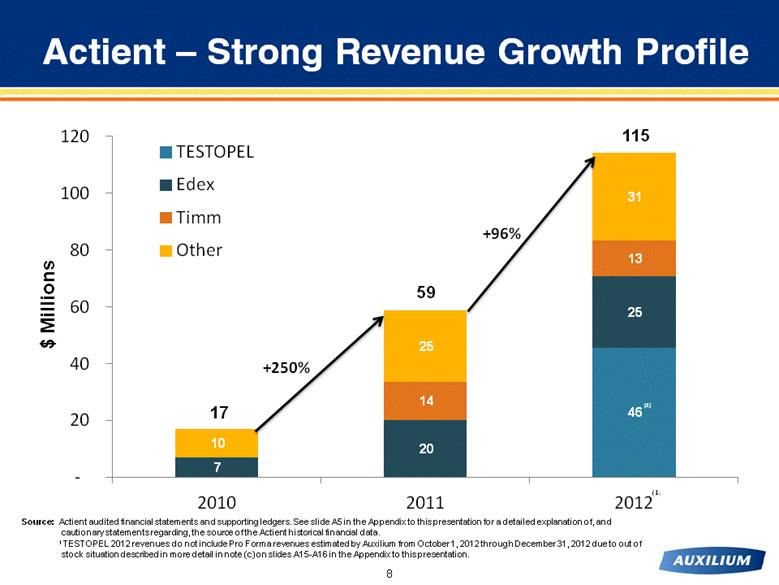

Actient – Strong Revenue Growth Profile 17 59 115 $ Millions (1) (1) Source: Actient audited financial statements and supporting ledgers. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. 1 TESTOPEL 2012 revenues do not include Pro Forma revenues estimated by Auxilium from October 1, 2012 through December 31, 2012 due to out of stock situation described in more detail in note (c) on slides A15-A16 in the Appendix to this presentation. 8 46 7 20 25 14 13 10 25 31 - 20 40 60 80 100 120 2010 2011 2012 TESTOPEL Edex Timm Other +250% +96% 17 59 115 $ Millions (1) (1) |

|

|

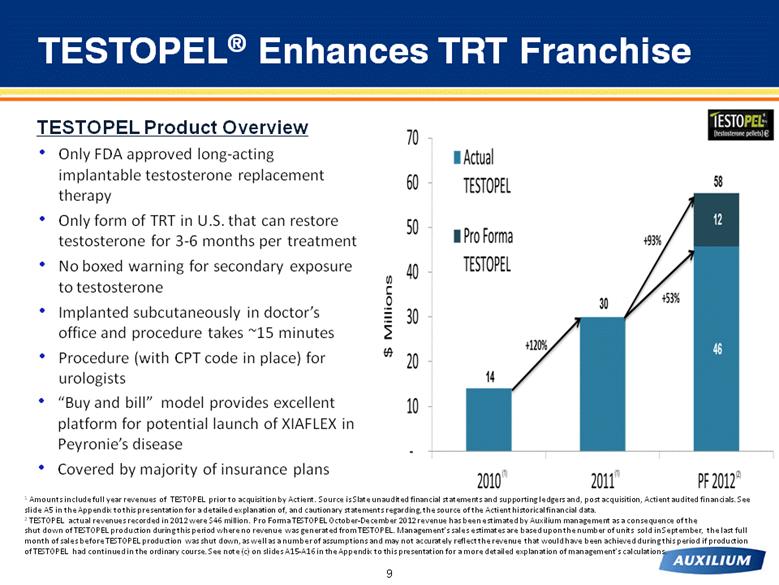

TESTOPEL® Enhances TRT Franchise TESTOPEL Product Overview Only FDA approved long-acting implantable testosterone replacement therapy Only form of TRT in U.S. that can restore testosterone for 3-6 months per treatment No boxed warning for secondary exposure to testosterone Implanted subcutaneously in doctor’s office and procedure takes ~15 minutes Procedure (with CPT code in place) for urologists “Buy and bill” model provides excellent platform for potential launch of XIAFLEX in Peyronie’s disease Covered by majority of insurance plans 1 Amounts include full year revenues of TESTOPEL prior to acquisition by Actient. Source is Slate unaudited financial statements and supporting ledgers and, post acquisition, Actient audited financials. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. 2 TESTOPEL actual revenues recorded in 2012 were $46 million. Pro Forma TESTOPEL October-December 2012 revenue has been estimated by Auxilium management as a consequence of the shut down of TESTOPEL production during this period where no revenue was generated from TESTOPEL. Management’s sales estimates are based upon the number of units sold in September, the last full month of sales before TESTOPEL production was shut down, as well as a number of assumptions and may not accurately reflect the revenue that would have been achieved during this period if production of TESTOPEL had continued in the ordinary course. See note (c) on slides A15-A16 in the Appendix to this presentation for a more detailed explanation of management’s calculations. 9 |

|

|

Edex® Enhances Urology Franchise Edex Product Overview Approved in 1997, Edex is a smooth muscle relaxant and works by dilating arteries in penis to allow blood to flow more easily and create an erection Market leading branded erectile dysfunction option for men who fail/are not candidates for oral therapy Only Edex provides an FDA-approved, injectable ED product in a single unit-of-use format, dual chamber syringe Pre-measured single dose preparation Onset in 5 - 20 mins and lasting up to one hour No need for refrigeration Sterile dosing Covered by majority of insurance plans Additional potential growth opportunity due to concerns around compounding pharmacies 1 2010 actual revenues recorded within Actient audited financial statements were $7 million. Edex was acquired from UCB in July 2010 and $9 million of revenues in 2010 were recorded by UCB. Source is Actient diligence data. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. 10 |

