Attached files

| file | filename |

|---|---|

| EX-4.1 - EX-4.1 - Textura Corp | a2215403zex-4_1.htm |

| EX-3.3 - EX-3.3 - Textura Corp | a2215403zex-3_3.htm |

| EX-3.2 - EX-3.2 - Textura Corp | a2215403zex-3_2.htm |

| EX-23.1 - EX-23.1 - Textura Corp | a2215403zex-23_1.htm |

| EX-23.2 - EX-23.2 - Textura Corp | a2215403zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on May 28, 2013

Registration No. 333-187745

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Textura Corporation

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7372 (Primary Standard Industrial Classification Code Number) |

26-1212370 (I.R.S. Employer Identification Number) |

1405 Lake Cook Road

Deerfield, IL 60015

(847) 457-6500

(Address, including zip code and telephone number, including area code, of registrant's principal executive offices)

Patrick J. Allin

Chief Executive Officer

1405 Lake Cook Road

Deerfield, IL 60015

(847) 457-6500

(Name, address, including zip code and telephone number, including area code, of agent for service)

| Copies to: | ||

| David A. Schuette Mayer Brown LLP 71 South Wacker Drive Chicago, IL 60606 (312) 782-0600 |

Christopher D. Lueking Latham & Watkins LLP 233 South Wacker Drive, Suite 5800 Chicago, IL 60606 (312) 876-7700 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Securities Being Registered |

Amount to be Registered(1) |

Estimated Maximum Offering Price Per Share(2) |

Estimated Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock $0.001 par value per share |

4,600,000 | $15.00 | $69,000,000 | $9,412 | ||||

|

||||||||

- (1)

- Includes

600,000 shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457 of the Securities Act of 1933, as amended.

- (3)

- The registrant previously paid $6,820 of this amount.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 28, 2013

4,000,000 Shares

Textura Corporation

Common Stock

This is the initial public offering of common stock of Textura Corporation.

We are selling 4,000,000 shares of common stock. Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $13.00 and $15.00 per share. Our common stock has been approved for listing on the New York Stock Exchange under the symbol "TXTR."

The underwriters have an option to purchase a maximum of 600,000 additional shares to cover over-allotments of shares.

We are an "emerging growth company" as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 12.

| |

Price to Public | Underwriting Discounts and Commissions(1) |

Proceeds, before Expenses, to Textura Corporation |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||||||

Total |

$ | $ | $ | |||||||

- (1)

- See "Underwriting" for additional information regarding underwriting compensation.

Delivery of the shares of common stock will be made on or about , 2013.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | William Blair |

| JMP Securities | Oppenheimer & Co. | Barrington Research |

The date of this prospectus is , 2013.

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

Information contained in our website does not constitute part of this prospectus.

Dealer Prospectus Delivery Obligation

Until , 2013, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus and the information set forth under the headings "Risk Factors," "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Unless the context requires otherwise, the words "Textura Corporation," "Textura," "we," "our company," "us" and "our" refer to Textura Corporation, a Delaware corporation, and its subsidiaries. Unless otherwise indicated, all numbers of shares, per share amounts and share prices related to our common stock in this prospectus reflect the 2 for 1 stock split in the form of a stock dividend declared on March 28, 2013.

Overview

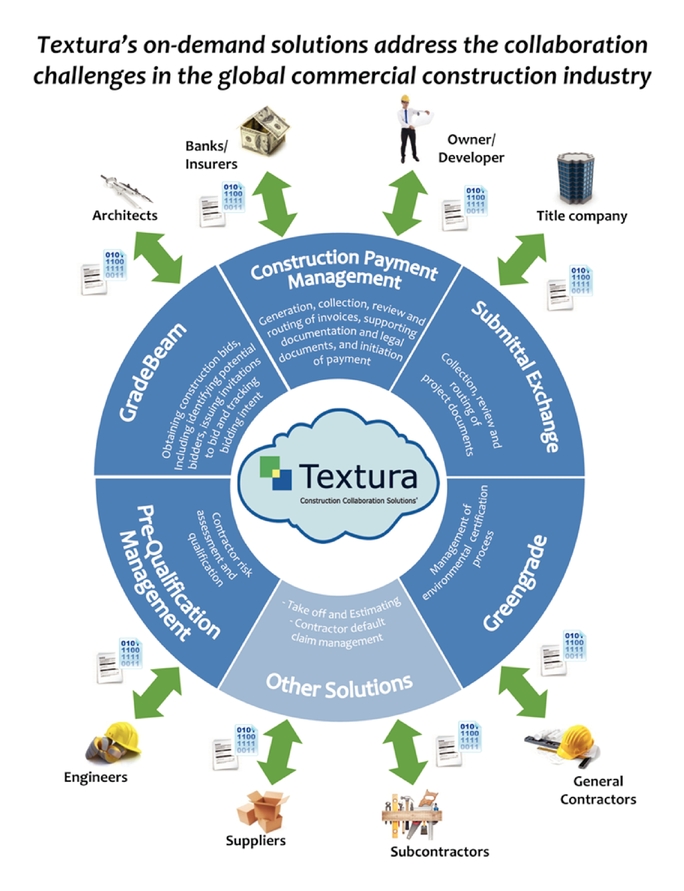

We are a leading provider of on-demand business collaboration software to the commercial construction industry. Our solutions are focused on facilitating collaboration between owners/developers, general contractors and subcontractors. Our solutions increase efficiency, enable better risk management, and provide improved visibility and control of construction activities for our clients.

Our collaboration solutions offer robust functionality, data sharing and exchange capabilities, and workflow tools that support several mission-critical business processes at various stages of the construction project lifecycle:

- •

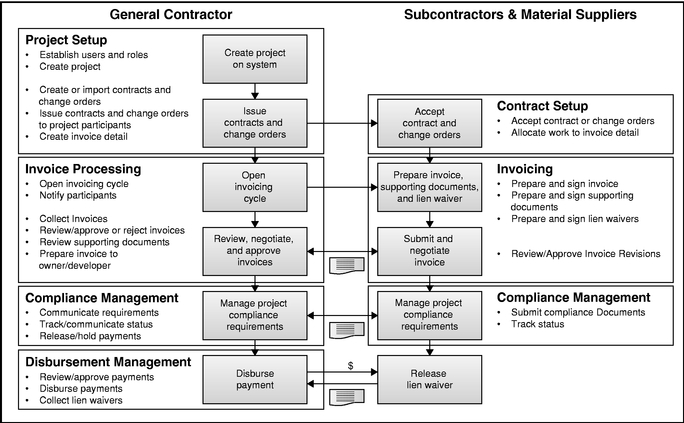

- Construction Payment Management ("CPM") enables the generation, collection, review and routing of invoices and the

necessary supporting documentation and legal documents, and initiation of payment of invoices.

