Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CapLease, Inc. | lse20130528b_8k.htm |

Exhibit 99.1

|

|

|

IMMEDIATE RELEASE

American Realty Capital Properties to Acquire CapLease Inc. in a $2.2 Billion Transaction, Creating Pro Forma Enterprise Value of Approximately $6.0 Billion

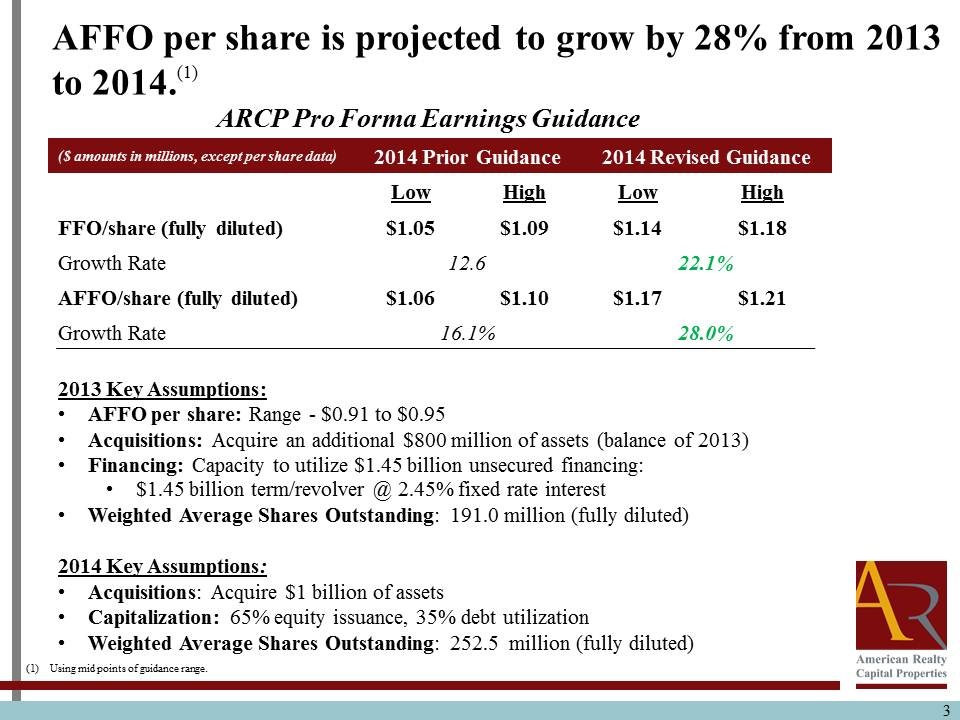

Transaction will be 10% Accretive to AFFO with a 28% Increase in 2014 over 2013

Acquisition Solidifies ARCP’s Position as Best Credit Quality, Fastest Growing Single Tenant Net Lease REIT

ARCP to Raise Dividend $0.03 Per Share and Raise 2014 Earnings Guidance to $1.19 Per Share

New York, New York, May 28, 2013 – American Realty Capital Properties, Inc. (“ARCP”) (NASDAQ:ARCP) and CapLease, Inc. (“CapLease”) (NYSE:LSE) announced today that they have signed a definitive merger agreement under which ARCP will acquire all of the outstanding shares of CapLease in a transaction valued at approximately $2.2 billion. Both companies’ boards of directors have unanimously approved the agreement. Following a stockholder vote by CapLease, the transaction is expected to close during the third quarter of 2013. As result of the merger, ARCP expects to be the 3rd largest net lease real estate investment trust (“REIT”) in the United States based on total pro forma equity market capitalization.

ARCP will pay an amount in cash equal to $8.50 per share for each outstanding share of CapLease common stock, and each share of Series A, Series B and Series C preferred stock of CapLease will be converted into the right to receive the sum of $25.00 in cash plus an amount equal to any accrued and unpaid dividends up to but excluding the closing date of the merger. Additionally, with respect to CapLease’s $1.2 billion of outstanding debt, ARCP intends to assume approximately $580 million and repay the balance.