|

|

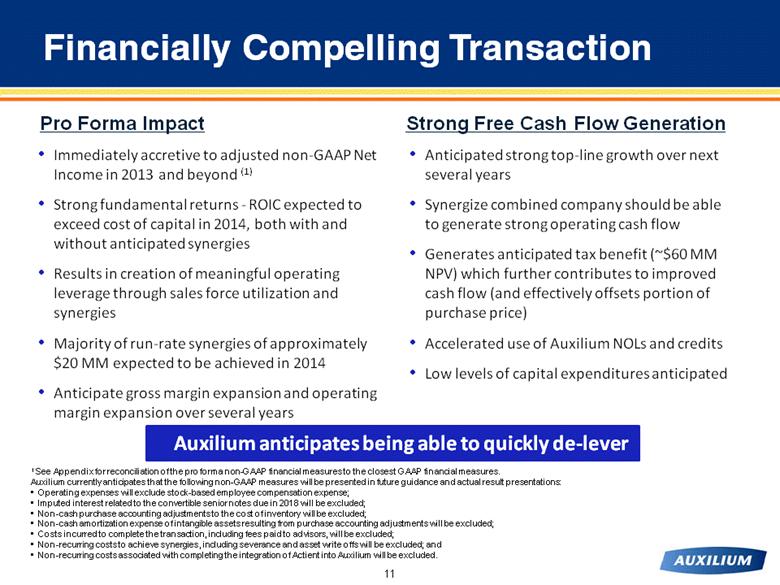

Financially Compelling Transaction Anticipated strong top-line growth over next several years Synergize combined company should be able to generate strong operating cash flow Generates anticipated tax benefit (~$60 MM NPV) which further contributes to improved cash flow (and effectively offsets portion of purchase price) Accelerated use of Auxilium NOLs and credits Low levels of capital expenditures anticipated Strong Free Cash Flow Generation Immediately accretive to adjusted non-GAAP Net Income in 2013 and beyond (1) Strong fundamental returns - ROIC expected to exceed cost of capital in 2014, both with and without anticipated synergies Results in creation of meaningful operating leverage through sales force utilization and synergies Majority of run-rate synergies of approximately $20 MM expected to be achieved in 2014 Anticipate gross margin expansion and operating margin expansion over several years Pro Forma Impact 1 See Appendix for reconciliation of the pro forma non-GAAP financial measures to the closest GAAP financial measures. Auxilium currently anticipates that the following non-GAAP measures will be presented in future guidance and actual result presentations: • Operating expenses will exclude stock-based employee compensation expense; • Imputed interest related to the convertible senior notes due in 2018 will be excluded; • Non-cash purchase accounting adjustments to the cost of inventory will be excluded; • Non-cash amortization expense of intangible assets resulting from purchase accounting adjustments will be excluded; • Costs incurred to complete the transaction, including fees paid to advisors, will be excluded; • Non-recurring costs to achieve synergies, including severance and asset write offs will be excluded; and • Non-recurring costs associated with completing the integration of Actient into Auxilium will be excluded. Auxilium anticipates being able to quickly de-lever 11 |

|

|

Update on Actient Integration 12 First step toward expected synergies taken - All Actient employees notified of status – permanent employment, transitional or elimination of position - Transitional employees’ assignments to end August 30 and December 31 Leveraging sales expertise with three sales forces - Men’s Health Buy and Bill (to include primary responsibility for XIAFLEX in Peyronie’s, subject to FDA approval) - Men’s Health Retail (to include support for XIAFLEX in Peyronie’s, subject to FDA approval - Orthopedics (Dupuytren’s) Further integration update scheduled for Q2 conference call |

|

|

Total Revenues $325 - 355 $360 – 415 (1) Global Testim Revenues $250 - 265 $210 – 240 XIAFLEX: U.S. Revenues $65 - 75 $55 – 65 Ex-U.S. / Def. Rev $10 - 15 $10 – 15 Total XIAFLEX Revenues $75 - 90 $65 - 80 Total Actient Revenues $85 – 95 (1) R & D Expense (non-GAAP) $45 - 55 S G & A Expense (non-GAAP) $185 - 195 Interest Inc. (Exp.) (non-GAAP) $(3 - 4) Non-GAAP Net Income $18 - 23 Accretive to $18-23 2013 Financial Guidance (amounts in millions) Updated 2013 Guidance 1 2013 net revenue guidance represents only 8 months of Actient revenue Previous 2013 Guidance 13 |

|

|

Projected 2013 Revenue Growth 2 Mid-point of guidance; Actient 8 months revenues included 1 See Appendix for reconciliation of the pro forma non-GAAP financial measures to the closest GAAP financial measures 15% 27% 14 0 50 100 150 200 250 300 350 400 2011 2012 2013 Actient Auxilium $264.3 ~$387.5 $303.3(1) $ millions |

|

|

Therapeutic Area Nonclinical Phase I Phase II Phase III Approved Urology Male Hypogonadism Testim 1% Male Hypogonadism TESTOPEL Erectile Dysfunction Edex Erectile Dysfunction Osbon ErecAid Male Hypogonadism Striant Peyronie’s Disease CCH Male Hypogonadism T-gel Orthopedics Dupuytren’s Contracture XIAFLEX Dupuytren’s Contracture XIAFLEX (multi-cord) Frozen Shoulder CCH Dermatology Cellulite (EFP) CCH Canine Lipoma (1) CCH Human Lipoma (1) CCH Non-Promoted Products Theo-24, Semprex-D and three other non-promoted products A Broader and More Diversified Portfolio CCH – Collagenase Clostridium Histolyticum (XIAFLEX®) 1 Initial development by Biospecifics Technologies ® ® ® ® 15 |