- •

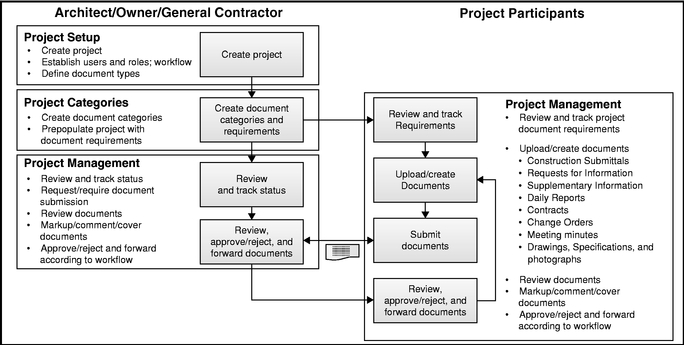

- Submittal Exchange enables the collection, review and routing of project documents.

- •

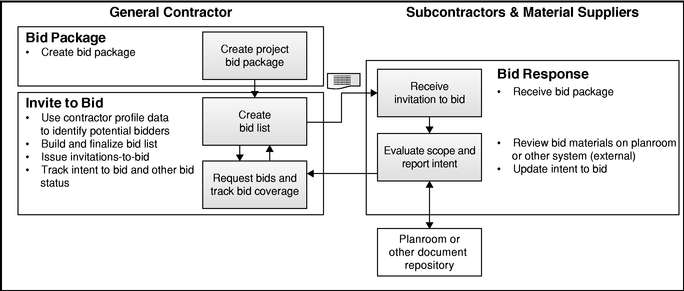

- GradeBeam supports the process of obtaining construction bids, including identifying potential bidders, issuing

invitations-to-bid and tracking bidding intent.

- •

- Pre-Qualification Management ("PQM") supports contractor risk assessment and qualification.

- •

- Greengrade facilitates the management of environmental certification processes.

In addition, we offer PlanSwift, a take-off and estimating solution used in preparing construction bids, and Contractor Default Claims Management, which supports the process of documenting a subcontractor default insurance claim.

Each of our collaboration solutions was designed from inception as a software-as-a-service ("SaaS") solution with an on-demand architecture. Our collaboration solutions each use a single code base and we do not customize our solutions for any of our clients. Our technology platform is designed to be highly configurable, scalable, reliable and secure.

We believe we are a leading example of a new generation of on-demand software solutions focused on enablement of business-to-business collaborative processes. Such solutions are by design on-demand, as they require neutral third parties to act as the platform for collaboration by multiple parties and to facilitate the exchange of data and documents.

We believe the construction industry represents a large and growing market for technology solutions of all types. The industry, we believe, is especially attractive for our solutions and our growth because it is underpenetrated by technology solutions that enable construction industry participants to more easily collaborate and operate more effectively. We have established a strong market position serving this industry. As of March 31, 2013, since the date of launch or acquisition of our solutions, our clients have used one or more of our on-demand collaboration solutions to help manage over 13,000

1

commercial construction projects representing more than $125 billion in construction value as reported by our clients. Our collaboration solutions have been used by more than 3,000 general contractors, owners/developers, and architects. This includes 41 of the 100 largest general contractors in North America, ranked as of May 2012 by Engineering News-Record based on annual construction revenues. In addition, based on management estimates, approximately 300,000 subcontractors were active on our solutions during fiscal 2012. Our solutions are used on construction projects of all sizes, from small remodels or renovations to multi-billion dollar developments.

We have achieved significant growth since introducing our solutions to the market. In the fiscal years ended September 30, 2010, 2011 and 2012, we generated revenue of $6.0 million, $10.5 million and $21.7 million, respectively, which represented growth over the prior period of 90.0%, 74.7% and 106.2%, respectively. In those same periods, we had net losses of $15.9 million, $18.9 million and $18.8 million, respectively.

Our Industry

Construction is a major global industry and consists of building new structures, making additions and modifications to existing structures, as well as conducting maintenance, repair and improvements on existing structures. Worldwide construction spending was $7.2 trillion in 2010, according to "Global Construction 2020," a study produced by Global Construction Perspectives, an industry research provider. A total of $97.7 trillion will be spent on construction worldwide during this decade, and by 2020 construction is expected to reach more than $12 trillion in annual spending and account for 13.2% of world GDP, according to the same study.

We believe the outlook for the construction industry is strong. The industry currently continues to be impacted in certain markets across the globe by slow economic recovery from the global financial crisis, oversupply of occupiable space, and limited availability of credit. However, long-term trends of population growth, deteriorating infrastructure and changing needs for buildings—driven by both socioeconomic and technological changes—all imply a continuing and growing need for construction activity. In certain markets, including our core markets in North America, the industry's growth rate also is benefitting as a result of the recovery from the factors described above. Overall, global construction spending is expected to grow at a compounded annual growth rate of 5.2% from 2010 to 2020, according to Global Construction Perspectives.

Each construction project requires a complex collaborative effort between the many different participants that play a part throughout or at different stages of the project's lifecycle. The practices used by the industry to manage this complexity have been largely manual, paper-based and inefficient, or have relied on technology solutions not designed for collaboration. As a result, we believe participants face numerous challenges collaborating on construction projects, including significant administrative overhead burdens; disparate standards, procedures and systems; lack of workflow discipline and control; inefficient process coordination; errors, inconsistencies and omissions; limited risk management tools; and siloed applications and data repositories. Furthermore, the industry is changing in response to the many issues it faces, including those resulting from the global financial crisis, new approaches to project delivery and an increased focus on risk management, transparency and efficiency.

In order to meet these challenges and as companies seek to support growth while limiting costs, we believe industry participants are increasingly adopting software solutions that can also increase visibility into and control over critical stages of the construction lifecycle. We believe software solutions delivered on an on-demand basis and by a neutral third party are necessary to meet this demand. Such solutions can facilitate the exchange of data and information in a cost-effective, flexible, scalable and secure manner.

2

We believe therefore there is a significant opportunity to offer comprehensive on-demand collaboration software solutions that are designed to address the evolving needs of the construction industry as it responds to the many challenges it faces and seeks to achieve greater operational and financial efficiencies, better manage risk and grow significantly over the next decade and beyond.

Our Solution

Our on-demand business collaboration software solutions address the several challenges associated with the traditional paper-based and personnel-intensive manual approaches or with technology solutions not designed for collaborative processes, and support many of the trends currently occurring within the commercial construction industry. We believe our solutions benefit our clients because they are:

- •

- Designed specifically for collaborative processes. Our

collaboration solutions facilitate the sharing and exchange of data between and within organizations and provide robust workflow tools to ensure that necessary steps are carried out in the right

sequence by appropriately authorized users.

- •

- Developed to meet the needs of the construction

industry. Our solutions are built to meet the unique requirements of the construction industry and our delivery capabilities have been

organized around the specialized needs of our clients.

- •

- Delivered through a trusted and neutral third party. We

host, provide access to and facilitate the exchange of information, enabling project participants to achieve a common and transparent view of project status.

- •

- Valuable to all participants. Our solutions are designed

to reduce costs, manage risk and improve visibility and decision-making for each participant independent of their specific role or responsibility.

- •

- Interfaced with existing enterprise systems. Our solutions

leverage and protect our clients' existing investments, facilitate their business processes and reduce or eliminate duplicate data entry.

