Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WAYNE SAVINGS BANCSHARES INC /DE/ | form8k-130866_wayne.htm |

Mission To Excel in Customer Service, Operate Profitably, and be Community - Minded Vision Shared Values To be the Community Bank of choice for Customers, Employees, and Investors

| 1 |

WELCOME 2013 Annual Shareholders’ Meeting Wayne Savings Bancshares, Inc. May 23, 2013

| 2 |

CALL TO ORDER Peggy J. Schmitz Chair, Board of Directors

| 3 |

DIRECTORS Peggy Schmitz, Chair, Board of Directors Daniel R. Buehler Jonathan Ciccotelli, CPA David L. Lehman Debra A. Marthey Glenn W. Miller Rod Steiger, President & CEO

| 4 |

NOMINEES Jonathan Ciccotelli Peggy Schmitz

| 5 |

Executive Management Rod Steiger – President and CEO H. Stewart Fitz Gibbon III – Executive Vice President , COO, CRO, Secretary and Treasurer Joel D. Beckler – SVP, Senior Loan Officer Myron Swartzentruber, CPA – SVP, CFO

| 6 |

Also present Becky Rose – VP, Internal Audit Brittany Hartzler - AVP, Shareholder Services and Assistant Corporate Secretary Craig Liechty , CPA - Partner, BKD LLP Francis Grady – Grady & Associates

| 7 |

INSTRUCTIONS ON PROCEDURES

| 8 |

OPENING OF THE POLLS

| 9 |

CLOSING OF THE POLLS

| 10 |

BUSINESS OVERVIEW Rod Steiger President and CEO

| 11 |

In memory of Terry A. Gardner Wayne Savings Director since 1994

Terry Gardner -- Director of Wayne Savings Bancshares & Wayne Savings Community Bank since 1994. His goal was to reach 20 years and fell just short, as he passed away on Saturday, March 2nd. He was a businessman, entrepreneur— Wooster and Wayne County through and through—and an all-around nice guy. We are grateful for Terry’s long-service and miss him. We also dedicated our annual report to him.

| 12 |

EVOLUTION 1899 Wayne Building & Loan Company ( Thrift) Mutual Company with $300,000 capital, 214 depositors , assets of $ 23,996.22 1902 Bought our existing building on N. Market for $ 900.00 1902

| 13 |

EVOLUTION 1964 The Wayne Savings & Loan Company 1993 Converted to an Ohio - chartered capital stock savings association and was listed on NASDAQ for the first time; “First - Step Conversion”

| 14 |

EVOLUTION 1997 Wayne Savings Community Bank and formed a holding company: Wayne Savings Bancshares, Inc. “Second Step” conversion was completed 2003

| 15 |

WHERE ARE WE TODAY? • Still a Thrift, but need to perform more like a commercial bank • Need to continue to lower high - cost deposits • Need to improve our loan portfolio mix with less reliance on 1 - 4 family loans and more C&I and consumer loans

| 16 |

• Need to improve our noninterest fee income • Need to evaluate our branch network and improve market share • Need to control costs, especially with escalating costs associated with regulatory, compliance, and healthcare

| 17 |

In 2011 we began to evaluate our Trust Dept and determined we were losing $100k+ a year due to escalating payroll and processing costs. We also determined a trust dept needed to manage $200 million or more to have the economy of scale to make a profit; we had only $40 million after 7 years. We wanted to still provide the products and services and thought “out of the box” for ways to make it work. We found Thomasville National Bank in GA with over $1 billion of assets under management, and arranged with them to hire our staff, and assume all the back room operations plus fiduciary responsibilities. It’s a win-win situation to help cut costs and bolster our noninterest fee-income.

David Weiss did a great job evaluating the management of our inventory and supplies, and when a person retired he found a very good out sourcing solution that saved the bank upwards of $200k.