|

|

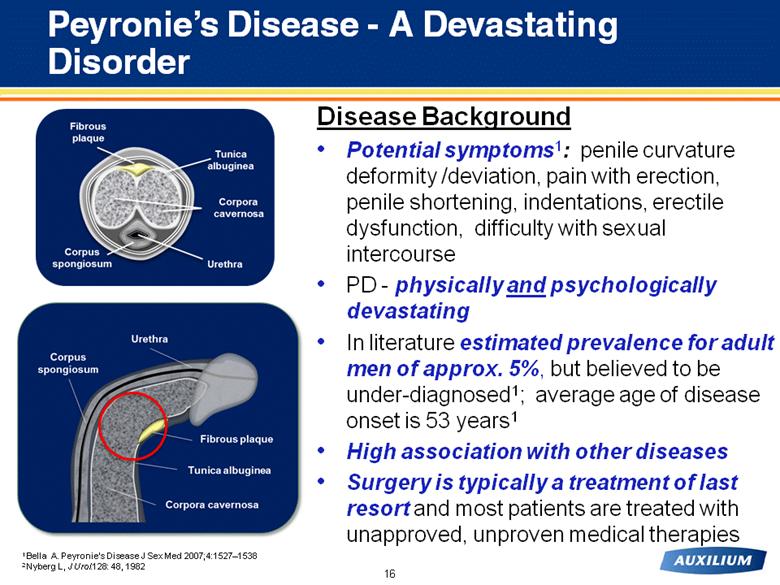

Peyronie’s Disease - A Devastating Disorder Disease Background Potential symptoms1: penile curvature deformity /deviation, pain with erection, penile shortening, indentations, erectile dysfunction, difficulty with sexual intercourse PD - physically and psychologically devastating In literature estimated prevalence for adult men of approx. 5%, but believed to be under-diagnosed1; average age of disease onset is 53 years1 High association with other diseases Surgery is typically a treatment of last resort and most patients are treated with unapproved, unproven medical therapies 1 Bella A. Peyronie’s Disease J Sex Med 2007;4:1527–1538 2 Nyberg L, J Urol.128: 48, 1982 16 |

|

|

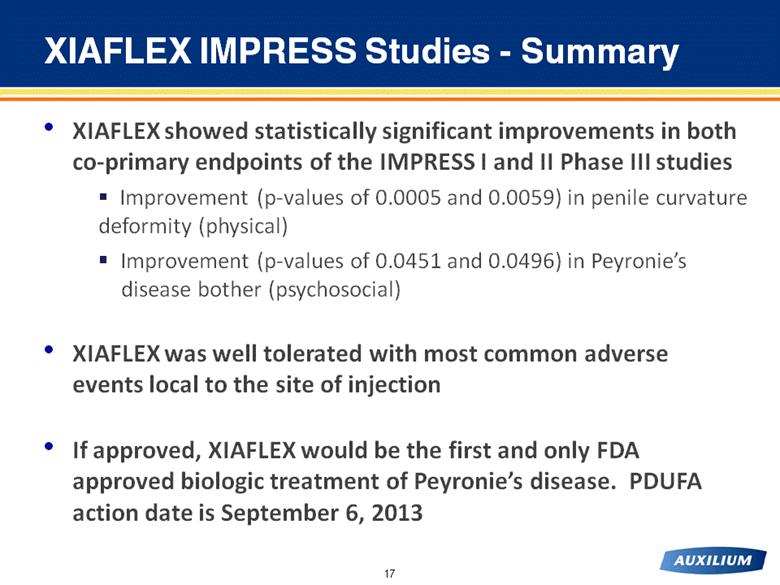

XIAFLEX IMPRESS Studies - Summary XIAFLEX showed statistically significant improvements in both co-primary endpoints of the IMPRESS I and II Phase III studies Improvement (p-values of 0.0005 and 0.0059) in penile curvature deformity (physical) Improvement (p-values of 0.0451 and 0.0496) in Peyronie’s disease bother (psychosocial) XIAFLEX was well tolerated with most common adverse events local to the site of injection If approved, XIAFLEX would be the first and only FDA approved biologic treatment of Peyronie’s disease. PDUFA action date is September 6, 2013 17 |

|

|

XIAFLEX 3-D Photographic Evaluation Subject 1106-7852 –Baseline curvature deformity - 45° End of study curvature deformity - 28°(38% Improvement) AUX-CC-802 Photo Sub-Study Subject 38% Improvement 18 |

|

|

Peyronie’s Disease Market Opportunity Category Invasive Surgical1 Invasive Non-Surgical1 Non-Invasive No Treatment2,4 Description / Examples Plication, grafting, prosthesis Verapamil injection Vitamin E, potaba, colchicine Patient Counts 1,500 – 2,000 3,500 – 4,500 40,000 – 66,500 20,000 – 47,000 Urology Centers ~1,000 Urologists treat PD invasively1 Additional ~7,000 Urologists1 % of Invasive Procedures ~400 Urologists account for 90% of PD surgeries5 No invasive procedures performed1 65,000 – 120,000 patients diagnosed in 20101,2,3 Initial Focus for XIAFLEX Market Development Opportunity IMS/SDI Claims Database, 2010 Auxilium 700 patient chart audit, 2011 DiBenedetti, Adv Urol, 2011 Shindel, J Sex Med, 2008; LaRochelle, J Sex Med, 2007. Qforma IQ Map, utilizing Wolters-Kluwer claims data Treatment Modalities 19 1. 2. 3. 4. 5. |

|

|

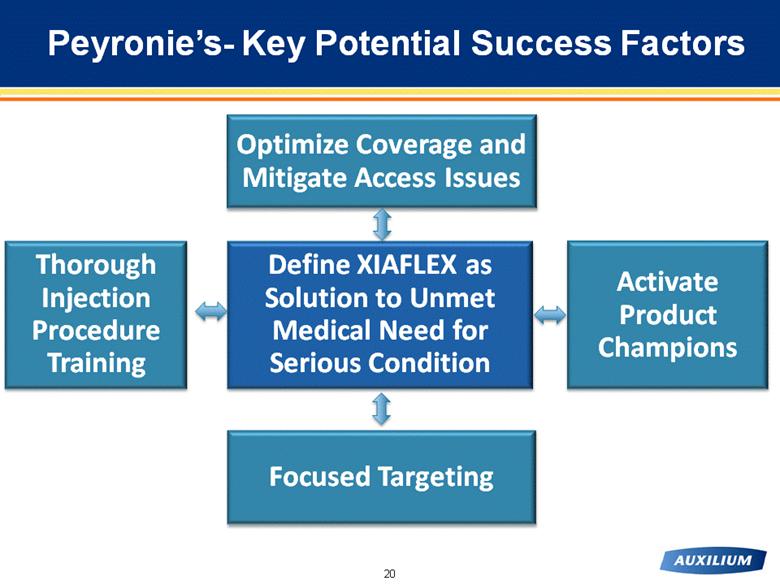

Peyronie’s- Key Potential Success Factors Define XIAFLEX as Solution to Unmet Medical Need for Serious Condition Optimize Coverage and Mitigate Access Issues Thorough Injection Procedure Training Focused Targeting Activate Product Champions 20 |