- •

- Easy to implement, use and adopt. Our solutions can be

configured by our clients to meet their specific needs without needing customization, and can be rapidly implemented by our clients across their organizations.

- •

- Accompanied by high levels of training and support to all users. Our client services team provides extensive on-site training for enterprise clients and unlimited remote live support for all end-users.

Our Key Business Attributes

Key attributes of our business include the following:

- •

- Large, attractive market. The construction industry

affords us a large market in which to sell our solutions and we believe it is currently underutilizing on-demand business collaboration software solutions.

- •

- Next-generation approach to solving the challenges facing our

clients. We believe ours is a disruptive approach to solving business-to-business collaboration challenges and also can be applied to

many processes and industries.

- •

- High recurrence of fees, favorable timing of cash flow and predictable reported revenue. Our revenue is derived primarily from fees driven by construction project activity and from monthly fees. We increase revenue both as we add clients and our clients increase the number of their

3

- •

- Highly defensible market position. We believe our industry

expertise, leading market share, large installed base and strong intellectual property portfolio represent significant barriers to successful competitive entry.

- •

- Ability to differentiate through our business and technology

approach. We believe we are uniquely positioned to integrate our solutions with other enterprise software and support our solutions with

a strong client service capability, and that we have the resources to support significant investment.

- •

- Focus on quality of service. Our solutions support mission-critical processes and time-sensitive interactions and communications, which require timely and accurate client support. Client service and support is a cornerstone of our value proposition, and we believe it is a significant element of our long-term success.

projects on our solutions. We historically have experienced high recurrence of fees, favorable timing of cash flow and predictable reported revenue.

Our Strategy

We intend to leverage our existing solutions and industry presence to become the industry standard for collaboration solutions in the construction industry, both domestically and in targeted international markets. The key elements of our strategy to accomplish these objectives are as follows:

- •

- Increase our market penetration of the construction

industry. We intend to actively pursue new client relationships with owners/developers, general contractors and subcontractors that do

not currently use our solutions. We intend to focus our existing sales and marketing capabilities on large, strategic owners/developers and general contractors, as they can generate significant,

multi-year growth. At the same time, we plan to launch solution and channel initiatives that target smaller industry participants in a cost-effective fashion.

- •

- Expand our suite of solutions. We plan to continue to use

our domain expertise in construction and to work closely with our clients to identify and develop new applications, features and functionality that address business processes we currently do not

support.

- •

- Pursue acquisitions of complementary businesses. We

believe that acquisitions of complementary businesses can help us expand our suite of solutions more rapidly, enter into new markets, expand our client base and increase the knowledge and skill sets

within our organization. We believe we can enhance the value of these solutions through our financial, technical and other resources, industry presence and their integration into our existing suite of

solutions.

- •

- Increase our client penetration. We believe we have a

significant opportunity to cross-sell to our existing clients both our current and our future solutions, and increase the utilization or adoption of our solutions to include a greater number of their

projects. We also plan to integrate both our current and our future solutions into a single platform solution, which we believe will significantly increase the value of our solutions and drive

increased adoption of multiple solutions by our clients.

- •

- Expand globally. We believe a substantial opportunity exists to grow sales of our solutions globally. To date, substantially all of our revenue has been generated from clients located in the United States and Canada. However, in certain markets, due to local business practices and regulations, we believe our value proposition could be even stronger than in our established markets in North America. Certain of our large current and potential construction clients also have or are seeking to establish international operations, and have indicated their interest that we support their current or planned international operations, especially as they seek new growth

4

- •

- Increase the number of industries we serve. Our solutions are designed for complex collaborative environments with significant subcontracting activity. We believe that these characteristics exist in several industries in addition to the construction industry. While we currently do not operate in these other industries, we believe based on our research that there could be demand for our solutions in these other industries.

opportunities outside their traditional North American markets. We believe we have accumulated significant experience with the process necessary to enter new markets successfully.

Our Sales Approach

We generally market and sell our solutions directly to our clients. Our solutions generally provide significantly greater benefits if deployed to manage all of a client's related construction activities, which requires buy-in and commitment at the highest levels of our clients' organizations. In our experience, this requires an in-person, relationship-driven, consultative approach with a high degree of solution and domain expertise on the part of our employees. Certain of our solutions or clients, however, are effectively sold and supported remotely, primarily over the phone and using email, webinars and other appropriate methods. We intend to grow our remote sales and support capability significantly in order to address the market opportunity we believe is available to us, as well as to support new solutions and segment initiatives.

Risks Affecting Us

Our business is subject to a number of risks, which could materially and adversely affect our business, financial condition, results of operations and prospects. You should consider carefully these risks before making an investment decision. These risks are described more fully in the "Risk Factors" section beginning on page 12 and include, but are not limited to, the following:

- •

- we have a history of losses and we do not expect to be profitable for the foreseeable future;

- •

- we may be adversely affected by conditions in the global and domestic economy or a downturn in the construction industry;

- •

- we may not be able to execute our growth strategy including expanding into international markets, successfully acquiring

complementary businesses or entering into new industries;

- •

- we may not succeed in developing the market for our solutions;

- •

- we derive a significant portion of our revenue from a relatively limited number of large client relationships and from a

single software solution; and

- •

- we may be adversely affected if our solutions fail to perform properly.

Recent Developments

In March 2013, we entered into a non-binding letter of intent related to a potential software development arrangement with an existing client. This development arrangement would result in our company acquiring certain intellectual property rights from the client in connection with the further joint development of these intellectual property rights for use by the client and subsequent commercialization by us in the form of a new collaboration solution for the construction market. The letter of intent contemplates that, in consideration for the transfer of the intellectual property rights and other consideration, including cash, we will issue a number of shares of common stock equal in value to $12 million with the value of such shares set at 85% of the initial public offering price in this offering. The letter of intent contemplates that 50% of the shares will be issued upon signing of a definitive agreement with the remainder issued over the term of the development arrangement upon the achievement of specified milestones. This development arrangement is subject to further due

5

diligence by us and the client and the parties' negotiation and agreement to acceptable terms of a definitive agreement. Accordingly, the terms described above are subject to change.

Corporate Information

Our business was founded in 2004 and we were incorporated in Delaware in 2007. Our principal executive offices are located at 1405 Lake Cook Road, Deerfield, IL 60015, and our telephone number is (847) 457-6500. Our website address is www.texturacorp.com. Information contained on our website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

"Textura," "Textura Construction Payment Management," "Submittal Exchange," "GradeBeam," "Greengrade" and "PlanSwift" are registered trademarks or logos appearing in this prospectus and are the property of Textura Corporation or one of our subsidiaries. All other trademarks, service marks and trade names in this prospectus are the property of their respective owners.