Nicholas S. Schorsch, Chairman and Chief Executive Officer of ARCP commented, “The combination of ARCP with CapLease allows us to expand and further diversify our property portfolio, fortify our credit quality, reduce our tenant concentration, and enhance our management team. This transaction is immediately accretive and is expected to generate approximately $0.11 per share in additional adjusted funds from operations (“AFFO”) annually and, upon closing, will allow us to increase our dividends to stockholders by $0.03 per share to an annualized rate of $0.94 per share. We anticipate that virtually all of CapLease’s senior management will join ARCP’s management team, providing unparalleled bench strength and bringing us considerably closer to being able to “internalize” ARCP’s management. This transaction will further institutionalize the notion of durable, defensive dividends for our stockholders by allowing them to become owners on a very favorable basis of the 3rd largest net lease REIT in the United States, and, we believe, now the best, publicly-traded net lease real estate company, period. Size, low-cost capital, and broad-based management skills are the competitive advantages in the net lease sector.”

Paul H. McDowell, Chairman of the Board of Directors and Chief Executive Officer of CapLease, said, “Our Board has unanimously approved this merger with ARCP as being in the best interests of CapLease and our stockholders, who will receive a certain cash premium for their shares. We believe that the structure of this transaction creates the greatest value for all stockholders over both the near and long term. My management team looks forward to the opportunities of continuing to build out the high quality assets of the company.”

Michael Weil, President of ARCP, observed, “In an industry where size matters, ARCP combined with CapLease has managed to construct a combination that is of sufficient order of magnitude and financial strength so as to compare very favorably to its competitive set. The company is positioned for ongoing growth in assets and earnings. ARCP’s stockholders remain in capable hands. With this acquisition, ARCP will add over 70 properties to its portfolio, increasing the total number of properties to approximately 800 properties owned under long-term and medium-term leases to major commercial and retail tenants. By maintaining the integrity of ARCP’s capital structure, we remain well positioned to leverage this platform to continue to pursue additional accretive opportunities in the coming years.”

Brian S. Block, Executive Vice President and Chief Financial Officer of ARCP, pointed out, “This transaction offers significant operating synergies and value to our shareholders. On an annualized basis, the impact to our operating results is anticipated to be accretive by approximately 10%. We have announced revised earnings guidance for 2014 of between $1.17 to $1.21 per share based on AFFO, representing a 28% increase over previously announced 2013 guidance. In connection with closing this merger, we anticipate increasing our monthly distribution rate while simultaneously reducing our projected payout ratio.”

The merger agreement provides for a “go-shop” period commencing immediately and ending on July 7, 2013, during which CapLease, with the assistance of its advisors, will actively solicit alternative transaction proposals from third parties. The merger agreement provides for a termination fee and expense reimbursement of $15 million if CapLease terminates the agreement in connection with a superior proposal that first arose during the go-shop period, subject to certain other terms and conditions described in the merger agreement.

ARCP Strategic, Financial and Portfolio Benefits

Strategic Alignment. This acquisition significantly advances ARCP’s strategic objectives to grow its property portfolio consistent with its investment strategy and further reduce its credit concentration.

Accretion to Earnings and Dividends. The transaction is expected to be immediately accretive to ARCP’s AFFO per share of approximately $0.11 per share. Given the positive impact the transaction is expected to have on operating results, ARCP anticipates that, upon closing, it will increase its dividend by $0.03 per share, or 3.2% to $0.94 per share, while maintaining a conservative payout ratio.

Increased Diversification. With the addition of these properties to the portfolio, the pro forma rental revenue generated by ARCP’s largest 10 tenants declines from 60% to 43%. This added diversification further strengthens the sources of the lease revenue supporting the payment of monthly dividends.

Maintains High Occupancy Levels and Low Lease Rollover. The overall occupancy of the combined real estate portfolio will be approximately 100% post-transaction, excluding certain assets anticipated to be held for sale. The average remaining lease term, after the transaction, will be approximately 10 years. There is only modest lease rollover occurring until 2018.

Increased Size and Scale. Upon closing of the transaction, based on current prices, ARCP would have a pro forma enterprise value of approximately $6.0 billion and will be among the largest and the fastest growing publicly traded net lease REITs. ARCP’s management believes the increased size and scale resulting from the transaction further enhances ARCP’s ability to execute large transactions and strengthens its position as an industry consolidator in the relatively fragmented market of net leased real estate.