|

|

CCH Top-line Day 30 Cellulite Phase Ib Data Supports Progression into Phase II XIAFLEX was well-tolerated in the Cellulite Phase Ib 21 |

|

|

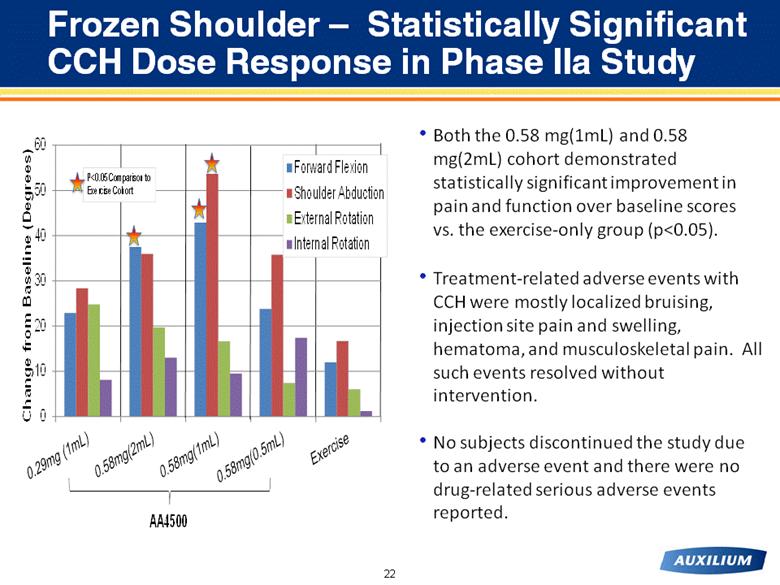

Frozen Shoulder – Statistically Significant CCH Dose Response in Phase IIa Study Both the 0.58 mg(1mL) and 0.58 mg(2mL) cohort demonstrated statistically significant improvement in pain and function over baseline scores vs. the exercise-only group (p<0.05). Treatment-related adverse events with CCH were mostly localized bruising, injection site pain and swelling, hematoma, and musculoskeletal pain. All such events resolved without intervention. No subjects discontinued the study due to an adverse event and there were no drug-related serious adverse events reported. 22 0 10 20 30 40 50 60 Change from Baseline (Degrees) Forward Flexion Shoulder Abduction External Rotation Internal Rotation P<0.05 Comparison to Exercise Cohort AA4500 |

|

|

“New” Auxilium: Near Term Priorities Efficiently integrate Actient Maximize value of current portfolio Stabilize/grow Testim market share & increase unit sales Drive to standard of care in Dupuytren’s for XIAFLEX Grow TESTOPEL, Edex, Osbon ErecAid and Striant use with Urologists Prepare for and successfully launch XIAFLEX in Peyronie’s disease, if approved Successfully advance R&D pipeline Complete Multicord Ph. IIIb study enrollment (2Q13) Initiate Cellulite Ph. II study (2H13) Initiate Frozen Shoulder later stage study (2H13) Deliver strong and sustainable financial performance Auxilium is well positioned to drive shareholder value 23 |

|

|

Deutsche Bank Conference “Corporate Overview and Strategy” May 29, 2013 |

|

|

Appendix |

|

|

This presentation contains pro-forma financial measures that are not consistent with the financial measures that would be reported in financial statements prepared in accordance with generally accepted accounting principles, or GAAP. These non-GAAP financial measures should not be relied upon as an alternative to GAAP financial measures. Auxilium management believes the non-GAAP information included in this presentation will be useful for investors by: • offering them the ability to better identify trends in our business; • allowing investors to use the same non-GAAP financial measures to monitor and evaluate our operating results and trends on an ongoing basis as are used by management internally for operating, budgeting and financial planning purposes; and • providing a useful measure to compare our results period-over-period. The attached Appendix contains reconciliations of the non-GAAP financial measures to the closest comparable GAAP financial measures. The attached Appendix also contains explanations of the adjustments that were made to Actient’s pro-forma revenue for 2012 that is set forth in this presentation. These adjustments were based upon projections that Auxilium management used and are based upon assumptions that are subject to many variables that may prove to be unreliable. This presentation highlights certain of our assumptions. Actual results may differ materially from those reflected in these forward-looking statements due to various factors, including those set forth in the Forward Looking Statements disclosure of this presentation on slide 1. Auxilium currently anticipates that the following non-GAAP measures will be presented in future guidance and actual result presentations: • Operating expenses will exclude stock-based employee compensation expense; • Imputed interest related to the convertible senior notes due in 2018 will be excluded; • Non-cash purchase accounting adjustments to the cost of inventory will be excluded; • Non-cash amortization expense of intangible assets resulting from purchase accounting adjustments will be excluded; • Costs incurred to complete the transaction, including fees paid to advisors, will be excluded; • Non-recurring costs to achieve synergies, including severance and asset write offs will be excluded; and • Non-recurring costs associated with completing the integration of Actient into Auxilium will be excluded. USE OF NON-GAAP FINANCIAL MEASURES A1 |