6

The Offering

Common stock we are offering |

4,000,000 shares | |

Common stock to be outstanding after this offering |

20,961,604 shares (21,561,604 shares if the over-allotment option is exercised in full) |

|

Use of proceeds |

We will use $8.1 million of the net proceeds from this offering to repay indebtedness. We currently intend to use the remainder of the net proceeds for financing our growth, working capital and other general corporate purposes. In addition, we believe that opportunities may exist from time to time to expand our current business through acquisitions of, or investments in, complementary companies, products or technologies. Other than as described in "—Recent Developments," we have no current agreements, commitments or understandings for any specific acquisitions or investments at this time. However, we may use a portion of the net proceeds for these purposes in the future. |

|

Underwriters' option to purchase additional shares |

The underwriters have an option to purchase a maximum of 600,000 additional shares of common stock from us to cover over-allotments. The underwriters could exercise this option at any time within 30 days from the date of this prospectus. |

|

Risk Factors |

See "Risk Factors" and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

New York Stock Exchange symbol |

"TXTR" |

The number of shares of common stock that will be outstanding after this offering is based on the number of shares outstanding as of March 31, 2013 and excludes:

- •

- 623,834 shares of common stock issuable upon settlement of restricted stock units outstanding as of March 31, 2013;

- •

- 2,442,514 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2013, with

a weighted average exercise price of approximately $13.77 per share;

- •

- 1,499,378 shares of common stock issuable upon the exercise of warrants outstanding as of March 31, 2013, with a

weighted average exercise price of approximately $13.35 per share (including warrants to purchase preferred stock that if not exercised prior to the closing of this offering will become warrants to

purchase common stock); and

- •

- 6,000,000 shares of common stock reserved for future awards under our 2013 Long Term Incentive Plan including awards to be granted effective with this offering consisting of restricted stock units having an aggregate grant date fair value, based on the initial public offering price, equal to $1.1 million and stock options having an aggregate grant date fair value of approximately $7.1 million with exercise prices equal to the initial public offering price.

7

Unless otherwise indicated, all information in this prospectus is presented on a pro forma basis assuming:

- •

- the conversion of all outstanding shares of our convertible preferred stock into 5,168,510 shares of our common

stock and the issuance of 426,403 shares of common stock in satisfaction of the dividends accrued on such shares of convertible preferred stock, based on a value equal to the assumed initial public

offering price of $14.00 per share, the midpoint of the price range set forth on the cover page of this prospectus, and assuming the conversion had occurred on March 31, 2013;

- •

- the conversion of all Submittal Exchange Holdings, LLC Class A Preferred Units into 963,400 shares of our

common stock;

- •

- the conversion of all of our outstanding convertible debentures and accrued interest thereon through March 31, 2013

into 468,457 shares of our common stock at a conversion price equal to the initial offering price based on an assumed initial offering price of $14.00 per share, the midpoint of the price range

set forth on the cover page of this prospectus, and assuming the conversion had occurred on March 31, 2013;

- •

- no exercise by the underwriters of their over-allotment option to purchase up

to additional shares of

common stock from us; and

- •

- the filing of an amendment to our certificate of incorporation.

All outstanding shares of our convertible preferred stock, Submittal Exchange Holdings, LLC Class A Preferred Units and convertible debentures automatically convert into shares of our common stock immediately prior to or concurrently with the completion of this offering. Because the number of shares that will be issued in satisfaction of the accrued dividends on the convertible preferred stock and upon conversion of the convertible debentures depends upon the actual initial public offering price per share in this offering and the closing date of this offering, the actual number of shares issuable at such time will differ from the number of shares set forth above.

8

Summary Consolidated Financial Data

The following summary consolidated financial data should be read together with "Use of Proceeds," "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes included elsewhere in this prospectus. We derived the summary consolidated statement of operations data for each of the years ended September 30, 2010, 2011 and 2012 and the summary consolidated balance sheet data as of September 30, 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statement of operations data for the six months ended March 31, 2012 and 2013 and the summary consolidated balance sheet data as of March 31, 2013 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited condensed consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in the opinion of management, all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of the financial information contained in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future.

| |

Years Ended September 30, | Six Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||

Revenue(1) |

$ | 6,020 | $ | 10,514 | $ | 21,681 | $ | 9,673 | $ | 15,319 | ||||||

Operating expense: |

||||||||||||||||

Cost of services(2) |

4,187 | 4,395 | 6,152 | 2,788 | 3,468 | |||||||||||

General and administrative |

5,654 | 6,856 | 11,105 | 5,391 | 8,266 | |||||||||||

Sales and marketing |

3,122 | 2,601 | 5,995 | 2,509 | 4,102 | |||||||||||

Technology and development |

4,747 | 6,169 | 11,123 | 5,545 | 6,345 | |||||||||||

Depreciation and amortization |

2,621 | 2,161 | 4,080 | 1,963 | 1,873 | |||||||||||

Total operating expense |

20,331 | 22,182 | 38,455 | 18,196 | 24,054 | |||||||||||

Loss from operations |

(14,311 | ) | (11,668 | ) | (16,774 | ) | (8,523 | ) | (8,735 | ) | ||||||

Other expense, net |

(1,612 | ) | (7,260 | ) | (2,019 | ) | (989 | ) | (2,119 | ) | ||||||

Loss before income taxes |

(15,923 | ) | (18,928 | ) | (18,793 | ) | (9,512 | ) | (10,854 | ) | ||||||

Income tax provision |

— | — | — | — | 84 | |||||||||||

Net loss |

(15,923 | ) | (18,928 | ) | (18,793 | ) | (9,512 | ) | (10,938 | ) | ||||||

Less: Net loss attributable to non-controlling interests |

— | — | (2,866 | ) | (1,108 | ) | (1,757 | ) | ||||||||

Net loss attributable to Textura Corporation |

(15,923 | ) | (18,928 | ) | (15,927 | ) | (8,404 | ) | (9,181 | ) | ||||||

Accretion (decretion) of redeemable Series A-1 preferred stock |

(19,802 | ) | 11,486 | 3,373 | 505 | 1,239 | ||||||||||

Accretion of redeemable non-controlling interest |

— | — | — | — | 147 | |||||||||||

Dividends on Series A-2 preferred stock |

480 | 480 | 480 | 240 | 240 | |||||||||||

Undistributed earnings allocated to participating securities |

1,506 | — | — | — | — | |||||||||||

Net income (loss) available to Textura Corporation common stockholders |

$ | 1,893 | $ | (30,894 | ) | $ | (19,780 | ) | $ | (9,149 | ) | $ | (10,807 | ) | ||

Net income (loss) available to Textura Corporation common stockholders, basic and diluted |

$ | 1,893 | $ | (30,894 | ) | $ | (19,780 | ) | $ | (9,149 | ) | $ | (10,807 | ) | ||