TO SURVIVE . . . 1. Continue to rein in costs and increase revenue In 2012 achieved: • $160,000 positive swing in Trust Services • $ 200,000 savings in inventory, supplies, payroll WHAT DO WE HAVE TO DO . . . SUCCESSFULLY

| 18 |

2. Embrace change and take on a sense of urgency to create and understand our VISION of the future 3. Understand and improve our organizational health/culture

| 19 |

(4) Susan Madura, along with several others, has done a wonderful job regenerating our Marketing & Sales Programs

4. Continue to develop our comprehensive marketing and sales program to increase top - line revenue through loans and fee - income generating activities 5. On going review of facilities and staff to identify opportunities for cost effective reductions to improve operational efficiency

| 20 |

(6) On line and mobile banking have changed the way many people bank, and we can clearly see decreasing lobby traffic. “The day of the big branch doesn’t make sense for the customer or the bank,” (according to) Andy Harmening, Bank of the West, WSJ April 12, 2013

Stewart will have more to say about technology and operations in a few minutes.

(7) “Out-of-the-Box Thinking” has been greatly over-stated, but we need to continue to do just that, as we did with our Trust Department, inventory & supplies.

6. Evaluation of information technology solutions to improve internal efficiency and customer service 7. Invest in people, training, and technology

| 21 |

WHAT WE MUST NOT DO . . . • The same things over and over again, expecting better results • Accept the status quo • Think we can cut our way to long - term profitability and sustainability AND And . . . NOTHING . . .

| 22 |

H. Stewart Fitz Gibbon, III Executive Vice President , Chief Operating Officer, Chief Risk Officer, Secretary and Treasurer

| 23 |

Performance Measures & Risk Management • SEC Form 10 - K, pages 39 and 40 give you a good snapshot of key financial measures • Recall from previous years the basic risk management framework of CAMELS • A few highlights…

| 24 |

Capital is the Company’s primary tool to manage risk. As indicated regularly in the media both legislators and regulators are requiring banks to hold more capital in general. We have accomplished the goal of increasing our book capital ratio as illustrated in this slide.

C - CAPITAL 7.5 8 8.5 9 9.5 10 3/31/09 3/31/10 3/31/11 12/31/11 12/31/12 Equity to Assets at Period End (%) Equity to Assets at Period End (%)

| 25 |

The accounting measure of nonperforming and impaired assets, which is a function of the difficult economic environment, continues at a high level and is a principal reason behind the need to maintain higher capital levels as shown in the previous slide.

A - Asset Quality 0 0.5 1 1.5 2 2.5 3 3.5 4 Nonperforming and impaired assets to total assets (%) Nonperforming and impaired assets to total assets (%)

| 26 |

Unlike the steady increase in the total of nonperforming and impaired loans, the total of nonperforming loans has remained relatively steady, although at levels that are higher than anyone would prefer. A high priority for management is the workout of nonperforming loans.

A - Asset Quality - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 3/31/09 3/31/10 3/31/11 12/31/11 12/31/12 Nonperforming Loans ($000) Nonperforming Loans ($000)

| 27 |

However, a hopeful sign of future improvement is in the decreasing level of past due loans.

A - Asset Quality - 1,000 2,000 3,000 4,000 5,000 6,000 Total $ Past Due ($000) Total $ Past Due ($000)

| 28 |

M - Management • Everything not in C, A, E, L or S • Strategy , Reputation, Operations, Compliance , Information Security • Some acronyms you might have heard – CRA (Community Reinvestment Act) – BSA (Bank Secrecy Act) – GLBA (Gramm - Leach - Bliley Act)

| 29 |

Earnings continue to be affected by the consequences of the financial crisis, including a shrinking net interest margin, credit costs for impairments and provisions and expenses for maintenance and disposal of real estate acquired through foreclosure. While our earnings haven’t been even, we have been profitable through this difficult economic cycle.

E - Earnings - 500 1,000 1,500 2,000 2,500 12 M 3/31/09 12 M 3/31/10 12 M 3/31/11 9 M 12/31/11 12 M 12/31/12 Net Income ($000) Net Income ($000)