|

|

Auxilium Reconciliation of GAAP to Non-GAAP Net Income (Loss) A2 3 Months Ended March 31, 2013 3 Months Ended March 31, 2012 GAAP Adjustments Non-GAAP GAAP Adjustments Non-GAAP Net revenues 66.2 $ - $ 66.2 $ 73.6 $ - $ 73.6 $ Operating expenses: Cost of goods sold 15.1 (0.0) (a) 15.1 16.6 (0.0) (a) 16.6 Research and development 11.9 (0.7) (b) 11.2 12.0 (0.6) (b) 11.4 Selling, general and administrative 44.3 (3.0) (c) 41.3 46.9 (3.1) (c) 43.9 Total operating expenses 71.3 (3.7) 67.5 75.5 (3.7) 71.9 Income (loss) from operations (5.1) 3.7 (1.4) (1.9) 3.7 1.7 Interest income (expense), net (3.1) 2.1 (d) (0.9) 0.2 - (d) 0.2 Net income (loss) (8.2) $ 5.9 $ (2.3) $ (1.7) $ 3.7 $ 1.9 $ Basic and diluted net income (loss) per common share (0.17) $ (0.05) $ (0.04) $ 0.04 $ Weighted average common shares outstanding 49.2 49.2 48.3 48.3 (In millions, except per share amounts) (Unaudited) |

|

|

Auxilium Reconciliation of GAAP to Non-GAAP Net Income (Loss) A3 3 Months Ended 3 Months Ended March 31, 2013 March 31, 2012 (a) Costs of goods sold: Employee stock-based compensation (1) (0.0) (0.0) (b) Research and development expenses: Employee stock-based compensation (1) (0.7) (0.6) (c) Selling, general and administrative expenses Employee stock-based compensation (1) (3.0) (3.1) (d) Interest income (expense), net 2.1 - Non cash convertible debt (2) (1) (2) The effects of employee stock-based compensation are excluded because of varying available valuation methodologies and subjective assumptions. We believe this is a useful measure for investors because such exclusion facilitates comparison to peer companies who also provide similar non-GAAP disclosures and is reflective of how Auxilium management internally manages the business. The effects of non-cash interest related to the convertible senior notes due 2018 are excluded. We believe this is a useful measure for investors because such exclusion facilitates an understanding of the effects of the debt service obligations on the Company's liquidity and comparisons to peer group companies, and is reflective of how Auxilium management internally manages the business. (In millions, except per share amounts) (Unaudited) |

|

|

Auxilium 1st Quarter 2013 Net Revenue Details A4 Increase 2013 2012 (Decrease) Testim revenues- Net U.S. product sales $45.3 $57.9 -22% International revenues 0.2 0.8 -78% Total Testim revenues $45.5 $58.7 -23% XIAFLEX revenues- Net U.S. product sales $12.0 $12.6 -5% International revenues 8.8 2.3 276% Total XIAFLEX revenues $20.7 $14.9 39% Total net revenues $66.2 $73.6 -10% International revenues represent amortization of deferred upfront and milestone payments received on our licensing agreements, together with royalties earned on product sales by licensees. (In millions, except for percentages) (Unaudited) Three Months Ended March 31, |

|

|

The audited financial information and other financial information of Actient contained in this presentation has not been audited or independently verified by Auxilium or its registered independent public accountants. The financial information of Actient is being provided by Auxilium for information purposes only. Auxilium intends to amend its Current Report on Form 8-K filed with the Securities and Exchange Commission on April 29, 2013 with respect to Auxilium’s acquisition of Actient (the “Actient 8-K”) for the purpose of including the pro-forma historic financial information of the combined company required by Regulation S-X. The financial information contained in this presentation should not be relied upon: for purposes of making an investment decision, as an alternative to the financial information that Auxilium will report on the amended Actient 8-K, or as any indication of the financial information that Auxilium may disclose as part of the amended Actient 8-K. During the periods covered by the Actient historical financial data, Actient completed the following company or asset acquisitions and only reported the financial information relating to these products and businesses from their respective dates of acquisition: July 2010 – Acquisition of the U.S. rights to six products from UCB, Inc., including Edex, January 2011 – Acquisition of Timm Medical Technologies, Inc., including Osbon ErecAid, April 2011 – Acquisition of Striant from Columbia Laboratories, Inc., December 2011 – Acquisition of Slate Pharmaceuticals, Inc., including TESTOPEL, and June 2012 – Acquisition of Bartor Pharmacal Co., Inc., the manufacturer of TESTOPEL. Disclaimer Regarding Source of Actient Historical Financial Data A5 |

|

|

Actient Audited Revenues – 2010 - 2012 $ Millions +250% +96% Source: Actient audited financial statements and supporting ledgers. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. 1 2012 revenues do not include TESTOPEL Pro Forma revenues estimated from October 1, 2012 through December 31, 2012 due to out of stock situation described in more detail in note (c) on slide A16 in the Appendix to this presentation. (1) A6 |

|

|

Pro Forma As Adjusted 2012 EBITDA 1 See slide A11 in the Appendix to this presentation for details 2 See slides A15-A16 in the Appendix to this presentation for details 3 Reflects full year run rate synergies expected to be achieved by 2015. The majority of run rate synergies are expected to be achieved in 2014. (3) (2) (1) A7 |

|

|

2012 Combined Pro Forma As Adjusted Revenues b c a d See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. A8 Auxilium Reported 2012 Revenue 395.3 Less Pfizer Termination Revenue Included (92.0) Auxilium 2012 Pro forma Revenue 303.3 Opal Reported 2012 Revenue 114.9 Plus Estimated Impact of TESTOPEL Stock Out 12.0 Remove UCB Products Non Recurring Return Reserve Reversal (1.5) Opal 2012 Revenue 125.3 Combined 2012 Revenue 428.6 $ 2012 Combined Pro forma As Adjusted Revenue (MM) (a) We have excluded the amount of income and expense related to a change in estimate that we recognized on a GAAP basis as a consequence of the mutual termination of our collaboration agreement with Pfizer. Prior to the mutual termination of our collaboration agreement with Pfizer, the cash received from Pfizer and payments made to our Xiaflex licensor were deferred income and expenses, respectively, which we were amortizing on a straight-line basis over a 20 year period in accordance with GAAP. Upon termination of the agreement the life of the contract was shortened such that all deferred income and expense associated will be recognized by April 24, 2013. We believe that excluding the amount of deferred income and deferred expense that represents the change in estimate related to the shorter life provides investors with a better understanding of the income that was generated by the Company’s operations during the period, and allows investors to evaluate our operations on the same basis as management did during the period. (b) Amount is as reported in Actient's 2012 audited financial statements. |