Net income (loss) per share available to Textura Corporation common stockholders: |

||||||||||||||||

Basic |

$ | 0.27 | $ | (4.18 | ) | $ | (2.31 | ) | $ | (1.07 | ) | $ | (1.18 | ) | ||

Diluted |

$ | 0.26 | $ | (4.18 | ) | $ | (2.31 | ) | $ | (1.07 | ) | $ | (1.18 | ) | ||

Weighted average number of common shares outstanding: |

||||||||||||||||

Basic |

6,942 | 7,392 | 8,548 | 8,544 | 9,161 | |||||||||||

Diluted |

7,166 | 7,392 | 8,548 | 8,544 | 9,161 | |||||||||||

Pro forma net loss per share, basic and diluted(3) |

$ | (1.05 | ) | $ | (0.54 | ) | ||||||||||

Pro forma weighted average common shares outstanding, basic and diluted(3) |

16,689 | 16,998 | ||||||||||||||

9

| |

Years Ended September 30, | Six Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in thousands, except where otherwise indicated) |

|||||||||||||||

Operational Data: |

||||||||||||||||

Activity-driven revenue |

$ | 5,705 | $ | 9,875 | $ | 19,064 | $ | 8,496 | $ | 12,758 | ||||||

Organization-driven revenue |

315 | 639 | 2,617 | 1,177 | 2,561 | |||||||||||

Total revenue |

$ | 6,020 | $ | 10,514 | $ | 21,681 | $ | 9,673 | $ | 15,319 | ||||||

Activity-driven revenue: |

||||||||||||||||

Number of projects added |

1,898 | 2,475 | 4,167 | 1,766 | 2,291 | |||||||||||

Client-reported construction value added (billions) |

$ | 18.4 | $ | 19.4 | $ | 33.8 | $ | 16.8 | $ | 18.1 | ||||||

Active projects during period |

2,783 | 3,952 | 6,393 | 4,074 | 6,249 | |||||||||||

Organization-driven revenue: |

||||||||||||||||

Number of organizations |

151 | 945 | 5,204 | 4,029 | 6,997 | |||||||||||

Adjusted EBITDA(4) |

$ | (9,565 | ) | $ | (8,031 | ) | $ | (9,346 | ) | $ | (4,728 | ) | $ | (4,951 | ) | |

Deferred revenue balance as of the end of period |

$ | 2,396 | $ | 5,279 | $ | 14,166 | $ | 10,894 | $ | 16,963 | ||||||

| |

March 31, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro forma(6) | Pro forma as adjusted(7) |

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash |

$ | 5,021 | $ | 5,021 | $ | 46,652 | ||||

Property and equipment, net |

18,133 | 18,133 | 18,133 | |||||||

Goodwill and other intangibles |

34,983 | 34,983 | 34,983 | |||||||

Total assets |

64,546 | 64,546 | 106,177 | |||||||

Deferred revenue, current and long-term |

16,963 | 16,963 | 16,963 | |||||||

Total debt, current and long-term(5) |

24,637 | 19,056 | 11,525 | |||||||

Redeemable Series A-1 preferred stock |

44,374 | — | — | |||||||

Total Textura Corporation stockholders' equity (deficit) |

(48,120 | ) | 9,606 | 58,870 | ||||||

- (1)

- The

acquisitions of GradeBeam and Submittal Exchange contributed $4.9 million and $1.9 million of revenue for the fiscal year ended

September 30, 2012 and the six months ended March 31, 2012, respectively. The acquisition of PlanSwift contributed $1.0 million of revenue for the six months ended

March 31, 2013.

- (2)

- Cost

of services is exclusive of depreciation and amortization, which is shown separately below.

- (3)

- Unaudited

basic and diluted pro forma net loss per share has been calculated assuming the conversion (using the if-converted method) of all

outstanding shares of our convertible preferred stock, Submittal Exchange Holdings, LLC Class A Preferred Units and convertible debentures into our common stock and the settlement of restricted

stock units that become fully vested upon this offering as though the conversion and settlement had occurred on October 1, 2011. See Note 15 to our audited consolidated financial

statements and Note 9 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. In addition, the pro forma calculation for the six months ended

March 31, 2013 assumes the sale of 582,080 shares of common stock issued by us at the assumed initial public offering price of $14.00 per share, the midpoint of the price range set forth

on the cover page of this prospectus, the proceeds from which will be used to repay indebtedness of $8.1 million.

- (4)

- Adjusted

EBITDA represents loss before interest, taxes, depreciation and amortization, share-based compensation expense and acquisition-related expense.

Adjusted EBITDA is not determined in accordance with accounting principles generally accepted in the United States ("GAAP"), and is a performance measure used by management in conjunction with

traditional GAAP operating performance measures as part of the overall assessment of our performance including:

- •

- for planning purposes, including the preparation of the annual budget;

- •

- to evaluate the effectiveness of business strategies; and

- •

- as a factor when determining management's total compensation.

- We believe the use of Adjusted EBITDA as an additional operating performance metric provides greater consistency for period-to-period comparisons of our operations. For our internal analysis, Adjusted EBITDA

10

removes fluctuations caused by changes in our capital structure (interest expense) and non-cash items such as depreciation, amortization and share-based compensation. These excluded amounts in any given period may not directly correlate to the underlying performance of the business or may fluctuate significantly from period to period due to the issuance or conversion of convertible debentures, acquisitions, fully amortized tangible or intangible assets, or the timing and pricing of new share-based awards. We also believe Adjusted EBITDA is useful to investors and securities analysts in evaluating our operating performance as it provides them an additional tool to compare business performance across companies and periods.

- Adjusted

EBITDA is not a measurement under GAAP and should not be considered an alternative to net loss or as an alternative to cash flows from

operating activities. The Adjusted EBITDA measurement has limitations as an analytical tool and the method of calculation may vary from company to company.

- The following table presents a reconciliation from the most directly comparable GAAP measure, net loss, to Adjusted EBITDA:

| |

Years Ended September 30, | Six Months Ended March 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(in thousands) |

|||||||||||||||

Net loss |

$ | (15,923 | ) | $ | (18,928 | ) | $ | (18,793 | ) | $ | (9,512 | ) | $ | (10,938 | ) | |

Net interest expense |

1,612 | 7,260 | 2,200 | 1,074 | 2,477 | |||||||||||

Income tax provision |

— | — | — | — | 84 | |||||||||||

Depreciation and amortization |

2,621 | 2,161 | 4,080 | 1,963 | 1,873 | |||||||||||

EBITDA |

(11,690 | ) | (9,507 | ) | (12,513 | ) | (6,475 | ) | (6,504 | ) | ||||||

Share-based compensation expense |

2,125 | 1,468 | 2,676 | 1,355 | 1,139 | |||||||||||

Acquisition-related expense |

— | 8 | 491 | 392 | 414 | |||||||||||

Adjusted EBITDA |

$ | (9,565 | ) | $ | (8,031 | ) | $ | (9,346 | ) | $ | (4,728 | ) | $ | (4,951 | ) | |

- (5)

- Total

debt, representing the current and long-term portions, includes our loan payable to related party for the purchase of land and construction of our

corporate headquarters, convertible debentures, notes payable and leases payable.

- (6)

- The

pro forma consolidated balance sheet data gives effect to the automatic conversion of all outstanding shares of our convertible preferred stock into

shares of our common stock; the automatic conversion of all Submittal Exchange Holdings, LLC Class A Preferred Units into shares of our common stock; the automatic conversion of all of our

outstanding convertible debentures and accrued interest thereon through March 31, 2013 into shares of our common stock at a conversion price equal to the initial offering price based on an

assumed initial offering price of $14.00 per share, the midpoint of the price range set forth on the cover page of this prospectus; and compensation expense of $8.7 million related to

restricted stock units that become payable upon completion of this offering.