Impact on Balance Sheet. The transaction is essentially balance sheet neutral. With respect to CapLease’s $1.2 billion of outstanding debt, ARCP intends to assume approximately $580 million and repay the balance, thus materially reducing CapLease’s leverage and paying off its high coupon preferred equity.

Management Additions, Integration and Operating Synergies. All of the properties owned by CapLease are net leased properties similar to ARCP’s existing property portfolio. In addition CapLease’s senior management is anticipated to be joining the management team at American Realty Capital, the parent company of ARCP’s external manager, upon completion of the merger. As such, ARCP believes any integration, additional resources or ongoing expenses will be minimal in order to integrate the CapLease properties into ARCP. In addition, ARCP, upon closing, will maintain its current board membership and structure.

CapLease Transaction Rationale

Attractive Return to CapLease Stockholders. Upon closing, CapLease stockholders will receive $8.50 in cash for each share of CapLease common stock that they own. This reflects, at an average share price over the last 30 trading days of $7.05 per share, resulting in a premium to CapLease stockholders in excess of 20%.

Premium to Share Price and Asset Values. This transaction enables CapLease stockholders to capitalize on the recent upward price movement of the shares of CapLease, and to achieve a premium valuation for their shares. Furthermore, CapLease’s assets were acquired at an opportune time in the market. This transaction allows CapLease’s stockholders to realize a premium over their purchase price.

Transaction Advisors

RCS Capital, the investment banking and capital markets division of Realty Capital Securities, LLC, is acting as exclusive financial advisor, Proskauer Rose LLP is acting as legal counsel and Miles & Stockbridge P.C. is acting as Maryland counsel to ARCP in connection with the transaction. Wells Fargo Securities, LLC and Houlihan Lokey Financial Advisors, Inc. are acting as financial advisors, Hunton & Williams LLP is acting as legal counsel and Venable LLP is acting as Maryland counsel to CapLease in connection with the transaction.

Timing and Closing Process

The transaction is subject to certain closing conditions, including the approval of CapLease’s stockholders and the satisfaction of other customary closing conditions. There is no financing condition to consummate the transaction. CapLease expects to hold a special meeting of its stockholders to consider and vote on the proposed merger and the other transactions contemplated by the merger agreement. The parties expect the merger to be completed during the third quarter 2013.

ARCP Raise 2014 Earnings Estimates

ARCP estimates that 2014 funds from operations (“FFO”) per share should range from $1.14 to $1.18 per share, an increase of approximately 22% over the 2013 FFO per share of $0.95. ARCP estimates that 2014 AFFO should range from $1.17 to $1.21 per share, an increase of approximately 28% over the 2013 AFFO per share of $0.93. The AFFO per share estimate for 2014 is based acquiring $1 billion of real estate investments.

Additional earnings estimates can be found in Annex A attached hereto.

Conference Call and Investor Presentation Information

ARCP and CapLease have scheduled a conference call to be held at 2:00pm ET on May 28, 2013 to discuss the acquisition. Information regarding the conference call will be distributed separately. An investor presentation discussing the transaction will be available on ARCP’s website at www.arcpreit.com.

About ARCP

ARCP is a publicly traded Maryland corporation listed on The NASDAQ Global Select Market that qualified as a real estate investment trust (“REIT”) for U.S. federal income tax purposes for the taxable year ended December 31, 2011, focused on acquiring and owning single tenant freestanding commercial properties subject to net leases with high credit quality tenants. Additional information about ARCP can be found on its website at www.arcpreit.com. ARCP may disseminate important information regarding ARCP and its operations, including financial information, through social media platforms such as Twitter, Facebook and LinkedIn.

About CapLease

CapLease is a REIT that primarily owns and manages a diversified portfolio of single tenant commercial real estate properties subject to long-term leases to high credit quality tenants.

Basis of Pro Forma Data and Funds from Operations and Adjusted Funds from Operations

The rental revenue changes and statistics described above are based on the companies’ results for the three months ended March 31, 2013, and assume the acquisition occurred at the beginning of the period. Other data, such as occupancy and lease rollover figures, are based on data as of March 31, 2013.