|

|

2012 Combined Pro Forma Revenues (cont.) (d) In 2012, Actient adjusted the return reserve for UCB products to reflect a lower return rate based on actual returns experienced. This reduction in the reserve resulted in higher net revenues recorded. Auxilium believes that $1.5 MM of this reduction in the return reserve related to periods prior to 2012. A9 (c) On June 20, 2012 Actient acquired the manufacturer of TESTOPEL, Bartor Pharma. After acquiring the company, Actient shut down the manufacturing facility to make certain improvements and as a result, TESTOPEL was out of stock for a portion of October and the months of November and December. The facility resumed production in January and is working to fill all back orders and current product demand. Auxilium has included an estimate of the TESTOPEL October to December sales that would have been achieved had the out of stock situation not occurred. We believe that the revenues and EBITDA that we included are a reasonable estimate of the lost October to December revenues and EBITDA based on the $5.3 MM of TESTOPEL sales that Actient recorded in September, the last full month of sales before the out of stock situation occurred and certain other assumptions. Using the September actual revenues for each of the full three months of the fourth quarter yields $15.9 MM in estimated revenues. This amount was then reduced for the $3.9 million actually sold in the fourth quarter prior to the stock out beginning, resulting in the $12.0 million pro forma adjustment. The Company considered two alternative ways of estimating TESTOPEL revenue and EBITDA for this period. The first used a 2 year trend of actual net revenues through September 2012 and continued a linear extrapolation of monthly sales through December. This would have resulted in a pro forma adjustment to revenues and EBITDA substantially similar to the $12.0 million in revenues and $10.2 million in EBITDA adjustment above. The second alternative considered was to calculate an average monthly sales for the product based on the first 9 months of actual TESTOPEL revenue recorded and use this amount for the fourth quarter. This method would have resulted in pro forma revenues of approximately $10 million being added to the actual sales recorded in Q4 of $3.9 and an EBITDA adjustment of approximately $8.5 million. The Company believes that the amount included as a pro forma adjustment is reasonable and provides investors with a reasonable estimate of the revenues and EBITDA that the business may generate now that TESTOPEL production has resumed. These assumptions and estimates are based upon many variables that are inherently subjective and prone to variance. Our assumptions and estimates may not accurately reflect the revenue and EBITDA that would have been achieved during this period if production of TESTOPEL had continued in the ordinary course. (d) On June 20, 2012 Actient acquired the manufacturer of TESTOPEL, Bartor Pharma. The adjustment represents management's pro-forma EBITDA estimate to assume that the acquisition of Bartor Pharma occurred January 1, 2012 and removes the manufacturing profit that was included in the cost of goods sold by Actient in 2012. The Company believes that the amount included as a pro forma adjustment is reasonable and provides investors with a more accurate trend of EBITDA that the business may generate now that the manufacturing of TESTOPEL has been vertically integrated. These assumptions may not accurately reflect the EBITDA that would have been achieved during this period if production of TESTOPEL had been integrated for the full year 2012. |

|

|

Auxilium Historical and Pro Forma Financial Performance $MM $MM $MM $MM 2010 2011 2012 2010 2011 2012 Revenue PF Adj. EBITDA Gross Profit PF Adj. EBITDA less Capex Note: See slides A11-A13 in the Appendix to this presentation for explanation of all adjustments made to audited financial statements of Auxilium. A10 |

|

|

Auxilium 2012 Pro Forma Financial Data A11 EBITDA EBITDA $ millions Revenue Gross Profit Net Income Adjustments EBITDA CapEx Less CapEx As Reported 395.3 $ 316.9 $ 85.9 $ 8.7 $ 94.6 $ 94.6 $ (a) Eliminate Pfizer Termination (92.0) $ (83.7) $ (83.7) $ (83.7) $ (83.7) $ (b) Eliminate Stock Based Compensation 15.0 $ 15.0 $ 15.0 $ (c) Capital Expenditures - $ - $ (8.8) $ (8.8) $ (d) Adjusted non-GAAP 303.3 $ 233.2 $ 17.2 $ 8.7 $ 25.9 $ (8.8) $ 17.1 $ (a) Adjustment of $8.7 million represents elimination of depreciation and amortization of $18.1 million per statement of cash flows, less $8.9 million of deferred costs related to licensing activities and elimination of interest income of $0.5 million. (b) We have excluded the amount of income and expense related to a change in estimate that we recognized on a GAAP basis as a consequence of the mutual termination of our collaboration agreement with Pfizer. Prior to the mutual termination of our collaboration agreement with Pfizer, the cash received from Pfizer and payments made to our Xiaflex licensor were deferred income and expenses, respecively, which we were amortizing on a straight-line basis over a 20 year period in accordance with GAAP. Upon termination of the agreement the life of the contract was shortened such that all deferred income and expense associated will be recognized by April 24, 2013. We believe that excluding the amount of deferred income and deferred expense that represents the change in estimate related to the shorter life provides investors with a better understanding of the income that was generated by the Company’s operations during the period, and allows investors to evaluate our operations on the same basis as management did during the period. (c) We have excluded those costs related to employee stock based compensation because they constitute non-cash expenditures that are determined based on complex assumptions that may vary as a result of conditions outside of our control, and because we believe exclusion of these expenses facilitates comparison of Auxilium’s operating results to those of our peer group companies that report similar non-GAAP financial measures. For the foregoing reasons we believe that including this non- GAAP financial measure provides investors with a better understanding of how management measures the financial performance of the Company, both internally and against that of our peer group companies. (d) Adjustment represents capital expenditures per statement of cash flows. |