- (7)

- The pro forma as adjusted consolidated balance sheet data gives effect to the pro forma adjustments described in footnote (6) above, the sale by us of 4,000,000 shares of common stock in this offering based on an assumed initial public offering price of $14.00 per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us and the application of the proceeds therefrom as described in "Use of Proceeds."

11

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We have a history of cumulative losses and we do not expect to be profitable for the foreseeable future.

We have incurred significant losses in each period since our inception in 2004. We incurred net losses of $15.9 million in the fiscal year ended September 30, 2010, $18.9 million in the fiscal year ended September 30, 2011 and $18.8 million in the fiscal year ended September 30, 2012. As of March 31, 2013, we had an accumulated deficit of $150.4 million. These losses and accumulated deficit reflect the substantial investments we made to acquire new enterprise client relationships and develop our solutions. We expect our operating expenses to increase in the future due to anticipated increases in research and development expenses, sales and marketing expenses, operations costs and general and administrative costs, and, therefore, we expect our losses to continue for the foreseeable future. Although our revenues have increased significantly over the past three years, you should not consider our recent growth as indicative of our future performance. We cannot assure you that we will achieve profitability in the future, nor that, if we do become profitable, we will sustain profitability.

Economic conditions of the global and domestic economy or a substantial or prolonged downturn in the commercial construction business cycle may have a material adverse effect on our business, financial condition, results of operations and prospects.

Economic trends that negatively affect the commercial construction industry may adversely affect our business by reducing the number of commercial construction projects that are occurring, the number of general contractors and subcontractors operating in our markets, or the amount that such clients spend on our solutions. The global and domestic economies currently face a number of economic challenges, including threatened sovereign defaults, credit downgrades, restricted credit for businesses and consumers and potentially falling demand for a variety of products and services. These factors have materially and adversely affected, and may continue to materially and adversely affect, the financial markets and the availability of credit for the commercial construction industry. A reduction in the number of commercial construction projects that are undertaken, the number of general contractors and subcontractors operating in our markets or the amount that clients spend on solutions due to economic conditions could have a material adverse effect on our business, financial condition, results of operations and prospects.

We have experienced rapid growth in recent periods. If we fail to effectively manage our growth, our business and operating results may suffer.

We have experienced, and expect to continue to experience, significant growth. This rapid growth has placed, and will continue to place, significant demands on our management and our operational and financial infrastructure. We intend to further expand our overall business, client base, headcount and operations, both domestically and internationally. We expect that we will be required to continue to commit substantial financial, operational and technical resources to implement our growth strategy. Continued growth could also strain our ability to maintain reliable operation of our solutions for our clients, develop and improve our operational, financial and management controls and recruit, train and retain highly skilled personnel. As our operations grow in size, scope and complexity, we will also need to continue to improve and upgrade our systems and infrastructure, which will require significant expenditures and allocation of valuable management resources. If we fail to effectively manage our

12

growth, our business, financial condition, results of operations and prospects could be materially adversely affected.

We may not succeed in developing the market for our solutions and we may face competition that is harmful to our business.

We face challenges in developing a market for our solutions and from current and potential products developed or sold by third-party competitors. Currently, our largest source of competition for CPM is from existing manual processes or internally-developed systems that our potential clients have been using for a long period of time and from which they may be reluctant to change. In addition, some competitors may address part of CPM's functional capabilities.

For our solutions other than CPM, we face current competition from both traditional, larger software vendors offering enterprise-wide software applications and services and smaller companies offering point solutions for the commercial construction industry. Our principal competitors vary depending on the solution we offer. Some of our competitors enjoy substantial competitive advantages over us, such as greater name recognition, more comprehensive and varied products and services, and substantially greater financial, technical and other resources. Certain of our competitors offer, or may in the future offer, lower priced, or free, products or services that compete with our solutions.

In addition, our industry is highly fragmented, and we believe it is likely that some of our existing competitors will consolidate or will be acquired. Some of our competitors may also enter into new alliances with each other or may establish or strengthen cooperative relationships with systems integrators, third-party consulting firms or other parties. Any such consolidation, acquisition, alliance or cooperative relationship could lead to pricing pressure, reduced profit margins and our loss of market share and could result in one or more competitors with greater financial, technical, marketing, service and other resources, all of which could have a material adverse effect on our business, financial condition, results of operations and prospects.

A significant portion of our revenue is derived from a relatively limited number of large client relationships and any loss of, or decrease in sales related to, these client relationships could harm our results of operations.

A significant portion of our revenue is derived from our relationships with a relatively limited number of large clients, either directly from those clients or from the subcontractors also working on projects that those clients control. Revenue derived from our ten largest client relationships, collectively, accounted for 41.5% of our revenue in fiscal 2012. Our largest client relationship accounted for 10.8% of our revenue in fiscal 2012. This revenue is generated from these clients' use of our CPM solution. We may continue to experience ongoing client concentration, particularly if we are successful in attracting large general contractor clients and in selling additional solutions to our existing clients. In addition, it is possible that revenue from these client relationships, either individually or as a group, may not reach or exceed historical levels in any future period or that one or more of our existing clients may stop utilizing our solutions entirely. We believe that the implementation of our CPM solution results in our clients changing their business processes in ways that make it difficult to discontinue use; however, the loss or significant reduction of business from one or more of our major client relationships would materially adversely affect our business, financial condition, results of operations and prospects.

Our business could be adversely affected if our clients are not satisfied with our solutions.

Our business model depends in large part on our ability to continue to ensure our clients' satisfaction with our solutions and their resulting decision to continue their reliance on our solutions. Our client services group is organized to provide high levels of service and support to our clients. However, if a client is not satisfied with the functionality or quality of our solutions, or with the type of solutions provided, then they may elect to discontinue using our solutions for future projects or we could incur additional costs to address their dissatisfaction. In addition, negative publicity related to our

13

client relationships or the satisfaction of our clients, regardless of its accuracy, may further damage our business by affecting our ability to compete for new enterprise relationships with prospective clients.

If our solutions fail to perform properly, our reputation could be adversely affected, our market share could decline and we could be subject to liability claims.

Our solutions are inherently complex and involve the generation and exchange of legal documentation and facilitation of financial transactions. In particular, clients using our CPM solution rely on us to properly generate lien waivers and initiate payment instructions. Our solutions may contain material defects or errors and rely in part on data entered by our clients, the accuracy of which we do not control. This may result in our solutions failing to perform as intended. Such failure may result in:

- •

- diversion of development and client service resources;

- •

- injury to our reputation;

- •

- loss of existing clients and difficulty in attracting new clients;

- •

- claims by clients that we are liable for any damages to them as a result of such defects or errors;

- •

- increased insurance costs; and

- •

- sales credits or refunds for prepaid amounts related to unused subscription services.

The costs incurred in correcting any material defects or errors or in connection with any of the consequences above might be substantial and could adversely affect our business, financial condition, results of operations and prospects.

The availability or performance of our solutions could be adversely affected by a number of factors, including clients' inability to access the Internet, the failure of our network or software systems, security breaches, variability in user traffic for our solutions or the operation of the ACH Network and other payment clearing systems. Furthermore, because of the large amount of data that we collect and manage, it is possible that hardware failures or errors in our systems could result in data loss or corruption, or cause the information that we collect to be incomplete or contain inaccuracies that our clients regard as significant.