| 30 |

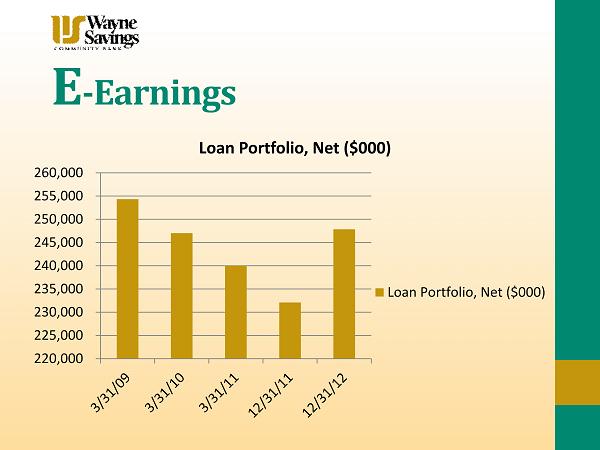

The single most important driver of earnings is the size of the loan portfolio. Following the financial crisis, borrowers paid off loans steadily through 2011. 2012 brought some renewed loan demand and a recovery in loan balances.

E - Earnings 220,000 225,000 230,000 235,000 240,000 245,000 250,000 255,000 260,000 Loan Portfolio, Net ($000) Loan Portfolio, Net ($000)

| 31 |

L - Liquidity • Deposits are our principal source of funds. • Two principal types – low - cost transaction accounts for everyday use by consumers and businesses and higher - cost time deposits, mainly by consumers. • Liquidity is our ability to fund loans or deposit withdrawals when they occur – Investment Portfolio – Borrowed Funds

| 32 |

S - Sensitivity Interest Rate Risk • Hard to measure due to lots of assumptions required to run models to estimate IRR. • Falling rates - borrowers refinance loans at lower rates and securities pay down faster with reinvestment at lower rates. Asset yields generally fall faster than the cost of funds , reducing net income .

| 33 |

S - Sensitivity • Rising rates – depositors move into higher yielding accounts. Cost of funds generally rises faster than asset yields, reducing net income.

| 34 |

S - Sensitivity • Interest rates are low and have been low for an extended period since the financial crisis of 2008. • When will rates go up? • The Federal Reserve is holding rates down through monetary policy and has published criteria for when it will allow rates to rise.

| 35 |

The Federal Reserve’s new transparency allows us to keep track of their measures and have an idea of when interest rates might start to rise.

S - Sensitivity Measure Target April 2013 March 2013 February 2013 January 2013 Unemployment 6.5% 7.5% 7.6% 7.7% 7.9% Current Inflation 2.5% n/a 1.5% 2.0% 1.6% Expected Inflation 2.5% 1.5% 1.4% 1.5% 1.5%

| 36 |

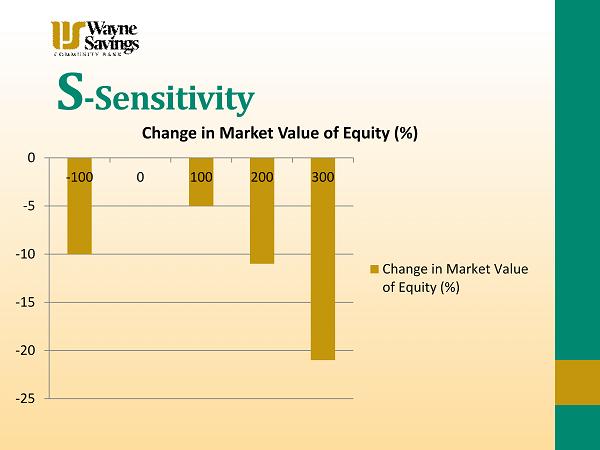

The effect of rising rates is illustrated by this chart taken from market value data in the 10-K. Again, this is a model projection and not a forecast, but it illustrates the potential risk of rising rates and our need to manage that risk through the composition of our assets and liabilities.

S - Sensitivity -25 -20 -15 -10 -5 0 -100 0 100 200 300 Change in Market Value of Equity (%) Change in Market Value of Equity (%)

| 37 |

Our single most notable advancement in customer technology this year was the introduction of mobile banking.

Technology

| 38 |

Operations • Branch traffic is decreasing, as transactions increasingly move to electronic channels. • However , new accounts are still generally opened in branches, and service questions come to the branches. • So , we’ve reduced staffing in our branches, but certain minimums are required for security and to provide adequate service levels .

| 39 |

QUESTIONS

| 40 |

REPORT OF THE INSPECTOR OF ELECTION Becky Rose, VP, Internal Audit

| 41 |

THANK YOU

| 42 |