|

|

Auxilium 2011 Financial Data A12 EBITDA EBITDA $ millions Revenue Gross Profit Net (Loss) Adjustments EBITDA CapEx Less CapEx As Reported 264.3 $ 208.7 $ (32.9) $ 7.7 $ (25.2) $ (25.2) $ (a) Eliminate Stock Based Compensation 17.3 $ 17.3 $ 17.3 $ (b) Capital Expenditures - $ - $ (6.6) $ (6.6) $ (c) Adjusted non-GAAP 264.3 $ 208.7 $ (15.6) $ 7.7 $ (7.9) $ (6.6) $ (14.5) $ (c) Adjustment represents capital expenditures per statement of cash flows. (a) Adjustment of $7.7 million represents elimination of depreciation and amortization of $8.0 million per statement of cash flows, less elimination of interest income of $0.3 million. (b) We have excluded those costs related to employee stock based compensation because they constitute non-cash expenditures that are determined based on complex assumptions that may vary as a result of conditions outside of our control, and because we believe exclusion of these expenses facilitates comparison of Auxilium’s operating results to those of our peer group companies that report similar non-GAAP financial measures. For the foregoing reasons we believe that including this non-GAAP financial measure provides investors with a better understanding of how management measures the financial performance of the Company, both internally and against that of our peer group companies. |

|

|

Auxilium 2010 Financial Data A13 EBITDA EBITDA $ millions Revenue Gross Profit Net (Loss) Adjustments EBITDA CapEx Less CapEx As Reported 211.4 $ 161.7 $ (51.2) $ 6.2 $ (45.0) $ (45.0) $ (a) Eliminate Stock Based Compensation 18.0 $ 18.0 $ 18.0 $ (b) Capital Expenditures - $ - $ (11.3) $ (11.3) $ (c) Adjusted non-GAAP 211.4 $ 161.7 $ (33.2) $ 6.2 $ (27.0) $ (11.3) $ (38.3) $ (a) Adjustment of $6.2 million represents elimination of depreciation and amortization of $5.9 million per statement of cash flows, plus elimination of interest expense of $0.3 million. (b) We have excluded those costs related to employee stock based compensation because they constitute non-cash expenditures that are determined based on complex assumptions that may vary as a result of conditions outside of our control, and because we believe exclusion of these expenses facilitates comparison of Auxilium’s operating results to those of our peer group companies that report similar non-GAAP financial measures. For the foregoing reasons we believe that including this non- GAAP financial measure provides investors with a better understanding of how management measures the financial performance of the Company, both internally and against that of our peer group companies. (c) Adjustment represents capital expenditures per statement of cash flows. |

|

|

Actient Historical and Pro Forma Financial Performance Revenue $MM PF Adj. EBITDA $MM Gross Profit $MM PF Adj. EBITDA less Capex $MM 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Note: See slides A15-A18 in the Appendix to this presentation for explanation of all adjustments made to audited financial statements of Actient. See slide A5 in the Appendix to this presentation for a detailed explanation of, and cautionary statements regarding, the source of the Actient historical financial data. A14 |

|

|

Actient 2012 Pro Forma Financial Data A15 EBITDA EBITDA $ millions Revenue Gross Profit Net Income Adjustments EBITDA CapEx Less CapEx Per Financial Statements 114.9 $ 85.0 $ (24.2) $ 42.7 $ 18.5 $ 18.5 $ (a) Change in Fair Value of Contingent Consideration - $ 20.3 $ 20.3 $ 20.3 $ (b) TESTOPEL Out of Stock Adjustment 12.0 $ 10.2 $ 10.2 $ 10.2 $ 10.2 $ (c) Bartor Pro Forma adjustment 6.3 $ 6.3 $ 6.3 $ 6.3 $ (d) Transaction-related Expenses 4.3 $ 4.3 $ 4.3 $ (e) Other non-recurring adjustments (1.6) $ 1.6 $ 1.6 $ 1.6 $ (f) Capital Expenditures - $ - $ (1.4) $ (1.4) $ (g) Adjusted, pro forma non-GAAP 125.3 $ 101.5 $ 18.5 $ 42.7 $ 61.2 $ (1.4) $ 59.8 $ (a) Adjustment of $42.7 million represents elimination of depreciation and amortization of $28.9 million per statement of cash flows, elimination of $14.4 million in interest costs and elimination of income tax benefit of $0.6 million. (b) Adjustment represents the non-cash expense recorded to adjust for future contingent considerations that may be paid for the acquisitions of products from UCB, Slate Pharmaceuticals and Timm Medical. |