Additionally, our clients may use our solutions together with software and hardware applications and products from other companies. As a result, when problems occur, it may be difficult to determine the cause of the problem, and our solutions, even when not the ultimate cause of the problem, may be misidentified as the problem. If our solutions are misidentified as the source of the problem, we might incur costs associated with litigation or correcting the problem, and our reputation could be damaged, resulting in a loss of clients.

Although we currently carry errors and omissions insurance, such insurance may be inadequate or may not be available in the future on acceptable terms, or at all. In addition, our policy may not cover all claims made against us, and defending a suit, regardless of its merit, could be costly and divert management's attention.

We derive a substantial portion of our revenues from a single software solution.

We derive a substantial portion of our total revenues from sales of CPM. Therefore, any factor adversely affecting sales of this solution, including market acceptance, product competition, performance and reliability, reputation, price competition, or economic and market conditions, could have a disproportionally material adverse effect on our business, financial condition, results of operations and prospects.

14

We have a long selling cycle to secure a new enterprise relationship for CPM, which requires significant investments of resources.

We typically face a long selling cycle of a year or longer to secure a new enterprise client relationship for CPM, which typically requires significant investment of resources and time by both our clients and us. Our enterprise selling cycle is subject to many risks and delays over which we have little control, including our clients' decisions to choose alternatives to our solutions (including internally-developed solutions) and the timing of our clients' budget cycles and approval processes. Before committing to use our solutions, potential clients require us to spend time and resources educating them on the value of our solutions and assessing the feasibility of integrating our solutions with their existing technology. If a potential client does not ultimately choose our solutions, we are unable to recoup these expenses. Even where we have secured a new enterprise relationship with a general contractor or owner/developer, there are no assurances that the general contractor or owner/developer will choose to use our solutions for any or all of their current or future projects.

Our business, financial condition, results of operations and prospects may be materially adversely affected if we are unable to cross-sell our solutions.

A significant component of our growth strategy is to increase cross-selling of our solutions to current and future clients. We may not be successful in cross-selling our solutions, however, if our clients find our additional solutions to be unnecessary or unattractive. We have invested, and intend to continue to invest, significant resources in developing and acquiring additional solutions, which resources may not be recovered if we are unable to successfully cross-sell these solutions to clients using our existing solutions. Any failure to sell additional solutions to current and future clients could materially adversely affect our business, financial condition, results of operations and prospects.

We may be unable to adequately protect, and we may incur significant costs in defending, our intellectual property and other proprietary rights.

Our success depends, in part, upon our intellectual property rights. We rely upon a combination of trademark, trade secret, copyright, patent and unfair competition laws, as well as license agreements and other contractual provisions, to protect our intellectual property and other proprietary rights. In addition, we attempt to protect our intellectual property and proprietary information by requiring our employees and consultants to enter into confidentiality, non-competition and assignment of inventions agreements. To the extent that our intellectual property and other proprietary rights are not adequately protected, third parties might gain access to our proprietary information, develop and market solutions similar to ours, or use trademarks similar to ours. Existing United States federal and state intellectual property laws offer only limited protection. Moreover, the laws of Canada, Australia, New Zealand, and any other foreign countries in which we may market our solutions in the future, may afford little or no effective protection of our intellectual property. Changes in patent law, such as changes in the law regarding patentable subject matter, could also impact our ability to obtain patent protection for our solutions. In particular, recent amendments to the United States patent law became effective in 2012 and may affect our ability to protect our solutions and defend against claims of patent infringement.

In addition, patents may not be issued with respect to our pending or future patent applications, and our patents may not be upheld as valid, may be contested or circumvented or may not prevent the development of competitive solutions. If we resort to legal proceedings to enforce our intellectual property rights or to determine the validity and scope of the intellectual property or other proprietary rights of others, the proceedings could be burdensome and expensive. Such legal proceedings or reductions in the legal protection available for intellectual property rights could have a material adverse effect on our business, financial condition, results of operations and prospects, and we may not prevail.

15

We could be subject to assertions of infringement or other violations by us of intellectual property rights (whether actual or alleged), which could result in significant costs and substantially harm our business, financial condition, results of operations and prospects.

Software and technology companies are frequently subject to litigation based on allegations of infringement, misappropriation or other violations of intellectual property rights or rights related to use of technology. Some software and technology companies, whether our direct competitors or not, own large numbers of patents, copyrights, trademarks and trade secrets, which they may use to assert claims against us. Third parties may in the future assert that we have infringed, misappropriated or otherwise violated their intellectual property rights, and as we face increasing competition, the possibility of intellectual property rights claims against us grows. Such litigation may involve patent holding companies or other adverse patent owners who have no relevant product revenue, and therefore our own issued and pending patents may provide little or no deterrence to these patent owners in bringing intellectual property rights claims against us. Existing laws and regulations are evolving and subject to different interpretations, and various federal and state legislative or regulatory bodies may expand current or enact new laws or regulations. Although we believe that our solutions do not infringe upon the intellectual property rights of third parties, we cannot assure you that we are not infringing or violating any third-party intellectual property rights or rights related to use of technology.

Any intellectual property infringement or misappropriation claim or assertion against us, our clients or strategic alliance partners, and those from whom we license technology and intellectual property could have a material adverse effect on our business, financial condition, results of operations and prospects regardless of the validity or outcome. If we are forced to defend against any infringement or misappropriation claims, whether they are with or without merit, are settled out of court, or are determined in our favor, we may be required to expend significant time and financial resources on the defense of such claims. Furthermore, an adverse outcome of a dispute may require us to pay damages, potentially including treble damages and attorneys' fees, if we are found to have willfully infringed a party's intellectual property; cease making, licensing or using technology, content or material that is alleged to infringe or misappropriate the intellectual property of others; expend additional development resources to redesign our technology; enter into potentially unfavorable royalty or license agreements in order to obtain the right to use necessary technologies, content or materials; and to indemnify our partners and other third parties. Royalty or licensing agreements, if required or desirable, may be unavailable on terms acceptable to us, or at all, and may require significant royalty payments and other expenditures. In addition, any lawsuits regarding intellectual property rights, regardless of their success, could be expensive to resolve and would divert the time and attention of our management and technical personnel.

We rely on technology and intellectual property of third parties, the loss of which could limit the functionality of our solutions and disrupt our business.

We use technology and intellectual property licensed from unaffiliated third parties in certain of our solutions, and we may license additional third-party technology and intellectual property in the future. Any errors or defects in this third-party technology and intellectual property could result in errors that could harm our brand and business. In addition, licensed technology and intellectual property may not continue to be available on commercially reasonable terms, or at all. The loss of the right to use or allow our clients to use this third party technology could limit the functionality of our solutions and might require us to redesign our solutions.