ARCP considers FFO and AFFO, which is FFO as adjusted to exclude acquisition-related fees and expenses, amortization of above-market lease assets and liabilities, amortization of deferred financing costs, straight-line rent, non-cash mark-to-market adjustments, amortization of restricted stock, non-cash compensation and non-recurring gains and losses useful indicators of the performance of a REIT. Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), they facilitate comparisons of operating performance between periods and between other REITs in ARCP’s peer groups. Accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves.

Additionally, ARCP believes that AFFO, by excluding acquisition-related fees and expenses, amortization of above-market lease assets and liabilities, amortization of deferred financing costs, straight-line rent, non-cash mark-to-market adjustments, amortization of restricted stock, non-cash compensation and non-recurring gains and losses, provides information consistent with management's analysis of the operating performance of the properties. By providing AFFO, ARCP believes they are presenting useful information that assists investors and analysts to better assess the sustainability of their operating performance. Further, ARCP believes AFFO is useful in comparing the sustainability of their operating performance with the sustainability of the operating performance of other real estate companies, including exchange-traded and non-traded REITs.

As a result, ARCP believes that the use of FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of our performance relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities.

FFO and AFFO are not in accordance with, or a substitute for, measures prepared in accordance with GAAP, and may be different from non-GAAP measures used by other companies. In addition, FFO and AFFO are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures, such as FFO and AFFO, have limitations in that they do not reflect all of the amounts associated with ARCP’s results of operations that would be reflected in measures determined in accordance with GAAP. These measures should only be used to evaluate ARCP’s performance in conjunction with corresponding GAAP measures.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, CapLease expects to prepare and file with the Securities and Exchange Commission (“SEC”) a proxy statement and other documents regarding the proposed transaction. The proxy statement will contain important information about the proposed transaction and related matters. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED BY ARCP OR CAPLEASE WITH THE SEC CAREFULLY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCP, CAPLEASE AND THE PROPOSED TRANSACTION.

Investors and security holders of CapLease will be able to obtain free copies of the proxy statement and other relevant documents filed by CapLease with the SEC (if and when then become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by CapLease with the SEC are also available on CapLease’s website at www.caplease.com, and copies of the documents filed by ARCP with the SEC are available on ARCP’s website at www.arcpreit.com.

Participants in Solicitation

The directors, executive officers and employees of CapLease may be deemed “participants” in the solicitation of proxies from stockholders of CapLease in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of CapLease in connection with the proposed merger will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. You can find information about CapLease’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and in its definitive proxy statement filed with the SEC on Schedule 14A on April 19, 2013.

Forward-Looking Statements

Information set forth herein (including information included or incorporated by reference herein) contains “forward-looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934, as amended), which reflect ARCP’s and CapLease’s expectations regarding future events. The forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements include, but are not limited to whether and when the transactions contemplated by the merger agreement will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and estimates of growth, including FFO and AFFO, and other statements that are not historical facts.

The following additional factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (2) the inability to complete the proposed merger due to the failure to obtain CapLease stockholder approval for the merger or the failure to satisfy other conditions to completion of the merger, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the merger; (3) risks related to disruption of management’s attention from the ongoing business operations due to the transaction; (4) the effect of the announcement of the proposed merger on CapLease’s or ARCP’s relationships with its customers, tenants, lenders, operating results and business generally; (5) the outcome of any legal proceedings relating to the merger or the merger agreement; and (6) risks to consummation of the merger, including the risk that the merger will not be consummated within the expected time period or at all. Additional factors that may affect future results are contained in ARCP’s and CapLease’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. ARCP and CapLease disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

Contacts:

|

ARCP |

|

|

Anthony J. DeFazio |

Brian S. Block, EVP & CFO |

|

DDCWorks |

American Realty Capital Properties, Inc. |

|

tdefazio@ddcworks.com |

bblock@arlcap.com |

|

Ph: (484) 342-3600 |

Ph: (212) 415-6500 |

|

CapLease |

|

|

Brad Cohen |

|

|

ICR, LLC |

|

|

bcohen@ircinc.com |

|

|

Ph: (212) 217-6393 |

Annex A