|

|

Actient 2012 Pro Forma Financial Data – Cont’d A16 (g) Adjustment represents capital expenditures per statement of cash flows. (f) Respesents a number of smaller adjustments to Revenues and EBITDA that the Company believes are reasonable to include as a pro forma adjustment and provides investors with a more accurate trend of EBITDA that the business can generate. These assumptions may not accurately reflect the EBITDA that would have been achieved during this period. (c) On June 20, 2012 Actient acquired the manufacturer of TESTOPEL, Bartor Pharma. After acquiring the company, Actient shut down the manufacturing facility to make certain improvements and as a result, TESTOPEL was out of stock for a portion of October and the months of November and December. The facility resumed production in January and is working to fill all back orders and current product demand. Auxilium has included an estimate of the TESTOPEL October to December sales that would have been achieved had the out of stock situation not occurred. We believe that the revenues and EBITDA that we included are a reasonable estimate of the lost October to December revenues and EBITDA based on the $5.3 MM of TESTOPEL sales that Actient recorded in September, the last full month of sales before the out of stock situation occurred and certain other assumptions. Using the September actual revenues for each of the full three months of the fourth quarter yields $15.9 MM in estimated revenues. This amount was then reduced for the $3.9 million actually sold in the fourth quarter prior to the stock out beginning, resulting in the $12.0 million pro forma adjustment. The Company considered two alternative ways of estimating TESTOPEL revenue and EBITDA for this period. The first used a 2 year trend of actual net revenues through September 2012 and continued a linear extrapolation of monthly sales through December. This would have resulted in a pro forma adjustment to revenues and EBITDA substantially similar to the $12.0 million in revenues and $10.2 million in EBITDA adjustment above. The second alternative considered was to calculate an average monthly sales for the product based on the first 9 months of actual TESTOPEL revenue recorded and use this amount for the fourth quarter. This method would have resulted in pro forma revenues of approximately $10 million being added to the actual sales recorded in Q4 of $3.9 and an EBITDA adjustment of approximately $8.5 million. The Company believes that the amount included as a pro forma adjustment is reasonable and provides investors with a reasonable estimate of the revenues and EBITDA that the business may generate now that TESTOPEL production has resumed. These assumptions and estimates are based upon many variables that are inherently subjective and prone to variance. Our assumptions and estimates may not accurately reflect the revenue and EBITDA that would have been achieved during this period if production of TESTOPEL had continued in the ordinary course. (d) On June 20, 2012 Actient acquired the manufacturer of TESTOPEL, Bartor Pharma. The adjustment represents management's pro-forma EBITDA estimate to assume that the acquisition of Bartor Pharma occurred January 1, 2012 and removes the manufacturing profit that was included in the cost of goods sold by Actient in 2012. The Company believes that the amount included as a pro forma adjustment is reasonable and provides investors with a more accurate trend of EBITDA that the business may generate now that the manufacturing of TESTOPEL has been vertically integrated. These assumptions may not accurately reflect the EBITDA that would have been achieved during this period if production of TESTOPEL had been integrated for the full year 2012. (e) Reflects costs related to completed or attempted transactions in 2012. The Company believes that the amount included as a pro forma adjustment is reasonable and provides investors with a more accurate trend of EBITDA that the business may generate. These assumptions may not accurately reflect the EBITDA that would have been achieved during this period. |

|

|

Actient 2011 Financial Data A17 EBITDA EBITDA $ millions Revenue Gross Profit Net Income Adjustments EBITDA CapEx Less CapEx Per Financial Statements 58.6 44.3 1.3 $ 14.7 $ 16.0 $ 16.0 $ (a) Change in Fair Value of Contingent Consideration 2.5 $ 2.5 $ 2.5 $ (b) Intangible Asset Impairment 3.2 $ 3.2 $ 3.2 $ (c) Capital Expenditures - $ - $ (0.7) $ (0.7) $ (d) Adjusted, pro forma non-GAAP 58.6 $ 44.3 $ 7.0 $ 14.7 $ 21.7 $ (0.7) $ 21.0 $ (d) Adjustment represents capital expenditures per statement of cash flows. (a) Adjustment of $14.7 million represents elimination of depreciation and amortization of $9.5 million per statement of cash flows, elimination of $5.3 million in interest costs and elimination of income tax benefit of $0.1 million. (b) Adjustment represents the non-cash expense recorded to adjust for future contingent considerations that may be paid for the acquisitions of products from UCB and Timm Medical. (c) Amount represents a charge taken for a reduction in the estimated fair value and estimated useful lives of two products acquired from UCB in 2010. Auxilium believes that elimination of this non cash adjustement of intangible assets established under the purchase accounting adjustments for the UCB products will provide investors with a more accurate trend of the EBITDA that the business generated in 2011 Note: Included in 2011 Net Income, EBITDA and EBITDA less CapEx are $2.4 million in transaction related fees and costs and $1.3 million of loss on extinguishment of debt and $0.1 million of change in fair value of interest rate cap. |

|

|

Actient 2010 Financial Data A18 EBITDA EBITDA $ millions Revenue Gross Profit Net (Loss) Adjustments EBITDA CapEx Less CapEx Per Financial Statements 16.7 12.4 (2.8) $ 6.2 $ 3.4 $ 3.4 $ (a) Capital Expenditures - $ - $ (0.1) $ (0.1) $ (b) Adjusted, pro forma non-GAAP 16.7 $ 12.4 $ (2.8) $ 6.2 $ 3.4 $ (0.1) $ 3.3 $ (b) Adjustment represents capital expenditures per statement of cash flows. (a) Adjustment of $6.2 million represents elimination of depreciation and amortization of 3.6 million and elimination of $2.6 million in interest costs. Note: Included in 2010 Net Loss, EBITDA and EBITDA less CapEx are $4.4 million in transaction related fees and costs. |

|

|

Actient’s Other Products Product Therapeutic Area Description (theophylline anhydrous) Respiratory Theophylline is a methylxanthine drug that treats both COPD and asthma Approved in 1983; BC rated generic and not substitutable without physician consent Theo-24 has a narrow therapeutic window with a unique OD delivery system Theophylline is still a mainstay for COPD and refractory asthma (~1.6M TRx’s/yr.) (acrivastine & pseudoephedrine hydrochloride) Respiratory Semprex-D is a mildly sedating antihistamine / decongestant approved in 1994 Antihistamine is acrivastine (8mg/capsule) / Decongestant is pseudoephedrine (60mg/capsule) In March 2011, the FDA ordered the removal of over 1,000 DESI and non-NDA/ANDA allergy cough/cold products creating a growth opportunity Acrivastine is difficult to source (isosorbide dinitrate) Cardiovascular Approved in 1998, Dilatrate-SR is an extended release oral capsule indicated for the prevention of angina pectoris due to coronary artery disease The onset of action of controlled-release oral isosorbide dinitrate is not sufficiently rapid for this product to be useful in aborting an acute anginal episode (penbutolol sulfate) Cardiovascular Oral tablet indicated for mild to moderate arterial hypertension approved in 1989 It may be used alone or in combination with other antihypertensive agents, especially thiazide-type diuretics (methocarbamol, tablets, USP) Pain Approved in 1982, Robaxin is an oral tablet indicated as an adjunct to rest, physical therapy, and other measures for the relief of discomfort associated with acute, painful musculoskeletal conditions The mode of action of methocarbamol has not been clearly identified, but may be related to its sedative properties; Methocarbamol does not directly relax tense skeletal muscles in man A19 |