Further, although we believe that there are currently adequate replacements for the third-party technology and intellectual property we presently use, the loss of our right to use any of this technology and intellectual property could result in delays in producing or providing affected solutions until equivalent technology or intellectual property is identified, licensed or otherwise procured, and integrated. Our business would be disrupted if any technology and intellectual property we license from others or functional equivalents of this software were either no longer available to us or no longer

16

offered to us on commercially reasonable terms. In either case, we would be required either to attempt to redesign our solutions to function with technology and intellectual property available from other parties or to develop these components ourselves, which would result in increased costs and could result in delays in sales and the release of new solution offerings. Alternatively, we might be forced to limit the features available in affected solutions. Any of these results could harm our business and impact our results of operations.

The use of open source software in our solutions and technology may expose us to additional risks and harm our intellectual property.

We use open source software development tools and may incorporate open source software into portions of our technology. Given the nature of open source software, third parties might assert copyright and other intellectual property infringement claims against us based on our use of certain open source software programs. The terms of many open source licenses to which we are subject have not been interpreted by United States or foreign courts, and there is a risk that those licenses could be construed in a manner that imposes unanticipated conditions or restrictions on our ability to commercialize our solutions. In that event, we could be required to seek licenses from third parties in order to continue offering our solutions, to redevelop our solutions, to discontinue sales of our solutions or to release our proprietary software code under the terms of an open source license, any of which could materially and adversely affect our business, financial condition, results of operations and prospects.

Some of our solutions use software development tools that are subject to one or more open source licenses. Open source software is typically freely accessible, usable and modifiable. Certain open source software licenses require a user who intends to distribute the open source software as a component of the user's software to disclose publicly part or all of the source code to the user's software. In addition, certain open source software licenses require the user of such software to make any derivative works of the open source code available to others on unfavorable terms or at no cost. This can subject previously proprietary software to open source license terms. In addition to risks related to license requirements, usage of open source software can lead to greater risks than use of third-party commercial software, as open source licensors generally do not provide warranties or controls on origin of the software.

While we monitor the use of all open source software in our solutions, processes and technology and try to ensure that no open source software is used in such a way as to require us to disclose the source code to the related solution when we do not wish to do so, such use may have inadvertently occurred in deploying our proprietary solutions. Additionally, if a third-party software provider has incorporated certain types of open source software into software we license from such third party for our products and solutions, we could, under certain circumstances, be required to disclose the source code to our solutions. This could harm our intellectual property position and have a material adverse effect on our business, financial condition, results of operations and prospects.

Certain of our solutions are dependent on the use and acceptance of electronic signatures, which are governed by relatively new laws and their acceptance in the commercial construction industry may not be complete.

In the United States, the enforceability of electronic transactions is primarily governed by the Electronic Signatures in Global and National Commerce Act, a federal law enacted in 2000 that largely preempts inconsistent state law, and the Uniform Electronic Transactions Act, a uniform state law that was finalized by the National Conference of Commissioners on Uniform State Laws in 1999 and has now been adopted by most states. If, in the United States or other markets where we offer our solutions, a court were to find that electronic signatures are insufficient to establish that the documents generated by our system have been signed by an authorized person, existing laws were to change, or participants in the commercial construction industry were unwilling to rely on electronic signatures, then acceptance of our solutions would be adversely affected.

17

Our business is substantially dependent on market demand for, and acceptance of, the on-demand model for the use of software in the commercial construction industry.

We sell our collaboration solutions as on-demand solutions, which are an alternative to traditional licensed hardware and software solutions, and solutions developed in-house to which many of our clients or potential clients are accustomed. Our collaboration solutions rely on the acceptance and proliferation of web-based software, which may not be widespread or happen in a timely fashion. Under the perpetual or periodic license model for software procurement, users of the software typically run applications on their hardware. Because commercial construction companies utilizing these perpetual or periodic license models may be predisposed to maintaining control of their IT systems and infrastructure, there may be resistance to the concept of accessing the functionality of software provided as a service through a third party.

Furthermore, many commercial construction companies currently conduct the business processes that our collaboration solutions support using paper-based processes and a combination of mail services, telephone, facsimile, email and the Internet. Growth in the demand for our collaboration solutions depends on the adoption of our technology-enabled commercial construction management solutions and we may not be able to persuade these prospective clients to change their traditional processes. If our collaboration solutions are not accepted by the commercial construction industry or if the market for on-demand solutions fails to grow, or grows more slowly than we currently anticipate, demand for our collaboration solutions could be negatively affected.

If we are not successful in expanding our international business, we may incur additional losses and our revenue growth could be materially adversely affected.

Our future results depend, in part, on our ability to expand into international markets. We currently operate in the United States and Canada and, effective October 2012, we entered into a joint venture to begin operations in Australia and New Zealand. We also have a number of distributor and reseller relationships for our PlanSwift solution in international markets. Our ability to expand internationally will depend upon our ability to deliver solution functionality and foreign language translations that reflect the needs of the local commercial construction industries of the international clients that we target. Our ability to expand internationally involves various risks, including the need to invest significant resources in such expansion, the possibility that returns on such investments will not be achieved in the near future or in unfamiliar competitive environments. We may also choose to conduct our international business through strategic alliances. If we are unable to identify strategic alliance partners or negotiate favorable alliance terms, our international growth may be hampered. In addition, we have incurred and may continue to incur significant expenses in advance of generating material revenues as we attempt to establish our presence in particular international markets.

Expansion internationally will also require significant attention from our management and will require us to add additional management and other resources in these markets. Our ability to expand our business and to attract talented employees and strategic alliances in an increasing number of international markets requires considerable management attention and resources and is subject to the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems, commercial infrastructures and technology infrastructure. If we are unable to grow our international operations in a timely manner, we may incur additional losses and our revenue growth could be materially adversely affected.

As we expand internationally, our business will become more susceptible to risks associated with international operations.

We currently operate in the United States and Canada and, effective October 2012, we entered into a joint venture to begin operations in Australia and New Zealand. We also have a number of distributor and reseller relationships for our PlanSwift solution in international markets. Our limited

18

experience in operating our business outside the United States increases the risk that our current and future international expansion efforts may not be successful. In particular, our business model may not be successful in particular countries or regions outside the United States for reasons that we currently are unable to anticipate. In addition, conducting international operations subjects us to risks that we have not generally faced in the United States. These include:

- •

- fluctuations in currency exchange rates;

- •

- unexpected changes in foreign regulatory requirements;

- •

- difficulties in managing the staffing of international operations;

- •

- potentially adverse tax consequences, including the complexities of foreign value added tax systems, restrictions on the

repatriation of earnings and changes in tax rates;

- •

- dependence on strategic alliance partners to increase client acquisition;

- •

- the burdens of complying with a wide variety of foreign laws and different legal standards;

- •

- data privacy laws that require that client data be stored and processed in a designated territory;

- •

- increased financial accounting and reporting burdens and complexities;

- •

- political, social and economic instability abroad;

- •

- laws and business practices favoring local competitors;

- •

- terrorist attacks and security concerns in general; and

- •

- reduced or varied protection for intellectual property rights in some countries.

The occurrence of any one of these risks could negatively affect our international business and, consequently, our operating results. Additionally, operating in international markets requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required to operate in other countries will produce desired levels of revenue or profitability.